Türkiye - 3 Logistics Services

The following section contains information on the logistics services of Türkiye.

The Turkish Government’s efforts to develop the country to be one of the top 10 economies in the world by 2023, often make way for major infrastructure and superstructure projects. By that year, Türkiye will boast 10,000 km of high speed railway, an extensive metro system in Istanbul and Ankara, a new airport and a large suspension bridge over the Bosphorus in Istanbul, thousands of km of new highways and as many as 7 million rebuilt, earthquake-safe homes.

Türkiye’s transportation and logistics sector is one of the country’s fastest growing industries—tripling in value since 2002, while averaging a growth rate of 20 percent over the last five years. This growth combined with Türkiye’s strategic location as a bridge between East and west are creating new opportunities in the country.

The influence of the transportation sector is expected to increase more in the future, as high amounts of highway, railway, and other transportation related projects are either already underway or expected to accommodate for an increasingly industrialized country in the years to come.The Government of Türkiye has committed to new investments in this industry to keep up with future demand which is expected to reach the following targets in 2023, the centennial of the Turkish Republic:

- Foreign Trade Volume to reach $1.1 trillion, with $500 billion in exports and $600 billion in imports.

-

Transported Cargo to reach 625 billion tons

Disclaimer: Registration does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities. Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse,comment on any company's suitability as a reputable service provider.

Türkiye - 3.1 Fuel

Fuel Overview

Türkiye produces only 7% of its oil annual consumption therefore, it depends on importing oil and oil products such as petrol and diesel. over half of which is consumed in the country's road vehicles. Turkey is the world's largest user of liquefied petroleum gas (LPG) for road transport. In 2022, 28 billion liters of diesel and 4 billion liters of petrol were sold in Turkey. Seventy percent of cars registered in 2022 were petrol, 18% diesel, and 9% hybrid; and of cars on the road that year, 37% were diesel, 35% LPG and 27% petrol.

For more information on government and fuel provider contact details, please see the following links: 4.1 Government Contact List and 4.7 Fuel Providers Contact List.

Information may also be found at: http://www.mytravelcost.com/petrol-prices/ which is updated monthly.

Fuel Pricing

The Free Pricing System was adopted on January 1, 2005, as stipulated by the Petroleum Market Law. According to this system, fuel distribution companies in the sector are free to set their wholesale price, while dealers are free to apply the pump price ceilings recommended by the distribution companies or to set their own pump prices to respond to the competition in their area. In Türkiye, retail prices are formed based on the competition.

|

Fuel Prices per Litre as of: August 2023 (Local currency and USD - $) |

|

|---|---|

|

Petrol (95) |

37.69 TL = 1.39 $ |

|

Diesel |

37.79 TL = 1.40 $ |

|

Paraffin |

N/A |

|

Jet A-1 |

N/A |

Seasonal Variations

|

Seasonal Variations |

|

|---|---|

|

Are there national priorities in the availability of fuel? (i.e., are there restrictions or priorities for the provision of fuel such as to the military?) |

No |

|

Is there a rationing system? |

No |

|

Is fuel to lower income / vulnerable groups subsidized? |

No |

|

Can the local industry expand fuel supply to meet humanitarian needs? |

Yes |

|

Is it possible for a humanitarian organization to directly contract a reputable supplier / distributor to provide its fuel needs? |

Yes |

Fuel Transportation

Transportation of fuel takes place through a huge fleet of road tankers equipped with the latest environmental, security, and safety technologies that can carry different forms of petroleum products. The fleet of road tankers offers flexible transport options with various tanker sizes and capacities. (18,000 liters / 20,000 liters / 33,000 liters / 36000 liters). Fuel transportation operates 24 hours a day, seven days a week including public and national holidays, in order to fulfill the market needs.

