South Sudan, Republic of

|

Country Name |

Republic Of South Sudan |

|---|---|

|

Official Country Name |

Juba South Sudan |

|

Assessment Details |

|

|

From |

10th/Aug/2023 |

|

To |

31st/Dec/2023 |

|

Name of Assessor |

Lemi Angelo John, Mahlet Sisay, |

|

Title and Position |

Logistics Associate, Logistics Officer |

|

Contact |

|

Table of Contents

| Chapter | Name of Assessor | Organization | Date updated |

|---|---|---|---|

1 South Sudan Country Profile |

Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 1.1 South Sudan Humanitarian Background | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 1.2 South Sudan Regulatory Departments and Quality Control | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 1.3 South Sudan Customs Information | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

2 South Sudan Logistics Infrastructure |

Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.1 South Sudan Juba Port Assessment | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.1.1 South Sudan Port of Total/Malualgurubar | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.2 South Sudan Aviation | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.2.1 South Sudan Juba International Airport | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.2.2 South Sudan Malakal National Airport | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.2.3 South Sudan Wau National Airport | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.2.4 South Sudan Rumbek National Airport | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.3 South Sudan Road Network | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.4 South Sudan Railway Assessment | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.5 South Sudan Waterways Assessment | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.6 South Sudan Storage Assessment | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 2.7 South Sudan Milling Assessment | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

3 South Sudan Logistics Services |

Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 3.1 South Sudan Fuel | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 3.2 South Sudan Transporters | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 3.3 South Sudan Manual Labor Costs | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 3.4 South Sudan Telecommunications | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 3.5 South Sudan Food and Additional Suppliers | Maureen Gitau, Fiona Lithgow | WFP | Aug-15 |

| 3.6 South Sudan Additional Service Providers | Maureen Gitau, Fiona Lithgow | WFP | Aug-15 |

| 3.7 South Sudan Waste Management Infrastructure Assessment | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

4 South Sudan Contacts |

Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.1 South Sudan Government Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.2 South Sudan Humanitarian Agency Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.4 South Sudan Ports & Waterways Companies Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.6 South Sudan Storage & Milling Companies Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.7 South Sudan Fuel Providers Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.8 South Sudan Transporter Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.11 South Sudan Additional Services Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

| 4.12 South Sudan Waste Management Companies Contact List | Lemi Angelo John, Mahlet Sisay | WFP | Dec-23 |

5 South Sudan Annexes |

Maureen Gitau, Fiona Lithgow | WFP | Aug-15 |

| 5.1 South Sudan Acronyms and Abbreviations | Maureen Gitau, Fiona Lithgow | WFP | Aug-15 |

South Sudan, Republic of - 1 Country Profile

Generic Information

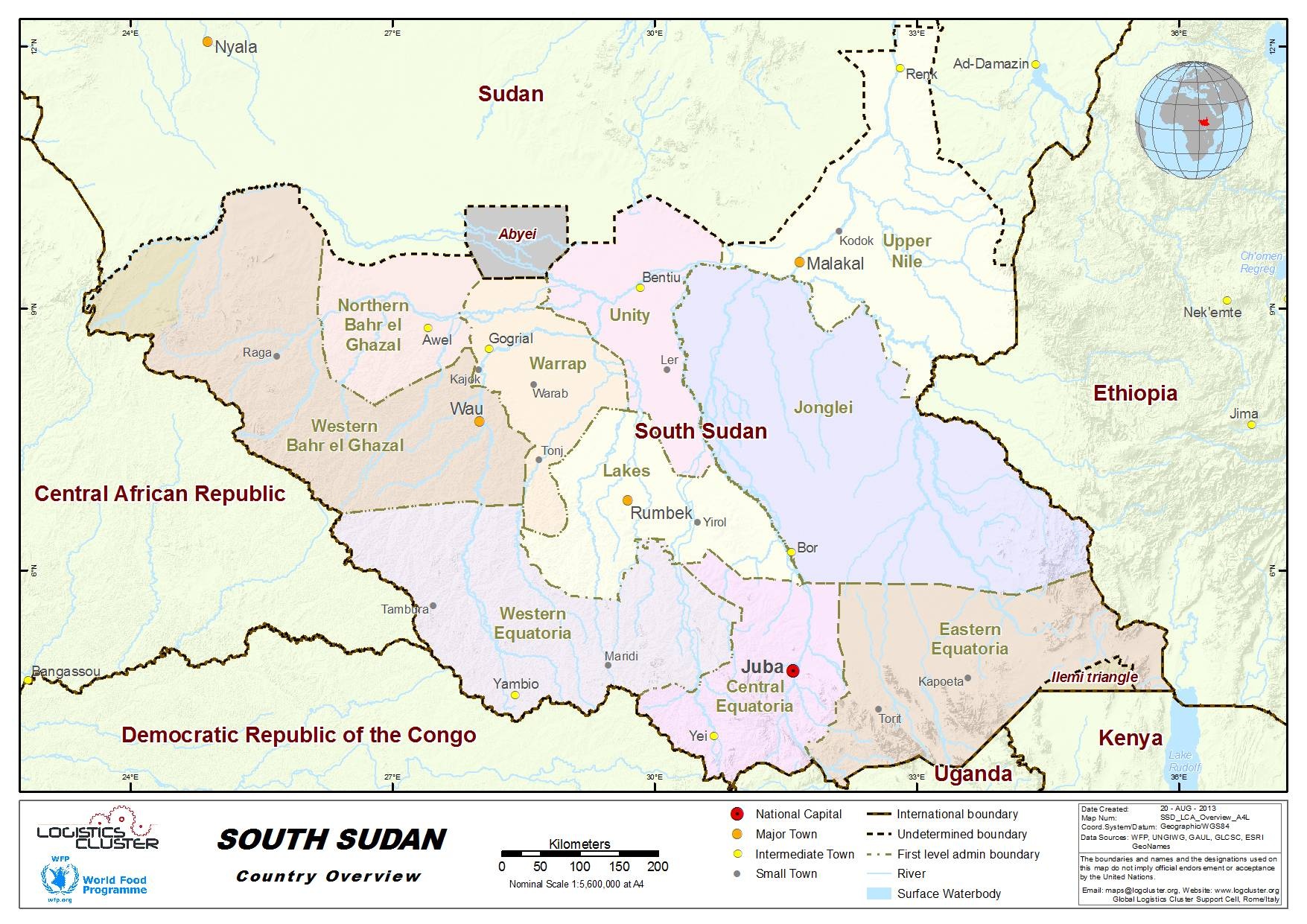

South Sudan, officially the Republic of South Sudan, is a landlocked country in East-Central Africa that is part of the United Nations Sub-Region of East Africa. Juba is the capital and largest city.

South Sudan gained independence from Sudan on 9 July 2011, making it the most recent sovereign state or country with widespread recognition as of 2023. It includes the vast swamp region of the Sudd, formed by the White Nile and known locally as the Bahr al Jabal, meaning "Mountain Sea".

