South Africa

|

Country name |

South Africa |

|---|---|

|

Official country name |

South Africa |

|

Review dates |

|

|

From |

December 2020 |

|

To (Month / Year) |

February 2021 |

|

Name of Reviewers |

Granville Swigelaar LCA Consultant, WFP

Drake Kataaha Logistics Officer, WFP |

Table of Contents

| Chapter | Assessors | Organization | Assessment Date |

|---|---|---|---|

| 1 South Africa Country Profile | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 1.1 South Africa Humanitarian Background | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| Granville Swigelaar & Drake Kataaha | WFP | February 2021 | |

| 1.3 South Africa Customs Information | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2 South Africa Logistics Infrastructure | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.1.1 South Africa Port of Durban | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.1.2 South Africa Port of Cape Town | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.1.3 South Africa Port of Gqeberha (Port of Port Elizabeth) | Lennart Koch & Ferdinand Möhring | BLG Logistics Group | October 2023 |

| 2.1.4 Port of Ngqura | Lennart Koch & Ferdinand Möhring | BLG Logistics Group | October 2023 |

| 2.1.5 South Africa Port of East London | Lennart Koch & Ferdinand Möhring | BLG Logistics Group | October 2023 |

| 2.2 South Africa Aviation | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.2.1 South Africa O.R. Tambo International Airport | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.2.2 South Africa Lanseria International Airport | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.3 South Africa Road Network | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

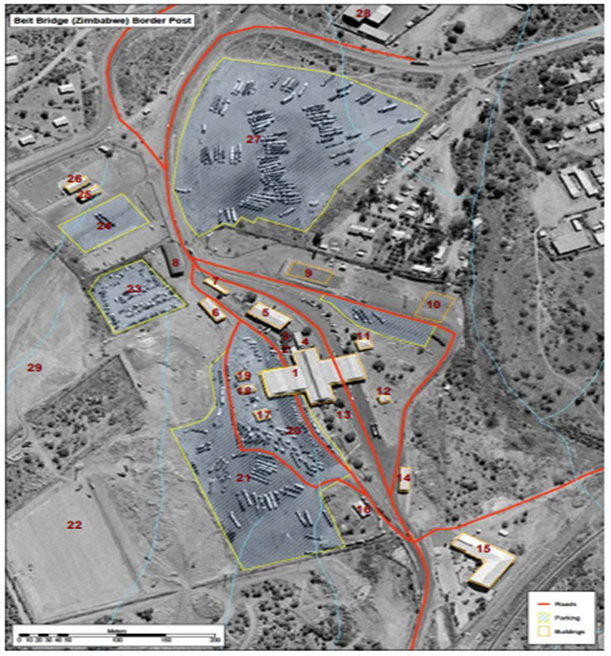

| 2.3.1 South Africa Land Border Crossing of Beitbridge (Zimbabwe) | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.4 South Africa Railway Assessment | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.5 South Africa Waterways Assessment | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.6 South Africa Storage Assessment | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 2.7 South Africa Milling Assessment | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 3 South Africa Services and Supply | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 3.1 South Africa Fuel | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 3.2 South Africa Transporters | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 3.3 South Africa Manual Labor | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 3.4 South Africa Telecommunications | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 3.5 South Africa Food and Additional Suppliers | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4 South Africa Contact Lists | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.1 South Africa Government Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.2 South Africa Humanitarian Agency Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.3 South Africa Laboratory and Quality Testing Companies Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.4 South Africa Port and Waterway Companies Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.5 South Africa Airport Companies Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.6 South Africa Storage and Milling Companies Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.7 South Africa Fuel Providers Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.8 South Africa Transporter Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.9 South Africa Railway Companies Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

| 4.10 South Africa Supplier Contact List | Granville Swigelaar & Drake Kataaha | WFP | February 2021 |

