Türkiye

|

Country name: |

Türkiye |

|---|---|

|

Official country name: |

The Republic of Türkiye |

Assessment details - based on field mission

| From | August 2023 |

|---|---|

| To | August 2023 |

| Name, Title and Contact of Assessors |

Ahmed Abu Elkheir;

|

Table of Contents

| Chapter | Name of Assessor | Organization | Date updated |

|---|---|---|---|

1 Türkiye Country Profile |

Ahmed Abu Elkheir | WFP | August 2023 |

| 1.1 Türkiye Humanitarian Background | Ahmed Abu Elkheir;

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 1.2 Türkiye Regulatory Departments and Quality Control | Ahmed Abu Elkheir | WFP | August 2023 |

| 1.3 Türkiye Customs Information |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

2 Türkiye Logistics Infrastructure |

Debora GROSSI Ozan TUNC |

WFP | August 2023 |

| 2.1 Türkiye Port Assessment | Debora GROSSI | WFP | August 2023 |

| 2.1.1 Türkiye Port of Mersin |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.2 Türkiye Port of Izmir |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.3 Türkiye Port of Akdeniz – Antalya |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.4 Türkiye Port of Limak-Iskenderun |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.5 Türkiye Port of Borusan |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.6 Türkiye Port of Samsun |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.7 Türkiye Port of Asyaport |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.8 Türkiye Port of Gemlik |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.1.9 Türkiye Port of Ambarli |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 2.2 Türkiye Aviation |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 2.2.1 Türkiye Istanbul International Airport |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

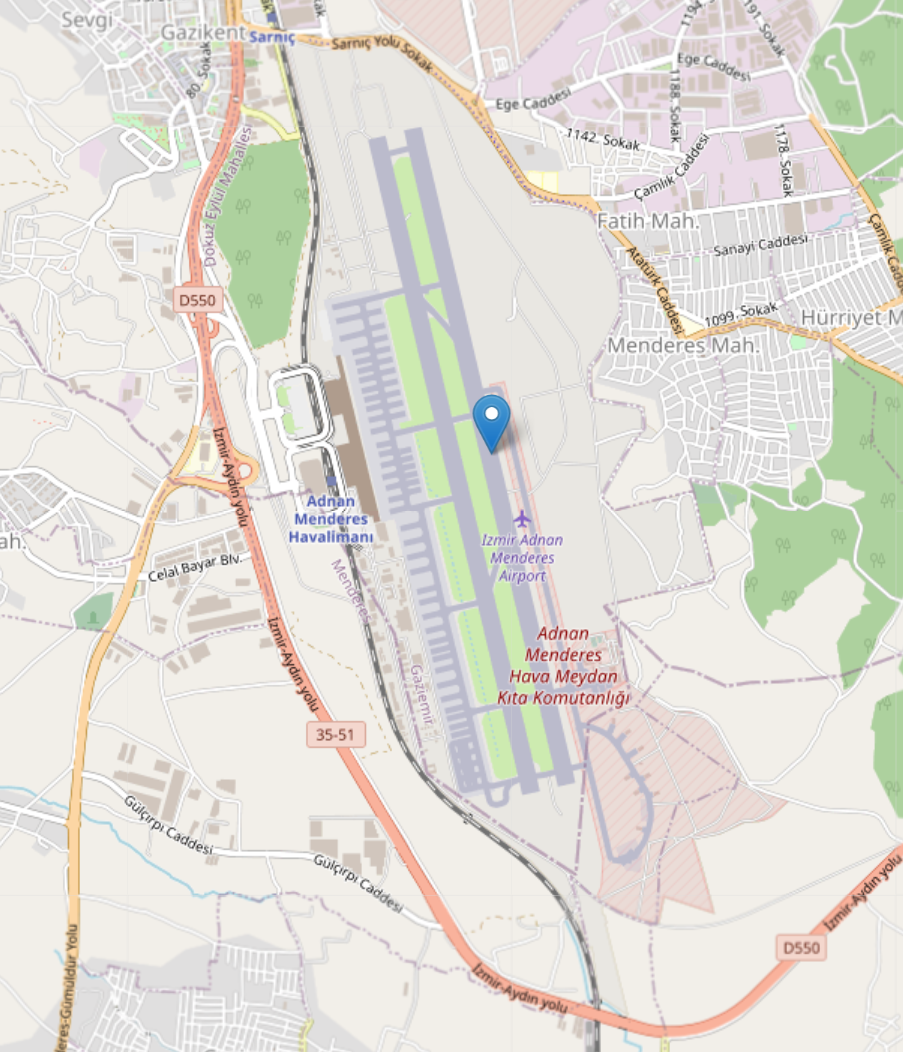

| 2.2.2 Türkiye Izmir International Airport |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.2.3 Türkiye Antalya International Airport |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

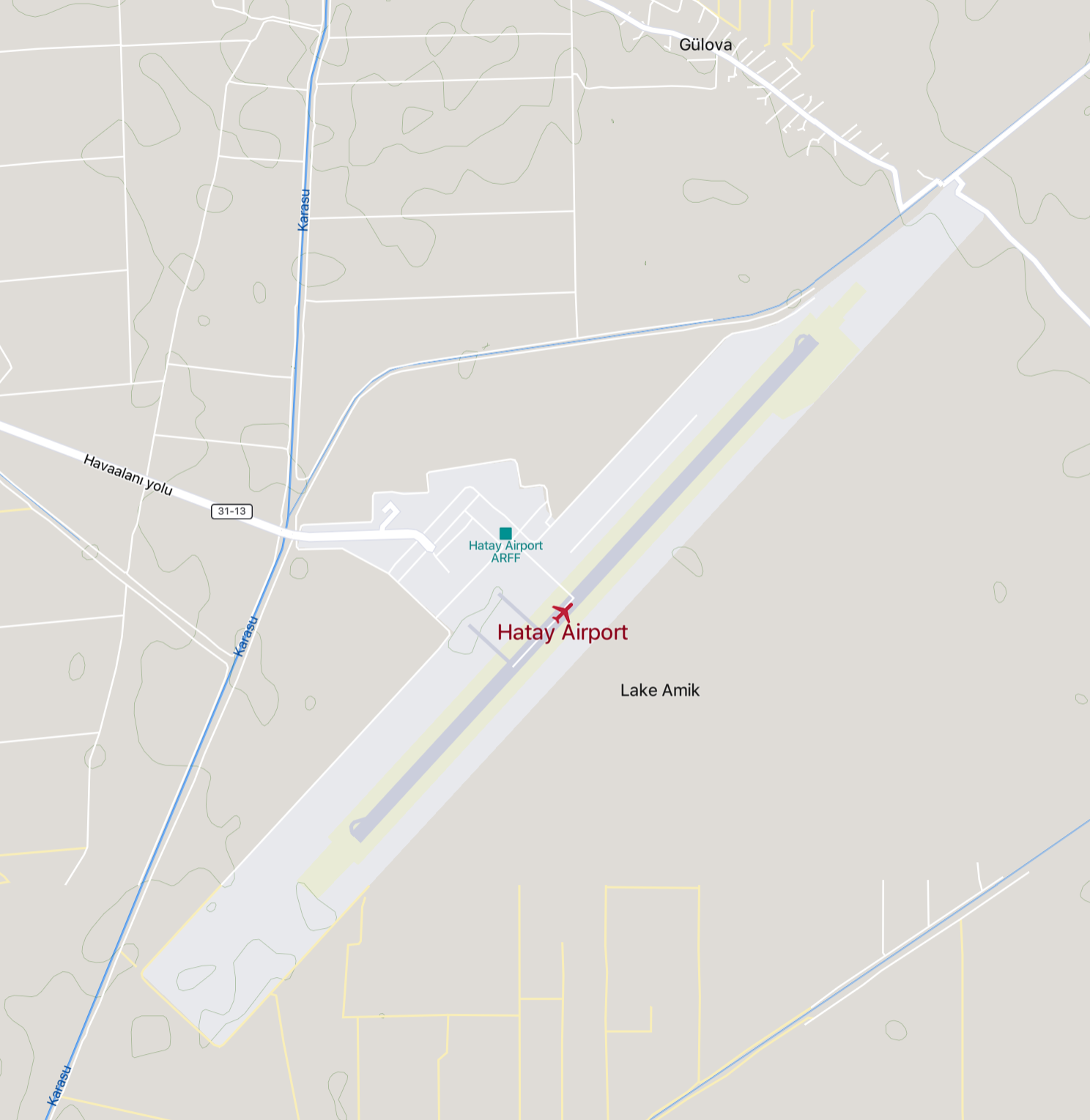

| 2.2.4 Türkiye Hatay Airport |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

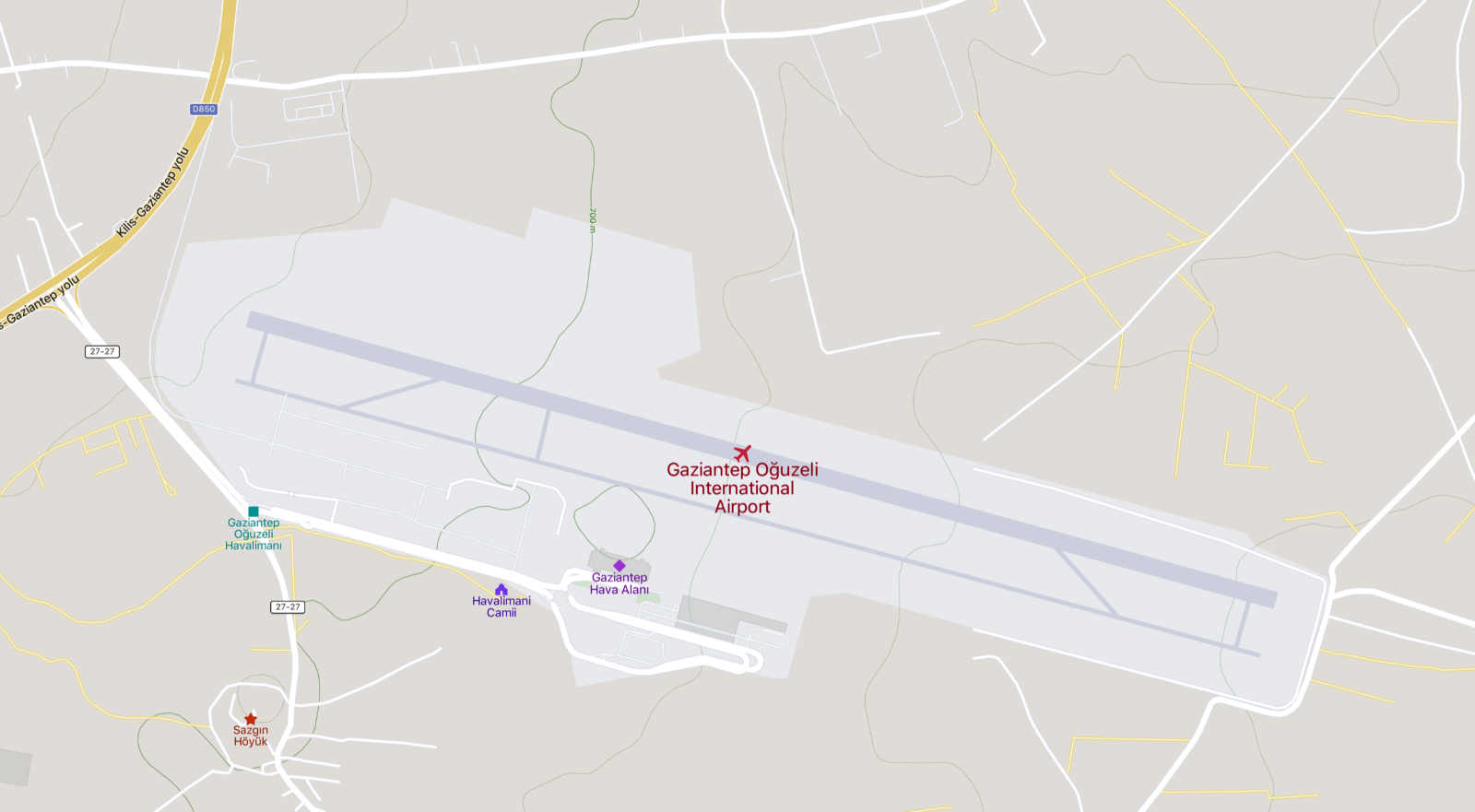

| 2.2.5 Gaziantep Oğuzeli International Airport |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.2.6 Trabzon International Airport |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

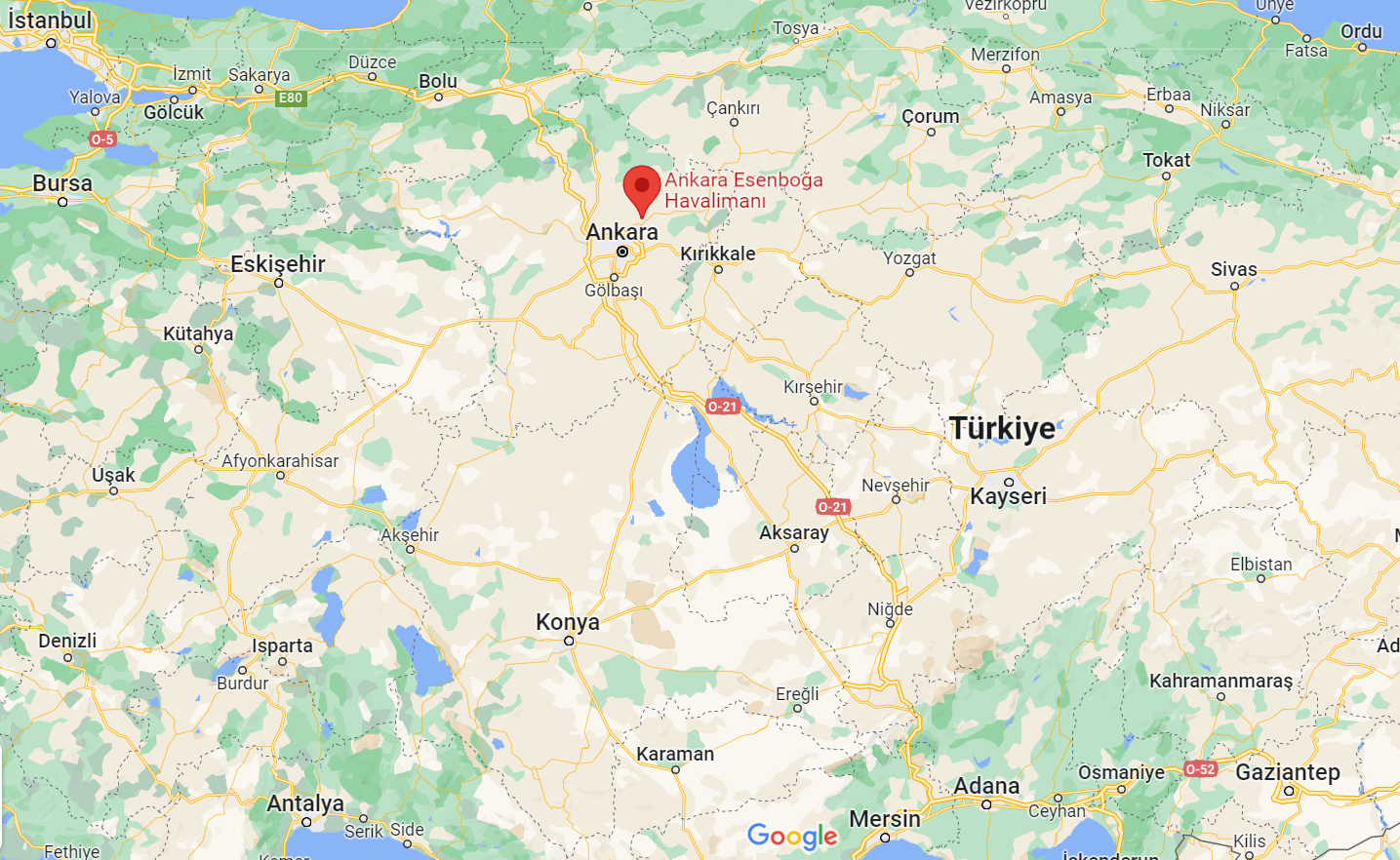

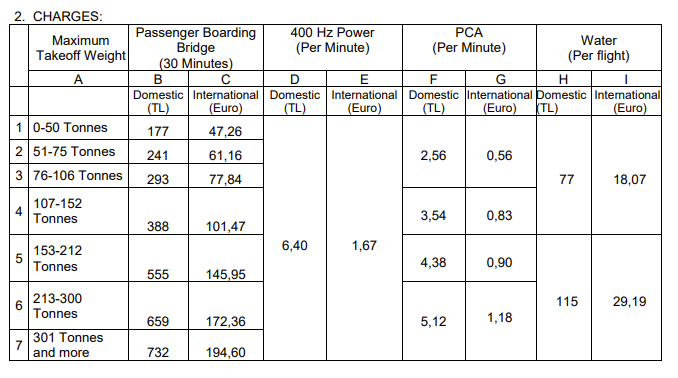

| 2.2.7 Ankara Esenboğa International Airport |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

