Armenia - 1.3 Customs Information

The State Revenue Committee is a tax and customs authority established under the RA laws “On Tax Service,” “On Customs Regulations” and “On Customs Service.”

The Eurasian Economic Union (EAEU) Customs Code substantially controls Armenia’s foreign trade regime and customs regulations.

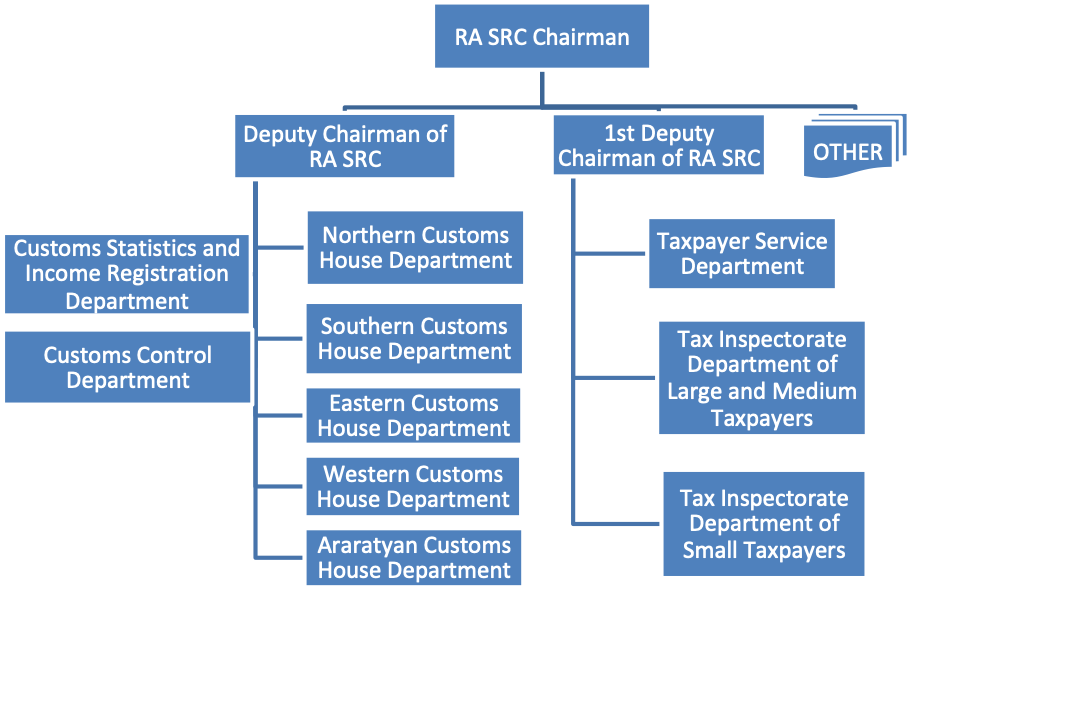

In 2001, customs department was split from the Ministry of State Revenues and the State Customs Committee of the Government of Armenia was formed. However, by the presidential decree NH-226-N of August 20, 2008, State Customs Committee and State Tax Service of the Government of the Republic of Armenia were re-organized into State Revenue Committee of the Government of Armenia through a merger. The below diagram demonstrates the organizational structure of the State Revenue Committee concerning the Tax Service and Customs Service.

The regional customs houses are customs entities where the goods and means of transportation/vehicles transferred by the organizations registered in the customs zone of activity of the given regional customs house are processed. Each regional customs house has some customs points under its subordination. The customs points are customs entities where goods and vehicles conveyed by physical persons undergo final processing, as well as goods and vehicles conveyed by legal entities undergo registration and initial customs processing (in case of import and transit) or registration and release (in case of export and transit).

Contacts:

Hours of operation are Monday to Friday from 9:00 AM to 6:00 PM

The Call Centre is available on working days from 09:00 till 18:00 and can be reached at the phone numbers 08000 1008 and +(374) 60 844 444

General Department of the RA SRC Secretariat +374 (60) 84 46 57

General Department of the RA SRC Secretariat +374 (60) 84 46 59

Duties and Tax Exemption

- VAT - 20% from customs value (cost of goods plus transport cost) Import

- Duty an average 10% for specified goods

- Road Tax

- Ecology Tax

- Goods and services recognized as humanitarian assistance within the framework of humanitarian aid programs are exempt from all duties and taxes

- Generally, all imported goods to Republic of Armenia are subject for duties, however in order not to pay the duties for humanitarian assistance, as per local legislation, importer has to request prior to arrival of the goods to humanitarian assistance central committee, to explain purpose of imported.

In order to get HACC (Humanitarian Assistance Central Committee) approval prior of arrival of goods, letter request with supporting docs (cargo docs, distribution plan) should be submitted to HACC.

Copy of recognition letter should be submitted to Head of Customs before declaring goods.