Standards, Quality and Testing

|

Industry Control Measures |

|

|---|---|

|

Do tanks have adequate protection against water mixing with the fuel? |

Yes |

|

Are there filters in the system which monitor where fuel is loaded into aircraft? |

Yes |

|

Is there adequate epoxy coating of tanks on trucks? |

Yes |

|

Is there a presence of suitable firefighting equipment? |

Yes |

|

Standards Authority |

|

|---|---|

|

Is there a national or regional standards authority? |

Yes |

|

If yes, please identify the appropriate national and/or regional authority. |

National: EPDK (Energy Market Regulatory Authority). |

|

If yes, are the standards adequate/properly enforced? |

Yes |

|

Testing Laboratories |

|

|---|---|

|

Are there national testing laboratories? |

Yes |

|

Fuel Quality Testing Laboratory (Saybolt Inspection and Laboratory Services S.A.) |

|

|---|---|

|

Company |

Saybolt Inspection and Laboratory Services S.A.) |

|

Address |

Gündoğdu Mahallesi 5786 Sokak No. 2 Mersin, Türkiye |

|

Telephone and Fax |

+903242349520 |

|

Contact |

Gokhan USTUN - Mersin Branch Manager |

|

Standards Used |

ISO 9001, ISO 14001, ISO 22000 and ISO 50001 systems with TÜRKAK accreditation. |

|

Fuel Quality Testing Laboratory (Control Union) |

|

|---|---|

|

Company |

Control Union |

|

Address |

Tatlisu Mahallesi – Pakdil Sokak No.9, 34774 – Istanbul |

|

Telephone and Fax |

+902464697557 |

|

Contact |

Bahar Soner – Inspection Manager |

|

Standards Used |

ISO 9001, ISO 14001, ISO 22000 and ISO 50001 systems with TÜRKAK accreditation. |

|

Fuel Quality Testing Laboratory (Intertek) |

|

|---|---|

|

Company |

Intertek Turkey |

|

Address |

|

|

Telephone and Fax |

|

|

Contact |

|

|

Standards Used |

ISO 17025 |

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Türkiye - 3.2 Transporters

The road transport market in Türkiye is a large and growing one, with a wide range of operators, from large, multinational companies to small, family-owned businesses. The number of large-scale operators in Türkiye is relatively small, but they account for a significant share of the market. These companies operate fleets of modern trucks and trailers, and they offer a wide range of services, including international freight transportation, domestic trucking, and specialized logistics services.

The current capacity of the Turkish road transport market meets domestic needs. However, the market is also well-positioned to accommodate an influx in demand from the humanitarian community. This is due to the country's strategic location, its well-developed road infrastructure, and its experienced workforce. Foreign operators are allowed to operate domestically in Türkiye.

UND (Transporters Association) was established in 1974 with the identity of a professional organization by sector representatives who came together to solve all kinds of problems of the Turkish land transport sector on national and international platforms. The global economic order, which has dominated the world in the intervening years, has changed both the Turkish economy and the land transportation sector, and the sector has become one of the sectors that show remarkable development in Türkiye.

UND's National Mission is to inform the Turkish Road Transport Sector on every issue - to inform them of global developments, the risks and opportunities that may arise; To encourage the Turkish Road Transporter to national and international partnerships and strategic collaborations, and to ensure that its establishments are modern, effectively managed and respectful to the society and the environment. to work; to cooperate with relevant international organizations, especially the IRU, for this purpose; to work with industry associations in other countries and to establish international, regional and inter-association alliances and strategic partnerships whenever possible.

The main issues faced by transporters while crossing from/to European countries is related to visa for drivers and transit quota imposed by some European countries to Turkish trucks, which may result in longer transit times and higher costs.

The UND is available to provide information about transporters in Türkiye to the humanitarian community. They are a reliable partner and can also help with crisis management. They can be reached at: info@und.org.