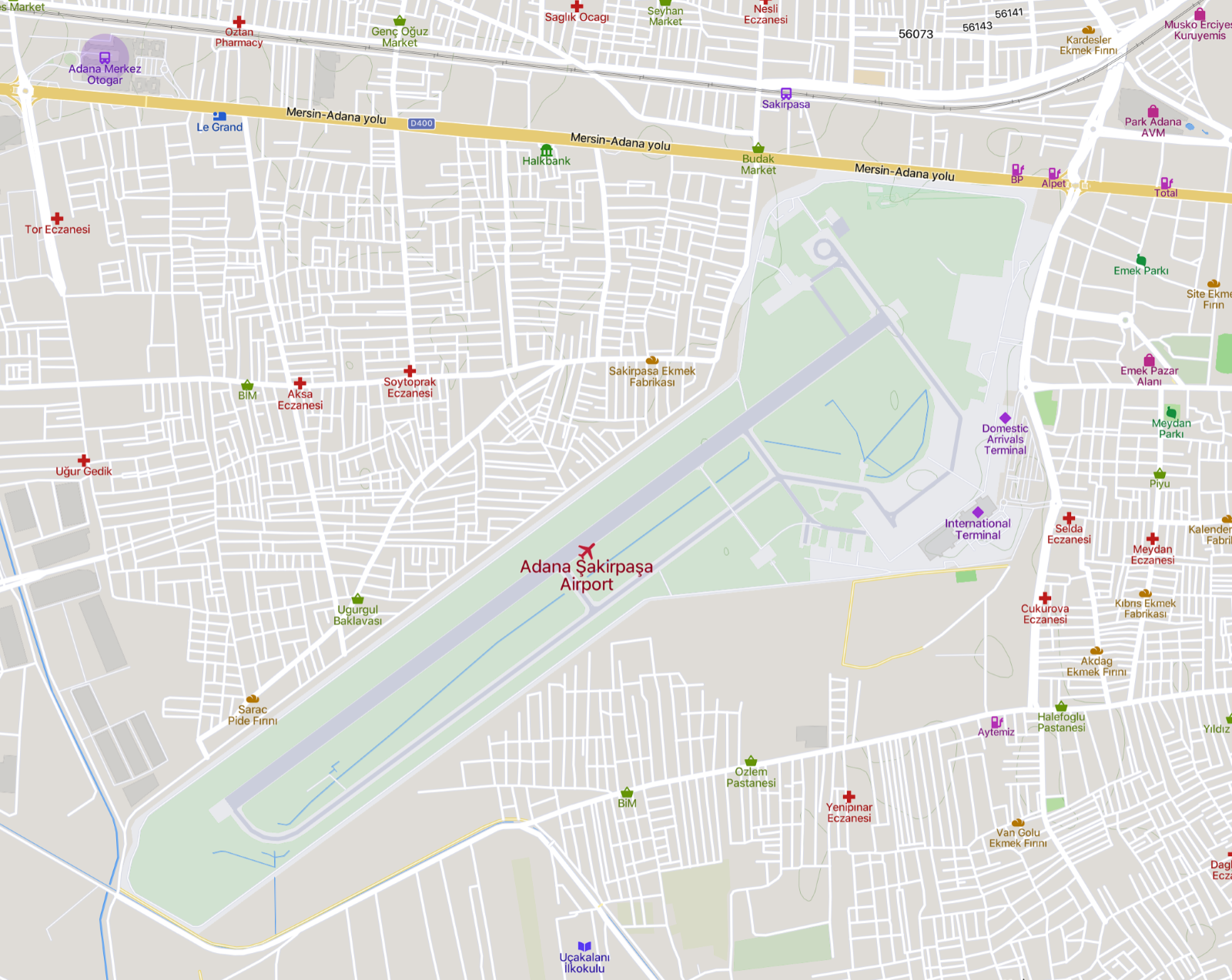

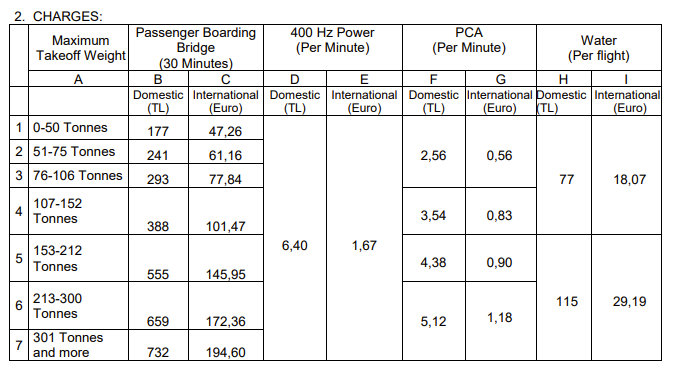

| 2.2.8 Adana Şakirpaşa International Airport |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.2.9 Istanbul Sabiha Gökçen International Airport |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

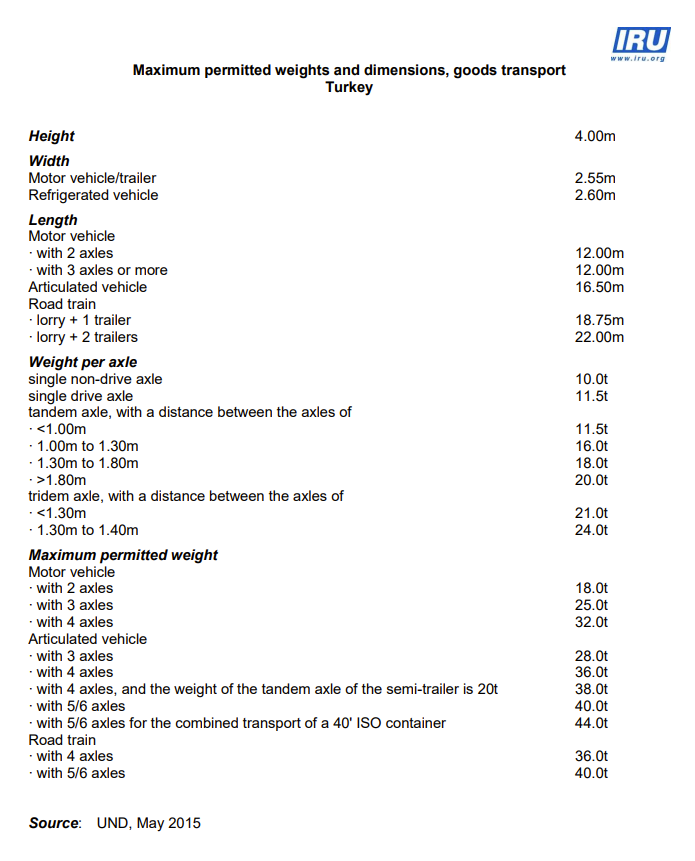

| 2.3 Türkiye Road Network |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 2.3.0 Border Crossing of Bulgaria and Greece |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 2.3.1 Border Crossing of Reyhanlı |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.3.2 Border Crossing of Öncüpınar |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.3.3 Border Crossing of Cobanbey |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.3.4 Border Crossing of Habur |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.3.5 Border Crossing of Gürbulak |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.3.6 Border Crossing of Sarp Sınır Kapısı |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.3.7 Border Crossing of Kipi İpsala |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 2.3.8 Border Crossing of Hamzabeyli Lesovo |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 2.3.9 Border Crossing of Kapitan Andreevo Kapikule |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

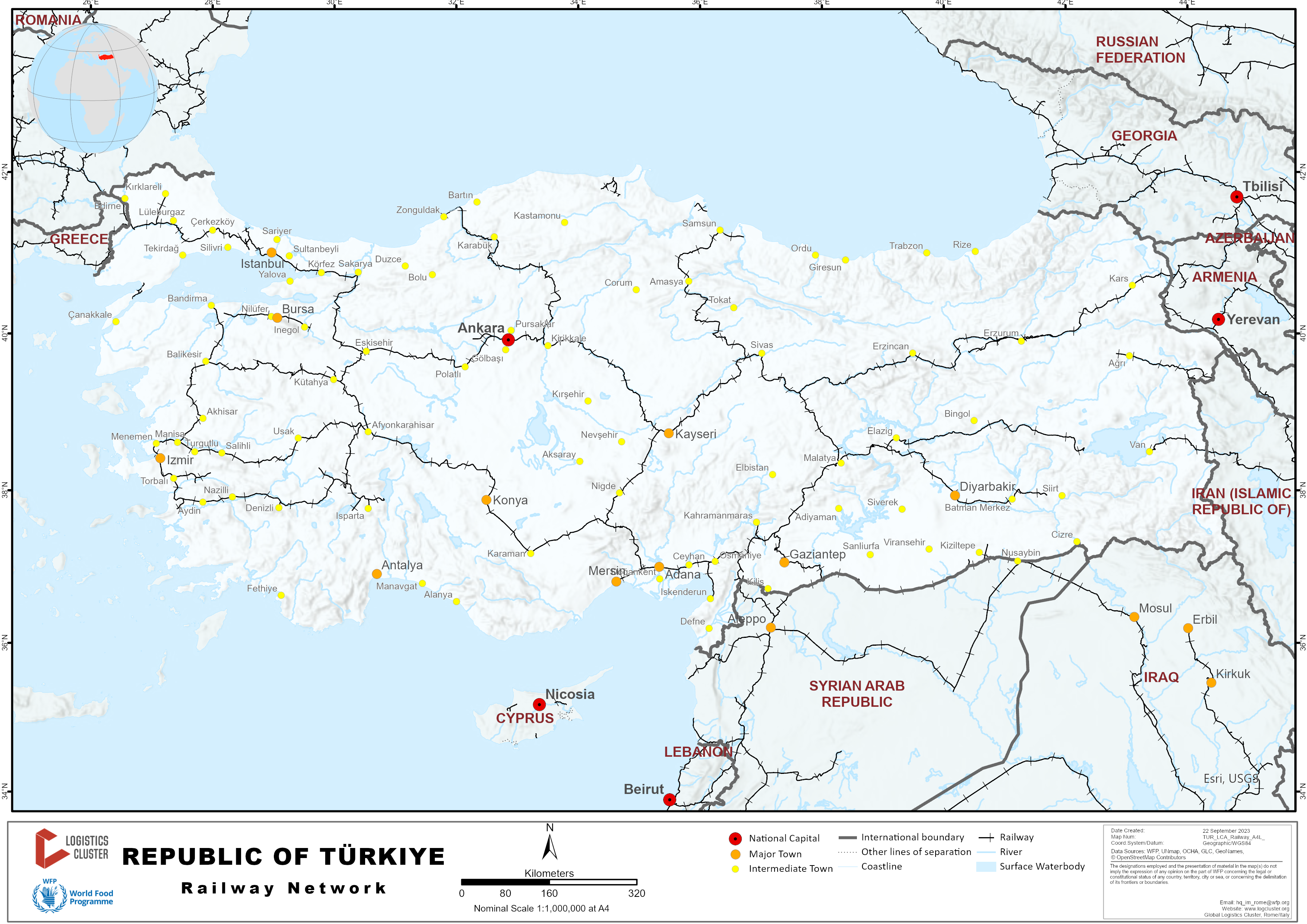

| 2.4 Türkiye Railway Assessment |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

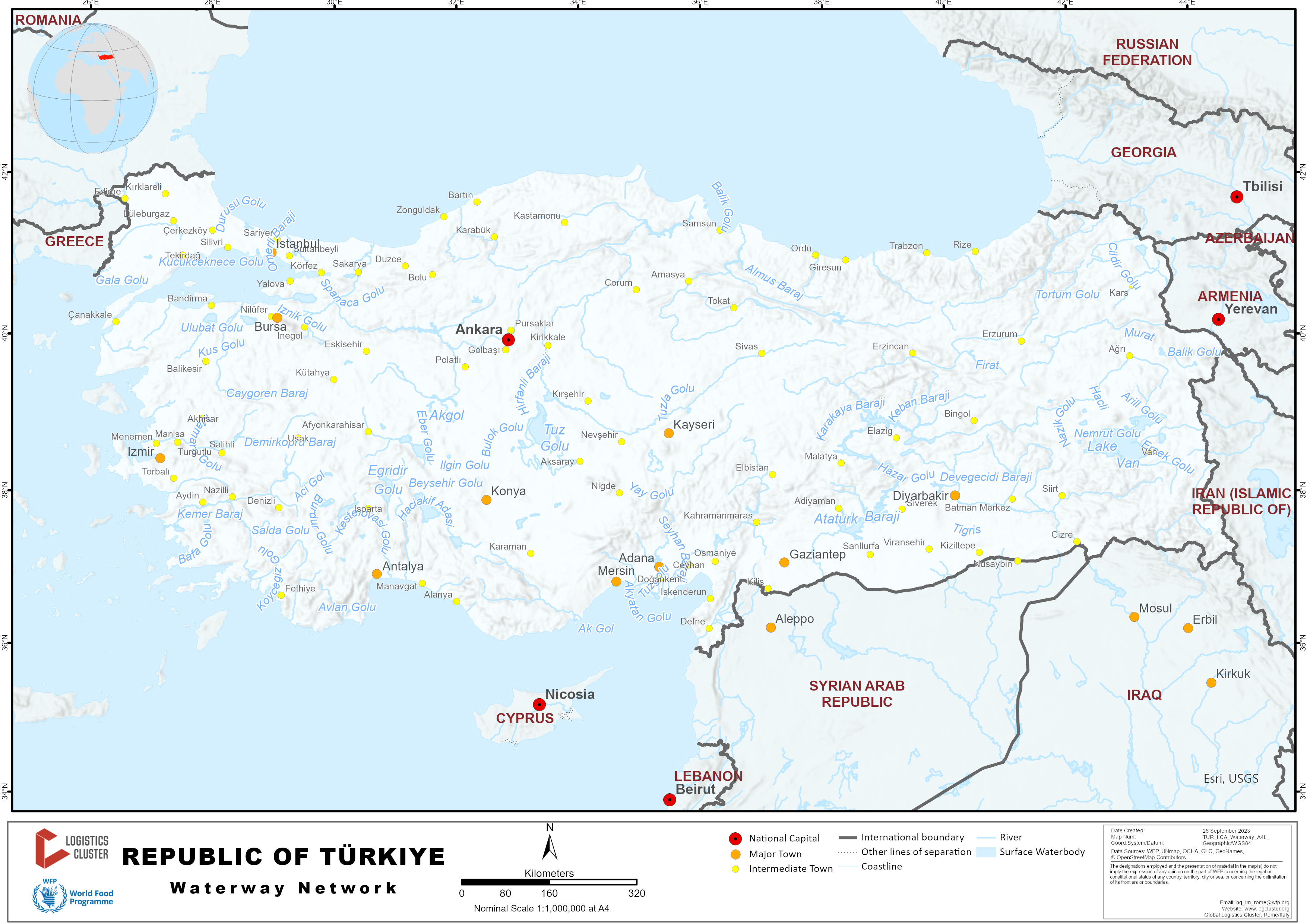

| 2.5 Türkiye Waterways Assessment |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

| 2.6 Türkiye Storage Assessment |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

|

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 | |

| 2.7.1 Türkiye Milling Assessment - Ozmen Un |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.7.2 Türkiye Milling Assessment - Beşler Un |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.7.3 Türkiye Milling Assessment - Eksun Un |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 2.7.4 Türkiye Milling Assessment - Ozmermer Un |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

