Sri Lanka - 1 Country Profile

Generic Information

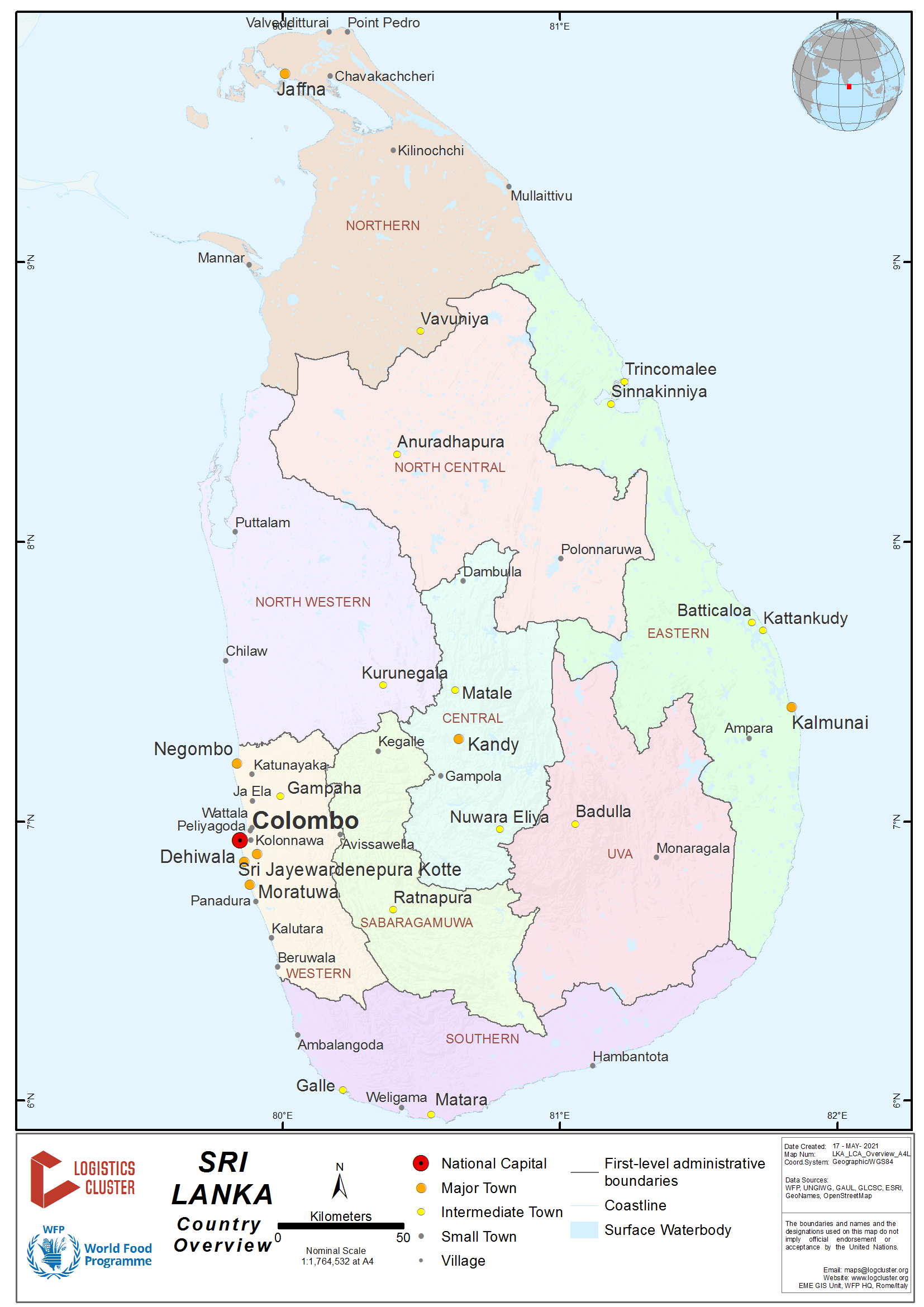

Sri Lanka (formerly known as Ceylon), officially the Democratic Socialist Republic of Sri Lanka, is an island country in South Asia, located in the Indian Ocean to the southwest of the Bay of Bengal and to the southeast of the Arabian Sea. The island is historically and culturally intertwined with the Indian subcontinent but is geographically separated from the Indian subcontinent by the Gulf of Mannar and the Palk Strait.

Sri Lanka is a middle-income country with high human development. The GDP per capita in Sri Lanka was 4,013.69 U.S. dollars in 2021, and GDP Annual Growth Rate averaged 4.49 per cent from 2003 until 2022. Sri Lanka ranked 73 out of 191 countries in the 2021 UNDP Human Development Index. Rice is the staple food in Sri Lanka and is cultivated during Maha and Yala, the two major paddy-producing seasons. The prevalence of undernourishment averaged 3.4% from 2019 until 2021. In 2020, rates of wasting, stunting, and being overweight in children under 5 were estimated at 15.1%, 16.0% and 1.3% respectively. The prevalence of anaemia in women aged 15 to 49 was 34.6% in 2019.

The humanitarian situation in Sri Lanka has deteriorated since 2022, owing to the worst-ever multi-dimensional crisis since independence in 1948. The country’s high public debt levels and depleted forex reserves have triggered severe inflation, anti-government protests, daily blackouts, and shortages of necessities such as fuel and medicines. Sri Lanka continues to face this serious economic crisis, while food security levels deteriorating to concerning levels in recent months and with a food inflation (year-on-year) increase that reached 93.7% in urban areas of Colombo. This, compounded by reduced agriculture production and soaring food prices, whipped into an acute food and malnutrition crisis nationwide, leaving over 6.2 million people, 28% of the total population, moderately food insecure and about 66,000 people in severe food insecurity, according to the 2022 FAO/WFP Crop and Food Security Assessment Mission (CFSAM) report. A UNICEF report in September 2022 estimated that 2.3 million children in Sri Lanka require immediate humanitarian assistance, making it among the top 10 countries with the highest number of malnourished children and the numbers are expected to rise further. A substantial proportion of markets were reporting concerns around rising and/or unstable prices, according to WFP’s recently released Market Functionality Index (MFI) reports.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a generic country overview, please consult the following sources:

Generic Information

Wikipedia information on Sri Lanka

Economist Intelligence Unit information on Sri Lanka*

(*note - this is a paid service)

