3 Tanzania Logistics Services

The urban areas, such as Dar es Salaam, Dodoma and Arusha, have a well-developed availability of services and supply. The available products and services are relatively diversified and different level of quality can be found in the market. For their part, rural areas have limited access to a variety of goods and services, even if an improvement is noticed due to the transport network development. Indeed, the recent investments in the transport network infrastructure allow a better connectivity between the markets and the remote areas.

Tanzania, United Republic of - 3.1 Fuel

Fuel Overview

The Zanzibar Utilities Regulatory Authority (ZURA) is responsible under the Energy and Water Utilities Act No. 7 of 2013 to oversee and regulate the Energy and Water sectors, ZURA has the duty to regulate these sectors both technically and economically. The sub-sectors regulated by the Authority include Oil, Liquefied Petroleum Gas, Electricity, and Water. The Authority is responsible for ensuring that the services provided are available at adequate standards, at fair prices, safely and reliably, and that service providers receive fair returns on their investments

In October 2021, the Authority on behalf of the Government implemented changes in the country's fuel importation system, transitioning from multiple importers to the establishment of a Bulk Procurement System (BPS). Currently, oil is imported into the country through the awarded company GBP TANZANIA LIMITED in Tanzania. The imported products include gasoline, diesel, aviation fuel, and kerosene. The annual volume of oil imported into Zanzibar is approximately 180,000 metric tons with a variance of +/- 20%.

Currently Oil imported into Zanzibar is collected from the ports of Tanga and/or Dar es Salaam by GBP TANZANIA LIMITED. They then distribute the oil to Zanzibar's oil companies, which include GAPCO, PUMA, and Zanzibar Petroleum (ZP) located at Mtoni port Unguja, United Petroleum (UP) located at Mangapwani Port Unguja. These companies receive their oil from the supplier after submitting their required quantity orders for the respective timeframes.

The oil storage facility in Mtoni has a capacity to store up to 16,487,039 liters and 21,000,000 at Mangapwani depot liters of oil for all products, On the other hand, in Pemba, the Wesha depot in Pemba has a total capacity of 2,013,000 liters. However, the average actual consumption of oil required is 15,000,000 liters per month. These requirements can increase to 17,000,000 liters per month during periods of higher demand.

For more information on government and fuel provider contact details, please see the following links: 4.1 Government Contact List and 4.7 Fuel Providers Contact List.

Information may also be found at: http://www.mytravelcost.com/petrol-prices/ which is updated monthly.

Fuel Pricing

ZURA has developed Petroleum Products Price Setting Rules which provide a pricing formula for computing the petroleum products' prices. The formula is composed by:

FOB price – It is computed based on the weighted average FOB price of vessels that discharged fuel in a given month. The weighted average FOB price of each product is computed separately. The price of the products for each cargo is based on the monthly average price of the products as published by Platts. Premiums are determined based on the results of supply tenders floated every month. Local charges are fixed in the formula based on various legal provisions that impose a charge in importation or in doing business in the petroleum sub-sector. They also include some variable business costs that have been identified and approved by EWURA as prudent costs. Margins to wholesalers and retailers to cover operations cost and a return on investment.

|

Fuel Prices per Litre as of 09 -Sept- 23 (local currency and USD - $) |

|

|---|---|

|

Petrol |

2950 TZS – 1.18 USD |

|

Diesel |

3012 TZS - 1.2 USD |

|

Kerosene |

2921 TZS - 1.17 USD |

|

Jet A-1 |

2448 TZS - 0.98 USD |

N.B*The price cap for petroleum product is announced on 8th every month and implemented on 9th.

Seasonal Variations

|

Seasonal Variations |

|

|---|---|

|

Are there national priorities in the availability of fuel? (i.e., are there restrictions or priorities for the provision of fuel such as to the military?) |

NO |

|

Is there a rationing system? |

NO |

|

Is fuel to lower income / vulnerable groups subsidized? |

NO |

|

Can the local industry expand fuel supply to meet humanitarian needs? |

YES |

|

Is it possible for a humanitarian organization to directly contract a reputable supplier / distributor to provide its fuel needs? |

YES |

Fuel Transportation

Fuel is transported within the country using fuel trucks. Transportation is arranged between the owner of the trucks and a petrol station requiring the fuel or the Oil Marketing Company (OMC). For large customers who buy fuel directly from the OMC, the OMC arranges to deliver the products to the client accordingly to the agreement between the two parties.

Standards, Quality and Testing

At 15 degrees centigrade, the petrol must have a density between 720-780 Kg/m3, a minimal motor octane number of 83, and maximum sulphur content of 0.015%.

At 15 degrees centigrade, diesel must have a density between 820-870 Kg/m3, a minimum cetane index of 48, and a maximum sulphur content of 0.05%.

At 15 degrees centigrade, kerosene must have a density between 776-840 Kg/m3 and a maximum of sulphur content of 0.15%.

The quality of fuel is checked by Zanzibar Bureau of standards (ZBS) on arrival of a fuel vessel at the port. In addition, ZURA carries out regular checks of fuel quality at the depots and petrol stations.

|

Industry Control Measures |

|

|---|---|

|

Do tanks have adequate protection against water mixing with the fuel? |

As part of routine inspection activities, ZURA ensures that manholes (filler boxes) of underground storage tanks are watertight. |

|

Are there filters in the system which monitor where fuel is loaded into aircraft? |

YES |

|

Is there adequate epoxy coating of tanks on trucks? |

Yes |

|

Is there a presence of suitable firefighting equipment? |

YES |

|

Standards Authority |

|

|---|---|

|

Is there a national or regional standards authority? |

YES |

|

If yes, please identify the appropriate national and/or regional authority. |

National: Zanzibar bureau of standards Regional: |

|

If yes, are the standards adequate/properly enforced? |

YES |

|

Testing Laboratories |

|

|---|---|

|

Are there national testing laboratories? |

YES |

|

Fuel Quality Testing Laboratory |

|

|---|---|

|

Company |

Zanzibar bureau of standards |

|

Name |

Director General |

|

Address |

Maruhubi, Unguja, P.O.Box 1136 |

|

Telephone and Fax |

Tel: +255-24-2232225 Fax: +255-24-2232225 |

|

Contact |

Email: info@zbs.go.tz Website: www.zbs.go.tz |

|

Standards Used |

|

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Tanzania, United Republic of - 3.2 Transporters

Overview

The Tanzanian Road transport market is a critical component of the country's economy, accounting for over 8% of GDP. The sector is dominated by trucking, which accounts for over 75% of all freight traffic. The passenger transport sector is also important, with over 90% of all passenger journeys made by road. The demand for freight transport is increasing in Tanzania, driven by economic growth and trade liberalization across the East African Community (EAC). This is creating opportunities for trucking companies and logistics providers. The Tanzanian government is investing heavily in road infrastructure, with a focus on upgrading existing roads and constructing new ones. This is improving road connectivity and reducing transportation costs. The road transport sector in Tanzania is slowly adopting technology, such as GPS tracking and fleet management systems. This is improving efficiency and safety. Transportation costs in Tanzania are relatively high, due to factors such as fuel prices and road taxes. This can make it difficult for businesses to compete. The informal sector is prevalent in the Tanzanian road transport market, with many unlicensed operators competing with formal companies. This can lead to unfair competition and safety concerns.