3 Türkiye Logistics Services |

Bashar Shehadeh, Veton Gorani | WFP | Oct-17 |

| 3.1 Türkiye Fuel |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 3.2 Türkiye Transporters |

Ahmed Abu Elkheir Erdi YATGIN Cholpon TURSUNALIEVA |

WFP | August 2023 |

| 3.3 - Türkiye Manual Labour | Cholpon TURSUNALIEVA | WFP | August 2023 |

| 3.4 Türkiye Telecommunications | Noran ELSONBOSY | WFP | August 2023 |

| Noran ELSONBOSY | WFP | August 2023 | |

|

Ahmed Abu Elkheir Cholpon TURSUNALIEVA |

WFP | August 2023 | |

| 3.6 Türkiye Additional Services | Bashar Shehadeh, Veton Gorani | WFP | Oct-17 |

| 3.7 Waste Management and Recycling Infrastructure Assessment |

Debora GROSSI Ozan TUNC Derya BAYKAL |

WFP | August 2023 |

4 Türkiye Contact Lists |

Ahmed Abu Elkheir, Mustafa Aydin | WFP | August 2023 |

| Ahmed Abu Elkheir | WFP | August 2023 | |

| 4.2 Türkiye Humanitarian Agency Contact List | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.3 Türkiye Laboratory and Quality Testing | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.4 Türkiye Port and Waterways Company Contact List | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.5 Türkiye Airport Companies Contact List | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.6 Türkiye Storage and Milling Company Contact List | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.7 Türkiye Fuel Providers Contact List | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.8 Türkiye Transporter Contact List | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.10 Türkiye Supplier Contact List | Ahmed Abu Elkheir | WFP | August 2023 |

| 4.11 Türkiye Additional Services Contact Lists | Bashar Shehadeh, Veton Gorani | WFP | Oct-17 |

5 Türkiye Annexes |

Ahmed Abu Elkheir, Mustafa Aydin | WFP | August 2023 |

| 5.1 Türkiye Acronyms and Abbreviations | Ahmed Abu Elkheir, Mustafa Aydin | WFP | Jan-14 |

| 5.2 Customs information 2015 | WFP | August 2023 | |

| 5.3 Customs information - list and classes of customs offices | WFP | August 2023 | |

| 5.4 Transport and Logistics Master Plan | WFP | August 2023 | |

| 5.5 Logistics Market Overview | WFP | August 2023 | |

| 5.6 Maritime Sector Report 2022 | WFP | August 2023 | |

| 5.7 Port Sector 2023 Report | WFP | August 2023 | |

| 5.8 Airport changes 2023 | WFP | August 2023 | |

| 5.9 Road Network Distances Matrix | WFP | August 2023 | |

| 5.10 Rail Transport Map | WFP | August 2023 | |

| 5.11 Izmir Rapid Transit Map | WFP | August 2023 | |

| 5.12 Transporters and Logistics Services Professional Committee - Ankara | WFP | August 2023 |

Türkiye - 1 Country Profile

Generic Information

Türkiye, officially the Republic of Türkiye, is a transcontinental country located mainly on the Anatolian Peninsula in Western Asia, with a small portion on the Balkan Peninsula in Southeast Europe. It borders the Black Sea to the north; Georgia to the northeast; Armenia, Azerbaijan, and Iran to the east; Iraq to the southeast; Syria and the Mediterranean Sea to the south; the Aegean Sea to the west; and Greece and Bulgaria to the northwest. Cyprus is off the south coast. Most of the country's citizens are ethnic Turks, while Kurds are the largest ethnic minority. Ankara is Türkiye's capital and second-largest city; Istanbul is its largest city and main financial center.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a generic country overview, please consult the following sources:

Türkiye Wikipedia Country Information https://en.wikipedia.org/wiki/Türkiye

Türkiye IMF Country Information https://www.imf.org/en/Countries/TUR

Türkiye Economist Intelligence Unit Information* http://country.eiu.com/Türkiye

(*note - this is a paid service)

Humanitarian Info

Türkiye World Food Programme Information https://www.wfp.org/countries/turkiye

Türkiye UN Office for the Coordination of Humanitarian Affairs Information https://www.unocha.org/turkiye

Facts and Figures

Türkiye Wolfram Alpha Information https://www.wolframalpha.com/input?i=Türkiye

Türkiye World Bank Information https://www.worldbank.org/en/country/Türkiye

Türkiye Population Information https://worldpopulationreview.com/countries/Türkiye-population

Türkiye - 1.1 Humanitarian Background

Disasters, Conflicts and Migration

|

Natural Disasters |

||

|---|---|---|

|

Type |

Occurs |

Comments / Details |

|

Drought |

Yes |

Drought is common in Türkiye, especially in the south and center of the country, with 2021 being the driest in 2 decades. Droughts are forecast to occur more frequently due to climate change, and 2023 began with drought. Most water loss is due to poor irrigation. In 2022 the World Bank said that “without reform, a 10% fall in water supply in Türkiye could reduce GDP by 6% |

|

Earthquakes |

Yes |

Türkiye is in one of the most actively deforming regions in the world. In Türkiye, there are partly large earthquakes with strengths of more than 7.0, which cause damages within a radius of over 100 kilometers. Compared to the size of the country, earthquakes occur with above-average frequency Since 1950, more than 85,000 people died from the direct consequences of earthquakes. There were 7 earthquakes that also caused a subsequent tsunami, which claimed further lives and cause additional damage. The strongest earthquake in Türkiye happened on 02/06/2023 in Türkiye; Syria region with a magnitude of 7.8 on the Richter scale. The shifting of tectonic plates in a depth of 17 km resulted in 49470 deaths. |

|

Epidemics |

Yes |

Türkiye reported its first COVID-19 case on March 10, 2020. Although a variety of preventive measures had been put into practice at individual and public levels starting from mid-January 2020 and were tightened over the course of COVID-19 in Türkiye, the number of cases has increased rapidly. Türkiye has risen to the list of top 10 countries with the highest COVID-19 cases globally |

|

Extreme Temperatures |

Yes |

on 20th July 2021, Türkiye set a new national temperature record, as the Cizre district in the southeastern province of Şanlıurfa registered a temperature of 49.1°C, local media outlets said. The previous record, 49.0°C was registered on Aug. 27, 1961 – again in Cizre.

The lowest temperature in the country was recorded in the Çaldıran district in the eastern province of Van on Jan. 9, 1990 at -46.4°C. |

|

Flooding |

Yes |

Istanbul Flood, 2009 The 2009 Turkish flash floods were a series of flash floods that occurred on 9 September 2009 in and around Istanbul, Tekirdağ, and the rest of the Marmara Region of Türkiye. The floods led to the death of at least 31 people and the cost of damage has been estimated as being in excess of $70 million. At least 31 people were killed across the region and dozens were stranded in cars or on rooftops and an unknown number remain missing. Three of the deaths occurred in the western suburbs of Istanbul on 8 September, and 21 people lost their lives in Istanbul on 9 September.

In some places the water reached a meter (3 ft) in height, cutting access to Istanbul's main airport and the highway running to Bulgaria and Greece. According to state-run news agency Anatolia News, one building collapsed, although there were no reported casualties. In northwest Türkiye two bridges on the Bahçeköy–Saray highway were also destroyed by floods at the same time. More than 200 cars have been washed into the Marmara Sea and dozens of trucks damaged. EDİRNE FLOOD, 2015 Heavy rainfall hit Edirne, a north-western province on the border with Greece, causing the Tunca and Meriç riverbeds to overflow and forcing hundreds of people to be evacuated from their villages to safer zones on Sunday. 1,500 people had to evacuate in the Karaağaç neighbourhood and all residents living in Değirmen Village. The evacuated residents were placed in a public gymnasium hall, as experts expect the river discharge to rise to 2,500 cubic meters per second.

The overflow of Tunca and Meriç rivers as a result of heavy precipitation caused closures on the main road in Karaağaç neighbourhood, where 5000 people reside.

|

|

Insect Infestation |

No |

|

|

Landslides |

Yes |

Earthquakes and landslides are the most serious geological hazards in Türkiye. The landslide phenomenon in Türkiye is mostly observed in the Eastern Black Sea Region in the Black Sea Region, mostly in the Central and Eastern Anatolia Regions almost every year lead to many loss of life and property 1985 WEST CARIBBEAN MARITIME DISTRICTS: Following the extremely snowy winter season, 1684 houses in Zonguldak, Kastamonu and Sinop provinces suffered landslide damage, which suddenly appeared at the beginning of spring as snow. 23.06.1988 ÇATAK TEXTURE: Catak village in Trabzon Province, Türkiye, is a scattered collection of houses on the main Trabzon-Erzurum road, 30 km inland from the Black Sea coast. The village is sited on the valley floor of the Degirmen River, which has incised deeply through an alternating sequence of Upper Cretaceous flysch deposits and volcanic lavas to yield steep terrain with a relative relief of about 1000 m. The confined nature of the valley floor at Catak, together with the additional constraints imposed by a river confluence and a cemetary, necessitated that improvement of the road in 1984 involved an alignment on the eastern margin of the valley. This cut into the base of a slope 225 m high, standing at an overall angle of 40°. On 22 June 1988 the colluvial materials mantling the lower part of this slope failed and blocked the road. A grader was despatched to the scene, but clearing operations were postponed until the morning because of fears that continuing heavy rainfall might cause further failures. The Catak landslide received widespread media coverage as the death toll was initially estimated as being up to 300 people. 19 / 20.06.1990 TRABZON-GİRESUN-GÜMÜŞHANE TERMS: The events of landslides and floods, which caused the death of 65 people in each of the three villages and caused massive loss of money, came to fruition. 07 / 08.08.1998 TRABZON-BEŞKÖY LAYER: 50 people lost their lives and 101 houses were destroyed. Trabzon, which is located in the northeast region near the Black Sea, is one of the areas where landslides most commonly occur. Between 1950 and the present, there have been more than 270 landslides in Trabzon. The factors affecting the occurrence of landslides are the morphology of the region, geological structure, weathering of rocks, meteorological characteristics, settlement types, and various types of excavation work. Heavy precipitation, sloping topography, and the removal of forests for agricultural purposes increase the landslide risk. AYVACIK LANDSLIDE 12 / 02/2017 Following the earthquake of 5.3, a mountain slip on the mountain near the Babakale Harbor in the Ayvacik district came to the scene. There was a landslide during an earthquake on a steep slope at Babakale Harbor, which is very close to the earthquake zone. |

|

Volcanic Eruptions |

Yes |

Türkiye isn’t best known for exploding mountains, but the fact is that it has both active and extinct volcanoes, one of which is none other than the famed Mount Ararat. The last major volcanic disaster in Türkiye occurred in 1840 from Mount Ararat, when an estimated 1900 people lost their lives. However, there is a 70% chance of a major eruption in this century based on global statistics and preliminary analysis of Turkish eruption records. |

|

High Waves / Surges |

Yes |

A total of 7 tidal waves classified as a tsunami since 365 have killed 705 people in Türkiye. Compared to other countries, Tsunamis, therefore, occur rather rarely. The strongest tidal wave registered in Türkiye so far reached a height of 5.3 meters. On 10/30/2020, no losses of human lives have been registered by this tsunami. |

|

Wildfires |

Yes |

Wildfires in the forests of Türkiye are common in summer, principally in the Mediterranean and Aegean regions, Since the 1940's the number of fires per year had increased from around 1000 to around 3500. In July and August 2021, a series of more than two hundred wildfires burnt 1,700 square kilometres of forest in Türkiye's Mediterranean Region in the worst-ever wildfire season in the country's history. The wildfires started in Manavgat, Antalya Province, on 28 July 2021, with the temperature around 37 °C (99 °F). As of 9 August 2021, two fires were still burning, both in Muğla. The fires are part of a larger series of wildfires, including those in neighbouring Greece, originating from a heatwave made more likely by climate change. |

|

Other Comments |

|

|

|

Man-Made Issues |

||

|

Civil Strife |

Yes |

Approximately thirty million Kurds live in the Middle East—primarily in Iran, Iraq, Syria, and Türkiye—and the Kurds comprise nearly one-fifth of Türkiye’s population of seventy-nine million. The PKK, established by Abdullah Ocalan in 1978, has waged an insurgency since 1984 against Turkish authorities with the objective of establishing an independent Kurdish state. The ongoing conflict has resulted in nearly forty thousand deaths.

in June 2013 Gezi Park protests, a group of activists staged a sit-in at Istanbul’s Gezi Park, protesting the Turkish government’s plans to demolish the park to build a replica of the Ottoman-era Taksim Military Barracks that would include a shopping mall. The forced eviction of protesters from the park sparked an unprecedented wave of mass demonstrations. Around 3 million people took to the streets across Türkiye over a three-week period.

in July 2016 coup attempt, a faction within the Turkish Armed Forces, organized as the Peace at Home Council, attempted a coup d'état against state institutions, including the government. They attempted to seize control of several places in Ankara, Istanbul, Marmaris, and elsewhere, such as the Asian side entrance of the Bosphorus Bridge but failed to do so after pro-government protestors tackle them. During the coup attempt, over 300 people were killed and more than 2,100 were injured. Many government buildings, including the Turkish Parliament and the Presidential Palace, were bombed.

|

|

International Conflict |

Yes |

The Cyprus conflict is an ongoing dispute between Greek Cypriots in the south and Turkish Cypriots in the north. Initially, with the occupation of the island by the British Empire from the Ottoman Empire in 1878 and subsequent annexation in 1914, the "Cyprus dispute" was a conflict between the Turkish and Greek islanders. In 1983, the Turkish Cypriot community unilaterally declared independence, forming the Turkish Republic of Northern Cyprus, a sovereign entity that lacks international recognition with the exception of Türkiye, with which Northern Cyprus enjoys full diplomatic relations, in violation of Resolution 550, adopted on 11 May 1984 by the United Nations Security Council. As a result of the two communities and the guarantor countries committing themselves to finding a peaceful solution to the dispute, the United Nations maintains a buffer zone (known as the "Green Line") to avoid any further intercommunal tensions and hostilities. This zone separates the southern areas of the Republic of Cyprus (predominantly inhabited by Greek Cypriots), from the northern areas (where Turkish Cypriots and Turkish settlers are a majority). Recent years have seen a warming of relations between Greek and Turkish Cypriots, with officially renewed reunification talks beginning in early 2014, though the talks have continuously stalled and resumed multiple times since they began. United Nations-led talks in 2021 similarly failed. |

|

Internally Displaced Persons |

Yes |

According to MHP Chairman Devlet Bahçeli, due to the earthquakes that began on 6 February 2023, 1,914,292 people are sheltered in tents, containers, dormitories, hotels, public guesthouses and facilities and other accommodation areas in and outside the disaster area. |

|

Refugees Present |

Yes |

Türkiye currently hosts the largest refugee population in the world with nearly 4 million people. Some 3.7 million of them are Syrians who fled the ongoing conflict that has been ravaging their country for over 11 years, while 322,000 registered refugees come from Afghanistan, Iraq, Iran and Somalia amongst other countries. Most refugees in Türkiye live outside camps, with growing but still limited access to basic services. |

|

Landmines / UXO Present |

Yes |

According to Turkish government data, Türkiye has a total of 3,834 areas measuring 145,733,105 square meters containing 855,782 anti-personnel and anti-tank mines. It has 20,275 anti-personnel mines positioned in 43 zones along the Armenian border and 116,115 mines in 471 zones along the Iranian border. Türkiye has 78,917 mines at 874 places along the Iraqi border. Most mines were planted along the Syrian border, where 411,490 anti-personnel and 194,615 anti-tank mines remain. In total Türkiye has nearly 700,000 mines that need to be destroyed by 2025. |

|

Other Comments |

|

|

For a more detailed database on disasters by country, please see the Centre for Research on Epidemiology of Disasters Country Profile.