1 South Africa Country Profile

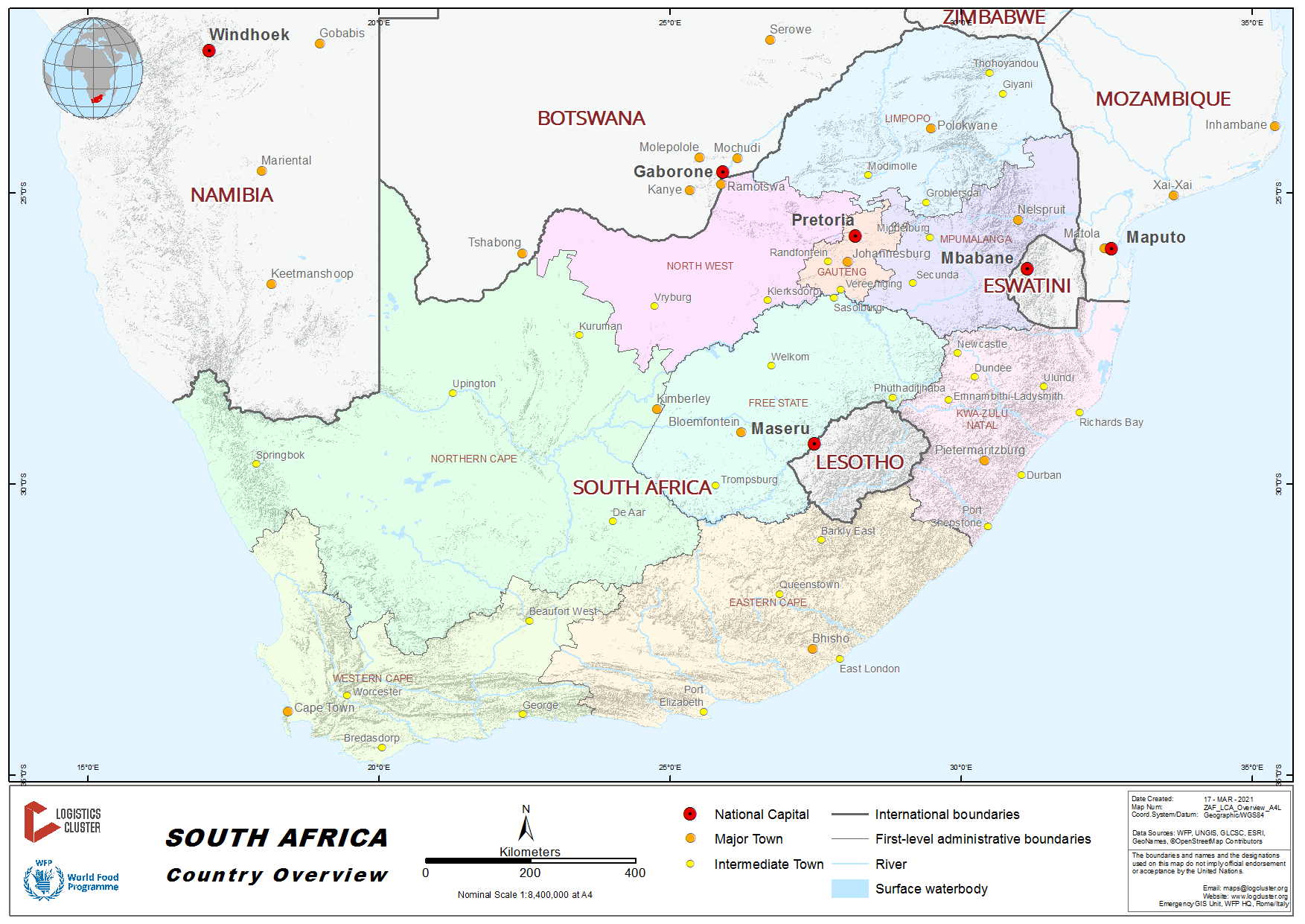

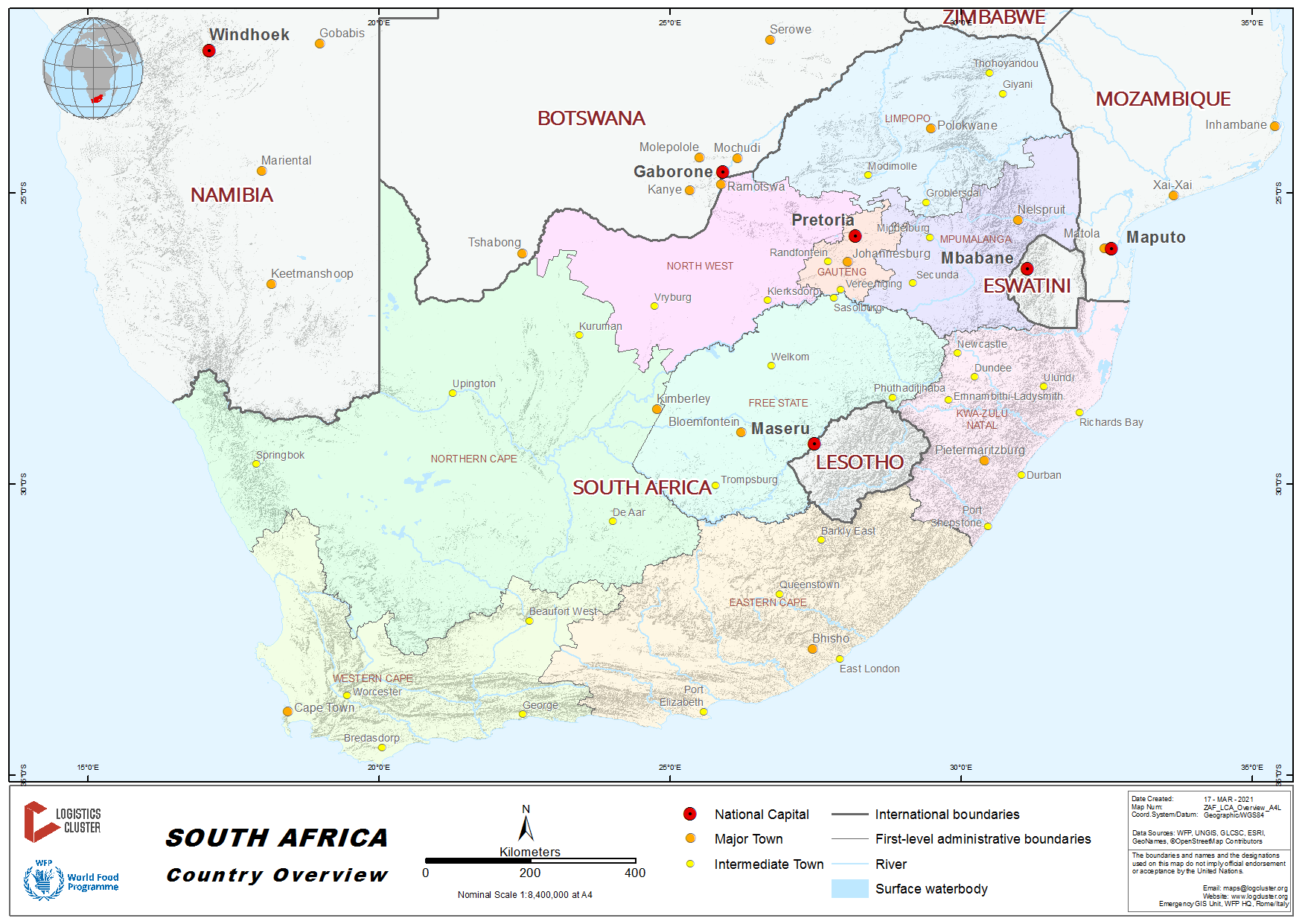

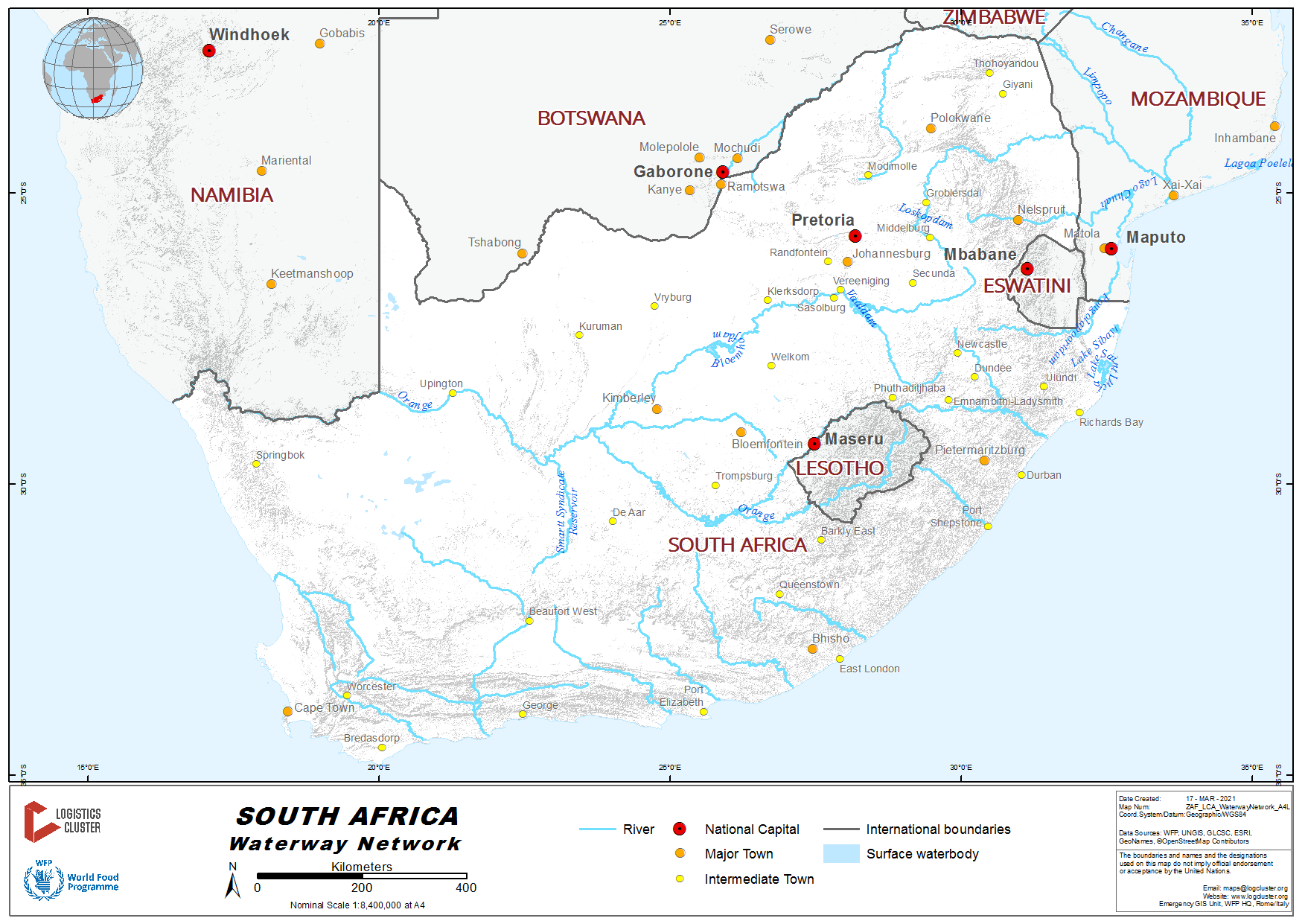

South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. With over 59 million people, it is the world's 24th-most populous nation and covers an area of 1,221,037 square kilometers (471,445 square miles). South Africa has three capital cities: executive Pretoria, judicial Bloemfontein and legislative Cape Town. The largest city is Johannesburg. It is bounded to the south by 2,798 kilometers (1,739 mi) of coastline of Southern Africa stretching along the South Atlantic and Indian Oceans; to the north by the neighboring countries of Namibia, Botswana, and Zimbabwe; and to the east and northeast by Mozambique and Eswatini (former Swaziland); and it surrounds the enclaved country of Lesotho, the country lies between latitudes 22° and 35°S, and longitudes 16° and 33°E.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a generic country overview, please consult the following sources:

Generic Information

Wikipedia Information on South Africa

IMF Information on South Africa

Economist Intelligence Unit Information on South Africa*

(*note - this is a paid service)

Humanitarian Info

Office for Coordination of Humanitarian Affairs Regional Office for Southern Africa

Facts and Figures

Wolfram Alpha Information on South Africa

1.1 South Africa Humanitarian Background

Disasters, Conflicts and Migration

|

Natural Hazards |

||

|---|---|---|

|

Type |

Occurs |

Comments / Details |

|

Drought |

Yes |

Periodic droughts, especially during years with El Nino weather phenomenon. |

|

Earthquakes |

No |

Unlikely |

|

Epidemics |

Yes |

High population density in informal settlements, low health care regime in such areas. Limited early alert and prevention mechanisms. |

|

Extreme Temperatures |

Yes |

High temperatures common in the arid northern regions. |

|

Flooding |

Yes |

Localised flooding in low-lying areas, often occupied by informal settlements. |

|

Insect Infestation |

No |

|

|

Mudslides |

No |

|

|

Volcanic Eruptions |

No |

|

|

High Waves / Surges |

Yes |

Seasonal occurence along the south-western coastline during winter months (June to August). |

|

Wildfires |

Yes |

Two fire seasons, during dry summer months (December to February) in the Western Cape, during dry winter months (June to August) rest of the country. |

|

High Winds |

Yes |

During winter months (June to August) in the Western Cape, during November in the Western Cape (locally known as the South-Easter / Cape Doctor) average wind speed 160 km/h. |

|

Other Comments |

N/A |

|

|

Man-Made Issues |

||

|

Civil Strife |

Yes |

Civil unrest may occur as result of benefits negotiation disputes between employers and labour unions (approx. April for para-statals), service delivery protest against government structures, or other socio-economic issues. |

|

International Conflict |

No |

|

|

Internally Displaced Persons |

No |

|

|

Refugees Present |

Yes |

Refugees from many African countries, 273,488 (documented) refugees and asylum seekers, of whom 84% come from sub-Saharan Africa. |

|

Landmines / UXO Present |

No |

|

|

Other Comments |

Road transport susceptible to disruption due to prevalence of foreign truck driver labour and xenophobic violence. |

|

For a more detailed database on disasters by country, please see the Centre for Research on Epidemiology of Disasters.

Seasonal Effects on Logistics Capacities

|

Seasonal Effects on Transport |

||

|---|---|---|

|

Transport Type |

Time Frame |

Comments / Details |

|

Primary Road Transport |

N/A |

|

|

Secondary Road Transport |

N/A |

|

|

Rail Transport |

N/A |

|

|

Air Transport |

N/A |

|

|

Waterway Transport |

N/A |

|

Some seasonal impact to primary and secondary transport may occur during citrus export season in Durban and Port Elizabeth, during deciduous and avocado export season in Cape Town and Port Elizabeth. The impact may be greatly attributed to delays in truck turnaround at terminals as result of terminal congestion. Further impact may also occur during late November to December and possibly early January due to demands for festive season supply deadline and some operators closing or scaling down for end of breaks.

|

Seasonal Effects on Storage and Handling |

||

|---|---|---|

|

Activity Type |

Time Frame |

Comments / Details |

|

Storage |

N/A |

|

|

Handling |

N/A |

|

|

Other |

N/A |

|

Capacity and Contacts for In-Country Emergency Response

Government

South Africa faces increasing levels of disaster risk. It is exposed to a wide range of weather hazards, including drought, cyclones and severe storms that can trigger widespread hardship and devastation. As such sustained, committed and concerted efforts with regard to disaster risk management reform by the government and a wide range of stakeholders were reflected in the promulgation of the Disaster Management Act, 2002 (Act No. 57 of 2002) on 15 January 2003. The Act provides for, an integrated and coordinated disaster risk management policy that focuses on preventing or reducing the risk of disasters, mitigating the severity of disasters, preparedness, rapid and effective response to disasters, and post-disaster recovery, the establishment of national, provincial and municipal disaster management centers, disaster risk management volunteers, matters relating to these issues.

The National Disaster Management Centre (NDMC) is responsible for establishing effective institutional arrangements for the development and approval of integrated disaster risk management policy. One way of achieving this is through intergovernmental structures. In this regard, the Act calls for the establishment of an Intergovernmental Committee on Disaster Management (ICDM) consisting of various ministry as well as various levels of government (national, provincial, district municipalities).

Ministries considered core to any disaster impact and response: Departments of Agriculture and Land Affairs, Defence, Education, Environmental Affairs and Tourism, Foreign Affairs, Health, Home Affairs, Housing, Minerals and Energy, National Treasury, Provincial and Local Government, Public Works, Safety and Security, Social Development, The Presidency, Transport, Water Affairs and Forestry.

Funding and resources (including military personnel and assets) may be called upon during and post disaster from government via the NDMC and structures according to the Act of 2002 and its framework.

For more information on government contact details, please see the following links: http://www.ndmc.gov.za/Pages/Home-Page.aspx and 4.1 Government Contact List.