In addition, Tanzania plays a pivotal role in connecting neighbouring landlocked countries with international markets, namely Uganda, Rwanda, Burundi, DR Congo, Zambia, Malawi and South Sudani. Transport routes from the Port of Dar es Salaam to these landlocked countries are vital for both import and export of goods. Tanzania is bordered by the Indian Ocean and the three largest African Great Lakes, namely Lake Victoria, Lake Tanganyika, and Lake Nyasa (Malawi). Due to Tanzania being so close to the equator and surrounded by such large bodies of water, the country is seasonally subjected to large masses of warm, humid tropical air, which can induce heavy rains and thunder storms. Floods are frequent and affect most regions of the country these are the main cause of transportation disruptions.

For more information on transport company contact details, please see the following link: 4.8 Transporter Contact List.

|

Ali Juma Ramadhani and company limited - Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

East Africa, DRC, South Sudan, Rwanda, Burundi, Kenya, Malawi, Uganda. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

60 |

32 |

Oldest is 2004 |

|

Vehicle Type |

10 |

38 |

20 new trucks purchased in Jan 2023 |

|

Total Capacity |

70 |

2,300 |

New vehicles are purchased every January to expand the fleet every year. |

.

|

WH Logistics Company Limited - Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

East Africa, DRC, South Sudan, Rwanda, Burundi, Kenya, Malawi Uganda. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

20 |

32 |

Good |

|

Vehicle Type |

15 |

31 |

Good |

|

Vehicle Type |

5 |

10-20 |

Good |

|

Total Capacity |

40 |

1,205 |

|

|

Export Trading Company (ETC) - Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

East Africa, South Sudan, DRC, Rwanda, Burundi, Kenya, Malawi, Uganda. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

300 |

30 |

Lage modern fleet of vehicles |

|

Vehicle Type |

|

|

|

|

Total Capacity |

300 |

9,000 |

|

|

Saratoga Investment Co. - Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

bus and truck services Kigoma – Dar es Salam/ Kigoma- Mwanza. Truck transport to Burundi on request. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

40 |

Buses |

Saratoga utilise vehicle tracking software to provide real-time monitoring of location, speed and several other data sets for tracking cargo. |

|

Vehicle Type |

35 |

Trucks very between 30-35 Mt |

Saratoga utilise vehicle tracking software to provide real-time monitoring of location, speed and several other data sets for tracking cargo. |

|

Total Capacity |

75 |

||

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.3 Tanzania Manual Labour

Manual labour is submitted to the Employment and Labour Relations Act, 2004 which serves as a frame of reference for workers’ security. The average daily remuneration in Tanzania is 10,000 TSH. This rate varies in function of the goods, weather condition and type of work. Also, night work should be paid at the premium rate of 5%, according to the Tanzanian law. The manual labour has no provision for holidays.

According to the law, the minimum rates for casual unskilled workers have been fixed at TSH 3,816.45 (USD 1.69). As per the government wages order GN196 issued in June 2013 (not revised up to now), there is no specific rate for skilled and semi-skilled workers. The two are being controlled by the market force.

The table below shows average rates. The rates scale may considerably vary in terms of the sector. The different categories and the minimum wages are available on this website: https://africapay.org/tanzania/home/salary/minimum-wages

|

Labour Rate(s) Overview |

||

|---|---|---|

|

|

Daily average cost |

Rate as of JUNE 2013 |

|

Daily General Worker (Unskilled casual labour) |

TSH 5,000 (USD 2.22) |

n/a |

|

Daily General Worker (Semi-skilled labour) |

TSH 10,000 (USD 4.44) |

n/a |

|

Skilled Worker |

TSH 15,000 (USD 6.66) |

n/a |

Tanzania, United Republic of - 3.4 Telecommunications

Telecommunications

For more information on telecoms contacts, please see the following link: 4.11 Additional Services Contact List.

|

Telephone Services |

|

|---|---|

|

Is there an existing landline telephone network? |

Yes |

|

Does it allow international calls? |

Yes |

|

Number and Length of Downtime Periods (on average) |

N/A |

|

Mobile Phone Providers |

Vodacom, Airtel, Tigo, TTCL, Smile, Halotel, Zantel |

|

Approximate Percentage of National Coverage |

Mobile communication coverage levels for 2G, 3G and 4G are estimated to be 99%, 81%, and 55% of the population respectively. 5G is not yet commercially available in the country. (January 2023 report Tanzania’s Digitalisation Journey) |

Telecommunications Regulations

Tanzania Communications Regulatory Authority (TCRA)

Tanzania Communications Regulatory Authority (TCRA) is a statutory regulatory body responsible for regulating the electronic and postal communication sector in Tanzania. It was established under the Tanzania Communications Regulatory Authority Act, No.12 of 2003, which merged the Tanzania Communications Commission (TCC) and the Tanzania Broadcasting Commission (TBC).

Tanzania Communications Commission (TCC) was established in 1993 with the mandate of regulating the telecommunications and postal services. Tanzania Broadcasting Commission (TBC) was established in 1993 with the mandate of regulating the broadcasting sector.

Due to technological advancement, there was a need to streamline government services to enhance public service delivery, minimising bureaucracy and increase efficiency, the two regulatory bodies (TCC and TBC) were merged in 2003 to form Tanzania Communications Regulatory Authority (TCRA).

The Authority became operational on 1st November 2003 and effectively took over the functions of the merged two Commissions. This is mandated by section 4 (1) to (7) of the TCRA Act, 2003.

the Tanzania Communications Regulatory Authority (TCRA) is an independent regulatory authority for the postal, broadcasting, and electronic communications industries in the United Republic of Tanzania. It was established under the TCRA Act No. 12 of 2003 by merging the Tanzania Communications Commission (TCC) and the Tanzania Broadcasting Commission (TBC).

The TCRA is responsible for promoting competition and protecting consumers in the communications sector. It also plays a key role in the development of the communications sector in Tanzania.

The TCRA's core functions include:

Licensing and regulating communications service providers.

Promoting competition and protecting consumers in the communications sector

Developing and implementing policies and regulations for the communications sector

Monitoring and enforcing compliance with communications laws and regulations

Resolving disputes between communications service providers and consumers

The TCRA is governed by a Board of Directors, which is appointed by the President of Tanzania. The Board is responsible for setting the strategic direction of the TCRA and overseeing its operations.

|

Regulations on Usage and Import |

||

|---|---|---|

|

Regulations in Place? |

Regulating Authority |

|

|

Satellite |

Yes |

TCRA |

|

HF Radio |

Yes |

TCRA |

|

UHF/VHF/HF Radio: Handheld, Base and Mobile |

Yes |

TCRA |

|

UHF/VHF Repeaters |

Yes |

TCRA |

|

GPS |

No |

N/A |

|

VSAT |

Yes |

TCRA |

|

Individual Network Operator Licenses Required |

||

|

Yes, The Electronic And Postal Communications (Digital And Other Broadcasting Networks And Services) Regulations, 2018 is the regulation which allows for individual network operator licenses |

||

|

Frequency Licenses Required |

||

|

Yes, the Electronic and Postal Communications (Radio Communication And Frequency Spectrum) Regulations, 2018 is the regulation which allows for frequency licenses. |

||

Existing Humanitarian Telecoms Systems

The UN country team have an Information and Communication Technologies (ICT) working group with the goal to develop a common network and a common business continuity management strategy. The ICT working group consist of representative from WFP, UNICEF, WHO, ILO, FAO, IOM, UN Women, UNDSS, UNHCR (currently chair the WG) and UNDP who also represent the smaller UN agencies in Tanzania.

