1 South Africa Country Profile

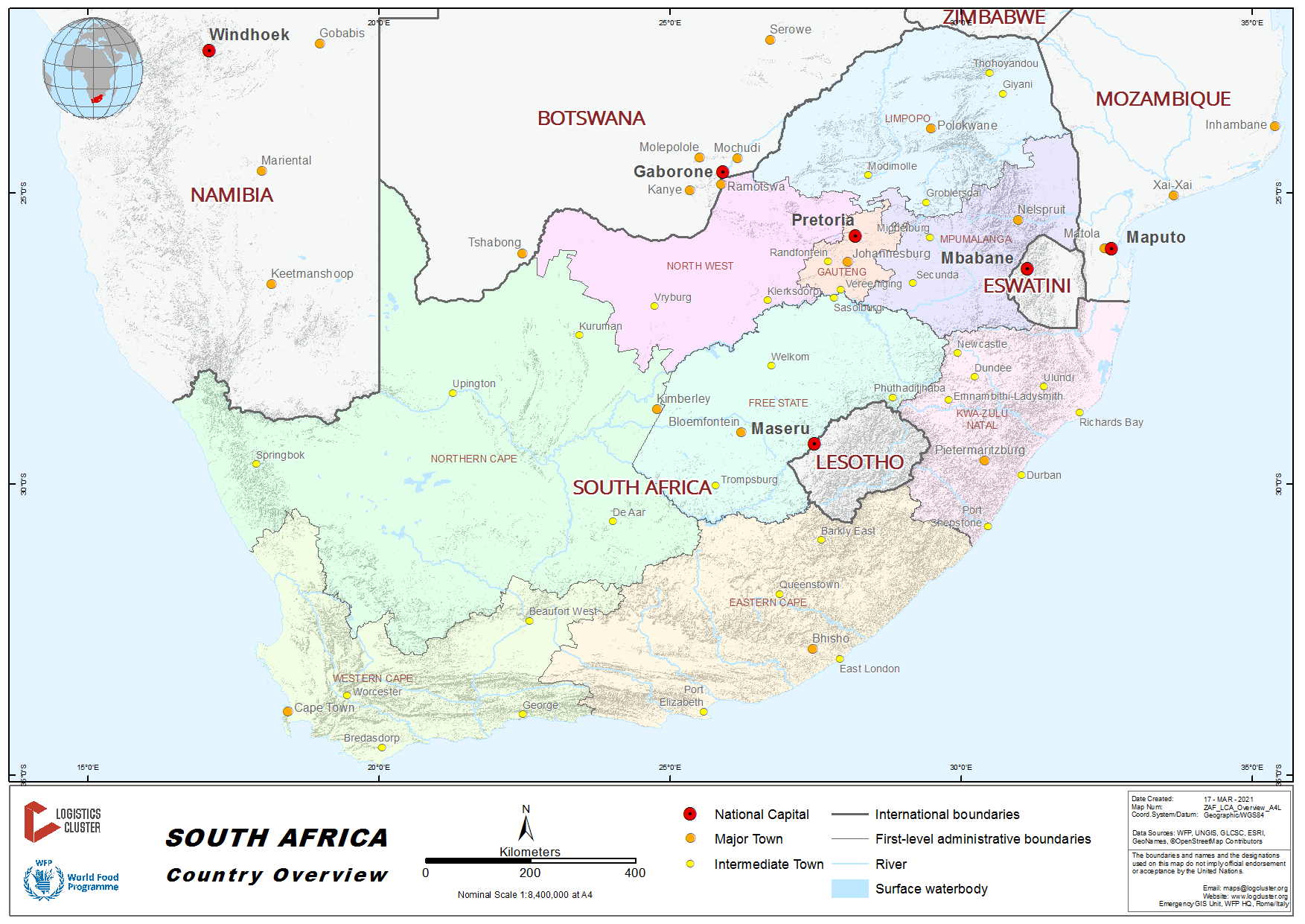

South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. With over 59 million people, it is the world's 24th-most populous nation and covers an area of 1,221,037 square kilometers (471,445 square miles). South Africa has three capital cities: executive Pretoria, judicial Bloemfontein and legislative Cape Town. The largest city is Johannesburg. It is bounded to the south by 2,798 kilometers (1,739 mi) of coastline of Southern Africa stretching along the South Atlantic and Indian Oceans; to the north by the neighboring countries of Namibia, Botswana, and Zimbabwe; and to the east and northeast by Mozambique and Eswatini (former Swaziland); and it surrounds the enclaved country of Lesotho, the country lies between latitudes 22° and 35°S, and longitudes 16° and 33°E.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a generic country overview, please consult the following sources:

Generic Information

Wikipedia Information on South Africa

IMF Information on South Africa

Economist Intelligence Unit Information on South Africa*

(*note - this is a paid service)

Humanitarian Info

Office for Coordination of Humanitarian Affairs Regional Office for Southern Africa

Facts and Figures

Wolfram Alpha Information on South Africa

1.1 South Africa Humanitarian Background

Disasters, Conflicts and Migration

|

Natural Hazards |

||

|---|---|---|

|

Type |

Occurs |

Comments / Details |

|

Drought |

Yes |

Periodic droughts, especially during years with El Nino weather phenomenon. |

|

Earthquakes |

No |

Unlikely |

|

Epidemics |

Yes |

High population density in informal settlements, low health care regime in such areas. Limited early alert and prevention mechanisms. |

|

Extreme Temperatures |

Yes |

High temperatures common in the arid northern regions. |

|

Flooding |

Yes |

Localised flooding in low-lying areas, often occupied by informal settlements. |

|

Insect Infestation |

No |

|

|

Mudslides |

No |

|

|

Volcanic Eruptions |

No |

|

|

High Waves / Surges |

Yes |

Seasonal occurence along the south-western coastline during winter months (June to August). |

|

Wildfires |

Yes |

Two fire seasons, during dry summer months (December to February) in the Western Cape, during dry winter months (June to August) rest of the country. |

|

High Winds |

Yes |

During winter months (June to August) in the Western Cape, during November in the Western Cape (locally known as the South-Easter / Cape Doctor) average wind speed 160 km/h. |

|

Other Comments |

N/A |

|

|

Man-Made Issues |

||

|

Civil Strife |

Yes |

Civil unrest may occur as result of benefits negotiation disputes between employers and labour unions (approx. April for para-statals), service delivery protest against government structures, or other socio-economic issues. |

|

International Conflict |

No |

|

|

Internally Displaced Persons |

No |

|

|

Refugees Present |

Yes |

Refugees from many African countries, 273,488 (documented) refugees and asylum seekers, of whom 84% come from sub-Saharan Africa. |

|

Landmines / UXO Present |

No |

|

|

Other Comments |

Road transport susceptible to disruption due to prevalence of foreign truck driver labour and xenophobic violence. |

|

For a more detailed database on disasters by country, please see the Centre for Research on Epidemiology of Disasters.

Seasonal Effects on Logistics Capacities

|

Seasonal Effects on Transport |

||

|---|---|---|

|

Transport Type |

Time Frame |

Comments / Details |

|

Primary Road Transport |

N/A |

|

|

Secondary Road Transport |

N/A |

|

|

Rail Transport |

N/A |

|

|

Air Transport |

N/A |

|

|

Waterway Transport |

N/A |

|

Some seasonal impact to primary and secondary transport may occur during citrus export season in Durban and Port Elizabeth, during deciduous and avocado export season in Cape Town and Port Elizabeth. The impact may be greatly attributed to delays in truck turnaround at terminals as result of terminal congestion. Further impact may also occur during late November to December and possibly early January due to demands for festive season supply deadline and some operators closing or scaling down for end of breaks.

|

Seasonal Effects on Storage and Handling |

||

|---|---|---|

|

Activity Type |

Time Frame |

Comments / Details |

|

Storage |

N/A |

|

|

Handling |

N/A |

|

|

Other |

N/A |

|

Capacity and Contacts for In-Country Emergency Response

Government

South Africa faces increasing levels of disaster risk. It is exposed to a wide range of weather hazards, including drought, cyclones and severe storms that can trigger widespread hardship and devastation. As such sustained, committed and concerted efforts with regard to disaster risk management reform by the government and a wide range of stakeholders were reflected in the promulgation of the Disaster Management Act, 2002 (Act No. 57 of 2002) on 15 January 2003. The Act provides for, an integrated and coordinated disaster risk management policy that focuses on preventing or reducing the risk of disasters, mitigating the severity of disasters, preparedness, rapid and effective response to disasters, and post-disaster recovery, the establishment of national, provincial and municipal disaster management centers, disaster risk management volunteers, matters relating to these issues.