Humanitarian Community

Medécins Sans Frontières has a regional base of operations in South Africa servicing projects within the country and neighbouring countries, their main warehousing site is based in Cape Town from where supplies to support projects are distributed to field sites where supplies for the short to medium term are held. The Red Cross Society has a national base of operations in Pretoria along with their main 3PL contracted depot of mainly disaster relief (clothes, blankets etc.) and some non-perishable food items. Regional / field offices operates their own limited storage facilities on either owned or leased compounds.

Gift of the Givers has a base of operations and head office in Pietermaritzburg, with offices in various provinces in the country. Registered as a NGO with department of social development, they undertake post-disaster relief operations along with government structures, as well as their own independently funded and coordinated relief operations. Various agencies of the United Nations are also present in the country most based in Johannesburg and Pretoria, supporting projects around the county and the region.

For more information on humanitarian agency contact details, please see the following link: 4.2 Humanitarian Agency Contact List.

1.2 South Africa Regulatory Departments and Quality Control

South African Revenue Services (SARS) is the revenue service (tax-collecting agency) of the South African government, reporting to the Minister of Finance. Its main functions are to - collect and administer all national taxes, duties and levies; collect revenue that may be imposed under any other legislation, as agreed on between SARS and an organ of state or institution entitled to the revenue; provide protection against the illegal importation and exportation of goods; facilitate trade; and advise the Minister of Finance on all revenue matters.

The Department of Health sets policy for regulations and standards on various aspects for the safeguarding of South African life including food and medical supplies. Setting and standards of testing are maintained via the South Africa Bureau of Standards and relevant code(s) assigned within a regulatory framework.

The Department of Minerals and Energy sets policy for regulations and standards of various types and grades of fuel (for both hydrocarbon and biofuels) in South Africa. Setting and standards of testing are maintained via the South Africa Bureau of Standards and relevant code(s) assigned within a regulatory framework.

The South African Bureau of Standards (SABS) is a South African statutory body, as the national standardization authority, the SABS is responsible for maintaining South Africa's database of more than 6,500 national standards. Internationally, SABS experts represent South Africa's interests in the development of international standards, through their engagement with bodies such as the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC). South Africa has a long and proud history of involvement with these bodies and was a founder member of ISO. To improve its service offerings and responsiveness to customer needs, the SABS also restructured its commercial services into seven industry clusters, namely : Chemicals, Electro-technical, Food & Health, Mechanical & Materials, Mining & Minerals, Services and Transportation.

In South Africa all the activities with GMOs are primarily regulated under the Genetically Modified Organisms Amendment Act 23 of 2006 (GMO Act) along with its subsidiary legislation. These activities include research. Development, import, export, transport, use and application of upon obtaining an authorization from the Department of Agriculture. Then, under the Consumer Protection Act (CPA) and 2008 (Act No. 68 of 2008) Regulations (R.293 of 2011) , in the case, where the foodstuff is containing at least 5% GMOs, the product must be labelled with the statement ‘Contains Genetically Modified Organisms’ and whereas a product has less than 5% GMOs, it is voluntary to include the statement ‘Contains <5% GMO.’ Moreover, The requirement for making the claim ‘Does not contain GMO’ or ‘GMO free’ is that the product must be tested and found to contain <1% GMOs.

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List and 4.3 Laboratory and Quality Testing Company Contact List.

1.3 South Africa Customs Information

Duties and Tax Exemption

For contact information regarding government custom authorities, please follow the link: 4.1 Government Contact List.

Emergency Response

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes , 24 Mar 1964 |

|

Annex J-5 Revised Kyoto Convention |

Yes , 18 May 2004 |

|

OCHA Model Agreement |

Yes , 19 Dec 1991 |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

No |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

Yes |

Exemption Regular Regime (Non-Emergency Response)

SCHEDULE 4

REBATES AND REFUNDS OF CUSTOMS DUTIES, EXCISE DUTIES, FUEL LEVY, ROAD ACCIDENT FUND LEVY, ENVIRONMENTAL LEVY AND HEALTH PROMOTION LEVY

NOTES:

- The goods specified in the Column headed "Description" of this Schedule shall, subject to the provisions of Section 75, be admitted under rebate of the customs duty specified in Parts 1 and 2 and the fuel levy (except the fuel levy specified in fuel levy item 195.30) in Part 5 of Schedule No. 1 in respect of such goods at the time of entry for home consumption thereof, to the extent stated in the Column headed "Extent of Rebate" of this Schedule in respect of those goods.

- Unless the context otherwise indicates, Notes Nos. A, C and H

of the General Notes to Schedule No. 1 and the section and chapter

notes in the said Schedule shall mutatis mutandis apply to this

Schedule.

- Note 3 to Schedule No. 3 shall apply mutatis mutandis in respect of any expression relating to the extent of any rebate in this Schedule. This shall be deemed to include a rebate of any environmental levy payable in terms of Part 3 of Schedule No. 1, subject to the Notes to Part 5 of this Schedule and health promotion levy payable in terms of Part 7 of Schedule No.1.

- Note 5 to Schedule No. 3 shall apply mutatis mutandis to any reference to a tariff heading or subheading in this Schedule.

- For the purposes of this Schedule, the expression "effective rate of duty" means the duty calculated according to a unit of quantity expressed as a percentage of the value for duty purposes.

- For the purposes of items 409.00, 480.00 and 490.00:

- Where any goods or vehicles are imported or re-imported, as the case may be, in terms of these items by a person who is required to declare goods in terms of section 15, that person means a "traveller" as defined in the rules for that section and as contemplated in form TC-01; and

- in addition to the Notes to these items, such a traveller must comply with the requirements of section 15, the rules for that section and form TC-01.

- Any reference to the Kingdom of Swaziland and BLNS in any provision of this Schedule shall, with effect from 19 April 2018, be deemed to be a reference to the Kingdom of Eswatini and BELN, respectively, in terms of the provisions which existed before 19 April 2018.

405.04 GOODS FOR DISABLED PERSONS OR FOR THE UPLIFTMENT OF INDIGENT PERSONS

405.04 00.00 01.00 07

Goods (excluding motor vehicles) specially designed for use by persons with disabilities, subject to the production of a certificate from an official of the South African National Council for the Blind, the Deaf Federation of South Africa, the South African Federation for Mental Health, the National Council for Persons with Physical Disabilities in South Africa or Epilepsy South Africa or of a body which is affiliated to the Council, Federation or League concerned, or a certificate from a registered medical practitioner, that such goods are for use exclusively by such persons with disabilities, such certificate being endorsed by the International Trade Administration Commission that such or similar goods are not ordinarily nor satisfactorily made in the Republic Full duty rebated.

405.04 00.00 02.00 01

Machines, implements and materials for use in the manufacture of goods by persons with disabilities, subject to the production of a certificate from an official of the South African National Council for the Blind, the Deaf Federation of South Africa, the National Council for Persons with Physical Disabilities in South Africa, or Epilepsy South Africa or a body which is affiliated to the Council, Federation or League concerned, or a certificate from a registered medical practitioner, that such machines, implements and materials are for the exclusive use by such persons with disabilities, such certificate being endorsed by the International Trade Administration Commission that such or similar goods are not ordinarily nor satisfactorily manufactured in the Republic Full duty

405.04 00.00 04.00 00

Goods (excluding clothing) forwarded unsolicited and free to any organisation registered in terms of the National Welfare Act, 1978 (Act No. 100 of 1978), entered in terms of a specific permit issued by the International Trade Administration Commission, for the distribution free of charge by such organisation Full duty

405.04 00.00 05.00 05

Goods (excluding clothing) forwarded unsolicited and free to any organisation registered in terms of the National Welfare Act, 1978 (Act No. 100 of 1978), entered in terms of a specific permit issued by the International Trade Administration Commission, for the official use by such organisation Full duty rebated

405.04 00.00 06.00 09

Goods (excluding foodstuffs and clothing) forwarded free, as a donation to any educational organisation, hospital (including clinic), welfare organisation, religious organisation or sporting organisation, in such quantities and under such conditions as the International Trade Administration Commission, may allow by specific permit and that the Commission is satisfied that the issuing of such permit will not have a detrimental effect on local industry within the common customs area: Provided that the applicant and anybody responsible for the distribution have furnished an undertaking that -

(a) such goods are for use by the organisation or for free distribution;

(b) such goods will not be sold, leased, hired or otherwise disposed of for gain without the duty which has been rebated being paid to the Commissioner; and

(c) no donation or other counter-performance may be accepted by anybody in respect of such goods full duty rebated

Exemption Certificate Application Procedure

Please see the rebate provisions above.

Exemption Certificate Document Requirements

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

AWB/BL/Other Transport Documents |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Donation/Non-Commercial Certificates |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Packing Lists |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Other Documents |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Additional Notes |

||||||

|

Consult with your appointed Clearing and Forwarding Agent to ensure you have the correct number of copies of all the required documents. |

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

An importer should present the following documentation electronically to the South African Revenue Services: Customs

Importers must also register as an importer with the South African Customs. Information is available here: www.sars.gov.za. The process for sending donations to South Africa includes the prior verification by the importer if there are rebate provision for the donations in Schedule 4 of the Customs Act no 91 of 1964, otherwise full duty and VAT will be brought to account. Furthermore, all second hand imported commodities require an import permit issued by ITAC. The donating party (importer) should appoint a Clearing and Forwarding Agent to act on their behalf. |

|

Embargoes |

Goods can be removed under embargo to an importer premises for examination. Subject to application and payment of a security amount. |

|

Prohibited Items |

See the prohibited and restricted import and export list available here: www.sars.gov.za |

|

General Restrictions |

See the prohibited and restricted import and export list available here: www.sars.gov.za |

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

|

AWB/BL/Other Transport Documents |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

|

Donation/Non-Commercial Certificates |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

|

Packing Lists |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

|

Phytosanitary Certificate |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

|

Other Documents |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

|

Additional Notes |

||||||

|

||||||

Transit Regime

Transit can be divided into two categories, i.e. national and international transits. National transit is the movement of goods in bond within South Africa and within the Southern African Customs Union (SACU) from one customs controlled area to another. International transit applies to imported goods not destined for South Africa which move through South Africa to its final destination e.g. Zimbabwe.

Current legislation and policy require specific documents to be endorsed, which could entail the completion of required fields on a form such as findings of an examination, date stamping and signing. To see which documents are required and under which circumstances, click here.

In transit goods must be carried by a licensed remover of goods in bond. Clients must also be aware that before any application for cabotage permits (when transport is undertaken on SA roads by foreign carriers) will be considered by the Cross Border Road Transport Agency (CBRTA), a permit must first be obtained from the International Trade Administration Commission (ITAC) and temporary clearance must be made at a SARS Customs Office.

