Customs Office Overview

Sarlahi Customs Office is at Malangwa Municipality-8 and oversees 7 entry points (Sangrampur, Parsa, Tribhuvanngar, Bhadsar, Fenha, Bara, and Balara Sub-custom Office, except Balara Sub-custom office, other six are closed) in the district. Sarlahi is a minor border crossing, 0.14% of total country import share value as of the statistics of 2022/23.

|

|

|

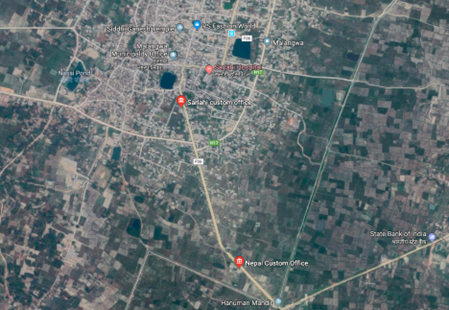

Aerial View of Sarlahi Customs Office. |

|

Border Crossing Location and Contact |

|

|---|---|

|

Name of Border Crossing |

Nepal: Malangawa / Sarlahi |

|

Province or District |

Madhesh Province , Sarlahi |

|

Nearest Town or City with Distance from Border Crossing |

Malangwa 2 km N |

|

Latitude |

26.8522745 |

|

Longitude |

85.5595633 |

|

Managing Authority / Agency |

Department of Customs |

|

Contact Person |

Mr. Naresh Shah (Custom Officer) Sarlahi Custom Office Tel: 046-520154 Mob: 9854030125 Official Mob:9854042144 |

|

Travel Times |

|

|---|---|

|

Nearest International Airport |

Tribhuvan International Airport 206 KM Truck Travel Time: 11 hrs Car Travel time: 6:35 hrs |

|

Nearest Port |

Sirsiya Dry Port 118 Km Truck Travel Time: 5-6 hrs Car Travel time: 3 hrs |

|

Nearest location with functioning wholesale markets, or with significant manufacturing or production capacity |

Malangwa 2 KM Truck Travel Time: 4 hrs mins Car Travel time: 2:34 mins |

|

Other Information |

Bank facilities within the office premises for revenue filing, office for export and import at a distance of 1 km, animal quarantine, plant quarantine office and food quarantine 40 km at Jaleshwar. |

|

Hours of Operation |

|

|---|---|

|

Weekdays |

6:00 am to 11:00 pm |

|

National Holidays |

Generally, 3 days during Dashain (Nepal national festival, 3 days for Tihar, 1 day for Chhat pooja and 1 day Holi) and up to another 7 days / year at Government’s discretion. The Customs office is closed on Jesth 15 (28 or 29 April every year) on account of New Fiscal Budget Announcement day. |

|

Seasonal Constraints |

Rainy Seasons Due to Flood Inundation. |

Daily Capacity

Private cars are not provided the separate lane. The road is double lane; lane for incoming vehicle and an adjacent lane for outgoing vehicles.

Customs Clearance

Compulsory Document for custom clearance.

-

D & T Exemption Certificate

-

Performa invoice

-

Invoice

-

AWB/BL/Other Transport Documents- Freights

-

Donation/Non-Commercial Certificates

-

Packing list

-

Letter of credit

-

Mode of payments ( LC/TT/Draft)

-

Certificate of origin

-

Certificate of insurance

-

Bill of Lading/Airway Bill for 3rd country imports

-

Industry Registration Certificates

-

EXIM Code. (EXIM Code is mandatory for Commercial trading and not mandatory for humanitarian support goods.

-

Bill of Entry From Indian Customs Office

-

Exit Note

-

VCTS

-

Recommendation letter

-

Tariff will be imposed on imported goods as per the Integrated Customs Tariff 2080/081 for FY 2080/81 ( FY- 2023/024)

-

GST Bill

For more information on government contact details, please see the following link: 4.1 Government Contact List.