The National Disaster Management Centre (NDMC) is responsible for establishing effective institutional arrangements for the development and approval of integrated disaster risk management policy. One way of achieving this is through intergovernmental structures. In this regard, the Act calls for the establishment of an Intergovernmental Committee on Disaster Management (ICDM) consisting of various ministry as well as various levels of government (national, provincial, district municipalities).

Ministries considered core to any disaster impact and response: Departments of Agriculture and Land Affairs, Defence, Education, Environmental Affairs and Tourism, Foreign Affairs, Health, Home Affairs, Housing, Minerals and Energy, National Treasury, Provincial and Local Government, Public Works, Safety and Security, Social Development, The Presidency, Transport, Water Affairs and Forestry.

Funding and resources (including military personnel and assets) may be called upon during and post disaster from government via the NDMC and structures according to the Act of 2002 and its framework.

For more information on government contact details, please see the following links: http://www.ndmc.gov.za/Pages/Home-Page.aspx and 4.1 Government Contact List.

Humanitarian Community

Medécins Sans Frontières has a regional base of operations in South Africa servicing projects within the country and neighbouring countries, their main warehousing site is based in Cape Town from where supplies to support projects are distributed to field sites where supplies for the short to medium term are held. The Red Cross Society has a national base of operations in Pretoria along with their main 3PL contracted depot of mainly disaster relief (clothes, blankets etc.) and some non-perishable food items. Regional / field offices operates their own limited storage facilities on either owned or leased compounds.

Gift of the Givers has a base of operations and head office in Pietermaritzburg, with offices in various provinces in the country. Registered as a NGO with department of social development, they undertake post-disaster relief operations along with government structures, as well as their own independently funded and coordinated relief operations. Various agencies of the United Nations are also present in the country most based in Johannesburg and Pretoria, supporting projects around the county and the region.

For more information on humanitarian agency contact details, please see the following link: 4.2 Humanitarian Agency Contact List.

1.2 South Africa Regulatory Departments and Quality Control

South African Revenue Services (SARS) is the revenue service (tax-collecting agency) of the South African government, reporting to the Minister of Finance. Its main functions are to - collect and administer all national taxes, duties and levies; collect revenue that may be imposed under any other legislation, as agreed on between SARS and an organ of state or institution entitled to the revenue; provide protection against the illegal importation and exportation of goods; facilitate trade; and advise the Minister of Finance on all revenue matters.

The Department of Health sets policy for regulations and standards on various aspects for the safeguarding of South African life including food and medical supplies. Setting and standards of testing are maintained via the South Africa Bureau of Standards and relevant code(s) assigned within a regulatory framework.

The Department of Minerals and Energy sets policy for regulations and standards of various types and grades of fuel (for both hydrocarbon and biofuels) in South Africa. Setting and standards of testing are maintained via the South Africa Bureau of Standards and relevant code(s) assigned within a regulatory framework.

The South African Bureau of Standards (SABS) is a South African statutory body, as the national standardization authority, the SABS is responsible for maintaining South Africa's database of more than 6,500 national standards. Internationally, SABS experts represent South Africa's interests in the development of international standards, through their engagement with bodies such as the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC). South Africa has a long and proud history of involvement with these bodies and was a founder member of ISO. To improve its service offerings and responsiveness to customer needs, the SABS also restructured its commercial services into seven industry clusters, namely : Chemicals, Electro-technical, Food & Health, Mechanical & Materials, Mining & Minerals, Services and Transportation.

In South Africa all the activities with GMOs are primarily regulated under the Genetically Modified Organisms Amendment Act 23 of 2006 (GMO Act) along with its subsidiary legislation. These activities include research. Development, import, export, transport, use and application of upon obtaining an authorization from the Department of Agriculture. Then, under the Consumer Protection Act (CPA) and 2008 (Act No. 68 of 2008) Regulations (R.293 of 2011) , in the case, where the foodstuff is containing at least 5% GMOs, the product must be labelled with the statement ‘Contains Genetically Modified Organisms’ and whereas a product has less than 5% GMOs, it is voluntary to include the statement ‘Contains <5% GMO.’ Moreover, The requirement for making the claim ‘Does not contain GMO’ or ‘GMO free’ is that the product must be tested and found to contain <1% GMOs.