Seasonal Effects on Logistics Capacities

|

Seasonal Effects on Transport |

||

|---|---|---|

|

Transport Type |

Time Frame |

Comments / Details |

|

Primary Road Transport |

mid-December to mid-March |

Severe winter weather, including low temperatures, high winds, and heavy precipitation, causes ground and air transport disruption Traffic and commercial trucking delays are possible along regional highways. Difficult and potentially dangerous driving conditions are also likely on secondary and rural roadways in the affected provinces as maintenance crews prioritize clearing major routes. Authorities could close stretches of the highway if driving conditions become too hazardous. Mountain passes and tunnels could be closed as a precautionary measure during periods of intense snowfall. Gusty winds may threaten to topple high-profile vehicles throughout the affected area. Flight delays and cancellations are likely due to ground stops and de-icing operations at airports in the affected regions. |

|

Secondary Road Transport |

mid-December to mid-March |

Same as Primary Transportation |

|

Rail Transport |

mid-December to mid-March |

Flooding or snow could block regional rail lines; freight and passenger train delays and cancellations are possible in areas that see heavy rainfall and potential track blockages. |

|

Air Transport |

mid-December to mid-March |

Severe winter weather, including low temperatures, high winds, and heavy precipitation, causes ground and air transport disruption Traffic. Flight delays and cancellations are likely due to ground stops and de-icing operations at airports in the affected regions. |

|

Waterway Transport |

mid-December to mid-March |

Rising sea levels and greater wave activity causing erosion put vital coastal transport infrastructure at risk causing disruptions to operations and closure of seaports for many days also Floodwaters and related debris may render some bridges impassable |

|

Seasonal Effects on Storage and Handling |

||

|---|---|---|

|

Activity Type |

Time Frame |

Comments / Details |

|

Storage |

|

No significant Effect |

|

Handling |

|

No significant Effect |

Capacity and Contacts for In-Country Emergency Response

GOVERNMENT

Disaster and Emergency Management Authority (AFAD)

The 1999 Marmara earthquake marked a turning point in the area of disaster management and coordination. This devastating disaster clearly demonstrated the need to reform disaster management and compelled the country to establish a single government institution to single-handedly coordinate and exercise legal authority in cases of disaster and emergencies. In line with this approach, the Turkish Parliament passed Law No.5902 in 2009 to form the Disaster and Emergency Management Authority (AFAD) under the Prime Ministry and abolish various agencies under whose jurisdiction the issue previously fell. Türkiye adopted a presidential system of governance after a referendum that took place on April 16, 2017. And the new executive presidential system entered into force with the June 24 elections. Presidential Decree No. 4 which was published in the Official Gazette on July 15, 2018, and the Disaster and Emergency Management Authority (previously an agency under the office of the Prime Ministry) re-formed as an agency under the Ministry of Interior.

Disaster and Emergency Management Authority is an institution working to prevent disasters and minimize disaster-related damages, plan and coordinate post-disaster response, and promote cooperation among various government agencies.

AFAD currently has 81 provincial branches across Türkiye in addition to 11 search and rescue units.

Notwithstanding its position as the sole authority on disasters and emergencies, AFAD cooperates with a range of government institutions and non-governmental organizations depending on the nature and severity of individual cases.

Over the past seven years, the Disaster and Emergency Management Authority coordinated to Türkiye's response to a number of devastating earthquakes and floods, among others, and helped survivors get their lives back on track. At the international level, AFAD completed successful missions to provide humanitarian assistance to over 50 countries in 5 continents including Somalia, Palestine, Ecuador, Philippines, Nepal, Yemen, Mozambique, Chad, and many others.

Address: Üniversiteler Mah. Dumlupınar Bulvarı No: 159 ( Eskişehir Yolu 9. Km ) Çankaya/ Ankara

Mail: basin.halklailiskiler@afad.gov.tr

Pbx: 0 (312) 258 23 23

Fax: 0 (312) 258 2082

Updated contact list: https://en.afad.gov.tr/afad-contact-list

For more information on government contact details, please see the following link: 4.1 Government Contact List

HUMANITARIAN COMMUNITY

The United Nations in Türkiye

The United Nations was established on 24 October 1945, after the Second World War, by 51 countries including Türkiye, to achieve a great vision for humanity: maintaining international peace and security, promoting sustainable development, and securing human rights. Its membership now encompasses 193 countries, with its work touching the lives of people in every corner of the globe. As a founding member of the United Nations, Türkiye has actively and significantly contributed to facilitating effective implementation of the UN mandate, ranging from peacekeeping and peace building to improving the lives and livelihoods of the poor world-wide.

The Organization has been working for more than 50 years in Türkiye, as a partner with the government, private sector, media, women’s groups, NGOs, academia and other representatives of civil society to support the implementation of Türkiye's national vision and implement national programmes and priorities.

UN Türkiye initiatives place special emphasis on building capacity, assisting in the design and formulation of national policies, strategies and action plans, sharing information, knowledge and experience and bringing best practices from around the globe to enrich the national development process, in addition to transferring Türkiye's success story in development to third countries.

Cooperation framework between the UN and Türkiye is to improve Türkiye’s performance in human development indices taking into consideration Türkiye’s status as an upper Middle Income Country (MIC) on the one hand, and the comparative and competitive advantages of the United Nations system in Türkiye on the other.

As a result of enhanced cooperation between Türkiye and the UN, İstanbul has become a regional hub to several UN agencies including the UN Development Coordination Office (DCO). The UN will continue to further strengthen the close work with the Turkish Government.

Türkiye continues to host the largest number of refugees worldwide, with close to 4.1 million refugees, including 3.7 million Syrians and nearly 322,000 asylum-seekers and refugees of other nationalities. UN will continue to work with Türkiye in refugee and migrant related issues and urge international community for more burden sharing in humanitarian issues.

UN Agencies contact list (Updated) : https://turkiye.un.org/en/contact-us

UN-OCHA

OCHA Türkiye is one of the three OCHA hubs working together to implement the Syria Humanitarian Response Plan (HRP) collectively in the spirit of the whole of Syria.

The coordination system in southern Türkiye for cross-border operations to Syria was established in 2013. OCHA Türkiye works with the United Nations agencies and humanitarian partners including international organizations, Syrian NGOs, Turkish NGOs, and various governmental and other authorities to support needs assessments, identification and analysis of needs, share information on the response, provide access analysis and facilitate the operating environment including on border crossing regulations. OCHA supports the southern Türkiye coordination architecture comprised of nine clusters, the Inter-Cluster Coordination Group (ICCG), other coordination forums, and the Humanitarian Liaison Group (HLG) under the leadership of the Deputy Regional Humanitarian Coordinator (DRHC).

OCHA Türkiye is responsible for the daily management of all programmatic and financial aspects of the Syria Cross-border Humanitarian Fund (SCHF) on behalf of the Deputy Regional Humanitarian Coordinator. The SCHF provides funding for projects that are in line with the priorities and objectives of the Syria Humanitarian Response Plan. (https://www.unocha.org/syrian-arab-republic)

For more information about the cross-border humanitarian response from Türkiye to Syria, please visit: Türkiye cross-border operations. (https://response.reliefweb.int/turkiye-cross-border?_gl=1%2A1evtun6%2A_ga%2AMTY0Nzc3NzcuMTY4Mjg2MDY5Ng..%2A_ga_E60ZNX2F68%2AMTY5MDkwMDIzNS40LjEuMTY5MDkwMTE5MS41LjAuMA )

Turkish Red Crescent

From the time of its establishment in 1868, the Turkish Red Crescent, besides contributing to the development of social welfare has been providing, presenting, and offering various and important services for social solidarity such as shelter and protection to the poor and needy, aids for nourishment and health care, blood, disaster operations, international aids, social services, health, first aid, education and youth, housing, immigration and refugee protection as well as operating mineral water facilities.

https://www.kizilay.org.tr/Iletisim

In July 2020, Kızılay Logistics was established in order to provide logistical support to Turkish Red Crescent activities and to create financial benefits. With over 150 years of experience and strong infrastructure of Kızılay, it provides logistics planning, warehouse and transportation operations services in accordance with the principles of operational excellence for both the Association and its other customers (private and humanitarian sector).

https://www.kizilaylojistik.com.tr/en/

Address: Kirimli Dr. Aziz Bey Binasi. Mustafa Kemal Mah. 2143 SI. 6510. Ankara, Istanbul

Mail: info@kizilaylojistik.com.tr

Pbx: 0212 263 18 85

https://www.kizilaylojistik.com.tr/en/contact/

For more information on humanitarian agency contact details, please see the following link: 4.2 Humanitarian Agency Contact List

Türkiye - 1.2 Regulatory Departments and Quality Control

Organizations responsible for the food quality infrastructure in Türkiye:

There are four public institutions and one semi-public one with relevance to food quality and safety in Türkiye:

-

the Ministry of Agriculture and Forestry is the authority for inspecting all food stages from production to consumption and took over all responsibility for food safety inspections. https://www.tarimorman.gov.tr/GKGM/Menus/81/Turkish-Food-Codex-Legislation

-

the Ministry of Health is the authority for Inspection and analysis of drinking water quality and safety.

-

The TSE (Turkish Standards Institution): is a public institution and the sole authorized body for standardization in Türkiye, operates in diverse fields of quality infrastructure that includes certification, testing, training as well as surveillance and inspection activities. TSE, as a standardization body, provides the standards aimed at enabling industrialists to produce goods and services in compliance with rules, laws, codes, and standards applicable in global markets, as well as being a notified body, enables clients to gain access to the European and Gulf market by ensuring their products meets all CE mark requirements according to European Directives/Regulations and G mark requirements according to GSO regulations. https://en.tse.org.tr/Hakkimizda

-

the Turkish Patent Institute (TPE) acts as a certification and auditing body for utility models, trademarks, geographical indications, traditional product names, designs, and integrated circuit topographies in accordance with the provisions of the relevant legislation and the protection of these rights. TPE has been established, as an independent legal entity with a special budget being attached to the Ministry of Industry and Trade with the objective to support technological development in Türkiye and to protect industrial property rights, as well as to provide the public with information on industrial property rights, thereby supporting the cultivation of a competitive environment and the development of research and development activities (www.tpe.gov.tr)

-

the Turkish Accreditation Agency (TÜRKAK) is a semi-public accreditation body affiliated with the Ministry of Foreign Affairs of Türkiye supplying accessibility of standards and quality audits worldwide. TÜRKAK has been established subject to private law provisions but is linked to the Prime Ministry. TÜRKAK accredits local and international bodies rendering laboratory, certification, and inspection services ensuring the operation in accordance with established national and international standards and thereby facilitating international recognition of products/services, system, personnel, and laboratory certificates (www.turkak.org.tr ).

A list of accredited labs can be found via this link https://secure.turkak.org.tr/kapsam/search

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List and 4.3 Laboratory and Quality Testing Company Contact List

Türkiye - 1.3 Custom Information

Türkiye Customs Information

Duties and Tax Exemption

For contact information regarding government customs authorities, please follow the link below: https://www.trade.gov.tr/customs-formalities

For more information please see the following link: 4.1 Türkiye Government Contact List

Emergency Response:

[Note: This section contains information which is related and applicable to ‘crisis’ times. These instruments can be applied when an emergency is officially declared by the Government. When this occurs, there is usually a streamlined process to import goods duty and tax free.]

In the following table, state which of the following agreements and conventions apply to the country and if there are any other existing ones

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes 16-06-1951 |

|

Annex J-5 Revised Kyoto Convention |

Yes 28-05-2009 |

|

OCHA Model Agreement |

Yes 07-06-2016

|

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

No |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

|

Exemption Regular Regime (Non-Emergency Response):

In Türkiye, under non-emergency conditions, the general framework regulating imports, including humanitarian aid, is outlined in the Turkish Customs Code. The primary objective of this legislation is to facilitate the smooth movement of goods while safeguarding national security, public health, and economic interests.

In terms of organizational structure, the General Directorate of Customs, falling under the Republic of Türkiye Ministry of Trade, is the chief authority overseeing customs operations. They have a hierarchical structure with regional customs offices managing specific entry points like airports, seaports, and land borders.

https://www.trade.gov.tr/customs-formalities/frequently-asked-questions/customs-offices

Türkiye’s humanitarian customs regulation contains all articles that refer to commodities importation, that are exempted from customs taxes and fees. Tax exemption from customs duties applies to the following:

-

Humanitarian aid which covers vital human need (e.g. food, medicine, clothing, bedding etc) imported by government institutions and by officially registered humanitarian aid organizations for the purpose of free distribution to the public.

-

Goods send by foreign persons or companies for non-profit use by government institutions or officially registered humanitarian aid organizations.

-

Office goods or other materials send by foreign persons or companies for the use of the officially registered charity/humanitarian aid organizations in the course of their activities.

-

Goods imported by government institutions or officially registered foundations working for the public, to be distributed to victims of a natural disaster, or left for use by such persons with ownership remaining with the institutions. (This does not apply to construction materials, even for the purpose of rebuilding after a natural disaster).

-

Goods imported by aid organizations for their own use during the period of their aid activities.

-

Agencies included are all UN agencies in addition to NGOs, and donors.

|

Organizational Requirements to obtain Duty Free Status |

|---|

|

United Nations Agencies |

|

Any UN agency intended to operate in Türkiye should be registered and shall have a signed agreement with the government, which include their project activities in Türkiye or any support they may seek for their transit activities. The Turkish Ministry of Foreign Affairs (MOFA) reviews the said activities against the basic agreement that was signed between the UN and the respective UN Agency. - The UN agency must have a memorandum of understanding (or any such document that waives them the duty and taxes on their project activities) apply to the Turkish Customs, using their agreement with MOFA for the exempted from all taxes and duties. - This would be applied to all food and non-food items that will be officially used or distributed by the UN agency and/or their subsidiaries. - Without the project-related agreements (memorandum of understanding / any such document) no UN agency is allowed to export from Turkiye to NWS or handle transit cargo. The Ministry of Customs and Trade forbids all non-Turkish non-commercial operators from handling and moving cargo into NWS. (Ministerial instruction dated 14 April 2015)

|

|

Non Governmental Organizations |

|

- Any non-governmental organization is not authorized to communicate with Turkish MOFA directly, in order to obtain the registration and license to operate, but rather via the Turkish Red Crescent (TRC). NGOs should approach and communicate with TRC in order to get all necessary approvals to operate in Türkiye. - All above mentioned procedures for UN agency applications are applied also to NGOs

|

|

Requirement |

United Nations Agencies |

Non-Governmental Organizations (NGOs) |

|---|---|---|

|

Registration in Turkey |

Not always necessary due to overarching international agreements with the UN and its specialized agencies. However, in some cases, specific UN agencies might need to notify or work in collaboration with related Turkish ministries for their operations. |

Essential. NGOs must be registered with the relevant government body, often the Department of Associations under the Ministry of Interior. Registration involves providing organizational details, objectives, and the nature of activities to be undertaken in Turkey. |

|

Documentation |

Letter of intent or notification detailing the nature and purpose of the import, which includes the list of goods, expected time of arrival, and the port of entry. |

Detailed documentation about the nature of the goods, their purpose, and any previous record of similar imports. The aim is to ensure that the goods are directly related to the NGO's mission and objectives in Turkey. |

|

Licenses/Permits |

In some cases, specific permits might be needed, especially for sensitive goods (e.g., medical equipment or communication devices). These are usually facilitated by the relevant Turkish ministry or department in collaboration with the UN agency. |

Necessary for certain types of goods, especially those which might have restrictions or special considerations. For instance, medical supplies might require permits from the Ministry of Health, while educational materials might need clearance from the Ministry of Education. |

|

Track Record |

UN agencies, due to their international stature, might not need to provide a detailed track record for each shipment. However, it helps if the agency has a prior working relationship with the Turkish government. |

A good track record in Turkey can be beneficial. NGOs with a history of successful imports and projects that align with Turkish development goals might find the customs process smoother. |

|

Collaboration with Local Entities |

Collaborating with local entities might not be mandatory but can facilitate the customs process. For instance, working with the Turkish Red Crescent or local municipalities can help expedite customs clearance. |

Often recommended. Collaboration with local NGOs, charities, or government bodies can aid in ensuring the imported goods reach their intended beneficiaries and might streamline the customs clearance process. |

|

Customs Broker |

Not mandatory but having a customs broker or a representative familiar with the local customs process can help ensure smooth clearance, especially for large shipments. |