|

Existing UN Telecommunication Systems |

|||||

|---|---|---|---|---|---|

|

UNDSS |

WFP |

UNHCR |

UNICEF |

World Bank |

|

|

VHF Frequencies |

Yes |

Yes |

Yes |

Yes |

No

|

|

HF Frequencies |

Yes |

No |

Yes |

Yes |

No

|

|

Locations of Repeaters |

Dar es Salaam & Zanzibar |

Dodoma |

Several in North-western Tanzania |

Dar es Salaam & Mbeya |

No

|

|

VSAT |

No |

Yes |

Yes |

Yes |

Yes

|

Internet Service Providers (ISPs)

The internet penetration rate in Tanzania is increasing, with 50% of the population currently having access to either mobile or fixed broadband internet. The reliability of internet services varies with urban centres like Dar es Salaam and Arusha having access to relatively stable connections, but speeds and reliability can vary greatly depending on the provider and infrastructure availability. The reliability of the national power grid is also an issue in maintaining connection.

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? |

Yes |

|

|

If yes, are they privately or government owned? |

Both |

|

|

Dial-up only? |

No |

|

|

Approximate Rates (local currency and USD - $) |

Dial-up |

|

|

Broadband |

|

|

|

Max Leasable ‘Dedicated’ Bandwidth |

10 Gbps |

|

Mobile Network Operators (MNOs)

In urban areas of Tanzania, mobile users can access 3G services or higher, however, 5G is not yet commercially available in the country at present. Whereas approximately one-fifth of the nation's population, mainly residing in rural communities remain with access limited to 2G network coverage.

Mobile money in Tanzania has expanded from traditional payments like airtime recharge and domestic remittances to more sophisticated financial services. The National Payment Systems (NPS) Act 2015 of Tanzania is a crucial piece of legislation that establishes a comprehensive framework for regulating and overseeing payment systems in the country including the use of mobile money. The Act empowers the Bank of Tanzania (BoT) as the primary regulator of payment systems, granting it authority to license and supervise payment system operators, establish clearing and settlement mechanisms, and implement risk mitigation measures. It also outlines the requirements for electronic money issuance and operation, ensuring consumer protection and promoting innovation in digital payments. The National Payment Systems (Electronic Money Transactions Levy) (Amendment) Regulations, 2022 outlines chargeable rate for electronic money in Tanzania.

For information on MNOs please visit the GSM Association website.

|

Company |

Number of Agent Outlets by Area |

Network Strength by Area |

Contracted for Humanitarian or Government Cash Transfer Programmes? |

Services Offered (i.e. Merchant Payment, Bulk Disbursement, Receive & Make Payment) |

|---|---|---|---|---|

|

VODACOM |

|

|

|

Yes- M-PESA

|

|

AIRTEL |

|

|

|

Yes - Airtel Money

|

|

TIGO

|

|

|

|

Yes- Tigopesa

|

|

TTCL |

|

|

|

Yes- T-PESA

|

|

SMILE

|

|

|

|

No |

|

HALOTEL |

|

|

|

Yes- Halopesa

|

|

ZANTEL |

|

|

|

Yes- EZYPESA

|

3.5 Tanzania Food and Additional Suppliers

At both regional and local scales, there are different vendors for food products, including maize grain, pulses (pigeon peas and beans), iodized salt and sorghum. Indeed, the agriculture in Eastern Africa is the principal economic sector. It is estimated that almost 70% of the regional population is relying on agriculture, and this sector absorbs a large proportion of the working population in the market (UN, NEPAD, 2013). However, the region is also subject to environmental effects which often affect the production, and the local market may be unable to meet the demand.

For non-food suppliers, the Tanzanian market is well-established, although it is mainly concentrated in the main cities. A large number of suppliers are offering a range of products and different quality levels.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a general overview of the country data related to the service and supply sectors, please consult the following sources:

- The Observatory of Economic Complexity – MIT (OEC): http://atlas.media.mit.edu/en/

- Ministry of Agriculture, Tanzania: http://www.mifugouvuvi.go.tz

Disclaimer: Inclusion of company information in the LCA does not imply any promotion or business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP and Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider

Tanzania, United Republic of - 3.5.1 Food Suppliers

Overview

The Tanzanian retail and wholesale food market is a large and growing sector, with an estimated value of US$15 billion in 2022. The market is dominated by informal retailers, such as street vendors and small shops, which account for an estimated 90% of all food sales. However, there is a growing trend towards formalization, with the emergence of supermarkets and hypermarkets in major cities. The formal retail sector is growing rapidly in Tanzania, driven by increasing urbanization and incomes. Supermarkets and hypermarkets are becoming increasingly popular, particularly among middle-class consumers. Demand for processed foods is rising in Tanzania, as consumers become more time-conscious and convenience-oriented. This is creating opportunities for manufacturers and retailers of processed food products. E-commerce is still in its early stages of development in Tanzania, but it is growing rapidly. This is creating new opportunities for retailers to reach consumers, particularly in urban areas.

The lack of adequate infrastructure in some areas, such as roads and cold storage facilities, is a major challenge for the retail and wholesale food market in Tanzania. This can lead to high transportation costs and food spoilage. Supply chain disruptions, such as droughts and floods, can have a significant impact on food prices and availability in Tanzania.

The retail and wholesale food market in Tanzania is expected to continue to grow in the coming years, driven by urbanization, population growth, and rising incomes. However, challenges such as infrastructure constraints and supply chain disruptions will need to be addressed in order to ensure that the market can continue to grow and meet the needs of the Tanzanian population.

For more information on food supplier contact details, please see the following link: 4.10 Supplier Contact List.

Wholesale – Export Trading Company (ETC)

Export Trading Company (ETC) was established in Kenya in the late 1960s to market locally produced goods in east and central Africa, over the years the company has diversified and expanded and is now part of the Export Trading Group (ETG). ETG is a global logistics provider with

|

Supplier Overview |

|

|---|---|

|

Company Name |

Export Trading Company ETC |

|

Address |

Plot 101/1-66. Block Q, Mbagala Rangi Tatu, Po. Box 104732 |

|

Does the supplier have its own production / manufacturing capacity?

|

Yes, bagging plant capacity 2500mt per day Commodity cleaning and sorting plants x 3 capacity 3000MT per day each |

|

Does the supplier have its own retail capacity?

|

Yes, for fertilizer and seeds x 6 |

|

Does the supplier have its own transport capacity? |

Yes, 300 x 30 MT each |

|

Does the supplier have its own storage facilities? |

Yes, 80,000MT across the country |

|

Approximate Turnover in MT

|

500,000 MT per year |

|

Payment Methods Accepted |

Bank Transfer |

|

Other Comments or Key Information |

Inland container depots and Customs clearance wing with licence |

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Dar es Salam |

Tazara |

|

Dar es Salam |

Mbagala |

|

Mtwara, |

Mtwara |

|

Mwanza, |

Mwanza |

|

Mbeya |

Mbeya |

|

Shinyanga |

Kahama |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

N/A |

|

|

01 - Meat and meat preparations |

N/A |

|

|

02 - Dairy products and birds’ eggs |

N/A |

|

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

N/A |

|

|

04 - Cereals and cereal preparations |

Yes |

wheat, rice, flour of maize, pasta... |

|

05 - Vegetables and fruit |

Yes |

On a third-party basis |

|

06 - Sugars, sugar preparations and honey |

Yes |

sugars cane |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

Coffee and Tea |

|

|

09 - Miscellaneous edible products and preparations |

N/A |

|

|

41 - Animal oils and fats |

N/A |

|

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

N/A |

|

Wholesale – Ali Juma Ramadhani and company limited.