A Customs Road Freight Manifest (DA 187) must accompany the vehicle carrying goods together with a processed Customs Declaration for removal in bond or for export as the case may be, and must accompany the driver of the means of transport. A copy of each must be delivered to the Controller/Branch Manager at the place of exit.

Every person must keep records as prescribed in terms of the Customs and Excise Act.

2 South Africa Logistics Infrastructure

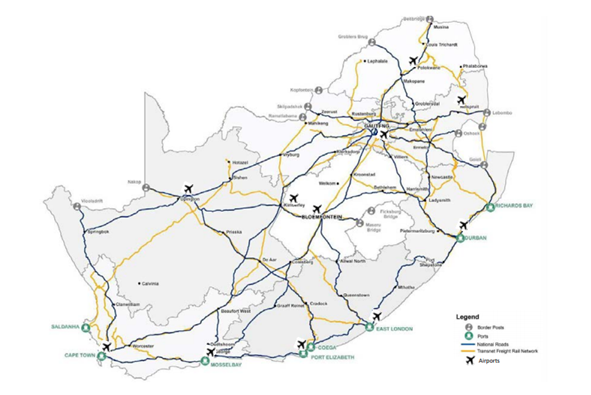

South Africa’s logistics infrastructure, the hard engineered, designed and constructed infrastructure – which includes but not limited to sea ports, airports, road, rail and fuel pipeline infrastructure, that supports the physical movement of goods and people is significantly well developed and maintained in comparison with its continental counterparts. Prompting many international organizations, both public and private, to use South Africa as a gateway into the rest of the continent.

Strategic logistics infrastructure, which include road, rail, fuel pipeline, airport and port networks, is owned and operated by the state or state owned companies (SOC), with reporting and oversight ultimately under the Department of Transport. At a national level all national roadways are under the authority of national government, whilst provincial and municipal secondary roads fall under the mandate and responsibility of the relevant provincial or district authorities. The freight rail network however is solely managed by the SOC Transnet Freight Rail (TFR), whilst passenger rail in the Western Cape and Gauteng are managed by the Passenger Rail Agency of South Africa (PRASA). Under the National Transport Master Plan (NATMAP) 2050 private sector participation in usage and operation of the rail network has been seen as a mean of unlocking potential to increase the market share and profitability of this infrastructure segment.

For more information about the National Transport Master Plan (NATMAP) 2050, please see this link: https://www.transport.gov.za/documents/11623/39906/0_ExecutiveSummary2017.pdf/cb353369-bc94-4d2f-8f7e-efe2f041e434.

The national road network consists of interconnected freeways that services every province and connects all major cities. Most major cities have intermodal logistics hubs of some form. The warehousing and road transports sectors are entirely privatized with both local and international firms (small to large scale) actively invested. Government and its SOC responsible for freight rail TFR are pursuing the potential to cover more long distance tonnage from road to rail, sighting benefit in transport cost saving, reduction of impact on of roadways by heavy vehicle traffic and congestion and elevating environmental pressures and footprint. However commercially competitive efficiency will be needed to promote the swing from road to rail and will likely require public-private partnership.

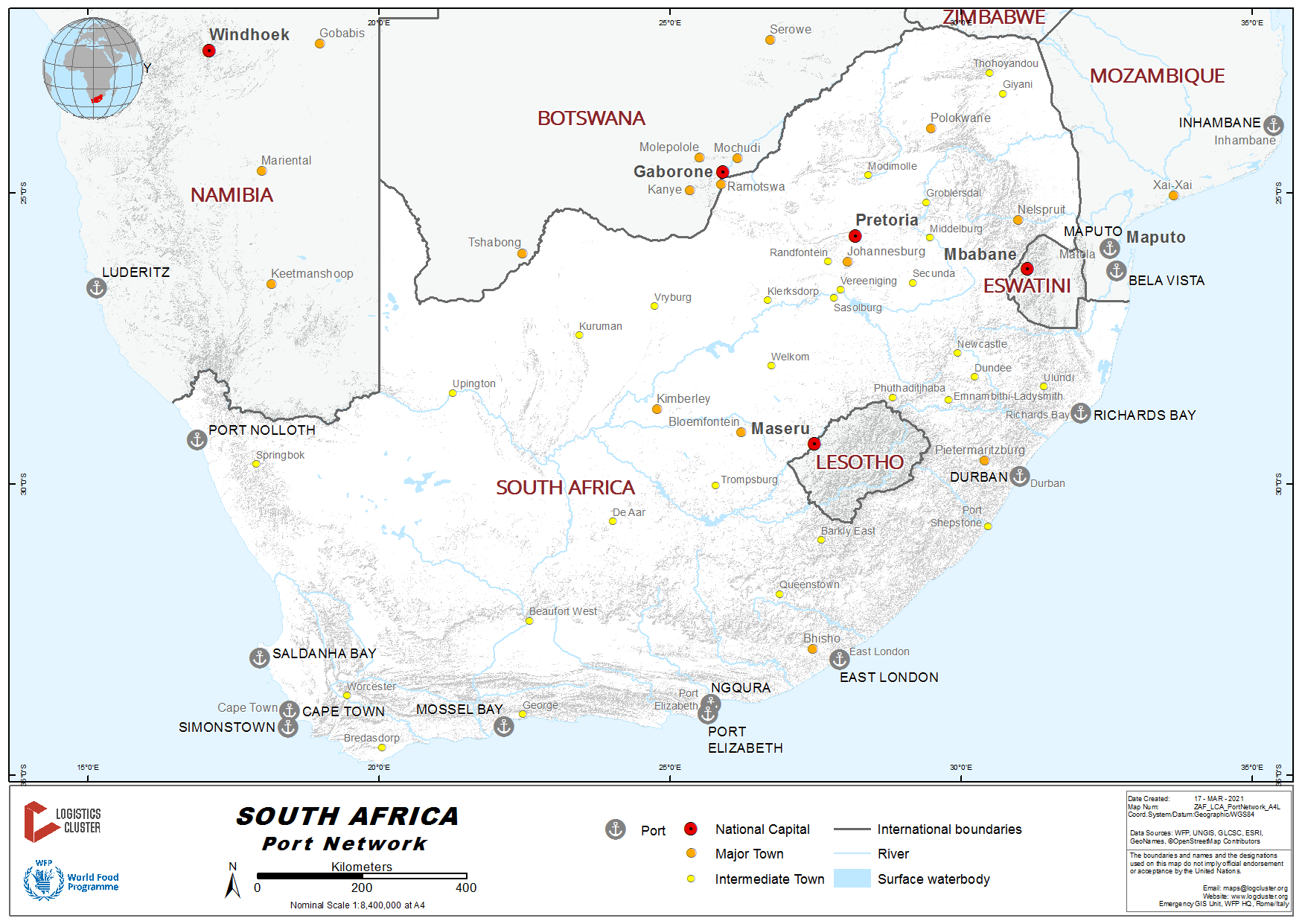

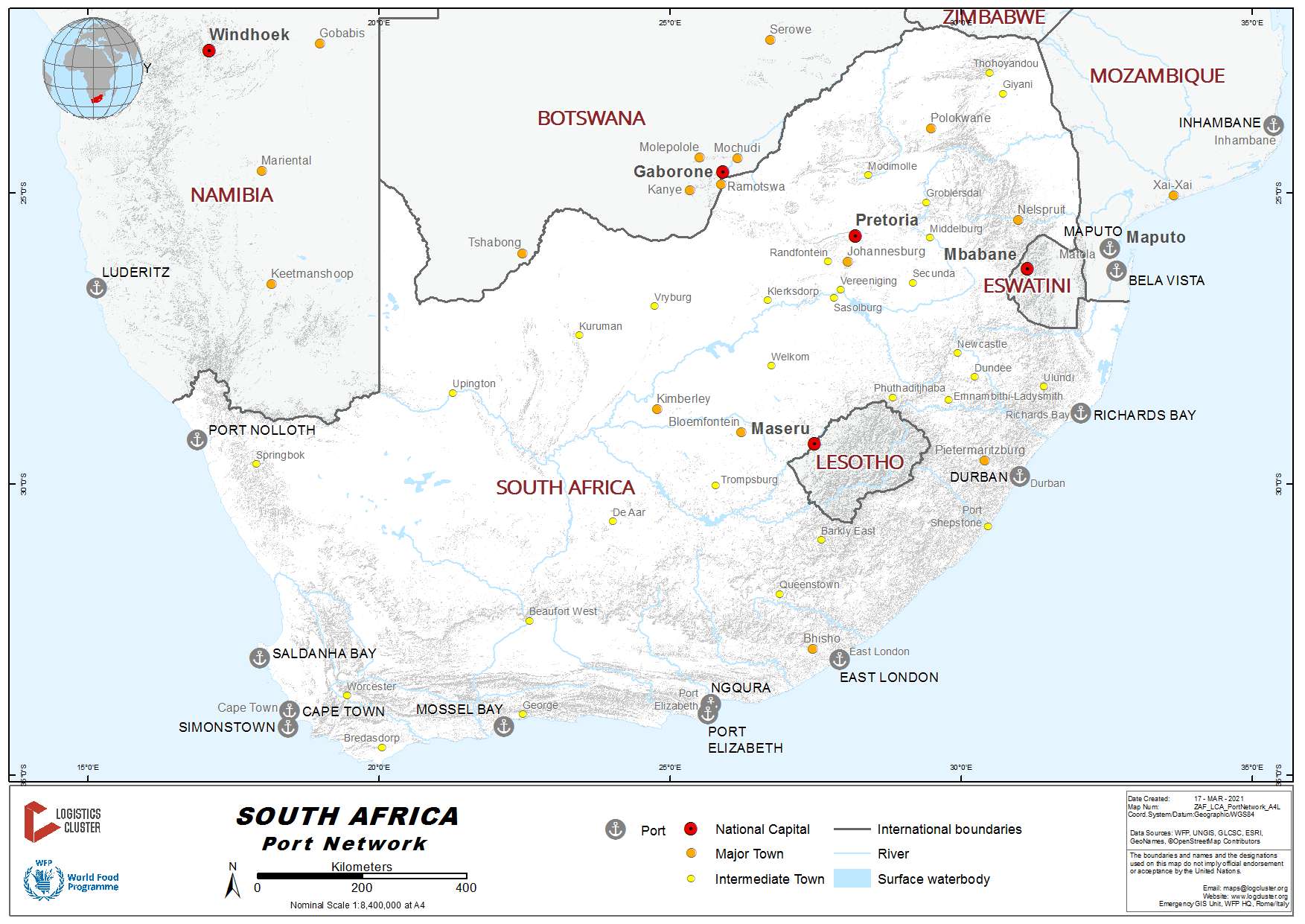

The spear tip of investment in the country’s freight infrastructure is aimed at the port network capacity, especially containerized capacity. The ports of Durban, Cape Town, and Port Elizabeth are currently the three main container ports with nearly 4 million twenty foot equivalent unit (TEU) (2008/09). With the addition of Ngqura at Port Elizabeth to handle about 70% of what Durban would usually handle, the expectation is that containerization will increase to 20 million TEU by 2034 from the same ports.