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a generic country overview, please consult the following sources:

Wikipedia information on South Sudan (https://en.wikipedia.org/wiki/South_Sudan)

IMF Country Information on South Sudan (https://www.imf.org/en/Countries/SSD)

Humanitarian Info

World Food Programme Information on South Sudan (https://www.wfp.org/countries/south-sudan)

UN Office for the Coordination of Humanitarian Affairs Information on South Sudan (https://www.unocha.org/south-sudan)

Facts and Figures

South Sudan Wolfram Alpha Information (https://www.wolframalpha.com/input/?i=South+Sudan)

South Sudan World Bank Information (https://www.worldbank.org/en/country/southsudan)

South Sudan Population Information (https://worldpopulationreview.com/countries/south-sudan-population)

South Sudan, Republic of - 1.1 Humanitarian Background

Disasters, Conflicts and Migration

|

Natural Disasters |

||

|---|---|---|

|

Type |

Occurs |

Comments / Details |

|

Drought |

Yes |

While accessibility throughout the country is marginally improved during the dry season, conflict over scarce resources in areas affected by drought can lead to insecurity and inter-communal conflict. Compounding this is the road and river infrastructure, which is poorly maintained without any long-term maintenance program, which is deteriorating yearly. Eastern Equatoria and parts of Jonglei are frequently affected by drought. Most conflict incidents occur during the dry season, with Jonglei, Unity, Lakes, Upper Nile, and Warrap states recording the largest number of incidents. |

|

Earthquakes |

No |

Earthquakes rarely occur in South Sudan. |

|

Epidemics |

No |

Poor sanitation and water contamination have led to outbreaks of cholera. For information on other major infectious diseases, please see the following link: https://www.indexmundi.com/south_sudan/major_infectious_diseases.html |

|

Extreme Temperatures |

No |

South Sudan can be hot, but extreme temperatures are rare; the average annual temperature is about 28.5° C, with an average annual high of 33.7° C. |

|

Flooding |

Yes |

For information on flooding in South Sudan, please see the following link: https://floodlist.com/tag/south-sudan |

|

Insect Infestation |

No |

Locusts, termites, stem-borer, and Dura-bugs can have an effect on crop production; however, the prevalence of such pests has been low. |

|

Mudslides |

No |

South Sudan has mainly flat terrain, characterized by rocky outcrops. Landslides are rare. |

|

Volcanic Eruptions |

No |

South Sudan has no active volcanoes. |

|

High Waves / Surges |

No |

South Sudan is completely land locked and there are no large bodies of water where high waves or sudden water surges could be a problem. |

|

Wildfires |

No |

Large areas of grassy plains, savannah and lowland forests characterize South Sudan. Wildfires often occur because of agricultural burning and are common in areas experiencing consistent drought. |

|

High Winds |

No |

High winds can occur and have damaged warehouse facilities in the past; however, they are not considered a constant hazard. |

|

Other Comments |

N/A |

|

|

Man-Made Issues |

||

|

Civil Strife |

Yes |

Since December 2013, South Sudan and its armed forces have been involved in non-international armed conflicts with several armed non-state actors, notably the Sudan People's Liberation Movement/Army-in-Opposition (SPLM/A-IO) and the National Salvation Front (NAS) |

|

International Conflict |

No |

There are no international conflicts between South Sudan and neighbouring countries. |

|

Internally Displaced Persons |

Yes |

For information on IDPs in South Sudan, please see the following link: https://www.unhcr.org/us/countries/south-sudan |

|

Refugees Present |

Yes |

For information on refugees in South Sudan, please see the following link: https://www.unhcr.org/us/countries/south-sudan |

|

Landmines / UXO Present |

Yes |

Parts of the country are still affected by landmines and UXO’s. Jonglei and Western, Central and Eastern Equatoria states have the highest number of known hazards. A few roads in Western and Northern Bahr El Ghazal, Unity, Jonglei and Lakes states are still minded (UNMAS 2023). For more information, see the following link: https://www.unmas.org/en/programmes/southsudan |

|

Other Comments |

N/A |

|

For a more detailed database on disasters by country, please see the Centre for Research on Epidemiology of Disasters Country Profile.

Seasonal Effects on Logistics Capacities

|

Seasonal Effects on Transport |

||

|---|---|---|

|

Transport Type |

Time Frame |

Comments / Details |

|

Primary Road Transport |

Rainy season: May to October Dry season: January to May

|

The total estimated track length in South Sudan is approximately 90,200 km (about 56047.68 mi). This includes approximately 14,000 km (about 8699.2 mi) of primary and secondary roads and 6,000 km (about 3728.23 mi) of tertiary tracks. Approximately 5,000 km (about 3106.86 mi) of roads remain passable during the rainy season. Road transport is severely affected during the rainy season, with some parts being completely inaccessible for months. Pre-positioning of supplies by road takes place during the dry season. |

|

Secondary Road Transport |

Rainy season: May to October Dry season: January to May |

The secondary road network is severely affected during the rainy season roads. Many primary and secondary roads receive little to no maintenance and during the wet season, vehicle traffic quickly destroys submerged and waterlogged roads. |

|

Rail Transport |

South Sudan has one rail connection, connecting Babanusa (Sudan) with Wau (444 km). This line comprises 248 km of narrow gauge, single-track rail within South Sudan. Rail transport is currently not operational. |

|

|

Air Transport |

Rainy season: May to October |

Air transport in South Sudan is weather dependent. Helicopter and small aircraft operations are grounded in bad weather. Landing strips are mostly gravel, making large numbers of airstrips unusable by fixed wing planes during the rainy season necessitating the need to revert to helicopters. At smaller airstrips, the proximity of local villages and lack of security makes incursions of people and animals onto airstrips a hazard to aircraft and crew. |

|

Waterway Transport |

All year on the river Nile. |

South Sudan controls the upper reaches of the Nile, which gives the country 1,400 km of navigable inland waterways. These main waterways remain navigable throughout the year. However, the barges and pushers have had little investment over the past years and are constantly breaking down, making the barge operations unreliable. |

South Sudan has an equatorial climate with high humidity and lots of rainfall. The temperature varies between an average low of 21° C and an average high of 34° C. The country experiences only two seasons. The rainy season varies between May and October, and the dry season varies between January and May. On average, the hottest month is March, and the coolest month is July, with the driest average month being January and the wettest month being August.

During the rainy season, road transport is severely affected as roads become flooded and waterlogged, with large parts of the country becoming inaccessible. The planting and harvest season coincides with the start of the rainy season and the beginning of the dry season. In general, agricultural production during this period does not impact the availability of trucks; however, in smaller locations where there is a general lack of services and service providers, seasonal agricultural practices can affect availability. Pre-positioning of supplies and cargo takes place during the dry season.

|

Seasonal Effects on Storage and Handling |

||

|---|---|---|

|

Activity Type |

Time Frame |

Comments / Details |

|

Storage |

Rainy season: May to October Dry season: January to May |

Seasonal flooding and insecurity remain the biggest factors affecting storage facilities. Storage facilities in certain areas are at elevated risk of flooding or of being cut-off because of roads being inaccessible. Storage facilities are at risk of being abandoned and/or looted due to insecurity in some areas, especially in those areas experiencing conflict. |

|

Handling |

June to February January to August |

Agricultural practices (food production and livestock) are the main livelihood activities and sources of income for most households in non-urban areas. Seasonal planting, harvesting and migratory patterns can result in a reduction of available labour. Insecurity due to historical inter-tribal conflict, armed insurgencies and cattle raiding in areas such as Jonglei and Unity states can result in the large displacement of people and the unavailability of permanent labour. |

|

Other |

Rainy season: May to October |

In some instances, transporters may refuse to go into areas affected by conflict. During the rainy season, road transporters may refuse to go into certain areas due to an increased risk of accidents or of getting stuck. Local transporters operate without support, and trucks can get stuck for weeks in areas affected by heavy rains. |

Physical access constraints because of perennial flooding, poor road conditions and insecurity remain the biggest factors influencing logistics operations in South Sudan. During the rainy season, 60% of the road network becomes inaccessible. 50% of all counties in 2012 experienced flooding, making moving heavy vehicles difficult. Historically, during the dry season, there is an increase in inter-communal violence and a decrease in the general security situation in certain parts, such as Jonglei. As a result, pre-positioning of stock must be a top priority for any organization during the dry season when the roads remain dry, river levels stable and counties are unaffected by perennial flooding.

