Vanuatu - 1 Country Profile

Generic Information

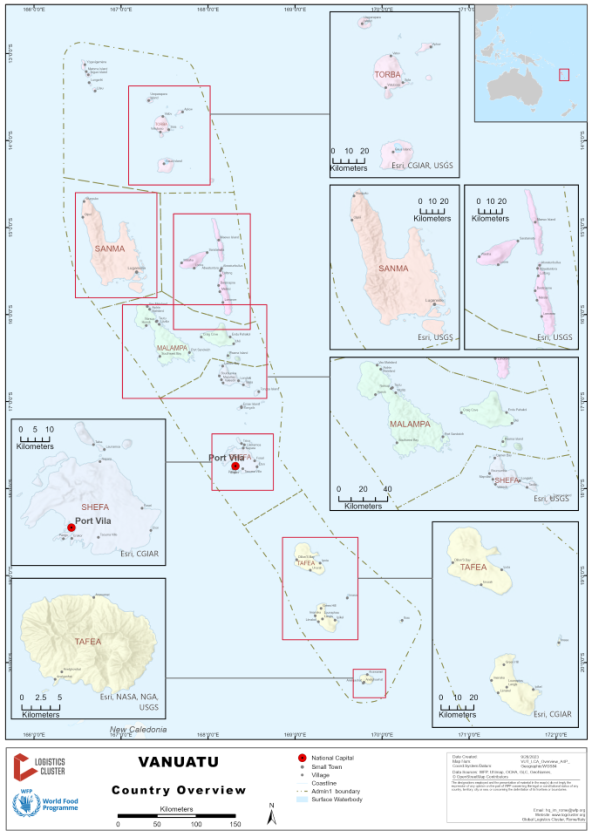

Vanuatu, officially the Republic of Vanuatu, is a Pacific Island nation located in the South Pacific Ocean. The archipelago, which is of volcanic origin, is some 1,750 km (1,090 mi) east of northern Australia, 540 km (340 mi) northeast of New Caledonia, east of New Guinea, southeast of Solomon Islands and west of Fiji.

There are 82 islands with a population of 300,019 people (2020 census).

Vanuatu was first inhabited by the Melanesian people. In the 1880s, France and the United Kingdom claimed parts of the archipelago, and in 1906, they agreed on a framework for jointly managing the archipelago as the New Hebrides through an Anglo-French condominium. An independence movement arose in the 1970s, and the Republic of Vanuatu was founded in 1980.

There are three official languages spoken in Vanuatu:

-

Bislama (local pidgin)

-

English

-

French

The islands also have many local dialects.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a generic country overview, please consult the following sources:

Vanuatu Wikipedia Country Information: https://en.wikipedia.org/wiki/Vanuatu

Vanuatu IMF Country Information: https://www.imf.org/en/Countries/VUT

Vanuatu Economist Intelligence Unit Information*: https://country.eiu.com/vanuatu

(*note - this is a paid service)

Humanitarian Info

Vanuatu UN Office for the Coordination of Humanitarian Affairs Information: https://www.unocha.org/office-pacific-islands/vanuatu

Facts and Figures

Vanuatu Wolfram Alpha Information: https://www.wolframalpha.com/input/?i=Vanuatu

Vanuatu World Bank Information: http://data.worldbank.org/country/vanuatu

Vanuatu Population Information:

-

https://worldpopulationreview.com/countries/vanuatu-population

-

Vanuatu 2020 National Population and Housing Census Analytical Report

Vanuatu - 1.1 Humanitarian Background

Disasters, Conflicts and Migration

|

Natural Disasters |

||

|---|---|---|

|

Type |

Occurs |

Comments / Details |

|

Drought |

Yes |

Vanuatu suffers from periodic drought. Scientists are predicting that an El Niño system is likely to develop later in 2023. This would mean below-normal rainfall in Vanuatu. |

|

Earthquakes |

Yes |

Vanuatu is situated on the Ring of Fire. On average about 186 earthquakes occur across Vanuatu each year. |

|

Epidemics |

Yes |

Mosquito-borne epidemics of malaria and dengue are common. Larger dengue outbreaks can occur seasonally often related to the rainy season and the La Niña phenomenon. COVID-19 remains a risk in Vanuatu. The Government of Vanuatu communicates COVID-19 risks and restrictions through the Vanuatu Outbreak Alert System. |

|

Extreme Temperatures |

No |

N/A |

|

Flooding |

Yes |

Many parts of Vanuatu are subject to flash flooding during the rainy season (November to April). Flood displacement risk is likely to double by 2060 and the average annual displacement is expected to quadruple. |