2.1 South Africa Port Assessment

The following sections show the assessments for the Ports of Durban and Cape Town.

2.1.1 South Africa Port of Durban

Port Overview

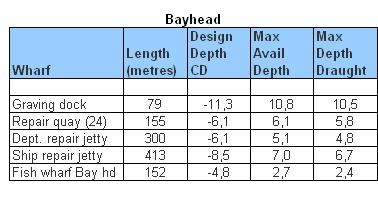

The port of Durban is the main container port on the South African coastline. While handling approximately 60% of South Africa’s container traffic, the port serves KwaZulu-Natal, the Gauteng region and a large portion of the Southern African hinterland. Together with containers the port also accommodates dry bulk, liquid bulk, automotive and break bulk. Other present port activities, include facilities for local fishing industry, ship repair industries, visiting cruise liner vessels and recreational boating. The Port of Durban is bounded by the city of centre to the north, residential areas to the west and east, and industrial land to the south.

The port, like all others in South Africa, is operated on a common-user basis and is managed by Transnet National Ports Authority (TNPA) – through it’s terminal operators organ Transnet Port Terminal (TPT), which provides and maintains the infrastructure as well as the superstructure of the port. TNPA provides cargo handling (except stevedoring aboard vessels which is undertaken by private enterprise) and marine services including tugs and pilotage. Cargo handling facilities are provided on a non-discriminatory basis, whilst vessels are served on a first planned-first served basis. Where necessary, special purpose quays may be provided on a common-user basis for the handling of specific commodities or types of cargo such as ore, grain, bulk cargoes, unitised cargo and containers.

Port website: http://www.transnetnationalportsauthority.net/OurPorts/Durban/Pages/Port-Directory.aspx

Key port information may also be found at: http://www.maritime-database.com

|

Port Location and Contact |

|

|---|---|

|

Country |

Republic of South Africa |

|

Province or District |

KwaZulu Natal |

|

Nearest Town or City with Distance from Port |

Durban (0 km) |

|

Port's Complete Name |

Port of Durban |

|

Latitude |

-29.881 |

|

Longitude |

31.0265 |

|

Managing Company or Port Authority |

Transnet National Ports Authority |

|

Management Contact Person |

Moshe Motlohi, Port Manager Tel (27) 031 361 8821 Email: moshe.motlohi@transnet.net |

|

Nearest Airport and Airlines with Frequent International Arrivals/Departures |

AIRPORT NAME : Durban International Airport (King Shaka Airport) (DUR / FALE) 17.1 km from port LIST OF INTERNATIONAL CARRIERS : Mango Airline (JE), Comair (MN), South African Airways (SAA), Emirates (EK), British Airways (BA), Air Mauritius Airways (MK) |

Port Picture

Description and Contacts of Key Companies

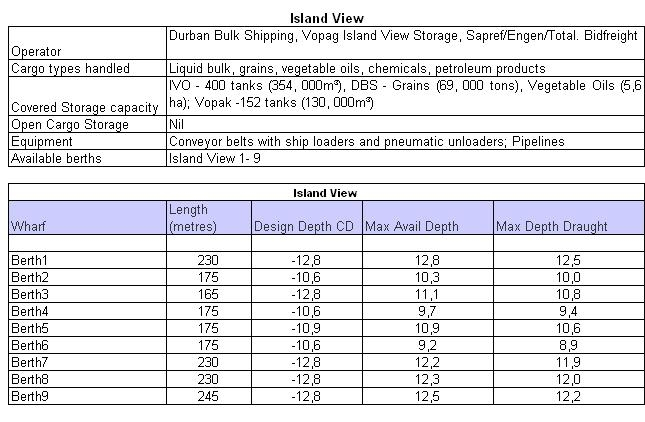

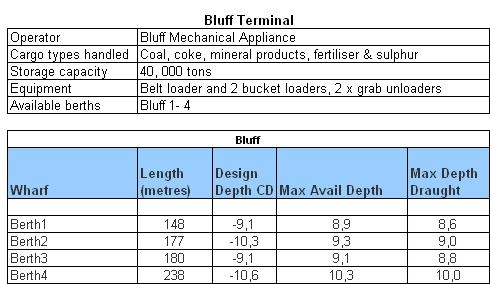

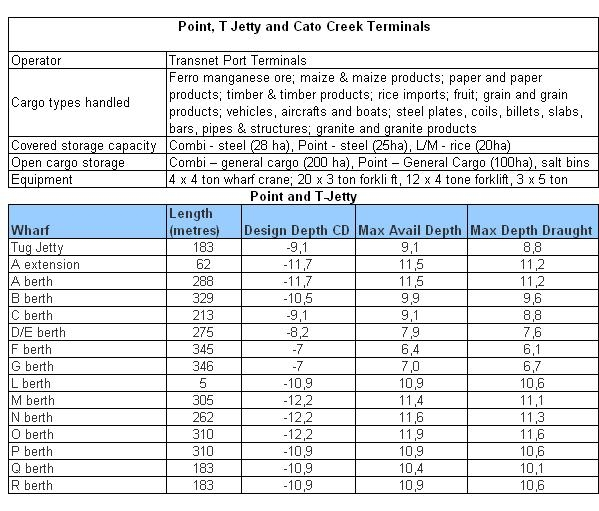

A number of companies operate within the port precinct and offer diverse or specialised services. Within the port certain berths / terminals have been concessioned to private operators some of these are Maydon Wharf – operated by the Grindrod Group offering container and breakbulk facilities, as well as port of call for a regional feeder Ocean Africa Container Lines (OACL), Bluff terminal – providing mineral handling facilities and Island View – offering hydrocarbons handling facilities.

For more information on port contacts, please see the following link: 4.4 Port and Waterways Companies Contact List.

Port Performance

The Port of Durban offers extensive safe anchorage outside the port. The Port of Durban has 59 berths (not counting fishing and ship repair) and an inner anchorage in the bay. Operating 24 hours a day, the entrance channel is 19 meters (62.3 feet) deep and 222 meters (728.3 feet) wide. Vessels up to 300 meters (984.2 feet) long and 37 meters (121.4 feet) wide can easily enter the port. The port operates a fleet of tugs owned and operated by the National Ports Authority (NPA), and the NPA conducts dredging on an ongoing basis. The two main commercial container terminals in Durban harbour (Pier 1 and Pier 2) operates a fixed berthing window strategy or a CTOC (CTOC – determination and coordination of container terminal operations contract berthing windows, which guarantee a departure time on condition that a vessel arrives on schedule and doesn’t exceed the number of contracted moves), negotiated on an annual basis with major shipping lines. Outside of this agreement berth availability is limited, unscheduled vessel calls may subject to waiting between 3 – 7 days. In relation to prioritising of humanitarian cargo, no standing agreement exist, however arrangement may be made (on a vessel by vessel basis).

|

Seasonal Constraints |

||

|---|---|---|

|

Occurs |

Time Frame |

|

|

Rainy Season |

Yes |

From October to April |

|

Major Import Campaigns |

Yes |

From November to February |

|

Other Comments |

South African citrus fruit exports during the months of April to November places significant pressure on the port (terminal congestion) and logistics infrastructure (traffic and transport resource availability) |

|

Discharge Rates and Terminal Handling Charges

For information on port rates and charges, please see the following link: https://www.transnetportterminals.net/Customer/Tariffs/Forms/AllItems.aspx

Berthing Specifications

|

Type of Berth |

Quantity |

Length (m) |

Maximum Draft (m) |

|

Conventional Berth |

31 |

228 |

9.6 |

|---|---|---|---|

|

Container Berth |

10 |

295 |

11.9 |

|

Silo Berth |

N/A |

N/A |

N/A |

|

Bulk Liquid |

9 |

288 |

12.8 |

|

Berthing Tugs |

N/A |

|

|

|

Water Barges |

N/A |

|

|

General Cargo Handling Berths

|

Cargo Type |

Berth Identification |

|---|---|

|

Imports - Bagged Cargo |

TBA |

|

Exports - Bagged Cargo |

TBA |

|

Imports and Exports - RoRo |

TBA |

|

Other Imports |

TBA |

Port Handling Equipment

Terminal assets within the two main container terminals (Pier 1 & Pier 2) are owned by the Transnet Port Terminals (TPT), a state owned company (SOC). Other leased terminals own handling equipment privately.

|

Equipment |

Available |

Total Quantity and Capacity Available |

Comments on Current Condition and Actual Usage |

|

Dockside Crane |

Yes |

2 x 50 MT 2 x 10 MT |

|

|---|---|---|---|

|

Floating Cranes |

Yes |

1 x 235 t at 10 m 1 x 125 t at 24 m 1 x 60 T at 6.1 m / 40.6 MT at 16.2 m |

|

|

Harbour Boat |

Yes |

1 |

100 passengers |

|

Floating Dock |

Yes |

2 4,500 MT 2 x 5 MT (electric) |

|

Container Facilities

The South African Government has embarked on a significant infrastructure drive to boost the economy and to alleviate poverty. As part of the MDS, Port Terminals will invest R37.2 billion over the next seven years to maintain and create new terminal capacity, ensuring that its terminals can facilitate projected demand. The container sector will see the largest expansion, with capacity increasing by 41% from 5,6 million twenty-foot equivalent units (TEUs) in 2014 to 7.9 million TEUs per year in 2021. The bulk sector will increase its capacity from 93 million tons per year in 2014 to 99 million tons in 2021, while break-bulk capacity will increase from 15.6 million tons per year in 2014 to 16.6 million tons in 2021. Automotive capacity will increase by 25% from 787,000 fully built units (FBUs) in 2014 to 987,000 FBUs in 2021. The fleet of ship-to-shore (STS) cranes in the container sector is planned to increase from 43 cranes in 2014 to 64 cranes in 2021. The number of straddle carriers will increase from 159 to 202; and there will be an increase in the number of Rubber Tyred Gantries (RTGs), from 72 to 140. In the bulk sector, the number of tipplers will increase from six to nine and the number of ship loaders/unloaders will increase from 19 to 21.

|

Facilities |

20 ft |

|---|---|

|

Container Facilities Available |

Yes |

|

Container Freight Station (CFS) |

Yes |

|

Refrigerated Container Stations |

Yes, pre-cooling facilities at berths O and P |

|

Other Capacity Details |

|

|

Daily Take Off Capacity |

N/A |

|

Number of Reefer Stations |

11 cooling chambers 27,000 m³ 69 pre-cooling funnels 9,500 m³ Open storage 4,000 m³ |

Customs Guidance

Customs and Excise office is located with the port precinct, customs also hold a 24/7 presence within the terminals for ongoing operations. Turnaround times are generally between 3 – 5 days from submission of clearance documents (without any queries). A container X-ray scanner is also located within the port precinct for any container deferred for further assessment, operating from 08:00 to 17:00. Various customs licensed depot are available in close proximity to the port for any such container deemed by customs to be opened for physical examinations. For vessels call the port customs & immigration will advise the Master of the local restrictions on berthing. Penalties are imposed for noncompliance with prescribed regulations.