Clearing cargo with incomplete documentation is not possible, in case of any missing documentation, goods could be unloaded at the bonded warehouse (or in case of big shipment or humanitarian assistance) in consignee's warehouse, however consignees do not have right to use goods until issue with docs are solved and clearance is done. Best before date of commodity, as per local legislation is a must on any kind of packaging, including bags. Usually as per law printing should be in Armenian as well, however for humanitarian assistance, issue with Armenian language was waived.

Since 2015 the Republic of Armenia became a member of Eurasian Economic Union (EAEU). The EAEU introduces the free movement of goods, capital, services and people and provides for common policies in macroeconomic sphere, transport, industry and agriculture, energy, foreign trade and investment, customs, technical regulation, competition and antitrust regulation. One of the main features of the Union is that there is no customs clearance required for the goods received from other member countries, which are Russian Federation, Kazakhstan, Kyrgyzstan and Belarus. For goods imported from EAEU, special tax forms need to be filled in and presented to the Tax Authorities: Import Declaration and a Statement on Import of Goods.

For contact information regarding government custom authorities, please follow the link below:

Emergency Response:

[Note: This section contains information which is related and applicable to ‘crisis’ times. These instruments can be applied when an emergency is officially declared by the Government. When this occurs, there is usually a streamlined process to import goods duty and tax free.]

In the following table, state which of the following agreements and conventions apply to the country and if there are any other existing ones

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes - Date: 30th June 1992 |

|

Annex J-5 Revised Kyoto Convention |

Yes - Date: 25th April 2003 |

|

OCHA Model Agreement |

Yes |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

Yes |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

Member of BSEC (Black Sea Economic Cooperation) Date: May 1st, 1999 Member of EAEU (Eurasian Economic Union) Date: January 2nd, 2015

The United Nations in Armenia and the Ministry of Emergency Situations in Armenia holds a Customs Facilitation Agreement, a bilateral agreement allowing the expedition of the import, export, and transit of relief consignments and possessions of relief personnel in the event of disasters and emergencies. |

Exemption Regular Regime (Non-Emergency Response):

[Note: This section should contain information on the usual duties & taxes exemption regime during non-emergency times, when there is no declared state of emergency and no streamlines process (e.g. regular importations/development/etc.).]

- Single Administrative Document (SAD) is completed based on this document.

- Goods and vehicle declaration is automated and is implemented by ASYCUDA system.

- Before starting declaration process the importer has the right to observe and measure goods and vehicles and take samples if permitted by customs bodies on condition that they will be included in the submitted declaration.

- Goods and vehicles are declared in the custom house by the following sequence:

- Registering a SAD

- Accepting a SAD

- Selectivity

- Payment

- Goods Release

SAD Registration

Based on the submitted documents the declarant fills out the corresponding fields in the SAD. The completed SAD is registered in the automated system.

The registered SAD is checked and signed by the declarant and stamped with the organization seal and is submitted to the authorized person in the custom house, i.e. to the estimating inspector

Amendments and supplements to the customs declaration are made before it is accepted by the authorized customs officer.

Accepting a SAD

Customs bodies check the accuracy of the order of filling out the SAD, the completeness and validity of submitted documents, the accuracy of applying the customs value method, etc.

After the documents are checked the declarant is notified about the responsibility he/she bears in case incorrect information is provided and only after that the SAD is estimated and accepted.

The estimated SAD is sealed with inspector’s personal seal, and the declarant signs and seals the document with the seal of the organization. The estimated SAD is considered to be accepted by customs bodies. It is a legal document starting from the moment it is accepted, and the declarant bears a responsibility for the inaccuracy of information declared by him.

Selectivity

After estimating the SAD, further declaration direction is automatically selected by ASYCUDA SAD can be selected by:

Red Passage - declared freight is subject to detailed inspection

Yellow Passage - declared freight is subject to partial inspection

Green Passage - declared freight is released without inspection

Payment

The declarant pays customs fees calculated in the SAD. All documents necessary for customs payments are to be completed, namely budget transfer notice of customs fees and customs fee receipt.

The SAD and the other above-mentioned documents are sealed by inspector’s seal.

Goods Release

In case red and yellow passages are selected, declared goods are inspected according to the procedures defined by the law, and correspondence between goods indicated in the SAD and actually existing goods is checked.

In case there is no correspondence between the information mentioned in the declaration and actual goods, a protocol regarding the violation of customs regulations is prepared in accordance with the legislation of the Republic of Armenia.

The declarant submits documents (a certificate of correspondence or about origin, etc.) provided by authorized bodies in case there is a necessity of non-tariff regulation defined by the legislation of the Republic of Armenia.

Declared goods are subject to veterinary, sanitary and other type of control provided by the state bodies of the RA, in case there is the necessity for it. After having inspected goods (red and yellow passages) in case information declared corresponds to actually existing goods, the freight is released by making an appropriate note on the SAD.