Highly recommended. Local customs brokers are familiar with the latest regulations, documentation requirements, and can assist in ensuring the goods are cleared without unnecessary delays. |

Exemption Certificate Application Procedure:

|

Duties and Taxes Exemption Application Procedure |

|---|

|

Process to be followed |

|

- The UN agency should submit a request to the Turkish MOFA, asking that all importations into the country are to be tax free, and exempted from all duties. - Turkish MOFA address and contacts: Dr. Sadık Ahmet Cad. No:8 Balgat / ANKARA - Türkiye 06100 Phone: +90 (312) 292 10 00 - Upon the approval of MOFA, a copy of this approval is attached to all shipping documents submitted when applying the customs clearance formalities. - For NGOs, they should approach Disaster and Emergency Management Authority (AFAD) under the Prime Ministry in order to be licensed by the Turkish government. - AFAD address and contracts: Address: Üniversiteler Mah. Dumlupınar Bulvarı No: 159 ( Eskişehir Yolu 9. Km ) Çankaya/ Ankara Mail: basin.halklailiskiler@afad.gov.tr Pbx: 0 (312) 258 23 23 Fax: 0 (312) 258 2082 |

Exemption Certificate Document Requirements

Duties and Taxes Exemption Certificate Document Requirements (by commodity)

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|---|---|---|---|---|---|---|

|

Invoice |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

AWB/BL/Other Transport Documents |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

|

Packing Lists |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

Yes, Original, 2 copies, applies to both UN and NGO |

|

Other Documents |

Depends on the nature of food (e.g., phytosanitarycertificate, Health Cert, Analysis Cert, Non GMO Cert)

|

|

Health Cert. Analysis certi.

|

Import license for vehicles |

|

Special permits for certain equipment. (E.g. Technical data sheet

Government License) |

|

Donation/Non-Commercial Certificates |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to UN only |

Yes, Original, 1 copy, applies to UN only |

No |

No |

|

Additional Notes:

|

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

|

|

Embargoes |

NONE: As of the last update, Turkey does not have specific embargoes on general humanitarian goods. However, geopolitical situations can change, and it's always advisable to check the latest with local authorities. |

|

Prohibited Items |

Drugs: Narcotics and psychoactive substances not approved by the Turkish Ministry of Health. Protected Species: Any item or product derived from animals or plants listed under the CITES (Convention on International Trade in Endangered Species of Wild Fauna and Flora). Imitation and Counterfeit Material: Any product or item that infringes on intellectual property rights. Wine and Spirits: There are restrictions on the import of alcohol for non-commercial purposes, and quantities may be limited for personal consumption. |

|

General Restrictions |

GMO Commodities: Genetically Modified Organism products have restrictions, and specific approvals might be needed for import. Cultural Artifacts and Antiquities: Restrictions exist on the import of items that have historical or cultural significance to prevent illegal trade. Weapons and Ammunition: Strict restrictions and licenses are needed. |

Customs Clearance Document Requirements

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|---|---|---|---|---|---|---|

|

D&T Exemption Certificate |

Yes, one copy.Applied to both UN & NGOs |

Yes, one copy.Applied to both UN & NGOs |

Yes, one copy.Applied to both UN & NGOs |

Yes, one copy.Applied to both UN & NGOs |

Yes, one copy.Applied to both UN & NGOs |

Yes, one copy.Applied to both UN & NGOs |

|

Invoice |

Yes, one original |

Yes, one original |

Yes, one original |

Yes, one original |

Yes, one original |

Yes, one original |

|

AWB/BL/Other Transport Documents |

Yes, 3 original 3 copies

|

Yes, 3 original

|

Yes, 3 original

|

Yes, 3 original

|

Yes, 3 original

|

Yes, 3 original

|

|

Donation/Non-Commercial Certificates |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Packing Lists |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Phytosanitary Certificate |

Yes one original if the food is planted crop |

|

|

|

|

Technical Data Sheet |

|

Other Documents |

Health Certificate Analysis certificate Non GMO Certificate

|

|

Health Cert. Analysis certi.

|

|

|

|

Transit Regime

The Common Transit Procedure (CTP) is used for the movement of goods between the 28 EU Member States, the EFTA countries (Iceland, Norway, Liechtenstein and Switzerland) and Turkey (since 1 December 2012) and Republic of Macedonia (since 1 July 2015) and Serbia (1 February 2016). The legal basis of CTP is the Common Transit Convention (CTC) of 20 May 1987. CTP provides for customs and excise duties and other charges on goods to be suspended during their movement. Turkey became party to CTC since 1 December 2012.

CTP has been developed, for both economic operators and customs administrations, into an instrument of commercial policy essential for facilitating and managing the huge growth of international trade in goods. This system allows that goods can be dispatched between the Community customs territory and EFTA countries with a minimum of formalities and with customs duties and national charges suspended.

In Türkiye, the transit regime is especially crucial due to its strategic location, connecting Europe to Asia and acting as a pivotal hub for trade and aid movements. When humanitarian aid commodities are destined for another country but pass through Türkiye, they typically follow a bonded transit procedure, ensuring these goods are merely in transit and not meant for local distribution or sale.

The regulations about Transit Procedure are:

-

Turkish Customs Code Articles between 84-92,

-

Turkish Customs Regulation Articles between 212-244,

-

Common Transit Convention,

-

Circular No: 2012/4

-

Communique No: 3,4,5,6 and 8

There are two types of transit procedures in Türkiye:

National Transit Procedure is a transit procedure which allows movement of goods from a departure authority to an arrival authority both of which located within the Customs Territory of Türkiye. On the other hand, Community transit is a customs procedure that allows movement of goods from one point in the Community to another. Within provisions of CTP, “T1” symbol is applied for non-Community goods and “T2” for Community goods. Also, “TR” symbol is applied for National Transit Procedure in Türkiye.

Following an application by the holder of the procedure or the consignee, as appropriate, the competent authorities may authorise the following simplifications:

-

Use of a comprehensive guarantee or guarantee waiver,

-

Use of special type seals,

-

Authorized consignor status,

-

Authorized consignee status,

-

Procedures specific to certain modes of transport:

-

Goods carried by rail,

-

Goods carried by air,

For bonded transit in Türkiye’ the goods are usually placed under seal, ensuring that their contents remain untouched and intact during transit. These seals are provided by the Turkish customs authorities and are essential to prevent the tampering of goods. In certain cases, especially when high-value or sensitive items are in transit, customs escorts might be required from the point of entry to the exit point. The need and cost of these escorts vary depending on the perceived risk of the consignment and the nature of the goods.

To ensure that the goods in transit do not unlawfully enter the Turkish market and bypass local import duties, organizations might be required to provide a transport bond. This bond serves as a financial guarantee that the organization will adhere to the transit regulations. If the organization follows all regulations, the bond is returned upon the goods' exit from Türkiye. However, any violation can lead to forfeiture of the bond to cover potential customs duties and other related fines.

Furthermore, Türkiye has several bonded warehouses where goods can be stored temporarily. These facilities are especially beneficial for aid agencies and organizations that might face delays or logistical challenges. In these bonded warehouses, goods remain under Turkish customs control and can be held without being subject to local import duties. They can only be released upon either re-exportation or once all relevant customs procedures have been fulfilled.

Overall, while Türkiye's transit regime is structured to ensure the integrity of goods passing through its borders, it's always advisable for organizations to be well-versed with the specific requirements and regulations to ensure smooth transit of their humanitarian aid consignments.

Türkiye - 2 Logistics Infrastructure

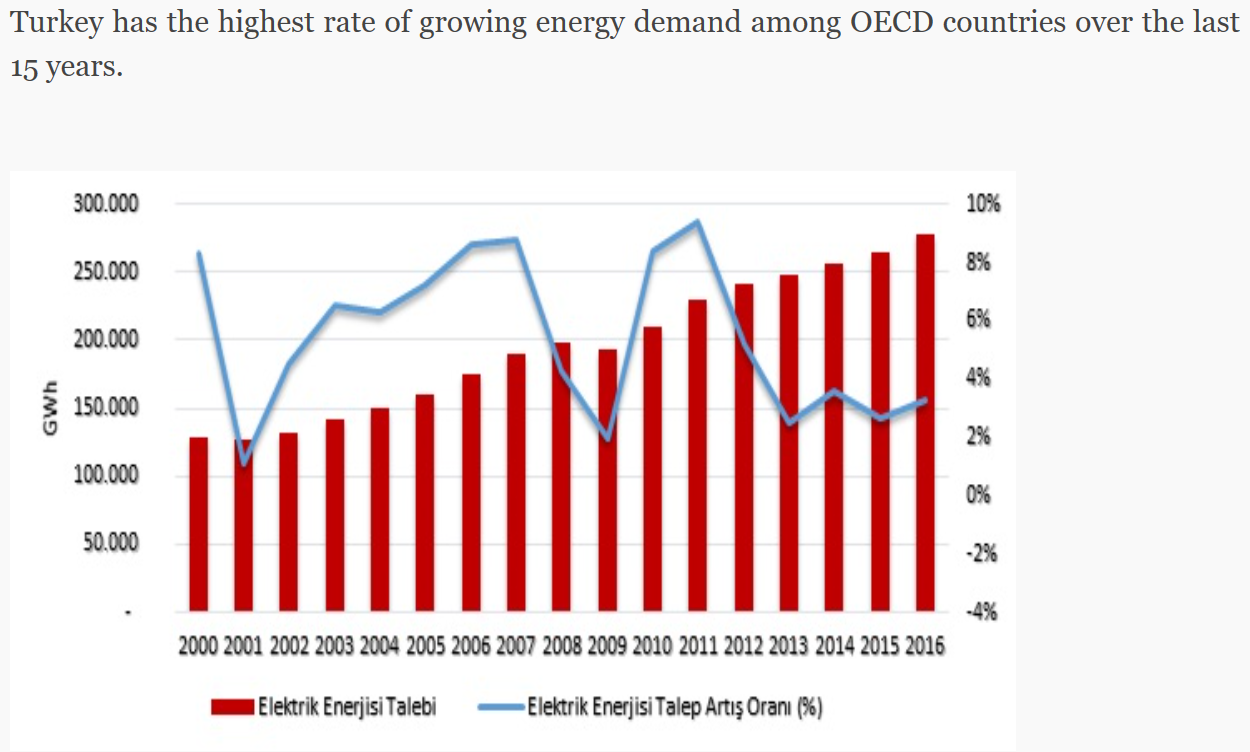

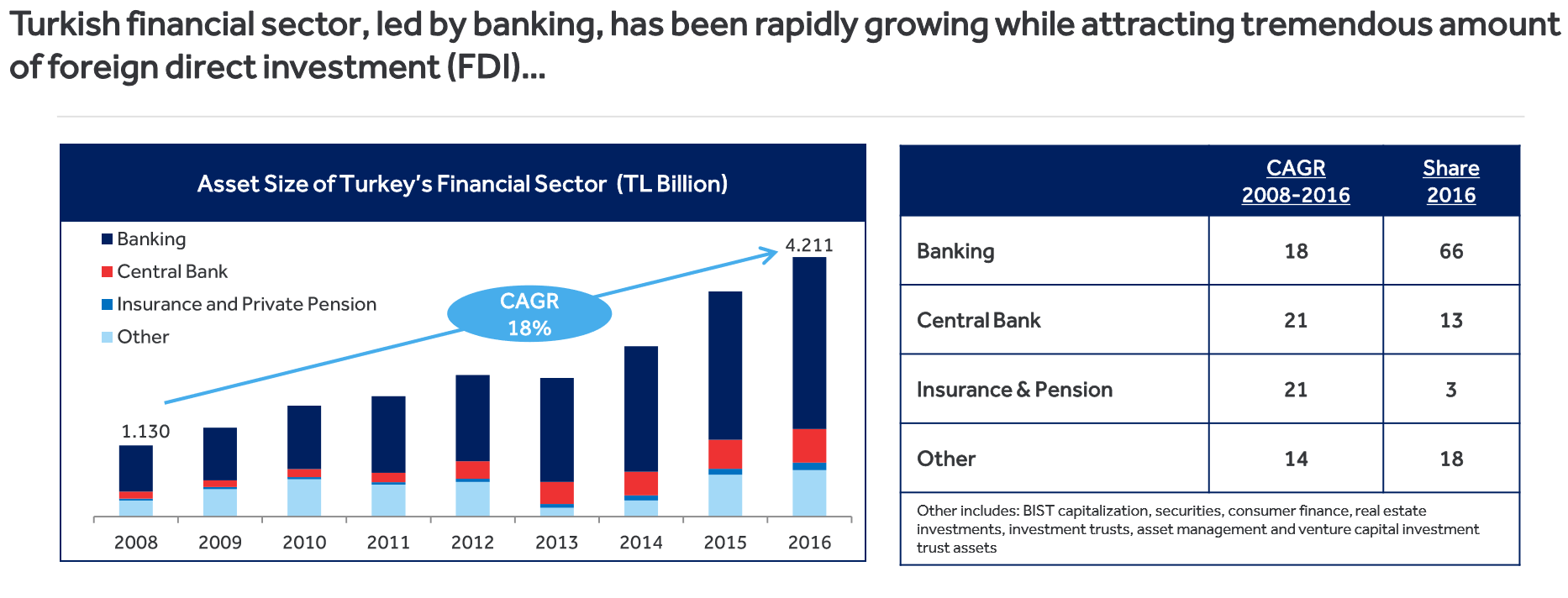

Türkiye, strategically positioned between Europe and Asia, has long realized the vital importance of robust logistics and transportation infrastructure for economic prosperity. In recent decades, both the government and private sectors, bolstered by foreign investments, have collaborated to launch and complete ambitious projects that elevate Türkiye's stature as a nexus for trade and transport. The current size of Türkiye’s logistics industry is such that it accounts for 11 percent of the country’s GDP in 2022.