For more information on customs in South Africa, please see the following link: 1.3 Customs Information.

Terminal Information

Multipurpose Terminal

The new MPT facilities at the Point incorporates a modern intermodal cargo exchange terminal, a bonded storage facility, and expanded cargo and container stacking areas covering about 20 hectares. The multi-purpose terminal, which handles break-bulk, bulk and containerised cargoes, has become this port's largest general cargo-handling facility. It operates across 14 berths at Pier 1, the Point and on the T-Jetty, and handles both import and export breakbulk cargo. Products handled at Durban MPT include steel, ferro-alloys, granite, rice, fruit and containers. A Ro-Ro terminal, mainly serving the coastal trade, is attached to the main container complex. A shed is available with an undercover storage area of 8 380 square metres. Total area (including Container Depot) 102.00 ha Actual container/Ro-Ro stacking area 26.33 ha. The Maydon Wharf MPT terminal operates across a number of berths at Maydon Wharf, principally between berths 8 to 13, and handles a variety of commodities, focusing on niche cargo including neo-bulks (salt, fertilisers and other mineral products, steel, scrap metal and forest products). The port has a well-equipped passenger terminal at N- berth on the T-Jetty for the convenience of cruise ships, which operate mostly between November and May.

Grain and Bulk Handling

There are 13 dry bulk berths at the Port of Durban with a current theoretical and installed capacity of 16 million tons per annum (MTPA). These berths include three berths at the Bluff, one berth at Island View

(IV3) and nine berths at Maydon Wharf. Rennies Bulk Terminals operates multi-product bulk handling facilities at Berth 5 at the Maydon Wharf in the Port of Durban. Products include wheat, rice, maize (corn), soda ash, fluorspar, soya meal, and palletized protein feeds. The terminal can store 100 thousand tons of agricultural products and 40 thousand tons of mineral products. This Port of Durban facility can bag 750 tons per day. Greystones Enterprises operates a Container Freight Station in the Port of Durban that is served by rail siding and roads. The facility offers the full range of services that include container stuffing and de-stuffing and cargo unitizing, including palletizing and bagging.

Main Storage Terminal

There are several privately-owned bulk storage and handling facilities in the Port of Durban. Outspan International operates a citrus terminal at the Port of Durban's Point with storage capacity of 176.2 thousand cubic meters for over 17.5 thousand pallets in 13 holding chambers. The Port of Durban's Citrus Terminal also has 72 rapid-cooling tunnels with capacity of 7.8 thousand cubic meters for 3456 pallets. The container area has capacity for 2356 cubic meters for 1040 pallets. The Citrus Terminal in the Port of Durban can handle 2000 pallets per day. SA Terminals operates a Bulk-Sugar Terminal at Berth 2 at the Maydon Wharf. It has capacity for 520 thousand tons in silos and for 57 thousand tons at the bagged sugar warehouse. The Bulk-Sugar Terminal in the Port of Durban can handle as much as 1000 tons per hour. Durban Bulk Shipping operates a multi-product bulk shipping terminal at Berth 3 at the Port of Durban's Island View facilities. Products include wheat, maize and maize products, vegetable oils, ores, and minerals. The Durban Bulk Shipping multi-purpose facility has capacity to store 68 thousand tons of bulk maize products, eight thousand tons of both andalucite and mono-calcium phosphates, 33.5 thousand tons of coal, 24 thousand tons of chrome ore, and 4956 cubic meters of vegetable oils.

|

Storage Facility – Contact |

|

|

Company |

Manica Africa |

|---|---|

|

Contact |

Dean Harris/Royston Denysschen |

|

Telephone |

+27(031)3280284 |

Stevedoring

Stevedoring in the terminal is offering by the terminal, however stevedoring companies may be contracted to the terminal or contracted freely on a vessel by vessel basis to vessels and their port agents

For contact information for stevedoring companies operating at the Port of Durban, please see the following: 4.4 South Africa Port and Waterway Companies Contact List.

Sturrock Grindrod - stevedoring operations are in Durban, Richards Bay, Maputo and Walvis Bay. Stevedoring services include the handling of bulk commodities, break bulk commodities, containers and vehicles.

P & O Ports Nationwide Cargo Terminals Sa (PTY) Ltd - Address: Bon1, Duncan Dock Rd, Table Bay Harbour, Western Cape, 8001, South Africa, Cape Town.

Bidfreight Port Operations - Address: Coode Cres, Table Bay Harbour, Western Cape, 8001, South Africa, Cape Town.

P S Port Stevedoring - Address: 35 Grunter Gully, Bayhead, Kwazulu Natal, 4026, South Africa, Durban.

Good Hope Stevedoring (PTY) Ltd - Address: Unit9 Auckland Pk, Auckland St, Paarden Eiland, Western Cape, 7405, South Africa, Cape Town.

Port Stevedoring - Address: Ste300 3 Mansion Hse, 12 Joe Slovo St, Central, Kwazulu Natal, 4001, South Africa, Durban.

Bay Stevedores - Address: Newark Rd, Richards Bay, 3900, SouthAfrica, Kwazulu Natal.

Bid Freight Port Operations - Address: 27 Church St, Central, East London, 5201, South Africa, Eastern Cape.

P & O Ports Nationwide Cargo Terminals SA (PTY) Ltd - Address: Eastern Cape, 6001, South Africa, Port Elizabeth.

Hinterland Information

The Port of Terminal is the main gateway seaport (by volume) to sub-Saharan Africa. From the port strategic channels are provided to facilitate the smooth flow of cargo from the port terminals and vice versa, these include a roadway systems that interlinks with the rest of the country and with neighbouring countries, rail services are also available from the port connecting the major commercial centres in a hub and spoke layout – also able to connect to some neighbouring countries, it further also like road transport links to multimodal transit hubs for further connectivity.

Port Security

There are police, ambulances and fire-fighting services available. Private security companies are available for 24 hour on-board service. Stowaways have become a problem in Durban and Masters are advised to take the necessary precautions and do stowaway searches before the vessel sails. Firemen are on duty at all tanker and bunker berths whilst vessels are working cargoes/bunkering. Transnet National Port Authority has installed advanced security features such as closed-circuit television for some of its terminals and Automatic Identification Systems (AIS) that allow for remote ship identification by port control. The most obvious aspect of this compliance is that it impact access to ports by non-port related users. Many areas previously accessible by the general public such as cargo working terminals and ship repair lay-up quays are now only accessible by authorized personnel. The new Security regulations required the appointment of a Port Security Officer for each port and a Port Facility Security Officer for each terminal. These persons will coordinate security planning, implementation and maintenance between the port authority and port facility operators.

The wide-area surveillance and perimeter protection solution at Durban Port is comprised of an 'intelligent' command and control system that transforms a network of cameras into intelligent object detection, tracking and recording sensors. At Durban's Port over 120 cameras were placed on the perimeter with the addition of 13 PTZ cameras. Any breach in the perimeter or suspicious behaviour detected by the cameras sets off an alarm in the control centre via the command centre software, enabling the security personnel can react accordingly.

|

Security |

|

|---|---|

|

ISPS Compliant |

Yes |

|

Current ISPS Level |

Level 1 = Normal |

|

Police Boats |

Yes |

|

Fire Engines |

Yes |

2.1.2 South Africa Port of Cape Town

Port Overview

The Port of Cape Town is the premier port for the Western Cape region, providing a wide range of round-the-clock port operations. With a land area of 253 ha and a water area of 9163 ha, the port provides port services to a variety of sectors, including containers, general cargo, fresh produce and fishing (including international operations and exports), as well as the burgeoning offshore oil and gas industry.

Local and international demand for bunkering and ship repair is growing rapidly, and Cape Town has 3 ship repair facilities, one of which includes the largest dry dock in Southern Africa. The port also provides comprehensive marine services: navigation, towage, pilotage, berthing, and pollution control.

Cape Town is positioned as a hub linking the Americas and Europe with Asia, Southeast Asia, and Australia. As a result, a large percentage of cargo handled is transhipment cargo for onward transit. South Africa’s growing exports, particularly fresh fruit, perishables and frozen produce, travel to global destinations via the Port of Cape Town. Cargoes fall into four clusters: containers, liquid bulk, dry bulk and break-bulk. The port has facilities and infrastructure for container, multi-purpose and fresh produce terminals.

Port website: https://www.transnetportterminals.net/Ports/Pages/CapeTown_Multi.aspx

Key port information may also be found at: http://www.maritime-database.com

|

Port Location and Contact |

|

|---|---|

|

Country |

Republic of South Africa |

|

Province or District |

Western Cape |

|

Nearest Town or City with Distance from Port |

Cape Town (0 km) |

|

Port's Complete Name |

Port of Cape Town |

|

Latitude |

-33.912347 |

|

Longitude |

18.428383 |

|

Managing Company or Port Authority |

Transnet National Ports Authority |

|

Management Contact Person |

Sipho Nzuza – Port Manager +27 021 449 2612 Email : Sipho.Nzuza@transnet.net |

|

Nearest Airport and Airlines with Frequent International Arrivals/Departures |

AIRPORT NAME : Cape Town International Airport (IATA: CPT, ICAO: FACT) 19.5 km from port LIST OF INTERNATIONAL CARRIERS : Mango Airline (JE), Comair (MN), South African Airways (SAA), Emirates (EK), British Airways (BA), Air Mauritius Airways (MK), Aegean Airlines (A3), Air Botswana (BP), Air Canada (AC), Air France (AF), Air India (AI), Asiana Airlines (OZ), Cemair (5Z), Ethiopian Airlines (ET), Kenyan Airways (KQ). https://www.capetown-airport.com/airlines.php |

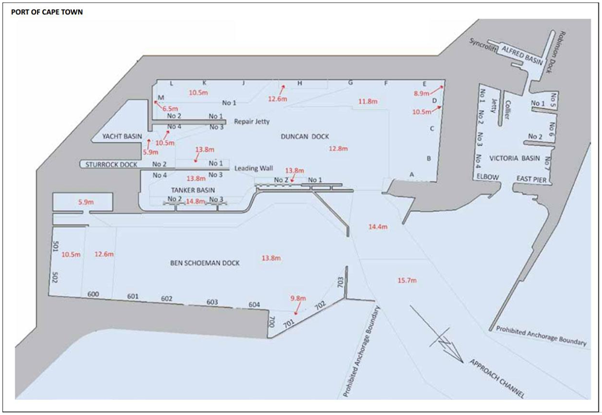

Port Picture

Image below, displays port layout showing approach channel, depths alongside and berth / quay number / letter naming.