Humanitarian Info

UNOCHA information on Sri Lanka

Facts and Figures

Wolfram Alpha information on Sri Lanka

World Bank information on Sri Lanka

World Population Review information on Sri Lanka

Sri Lanka - 1.1 Humanitarian Background

Disasters, Conflicts and Migration

Natural Disasters

|

Type |

Occurs |

Comments / Details |

|---|---|---|

|

Drought |

Yes |

Drought is a common hazard in Sri Lanka, primarily during January, March, August, and September, aligning with the inter-monsoon periods. About 2/3 of the country, designated as a dry zone, experiences moderate-to-severe dry periods. The most affected districts include Kurunegala, Puttalam, Hambantota, Monaragala, and Ampara. Drought tops the list of disaster-related events that contribute to the costs of sustaining national healthcare. The healthcare costs associated with floods and droughts are estimated at US$52.8 million annually, with 78% of the costs originating from droughts. (Sri Lanka Disaster Management Reference Handbook, 2021) The most recent significant drought event in Sri Lanka occurred in March 2020. As of 10 May, there were over 312,000 people in 14 districts in 8 provinces affected by drought according to the Disaster Management Centre. (ReliefWeb) |

|

Earthquakes |

No |

As per UBC world seismic zoning, Sri Lanka is situated in seismic zone 0. |

|

Epidemics |

Yes |

While not the main causes of death, epidemics still pose a threat to public health in Sri Lanka. Dengue in Sri Lanka is more common during certain seasons, with two peaks occurring during the monsoon rains in June-July and October-December. Most cases are reported during June-July, the summer monsoon. All areas of the country are dengue prone, with the highest case rate recorded in the Colombo, Gampaha, and Kalutara districts of the western province. As of May 10th, 2023, the country had diagnosed a total of 672,241 COVID-19 cases, of which 655,353 patients had recovered from the disease, while 16,851 patients had died. (Sri Lanka Epidemiology Unit) The following link provides the List of Notifiable Diseases: |

|

Extreme Temperatures |

Yes |

Sri Lanka experiences high levels of heat and humidity during both dry and rainy seasons.. With an average temperature of around 27 - 28°C and little monthly variation, Sri Lanka is one of the hottest countries globally. Altitude is the primary factor influencing temperature variations, with lower temperatures in the south-central mountain ranges. Sri Lanka can be quite humid, with coastal regions experiencing daytime humidity levels above 70% all year and rising to 90% during monsoon seasons. In the highland areas, humidity levels typically range from 70% to 79%. |

|

Flooding |

Yes |

Sri Lanka is ranked #6 on the 2020 Climate Risk Index (German watch). The flood risk profile is rising due to increasing impacts and frequency of hydro meteorological hazards during monsoon seasons (GFDRR (Global Facility for Disaster Reduction and Recovery), 2017). Flooding is one of the most prevalent disasters in Sri Lanka and the cause of most fatalities when external natural shocks occur. Major floods in Sri Lanka are associated with seasonal monsoons. Typically, during the Southwest monsoon season (May-September) the western, southern and Sabaragamuwa provinces are vulnerable to floods. During the Northeast monsoon (December-February) the eastern, northern, and north-central provinces are prone to flooding. In 2022, multiple heavy rainfall incidents in the country caused flooding, landslides, casualties, and damage to properties from August to October. (ReliefWeb) |

|

Insect Infestation |

Yes |

Sri Lanka faces several pest infestations that affect its agricultural sector. Some of the major pests that have been reported in the country include fall armyworm, rice sheath mite, coconut mite, thrips, brown plant hopper, yellow stem borer, rice leaf-folders, rice gall midge, and paddy bug. In 2019 Anuradhapura district corn farmers were affected by an insect infestation of Fall Armyworm damaging agricultural yields. In 2020, yellow-spotted grasshoppers destroyed the crops in Mawathagama, North Western Province. |

|

Mudslides |

Yes |

Landslides have become common during the monsoon season in Sri Lanka, especially in highland / mountainous areas where land has been heavily deforested to grow export crops like tea and rubber. More than 13,000 km2 of land in 13 administrative districts are prone to landslides, and almost 42% of the total population of the country lives in these districts. The occurrence of landslides and slope failures has increased due to extreme weather conditions caused by climate change impacts, changing monsoonal patterns, and cyclonic situations in the Indian Ocean. Despite the government's risk reduction efforts, economic damages and human losses have been on the rise since 2014. In May 2017, a significant landslide killed more than 100 people in the central part of the island. |

|

Volcanic Eruptions |

No |

|

|

High Waves / Surges |

Yes |

The Asian Tsunami in 2004 caused widespread destruction around the coastal areas of Sri Lanka, where more than 35,000 people lost their lives, and thousands were left homeless. Think Hazard classified the tsunami hazard in Sri Lanka as medium, indicating that the country has a greater than 10% chance of experiencing a potentially damaging tsunami within the next 50 years: https://thinkhazard.org/en/report/231-sri-lanka/TS. |

|

Wildfires |

No |

|

|

High Winds |

Yes |

Vulnerable to cyclones and storms due to its position near the confluence of the Arabian Sea, the Bay of Bengal and the Indian Ocean. In December 2020, cyclone Burevi made high winds, heavy rainfall, and flash floods in low lying areas in Northern and Eastern provinces. The cyclone caused severe damage in Sri Lanka, with 57 houses destroyed and 2,753 others damaged. More than 10,000 people were displaced. |

|

|

|

|

|

|

|

|

Man-Made Issues

|

Type |

Occurs |

Comments / Details |

|---|---|---|

|

Civil Strife |

No |

On May 18, 2009, Colombo declared the end of the 26-year civil war between the Sri Lankan government and the Liberation Tigers of Tamil Eelam (LTTE), also known as the Tamil Tigers. |

|

International Conflict |

No |

|

|

Internally Displaced Persons |

Yes |

Seasonal natural hazards typically cause only temporary displacement. |

|

Refugees Present |

No |

|

|

Landmines / UXO Present |

Yes |

The three-decade-long civil conflict in Sri Lanka left 2,061 km² of land in both the Northern and Eastern provinces widely contaminated with landmines and unexploded bombs. Over a decade after the fighting ended, Sri Lanka is edging closer to being landmine-free, with just over 13 km² of land remaining that is known to be contaminated. (ReliefWeb) Currently, 9 organizations are involved in demining Sri Lanka's Northern and Eastern regions, including MAG (Mines Advisory Group). SLNMAC (Sri Lanka National Mine Action Centre) aimed to clear the most affected areas by 2020; however, it was projected that the clearance efforts would continue until approximately 2032. (Landmine and Cluster Munition Monitor) |

|

Economic Crisis |

Yes |

The ongoing economic crisis in Sri Lanka started in 2019 and is the country's worst economic crisis since its independence in 1948. The crisis is caused by multiple factors, including tax cuts, money creation, a shift to organic farming, the 2019 Easter bombings, and the COVID-19 pandemic. It has resulted in unprecedented levels of inflation, near-depletion of foreign exchange reserves, shortages of medical supplies, and an increase in prices of basic commodities. In April 2022, Sri Lanka announced its first sovereign default in history due to the inability to pay its foreign debt obligations. |

|

Food Security Crisis |

Yes |

Sri Lanka has been facing a severe food crisis since 2022, due to a significant reduction in agricultural production, rising prices of fuel and basic food items. The crisis has affected an estimated 6.7 million people, with up to 70% of households reducing food consumption. The United Nations has launched a $47.2 million plan to respond to the government's request for support, and WFP has activated an emergency response to mitigate growing food insecurity. |

|

Other Comments |

|

|

For a more detailed database on disasters by country, please see the Centre for Research on Epidemiology of Disasters Country Profile.