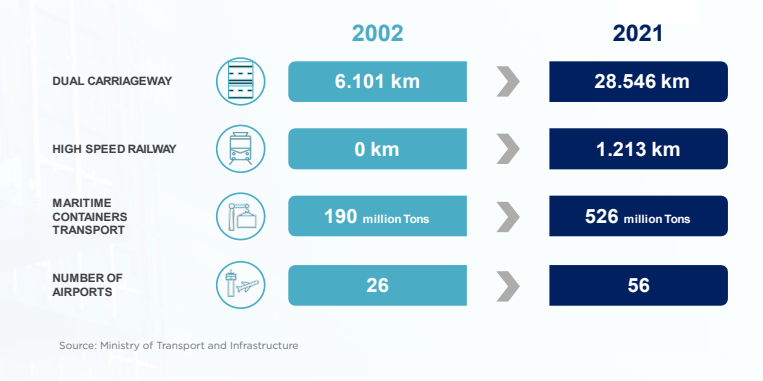

Investing in transportation has transformed Türkiye’s infrastructure landscape, below are some indicators:

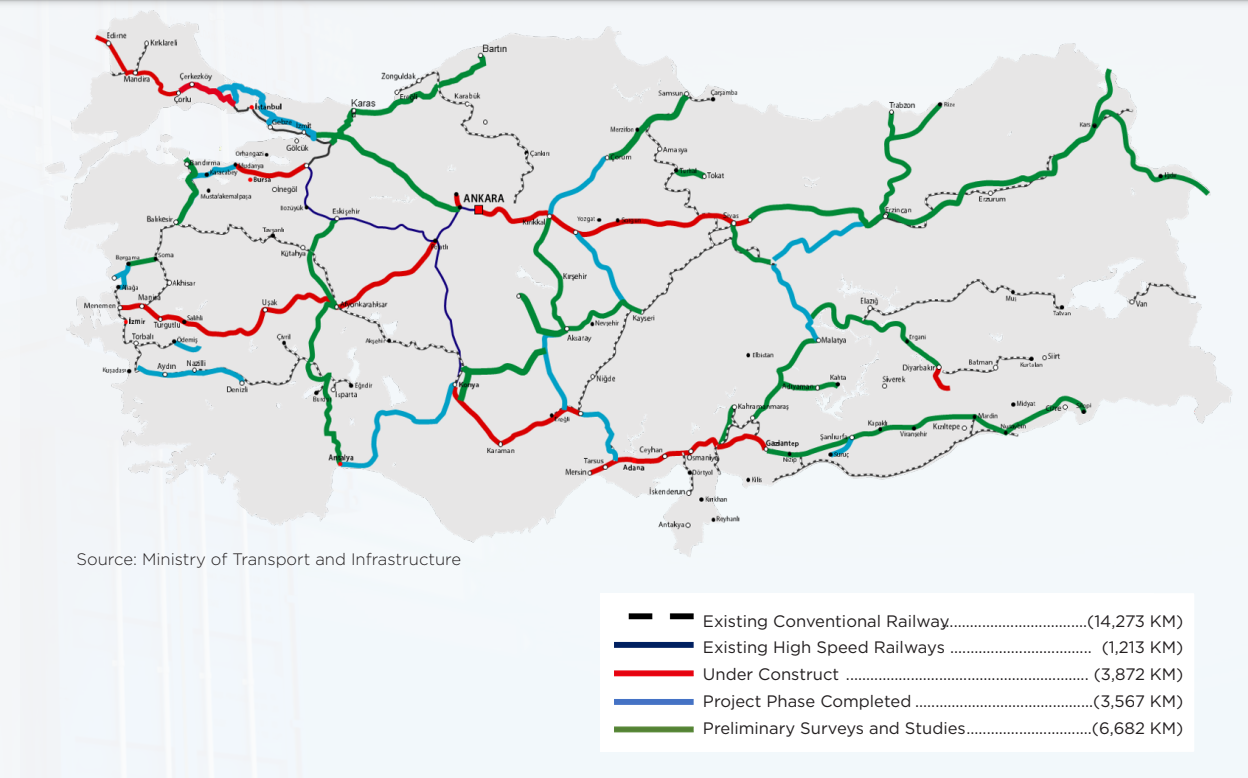

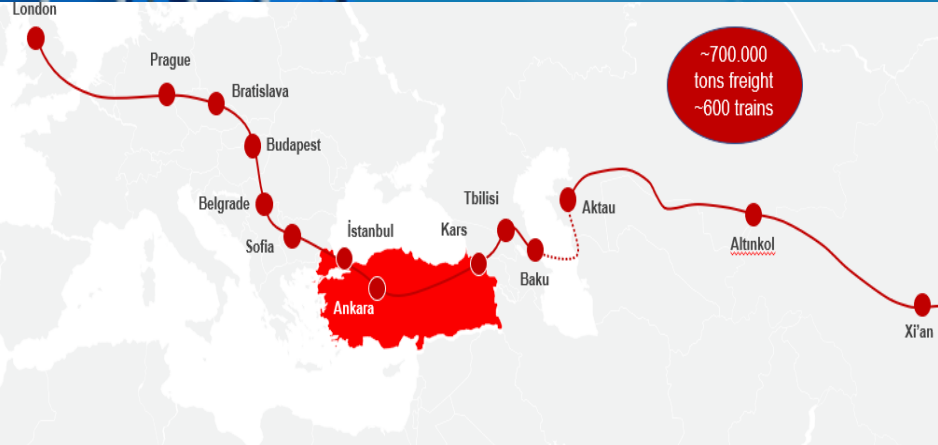

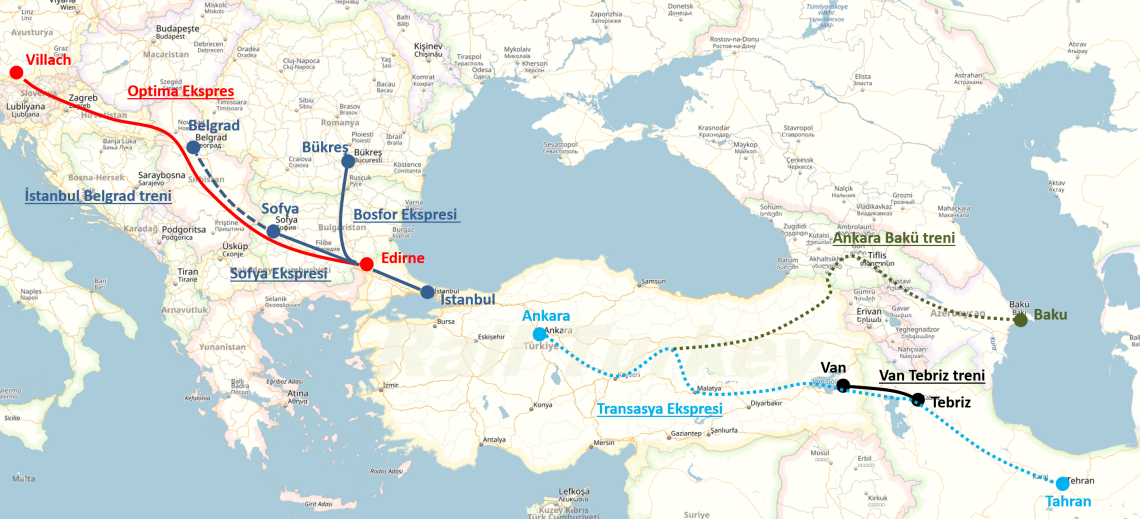

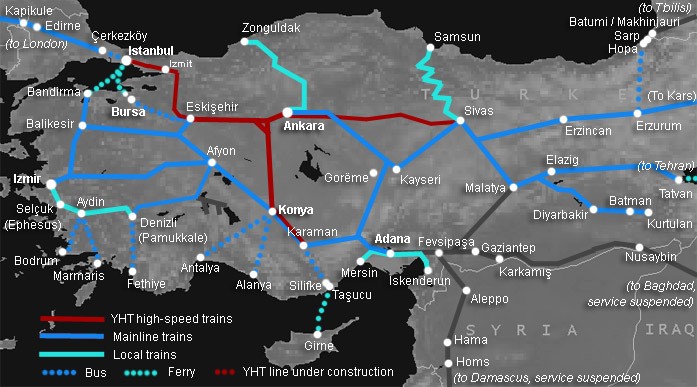

Public and private infrastructure investments in the last ten years have significantly improved the logistics services provided in Türkiye. Many new airports have been built, and highways have spread across the country. In addition, the thriving high-speed train network has begun connecting major cities and the capacity of Turkish ports has been increased. Türkiye is also building 26 logistics centres/villages, of which 13 have been completed, that will serve to lower the costs of transportation by offering various modes of transportation within these centres/villages.

A testament to this emphasis is the Marmaray project, completed in 2013, which seamlessly connects the European and Asian flanks of Istanbul via an underground rail, enhancing the city's role as a global transit hub. More rail projects are on the horizon, with high-speed lines linking Ankara to Izmir and Ankara to Sivas set for completion by 2023. Concurrently, efforts are underway to modernize existing railway networks, reflecting the nation's comprehensive approach to infrastructure development.

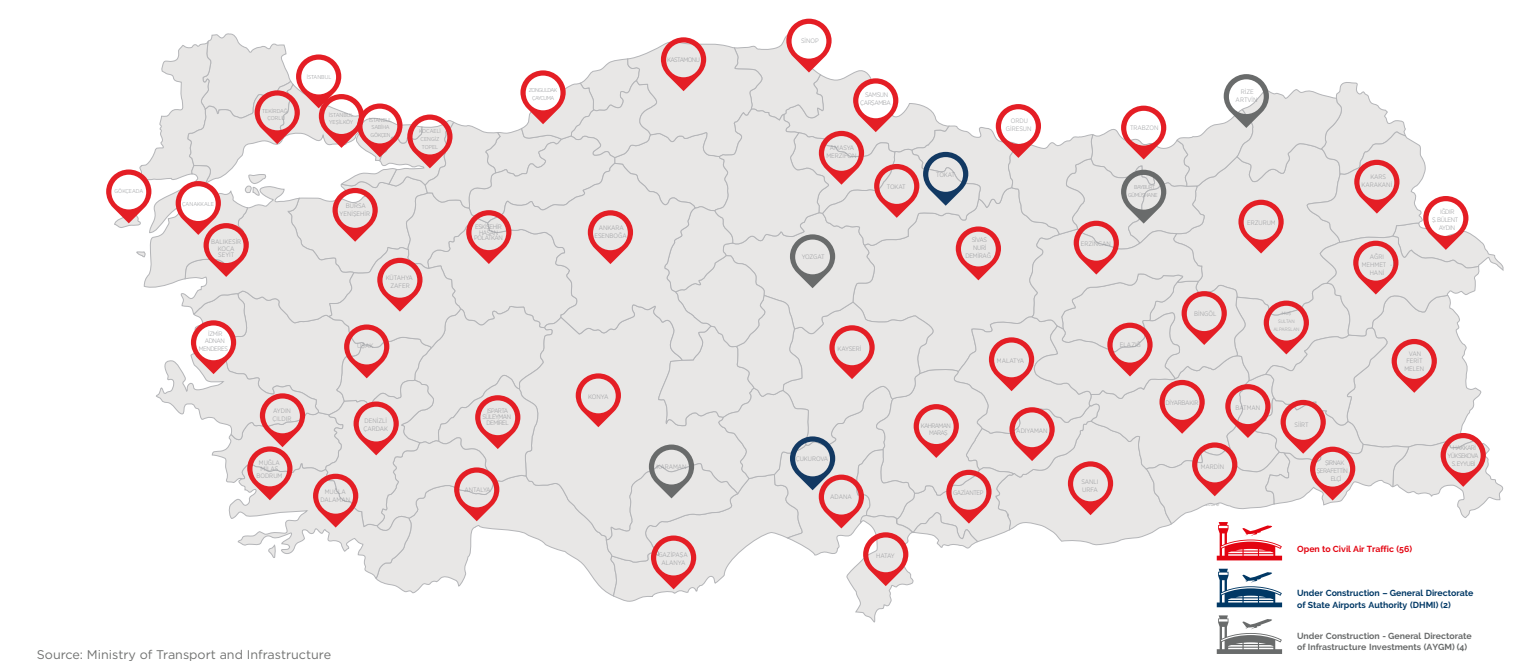

Air connectivity too has witnessed significant transformation. The Istanbul Airport, inaugurated in 2018, is emblematic of Türkiye's aviation ambitions, rapidly becoming one of the world's major aerial gateways. The government's commitment extends beyond this mega hub, with investments channelled to bolster air cargo facilities nationwide and plans afoot to upscale regional airports.

While railway and air infrastructure have been focal points, port development has also seen noteworthy advancements. New container terminals dotting the Mediterranean and Black Sea coasts are augmenting Istanbul's natural positioning as a maritime conduit between the European and Asian continents.

Melding historic importance with futuristic visions, Türkiye's logistics infrastructure stands out as a dynamic blend of strategy, ambition, and pragmatism. Challenges persist, but the concerted efforts from all stakeholders ensure Türkiye's continued ascent as a pivotal global logistics hub in the 21st century.

The Turkish government has set challenging targets to be achieved by 2053 in an effort to improve logistics infrastructure. These targets include, but are not limited to:

-

Currently having a total road network of 68,768 km, it aims to increase to 38,000 km being dual carriage way (50% of the Total Road network) by 2035.

-

Having a total railway network of 25,000 km, of which 12,000 km will be high-speed railway

-

Increasing annual passenger transportation to 1 billion persons and freight transportation to 125 million tons

-

Increasing the total number of passenger airplanes from 487 to 750

-

Constructing new airports in a move to increase total annual capacity to 400 million passengers

-

Increasing container handling capacity from 8.4 million TEU to 32 million TEU

-

Increasing vessel fleet carrying capacity from 29.2 million DWT to 50 million DWT

-

Building one port in each of the three seas surrounding Türkiye

Immense growth is expected according to 2023 GDP targets, with the industry estimated to reach a volume of USD 200-240 billion by 2023.

Türkiye - 2.1 Port Assessment

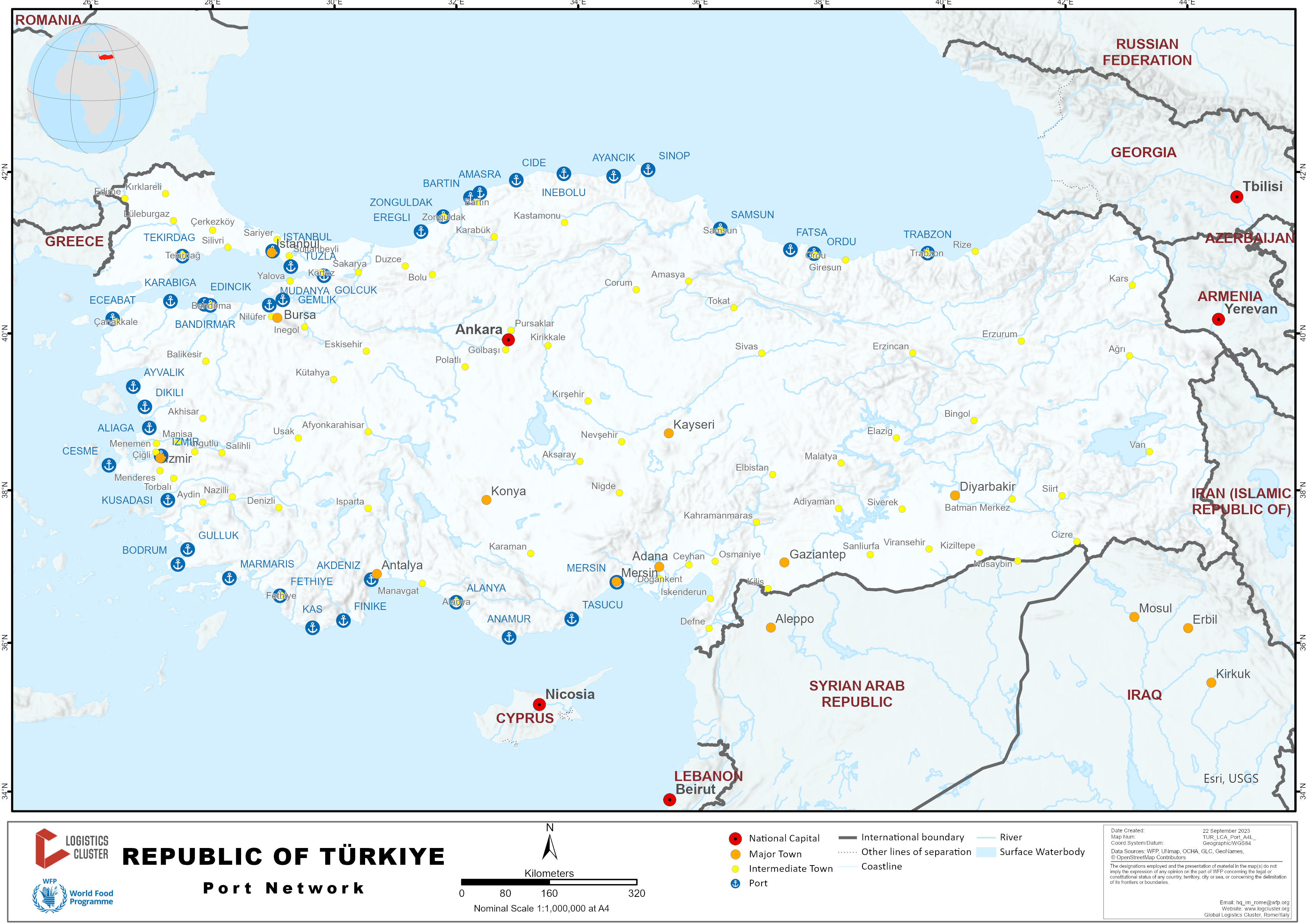

The government is investing heavily in the development of the port network, with the goal of making Türkiye a leading maritime hub in the region. Türkiye has a large and strategically important maritime area for the Black Sea, Western Europe, Middle East, and North Africa region, with its 8.333 km coastline providing direct sea connections to various countries belonging to the geographical and geopolitical areas.