|

Insect Infestation |

Yes |

Disease carrying and crop eating insects are present in Vanuatu. |

|

Mudslides |

Yes |

Heavy rain and flooding have resulted in mudslides. |

|

Volcanic Eruptions |

Yes |

There are five active volcanoes in Vanuatu. From 5 to 7 April 2023 volcanic activity on Ambae Volcano intensified with very high plumes of steam, gas and ash observed with lava glow at night. As of 29 September 2023 four volcanoes are at Alert Level 2 (Major unrest state) – Yasur on Tanna, Manaro Voui on Ambae, Lopevi on Lopevi and Mount Garet on Gaua. Volcanic activity bulletins are available from the Vanuatu Meteorology & Geo-Hazards Department. |

|

High Waves / Surges |

Yes |

Much of the coastal damage associated with TC Judy and TC Kevin was related to storm surges and high waves. High waves can prevent the use of small ports across Vanuatu, which are vital for emergency supply distribution to the islands. |

|

Tsunami |

Yes |

A massive tidal wave struck Marteli Bay, Pentecost Island on 2 December 1999 following a 7.1 magnitude earthquake on 27 November 1999. Tsunami waves were also observed around Aneityum Island on 5 March 2021 following an 8.1 magnitude earthquake. |

|

Wildfires |

No |

N/A |

|

High Winds |

Yes |

TC Lusi 2014, TC Pam 2015, TC Ula and Zena 2016, TC Cook 2017, TC Harold 2020, TC Judy and Kevin 2023 |

|

Other Comments |

|

|

|

Man-Made Issues |

||

|

Civil Strife |

No |

N/A |

|

International Conflict |

No |

N/A |

|

Internally Displaced Persons |

No |

There is natural migration of people during times of natural disasters, where local temporary residencies are created, but there are no managed camps. |

|

Refugees Present |

No |

N/A |

|

Landmines / UXO Present |

No |

N/A |

|

Other Comments |

N/A |

|

Seasonal Effects on Logistics Capacities

|

Seasonal Effects on Transport |

||

|---|---|---|

|

Transport Type |

Time Frame |

Comments / Details |

|

Primary Road Transport |

Nov-Apr |

There are sealed roads in Port Vila and Luganville. Heavy rain increases the size and depth of potholes making transport dangerous and hard on vehicle tires and axels. The bridge in Tanna was damaged due to the March 2023 cyclones. |

|

Secondary Road Transport |

Nov-Apr |

The secondary roads are dirt roads and are very quickly affected by rainfall. Continuous rain can quickly turn a road into an impassable one. It is best to get local knowledge to determine what port to deliver supplies to. |

|

Rail Transport |

N/A |

N/A |

|

Air Transport |

Nov-Apr |

Bauerfield International Airport is in Port Vila, Vanuatu. The airport runway has the capability and length to accept jets up to the Airbus A330. It serves as the hub for Vanuatu’s flag carrier airline, Air Vanuatu. Other local airlines operating in Vanuatu are Unity Airlines, Air Taxi and Belair Airways.

Heavy rain and cyclones can affect the secondary airstrips on outer islands rendering them unusable. |

|

Waterway Transport |

Nov-Apr |

Inter-island transport by small vessels to some ports cannot be undertaken during high seas and strong winds. |

The main seasonal effects on transport are climatic, occurring during the rainy season (November to April) when roads are subject to flooding and damage due to heavy rain. This may limit access to villages and small towns. During this period, inter-island sea and air transport may also be disrupted due to the cyclonic effects of high seas and strong winds.

|

Seasonal Effects on Storage and Handling |

||

|---|---|---|

|

Activity Type |

Time Frame |

Comments / Details |

|

Storage |

Nov-Apr |

Heavy rain and cyclones can affect storage quality and access to transportation of pre-positioned relief supplies, as many are containerised. In the event of an emergency, the National Disaster Management Office (NDMO) will engage a suitable warehouse for storage, repackaging, etc. |

|

Handling |

Nov-Apr |

As above. |

|

Other |

N/A |

N/A |

The main seasonal effects on storage and handling are climatic, occurring during the rainy season (November to April) when food supplies may be damaged due to exposure during handling and/or transportation.

Capacity and Contacts for In-Country Emergency Response

GOVERNMENT

The Vanuatu Government uses the Disaster Risk Management Act 2019 to regulate the management of disasters and for related purposes. The Act establishes the National Disaster Committee, the National Disaster Management Office (NDMO), the National Emergency Operations Center and the National Cluster Framework and National Cluster.

The NDMO is the government agency that leads on coordination of responses to emergencies and disasters across Vanuatu and sits under the Ministry of Climate Change. The NDMO works closely with local and international Non-Government Organisations helping communities to be disaster resilient in the development and strengthening of disaster risk reduction and disaster management plans, including mitigation, response, relief and recovery.