Capacity and Contacts for In-Country Emergency Response

GOVERNMENT

The Ministry of Humanitarian Affairs and Disaster Management is mandated to oversee all humanitarian work in South Sudan. In general, the use of military/defense assets in relief operations occurs rarely and, in most occurrences, such assets are utilised on a one time only basis and usually without humanitarian involvement. Close cooperation with military establishments involves the facilitation of access to affected areas in restricted areas.

For more information on government contact details, please see the following link: 4.1 Government Contact List.

HUMANITARIAN COMMUNITY

The current humanitarian structure in South Sudan involves several key agencies and organizations that are actively engaged in addressing the humanitarian needs of the population. These agencies work in collaboration to aid and support across various sectors.

The United Nations Office for the Coordination of Humanitarian Affairs (OCHA) plays a vital role in coordinating humanitarian efforts in South Sudan. OCHA works closely with other UN agencies, NGOs, and government entities to ensure effective coordination, information sharing, and resource allocation. They provide regular updates and reports on the humanitarian situation in the country, guiding the overall response efforts.

The United Nations World Food Programme (WFP) is one of the major agencies operating in South Sudan. WFP focuses on addressing food insecurity and malnutrition by providing food assistance to vulnerable populations. Their ongoing programs include general food distribution, nutrition support, and school feeding programs, which aim to improve the nutritional status of communities across the country.

The United Nations Children's Fund (UNICEF) is actively involved in South Sudan, working to protect and promote the rights of children. UNICEF's programs in the country focus on providing access to safe water, sanitation facilities, health services, and education. They also prioritize child protection initiatives, including family tracing and reunification for separated children, and psychosocial support interventions.

Other key agencies and organizations operating in South Sudan include the International Committee of the Red Cross (ICRC), Médecins Sans Frontières (MSF), and the South Sudan Red Cross Society (SSRCS). ICRC provides healthcare services, supports medical facilities, and promotes respect for international humanitarian law. MSF delivers medical assistance, emergency response, and long-term healthcare interventions. The SSRCS plays a vital role in responding to emergencies, providing relief items, and promoting community resilience.

These ongoing programs and initiatives are crucial in addressing the urgent needs of the population in South Sudan, particularly in the areas of food security, healthcare, water and sanitation, education, and protection. The collaborative efforts of these key agencies and organizations are instrumental in mitigating the impact of the ongoing humanitarian crisis in the country.

Source:

- United Nations Office for the Coordination of Humanitarian Affairs (OCHA): https://www.unocha.org/south-sudan

- United Nations World Food Programme (WFP): https://www.wfp.org/countries/south-sudan

- United Nations Children's Fund (UNICEF): https://www.unicef.org/southsudan/

- International Committee of the Red Cross (ICRC): https://www.icrc.org/en/where-we-work/africa/south-sudan

- Médecins Sans Frontières (MSF): https://www.msf.org/south-sudan

- South Sudan Red Cross Society (SSRCS): https://www.ifrc.org/en/what-we-do/where-we-work/africa/south-sudan-red-cross-society/

For more information on humanitarian agency contact details, please see the following link: 4.2 Humanitarian Agency Contact List.

South Sudan, Republic of - 1.2 Regulatory Departments and Quality Control

South Sudan National Bureau of Standards is responsible for the country’s national infrastructure in terms of standardization, metrology, and accreditation. However, the accreditation body has not been activated. The other stakeholders of the NQI system include various government ministries such as ministries of: Health, Environment and forestry, Livestock and Fisheries, Agriculture and Food Security, Trade and Industry, Transport, Roads and Bridges, Land, Housing and Urban Development, Information and Communication, Energy and Dams and agencies/parastatal bodies such as Drug and Food Control Authority (DFCA), National Communication Authority (NCA), South Sudan Roads Authority (SSRA), South Sudan Urban Water Corporation (SSUWC), South Sudan Electricity Corporation (SSEC) and South Sudan Civil Aviation Authority (CAA).

Responsibility for technical regulation and product certification currently falls under the purview of the SSNBS. SSNBS is responsible for ensuring fairness of trade and the protection of consumers against substandard, shoddy, and hazardous products. SSNBS support for trade includes the development and implementation of standards for various sectors mainly through product conformity assessment (testing, inspections, and certification). Conformity assessment is undertaken by different government agencies. For instance, the inspection of medicines and other regulated products is conducted by the DFCA while NCA conducts the inspection of electronic products, especially telecommunication products.

For more information on the department see the following links:

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List

South Sudan, Republic of - 1.3 Customs Information

Duties and Tax Exemption

Emergency Response:

[Note: This section contains information which is related and applicable to ‘crisis’ times. These instruments can be applied when an emergency is officially declared by the Government. When this occurs, there is usually a streamlined process to import goods duty and tax-free.]

In the following table, state which of the following agreements and conventions apply to the country and if there are any other existing ones

|

Agreements / Conventions Description |

Ratified by the Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes, ratified 18 July 2012 |

|

Annex J-5 Revised Kyoto Convention |

No |

|

OCHA Model Agreement |

No |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

No |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

N/A |

Exemption Regular Regime (Non-Emergency Response):

[Note: This section should contain information on the usual duties & taxes exemption regime during non-emergency times when there is no declared state of emergency and no streamlined process (e.g. regular importations/development/etc.).]

The South Sudan Customs Services exemptions unit handles tax exemptions. UN agencies and NGOs are exempt from import duty, excise duty, vehicles, customs warehouse rent (CWR) and VAT; however, specific exemption procedures must be adhered to by UN agencies or organisations.

Apart from UNMISS and UN agencies, tax exemptions can only be granted to registered taxpayers, and organisations must register for a Tax Identification Number (TIN) at a Directorate of Taxation branch office. A special tax exemption can be granted to non-UN/NGO organisations, but such exemptions are granted on a case basis and only under certain circumstances.

To be granted a tax exemption on imports, organisations must apply for an exemption at the South Sudan Customs Service unit within the Ministry of Finance and Economic Planning (MoFEP) and submit the required documentation related to the cargo. Only the minister of MoFEP can grant tax exemptions.

Once fully processed, an exemption letter will be issued by the South Sudan Customs Service, which will form part of the clearance documents to be presented to customs and border checkpoints.

|

Organisational Requirements to Obtain Duty Free Status |

|---|

|

United Nations Agencies |

|

There are no special requirements apart from submitting the necessary application and support documentation. |

|

Non-Governmental Organizations |

|

Before being granted tax exemptions, all NGOs must be registered to operate in South Sudan. All NGOs must register for an NGO Operations Certificate with the Relief and Rehabilitation Commission (RRC). NGOs must also register with the Ministry of Legal Affairs and Constitutional Development (MoLaCD), Directorate of Registration of Businesses, Associations and NGOs to obtain a registration certificate. All NGOs must register for a Tax Identification Number (TIN) at any Directorate of Taxation branch office. |

Exemption Certificate Application Procedure:

|

Duties and Taxes Exemption Application Procedure |

|---|

|

Generalities (include a list of necessary documentation) |

Required Documents

|

|

The process to be followed (step-by-step or flowchart) |

As stated above, and where applicable,

Additional Recommendations:

|

Exemption Certificate Document Requirements

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

|

AWB/BL/Other Transport Documents |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

|

Donation/Non-Commercial Certificates |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

|

Packing Lists |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

|

Tax exemption application form |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Application Cover Letter |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

MOFEP Cover Letter |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Certificate of Origin |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

Yes, Certified Copy, applies to UN and NGOs |

|

Operations Certificate |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

|

Registration Certificate |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

|

Tax Identification Number (TIN) Certificate |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

|

Import Permit from Ministry of Commerce, Industry, and Investment |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

Yes, Certified Copy, applies to NGOs |

|

Additional Notes |

||||||

|

Submit any additional documentation that might support the exemption certification process, but which is not necessarily required. |

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

Copy of the approved exemption application (including Exemption Number) and documentation for entry at borders. Exemption receives (including Exemption Number) for entry at Airport. |

|

Embargoes |

None |

|

Prohibited Items |

N/A |

|

General Restrictions |

N/A |

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

D&T Exemption Certificate |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

Invoice |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

|

AWB/BL/Other Transport Documents |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

|

Donation/Non-Commercial Certificates |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

|

Packing Lists |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

|

Phytosanitary Certificate |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

Yes, Copy, applies to both UN and NGO |

|

Import Permits |

Yes, Copy, applies to NGO |

Yes, Copy, applies to NGO |

Yes, Copy, applies to NGO |

Yes, Copy, applies to NGO |

Yes, Copy, applies to NGO |

Yes, Copy, applies to NGO |

|

Additional Notes |

||||||

|

Submit any additional documentation that might support the exemption certification process, but which is not necessarily required. |

||||||

Transit Regime

All transit goods are declared at the point of import and travel under bond where the customs will validate and discharge the documentation and at point of exit from South Sudan. This is a relatively uncomplicated process and works well.