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List and 4.3 Laboratory and Quality Testing Company Contact List.

1.3 South Africa Customs Information

Duties and Tax Exemption

For contact information regarding government custom authorities, please follow the link: 4.1 Government Contact List.

Emergency Response

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes , 24 Mar 1964 |

|

Annex J-5 Revised Kyoto Convention |

Yes , 18 May 2004 |

|

OCHA Model Agreement |

Yes , 19 Dec 1991 |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

No |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

Yes |

Exemption Regular Regime (Non-Emergency Response)

SCHEDULE 4

REBATES AND REFUNDS OF CUSTOMS DUTIES, EXCISE DUTIES, FUEL LEVY, ROAD ACCIDENT FUND LEVY, ENVIRONMENTAL LEVY AND HEALTH PROMOTION LEVY

NOTES:

- The goods specified in the Column headed "Description" of this Schedule shall, subject to the provisions of Section 75, be admitted under rebate of the customs duty specified in Parts 1 and 2 and the fuel levy (except the fuel levy specified in fuel levy item 195.30) in Part 5 of Schedule No. 1 in respect of such goods at the time of entry for home consumption thereof, to the extent stated in the Column headed "Extent of Rebate" of this Schedule in respect of those goods.

- Unless the context otherwise indicates, Notes Nos. A, C and H

of the General Notes to Schedule No. 1 and the section and chapter

notes in the said Schedule shall mutatis mutandis apply to this

Schedule.

- Note 3 to Schedule No. 3 shall apply mutatis mutandis in respect of any expression relating to the extent of any rebate in this Schedule. This shall be deemed to include a rebate of any environmental levy payable in terms of Part 3 of Schedule No. 1, subject to the Notes to Part 5 of this Schedule and health promotion levy payable in terms of Part 7 of Schedule No.1.

- Note 5 to Schedule No. 3 shall apply mutatis mutandis to any reference to a tariff heading or subheading in this Schedule.

- For the purposes of this Schedule, the expression "effective rate of duty" means the duty calculated according to a unit of quantity expressed as a percentage of the value for duty purposes.

- For the purposes of items 409.00, 480.00 and 490.00:

- Where any goods or vehicles are imported or re-imported, as the case may be, in terms of these items by a person who is required to declare goods in terms of section 15, that person means a "traveller" as defined in the rules for that section and as contemplated in form TC-01; and

- in addition to the Notes to these items, such a traveller must comply with the requirements of section 15, the rules for that section and form TC-01.

- Any reference to the Kingdom of Swaziland and BLNS in any provision of this Schedule shall, with effect from 19 April 2018, be deemed to be a reference to the Kingdom of Eswatini and BELN, respectively, in terms of the provisions which existed before 19 April 2018.

405.04 GOODS FOR DISABLED PERSONS OR FOR THE UPLIFTMENT OF INDIGENT PERSONS

405.04 00.00 01.00 07

Goods (excluding motor vehicles) specially designed for use by persons with disabilities, subject to the production of a certificate from an official of the South African National Council for the Blind, the Deaf Federation of South Africa, the South African Federation for Mental Health, the National Council for Persons with Physical Disabilities in South Africa or Epilepsy South Africa or of a body which is affiliated to the Council, Federation or League concerned, or a certificate from a registered medical practitioner, that such goods are for use exclusively by such persons with disabilities, such certificate being endorsed by the International Trade Administration Commission that such or similar goods are not ordinarily nor satisfactorily made in the Republic Full duty rebated.