Seasonal Effects on Logistics Capacities

Seasonal Effects on Transport

|

Transport Type |

Time Frame |

Comments / Details |

|---|---|---|

|

Primary Road Transport |

From (May-July) and (October-December) |

Excessive rains may significantly increase travel time on major roads. |

|

Secondary Road Transport |

From (May-July) and (October-December) |

Excessive rains may damage secondary roads to the degree of impassability. Landslides caused by heavy rainfalls, although rare, can impact plantation areas. |

|

Rail Transport |

From (May-July) and (October-December) |

Rains often negatively impact the punctuality of trains with trains tracks prone to flash floods and landslides during the monsoon seasons. |

|

Air Transport |

From (May-July) and (October-December) |

While air transport (helicopters) may be grounded during storm and bad weather, most air transport options resume quickly and can be used to transport goods in affected areas. |

|

Waterway Transport |

N/A |

N/A |

|

Maritime Transport |

From (May-July) and (October-December) |

Cargo ships can encounter difficulties during monsoon seasons due to the presence of high winds and rough seas. |

Road transportation is the most effective and widely used form of transportation for commercial goods in Sri Lanka. Road networks connect all districts in Sri Lanka. Material can now be delivered in any part of Sri Lanka with 12 hrs by road transport.

Seasonal Effects on Storage and Handling

|

Activity Type |

Time Frame |

Comments / Details |

|---|---|---|

|

Storage |

From January to December |

REPLACE THIS TEXT with brief comments that specify the: type of economic, social, or climate related seasonal impact; area or region of the country impacted; and other relevant facts. Over the monsoon season extra precautions are required to avoid water damage to commodities. During the hot season commodities can be spoiled due to high temperatures or/and high humidity. The GoSL (Government of Sri Lanka) Food Commissioner’s Department manages the majority of storage units across the country. Across Sri Lanka, there is very limited public storage facilities to accommodate storage of goods, especially for perishable items. Private storage has been growing steadily in recent years, with specialized storage facilities (Temperature / Humidity Controlled Warehousing) available across the country. |

|

Handling |

From January to December |

There are no reported seasonal effects on commodity handling activities, other than loading and offloading exercises during heavy monsoon rains, which can persist for two to three days uninterrupted. |

Capacity and Contacts for In-Country Emergency Response

GOVERNMENT

Sri Lanka has increased efforts to build a multi-hazard disaster management infrastructure since the 2004 Indian Ocean tsunami, which have led to reforms including the Disaster Management Act of 2005 and the establishment of the National Council for Disaster Management (NCDM) and its operative office, the Disaster Management Centre (DMC).

DMC is the lead agency for disaster management in Sri Lanka and is the executing agency of NCDM. DMC is mandated with the responsibility to implement and coordinate national and subnational level programs for reducing the risk of disasters with the participation of all relevant stakeholders.

In the event of a disaster, emergency operations are established to coordinate all response agencies to minimize the adverse effect of the disaster. The National Emergency Operation Centre (EOC) is responsible for coordinating with NGOs/INGOs and other stakeholders in an emergency. In the event of a disaster in Sri Lanka that requires international assistance, the DMC would coordinate the response. Sri Lanka's armed forces, comprising the Army, Navy, and Air Force, play a vital role in disaster relief. The Navy is capable of a full range of operations ranging from high-intensity war fighting to humanitarian assistance and disaster relief. The Air Force may also assist local disaster management agencies.

Apart from government, police, and military response, a range of national civilian stakeholders, including community groups, national civil society coalitions, academia, the private sector, Red Cross, NGOs, and civil society, play a significant role in disaster relief and emergency response. Community-Based Disaster Risk Management (CBDRM) plays a major role in Disaster Risk Management activities from preparing for and implementing disaster preparedness, mitigation and post-disaster relief, rehabilitation, reconstruction, and resettlement. International non-governmental organizations (INGOs) also play an important role in building trust and sustainable peace among communities in the aftermath of conflicts. UNDP works in Sri Lanka focusing on climate change adaptation and disaster risk reduction (DRR). The Global Facility for Disaster Risk Reduction and Recovery (GFDRR) builds technical capacity of the government to conduct flood and landslide risk assessments, urban risk assessments, and risk reduction in urban planning. The Sri Lanka Red Cross Society (SLRCS) is the National Society of the Red Cross in Sri Lanka and has an important role in emergency response and relief, along with the army and navy troops, to support search and rescue operations. The SLRCS mobilizes its organization and volunteers at appropriate levels to carry out disaster response and has been expanding its DRR initiatives up to the community level. USAID, the U.S. government affiliated agency, is a development partner working directly with communities on natural disaster and risk management in Sri Lanka.

Source: Sri Lanka Disaster Management Reference Handbook (March 2021)

Agencies and Ministries with disaster management role and responsibilities

|

GoSL Ministries and Departments |

Function/ responsibilities |

|---|---|

|

Ministry of Foreign Affairs

|

Responsible to communicate and share information with foreign embassies, UN, and international NGOs. Confirmation of projects under the external budget/aid, Facilitate/ issue of emergency visas.

|

|

(State) Ministry of Defense

|

The Ministry of Defense has oversight of the Internal Security, Home Affairs and Disaster Management State Ministry. The State Ministry oversees its four institutions: All District and Divisional Secretariats, Disaster Management Centre (DMC), Department of Meteorology, National Building Research Organization (NBRO) and the National Disaster Relief Services Centre (NDRSC).

The Ministry of Defense and the Armed Forces (Army, Navy and Air Force) perform an integral role in disaster management and response: by maintaining security, search and rescue, evacuation of victims, setup of shelters for IDPs (internally displaced persons), dead body management, support of emergency medical care, debris removal and clearing of roads and distribution of relief goods by road, water and air.

Focal point of the security forces is permanently deployed at DMC for emergency coordination. |

|

Disaster Management Council |

This is an Apex body for the disaster management in Sri Lanka which take policy decisions on disaster management and oversees implementation of the 2005 Disaster Management Act. |

|

Disaster Management Centre |

DMC is a coordination and implementation arm for the national council (Emergency coordination at national and Sub-national levels 72hr needs assessment & review of eligible beneficiaries, strategic contingency planning, coordination of Relief, Monitoring & Evaluation). Main focal point of the HCT during emergencies. |

|

Department of Meteorology |

Weather Forecasting and aviation forecast for international and domestic flight, provide early warning for weather related hazards and tsunami early warning conduct research on weather, climate and climate change. |

|

National Disaster Relief Services Centre |

Planning and implementation of relief management activities (Event specific contingency planning with local level stakeholders, Identification of beneficiaries, disaster response to populations affected by disaster) |

|

National Building Research Organisation |

NBRO is the agency providing advice and mapping on” landslide risk management” through multiple activities such as conduct awareness, DRR activities, research and early warning. |

|

Ministry of Finance |

Responsibilities in relation to macro-economic policies, annual budget and Appropriation Acts, finance and insurance activities, international financial cooperation and directing social security and economic development activities. |

|

Department of Samurdhi Development |

This department engaged on social safety net which addresses Alleviate poverty, ensure food security at the household level, promote saving habits among low-income family, ensure social equality, to provide social security to poor and micro financing |

|

Ministry of Finance, Partnership Management Secretariat. (WFP Counterpart Ministry)

|

The PMS (Project Management System) provides coordination with all line agencies, donors, World Food Programme, partners and related stake holders on national policies, decisions of the government on policy changes, project approvals, funds transfers, reports and ensure that the projects are implemented according to the LOU (Letter of Understanding). |

|

Ministry of Agriculture |

This ministry support during post disaster to provide input subsidies to the affected farmers. |

|

Food Commissioner’s Department |

Maintain rice buffer stocks; ensure the availability of rice at the market; effective co-ordination with the stakeholders for better management of department resources; create a pest free grain food store environment. |

|

Ministry of Health

|

Providing policy guidance to health, hygienic, medicine treatment, establish special clinics through the Department of Health Services based on demand, ensuring physical, mental, social wellness and distribution of nutritious supplements, conduct health awareness, health hazard preventive measures etc. Monitoring the food quality. |

|

Ministry of Education |

Provide policy guidance to use the school infra structure during the emergencies. |

|

Ministry of Foreign |

Based on the scale of emergency/disaster, the ministry providing policy guidance in relation to the subject of Foreign, implementation of projects under the external budget/aid, Facilitate for issue of visas etc. |

|

District/Divisional Secretariat |

District and divisional coordination and take lead role in implementation of the policy guidance provided by the Government. |