Image below, displays an aerial view of the port showing all ship repair facilities available to port users.

Description and Contacts of Key Companies

Cape Town Services

Working hours: Port Control – For emergencies and handling of ships – 24 hours a day, 365 days per year.

Cartage – 24 hours per day.

Breakbulk – 06:00 – 22:00, Monday to Friday.

Containers – 24 hours a day, 362 days per year (not 1 January, 1 May and 25 December).

Office hours - (including Revenue) 08:00 to 16:30 Monday to Friday, not public holidays.

Tankers are restricted to daylight berthing and unberthing. Under certain circumstances, vessels with a double hull will not be subject to these conditions.

Dry dock/ship repair facilities

Transnet National Ports Authority owns and operates two dry docks, a repair quay and a synchrolift.

Robinson Dry Dock

Situated at Victoria Basin, overall docking length 161,2 m, length on bottom = 152,4 m, width at entrance top 20,7 m, maximum width at bottom = 17,2 m, depth over entrance sill HWOST = 7,9 m.

Sturrock Dry Dock

Situated at Duncan Dock, overall docking length 360 m, length on bottom (dock floor) = 350,4 m, width at entrance top = 45,1 m, maximum width at bottom (dock floor) = 38,4 m, depth 14 m, depth over entrance sill HWOST = 13,7 m. A docking length of 369,6 m can be achieved by placing the caisson in the emergency stop at the entrance. The dock can be divided into two compartments of either 132,5 m and 216,1 m or 205,7 m and 142,9 m.

Repair Quay Length: 456 m, landing wall 548 m.

SYNCHROLIFT can handle 1 806 tonnes and vessels up to 61 m in length and 15 m in width. Repair lanes available (length) = 2 x 70 m, 1 x 55 m, 2 x 75 m.

Work is undertaken by private companies and services include, ship repair, engineering, refrigeration, hydraulics, cleaning and painting.

Bunkering

The Port of Cape Town has 61 bunkering points supplying marine fuel oil, gas oil and blended fuels at most berths. Bunker fuels are delivered by pipeline, gas oil is delivered by barge and diesel oil is not available. Joint Bunkering Services is a joint venture between BP South Africa, Caltex Oil, Shell SA and Engen Petroleum. Consumers can choose which oil company they want to supply their fuel while gaining from the economy of scale from the shared distribution system of the JBS.

Chandlers

Chandling services are available from private companies located around the port.

For more information on port contacts, please see the following link: 4.4 Port and Waterways Companies Contact List.

Port Performance

The port of Cape Town remains open 24 hours a day 7 days a week. The depth at the entrance channel is -15.9m Chart datum, is -15.4m at the 180m wide entrance into Duncan Dock and -14m at the entrance to Ben Schoeman Dock. The depth in the Duncan Dock varies between -9.9m near the repair quay to -12.4m at the tanker basin. Ben Schoeman Dock varies from -9m to -13.9m. Dredging is carried out regularly to maintain required depths alongside and in the harbour.

Pilotage is compulsory for all vessels with the pilot being taken on board 1.6 miles and 155º off the main breakwater. Pilot transfer is by pilot boat. Navigation is subject to VTS (vessel tracking system) and tug service is provided by four tugs. The harbour and Table Bay are subject to strong winds during the Cape winter (April to September) that can disrupt cargo and ship working in the port.

|

Seasonal Constraints |

||

|---|---|---|

|

Occurs |

Time Frame |

|

|

Rainy Season |

Yes |

From April to September |

|

Major Import Campaigns |

Yes |

From November to February |

|

Other Comments |

During October to March Cape Town is subject to it windy season with the south-easterly bring gale force condition over Cape Town and especially the exposed port area, bringing most container and vessel traffic to a standstill sporadically. |

|

|

Handling Figures for 2020 |

|

|---|---|

|

Vessel Calls |

552 |

|

Container Traffic (TEUs) |

26,801,656 |

|

Handling Figures Bulk and Break Bulk for 2020 |

|

|---|---|

|

Bulk (MT) |

3,532,483 |

|

Break bulk (MT) |

2,434,820 |

Discharge Rates and Terminal Handling Charges

For information on port rates and charges, please see the following link: https://www.transnetportterminals.net/Customer/Tariffs/TPT%20Tariff%20Book%202020.pdf

Berthing Specifications

|

Type of Berth |

Quantity |

Length (m) |

Maximum Draft (m) |

Comments |

|---|---|---|---|---|

|

Conventional Berth |

8 |

1937 m |

12.2 m |

|

|

Container Berth |

4 |

1151 m |

14.2 m |

|

|

Silo Berth |

No |

|

||

|

Berthing Tugs |

4 |

40 ton Bullard pull |

||

|

Water Barges |

No |

Quay side supply |

General Cargo Handling Berths

|

Cargo Type |

Berth Identification |

|---|---|

|

Imports - Bagged Cargo |

Berths : B, C, D, E, F, J |

|

Exports - Bagged Cargo |

Berths : B, C, D, E, F, J |

|

Imports and Exports - RoRo |

N/A |

|

Other Imports |

Hydrocarbons, Berths : TB1 & TB2 |

Port Handling Equipment

Terminal assets within the two main container terminals (CTCT and Multipurpose terminal) are owned by the Transnet Port Terminals (TPT) a state owned company (SOC). Other leased terminals own handling equipment privately.

|

Equipment |

Available |

Total Quantity and Capacity Available |

Comments on Current Condition and Actual Usage |

|---|---|---|---|

|

Dockside Crane |

Yes |

8 x 70 MT |

Good |

|

Container Gantries |

Yes |

28 |

Good |

|

Mobile Cranes |

Yes |

23 x 4 MT , 2 x 5 MT |

Good |

|

Reachstacker |

Yes |

5 |

Good |

|

RoRo Tugmaster (with Trailer) |

No |

||

|

Grain Elevator with Bagging Machines |

No |

||

|

Transtainer |

No |

||

|

Forklifts |

No |

Container Facilities

The image above shows the main container terminal know as CTCT (Cape Town Container Terminal). In the foreground is a straddle-carrier operated empty stacking yard with dry container and immediately next it (right foreground) are empty reefer containers in a typical wind-stack formation. Opposite the empty stack reefer towers for cold chain power supply and monitoring are visible. Along the main quay are container ships berthed and STS cranes extended, behind these a further RTG (Rubber Tyred Gantry) stacking yard is visible.

More depots, performing storage, pack/unpack, maintenance and repairs, prepping and other cargo and container related activities are also available within the immediate vicinity of the port terminal.

|

Facilities |

20 ft |

40 ft |

|---|---|---|

|

Container Facilities Available |

Yes |

Yes |

|

Container Freight Station (CFS) |

Yes |

Yes |

|

Refrigerated Container Stations |

Yes |

Yes |

|

Other Capacity Details |

- |

- |

|

Daily Take Off Capacity (Containers per Day) |

528 |

528 |

|

Number of Reefer Stations (Connection Points) |

- |

4000 |

|

Emergency Take-off Capacity |

1080 |

1080 |

|

Off take Capacity of Gang Shift (Containers per Shift) |

176 |

176 |

Customs Guidance

Customs and Excise office is located with the port precinct, customs also hold a 24/7 presence within the terminals for ongoing operations. Turnaround times are generally between 3 – 5 days from submission of clearance documents (without any queries). A container X-ray scanner is also located within the port precinct, alongside the reefer gate close to the main container terminal gate, for any container deferred for further assessment, operating from 08:00 to 18:00. Various customs licenced depot are available in close proximity to the port for any such container deemed by customs to be opened for physical examinations. For vessels call the port customs & immigration will advise the Master of the local restrictions on berthing. Penalties are imposed for noncompliance with prescribed regulations.

For more information on customs in South Africa: 1.3 Customs Information.

Terminal Information

Multipurpose Terminal

With its origins dating as far back as 1947, the Cape Town Multipurpose Terminal (MPT) has been the chosen import and export terminal for a large variety of commodities including fertilizer, soda-ash, soya, sunflower pellets, wheat, maize, cement and containerised cargo. Located in the Duncan Dock area of the harbour and in close proximity to major transport routes, the terminal operates within an area with a quayside length of almost 1.8 kilometers with a current staff complement of approximately 220 persons. Cape Town MPT trades with over 20 countries.

General cargo is served by the six berths of the Multi-purpose and Combi terminals, which between them handle a wide range of goods – up to 90 commodities on the ports list – from timber to frozen fish.

Grain and Bulk Handling

The average tonnage of all grains imported through the Port of Cape Town that can be expected in a month is approximately 90 000 tons. The maximum tonnage of all grains imported through the Port of Cape Town that can be expected in a month is approximately 180 000 tons. Bagging is generally not available for Cape Town Multipurpose Terminal (MPT), however may be discussed with Fresh Produce Terminal (FPT).

Main Storage Terminal

Limited warehousing (shed) space is available in the terminal as terminals are throughput focused. Fresh Produce Terminal (FPT), a private terminal operator (concession) has some warehousing space on their quayside. Privately held cold storage capacity is also available within the port precinct, to serve the agricultural (eg. fruits, animal proteins) and foodstuffs manufacturing (eg. dairy products) industries, such as CCS Logistics.

|

Storage Type |

Number of Storage Facilities |

Area (m2) |

|---|---|---|

|

Bagged Cargo |

1 FPT |

27848 |

|

Refrigerated Cargo |

5 CCS |

46,500 MT |

|

General Cargo |

1 FPT |

27848 |

Stevedoring

The following stevedoring services are offered by Transnet Port Terminals :

- stowage of cargo

- lashing and securing of cargo

- breaking out of cargo

- planning of cargo to stowage plan

- operating ships equipment

- cleaning of hatches and tanks

Other private stevedore services companies are also available with operations in various port locations around South Africa.