South Sudan, Republic of - 2 Logistics Infrastructure

The logistics infrastructure in South Sudan is in a poor state, with very little yearly maintenance undertaken. Nearly 40 years of conflict, underdevelopment, and virtually no investment have left the country with an ailing road network, limited air and water transport capacity and a large infrastructure gap.

Most roads and main transport corridors within the country comprise gravel roads severely affected by perennial flooding. The Juba to Nimule Road, Juba to Terekeka and Juba to Bor are currently the only sealed corridors connecting the country with neighbouring Uganda and other significant towns in the Country. Little maintenance, low adherence to road rules by road users, and the inability to enforce road weight limits lead to the quick deterioration of roads and bridges.

The country has access to hundreds of airstrips and helicopter landing areas; however, most of these are gravel strips. Encroachment and little to no maintenance create a hazardous flying environment at some airstrips. A limited number of airstrips are accessible by fixed-wing planes throughout the year, with a large number being accessible by helicopter or specialised aircraft (Buffalo) only. During the rainy season, the number of fixed-wing accessible airstrips further decreases. Currently, the country only has access to four asphalt runways in Juba, Paloich Wau and Malakal, and a few gravel strips capable of handling large aircraft. Current plans include the upgrade of Juba International Airport. As Paloich is a privately run airstrip, there are landing fees to be paid before departure, which is also applicable to UN Agencies.

The river Nile waterway network provides transport capacity to various downstream locations year-round. The barges and pushers have a capacity of 1,200mt per set (a set is comprised of 4 barges) but are old and unreliable from suffering from years of low investment. Compounded with security issues on the river, the turnaround times for barge movements from Bor to Malakal can vary from 2 to 6 months. WFP, at present, has a MoU for the cross-border movement of food and NFIs from Sudan into South Sudan using road and barge in the Renk corridor. Ports along the Nile are of poor standard and congested due to the current reliance on force protection for river movements. The River Sobat from Ethiopia is only open for 2-4 months of the year. Insecurity around the river has resulted in this being underutilised.

Mingkaman and Bor's ports are being supported for upgrades only.

For useful information on South Sudan's transport infrastructure, please see the following links:

https://www.afdb.org/en/countries/east-africa/south-sudan/south-sudan-and-the-afdb

South Sudan, Republic of - 2.1 Juba Port Assessment

South Sudan, Republic of - 2.1.1 Port of Total/Malualgurubar

Port Overview

Total/Malualgurubar port is in Bor South Sudan along Juba-Bor highway, it is under the management of WFP and is along the main river (River Nile). Barges and boats are used in this port mainly for loading/offloading of food commodities and NFIs (WFPs/ Logistics cluster). Some barge and boat owners have speedboats and depending on need, they can be hired to escort the barge and boat movements. The boat/barge operators ran the operations in all rivers the locations. The port operates in all locations along the North and has offshoots to Mangala, Minkaman and Juba.

The port has a well confined docking site for barges and boats however vessel dock at intervals. The offshoot from Juba highway to the port is murram road of about half KM and Cargo handling both loading and offloading is done by local labours and the rates are fluctuating depending on existing country’s economy.

Key port information may also be found at: http://www.maritime-database.com

|

Port Location and Contact |

|

|---|---|

|

Country |

South Sudan |

|

Province or District |

Jonglei state, Bor- South |

|

Nearest Town or City with Distance from Port |

Bor Town DISTANCE (15) |

|

Port's Complete Name |

Malualgorubar (Total) port |

|

Latitude |

6.11569 |

|

Longitude |

31.57925 deg Alt 468m |

|

Managing Company or Port Authority |

WFP management |

|

Management Contact Person |

WFP-Logistics Unit |

|

Nearest Airport and Airlines with Frequent International Arrivals/Departures |

AIRPORT NAME: Bor Airport LIST OF INTERNATIONAL CARRIERS: N/A |

Port Picture

Description and Contacts of Key Companies

The commercial companies do not have permanent presence at the port, however all WFP contracted commercial companies are active in this port depending on need and boat/barge cargo allocations granted to them, they can then position their boats and barges. Companies of heavy handling equipment’s (Cranes) operate at this port on request basis, examples of boat and barge companies; Ludier General Trading CO. Ltd, Transway Transporters and Logistics, Mango Tree Marine, Sharrow Trading, and investment CO. Ltd, interlink Inc, Northgate General Trading CO. Ltd for the boat operators and B&S group, Nile Barges, and Internet International trade and Transport Co/ltd for the barges.

For more information on port contacts, please see the following link: 4.4 Port and Waterways Companies Contact List.

Port Performance

The port has a well confined docking site for barges and boats however vessels dock at intervals due to insufficient docking area. The channel draft is estimated to 2–3-meter depth and reduces during dry season. Only metallic Barges and Boats of type used in South Sudan and neighbouring countries sharing the river Nile can operate in this port and no other larger vessel with containerized lot. The port is solely used for transportation of humanitarian Cargo mainly WFP food items and Non- Food Items for UN agencies and humanitarian Organizations. The port capacity is limited to loading of one vessel at a time, the port has no handling equipment, and most cargo is handled manually. The port is accessible from the offshoot of Juba-Bor Highway and is located about half kilometre from the highway, the access road is murram and can support the movement of 40Mt truck capacity. The port is located on the main river Nile, and it serves many locations downstream the river Nile and other sub rivers and waterways like zarf, Sobat, and lake Tayar. The loading capacity is about 200-300Mt per day and the lead time is as per size of the vessel.

|

Seasonal Constraints |

||

|---|---|---|

|

Occurs |

Time Frame |

|

|

Rainy Season |

Yes |

From April to November |

|

Major Import Campaigns |

No |

N/A |

|

Low water levels making access less navigable during dry season and during rainy season movement of water weeds causing blockage to certain waterways. |

||

|

Handling Figures for 2023 |

|

|---|---|

|

Vessel Calls |

Estimated 10 barge movement throughout the year, with approtimately-1500Mt per barge. Estimated 200 boat movement through the year with boat capacity ranging from 150-250 Mt per boat.

|

|

Container Traffic (TEUs) |

N/A |

|

Handling Figures Bulk and Break Bulk for 2023 |

|

|---|---|

|

Bulk (MT) |

N/A |

|

Break bulk (MT) |

45000MT |

Discharge Rates and Terminal Handling Charges

Handling charges depends on weight of cargo, quantity, and type of cargo. The rates are determined by leader of port union and barge/boat operators. The Non-food items rates are negotiable while the rate for food commodities is fixed.