Ali Juma Ramadani and company limited are a wholesale Grain and road transport company based in Dodoma. They have 1 x 10,000MT warehouse currently in use and 2 x 10,000MT warehouses under construction in two parallel sites off the B129 road. Ali Juma has a large fleet of modern trucks available for company use and to provide transport services across counties in east Africa. The company also maintains 3 retail premisses in Dodoma.

|

Supplier Overview |

|

|---|---|

|

Company Name |

Ali Juma Ramadani and company limited |

|

Address |

PO. BOX 322, Mpwapwa. |

|

Does the supplier have its own production / manufacturing capacity? |

No |

|

Does the supplier have its own retail capacity? |

Yes- 3 retail outlets in Dodoma |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes - 5 warehouses 30,000Mt

|

|

Approximate Turnover in MT |

30,000mt per year |

|

Payment Methods Accepted |

Bank transfer and cash |

|

Other Comments or Key Information |

70 Truck also used as the transport provider |

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Ruvuma Region |

Songea, 1 x warehouse, 10,000mt

|

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

N/A |

N/A |

|

01 - Meat and meat preparations |

N/A

|

N/A |

|

02 - Dairy products and birds’ eggs |

N/A

|

N/A |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

N/A

|

N/A |

|

04 - Cereals and cereal preparations |

Yes |

Currently only focusing on grains and cereals. |

|

05 - Vegetables and fruit |

N/A

|

N/A |

|

06 - Sugars, sugar preparations and honey |

N/A

|

N/A |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

N/A

|

N/A |

|

09 - Miscellaneous edible products and preparations |

N/A

|

N/A |

|

41 - Animal oils and fats |

N/A

|

N/A |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

N/A

|

N/A |

Wholesale – Apeck International Limited

Apeck International Limited is a regional wholesale grain supplier with offices in Tanzania, Kenya, Malawi and Zambia. Apeck Int. specialise in trading, storing and distributing agricultural commodities and providing high quality grains, pulses and oilseeds. Their facilities are strategically located close to our local farmers, collection centers and exporters.

|

Supplier Overview |

|

|---|---|

|

Company Name |

Apeck International Limited |

|

Address |

PO. Box 2770, Dodoma |

|

Does the supplier have its own production / manufacturing capacity? |

No. |

|

Does the supplier have its own retail capacity? |

No |

|

Does the supplier have its own transport capacity? |

Yes, 10 trucks x 32 Mt |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate Turnover in MT |

30,000mt per year |

|

Payment Methods Accepted |

Bank Transfer |

|

Other Comments or Key Information |

6 branches, Dar es salaam, Dodoma arusha Mbeya , Songea Rukwa |

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Dar es salaam, |

Dar es salaam - 5,000Mt warehouse |

|

Dodoma |

Dodoma - 10,000MTwarehouse |

|

arusha |

Arusha - 6,000 MT warehouse |

|

Mbeya |

Mbeya -10,000MT warehouse |

|

songea |

Songea - 5,000MT warehouse |

|

Rukwa |

Rukwa - 10,000Mt warehouse |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

N/A |

N/A |

|

01 - Meat and meat preparations |

N/A |

N/A |

|

02 - Dairy products and birds’ eggs |

N/A |

N/A |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

N/A |

N/A |

|

04 - Cereals and cereal preparations |

maize, sorghum, beans, and peas. |

Both direct from Farmers and bulk purchase |

|

05 - Vegetables and fruit |

N/A |

N/A |

|

06 - Sugars, sugar preparations and honey |

N/A |

N/A |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

N/A |

N/A |

|

09 - Miscellaneous edible products and preparations |

N/A |

N/A |

|

41 - Animal oils and fats |

N/A |

N/A |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

N/A |

N/A |

Wholesale – Dodoma Millers Company Limited

Dodoma Millers was established in 2021 as a wholesale Grain supplier, the company plans to open a milling production plant in 2024. They have a large 5400Mt warehouse located in Dodoma city

|

Supplier Overview |

|

|---|---|

|

Company Name |

Dodoma Millers Company Limited |

|

Address |

PO. Box 4044 Dodoma |

|

Does the supplier have its own production / manufacturing capacity?

|

No |

|

Does the supplier have its own retail capacity?

|

No |

|

Does the supplier have its own transport capacity? |

No |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate Turnover in MT

|

17,000 Mt maize 7000 MT sorghum |

|

Payment Methods Accepted |

Bank transfer |

|

Other Comments or Key Information |

planning to commence milling in 2024 |

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Dodoma . |

Dodoma city |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

N/A |

N/A |

|

01 - Meat and meat preparations |

N/A |

N/A |

|

02 - Dairy products and birds’ eggs |

N/A |

N/A |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

N/A |

N/A |

|

04 - Cereals and cereal preparations |

maize, sorghum, Pulses |

|

|

05 - Vegetables and fruit |

N/A |

N/A |

|

06 - Sugars, sugar preparations and honey |

N/A |

N/A |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

N/A |

N/A |

|

09 - Miscellaneous edible products and preparations |

N/A |

N/A |

|

41 - Animal oils and fats |

N/A |

N/A |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

N/A |

N/A |

Wholesale – WH Logistics Company Limited

WH Logistics Company Limited a wholesale Gain supplier and road transport provider, they have 2 warehouses in Dodoma with 2000MT and 1500MT capacity respectively and a fleet of 40 of varying sizes from 10MT to 32MT capacity. They can provide services across East Africa, servicing South Sudan Rwanda, Burundi, Kenya, Malawi and Uganda.

|

Supplier Overview |

|

|---|---|

|

Company Name |

WH Logistics Company Limited |

|

Address |

PO. Box 3073 Dodoma |

|

Does the supplier have its own production / manufacturing capacity? |

No |

|

Does the supplier have its own retail capacity? |

No |

|

Does the supplier have its own transport capacity? |

Yes- |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate Turnover in MT |

6500mt |

|

Payment Methods Accepted |

Bank transfer |

|

Other Comments or Key Information |

Also provide road transport services |

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Dodoma Region |

Dodoma city - 3500 Mt warehouse |

|

Dodoma Region |

Kondoa - 2000 Mt warehouse |

|

Singida Region |

Singida - 1500 Mt warehouse |

|

Ruvuma Region |

Songea - 2000 Mt warehouse |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