405.04 00.00 02.00 01

Machines, implements and materials for use in the manufacture of goods by persons with disabilities, subject to the production of a certificate from an official of the South African National Council for the Blind, the Deaf Federation of South Africa, the National Council for Persons with Physical Disabilities in South Africa, or Epilepsy South Africa or a body which is affiliated to the Council, Federation or League concerned, or a certificate from a registered medical practitioner, that such machines, implements and materials are for the exclusive use by such persons with disabilities, such certificate being endorsed by the International Trade Administration Commission that such or similar goods are not ordinarily nor satisfactorily manufactured in the Republic Full duty

405.04 00.00 04.00 00

Goods (excluding clothing) forwarded unsolicited and free to any organisation registered in terms of the National Welfare Act, 1978 (Act No. 100 of 1978), entered in terms of a specific permit issued by the International Trade Administration Commission, for the distribution free of charge by such organisation Full duty

405.04 00.00 05.00 05

Goods (excluding clothing) forwarded unsolicited and free to any organisation registered in terms of the National Welfare Act, 1978 (Act No. 100 of 1978), entered in terms of a specific permit issued by the International Trade Administration Commission, for the official use by such organisation Full duty rebated

405.04 00.00 06.00 09

Goods (excluding foodstuffs and clothing) forwarded free, as a donation to any educational organisation, hospital (including clinic), welfare organisation, religious organisation or sporting organisation, in such quantities and under such conditions as the International Trade Administration Commission, may allow by specific permit and that the Commission is satisfied that the issuing of such permit will not have a detrimental effect on local industry within the common customs area: Provided that the applicant and anybody responsible for the distribution have furnished an undertaking that -

(a) such goods are for use by the organisation or for free distribution;

(b) such goods will not be sold, leased, hired or otherwise disposed of for gain without the duty which has been rebated being paid to the Commissioner; and

(c) no donation or other counter-performance may be accepted by anybody in respect of such goods full duty rebated

Exemption Certificate Application Procedure

Please see the rebate provisions above.

Exemption Certificate Document Requirements

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

AWB/BL/Other Transport Documents |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Donation/Non-Commercial Certificates |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Packing Lists |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Other Documents |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

Yes, Original, 1 copy, applies to UN but not NGOs |

|

Additional Notes |

||||||

|

Consult with your appointed Clearing and Forwarding Agent to ensure you have the correct number of copies of all the required documents. |

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

An importer should present the following documentation electronically to the South African Revenue Services: Customs

Importers must also register as an importer with the South African Customs. Information is available here: www.sars.gov.za. The process for sending donations to South Africa includes the prior verification by the importer if there are rebate provision for the donations in Schedule 4 of the Customs Act no 91 of 1964, otherwise full duty and VAT will be brought to account. Furthermore, all second hand imported commodities require an import permit issued by ITAC. The donating party (importer) should appoint a Clearing and Forwarding Agent to act on their behalf. |

|

Embargoes |

Goods can be removed under embargo to an importer premises for examination. Subject to application and payment of a security amount. |

|

Prohibited Items |

See the prohibited and restricted import and export list available here: www.sars.gov.za |

|

General Restrictions |

See the prohibited and restricted import and export list available here: www.sars.gov.za |

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

|

AWB/BL/Other Transport Documents |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

|

Donation/Non-Commercial Certificates |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

|

Packing Lists |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy sent electronically Applies to both UN and NGO's |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

|

Phytosanitary Certificate |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

|

Other Documents |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

Yes Original One Copy Electronically No difference |

|

Additional Notes |

||||||

|

||||||

Transit Regime

Transit can be divided into two categories, i.e. national and international transits. National transit is the movement of goods in bond within South Africa and within the Southern African Customs Union (SACU) from one customs controlled area to another. International transit applies to imported goods not destined for South Africa which move through South Africa to its final destination e.g. Zimbabwe.

Current legislation and policy require specific documents to be endorsed, which could entail the completion of required fields on a form such as findings of an examination, date stamping and signing. To see which documents are required and under which circumstances, click here.

In transit goods must be carried by a licensed remover of goods in bond. Clients must also be aware that before any application for cabotage permits (when transport is undertaken on SA roads by foreign carriers) will be considered by the Cross Border Road Transport Agency (CBRTA), a permit must first be obtained from the International Trade Administration Commission (ITAC) and temporary clearance must be made at a SARS Customs Office.

A Customs Road Freight Manifest (DA 187) must accompany the vehicle carrying goods together with a processed Customs Declaration for removal in bond or for export as the case may be, and must accompany the driver of the means of transport. A copy of each must be delivered to the Controller/Branch Manager at the place of exit.

Every person must keep records as prescribed in terms of the Customs and Excise Act.