Goods entering the Republic of Armenia within the framework of programs of humanitarian assistance or charity.

In the event of absence of direct reference in the legislation (including the international agreements of the Republic of Armenia) to the nature of a program, the latter shall be classified as pertaining to humanitarian assistance, charity and technical (other) nature by the Authorized Body of the Government of the Republic of Armenia coordinating humanitarian assistance (HACC).

|

Organizational Requirements to obtain Duty Free Status |

|---|

|

United Nations Agencies |

|

|

Non Governmental Organizations |

|

Exemption Certificate Application Procedure:

|

Duties and Taxes Exemption Application Procedure |

|---|

|

Generalities (include a list of necessary documentation) |

|

NGO should be registered as entity in Ministry of Justices. NGO should have approved plan for humanitarian assistance with defined targeted group. Request to HACC. According to Local legislation Humanitarian organization can obtain exemption for import duties and VAT Exemption is granted either by HACC (in case of NGO both local or international) or based on an agreement with Government |

|

Process to be followed (step by step or flowchart) |

|

Registration certificate Shipping documents including detailed packing list with weight, number etc. (Process time - one week) HACC recognition and Duty-free entry permission |

Exemption Certificate Document Requirements

Duties and Taxes Exemption Certificate Document Requirements (by commodity)

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|---|---|---|---|---|---|---|

|

Invoice |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

|

AWB/BL/Other Transport Documents |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

|

Donation/Non-Commercial Certificates |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

|

Packing Lists |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes (detailed with number of pieces and weight) |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

Yes, Original, 1 copy, applies to UN and NGOs |

|

Other Documents |

Phytosanitary Certificate |

n/a |

Needs to be registered brand in Armenia |

Certificate of title or registration from origin |

n/a |

Import permission required from GoA |

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

Instruction of temporary import must be indicated on the invoice |

|

Embargoes |

None |

|

Prohibited Items |

Specific drugs, protected species, imitation and/or counterfeit material |

|

General Restrictions |

(GMO) commodities are not allowed into Armenia. The country has strict regulations prohibiting the import of GMO food products. The least shelf life required for food commodities to enter Armenia is at least six months. Additionally, the best before date must be displayed on the packaging. This ensures that the food products are safe for consumption for a reasonable period after entering the country |

Customs Clearance Document Requirements

Customs Clearance Document Requirements (by commodity)

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|---|---|---|---|---|---|---|

|

D&T Exemption Certificate |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

Invoice |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

AWB/BL/Other Transport Documents |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

Donation/Non-Commercial Certificates |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

Packing Lists |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

Phytosanitary Certificate |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

|

Other Documents |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Yes, Original, 1 copy, applies to both UN and NGO |

Transit Regime

The customs regime of transit shipment in Armenia is considered transportation of goods under customs control between two customs points without modification of the bill of lading. Transit shipment regime implies:

- No customs payments

- That the goods shall be transported from one customs point of destination to another within a ten-day period maximum and submission to customs bodies for temporary custody within the specified period in case of force majeure

- Exception of changes other than natural deterioration or changes caused by the transportation or storage under abnormal conditions.

- Obligatory customs accompanying in cases stipulated by the Rep of Armenia government if otherwise is not stipulated customs code.

There is government established list of goods that are prohibited to be transported through the Rep of Armenia territory. Those goods transportation through the Rep of Armenia territory shall be subject of licensing and the order of implementation. Carrier who arrange transit transportation of goods and means of transportation through the Rep of Armenia territory:

- Should incur liability for transit shipment of goods and means of transportation under the ‘transit shipment’ regime according to this code and other legal acts.

- In case of alienation, lost or not reaching to the customs point, or leaving the Rep of Armenia customs territory of goods and means of transportation without permission of the Customs Authorities, the carrier shall be obliged to pay the customs payments stipulated by "imported for free circulation" regime within 10 days following the date stipulated for the transit shipment and pay the penalties stipulated by the legislation in the event of failure to pay customs payments within the specified period.

- In case the goods are destroyed or lost irrevocably in consequence of force-majeure circumstances, or undergone natural deterioration, or are damaged due to transportation under abnormal conditions, or actions or idleness of the RA State authorities and officials and that fact is stated with the relevant documents.

Since 2008 the Customs committee has started to encourage all organizations importing or exporting goods in Armenia to use licensed customs brokers to conduct clearance process

Currently almost all transport companies either have their own employee who have license to do clearance or have a contract with small companies who are providing such services

Armenia Customs Additional Information

The United Nations in Armenia and the Ministry of Emergency Situations in Armenia signed a Customs Facilitation Agreement, a bilateral agreement allowing the expedition of the import, export, and transit of relief consignments and possessions of relief personnel in the event of disasters and emergencies. This marks a major step forward in strengthening preparedness and a pioneering initiative for others in the region.