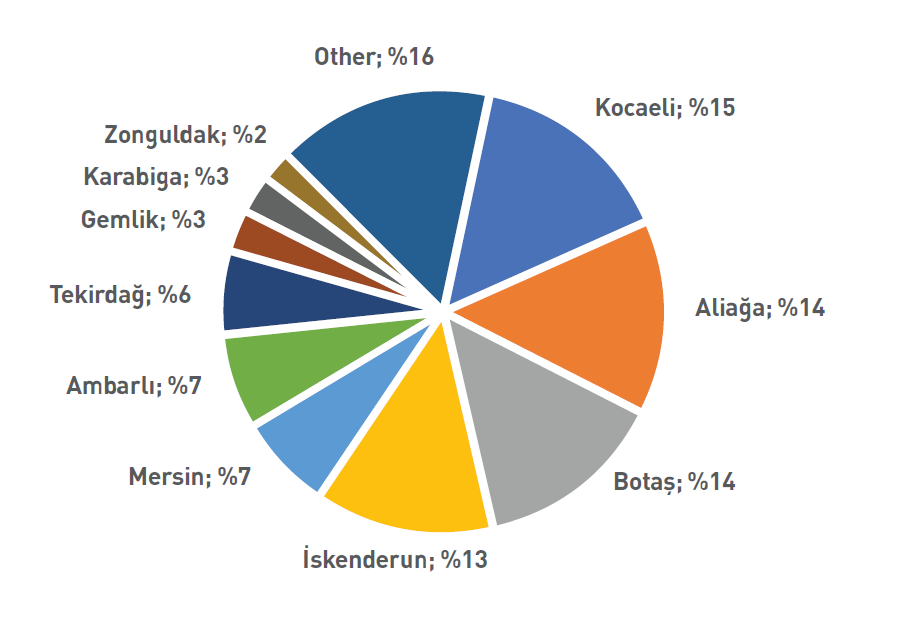

The role of ports in Türkiye is becoming increasingly important in integrating transport modes across the country, as well as connecting regional and international transport corridors from east to west and from north to south. For this reason, the port sector plays a vital role in the Turkish economy, especially in foreign trade. The distribution of the cargo handled in the ports according to the port authorities is as in Figure below;

Figure 1- TRANSPORT AND LOGISTICS MASTER PLAN - Ministry of transport and infrastructure

As of 2022, the number of coastal facilities serving maritime trade (in the form of piers, buoys, dolphin, and platform) is 216, including Lake Van (Tatvan and Van ferry port). Of the said coastal facilities, 192 serve maritime transport actively. The ports are classified into three groups: governmental, municipal, and private ports. The first group, general-purpose governmental ports, are operated by State Economic Enterprises (the Turkish State Railways (TCDD) ports and the Turkish Maritime Organization (TDI) ports). The second group is municipal ports which are managed by the Municipalities. These ports are comparatively small and are generally limited to a small volume of coastal traffic serving the local needs of provincial towns. The third group is made up of special private ports. These ports are mostly confined in purpose to the particular needs of industrial plants but are allowed to be used by third parties too.

In Türkiye, 81 of the said coastal facilities, which correspond to approximately 43%, are in the Marmara Region, 50 corresponding to 26% are in the Mediterranean Region, 31 corresponding to 16% are in the Black Sea Region and 28 corresponding to 15% are in the Aegean Region.

With looking on a city basis, a total of 35 facilities that actively serve seaborne trade are in the city of Kocaeli. There are 17 facilities of different specifications and sizes in Istanbul, coming second followed by 20 in Hatay, and 18 in Izmir.

Cargo handled at Turkish ports during 2022 increased by 16.3 million tons year-on-year and reached 542,610,283 tons. The 5.9% year-on-year increase in 2021 decreased to 3.1% in 2022. Port cargoes showed a significant increase in 2021 due to postponed demands as a result of the pandemic in 2019-2020. Demand stabilized and normal growth values were reached again by 2022.

|

No |

Port Facility |

Total Handling (Ton) |

|---|---|---|

|

1 |

MIP MERSIN PORT |

31,749,442 |

|

2 |

BTC HAYDAR ALİYEV TERMINAL |

30,355,849 |

|

3 |

BOTAŞ CEYHAN TERMINAL |

23,962,010 |

|

4 |

ASYAPORT |

23,729,203 |

|

5 |

TÜPRAŞ İZMİT REFINERY PORT |

23,585,615 |

|

6 |

STAR REFINERY PORT |

19,508,686 |

|

7 |

TÜPRAŞ-ALİAĞA TERMINAL |

17,424,260 |

|

8 |

MARPORT CONTAINER TERMINAL |

13,471,188 |

|

9 |

İSDEMİR PORT |

12,730,755 |

|

10 |

KUMPORT |

11,417,685 |

|

11 |

EREN PORT |

10,104,107 |

|

12 |

ERDEMİR PORT |

9,505,537 |

|

13 |

EGE GÜBRE PORT |

8,544,572 |

|

14 |

GEMPORT GEMLİK PORT |

8,261,879 |

|

15 |

ATAKAŞ PORT |

8,143,656 |

|

First 15 Ports |

252,494,444 |

|

|

Total of Türkiye |

542,610,283 |

|

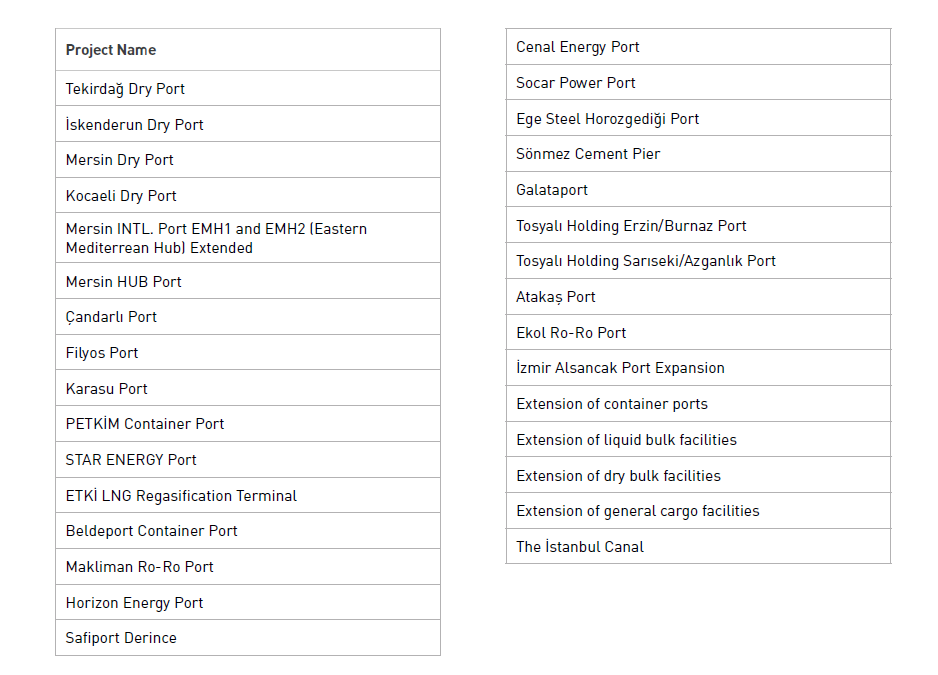

Port and seaway investments to be made in order to eliminate potential bottlenecks in these regions in the future should also intensify. In this context, infrastructure projects to develop ports and maritime network according to the Transport and Logistics Master Plan developed by the Ministry of Transport and Infrastructure is given in the below Table.

In addition to the infrastructure projects given in the table, the construction of the İyidere Logistics Port, which will be built within the scope of the İyidere Logistics Center planned to be built in Rize, has tarted. It is aimed that İyidere Logistics Port will be a logistics base that will make significant contributions to the regional and national economy.

For information on Türkiye port contact details, please see the following link:

4.4 Türkiye Port and Waterways Company Contact List

Türkiye - 2.1.1 Port of Mersin

Port Overview

Mersin International Port ranks amongst the top 100 container ports of the world. it is a trade gateway to 190 countries and one of the leading ports of Turkey with its total throughput.

Mersin International Port (MIP) is connected via railways and highways with Turkey’s industrialized cities such as Ankara, Gaziantep, Kayseri, Kahramanmaraş and Konya, and with bordering countries such as Syria, Iraq and CIS countries. It is one of the main container ports in the Mediterranean Region with its transit and hinterland connections with the Middle East and the Black Sea.

Mersin Port operating rights were assigned to PSA-Akfen joint venture of Mersin International Port Management Inc. (MIP) on 11th May 2007 for 36 years.

Port website: https://www.mersinport.com.tr/en

Key port information may also be found at: https://www.maritime-database.com/port.php?pid=2411

|

Port Location and Contact |

|

|---|---|

|

Country |

Türkiye |

|

Province or District |

Mersin |

|

Nearest Town or City with Distance from Port |

TOWN NAME: Mersin DISTANCE (5.5 km) |

|

Port's Complete Name |

Mersin International Port |

|

Latitude |

N 36° 47' 50.80" |

|

Longitude |

E 034° 39' 04.20" |

|

Managing Company or Port Authority

|

Mersin International Port Management Inc. (MIP) |

|

Management Contact Person |

Buket OZTURK – Sales and marketing Deputy Manager Engin AGALDAY – Sales and marketing specialist Emine AYDINOGLY – Sales and marketing specialist |

|

Nearest Airport and Airlines with Frequent International Arrivals/Departures |

AIRPORT NAME: Adana Airport (69 KM) LIST OF INTERNATIONAL CARRIERS: Pegasus, Turkish Airlines, Air Serbia, SunExpress, Aeroflot, Cathay Pacific, Corendon AIR, EUROWINGS, ITA AIRWAYS, OMAN AIR, ROYAL AIR MAROC, RWANDAIR, QATAR AIRWAYS, SINGAPORE AIRLINES, and TAP AIR PORTUGAL |

Port Picture

Description and Contacts of Key Companies

MIP - Mersin Uluslararası Liman İşletmeciliği A.Ş.:

E-mail : ir@mersinport.com.tr

Phone : +90 324 241 2914

Fax : +90 324 239 0849

https://www.mersinport.com.tr/en/investor-relations/detail/Company-Information/364/1198/0

The Company is the operator of Mersin International Port (Mersin Port), The services the Company provides as an operator of a multi-purpose port include loading, unloading, terminal handling and storage services for both container and conventional cargo. Together with its subsidiary, Mersin Denizcilik Faaliyetleri ve Ticaret Anonim Şirketi (MarineCo), the Company also provides marine services, such as pilotage and towage. The Company also provides a number of other value-added port services, such as handling containers and cargo via rail, stuffing and unstuffing goods to and from containers, and ancillary services such as supplying fresh water, and sludge and garbage disposal.

For more information on port contacts, please see the following link: 4.4 Port and Waterways Companies Contact List.

Port Performance

Mersin Port occupies an area of approximately 1240,000 SQM/ 124 hectares the largest area currently occupied by a Turkish port. It has 21 berths, including 9 container berths and 12 multi-purpose berths. It benefits from an extensive local cargo base from its hinterland which attracts over 20 shipping lines and 11 ro-ro lines that provide regular services linking Mersin Port to approximately 100 ports around the world. Mersin Port has an annual container and conventional cargo capacity of 2,6 million TEUs and 10 million tons, respectively. The average vessel waiting time at the Port of Mersin is 5.4 days.

Seasonal Constraints

|

|

Occurs |

Time Frame |

|---|---|---|

|

Rainy Season |

YES |

March – for one of two days |

|

Major Import Campaigns |

No |

N/A |

|

Handling Figures for 2022 |

|

|---|---|

|

Vessel Calls |

3584 |

|

Container Traffic (TEUs) |

2,020,967 |

|

Handling Figures Bulk and Break Bulk for 2022 |

|

|---|---|

|

Bulk (MT) |

7,739,550 |

|

Break bulk (MT) |

1,000,000 |

Discharge Rates and Terminal Handling Charges

For information on port rates and charges, please see the following link: https://www.mersinport.com.tr/en/online-services/detail/tariff/406/1222/0 & https://www.mersinport.com.tr/en/Images/ContentImages/MIP_Price_List_and_Specific_Conditions_01_July_2023.pdf

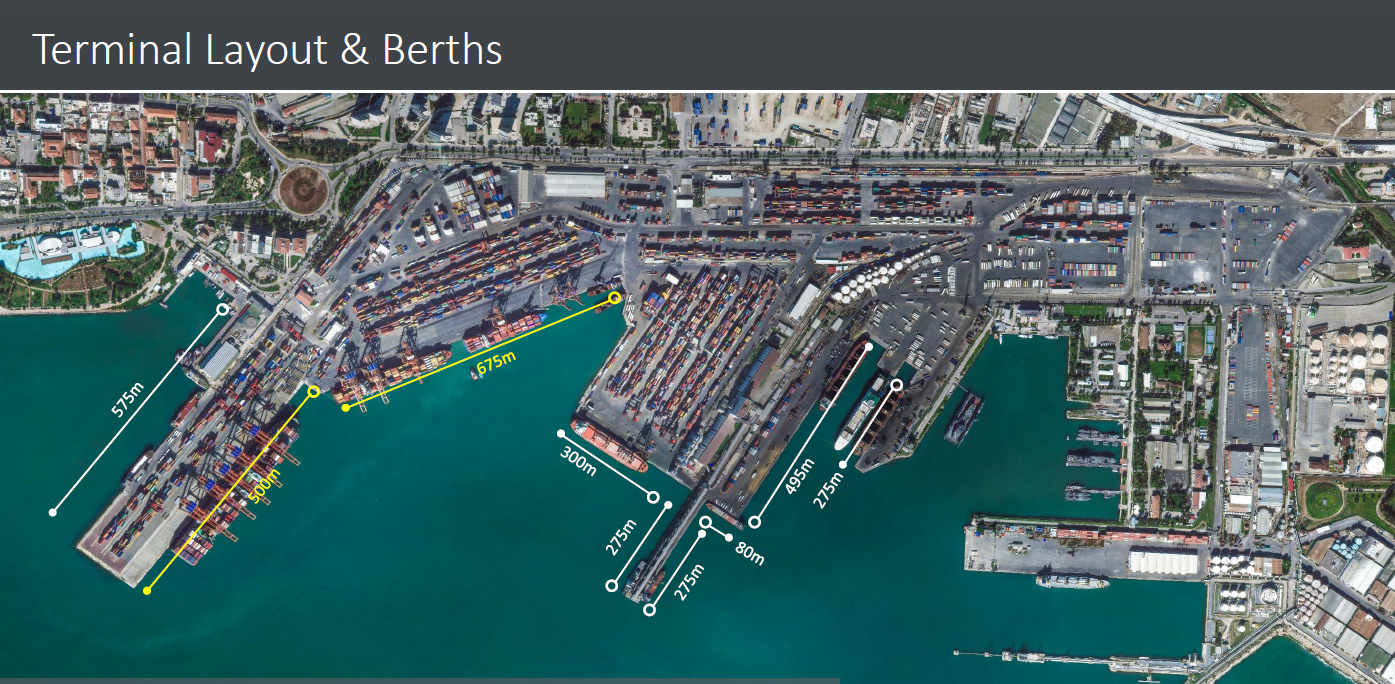

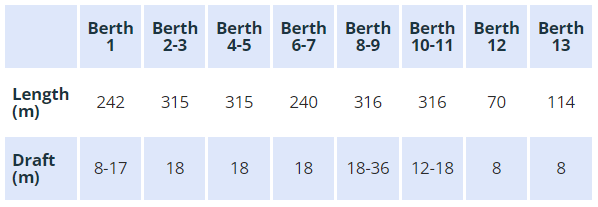

Berthing Specifications

|

Type of Berth |

Quantity |

Length (m) |

Maximum Draft (m) |

Comments |

|---|---|---|---|---|

|

Conventional Berth |

14 |

2215 |

16.3 |

Numbers: 1-2-3-7-12-13-14-15-16-17-18-19-20-21 LENGTH OF CONVENTIONAL CARGO BERTHS: BERTH 1 : 155 meters BERTH 2-3 : 275 meters BERTH 7 : 42 meters BERTH 12 : 225 meters BERTH 13 : 85 meters BERTH 14 : 275 meters BERTH 15 : 275 meters BERTH 16 : 80 meters BERTH 17-18-19 : 495 meters BERTH 20-21 : 255 meters |

|

Container Berth |

8 |

1395 |

15.8 |

CONTAINER BERTHS DRAUGHT RESTRICTION: BERTH 4-5-6 :15.00 meter BERTH 8-9 :12.75 meter BERTH 10 :11.25 meter BERTH 11 :9.50 meter BERTH 12 :11.50 meter LENGTH OF CONTAINER BERTHS: BERTH 4-5-6 : 500 meters BERTH 8 : 275 meters BERTH 9-10 : 225 meters BERTH 11 : 175 meters BERTH 12 : 225 meters |

|

Silo Berth |

3 |

708 |

14.5 |

|

|

Berthing Tugs |

4 |

|

|

Pilotage, towage, and mooring services are provided with; 13 Harbour Pilot 2 pieces 60-ton BP ASD type tugboat 1 piece 45-ton BP ASD type tugboat 1 piece 30-ton BP ASD type tugboat 2 pieces pilot boat 3 pieces mooring boat |

|

Water Barges |

1 |

|

|

available alongside at 15 tons/hour and from one barge of 100 tons capacity. |

General Cargo Handling Berths

|

Cargo Type |

Berth Identification |

|---|---|

|

Imports - Bagged Cargo |

1-2-3-7-12-13-14-15-16-17-18-19-20-21 |

|

Exports - Bagged Cargo |

|

|

Imports and Exports - RoRo |

1-16 & 21 RORO services

|

|

Other Imports |

1 Passengers as well as RORO cargo |

Port Handling Equipment

Is the port equipment managed by the government or privately? Mersin Port is operated and managed by Mersin International Port , a private company owned by the shareholders PSA International Pte Ltd and Akfen Holding A.Ş.