For more information on government contact details, please see the following link: 4.1 Government Contact List

HUMANITARIAN COMMUNITY

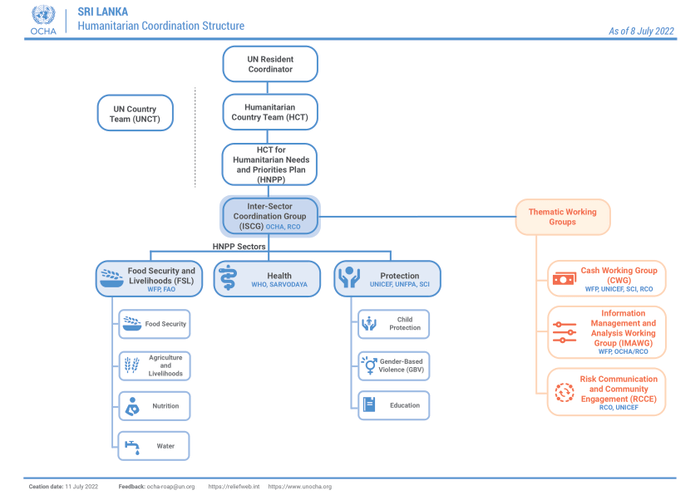

In Sri Lanka, the Sector system is activated by the UN Resident Coordinator Office (RCO). The RCO and WFP are responsible for preparedness and response contingency planning and coordination between UN and Government. The Humanitarian Country Team (HCT) is established and chaired by the UN Resident Coordinator, which is composed of representatives from UN agencies, INGOs (International Non-Governmental Organisations) and not- for-profit organisations.

Source: https://reliefweb.int/report/sri-lanka/sri-lanka-humanitarian-coordinat…

Globally, WFP is the lead agency in 3 clusters: the Logistics Cluster, the Food Security Cluster (co-leads with FAO), and the Emergency Telecommunications Cluster. In Sri Lanka, WFP has been providing technical assistance to the Ministry of Disaster Management and other agencies since 2018 to strengthen national emergency management, risk-reduction mechanisms, and operational tools. WFP has also supported the streamlining of the emergency management framework through the implementation of a national emergency operations plan. WFP technical assistance has focused on information management, the development of assessment tools, scenario-based contingency planning and relief management planning and response. WFP has also supported local risk-sensitive planning through disaster management and public administration institutions aimed at developing a sustainable approach to risk reduction in the development sector.

For more information on humanitarian agency contact details, please see the following link: 4.2 Humanitarian Agency Contact List

Sri Lanka - 1.2 Regulatory Departments and Quality Control

|

Regulatory Authorities |

Function/ responsibilities |

|---|---|

|

Ministry of Health, Food Control Administration Unit (FCAU) |

FCAU (Food Control Administration Unit) is responsible for import control, domestic control of food and issuing export certificates for exporting food items according to the 1980 Food Act No.26. |

|

Department of Imports and Export Controls |

Responsible for issuance of import and export licenses for items subject to import and export control licenses including: Issuance of import licenses for Pharmaceuticals Issuance of import licenses for Vehicles & Vehicle Parts Issuance of import licenses for Chemicals Issuance of import licenses for Communication Equipment Issuance of import licenses for Miscellaneous Items Debiting of Import Licenses Revision of Import and Export Licenses Gazetting of Standards The Department coordinates with the Sri Lanka Standards Institution in publishing specifications of standards relevant to items that have been identified by the Controller General of Import and Export as requiring mandatory standardization. |

|

Sri Lanka Standards institute (SLSI) |

SLSI plays an integral role with the FCAU and in formulation of National Standards under the Food Act. The Standards of the SLSI are mostly voluntary. Some of them are declared mandatory for verification of standard parameters at the point of import. The SLSI has mutual agreements with standards setting bodies of the exporting countries that certify the products exported from selected countries. Based on the certification of those bodies and verification checks carried out at national level the SLSI releases those products for further inspection and verification of FCAU. |

|

National Drug Regulatory Authority

|

The National Medicines Regulatory Authority (NMRA) plays a leading role in protecting and improving public health by ensuring medicinal products available in the country meet applicable standards of safety, quality and efficacy. The Authority regulates medicines, medical devices, borderline products, clinical trials and cosmetics. The National Medicines Quality Assurance Laboratory (NMQAL), charged with ensuring quality of medicinal products, also functions under the purview of the NMRA. |

|

Processing applications for the following licenses: Licenses to operate telecommunication systems in Sri Lanka under Section 17 of the Act. Licenses for use of radio frequency and radio frequency emitting apparatus under section 22 of the Act. Licenses to operate a private network under Section 20(ii) of the Act. Licenses for cabling works under Section 22A (1) of the Act. Formulate pricing policies. Monitoring and ensuring compliance with the Act (including rules and regulations made there under) and licenses by the licensed operators. To monitor and ensure proper utilization of the radio frequency spectrum. Providing information to the public on quality and variety of telecommunication services and encourage their participation by conducting public processes and public hearings. |

|

|

SLAERC is responsible for: Licensing of practices involving ionizing radiation, including all types of radiation facilities and radiation sources. Conducting safety and security inspections of licenced facilities. Assisting facilities with category 1 and category 2 radioactive sources to establish security measures to ensure physical protection of the radioactive sources. Taking legal measures for violations of the laws and regulations. Implementation of a National Radiological Emergency Response plan in collaboration with the National Disaster Management Centre. Implementation of the national policy on radioactive waste management. Meeting the national obligations with regard to international conventions Sri Lanka has entered into regarding nuclear safety, security and safeguards. Functioning as the national contact point for IAEA programmes on nuclear safety and security. Conducting seminars and training programmes for radiation protection officers and other personnel. Providing information to the public. |

|

|

Consumer Affairs Authority (CAA) |

Consumer Affairs Authority (CAA) is the apex government organization mandated to protect consumers’ interests and ensure fair market competition in Sri Lanka. It has been established under the Consumer Affairs Authority Act No.09 of 2003. The act has laid down the legal provisions empowering the CAA to take necessary actions to safeguard the interests of consumers while maintaining effective competition among suppliers of goods and services. |

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List and 4.3 Laboratory and Quality Testing Company Contact List

Sri Lanka - 1.3 Customs Information

Duties and Tax Exemption

For contact information regarding government custom authorities, please follow the link below: Importing Goods | Sri Lanka Customs

Sri Lanka Customs is a ministerial government department. The main functions of the department are:

- Collection of revenue

- Prevention of revenue leakages and other frauds

- Facilitation of legitimate trade

- Collection of import and export data to provide statistics.