During emergencies, the NDMO works with the private sector and partners for telecommunications, transportation and warehousing requirements. Local and international military assets are only accessible through the NDMO with the endorsement of the Joint Police Operations Centre. Clusters submit all requests for transportation, relief supplies, etc to NDMO using the Request for Assistance form. The NDMO Standard Operating Procedures itemises individual agencies responsibilities in the Emergency Operations Centre. Roles and responsibilities are clearly outlined for both the individual and agency levels.

For more information on government contact details, please see the following link: 4.1 Government Contact List.

HUMANITARIAN COMMUNITY

The Vanuatu Humanitarian Community, also known as the Vanuatu Humanitarian Team (VHT) consists of a network of agencies committed to effective humanitarian coordination, disaster preparedness and humanitarian response. The VHT is convened by Oxfam and its members include the Vanuatu Red Cross, Vanuatu Association of NGOs, UNICEF, Oxfam, CARE International, Save the Children, Adventist Development and Relief Agency (ADRA), the World Health Organization (WHO), PeaceCorps, World Vision and Act for Peace, IOM and UN OCHA.

For more information on humanitarian agency contact details, please see the following link: 4.2 Humanitarian Agency Contact List.

Vanuatu - 1.2 National Regulatory Departments

Department of Customs and Inland Revenue

Responsible for facilitating the clearance of emergency relief items (by air and sea) once proper documents are provided by NDMO. Also responsible for the waiver of customs duties and VAT for all items purchased externally for humanitarian assistance.

Biosecurity Vanuatu

Responsible for safeguarding Vanuatu’s borders from foreign pests and diseases. Facilitates quarantine clearance of emergency relief items brought in via air and sea.

Telecommunications Radiocommunications and Broadcasting Regulator

Responsible for regulating telecommunications, radiocommunications and broadcasting services. Also responsible for managing the radio-frequency spectrum.

Ministry of Health

Leads and coordinates the national Health Cluster with WHO as co-lead. Responsible for coordinating and conducting post-disaster field assessment as required, coordination of international medical personnel and inspection of food items before general food distribution (checking expiry dates). Also responsible for coordinating the management of deceased persons, provision of primary health care and public health services. Provides regular status reports to NDMO which inform situation reports.

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List and 4.3 Laboratory and Quality Testing Company Contact List

Vanuatu - 1.3 Customs Information

Duties and Tax Exemption

For contact information regarding government custom authorities, please follow the link below:

Emergency Response:

[Note: This section contains information which is related and applicable to ‘crisis’ times. These instruments can be applied when an emergency is officially declared by the Government. When this occurs, there is usually a streamlined process to import goods duty and tax free.]

In the following table, state which of the following agreements and conventions apply to the country and if there are any other existing ones.

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes, 17 NOV 09 |

|

Annex J-5 Revised Kyoto Convention |

Yes, 17 JUL 01 |

|

OCHA Model Agreement |

No |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

No |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

The National Disaster Management Office (NDMO) is authorised under legislation to provide tax exemptions on behalf of Customs for emergency relief supplies in an emergency response situation. A Manifest, Bill of Lading and written information on the importing NGO (TOR, registered approval to operate in country) and beneficiaries must be provided to the Director NDMO during emergency and early recovery. Evidence that the intended beneficiaries are in disaster declared areas must be provided. |

|

Other comments |

The Vanuatu Department of Customs and Inland Revenue is also part of the World Trade Organisation (WTO) and Oceania Customs Organisations (OCO). |

Exemption Regular Regime (Non-Emergency Response):

[Note: This section should contain information on the usual duties & taxes exemption regime during non-emergency times, when there is no declared state of emergency and no streamlines process (e.g. regular importations/development/etc.).]

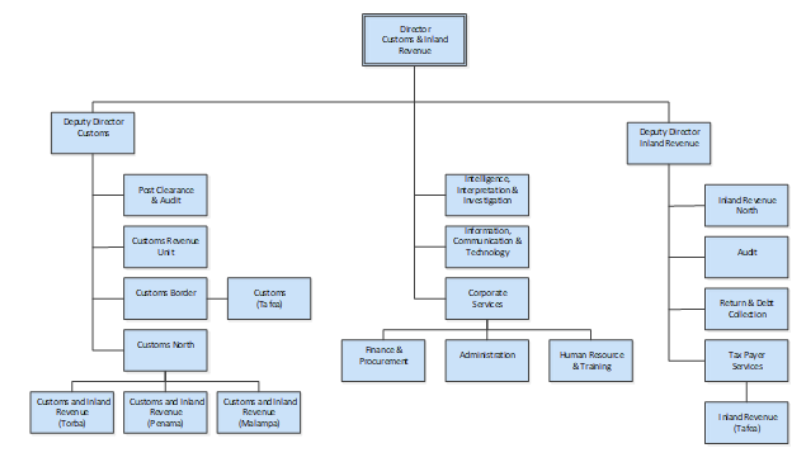

The Department of Customs and Inland Revenue (DCIR) is part of the Vanuatu public service and reports through the Ministry of Finance and Economic Management to the Public Service Commission. The Department has over 150 employees and its organisational structure is given below.