Berthing Specifications

|

Type of Berth |

Quantity |

Length (m) |

Maximum Draft (m) |

Comments |

|---|---|---|---|---|

|

Conventional Berth |

0 |

N/A |

N/A |

|

|

Container Berth |

0 |

N/A |

N/A |

|

|

Silo Berth |

0 |

N/A |

N/A |

|

|

Berthing Tugs |

0 |

N/A |

N/A |

|

|

Water Barges |

|

Barges and boats are moored on trees along riverbanks as there are no permanent mooring fixtures at the port.

General Cargo Handling Berths

|

Cargo Type |

Berth Identification |

|---|---|

|

Imports - Bagged Cargo |

N/A |

|

Exports - Bagged Cargo |

N/A |

|

Imports and Exports - RoRo |

N/A |

|

Other Imports |

N/A |

Port Handling Equipment

Is the port equipment managed by the government or privately?

The port is managed by WFP and no existence of port equipment’s. For Handling of heavy equipment’s, such as generators and containerized cargo, cranes are hired from private companies and for the bagged, cartoons and other parcel cargo, porters physically handle both the loading and offloading at a cost. Hired commercial cranes helps in loading and offloading of containers depending on request. The rates are as per the contract, ranging from 600-1200$ per workload/rotations.

|

Equipment |

Available |

Total Quantity and Capacity Available |

Comments on Current Condition and Actual Usage |

|---|---|---|---|

|

Dockside Crane |

No |

No |

Hired commercial cranes |

|

Container Gantries |

No |

N/A |

N/A |

|

Mobile Cranes |

No |

No |

Hired commercial cranes |

|

Reachstacker |

No |

N/A |

N/A |

|

RoRo Tugmaster (with Trailer) |

No |

N/A |

N/A |

|

Grain Elevator with Bagging Machines |

No |

N/A |

N/A |

|

Transtainer |

No |

N/A |

N/A |

|

Forklifts |

No |

N/A |

Hired commercial forklifts |

Container Facilities

No container facilities neither storage.

|

Facilities |

20 ft |

40 ft |

|---|---|---|

|

Container Facilities Available |

None |

None |

|

Container Freight Station (CFS) |

N/A |

N/A |

|

Refrigerated Container Stations |

N/A |

N/A |

|

Other Capacity Details |

N/A |

N/A |

|

Daily Take Off Capacity |

N/A |

N/A |

|

Number of Reefer Stations |

N/A |

N/A |

|

Emergency Take-off Capacity |

N/A |

N/A |

|

Off take Capacity of Gang Shift |

N/A |

N/A |

Customs Guidance

The port is mainly involved with coordination of WFP- humanitarian food and Non-Food items that is exempted from custom taxation. The port mainly serves deliveries within the country with no cross-border operation.

For more information on customs in South Sudan, please see the following link: 1.3 Customs Information.

Terminal Information

MULTIPURPOSE TERMINAL

N/A

GRAIN AND BULK HANDLING

N/A

MAIN STORAGE TERMINAL

The port is connected to warehouse premise with 30 existing Mobile storage Units (MSUs) for indoor storage and a large yard for outdoor storage. The warehouse serves as a hub for storage of food and Non-food supplies for further river deliveries.

|

Storage Type |

Number of Storage Facilities |

Area (m2) |

|---|---|---|

|

Bagged Cargo |

27(about 12000Mt) |

7500 |

|

Refrigerated Cargo |

0 |

0 |

|

General Cargo |

3(1500CBM) |

840 |

Stevedoring

There are no stevedoring companies however the offloading is directly arranged by boat and barge operators and casual labourers (porters). The rates for loading and offloading varies depending on type and weight of cargo. There is no shortage of labours, there can be available more than 100 labours available to perform any task.

Hinterland Information

Road is used to move cargo out of the port and access to the port is only to commercial trucks carrying WFP Food and other humanitarian cargo.

Port Security

The access road to total port is through the WFP warehouse facility which has security personnel, and all vehicles and people requiring access into the port must clear with the security personnel. The area is fenced, has solar lighting and minor firefighting facilities such as fire extinguishers distributed in MSUs premises. During loading and offloading, boat and barge operators normally have their own security that remains on water vessels.

|

Security |

|

|---|---|

|

ISPS Compliant |

No |

|

Current ISPS Level |

N/A |

|

Police Boats |

No |

|

Fire Engines |

No |

South Sudan, Republic of - 2.2 Aviation

2.2 South Sudan Aviation

Key airport information may also be found at: http://worldaerodata.com/

- For South SUDAN AIP : https://sscaa.co/

Civil aviation falls under the authority of the Ministry of Transport and South Sudan, which has been a member of the International Civil Aviation Organization (ICAO) since 10 November 2011. In 2013, the South Sudan Civil Aviation Authority was established, and this statutory authority aims to formally oversee and regulate the country's aviation industry, airline companies, and operations. South Sudan’s Juba International Airport (JIA) is the only airport receiving flights from international commercial airline carriers. The other significant airports include Wau, Malakal and Rumbek.

The aviation industry is generally characterised by decades of underdevelopment, little investment in infrastructure, low capacity and a poor safety record and adherence to international standards. The country is, however, readily accessible by air as there are hundreds of fixed-wing and helicopter landing sites spread out across the country, of which more than 50 airstrips are serviceable by fixed-wing aircraft. Most of these strips are gravel, however, and only accessible by light aircraft. Only Juba, Paloich, Malakal and Wau airports currently have asphalted runways capable of handling large aircraft.

The availability of fuel, aircraft maintenance facilities and handling services remains an issue, especially in remote areas. A few private sector operators can supply fuel at the various significant airports; however, fuel is imported from neighbouring countries, increasing costs and risking fuel shortages, especially during the rainy season. Basic repairs and maintenance can be conducted in South Sudan; however, significant repairs must be conducted in neighbouring countries or, in some cases, Europe.

More recently, a concerted effort by the government is being made to upgrade existing aviation infrastructure, expand the network, and manage its airspace. The runways of major airports such as Wau and Malakal have been upgraded to asphalt. Recently, there have also been growths in commercial, domestic carriers, air charter and airfreight companies providing reliable service.

For more information on government agency and airport company contact information, please see the following links: 4.1 Government Contact List and 4.5 Airport Companies Contact List.

Procedures for Foreign-Registered Aircraft

In South Sudan, the Civil Aviation Authority is responsible for the registration of foreign aircraft operating within the country. The CAA is currently working on a formal process to register foreign aircraft operating in South Sudan and the current process is largely uncomplicated.

General Aviation:

1) Register for a business license from the Ministry of Justice as per regular business registration procedures. This includes registering for a Tax Identification Number (TIN).

2) Write an application letter, on company letterhead addressed to the Director General of Civil Aviation, expressing the company’s intentions of operating in South Sudan.

3) Attach:

-

- List of aircraft intended to operate in South Sudan, including aircraft details and roles i.e. cargo or passenger aircraft;

- All relevant aircraft documentation such as insurance and most recent maintenance inspection/reviews.

- All relevant pilot documentation such as recent medical certificates and licenses;

- Organizational diagram including maintenance and engineering staff;

- Business and TIN registration documentation.

4) Submit to the Civil Aviation Authority for approval.

The Director of Aviation Safety and flight operations office will review the submitted application and inspect the aircraft and aircrew upon arrival in South Sudan.

- If approved, it will issue a permit to operate in South Sudan.

- If denied, the applying organization will be asked for additional clarification and/or documentation. The CAA could also contact the country of origin for further information.

Humanitarian Aviation:

1) Write an application letter, on organization letter head addressed to Director General of Civil Aviation, expressing the organizations intensions of operating in South Sudan.

2) Attach:

- List of aircraft intended to operate in South Sudan, including aircraft roles i.e., cargo or passenger aircraft.

- All relevant aircraft documentation such as insurance and most recent maintenance inspection/reviews.

- All relevant pilot documentation such as recent medical certificates and licenses.