Duncan Dock Cold Storage Stevedoring Services provides the clients of the cold storage facility with a one stop service in discharging vessel to the cold store.

Cargo Handling Specialists

5 Carlisle Street, Paarden Eiland,

South Africa, 7405

082 457 9557

(021) 511-9748

Port Stevedoring (PS)

https://www.portstevedoring.co.za/

+27 (0) 21 401 8847

South Arm Road, Duncan Dock,

Table Bay Harbour, Cape Town, 8001,

Western Cape

Bidfreight Port Operations

Tel: +27 (0)21 421 3122

Fax: +27 (0)21 421 3136

Alkmaar Road, Table Bay Harbour, Cape Town, 8001, Western Cape

Email: capetown@bidports.co.za

Hinterland Information

From the port strategic channels are provided to facilitate the smooth flow of cargo from the port terminals and vice versa, these include a roadway systems that interlinks with the rest of the country, rail services are also available from the port connecting the major commercial centres in a hub and spoke layout and linking to multimodal transit hubs for further connectivity. The terminal as a seaport gateway holds significant interconnectivity to the rest of South Africa and some of its Sub-Saharan neighbours (Namibia, Botswana, Angola) by means of mainly road network and feeder vessel transport (coastal countries, ie. Namibia & Angola). The port serves as a major export gateway to the agricultural industry servicing areas as far afield as the Northern Cape and Limpopo province, with reserve logistics feasible.

Port Security

There are police, ambulances and fire-fighting services available. Private security companies are available for 24 hour on-board service. Stowaways do pose a problem in Cape Town, however to a small degree, nonetheless, Masters are advised to take the necessary precautions and do stowaway searches before the vessel sails. Firemen are on duty at all tanker and bunker berths whilst vessels are working cargoes/bunkering. Transnet National Port Authority has installed advanced security features such as closed-circuit television for some of its terminals and Automatic Identification Systems (AIS) that allow for remote ship identification by port control. The most obvious aspect of this compliance is that it impact access to ports by non-port related users. Many areas previously accessible by the general public such as cargo working terminals and ship repair lay-up quays are now only accessible by authorized personnel. The new Security regulations required the appointment of a Port Security Officer for each port and a Port Facility Security Officer for each terminal. These persons will coordinate security planning, implementation and maintenance between the port authority and port facility operators.

|

Security |

|

|---|---|

|

ISPS Compliant |

Yes |

|

Current ISPS Level |

Level 1 |

|

Police Boats |

Yes |

|

Fire Engines |

Yes |

South Africa - 2.1.3 Port of Gqeberha (Port of Port Elizabeth)

The following assessment was produced thanks to the support of BLG Logistics Group: Port of Gqeberha

South Africa - 2.1.4 Port of Ngqura

The following assessment was produced thanks to the support of BLG Logistics Group: Port of Ngqura

South Africa - 2.1.5 Port of East London

The following assessment was produced thanks to the support of BLG Logistics Group: Port of East London

2.2 South Africa Aviation

Key airport information may also be found at: http://worldaerodata.com/

The Republic of South Africa is a signatory to the Convention on International Civil Aviation of 1944 (Chicago Convention), which led to the establishment of a United Nations specialized body, the International Civil Aviation Organization (ICAO). The ICAO is responsible for standardizing and administering the safety and security of civil aviation operations across the world. The SACAA is a juristic person established in terms of the Civil Aviation Authority Act, 2009 (Act No 13 of 2009). The SACAA’s mandate is to administer civil aviation safety and security oversight in the Republic of South Africa, in line with the Civil Aviation Authority Act (the Act), and in accordance with the standards and recommended practices (SARPs) prescribed by the ICAO.

The impact of the Aviation industry in South Africa's economy cannot be over-emphasized. South Africa has been able to implement international and our National Aviation Safety Plans, with our airports achieving impressive compliant safety records.

The Air Traffic and Navigation Services (ATNS) have made major strides to improve our airspace management safely scenarios. Infrastructure investments to assist the programme include the continued renewal of terrestrial aeronautical navigation systems and continued maintenance of radar systems.

Aviation Public Entities include:

| Public Aviation Entities | Website |

|---|---|

| Air Traffic and Navigation Services (ATNS) | https://www.atns.com/ |

| Airport Company South Africa (ACSA) | |

| South African Civil Aviation Authority (SACAA) | http://www.caa.co.za/ |

For more information on government agency and airport company contact information, please see the following links: 4.1 Government Contact List and 4.5 Airport Companies Contact List.

Procedures for Foreign Registered Aircraft

Type Acceptance Certificate (TAC) applied for with the South African Civil Aviation Authority (SACAA) means an approval issued in terms of regulation South African Civil Aviation Regulations (SACAR) 21.04.5, which signifies SACAA acceptance of the foreign Type Certificate (TC) of a product (aircraft, engine, or propeller), for which the holder is the foreign Type Certificate (TC) holder. The TAC defines the product design approval (TC) accepted, states who is the holder of the TAC, and lists any additional limitations or conditions applied for SACAA acceptance of the product. It also identifies the category of the product (standard or restricted for special purpose operations).

In order to place an aircraft on the SA Civil Aircraft Register, the aircraft must have been issued a TAC by the Director, as per SACAR 47.00.5 (2) (a) (iv).

In order to issue a Certificate of Airworthiness for an imported aircraft, the aircraft must have been issued with a TAC by the Director, as per SACAR 21.08.4 (1) (b) (i), and the aircraft must conform to that TAC, as per SACAR 21.08.4 (2) (a).

These have been requirements since the promulgation of the South African Civil Aviation Regulations of 1997.

The Technical Guidance Material describes how the SACAA Certification Engineering section processes an application for the issuing of a TAC.

Refer to SA-CATS 129 (http://caa.mylexisnexis.co.za/)

Issuance of Flight Authorisation

Only applications, submitted in the form and manner prescribed in this TS, will be considered for the issuing of a flight authorisation.

- The purpose for issuing flight authorisations is to control all movement of certain foreign registered aircraft in South African airspace and at South African airports. It is important to note that regulation 129.01.1 applies only to “foreign state aircraft or an aircraft operated by a foreign operator in an air transport operation”. It does not apply to private or corporate flights that are operating in accordance with an ATC flight plan and enter the RSA through and under the control of customs and immigration. All foreign state and foreign air operators, operating on an itinerate basis, are thereby tracked and accounted for. The main purposes for this type of itinerate activity is to perform on-demand charters, technical landings for normal or abnormal servicing, or to transit South African airspace enroute to other destinations. The primary users of this service are foreign charter companies or aircraft operated by a Foreign State, including military aircraft. Whatever the reason for travel, it is for safety and security reasons that the SACAA has a need to exercise oversight over such activity.

- A person, who is the holder of a SA-FAOC, does not require a flight authorisation, provided such flights are conducted in accordance with the provisions of their SA-FAOC.

- The application for a flight authorisation is less formal than for an actual operating certificate, and the fee required for this service is established by regulation.

- The following information shall be provided in an application

for flight authorisation to conduct an over-flight of South Africa,

or to operate in South Africa, or perform a technical stop in South

Africa. Aircraft on over-flights, private aircraft carrying 10

passengers or less, and military aircraft only need to provide the

information requested in paragraphs (a), (b), (c) (d), (f) and (j),

as applicable to the flight crew, and in the case of a Foreign

State aircraft, paragraph (j). In all cases paragraph (k) may apply

at the discretion of the Director.

-

Name of operator or person responsible for flight: The name of the operator must be the name of the person or organisation appearing on the certificate of registration or equivalent documentation The person or organisation responsible for the flight must take responsibility for being the SACAA point of contact on behalf of the operator.

-

Type of aircraft, registration marks and C of A expiry date, if applicable: The aircraft designation and full registration must be as indicated on the C of R. A copy of the C of R is also considered a good supporting document. The application should also be supported by a copy of a valid C of A, or a certification from the licensed AME attesting to the airworthiness of the aircraft flown.

-

Date and time of arrival at, and departure from, the airport concerned: The flight itinerary should include the date and estimated time of arrival and specify the routing filed with ATC and, if applicable, on the operational flight plan.

- Place or places of embarkation or disembarkation abroad, as the case may be, of passengers or freight.

-

Purpose of flight and number of passengers and the nature and amount of freight: Where possible, a passenger manifest should accompany the application or, if deemed necessary, be delivered prior to departure of the flight.

- Notification of dangerous goods and/or agricultural products.

- Name, address, telephone and telefax number and business of charterer, if any.

-

Name, address of the flight crew, including:

-

license numbers;

-

medical expiry dates;

-

expiry date of IFR and/or proficiency ratings, on the aircraft type to be operated.

-

- A certification that each pilot and cabin safety attendant meets the ICAO language requirements.

- If applicable, in the case of foreign state aircraft, a copy of the equivalent operations specification(s) issued by the regulating authority; and

- any other document the Director deems necessary to ensure that the intended operation will be conducted safely

-

- The flight authorisation will be issued on an official

document, normally in the form of an electronic transmission or

telex containing:

-

name and address of the operator;

-

type of aircraft and registration marks;

-

airport/s in South Africa to be visited as indicated on the application;

-

conditions with respect to required clearances to proceed to other airports subsequent to the initial arrival;

-

any other privilege granted, condition or restriction imposed; and

-

where the Director has decided not to allow the application, the reason for declining a flight authorisation will be stated.

-

For more information on procedures for foreign registered aircraft, please see the following attachments: List of SACAA TAC - Aircraft.

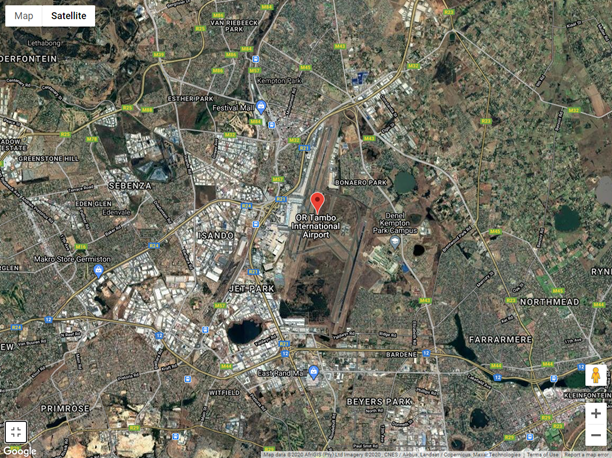

2.2.1 South Africa O.R. Tambo International Airport

Airport Overview