The DCIR’s work is governed by several legislations including the Import Duties (Consolidation) Act [CAP 91], Customs Act no.7 of 2013, Customs Valuation Act no.8 of 1999, Excise Tax Act no.24 of 2002, Export Duties Act (Cap 31) and the Tax Administration Act no.37 of 2018. Under Part 3 of Schedule 1 of the Import Duties Act [CAP 91], the Director of NDMO is the designated authority to approve any person or organisation who wishes to import goods into Vanuatu.

The goods must be:

-

for disaster relief;

-

funded by foreign states or international organisations; and

-

intended for free distribution in disaster declared areas.

In April 2023, the Automated System for Relief Emergency Consignments (ASYREC) was launched by the DCIR in partnership with NDMO and the Australia Governance for Growth Programme. Once operational, ASYREC will be automatically activated when Vanuatu makes a request for international assistance or accepts an offer of international assistance. ASYREC will expedite the movement of humanitarian relief items into the communities.

|

Organizational Requirements to obtain Duty Free Status |

||||||||||||||

|

United Nations Agencies |

||||||||||||||

|

|

||||||||||||||

|

Non-Governmental Organizations |

||||||||||||||

|

Refer to information in table above. Other goods eligible for concession are available here. |

Exemption Certificate Application Procedure:

|

Duties and Taxes Exemption Application Procedure |

|

Generalities (include a list of necessary documentation) |

|

For an agency to apply for duties and taxes exemptions (during non-emergency response time), the agency must write a letter to the Principal Officer of the Customs Authority explaining why the agency is in Vanuatu, its objectives and the timeframe for its activities in Vanuatu.

In addition, the agency requesting the permanent exemption, must be registered in Vanuatu with the Vanuatu Financial Service Commission as a charitable organisation. The registration process must be done once the exemption is ‘granted’ but before it is ‘released’. The agency representative must physically go to the Customs Office, collect the granted exemption and meet the Principal Officer who will allocate the agency with a registration number.

|

|

Process to be followed (step by step or flowchart) |

|

During non-emergency response time, tax free exemption certificates must be applied for through the DCIR.

During emergency response and early recovery phases, the NDMO can issue tax free exemption certificates for disaster-declared affected areas. |

Exemption Certificate Document Requirements

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes, manifest / invoice required |

Yes, manifest / invoice required |

Yes, manifest / invoice required |

Yes, manifest / invoice required |

Yes, manifest / invoice required |

Yes, manifest / invoice required |

|

AWB/BL/Other Transport Documents |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Donation/Non-Commercial Certificates |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Packing Lists |

No |

No |

No |

No |

No |

No |

|

Other Documents |

|

Information on NGO and beneficiaries |

Information on NGO and beneficiaries |

Information on NGO and beneficiaries |

Information on NGO and beneficiaries |

Information on NGO and beneficiaries |

|

Additional Notes:

|

||||||

|

|

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

The documents (as given in the table below) must be provided to Customs for clearance upon arrival. |

|

Embargoes |

None |

|

Prohibited Items |

|

|

General Restrictions |

|

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

D&T Exemption Certificate |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Invoice |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

AWB/BL/Other Transport Documents |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Donation/Non-Commercial Certificates |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Packing Lists |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Phytosanitary Certificate |

Yes, original (for relevant plant-based foods). Phytosanitary certificate needs for animal-based foods e.g. milk powder |

|

|

|

|

|

|

Other Documents |

Import Permit |

|

|

|

|

|

|

Additional Notes:

|

||||||

|

|

||||||

Transit Regime

There is no transit regime within the Customs Act 2013.

Challenges

-

Notification of arrival of relief items – As per Customs Act, the notification time to Customs for items coming by sea is 3 days before arrival and by air is 3 hours before arrival. During emergency response times, these timeframes are usually ignored with some notifications being sent to Customs 30 minutes before a plane lands.

-

Unknown goods – Sometimes relief items are sent to Vanuatu without informing NDMO beforehand. These items will not be cleared by Customs which will lead to storage issues. In most cases, Customs will seize the items and dispose of it through appropriate means.

-

Documentation – Some donated relief items arrive in Vanuatu with no or incomplete documentation. This prolongs the clearance process and the ASYCUDA system will not accept incomplete registrations.