- Organizational diagram including maintenance and engineering staff;

- Operations certificate, registration certificate, and TIN registration documentation (NGOs Only).

3) Submit to the Civil Aviation Authority for approval.

4) The Director of aviation safety and flight operations office will review documentation and inspect the aircraft and aircrew upon arrival in South Sudan.

- If approved, it will issue a permit to operate in South Sudan.

- If denied, the applying organization will be asked for additional clarification and/or documentation. The CAA could also contact the country of origin.

Other Comments:

- The duration of the operating permit issued by the CAA is limited to the duration of the aircraft insurance.

- The process timeline for registering foreign aircraft is fairly short as the process is relatively uncomplicated.

- Currently, no fees are applicable to register foreign aircraft.

- This registration process is subject to change as the CAA is currently formalising the process of registering foreign aircraft.

For more information on procedures for foreign-registered aircraft, please see the following attachments:

- For South SUDAN AIP : https://sscaa.co/

South Sudan, Republic of - 2.2.1 Juba International Airport

Juba International Airport is a joint civilian and military airfield with the SPLA, UNMISS, UNHAS and commercial airlines sharing the crowded airport facilities. The airport consists of a single asphalt runway, adjacent apron, terminal and emergency support buildings, control tower and fueling facilities. Apart from the main terminal building servicing all arriving and departing commercial and UNHAS flights, is an additional separate VIP terminal building which receives visiting dignitaries.

New terminal buildings have been under construction for some time; however there are no clear indications on its completion date. UNMISS also have a separate departure and arrival building located within the UNMISS compound with direct access to the airport to facilitate UNMISS flights. Including UNMISS and UNHAS flights, the airport is currently being serviced by an ever growing number of national and international commercial carriers and aircraft charter companies resulting, in an average of 60 ATMs a day. Several international airlines are operating in and out of Juba on a daily basis.

Airport operations in general are constrained by ageing and inadequate infrastructure. The current terminal buildings are small and unable to handle the increasing number of cargo and passengers arriving daily. There is no separate cargo terminal building and cargo is loaded and offloaded in a designated cargo area and transported to the customs warehouse on site for further processing. From July 2014, upgrades started including extension of the airport's runway from 2,400 meters to 3,100 meters, construction of more parking lots, and expansion of immigration offices. This is expected to be largely completed by mid 2016.

| Location Details | |||

|---|---|---|---|

| Country | South Sudan | Latitude | 4.870033 |

| Province / District | Central Equatoria State | Longitude | 31.60134 |

| Town or City (Closest) | Juba | Elevation (ft and m) | 1,513 ft / 461m |

| Airfield Name | Juba International Airport | IATA and ICAO Codes | JUB & HSSJ |

| Open From (hours) | 07:30am | Open To (hours) | 18:00pm |

Runways

Juba International Airport has a single runway capable of handling large, heavy aircraft. The runway is asphalt and in good condition. There are currently no surface issues or other concerns such as flooding, unsolicited access, standing water or water drainage and the runway is accessible through all weather conditions.

JIA only has one runway servicing all air traffic.

|

Runway #1 |

|

|---|---|

|

Runway Dimensions |

2,400 (m) X 175 (m) |

|

Orientation |

13/31 |

|

Surface |

Asphalt |

Helicopter Pad(s)

Juba airport has two designated helicopter landing areas towards opposite ends of the runway. Towards the western end of the airport, and adjacent to the UNMISS compound, part of the taxiway and a large open gravel area is reserved for UNMISS and humanitarian helicopters. Towards the eastern end of the runway and adjacent to the cargo apron, a smaller area is reserved for military and commercial helicopters.

|

Helipad #1 |

|

|---|---|

|

Present (Yes / No) |

Yes |

|

Largest helicopter that can land |

Mi-26 |

|

Width and Length (metres) |

200 (m) x 250 (m) |

|

Surface |

Asphalt & Gravel |

Airport Infrastructure Details

The airport consists of a single asphalt runway, adjacent apron, terminal and emergency support buildings, control tower and fueling facilities. Operational performance constraints are mainly influenced by the airports ability to handle daily air traffic movements with aircraft separation, available parking space, and subsequent passenger, cargo and aircraft service rates as some of the principal influencing factors.

Airport facilities are characterized by ageing and inadequate infrastructure. The current terminal buildings are small and unable to handle the increasing number of cargo and passengers arriving daily. There is no separate cargo terminal building and cargo is loaded and offloaded in a designated cargo area and transported to the customs warehouse on site for further processing.

|

Customs |

Yes |

JET A-1 fuel |

Yes |

|---|---|---|---|

|

Immigration |

Yes |

AVGAS 100 |

Yes |

|

Terminal Building |

Yes |

Single Point Refueling |

Yes |

|

Passenger Terminal |

Yes |

Air Starter Units |

Yes |

|

Cargo terminal |

No |

Ground Power (mobile) |

Yes |

|

Pax transport to airfield |

No |

Ground Handling Services |

Yes |

|

Control Tower |

Yes |

Latrine Servicing |

No |

|

Weather Facilities |

No |

Fire Fighting Category (ICAO) |

7 |

|

Catering Services |

No |

De-icing Equipment |

No |

|

Base Operating Room |

No |

Parking Ramp Lighting |

No |

|

Airport Radar |

Yes |

Approach & Runway Lights |

No |

|

NDB |

Yes |

VOR |

Yes |

|

ILS |

No |

|

Passenger and Cargo Performance Indicator

Current operations at JIA are relatively un-complex compared with other international airports owning to the single runway, small apron, and taxiway and terminal infrastructure size and layout. Operational performance constraints are mainly influenced by the airports ability to handle daily air traffic movements with aircraft separation, available parking space, and subsequent passenger, cargo and aircraft service rates as some of the principal influencing factors.

Current capacity delivers approximately 60 ATMs per day while at periods of high demand this number can exceed 100 ATMs. Currently the airport processes an average of 1300 passengers per day arriving and departing on all international, UNHAS and domestic flights. Whilst only a limited number of aircraft are able to park at any one time, a small arrival’s and departure terminal, and the outdated check-in, customs and immigrations and baggage collection areas further hamper the ability of the airport to process larger numbers of passengers.

Private companies mostly do cargo handling and the airports ability to handle bulk and other air cargo is hampered by the lack of a dedicated cargo terminal, handling equipment and a small customs warehouse. It is difficult to ascertain the total cargo handling figures for JIA. JIA is however the main destination for, and origin of cargo transported by air within South Sudan. The airport has neither a dedicated cargo terminal nor bulk cargo handling facilities.

|

Performance for 2014 |

Annual Figures |

Monthly | Daily |

|---|---|---|---|

|

Total aircraft movements |

21900 | 1800 | 60 |

|

Total passengers |

n/a | n/a | n/a |

|

Total capacity of the airport (metric tonnes) |

n/a | n/a | n/a |

|

Current activity of the airport (metric tonnes) |

n/a | n/a | n/a |

|

Current use by Humanitarian flights (UNHAS) |

5475-6570 | 480-540 | 15-18 |

Airport Operating Details

| Operating Details | |||

|---|---|---|---|

| Maximum sized aircraft which can be offloaded on bulk cargo: | No Such capacity | ||

| Maximum sized aircraft that can be offloaded on pallet | IL-76 | ||

| Total aircraft parking area (m²) | 7,500m2 | ||

| Storage Area (mt) | n/a | Cubic Meters (m³) | n/a |

| Cargo Handling Equipment Available (Yes / No) | Yes | If "Yes" specify below | |

| Elevators / Hi Loaders (Yes / No) | Yes | Max Capacity (mt) | n/a |

| Can elevators / hi loaders reach the upper level of a B747 (Yes / No) | No | ||

| Loading Ramps (Yes / No) | No | ||

Storage Facilities

The only storage facilities available at the airport are three large, private, bonded warehouses, a part of which are rented out to the government and serves as the airports customs warehouse. The warehouses are approximately 850m2.