- Cooperation and coordination with other Government Departments and stakeholders in respect of imports and exports

The executive responsible is the director general, currently Mr. P.B.S.C. Nonis appointed in 2022.

Formally known as HM Ceylon Customs from 1947 to 1972, the department can trace its roots to 1806. Formally, the agency as it exists today was formed under the Customs Ordinance No. 17 of 1869, to which 51 amendments have been made to date. Being a center for trade in the Indian Ocean since antiquity, however, the history of collection of customs duties in Sri Lanka dates far back as 2nd century BC.

The department works with the powers vested under the Customs Ordinance, as well as through several other related enactments. As such, it has vested with the powers, such as in the areas of the arrest and detention of suspects contravening customs and import/export laws, as well as the confiscation of contraband.

Number of employees: 2,339 (2022)

Parent agency: Ministry of Finance

Founded: June 1806

(Wikipedia, 2023)

For contact information regarding government custom authorities, please follow the link below: Importing Goods | Sri Lanka Customs

Link for duty free clearance: https://mfa.gov.lk/services/

Emergency Response:

[Note: This section contains information which is related and applicable to ‘crisis’ times. These instruments can be applied when an emergency is officially declared by the Government. When this occurs, there is usually a streamlined process to import goods duty and tax free.]

In the following table, state which of the following agreements and conventions apply to the country and if there are any other existing ones

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes - 29.05.1967 |

|

Annex J-5 Revised Kyoto Convention |

Yes - 17.06.2009 |

|

OCHA Model Agreement |

Yes |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

Yes - 05.08.1999 |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

Yes, SAARC Agreement on Rapid Response to Natural Disasters, 26.05.2011 |

Exemption Regular Regime (Non-Emergency Response):

[Note: This section should contain information on the usual duties & taxes exemption regime during non-emergency times, when there is no declared state of emergency and no streamlines process (e.g. regular importations/development/etc.).]

List of Customs Duty Exemptions (Imports)

The following categories of goods are exempted from Customs Import Duty, provided that the Director General of Customs is satisfied that those goods have been imported for the very purpose(s) approved under the respective category and that the approval had been obtained from the Secretary to the Treasury, or from such other authority as delegated by the Secretary to the Treasury:

- Passengers' baggage as defined by Regulations made by the Minister of Finance under Section 107A of the Customs Ordinance (Chapter 235).

- Films of educational, scientific or cultural character produced by the United Nations Organization or any of its specialized agencies imported, on the recommendation of the Secretary of the respective line Ministry, subject to approval of the Director General of Customs.

- Temporary import of professional and scientific equipment and pedagogic material, imported subject to a guarantee prescribed by the Director General of Customs.

- Articles awarded abroad to any person for distinction in art, literature, science or sport, or for public service or otherwise as a record of meritorious achievement and conduct, imported by or on behalf of that person, on the recommendation of the Secretary to the respective line Ministry, subject to submission of the relevant document to the Director General of Customs.

- Raw materials and packing materials for the manufacture of pharmaceuticals, imported by the pharmaceutical manufacturers, on the recommendation of the Secretary to the Ministry in charge of Health, subject to approval of the Director General of Customs.

- Ayurveda, Siddha and Unani, raw and prepared drugs (other than Cosmetics Preparations) and medicinal plants and Ayurveda, Siddha and Unani medicinal raw materials, specified by notification published in the Gazette by the Director General of Customs in consultation with the Secretary to the Ministry in charge of subject of Indigenous Medicines, imported on the recommendation of the Secretary to the Ministry in charge of subject of Indigenous Medicines, subject to approval by Director General of Customs.

- Packing materials for packing of Ayurveda, Siddha and Unani, raw and prepared drugs and medicinal raw materials other than Ayurveda / Herbal Soap and Ayurveda / Herbal Tooth Paste, imported on the recommendation of the Secretary to the Ministry in charge of subject of Indigenous Medicines, subject to approval of Director General of Customs.

- Prefabricated poultry houses, plant, machinery and equipment including parts and accessories for poultry industry, imported on the recommendation of the Secretary to the Ministry in charge of subject of Livestock, subject to approval of the Director General of Customs.

- Machinery including medical, surgical and dental equipment, instruments, apparatus, accessories and parts thereof, ambulances, required for the provision of health services, imported on the recommendation of the Secretary in charge of subject of Ministry of Health, subject to approval of the Director General of Customs.

- Articles of foreign production upon which import duty had previously been paid, re-imported subject to approval of the Director General of Customs.

- Goods being gifts from persons or organizations overseas for the relief of distress caused by natural or other disasters, imported on the recommendation of the Secretary to the respective line Ministry, subject to approval of the Director General of Customs.

- Goods for display or use at exhibitions, fairs, meetings or similar events, imported on the recommendation of Secretary to the respective line Ministry, subject to a guarantee prescribed by the Director General of Customs.

- Materials and parts for the fabrication of plant, machinery & equipment; capital and intermediate goods, and transport equipment, imported for exclusive use of an industry, which exports and/or supplies to direct exporters, 50% or more of its output, under such terms and conditions approved of the Secretary to the Treasury.

- Inputs (raw materials, components and parts) imported under inward processing scheme for export, under such terms and conditions approved by the Minister in charge of subject of Finance.

- Ornamental fish for re-export under such terms and conditions approved by the Director General of Customs.

- Fish caught by a fishing vessel operating from a Sri Lankan port and which has been duly registered at a Port of Registry in Sri Lanka or issued with a landing permit by the Secretary to the Ministry in charge of subject of Fisheries.

- Equipment and materials for use within the limits of an airport in Sri Lanka and parts and accessories for repair and maintenance of aircrafts in connection with the establishment and maintenance of international air service, imported on the recommendation of the Secretary to the respective line Ministry, subject to approval of the Director General of Customs.

- Apparatus, drugs and chemicals imported for educational purposes or for research work, imported on the recommendation of the Secretary to the respective line Ministry/authorized officers of respective Universities, subject to approval by the Director General of Customs.

- Containers and accessories thereof, including container seals used for the safe carriage and security of goods, imported subject to approval of the Director General of Customs.

- Products and preparations certified by the Ministry of Health as having been registered as drugs under the National Medicines Regulatory Authority Act, No.5 of 2015, imported subject to approval of the Director General of Customs.

- Import of personal items (including gifts) worth not more than Rs. 20,000/= subject to approval of the Director General of Customs.

- Import of samples in relations to business worth not more than Rs. 60,000/= subject to such terms and conditions as prescribed by the Director General of Customs.

- Multi-layered packing materials consisting of laminates of paper, polyethylene film and aluminum foil, or of polyethylene and ethylene vinyl alcohol polymer used for packing of liquid milk, vegetable juices and fruit juices, imported on the recommendation of the Secretary to the Ministry in charge of Industries, subject to approval of the Director General of Customs.