N/A |

N/A |

|

01 - Meat and meat preparations |

N/A |

N/A |

|

02 - Dairy products and birds’ eggs |

N/A |

N/A |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

N/A |

N/A |

|

04 - Cereals and cereal preparations |

wheat, rice, sorghum. |

|

|

05 - Vegetables and fruit |

N/A |

N/A |

|

06 - Sugars, sugar preparations and honey |

N/A |

N/A |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

N/A |

N/A |

|

09 - Miscellaneous edible products and preparations |

N/A |

N/A |

|

41 - Animal oils and fats |

N/A |

N/A |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

N/A |

N/A |

Wholesale – Alpha Group Tanzania

Alpha Group is a family run business and one of the largest wholesalers in Arusha, they supply retailers across northern Tanzania from Tanga to Mwanza. Alpha Group have close business ties on both sides of the Tanzania/Kenya border with many of their suppliers from Kenya. They have a fleet of 50 x 30t trucks to supply the market with both food and non-food items. The range of food items includes of Sugar, Oil, Rice, Salt, Flour, Margarine, Sembe (Corn flour), Pasta, Milk powder and Juice, Biscuit/cereal etc. While the non-food item range is made up of Detergents, Antibacterial Soap, Bar Soap, Diapers, Toothpaste & Brushes, Hygiene liquids, Vaseline/lotion/petroleum jelly. The facilities include a large well-maintained and well-ventilated warehouse with a capacity of 12000m, the compound also have maintenance facilities for their transport fleet.

|

Supplier Overview |

|

|---|---|

|

Company Name |

Alpha Group |

|

Address

|

P.O. Box 13242 Arusha Tanzania |

|

Does the supplier have its own production / manufacturing capacity?

|

No |

|

Does the supplier have its own retail capacity?

|

No |

|

Does the supplier have its own transport capacity?

|

Yes |

|

Does the supplier have its own storage facilities?

|

Yes |

|

Approximate Turnover in MT

|

44,000 MT Per month |

|

Payment Methods Accepted

|

Bank transfer / cash |

|

Other Comments or Key Information |

Reach is all northern Tanzania with many suppliers from Kenya |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

No |

N/A |

|

01 - Meat and meat preparations |

No |

N/A

|

|

02 - Dairy products and birds’ eggs |

Yes |

Powdered milk |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

No |

N/A

|

|

04 - Cereals and cereal preparations |

Yes |

Wheat and rice

|

|

05 - Vegetables and fruit |

No |

N/A

|

|

06 - Sugars, sugar preparations and honey |

Yes |

Sugar |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

No |

|

|

09 - Miscellaneous edible products and preparations |

Yes |

Margarine, salt, |

|

41 - Animal oils and fats |

No |

N/A

|

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated. |

Yes |

veg oils |

Wholesale – Kivumu Investment Ltd

Kivumu Investment Ltd is a local wholesale supplier in Kigoma, the company has four premises in Kigoma city providing both wholesale and retail services with a total storage capacity of 3000 metric tons. Commodities are wheat, rice, flour of maize, pasta, and vegetable oil. The company has been in operated for 25 years, has a total of staff numbers 90 full time and seasonal. Kivumu provide wholesale goods to retail clients in the Kigoma area, DRC and Burundi.

|

Supplier Overview |

|

|---|---|

|

Company Name |

Kivumu Investment Ltd. |

|

Address |

PO. Box 512 Kigoma |

|

Does the supplier have its own production / manufacturing capacity?

|

Yes |

|

Does the supplier have its own retail capacity?

|

Yes: four locations in Kigoma city |

|

Does the supplier have its own transport capacity? |

Yes, 2 trucks of 15 Mt each |

|

Does the supplier have its own storage facilities? |

Yes: 3000 Mt capacity spread over 4 locations |

|

Approximate Turnover in MT

|

3000MT per Month |

|

Payment Methods Accepted |

Bank transfer or cash |

|

Other Comments or Key Information |

|

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

N/A |

|

|

01 - Meat and meat preparations |

N/A |

|

|

02 - Dairy products and birds’ eggs |

N/A |

|

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

N/A |

|

|

04 - Cereals and cereal preparations |

wheat, rice, flour of maize, pasta |

Locally produced |

|

05 - Vegetables and fruit |

N/A |

|

|

06 - Sugars, sugar preparations and honey |

sugar |

|

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

N/A |

|

|

09 - Miscellaneous edible products and preparations |

N/A |

|

|

41 - Animal oils and fats |

N/A |

|

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

Vegetable/ Sunflower and Palm oil… |

Locally produced |

Wholesale – AM Jaffer supplies ltd.

AM Jaffer supplies ltd has supplied the local market for over 60 years with food commodities such as wheat, rice, flour of maize, pasta, and vegetable oil. AM Jaffer supplies provide wholesale food supplies to retail clients in the Kigoma area, DRC and Burundi.

|

Supplier Overview |

|

|---|---|

|

Company Name |

AM Jaffer supplies ltd |

|

Address |

PO Box 156 Kigoma Tanzania |

|

Does the supplier have its own production / manufacturing capacity?

|

No. |

|

Does the supplier have its own retail capacity?

|

Yes |

|

Does the supplier have its own transport capacity? |

Yes 1 truck but can hire additional vehicles |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate Turnover in MT

|

5000mt per year

|

|

Payment Methods Accepted |

Cash, bank transfer |

|

Other Comments or Key Information |

Capacity to supply as required |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

N/A |

|

|

01 - Meat and meat preparations |

N/A |

|

|

02 - Dairy products and birds’ eggs |

N/A |

|

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

N/A |

|

|

04 - Cereals and cereal preparations |

wheat, flour of maize, |

Locally manufactured |

|

05 - Vegetables and fruit |

N/A |

|

|

06 - Sugars, sugar preparations and honey |

sugars |

Locally manufactured |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

N/A |

|

|

09 - Miscellaneous edible products and preparations |

N/A … |

|

|

41 - Animal oils and fats |

N/A |

|

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

Palm oil |

Locally manufactured |

**For non-FOOD products please see section 3.5.2 Additional Suppliers, and for FUEL/PETROLEUM products please see section 3.1 Fuel.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Tanzania, United Republic of - 3.5.2 Additional Suppliers

Overview

Retail and wholesale markets in Tanzania have been growing due to rising incomes, increased urbanisation, steady population increase, and ngoing economic growth. Demand for Fast-moving consumer goods (FMGC), household goods and other consumer goods has increased with new suppliers entering the market and demand for online shopping continuing to drive growth in e-commerce. Retail companies across Tanzania are improving economies of scale, boosting operational efficiency and diversifying revenue through e-commerce channels with many new domain names being registered. This demand had seen a growth in manufacturing output of 9.2% in 2022. The Government of Tanzania vision under the Integrated Industrial Development Strategy 2025 (IIDS 2025) has contributed to competitive business environment encouraging growth in the manufacturing sector.

For more information on suppliers’ contact details, please see the following link: 4.10 Supplier Contact List.