For more information on transport company contact details, please see the following link: 4.8 Transporter Contact List.

|

BGL Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

Covers all of Türkiye and offers overland transportation services to Syria, Iraq, Europe & CIS countries |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Different types |

700 |

25 MT |

Owned |

|

Different types |

1200 |

25 MT |

Outsourced |

|

OZCAGINDA Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

Covers the South part of Türkiye and offers overland transportation services to Syria and Iraq |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Different types |

120 Trucks /daily |

25 MT |

Outsourced |

|

DENKTAS Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

Covers all of Türkiye and offers overland transportation services to Syria, Iraq, Europe & CIS countries |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Different types |

21 |

25 MT |

Owned |

|

Different types |

Unlimited |

25 MT |

Outsourced |

|

ACT Transport Capacity Summary |

|||

|---|---|---|---|

|

Regions Covered |

Covers all of Türkiye and offers overland transportation services to Syria, Iraq, Europe & CIS countries |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Different types |

Unlimited |

25 MT |

Outsourced |

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Türkiye - 3.3 Manual Labour

Labour market in Türkiye is managed and supervised by ISKUR (Türkiye Is Kurumu). Turkish Employment Agency established for aiding activities of protecting, improving, generalizing of employment and preventing unemployment, and for executing unemployment insurance services has obtained a structure that enables it to implement active and passive labour force policies alongside its classical services of finding jobs and employees within an extended area.

Reference: https://www.iskur.gov.tr/en

Türkiye has a government-mandated minimum wage. No worker in Türkiye should be paid less than this minimum pay rate. Minimum wage as per the latest update in Türkiye is 11,402 TRY / 428,72 USD (August 2023).

|

Labour Rate(s) Overview |

||

|---|---|---|

|

|

Cost |

Rate as of 08/2023 |

|

Daily General Worker (Unskilled casual labour) |

250TRY / 9,39USD |

27.202 TRY |

|

Daily General Worker (Semi-skilled labour) |

N/A |

N/A |

|

Skilled Worker |

381TRY / 14,27USD |

27.202 TRY |

Türkiye - 3.4 Telecommunications

In the contemporary telecommunications landscape of Turkey, the infrastructure is a multifaceted system that involves a balance of government oversight, private sector involvement, and varying degrees of competition. Government regulations play a significant role in shaping the industry, influencing the extent of control exerted by authorities over telecommunications networks. These regulations encompass areas such as spectrum allocation and licensing prerequisites for service providers, thereby impacting the number of private companies operating within the sector. At present, Turkey hosts multiple private companies actively engaged in delivering telecommunications services, fostering competition that encourages innovative offerings and enhanced customer experiences.

Within this dynamic context, the process of registering SIM cards or mobile numbers typically entails specific procedures mandated by the government to bolster security and mitigate misuse. These procedures often involve identity authentication, submission of official documents, and adherence to privacy directives. Such measures are designed to ensure that mobile numbers are associated with legitimate individuals, discouraging fraudulent activities. Additionally, the provision of data plans has become an integral facet of contemporary telecommunications services. Given the escalating demand for data-driven applications, telecom companies in Turkey provide an extensive range of data plans tailored to cater to diverse user requirements, encompassing options like prepaid, postpaid, unlimited, and pay-as-you-go plans.

Additional Service Providers Contact List (Section 4.11):

|

Argela Contact Ankara: +90 312 912 92 00 İstanbul: +90 212 707 50 00 Website: https://www.argela.com.tr/ |

Turk Telekom

|

Turksat Contact: +90 312 925 3000 E-Mail: info@turksat.com.tr Website: https://www.turksat.com.tr/ |

|

Vodafone |

Turkcell |

TurkNet Contact: +90850 2886309 |

For more information on telecoms contacts, please see the following link: 4.11 Additional Services Contact List.

|

Telephone Services |

|

|---|---|

|

Is there an existing landline telephone network? |

Yes |

|

Does it allow international calls? |

Yes |

|

Number and Length of Downtime Periods (on average) |

One to two times a year for 2 days due to maintenance or weather condition |

|

Mobile Phone Providers |

Turkcell Vodafone Turk Telekom |

|

Approximate Percentage of National Coverage |

98.3% for all three providers |

Telecommunications Regulations

There are three national laws that set out the general legal framework for telecommunications in Türkiye. They contain a detailed institutional framework. They include licensing, competition policy, quality service, interconnection, scarce resources management, universal service, and tariffs regulation. It also covers the television service. These laws address the universal service regime.