- Basmati rice and Potato up to the approved limit of Quota under the Pakistan – Sri Lanka Free Trade Agreement, imported on the recommendation of the Director General of Commerce, subject to approval of the Director General of Customs.

- Any machinery, equipment, accessories and materials excluding items classified under the HS Heading 76.14 and 85.44 and utility vehicles, required for the purpose of providing electricity including distribution of electricity, by the Ceylon Electricity Board and its subsidiary companies, and such goods for the use of any project for generation of power including solar and wind power, under any agreement entered into between the Government of Sri Lanka and its development partners, as recommended by the Secretary to the Ministry in charge of subject of Power, subject to approval of the Director General of Customs.

- Cinematographic goods and any film, which is produced in Sri Lanka and sent abroad for further processing or printing/copying, on the recommendation of the National Film Corporation, imported subject to approval of the Director General of Customs.

- Finished leather to be used by leather products manufacturing industry / Semi Processed (Crust) leather to be used by registered tan / leather processing companies for the use of leather products manufacturing process, imported on the recommendation of the Secretary to the Ministry in charge of the subject of industries, subject to approval of the Director General of the Customs.

- Tools, materials and equipment, imported by a manufacturer to manufacture electronic and robotic related products, according to design made in Sri Lanka on the recommendation of a national university, (established under the University Grants commission) through the Secretary to the Ministry in charge of subject of Higher Education / Technical Education, subject to approval of the Director General of Customs.

- Weapons, armaments, ancillary equipment, ammunition, explosives, communication equipment, military vehicles, air crafts, vessels, equipment and spare parts thereof capable of being used by the armed forces and imported by the Commander of Army/ Navy/ Air Force and the Inspector General of Police for the purpose of national security as recommended by the Secretary to the Ministry in charge of Defense, subject to approval by the Secretary to the Treasury.

- Raw materials, components, parts and accessories for the manufacturing of fishing boats by registered boat manufacturers, imported on the recommendation of the Secretary to the Ministry in charge of subject of Fisheries, subject to approval of the Director General of Customs.

- Following equipment, accessories and parts thereof, for the use in agriculture and related activities, imported on the recommendation of the Secretary to the Ministry in charge of the subject of Agriculture, subject to approval of the Director General of Customs; weather stations, greenhouses, poly-tunnels, sprinkler / misting systems, drip irrigation systems, fertigation systems, hydroponic systems, mulch films, pond liner, hydroponic trays, horticulture lamps and shade for netting.

- Lacquers, coatings and varnishes used exclusively for coating of metal cans and closures which are used for packaging of food, imported on the recommendation of the Secretary to the Ministry in charge of Industries, subject to approval of the Director General of Customs.

- Import of vehicles, chassis fitted with engines, bodies and cut portions, as defined in chapter 87 where Excise (Special Provisions) duty under the Excise (Special Provisions) Act, No. 13 of 1989, is applicable.

- Parts and accessories of motor vehicles and locomotives imported by the Sri Lanka Transport Board and Department of Sri Lanka Railway, on the recommendation of the Secretary to the Ministry in charge of subject of Transport, subject to approval of the Director General of Customs.

- Unbranded new tyre casings without any markings, imported by a branded tyre manufacturer for local value addition process on the recommendation of the Secretary to the Ministry in charge of subject of Industries, subject to the approval of the Director General of Customs.

- Ingredients other than maize, lentils and rice, for the purpose of manufacturing animal and poultry feed, and linear low density polyethylene, classified under HS Code 3920.10.90, by a Silage Manufacturing entity to supply silage to the local livestock farmers imported on the recommendation of the Secretary to the Ministry in charge of subject of Livestock, subject to approval of the Director General of Customs

- Any machinery, equipment, accessory and raw materials or intermediate materials, to be used for manufacturing of biodegradable packaging products by manufacturers of such products, registered under the Ministry in charge of the subject of Industries, on the recommendation of Secretary to the Ministry in charge of the subject of Environment, subject to approval of Director General of Customs

- Any machinery and equipment including medical, surgical and dental instruments, apparatus, accessories and parts thereof, hospital/medical furniture and drugs, chemicals and similar items imported by the Ministry in charge of subject of Health directly, or imported and donated to the Ministry in charge of subject of Health or any institution coming under the purview of the said Ministry to facilitate the medical/ health services to manage COVID – 19 pandemic on the recommendation of the Secretary, Ministry in charge of subject of Health, subject to approval of the Director General of Customs.

- Shrimp brood stock varieties for the purpose of promoting a disease resistant and high yielding shrimp farming, imported on the recommendation of Secretary to the Ministry in charge of subject of Fisheries, subject to approval of Director General of Customs

- High Density Polyethylene (HDE) sheets of a thickness exceeding 0.5 mm and the width not less than 4.0 mm, in role form, for aquaculture ponds lining; Geo- Membrane and Nano Bubble Aeration System for the purpose of development prawn/shrimp cultivation and Vessel Monitoring System for the purpose of regulating the fishing vessels on the recommendation of the Secretary, Ministry / State Ministry in charge of subject of fisheries subject to the approval of the Director General of Customs.

- Importation of essential goods, to be received form any foreign states (governments), organizations including business entities, volunteer associations an dwell-wishers by any government entities, government approved entities and entities working on relief activities in direct collaboration with any government entities as aid/donations to provide relief measures or facilitate continuation of essential public services subject to;

(a) Recommendation of the Secretary (chief Accounting Officer), Ministry in Charge of donation recipient government entity or government approved entity or the directly collaborating government entity with the donation and relief measures, where; (i) The Secretary shall provide recommendation for exemption of Customs Import Duty only after his satisfaction on the purpose and target beneficiaries of the donation; and (ii) Such donated goods shall be consigned to the Secretary (Chief Accounting Officer). Who issued the Letter of Recommendation referee above; case by case basis;

(b)All donations shall be approved the Director General, Sri Lanka Customs upon receipt of the recommendation referred in (a) above;

(c)The Secretary (Chief Accounting Officer) referred in 9a) above is responsible and accountable for goods, received as aid/donation under this procedure until such goods are delivered or distributed for intended purpose(s) and beneficiaries free of charge; and,

(d)Any goods, received as aid/donation under this procedure shall not be sold, transferred or disposed or utilized for purposes other than the purpose stated above without prior approval of the Secretary to the Treasury. In the case of any violation on this procedure, action shall be taken by the Director General, Sri Lanka Customs under the provisions of the Customs Ordinance to recover the applicable taxes.

- Importation of raw materials or intermediate goods, classified under the HS Codes of 3920.10.20 (Polyethylene Film – Not metalized, of width exceeding 110 mm but not exceeding 230 mm, of a kind used in manufacturing of napkins, sanitary towels), 3920.10.90 – Other (Polyethylene Film (W) and 3926.90.99 – Other (Polypropylene Film) by domestic manufactures of sanitary napkins on recommendation of Secretary, Ministry in charge of subject of Industries and approval of the Director General of Customs.