Wholesale – Multi Cable Limited

Multi Cable Ltd is a Manufacturing Company located in the Nyakato Industrial area Plot number 172 in the Mwanza region. The company's main activities are manufacturing of plastic household goods and Pipes. The raw materials used are plastic wastes i.e., PET, PP, PE, PVC, and LD, collected by Community Based Organizations (CBOs). The Company collects the wastes plastics and performs the recycling processes to produces plastic products.

|

Supplier Overview |

|

|---|---|

|

Company Name |

MULTI CABLE LTD |

|

Address |

P.O Box 10380, India Street, Dar es Salaam, Tanzania |

|

Does the supplier have its own production / manufacturing capacity? |

Yes |

|

Does the supplier have its own retail capacity? |

Yes |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate turnover in USD - $

|

N/A |

|

Payment Methods Accepted |

Cash/Bank transfer |

|

Other Comments or Key Information |

The supplier collects Plastic wastes such as PET, PP, PE, PVC from CBOs groups and manufacturing Households such as jerry cans 5lt, jugs, plates, cups, and different types of pipes, |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

24/27 - Crude materials, inedible, except fuel |

N/A |

N/A |

|

Soaps, detergents and Cosmetics |

Soaps, detergents and Cosmetics, |

Antiseptic and Anti-bacterial Disinfectant (Chloroxylenol 4.8%), Hydrogen Peroxide, Povidone Iodine, Tincture Iodine

|

|

61 to 69 - Manufactured goods classified chiefly by material |

Cables, Pipes and Plastics, Ropes, Plastic Utensils, Energy Meters, Transformers, Aluminum, Steel Products

|

Products made from a combination of recycled plastics and commercially procured plastic polymers. PVC/XLPE power and control cables with aluminium and copper conductors, telecommunication cables, PVC insulated flexible cables, |

|

71 to 79 - Machinery and transport equipment |

N/A

|

|

|

81 to 89 - Miscellaneous manufactured articles |

|

|

|

91/93/96/97 - Commodities not classified elsewhere |

|

|

Wholesale – Superfoam Limited

Superfoam Ltd. is a new company manufacturing and supplying the Kigoma market with mattresses. The company has a new premises with modern machinery currently producing 200 mattresses per day, however there is sufficient capacity to greatly increase output to meet demand. Hilltop currently supply the Kigoma region and the nearby DRC and Burundi markets with their product.

|

Supplier Overview |

|||

|---|---|---|---|

|

Company Name |

Superfoam Limited |

||

|

Address |

PO. Box 1160, Kigoma Tanzania |

||

|

Does the supplier have its own production / manufacturing capacity? |

Yes. |

||

|

Does the supplier have its own retail capacity? |

No |

||

|

Does the supplier have its own transport capacity? |

Yes 2 trucks |

||

|

Does the supplier have its own storage facilities? |

Yes 280 m2 |

||

|

Approximate turnover in USD - $

|

N/A |

||

|

Payment Methods Accepted |

Cash / Bank transfer |

||

|

Other Comments or Key Information |

200 per day minimum, can produce to requirements |

||

|

Primary Goods / Commodities Available |

|||

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

||

|

24/27 - Crude materials, inedible, except fuel |

N/A |

|

|

|

51 to 59 - Chemical and related products |

N/A

|

|

|

|

61 to 69 - Manufactured goods classified chiefly by material |

Closed cell foam Mattrasses |

Sizes from 2.5’ x3” to 6’ x 12” |

|

|

71 to 79 - Machinery and transport equipment |

N/A |

|

|

|

81 to 89 - Miscellaneous manufactured articles |

N/A

|

|

|

|

91/93/96/97 - Commodities not classified elsewhere |

|||

Health Commodities supplier

The Tanzanian health commodity supply chain is complex and involves a variety of stakeholders, including international organizations, government agencies, private companies, and non-profit organizations. The regulation of health commodities in Tanzania rests with the Tanzania Medicines and Medical Devices Authority (TMDA)who are responsible for regulating quality, safety and effectiveness of medicines, medical devices, diagnostics, biocidal and tobacco products.

The Medical Stores Department (MSD) is an autonomous department under the Ministry of Health, MSD is the main government agency responsible for procuring and distributing essential medicines and medical supplies to public health facilities throughout the country. MSD Headquarter warehouses in Dar es salaam has strategically located Zonal Stores in different parts of the country. MSD has a fleet of 215 distribution vehicles, that delivers medicines, medical supplies and Laboratory reagents direct to more than 7,000 Heath facilities (hospitals, Health centres and dispensaries) across the country.

In Zanzibar, the Ministry of Health (MoH) and the Central Medical Stores Network (CMS) operate a parallel health management system for Unguja and Pemba islands. The CMS stores, manages and distributes medical supplies amongst health care facilities throughout Pemba and Unguja. Private companies also play a significant role in the supply chain, providing a wide range of commodities to both public and private healthcare providers across the Tanzanian mainland and islands.

Wholesale – Shelys Pharmaceuticals

Shelys is one of the largest pharmaceutical companies in East Africa with manufacturing facilities in Tanzania, Zambia, Malawi, DRC, Rwanda, Burundi, Mozambique, Madagascar, Mauritius, Djibouti, Uganda and Kenya. Shelys supplies over the counter and prescription medicines for coughs and colds, anti-infectives, nutraceuticals, antimalarials, gastro-intestinal issues, pain management, fever and topical inflammation, disinfectants, and cardiovascular dysfunction.

Shelys have acquired approval from the following authorities in east Africa from the following regulatory authorities:

- Tanzania Medicines & Medical Devices Authority (TMDA)

- Ethiopian Food and Drug Authority (EFDA)

- Zambia Medicines Regulatory Authority (ZAMRA)

- Pharmacy and Medicines Regulatory Authority (PMRA) of Malawi

- Autorité Ivoirienne de Régulation Pharmaceutique (AIRP), Côte d’Ivoire

- Pharmacy & Poisons Board (PPB) of Kenya

- National Agency for Food and Drug Administration and Control (NAFDAC) of Nigeria

- Ministry of Health (MoH) of Democratic Republic of Congo Among others

|

Supplier Overview |

|

|---|---|

|

Company Name |

Shelys Pharmaceuticals |

|

Address |

New Bagamoyo Road, Mwenge, Plot No. 696, Block No. 32 P.O. Box: 32781, Dar-es- Salaam, Tanzania Telephone: +255 22 2771715/6/7 Email: info@tz.betashelys.com Fax: +255 22 2772417 Website: http://www.shelysafrica.com |

|

Does the supplier have its own production / manufacturing capacity? |

Yes. |

|

Does the supplier have its own retail capacity? |

Yes |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate turnover in USD - $ |

N/A |

|

Payment Methods Accepted |

Cash, bank transfer, credit card and mobile transfer |

|

Other Comments or Key Information |

|

Wholesale – Keko Pharmaceutical Industries (KPI)

Keko Pharmaceutical Industries (1997) Ltd was established in 1968 as a Specialty Department in the Ministry of Health with the aim of distributing medicines at the main Pharmacy in the Country now known as the Medical Stores Department (MSD). The company was in state ownership until 1997 became a public private partnership with Diocare securing 60% of the shares. However, the new Shareholders Agreement signed in December 2019, was concluded that Diocare Company transferred 30% of the shares back to Government ownership. This means the Government of Tanzania now owns 70% shares while the Diocare Company remains with 30% shares. KPI is managed by a board of directors, the Chairperson of the Board is appointed by the President of the United Republic of Tanzania. Four (4) members of the Board are appointed by the Treasury Registrar and the remaining two (2) members of the Board are appointed by the Diocare Company Limited. The day-to-day operations of the company are the responsibility of the Management team led by Chief Executive Officer (CEO).