Airfield Cost

Navigation Charges

Navigation charges are currently not applicable to JIA

| Aircraft Weight - MTOW (kg) |

Navigation (per journey) USD - $ |

Landing USD - $ |

Night Landing USD - $ |

Night Take-Off USD - $ |

Parking | Handling Charges | |

|---|---|---|---|---|---|---|---|

| 0 | 7,000 | n/a | 172 - 265 | 0 | 0 | 70 | n/a |

| 7,001 | 136,000 | n/a | 265 - 1843 | 0 | 0 | 70 | n/a |

| 136,001 | and over | n/a | 1843 - 2083 | 0 | 0 |

70 |

n/a |

|

Note 1: Night landing is not permitted unless in an emergency Note 2: Parking charges are USD70 regardless of aircraft Note 3: All of these charges are administered by the CAA and are the same for all airports in Juba |

|||||||

Fuel Services Charges

Individual commercial companies determine fuel service charges. At the time of this study the average service charge was an all-inclusive USD$1.80 per litre.

Cargo Terminal Charges

JIA currently has no cargo terminal. Cargo is handled by commercial companies and or clearing agents.

Air-bridge Charges

No such capacity

Security

Airport security is the responsibility of the Civil Aviation Authority. In addition to aviation security personnel, the SSPS, SPLA and other national security agencies also have a presence at the airport.

Perimeter fencing is present, well maintained and surrounds the airport preventing access to the runway and airport grounds. Stringent access control to the main terminal building, departure lounge and administrative buildings is maintained, however the layout of the buildings, increased airport traffic and number of public and passengers needing access to the airport makes access and crowd control difficult.

The vehicle parking and public waiting areas are situated in close proximity to the terminal buildings and although the majority of vehicular traffic is directed to the main open parking area, a large number of vehicles still have access to parking close to the terminal buildings. A small vehicle gate also allows direct access from the parking area to the baggage areas and runway beyond. Access to the airport control tower and airport administration area is also relatively unrestrictive.

Security equipment such as metal detectors and X-ray machines are present, but is frequently broken down. One X-ray machine serving all checked-in baggage on domestic and international flights is currently operational. As a result, airport security personnel also physically examine passengers, baggage and cargo upon entering or exiting the airport. The CAA recently introduced a new ID card system for authorized personnel.

For information on South Sudan airport company contact details, please see the following links:

South Sudan, Republic of - 2.2.2 Malakal National Airport

Airport Overview

South Sudan has many airstrips across the country. These airstrips are mostly rudimentary gravel landing strips that are accessible by robust fixed-wing aircraft and helicopters. Of these approximately 50 airstrips are regularly serviced by UNHAS and other commercial charters. Apart from JIA only 3 other airstrips, Wau, Paloich and Malakal, have asphalt runways. Current plans are in place to upgrade the runway at Rumbek airport to asphalt and further expand the current airport network.

|

Airport Location and Contact |

|

|---|---|

|

Country |

South Sudan |

|

Province or District |

Upper Nile State |

|

Nearest Town or City |

Malakal 02 km North of City |

|

Airport’s Complete Name |

Malakal Airport |

|

Latitude |

9.558889 |

|

Longitude |

31.652222 |

|

Elevation (ft and m) |

1,900 ft |

|

IATA Code |

MAK |

|

ICAO Code |

HJMK |

|

Managing Company or Airport Authority |

CAA |

|

Management Contact Person |

Thon Monykur +211911161472 +211914308895 |

|

NGO and/or UN Presence at Airport? |

Yes |

Runway(s)

|

Runway #1 |

|

|---|---|

|

Runway Dimensions |

2000 (m) X 40 (m) |

|

Runway Orientation |

04 & 22 |

|

Runway Surface |

Asphalt |

|

Runway Condition |

Good |

Airport Infrastructure Details

|

Infrastructure |

|||

|---|---|---|---|

|

Passenger / Cargo Security Screening |

Yes |

Runway Lighting |

No |

|

Refuelling Capacity |

Yes |

Ground Handling Services |

Yes |

|

Air Traffic Control |

Yes |

Fire Fighting Equipment |

Yes |

|

Weather Information |

Yes |

Aircraft Parking Space |

Yes |

|

Navigation Aids |

No |

Perimeter Fencing |

Yes |

|

Windsock |

Yes |

|

|

Fuel Services Charges

The Fuel is provided by Fine Jet and Tristar at Malakal Airport and prices vary according to the contract with airline companies.

Royalties / Non-Objection Fees (NOFs)

N/A

South Sudan, Republic of - 2.2.3 Wau National Airport

Airport Overview

South Sudan has many airstrips across the country. These airstrips are mostly rudimentary gravel landing strips that are accessible by robust fixed-wing aircraft and helicopters. Of these approximately 50 airstrips are regularly serviced by UNHAS and other commercial charters. Apart from JIA only 3 other airstrips, Wau, Paloich and Malakal, have asphalt runways. Current plans are in place to upgrade the runway at Rumbek airport to asphalt and further expand the current airport network.

|

Airport Location and Contact |

|

|---|---|

|

Country |

South Sudan |

|

Province or District |

Upper Nile State |

|

Nearest Town or City |

Malakal 02 km North of City |

|

Airport’s Complete Name |

Malakal Airport |

|

Latitude |

9.558889 |

|

Longitude |

31.652222 |

|

Elevation (ft and m) |

1,900 ft |

|

IATA Code |

MAK |

|

ICAO Code |

HJMK |

|

Managing Company or Airport Authority |

CAA |

|

Management Contact Person |

Thon Monykur +211911161472 +211914308895 |

|

NGO and/or UN Presence at Airport? |

Yes |

Runway(s)

|

Runway #1 |

|

|---|---|

|

Runway Dimensions |

2000 (m) X 40 (m) |

|

Runway Orientation |

04 & 22 |

|

Runway Surface |

Asphalt |

|

Runway Condition |

Good |

Airport Infrastructure Details

|

Infrastructure |

|||

|---|---|---|---|

|

Passenger / Cargo Security Screening |

Yes |

Runway Lighting |

No |

|

Refuelling Capacity |

Yes |

Ground Handling Services |

Yes |

|

Air Traffic Control |

Yes |

Fire Fighting Equipment |

Yes |

|

Weather Information |

Yes |

Aircraft Parking Space |

Yes |

|

Navigation Aids |

No |

Perimeter Fencing |

Yes |

|

Windsock |

Yes |

|

|

Fuel Services Charges

The Fuel is provided by Fine Jet and Tristar at Malakal Airport and prices vary according to the contract with airline companies.