List of Exemptions - Excise (Special Provisions) Duty

Excise (Special Provisions) Duty is imposed in terms of section 3 of the Excise (Special Provisions) Act No. 13 of 1989. Please refer the Imports Tariff Guide for the rates specified. Under Extraordinary Gazette Notification No.1992/30 dated 10.11.2016, Excise (Special Provisions) Duty is exempted on the following:

- A Motor Vehicle/Article imported under various agreements and MOUs entered into by the Government of Sri Lanka with overseas organizations and foreign governments.

- Articles of every description imported or cleared from Customs bond for the official use of the President or the Prime Minister of the Democratic Socialistic Republic of Sri Lanka.

- Locally assembled/manufactured articles, classified under the H.S. Code 84 and 85, with not less than 30% domestic value addition recommended by the Minister-in-charge of the subject of industries.

- Every article entitled to duty free clearance under Passenger Baggage (Exemption) Regulations made under Section 107A of the Customs Ordinance (Chapter 235).

- Every article cleared ex-bond for the use as ship stores or for re-export.

- Every article manufactured in Sri Lanka and supplied to any exporter in Sri Lanka where sufficient proof is furnished to the satisfaction of the Director General of Excise that such manufactured article was exported.

- A motor vehicle imported by a Member of Parliament of the 9th Parliament under a permit issued by the Secretary of line Ministry of the subject of Parliament Affairs with Cost, Insurance and Freight (CIF) value of the vehicle not exceeding United States Dollars (USD) 62,500/- or Euro 55,000/- or Japanese Yen 7.0 million.

- A motor vehicle imported by the Governor of a Provincial Council, who have not imported or purchased a motor vehicle under any concessionary vehicle permit scheme during last five-year period, under a permit issued by the Secretary of line Ministry of the subject of Finance with Cost, Insurance and Freight (CIF) value of the vehicle not exceeding United States Dollars (USD) 62,500/- or Euro 55,000/- or Japanese Yen 7.0 million.

- A three-wheeler imported in respect to the decision on Meeting of Cabinet of Ministers held on March 23, 2021 of the Memorandum No. 21/0515/332/005-II/TBR dated March 18,2021 for the purchase of 2,000 three-wheelers to the Sri Lanka Police on the recommendation of the Secretary of the line Ministry in charge of Sri Lanka Police subject to the approval of the Secretary to the Treasury.

- A water browser classified under HS Code 8704.23.71 or a double cab classified under HS Code 8704.21.91 imported in respect to the decision on the Meeting of Cabinet of Ministers held on June 28, 2021 of the Cabinet Memorandum No.21/1140/304/094 dated June 11, 2021 to import fifty two (52) water bowsers and sixty two (62) double cabs for essential field activities, on the recommendation of the Director General of Department of National Budget subject to the approval of the Secretary to the Treasury.

Source: Sri Lanka Customs National Imports Tariff Guide 2023

Nation Building Tax (NBT)

Nation Building Tax was introduced under the Nation Building Tax Act, No. 09 of 2009 and subjected to amendments several times. As instructed by the Ministry of Finance and approved by the Cabinet of Ministers, NBT has been abolished with effect from December 01, 2019.

Social Security Contribution Levy (SSCL)

The Social Security Contribution Levy (SSCL) is a tax imposed on importers, manufacturers, service providers, wholesalers, and retailers. The levy was introduced in the Budget 2022 as a means of revitalizing Sri Lanka’s economy. As of 1 October 2022, it is required for this levy to be obligated on a quarterly basis.

The Social Security Contribution Levy (SSCL) applies to individuals or entities if their aggregate total turnover exceeds LKR 120,000,000 within the 12 months prior to the Act's implementation or exceeds LKR 30,000,000 within a single quarter. The Commissioner General of Inland Revenue (CGIR) can exclude a single isolated transaction when calculating the total turnover.

All persons who meet the registration threshold, excluding importers, must register for SSCL by submitting an application form to the CGIR within 15 days of the date of operation of the Act but not later than 15 days from the date on which it exceeds or is likely to exceed the quarterly registration threshold.

The rate of tax for the Simplified Sales and Services Tax (SSCL) will be 2.5% on the "liable turnover”, which refers to:

Importation of any article – 100% of the turnover

Manufacture of any article – 85% of the turnover

Service provider – 100% of the turnover

Wholesaler and retailer:

1. Sale of any article by a registered distributor, this includes all manufacturers and producers of any goods in Sri Lanka – 25% of the turnover

2. Wholesale or retail sale, excluding items mentioned under 1., including importation and sale – 50% of the turnover

The following goods and services are exempted from Social Security Contribution Levy (SSCL):

Exempt Articles (Goods)

Any article exported by the manufacturer

Any article not being a plant, machinery or fixture imported by any person exclusively for the use in, or for, the manufacture of any article for export

Fertilizer

Petroleum and petroleum products

L.P. Gas

Pharmaceuticals identified under the HS Coding System.

Any article manufactured by a company identified as a Strategic Development Project (SDP) under the SDP Act No. 14 of 2008 sold to another SDP or to a specialized project approved by the Minister of Finance.

Fresh milk, green leaf, cinnamon, or rubber purchased from any local manufacturer or local producer

Exempt Services

Generation and supply of electricity other than the supply of electricity by the Ceylon Electricity Board

Medical services

Supply of water

Transportation of goods and passengers

The business of life insurance

Any service provided by the Central Bank of Sri Lanka

Services provided by any Government Department, Ministry or Local Authority

Any services provided by the Employee’s Trust Fund, Provident Fund, Pension Fund, Pension Trust Fund and Gratuity Fund

SSCL is to be paid in three monthly instalments on a self-assessment basis. The due dates are as follows:

|

Instalment |

Deadline |

|---|---|

|

1st Instalment |

On or before the 20th day of the second month of that relevant quarter |

|

2nd Instalment |

On or before the 20th day of the third month of that relevant quarter |

|

3rd Instalment |

On or before the 20th day of the month immediately succeeding the end of that relevant quarter |

Note: The payment could be made to any branch of Bank of Ceylon and must include the following details in the payslip: Payment Period Code format: (YY/Q/O/M); Example: October 2022 – Payment code: 22401; Tax Type Code: 32; TIN Number.

For more detailed information regarding SSCL, please refer to the links below:

SOCIAL SECURITY CONTRIBUTION LEVY ACT, No. 25 OF 2022:

http://www.ird.gov.lk/en/publications/Acts_SSCL/SSCL_Act_No.%2025_2022_E.pdf

Application form is available at:

http://www.ird.gov.lk/en/Downloads/TaxpayerRegistrationDocs/TPR_005(SSCL)_E.pdf

|

Organizational Requirements to obtain Duty Free Status |

|---|

|

United Nations Agencies |

|

Letter of approval from the Ministry of Foreign affairs qualifies all items imported for sole use of the organization as duty free. Subject to the approval by the Director General of Customs. |

|

Non Governmental Organizations |

|

Not permitted to obtain duty free status. |

Exemption Certificate Application Procedure:

|

Duties and Taxes Exemption Application Procedure |

|---|

|

Generalities (include a list of necessary documentation) |

|

Clearance certificates should be submitted to the Protocol Division in triplicate with following documents. • Bill of Lading/Airway Bill • Packing List or Invoice • Copies of letters from the Ministry of Defence or/the Ministry of Mahaweli Development and Environment and the Department of Forest Conservation, the Department of Archaeology, and the Telecommunications Regulatory Commission (TRC) where it applicable. |

|

Process to be followed (step by step or flowchart) |

|

Import consignments should be declared to the customs through a Customs House Agent and submit the Customs Declaration online. The following documents are required. 1. Customs Goods Declaration 2. Commercial Invoice 3. Letter of Credit 4. Bill of Lading or Air Waybill (in case of air freight) 5. Delivery Order issued by the Shipping Agent 6. Value Declaration Form. |