|

Equipment |

Available

|

Total Quantity and Capacity Available |

Comments on Current Condition and Actual Usage |

|---|---|---|---|

|

Gantry Crane |

Yes |

Quantity: 12 Capacity: 40-65 Tons |

|

|

Mobile Cranes (MHC) |

Yes |

Quantity: 5 Capacity: 100-150 Tons |

|

|

stacker |

Yes |

Quantity: 17 With Capacity: 45 Ton |

|

|

Empty Stacker |

Yes |

Quantity: 21 Capacity: 12 Tons |

|

|

RoRo Tugmaster (with Trailer) |

Yes |

Quantity: 8 tug capacity of 160 tons |

|

|

Transtainer |

Yes |

Quantity: 38 Capacity: 35-41 Ton |

|

|

Forklifts |

Yes |

62 Forklift |

|

|

Bulk Dry Cargo Handling Equipment |

|||

|

Liebherr LHM 500 |

Yes |

Quantity: 2 Capacity: 100 Ton & 140 Ton |

|

|

Gottwald GHMK 7608 |

Yes |

Quantity:2 Capacity: 150 Ton |

|

|

Gottwald HMK 280 E |

Yes |

Quantity: 2 Capacity: 100 Ton |

|

|

LHM250 |

Yes |

Quantity 2 Capacity: 64 Ton |

|

|

Industrial excavator |

Yes |

3 Industrial excavator 10 tons 2 Industrial excavator 14 tons 2 Industrial excavator 20 tons 1 Industrial excavator 27 tons 1 Industrial excavator 30 tons |

|

Container Facilities

|

Facilities |

20 ft |

40 ft |

|---|---|---|

|

Container Facilities Available |

Yes |

Yes |

|

Container Freight Station (CFS) |

Yes |

Yes |

|

Refrigerated Container Stations |

Yes |

Yes |

|

Other Capacity Details |

|

|

|

Daily Take-Off Capacity |

Approx. 7000 TEU/Day |

|

|

Number of Reefer Stations |

1338 power plugs |

|

|

Offtake Capacity of Gang Shift |

Approx. 2400 TEU, Services are provided inside the port 24 hours with a rotation of three shifts: First Shifts: 08.00-16.30 Second Shift: 16.30-00.30 Third Shift: 00.30-08.00 |

|

Customs Guidance

-

Integrated (automated system) links between the port, customs, and banks.

-

There is no free time for import cargo, there are 6 days free time for in-transit cargo

For more information on customs in Türkiye , please see the following link: 1.3 Customs Information

Terminal Information

MULTIPURPOSE TERMINAL

General Cargo

General Cargo loading and discharging services can be provided on 15 different berths, out of which 5 have direct railway connections. Thus import/export cargoes can be berthed on berths with railway connections and can be loaded directly onto wagons.

General Cargo handling capacity at Mersin International Port, is 1 million tons per year. Bagged, Big Bagged, Bale, Palletized, Slinged, Caged, Cased, and Barrelled cargoes are among the types of general cargo handled at the port where all loading/discharging storage and terminal services are provided in 3 shifts, 24 hours a day, 7 days a week, in warehouses and open storage areas.

Additionally, the following cargoes can be loaded and discharged: IBC liquid cargo tanks, sheet and rolled steel, cased, bundle or rubble marbles, attached ingots and block metals, attached profile pipes, cased glass products, iron bars, wire rods, iron products, paper bobbins, rolled cargoes, vehicle tires, wrapped/bale cargoes (hay, straw, cotton), boxed cargoes, lumber, timber, and rails.

Ro-Ro Cargo

Mersin International Port has 8 berths with Ro-Ro handling capability. MIP provides loading /discharging services to 4 Ro-Ro vessels simultaneously. The port, which can serve vessels with rear ramps and quarter ramps, has a yearly vehicle handling capacity of 150,000 units.

There are weekly Ro-Ro vessel voyages to ports in Libya, Italy, Cyprus and other countries. Considered the most important port for transit, Mersin International Port has become a transit hub for Middle Eastern countries such as Iraq, Iran and the CIS countries. The inspection of Ro-Ro vehicles arriving at Mersin port, upon demand from Customs Directorates, is conducted in with the X-Ray machine available at the port.

GRAIN AND BULK HANDLING

Dry Bulk Cargo

Loading and discharging performance up to 20,000 tons per day can be provided to post-panamax vessels sizes of up to 60,000 tons. Dry bulk cargoes are handled such as: cereals, pulses, cement, clinker, coal, Petro coke, gypsum, salt, fertilizer, sand, chrome, iron ore, etc.

Dry bulk discharged at the Port of Mersin can be stuffed directly into containers by using bunkers and chassis with dumpers.

Liquid Bulk Cargo

The loading and discharging of all types of liquid bulk cargo can be handled at Mersin International Port with 3 mobile quay platforms and 2 conveyor pipelines.

Direct discharging operation can be provided using 2 direct discharging platforms for cargo types such as p-Xylene, caustic soda, sulfuric acid, and asphalt.

Types of liquid bulk cargoes handled include; sunflower oil, canola oil, corn oil, caustic, palm oil and sulfuric acid, etc.

MAIN STORAGE TERMINAL

There are two dry warehouses and one temperature control warehouse inside the port and in Terminal 2 port.

Stevedoring

Container stuffing and unstuffing operations of cargo subject to import, export or transit regimes, either with equipment or labor, are carried out at the CFS areas by the MIP CFS Department. In addition, wagon stuffing and unstuffing services are provided on a daily basis for regions including Gaziantep, Kahramanmaraş, Kayseri, Konya, Ankara and Iraq, and others.

Hinterland Information

Containers, bulk & breakbulk cargos are being transported outbound mainly by Road (Inland transportation) from 5 gates to other ports or to the final consignee in addition to one gate (E) leads direct to the freezone , however, part of the cargo is being moved by railway to Ankara, Adana, Karaman, Konya, Kayseri, Gaziantep and Kahramanmaraş and other industrialized cities as well as railway stations across the borders. Inside the port area, there is also a 4-lane railway terminal. With the RTG dedicated to the Railway Terminal, loading, and discharging operations however operating the railway services is done by TCDD.

Port Security

MIP provides services aligned to international standards and within the scope of the International Ship and Port Facility Security Code (ISPS) and fulfils the responsibility of port security measures. At the same time, MIP has been fulfilling ISO 45001 standards since 2017 and ensures the safety of life and property. MIP has made technological investments to ensure full security inside the port. Some of those are Access Control Systems, CCTV, Under Vehicle Search Systems, Speed Control Systems, Body Camera Systems, Marine Control with Thermal Cameras, and Carbon Dioxide Measurement Devices.

|

Security |

|

|---|---|

|

ISPS Compliant |

Yes |

|

Current ISPS Level |

1 |

|

Police Boats |

Yes |

|

Fire Engines |

Yes |

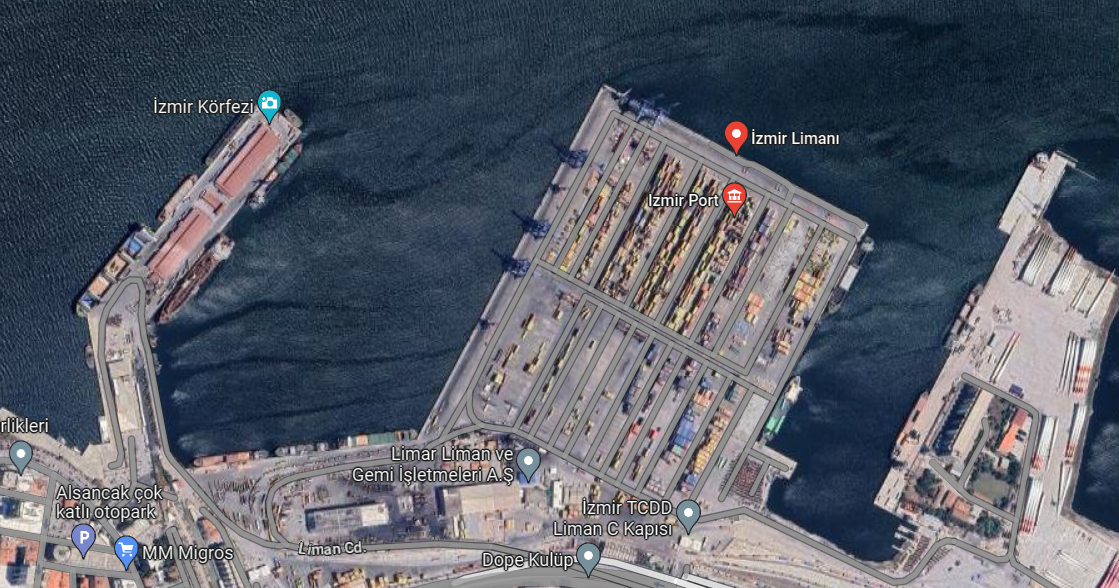

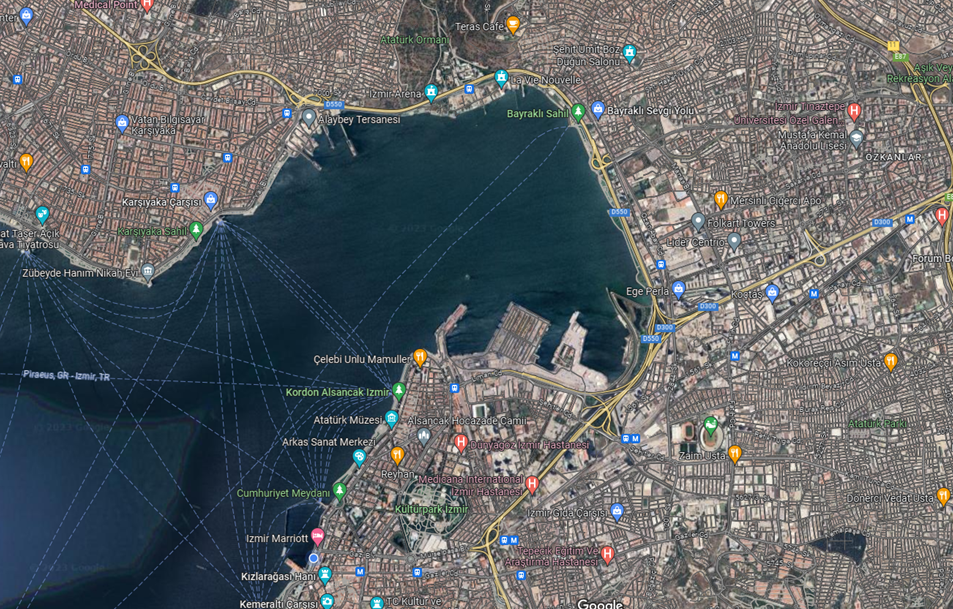

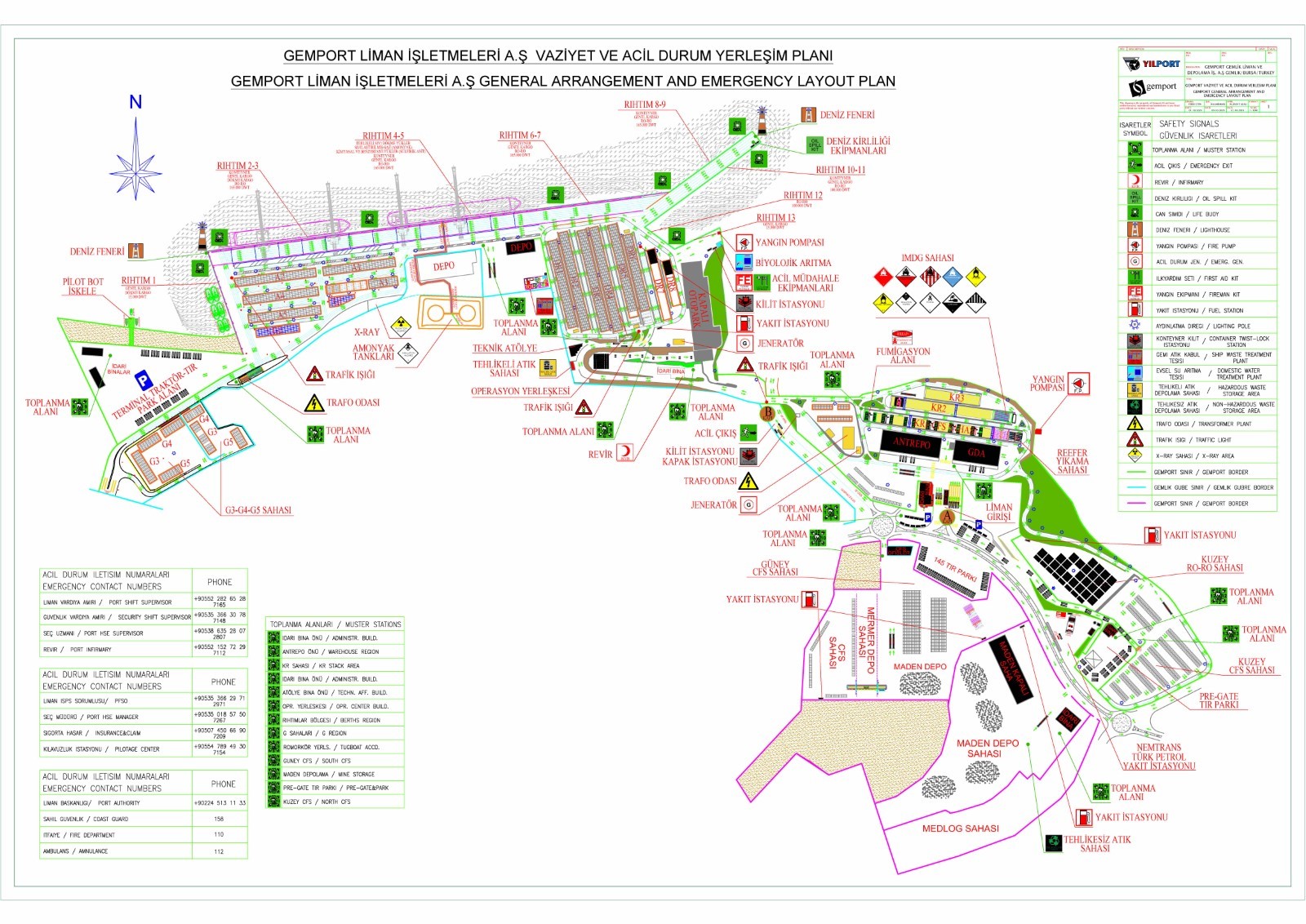

Türkiye - 2.1.2 Port of Izmir

Port Overview