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

24/27 - Crude materials, inedible, except fuel |

N/A |

|

|

51 to 59 - Chemical and related products |

Pharmaceuticals |

KPI manufactures ten (10) types of products. Solid forms only |

|

61 to 69 - Manufactured goods classified chiefly by material |

N/A |

|

|

71 to 79 - Machinery and transport equipment |

N/A |

|

|

81 to 89 - Miscellaneous manufactured articles |

N/A |

|

|

91/93/96/97 - Commodities not classified elsewhere |

N/A |

|

|

Company Name |

Keko Pharmaceuticals Industries |

|---|---|

|

Address |

Keko Mwanga, Napinduzi Street P.O.Box 40164, Dar es Salaam, Tanzania |

|

Does the supplier have its own production / manufacturing capacity? |

Yes |

|

Does the supplier have its own retail capacity? |

No. |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate turnover in USD - $

|

$9million |

|

Payment Methods Accepted |

Bank Transfer |

|

Other Comments or Key Information |

|

Wholesale- Mansoor Daya Chemicals Ltd

Mansoor Daya Chemicals manufactures a large range of products which can be broadly divided into pharmaceuticals, aerosols and over the counter preparations. These include antibiotics, anti–helminthics, anti-septic’s and disinfectants, anti-fungal, analgesics, cough and cold preparations, vitamins, sedatives, bronchodilators, oral hygiene products, nasal and ear preparations, insecticides and insect repellents.

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

24/27 - Crude materials, inedible, except fuel |

N/A |

|

|

51 to 59 - Chemical and related products |

Disinfectants, soaps, hygiene products, Insect repellents |

Oral liquid syrups |

|

61 to 69 - Manufactured goods classified chiefly by material |

N/A |

|

|

71 to 79 - Machinery and transport equipment |

N/A |

|

|

81 to 89 - Miscellaneous manufactured articles |

N/A |

|

|

91/93/96/97 - Commodities not classified elsewhere |

N/A |

|

|

Supplier Overview |

|

|---|---|

|

Company Name |

Mansoor Daya Chemicals Ltd |

|

Address |

P.O. Box 2999 Dar-es-Salaam, Tanzania |

|

Does the supplier have its own production / manufacturing capacity? |

Yes. |

|

Does the supplier have its own retail capacity? |

Yes – 1 retail outlet in Dar es Salam city centre |

|

Does the supplier have its own transport capacity? |

Yes 3 vehicles x 5.5 MT total capacity |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate turnover in USD - $ |

$ 2.8 million |

|

Payment Methods Accepted |

Bank Transfer |

|

Other Comments or Key Information |

|

**For FOOD products please see section 3.5.1 Food Suppliers, and for FUEL/PETROLEUM products please see section 3.1 Fuel.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.6 Tanzania Additional Services

Overview

For more information on company contact details, please see the following link: 4.10 Tanzania Additional Service Provision Contact List

Vehicle Rental

Two international organizations and one Tanzanian organization are recorded,Generic composite rates scenario applicable to a cross section of car hire organization in the Republic of Tanzania, which, although not implied may be open to negotiation.

For more information on Rates for Vehicle Rental, please select the following document:

Tanzania Additional Service Providers

Taxi Companies

For information on taxi companies, please select the contact list above.

Freight Forwarding Agents

For information on forwarding agents, please select the contact list above.

Electricity and Power

For information on electricity and power companies, please select the contact list above.

Power supply from Tanesco the electric supplier is sporadic throughout the country both in the Country office and sub offices. All offices have at least one generator.

- Last year, 2011, for several months power rationing was in place where electric was only available for a few hours per day.

- Currently there are power outages at least 5 times a week. Some last several hours, some lasting minutes.

|

Power grid / network coverage

|

-

|

|---|---|

|

Is supply regular and constant throughout the country?

|

no

|

|

Please describe

|

-

|

|

On average, how long does the outage last?

|

Some last several hours, some lasting minutes.

|

|

On average, how often does power supply go out?

|

Currently there are power outages at least 5 times a

week.

|

[1] E.g. Hydroelectric power, Thermal power…

Internet Service Providers (ISPs)

ISPs providing internet on telephones, USB modems etc have 3G. Airtel claim to have 3.75G, the Airtel coverage is reliable and country-wide – the other suppliers are mostly within Dar Es Salaam.

Airtel bandwidth costs are 115Tza ($0.07c) per MB.

Sasatel and Tigo who provide similar services have not been found to offer a reliable service.

Internet for offices/homes is expensive and mostly provided through wireless connections by companies like Simbanet (who WFP use), Castsnet and Vizada. Bandwidth costs approx...$350 per month for dedicated512kbps.

TTCL also provides business/home links but vary in quality, WFP has used them as a backup link in Kigoma, however cancelled the contract due to poor connectivity.

|

Internet Service Providers |

|||

|---|---|---|---|

|

Are there ISPs available? (Yes / No) |

Yes | ||

|

Private or Government |

Datel Tanzania Ltd: Private Africa Online: Private |

||

|

Dial-up only (Yes / No) |

Datel Tanzania Ltd: No Africa Online: Yes |

||

|

Approximate Rates |

Dial-up: |

Datel Tanzania Ltd: US$1,000 per month Africa Online: US$1,000 per month |

|

|

Broadband: |

Datel Tanzania Ltd: US$1,000 per month |

||

|

Max leasable ‘dedicated’ bandwidth |

Datel Tanzania Ltd: 64kbs or 128 kbs, varies according to requirements Africa Online: 128 kbs |

||

Tanzania, United Republic of - 3.7 Waste Management and Recycling Infrastructure Assessment

Overview

Waste collection in Tanzania is primarily carried out by local government authorities, private companies, and communities. There is a mix of formal and informal waste collection methods, with the involvement of both public and private entities. Additionally, community-based waste management initiatives are encouraged to promote sustainable waste collection at the grassroots level.

The Environmental Management Act EMA 2004 provides for a legal and institutional framework for sustainable management of the environment, prevention and control pollution, waste management, environmental quality standards, public participation, environmental compliance and enforcement. Under the EMA 2004 the National Environment Management Council (NEMC) is mandated to undertake enforcement, compliance, review and monitoring of environmental impacts assessments, research, facilitate public participation in environmental decision-making, raise environmental awareness through the collection and disseminate environmental information. Further details can be found on NEMC website: NEMC

Waste management services in Tanzania are provided by a combination of government agencies and private companies. Local government authorities often play a significant role in waste collection, while private companies are involved in areas such as waste transportation, disposal, and recycling. Community-based organizations also contribute to waste collection in many areas sorting waste into categories for disposal and recycling, selling the recyclable plastic, metal, and electronic waste to commercial recycling plants. In Zanzibar the CBO removes approximately 2.5 tons of plastic waste from the waste stream per day and sells this to commercial recycling companies on the mainland, significantly reducing the annual volume to landfill and providing an income stream for the community.

Tanzania local authorities are responsible for designating disposal sites for waste. Landfills are managed by local government authorities and private companies. The status of these landfills may vary across regions, some landfill sites currently in operation may not be approved by the local authority and therefore may not comply with either the Environmental Management Act, 2004, or the National Environmental Policy, 1997.