Royalties / Non-Objection Fees (NOFs)

N/A

South Sudan, Republic of - 2.2.4 Rumbek National Airport

Airport Overview

Rumbek Airport is in Rumbek Central County, Western Lakes State, in central South Sudan, near the town of Rumbek. Its location lies approximately 302 kilometres (188 mi), by air, northwest of Juba International Airport, the largest airport in the country.[1] Rumbek Airport is located at an altitude of 420 metres (1,380 ft) above sea level.[2] The geographical coordinates of this airport are: 6° 49' 48.00"N, 29° 40' 12.00"E (Latitude: 6.83000; Longitude: 29.6700).

|

Airport Location and Contact |

|

|---|---|

|

Country |

South Sudan |

|

Province or District |

Lakes State |

|

Nearest Town or City |

Rumbek Centre 1 (km) |

|

Airport’s Complete Name |

Rumbek Airport |

|

Latitude |

6.83000 |

|

Longitude |

29.6700 |

|

Elevation (ft and m) |

1380ft/420m |

|

IATA Code |

RBX |

|

ICAO Code |

HJRB |

|

Managing Company or Airport Authority |

SSCAA |

|

Management Contact Person |

Mr. Emmanuel Airport Manager |

|

NGO and/or UN Presence at Airport? |

Yes |

Runway(s)

|

Runway #1 |

|

|---|---|

|

Runway Dimensions |

1330 (m) |

|

Runway Orientation |

01/19 |

|

Runway Surface |

Gravel |

|

Runway Condition |

Good |

Airport Infrastructure Details

|

Infrastructure |

|||

|---|---|---|---|

|

Passenger / Cargo Security Screening |

Yes |

Runway Lighting |

No |

|

Refuelling Capacity |

Yes |

Ground Handling Services |

Yes |

|

Air Traffic Control |

Yes |

Fire Fighting Equipment |

Yes |

|

Weather Information |

No |

Aircraft Parking Space |

Yes |

|

Navigation Aids |

No |

Perimeter Fencing |

Yes |

|

Windsock |

Yes |

|

|

Fuel Services Charges

In Rumbek fuel service is provided by an external supplier; Finejet and Tristar who are contracted by the HQ. The refuelling process is always supervised by the UNHAS ground staff who collect the copies of the receipts on behalf of WFP and then compiled and verify it in the mid-month and at the end of the month then sent to Juba for payment.

|

Price per Litre USD - $ |

|

|---|---|

|

Jet A-1 |

1 USD |

|

Avgas |

- |

Royalties / Non-Objection Fees (NOFs)

N/A

South Sudan, Republic of - 2.3 Road Network

The road network in South Sudan is characterised by limited coverage and capacity, presenting significant challenges for transportation and connectivity. The road infrastructure is underdeveloped, lacking paved roads and inadequate maintenance. The road network primarily consists of unpaved and poorly maintained roads, making transportation difficult, especially during the rainy season when many roads become impassable.

Coverage of the road network is limited, particularly in remote and rural areas. Primary roads connect significant towns and cities, but access to rural communities is often limited or non-existent. This hampers economic development, access to essential services, and the movement of goods and people across the country.

One of the significant challenges facing the road network in South Sudan is the lack of investment in infrastructure development and maintenance. Limited financial resources have resulted in inadequate road maintenance, leading to further deterioration of the existing roads. This, coupled with the country's harsh climate and topography, exacerbates the challenges of maintaining the road network.

To address these challenges, the government of South Sudan has initiated national development and investment programs to improve the road network. These programs aim to expand road coverage, rehabilitate existing roads, and construct new infrastructure. The government has sought partnerships with international organisations and donor agencies to secure funding for these projects.

Despite these efforts, significant obstacles and bottlenecks remain. Insecurity and conflicts in certain regions of the country pose challenges to the implementation of road projects. Additionally, the vastness of the country and the need for extensive road construction present logistical and financial challenges.

In terms of maintenance, the government is working towards establishing sustainable maintenance programs. This includes training local personnel for road maintenance activities and procuring necessary equipment. However, a lack of resources and technical expertise remains a hurdle to effective maintenance.

For more information on government contact details, please see the following link: 4.1 Government Contact List.

Road Security

The road security situation in South Sudan remains a significant concern, posing numerous challenges and risks for pedestrians and motorists. The country's road infrastructure is relatively underdeveloped, with poorly maintained and inadequate roads exacerbating security issues. One of the primary areas of issue is the prevalence of armed conflicts and intercommunal violence, which directly impacts road safety.

In many regions of South Sudan, armed groups operate along major highways, leading to frequent road blockades, ambushes, and vehicle attacks. These incidents not only endanger travellers' lives but also impede the flow of goods and humanitarian aid across the country. Moreover, the presence of landmines and unexploded ordnance from past conflicts further adds to the risks faced by road users.

Another significant issue is the lack of law enforcement and traffic management systems. The scarcity of well-trained and equipped police forces hampers their ability to patrol and regulate traffic effectively. This absence of proper enforcement allows for reckless driving behaviours, such as speeding, drunk driving, and vehicle overloading, which contribute to a high rate of accidents and fatalities on South Sudan's roads.

Additionally, the absence of proper lighting, signage, and road markings poses a significant hazard, especially during night-time travel. The lack of streetlights and reflective materials increases the chances of accidents and makes navigation more difficult. Furthermore, the inadequate communication infrastructure hampers emergency response systems, making it challenging to provide timely assistance to road accident victims.

Addressing these road security issues in South Sudan requires a comprehensive approach that includes investing in road infrastructure development, enhancing law enforcement capabilities, demining efforts, and promoting road safety awareness among the population. Only through concerted efforts and collaboration between the government, international organisations, and local communities can South Sudan make significant progress in ensuring safer roads for its citizens.

Weighbridges and Axle Load Limits

Currently, there are no weighbridges in the country and low capacity to enforce axle load limits.

South Sudan is adjusting to the regional axle load limits set through the Common Market for Eastern and Southern Africa (COMESA) and East African Community (EAC) requirements, which is currently set at a maximum of 56 tonnes with a 0% weighbridge allowance. These requirements permit some of the highest Gross Vehicle Mass limits in the world; however, countries in the region apply these load limits differently, so vehicles travelling through the region to South Sudan will be subject to compliance with the lowest axle load limit. Note that traffic from Ethiopia into Upper Nile State can move payloads of 45MT per truck.

|

Axle Load Limits |

South Sudan |

Kenya |

Uganda |

|---|---|---|---|

|

Truck with 2 Axles |

No Limits |

18,000 |

18,000 |

|

Truck with 3 Axles |

No Limits |

24,000 |

24,000 |

|

Truck with 4 Axles |

No Limits |

28,000 |

30,000 |

|

Semi-trailer with 3 Axles |

No Limits |

28,000 |

28,000 |

|

Semi-trailer with 4 Axles |

No Limits |

34,000 |

32,000 |

|

Semi-trailer with 5 Axles |

No Limits |

42,000 |

40,000 |

|

Semi-trailer with 6 Axles |

No Limits |

48,000 |

48,000 |

|

Truck & Drawbar Trailer with 4 Axles |

No Limits |

36,000 |

38,000 |

|

Truck & Drawbar Trailer with 5 Axles |

No Limits |

42,000 |

42,000 |

|

Truck & Drawbar Trailer with 6 Axles |

No Limits |

48,000 |

50,000 |

|

Truck & Drawbar Trailer with 7 Axles |

No Limits |

54,000 |

56,000 |

Road Class and Surface Conditions

For more information on the road conditions follow this link to the access constraint maps which are updated every week: https://logcluster.org/en/document/south-sudan-access-constraints-map-16-october-2023

South Sudan, Republic of - 2.4 Railway Assessment

South Sudan, Republic of - 2.5 Waterways Assessment

A large section of the White Nile flows through South Sudan and the country have access to approximately 1400km of navigational waterways stretching from Juba in the south, to Kosti in North Sudan, and from Bentui in the west to Akobo on the Ethiopian border to the east. The river is accessible throughout the year, and during the rainy season the Nile is the only reliable transport link between the southern, central and northern areas of the country. Many of the rivers tributaries are also navigable, however these are only considered passable during the rainy reason.

Although navigational throughout the year, water levels fluctuate during the rainy and dry seasons. In some areas this results in the reduced cargo carrying capacity of barges with barge operators loading vessels according to seasonal draft and clearance requirements. Standard barges take around 400mt but at times during the dry season and in some sections such as between Juba-Bor, the river is only navigable with 300mt. Various barge operators and powerboat owner-operators provide transport services along the length of the river, with the major ports of Mangalla, Bor, Shambe, Adok, Malakal and Renk easily accessible. The majority of river ports are nothing more than an easily accessible riverbank from which porters can load and offload cargo. Loading and offloading facilities, including access to equipment remain problematic.