Armenia’s vulnerability to natural disasters led the Armenian Government to prioritize the rapid deployment of international aid in emergency situations by lowering customs barriers.

This Agreement will allow aid consignments (including search and rescue teams, search dog teams, and mobile medical units), high technology emergency communication equipment, and other emergency relief items a speedy import/export and transit into the country in the event of a disaster requiring external assistance. along with vital information shared by natural authorities, enable UN agencies, intergovernmental, governmental, and non-governmental organizations as well as other humanitarian actors to quickly contact appropriate National Customs Authorities to bring in relief consignments for saving lives and reducing the suffering of the affected people.

Focal points for information

Since 2008 the humanitarian community in Armenia has outsourced customs clearance services to licensed brokers, customs clearance agencies include:

- GOSSELIN YEREVAN" Armenian-Belgian Joint Venture, Closed Joint-Stock Company (CJSC) Phone +37491402445 Point of contact Vahram M. Jotyan, Director E mail yerevan@gosselinarmenia.com

- TRANSIMPEX" Limited Liability Company (LLC) Point of Contact Artur V. Abovyan, Director Phone +374-60-657070 http://www.transimpex.am

- “ARA AMIRYAN" Limited Liability Company (LLC), Point of Contact Ara Amiryan Phone +37491421530 e mail: araamiryan@gmail.com

In addition to above list there are several customs clearance agent available as per link https://www.spyur.am/en/business_directory/bd/9433

Customs Information by Entry Point

Each point of entry is equipped with customs office, immigration office and border authorities. Below are three main land entry points with description.

|

Entry Point Details: Bagradashen |

||||

|---|---|---|---|---|

|

Land |

Bagratashen, border with Georgia |

|||

|

Name of Customs Officer in Charge |

N/A |

|||

|

Title |

Shift leader |

|||

|

Address |

Bagratashen Village |

|||

|

Operating Hours |

0900 – 1800 |

|||

|

Telephone Number |

+374 (60) 54 44 44 |

|||

|

Web |

||||

|

Languages of Correspondence |

Armenian, Russian English (basic) |

|||

|

Entry Point Details: Agarak |

||||

|

Land |

Agarak, border with Iran |

|||

|

Name of Customs Officer in Charge |

N/A |

|||

|

Title |

Shift leader |

|||

|

Address |

Agarak Town of Syunik marz |

|||

|

Operating Hours |

0900 – 1800 |

|||

|

Telephone Number |

+374 10 285 452 |

|||

|

Web |

||||

|

Languages of Correspondence |

Armenian, Russian, English (basic) |

|||

|

Warehouse |

||||

|

Official customs warehouses in Armenia as of September 2019. All goods crossing customs border are assigned to one of below customs warehouses where customs clearance inspection should be done. All warehouses are equipped with scale, space for unloading / loading, labourers, fork lifts. |

||||

|

Name of Warehouse |

Location / Address |

Telephone |

Rail Access |

|

|

Yes |

No |

|||

|

Urban Logistics service |

62, 23 Araratyan St, Yerevan |

No |

||

|

Apaven |

43 Araratyan Street, Yerevan, Armenia |

+374 10 464 499 |

Yes |

|

|

Uratu OJSC |

12 Arin Berd Street, Yerevan, Armenia |

+374 10 474 631 |

Yes |

|

|

Firma New |

Kotayk Marz Arinj, Armenia |

+374 10 285 348 |

No |

|

|

Hayk CJSC |

11 Arin Berd Street, Yerevan, Armenia |

+374-11-252000 |

Yes |

|

|

Zangezur Terminal |

Kapan Gortsaranayin St, Yerevan, Armenia |

+374 28 566 500 |

No |

|

|

Trans Alians |

90 Araratyan Street, Yerevan, Armenia |

+374 10 52 95 98 |

Yes |

|

|

Zvartnots Cargo Terminal |

Zvartnots Cargo Terminal, Yerevan Airport, Armenia |

+374 10 493 000 Ext: 71-12 |

No |

|

|

MetXim |

15/1 Artashat Highway Yerevan, Armenia |

+374-10-287576 +374-10-287633 |

Yes |

|

Customs Information and Document Requirements

Clearing System

• Import/export completed by the organisation should clear goods only at the customs houses were the organisation is registered

• Since majority of international organisations are registered in capital of Armenia, all goods arriving by surface should be cleared at Araratyan customs house goods arriving by air can be cleared at Zvartnots customs house

• At border crossing points, customs officers checking the documents and issue transit documents, to the regional customs house.

• Note: there is deadline for completing the customs clearance on each transit declaration which is normally 10 days, in case it is not completed within this time there is a customs penalty.

For detailed information please check the following link with interactive map - Republic of Armenia Customs Service