There are recycling initiatives in place across the country operated by a mix of public and private entities many of which are supported by community-based organisations (CBO) who organise the collection and sorting of waste and sell the recyclable plastics, metal, and electronic waste to private recycling companies. The scale of recycling varies from region to region, some are large commercial operations producing high volumes of plastic items from recycled materials and some are small independent operations producing plastic pellets for sale to plastic manufacturing industry.

|

|

|

|

|

Photos show a Small independent plastics recycling facility in Arusha producing plastic pellets for commercial use

Hazardous Waste Disposal

The disposal of hazardous waste is regulated by Environmental Management Act EMA 2004 and audited by NEMC. Transportation of hazardous waste within Tanzania requires a permit granted by the Minister’s office and for export of hazardous waste a license is required accompanied by a permit issued by a competent authority of the receiving country. NEMC is also the authority for licensed disposal facilities for hazardous wastes, EMA 2004 places responsibility on the generator of hazardous waste for its disposal and shall be liable for any damage to human health or environment damage.

Growth of an information society is becoming a common phenomenon in many developing countries, including Tanzania. This has resulted in an increase of users of Electrical and Electronic Equipment (EEE). The 2020 Electronic Communications Equipment Standards and E-Waste Management regulations, outlines the obligation of parties involved in managing electronic communication equipment end of life processes. Tanzania has 17 of the region’s 39 EEE recycling plants in the East Africa. Tanzania is a party to the Basel Convention on the Control of Trans-boundary Movements of Hazardous Wastes and their Disposal and Bamako Convention on the Ban of the Import into Africa and the Control of Trans-boundary Movement of Hazardous Wastes within Africa. The Minister of State – Environment at the Vice President’s Office has issued Guidelines For Management Of hazardous Waste to serve as a quick reference on hazardous waste management so as to improve their management in the country, these guidelines elaborate the legal requirements and administrative procedures for handling of importation, transportation and disposal of hazardous waste as provided in the Environmental Management (Hazardous Waste Control and Management) Regulations, 2009. To facilitate awareness and understanding of key stakeholders in effectively fulfilling their roles in achieving environmentally sound management of hazardous waste. Licencing for disposal or treatment of hazardous wastes are issued by the Director of Environment – Vice President’s Office or respective authority at regional level. The licence restricts hazardous waste treatment plant or disposal sites to at least one thousand (1,000) metres away from a residential or commercial area and from water sources.

Health Care Waste Management (HCWM) is regulated for in National Policy Guidelines For Health Care Waste Management In Tanzania 2017 the Ministry of Health is responsible for promoting a centralized biomedical waste treatment facilities and ensure an effective management of current health care waste disposal sites. Tanzania Medicines and Medical Devices Authority (TMDA) have a project in process to developing a large capacity incinerator in Dodoma for the destruction of medical waste and expired medications, the project was delayed due to issues with the planned site proximity to a water source. TDMA have indicated they have identified a new site and expect construction to begin in 2024.

The disposal of waste oil in Tanzania is regulated by the National Environmental Management Council (NEMC) under the Environmental Management (Hazardous Waste Control and Management) Regulations, 2009. These regulations prohibit the disposal of waste oil into water bodies, soil, or landfills. Instead, waste oil must be collected, transported, and treated by authorized hazardous waste management facilities. Some of the recycling companies visited during the LCA used waste motor oil as fuel for their furnaces to smelt glass, plastic, and biological waste for recycling.

|

|

|

|

|

Photos above show a community recycling initiative using used motor oil to fuel a furnace for recycling glass to support disabled people in Moshi

Non-Hazardous Waste Disposal

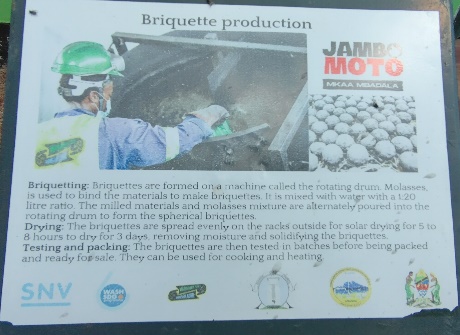

More than 90 per cent of Municipal Solid Waste (MSW) in Tanzania is believed to be disposed of in an unsatisfactory manner. Most of the MSW generated is disposed of in open and poorly operated dumpsites across the country, except for a few municipalities—including Arusha, Tanga, Mwanza, Mbeya, Dodoma, Kigoma and Mtwara—that have improved landfills (with lining and leachate collection system) constructed by the Tanzania Strategic Cities Project (TSCP). The management of biodegradable waste is challenging due to its perishable nature, its limited storage period, and its harmful impact when leeching out of landfills. However, it is also an area where significant improvements are possible by adoption of decentralized technologies such as composting and biomethanization. Some Municipal waste management sites have ongoing projects to generate biomass fuel for cleaner energy from a combination of blackwater and sawdust to make briquettes/charcoal for smokeless cooking.

|

|

|

|

Photos above show the Municiple landfill site in Arusha making charcoal for smokeless cooking from black water and sawdust for commercial sale.

The Assessment of Solid Waste Management Ecosystem in Tanzania report estimates “Urban areas in Tanzania are projected by 2030 to generate about 26 million tonnes of solid waste annually. To accommodate this amount of waste, about 10.6 × 107 cubic metres (m3) of landfill space is required; in terms of area approximately 200 hectares (about 494 acres) of land per year would be needed”.

In Dar es Salaam, Tanzania's most populous city, the majority of households depend on community-based organizations (CBOs) for their solid waste collection. The collection frequency varies from one to three times a week, with residents obligated to pay refuse collection charges (RCC) to these CBOs for the services provided. However, around 10% of households opt for informal workers who collect waste more frequently at a lower cost compared to CBOs. Informal waste pickers gather the organic waste and low-value dry waste (such as plastic and paper) from households, discarding the non-saleable portion in drains or common areas after extracting items with market value. Consequently, only 40% of the waste reaches the landfill, while 60% is either burned at the household level, dumped on roadsides, drainage canals, sewers, or buried. The informal sector is responsible for collecting valuable dry waste, mainly plastic and metal and removing it from the waste stream for sale to recycling companies. Public awareness regarding sanitation and proper municipal solid waste (MSW) storage and disposal is lacking. Informal settlements and peri-urban areas, not under city or municipal council jurisdiction, commonly exhibit poor waste management practices.

The NEMC has also developed guidelines for the management of non-hazardous waste, which provide more detailed information on the processes, regulations, and procedures that should be followed. These guidelines cover topics such as waste characterization, waste minimization, waste treatment, and waste disposal.

In addition to the EMA and the NEMC guidelines, there are several other regulations and procedures that govern non-hazardous waste disposal in Tanzania. These include:

- The Occupational Health and Safety Act (OHS Act ) of 2003, which sets standards for the protection of workers from workplace hazards, including exposure to non-hazardous waste.

- The Public Health Act (PHA)) of 1971, which regulates the disposal of waste in public places.

- The Local Government Act (LGA ) of 1992, which gives local governments the responsibility for managing waste within their jurisdictions.

Disclaimer: Registration does not imply any business relationship between the supplier and WFP/Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please Note: WFP/Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.