Exemption Certificate Document Requirements

Duties and Taxes Exemption Certificate Document Requirements (by commodity)

|

|

Food |

NFI (non-food items) (Shelter, WASH (Water Sanitation and Hygiene), Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|---|---|---|---|---|---|---|

|

D&T Exemption Certificate |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

|

Invoice |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

|

AWB/BL/Other Transport Documents |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

|

Donation/Non-Commercial Certificates |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

|

Packing Lists |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

Yes, Original, 1 copy, applies to both UN and NGOs |

|

Phytosanitary Certificate |

Yes, Original, 1 copy, applies to both UN and NGOs |

N/A |

N/A |

N/A |

N/A |

N/A |

|

Other Documents |

Yes, Original, 1 copy, applies to both UN and NGO Cargo Manifest, Fumigation certificate, Certificate of weight and quality, Non-GMO Composition/ Analysis Certificate, Import permit, Export permit (No Foreign Exchange Involved) |

Yes, Cargo manifest Certificate of origin |

Yes, Certificate of Good Manufacturing Practice. Test certificates |

Yes, Certificate of Good Manufacturing Practice. Test certificates |

Yes, Cargo manifest. Certificate of Origin |

Yes, Cargo manifest. Authorization from ARCT for importation. |

|

Additional Notes |

||||||

|

The copy here refers to one of the 3 copies submitted for the duty and tax exemption process. All copies of the documents are to be signed at all approval, authorizing stages and a copy kept by each signatory of the documents. Non-Commercial invoice to be sent to Colombo before loading of Cargo. |

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

Commercial invoice, Quarantine packing declaration (Where applicable), packing list, Bill of Lading, Insurance Certificate |

|

Embargoes |

NONE |

|

Prohibited Items |

Items to be declared to Customs: Visitors - All the items that will remain in Sri Lanka and items restricted or prohibited Residents - All the items acquired abroad, purchases of Sri Lankan Duty Free shops and items restricted or prohibited

A. Prohibited items Narcotics, Psychotropic Substances, Precursor Drugs, Pornographic and Pro-Religious Literature Cigarettes

B. Restricted items Gold, Jewellery, Gems and other Precious Metals Liquor and Wines Cosmetics, Medicinal drugs and devices Telecommunication Equipment Foreign currencies more than US$ 15000 or equivalent. If you intend to take back US$ 5000 or more, please declare the entire amount Srilankan ruppees not more than 20000 only for Srilankan citizens. Animals, Plants (including specimens) and their parts Firearms, Ammunition, Air Guns and Explosives Any other items which require special permits or licenses

Source: https://www.airport.lk/passenger_guide/arrival_info/customs |

|

General Restrictions |

Export Control License is required for the following items. Chanks Timber, i.e. Wood (including logs and sawn timber) classified under H.S. Chapter 44 excluding coconut shell charcoal, household utensils of wood and rubber wood. Passenger motor vehicles first registered in Sri Lanka prior to 1.1.1945 Ivory and ivory products Steel scrap

Note: Ebony products are allowed to be exported on the recommendation of the National Craft Council. |

Import Control License

An import license is a document issued by the Department of Imports and Exports Control permitting the importation of specific items into Sri Lanka. Importing without a license can result in a fine based on the value of imported items.

Required documents

|

No. |

Type of documents |

Note |

|---|---|---|

|

1 |

Application Form |

The applicant should be a Sri Lankan |

|

2 |

Recommendation letter from Relevant Authority by authorizing the importation of such Product |

|

|

3 |

Two Copies of Performa Invoice |

Pro forma Invoice issued by the Importer or Supplier, and it should include the following details: *Names and addresses of the Importer *Details of the good or commodity, quantity and value *Country of origin *Country of shipment |

|

4 |

Original copy and the Photocopy of the Business Registration Certificate (if the applicant is a Legal Person or National Identity Card (If the applicant is a Natural Person) |

|

Process steps

|

Step 1 |

Applicant should submit a duly filled application form together with aforesaid required documentation. |

|---|---|

|

Step 2 |

Department of Import – Export Control shall verify relevant documentation and entering data into license issuing computer system and forward approval of the Additional Controller. |

|

Step 3 |

After approving License request the system generates processing fee as pay in-voucher. If the application is rejected, a written reply specifying relevant reasons shall be made with clearly stated reasons. |

|

Step 4 |

Applicant should pay a processing fee as a fee for the license, thereafter he/she submit Receipt of payment to the officer in charge. |

|

Step 5 |

Licenses are issued with the signature of Additional Controller on behalf of Controller General Imports and Exports. |

Source: https://srilankatradeportal.gov.lk/index.php?r=searchProcedure/view1&id…

For more detailed information regarding import control license, please refer to the links below:

Import and Export Control Regulations No. 06 of 2022:

https://www.customs.gov.lk/wp-content/uploads/2022/04/ICL-06-2022.pdf

Application form is available at:

http://www.imexport.gov.lk/images/Applications/Vehicle%202.pdf

Food import control procedure:

https://eohfs.health.gov.lk/food/index.php?option=com_content&view=article&id=2&Itemid=136&lang=en

Transit Regime

The following are the available Bonded schemes (TIEP I/ TIEP IV/ Entreport etc.):

- Private Bonds – Warehouses owned by Private Companies to store goods without payment of duties and taxes under Customs purview

- Public Bonds – Warehouses woned by Sri Lanka Ports Authority to store goods without payment of duties and taxes under Custosm purview.

- TIEP I – Facilitates the import of goods for manufacturing, processing or assembling for export on conditional relief from payment of import Duties and Taxes

- TIEP IV – Facilitates the import of Capital and Intermediate Goods used for the manufacture of products and services for export, on whole or partial exemption of Customs Duties and Levies

- IG – Facilitates the import of goods for export purposes which does not qualify under TIEP – I, or TIEP -IV

- Entrepot – Facility to import manufactured or unmanufactured goods from one party of other country on free of Customs duty and other levies for Re-export to a third party of any country as imported or after simple processing (re-packing, re-labeling etc) with a value addition

- INFAC – Facility provided by the Ministry of Commerce for Non – BOI Apparel Industries to import raw materials and accessories under duty free basis and manufacture and export.

Goods not permitted for bonding

- Duty paid goods

- Perishable goods

- Damaged goods

- Inflammable/ dangerous goods

- Prohibited goods

- Restricted goods without necessary license or permit

Permitted period for bonded cargo

- Two months for confectionary

- Three months for cigarette and tin foods

- Six months for wine, beer in bottles

- Two years for all other goods

- Under the regulation initial period will be six months and approval to be obtained for the extension of the period.