Telecommunications Law No. 4673 of 12.5.2001

Telecommunications Law No. 4502 of 29.01.2000

Universal Service Law 2005

Regulations on Usage and Import

|

|

Regulations in Place? |

Regulating Authority |

|---|---|---|

|

Satellite |

Yes |

Ministry of Transport and Infrastructure |

|

HF Radio |

Yes |

Ministry of Transport and Infrastructure |

|

UHF/VHF/HF Radio: Handheld, Base and Mobile |

Yes |

Ministry of Transport and Infrastructure |

|

UHF/VHF Repeaters |

Yes |

Ministry of Transport and Infrastructure |

|

GPS |

Yes |

Ministry of Transport and Infrastructure |

|

VSAT |

Yes |

Ministry of Transport and Infrastructure |

|

Individual Network Operator Licenses Required |

||

|

For UN Agencies, it's acquired through MoFa in coordination with UNDSS also Tekser is the local service provider for configurations |

||

|

Frequency Licenses Required |

||

|

For UN agencies it's acquired through MoFa in coordination with UNDSS also Tekser is the local service provider for configurations |

||

Internet Service Providers (ISPs)

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? |

Yes |

|

|

If yes, are they privately or government owned? |

Turk Telecom (Government) Turk Cell and Vodafone (Private) |

|

|

Dial-up only? |

Yes |

|

|

Approximate Rates (local currency and USD - $) |

Dial-up |

Very Minimal |

|

Broadband |

300 TL, 10 USD |

|

|

Max Leasable ‘Dedicated’ Bandwidth |

200 MB |

|

Mobile Network Operators (MNOs)

For information on MNOs please visit the GSM Association website.

|

Company |

Number of Agent Outlets by Area |

Network Strength by Area |

Contracted for Humanitarian or Government Cash Transfer Programmes? |

Services Offered (i.e. Merchant Payment, Bulk Disbursement, Receive & Make Payment) |

|---|---|---|---|---|

|

Turk Telcom |

Enough Agent outlets throughout the country |

98.5% |

No, but the service is available |

No, but the service is available |

|

Vodafone |

Enough Agent outlets throughout the country |

98.0% |

No, but the service is available |

No, but the service is available |

|

Turk Cell |

Enough Agent outlets throughout the country |

98.3% |

No, but the service is available |

No, but the service is available |

Türkiye - 3.5 Food and Additional Suppliers

The food market in Türkiye covers all edible products that are bought and consumed for nutrient-based purposes. The market includes both fresh and processed foods and consists of 13 different segments: the dairy products & Eggs segment covers animal products, the Meat segment covers animal products, the Fish & Seafood segment, Fruits & Nuts cover fresh (processed and frozen), the Vegetables segment (processed and frozen), Bread & Cereal products, Oils and Fats, Sauces and Spices ,the Convenience food (ready-to-eat meals and meals that require little effort to prepare), Spreads and Sweeteners (food or beverages) Confectionery & Snacks ( sweet, savory, and salty food, Baby food & Pet food.

The market's largest segment is the segment Confectionery & Snacks

Also, Türkiye’s agricultural economy is among the top ten in the world, with half of the country consisting of agricultural land and nearly a quarter of the population employed in agriculture.

Türkiye is a major producer of wheat, sugar beets, milk, poultry, cotton, tomatoes, and other fruits and vegetables, and is the top producer in the world for apricots and hazelnuts.

Türkiye imports oilseeds, including soybean and meal, as well as grain products, as animal feed inputs for its meat and rapidly growing poultry sectors.

Türkiye also imports inputs for its food processing and bakery sector and additional cotton as an input for its advanced textile industry.

In addition it is not a self-sufficient country when it comes to pulses and must import them.

The country has a developed food processing industry with good quality products and competitive pricing . The food processing industry is one of the few industries with a trade surplus. Türkiye continues its structure with small- and medium-sized companies in food processing sector. The small number of large companies have modern techniques and technology, internationally operating enterprises are pioneering the sectoral development.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a general overview of country data related to the service and supply sectors, please consult the following sources:

The Observatory of Economic Complexity – MIT (OEC):

Türkiye (TUR) Exports, Imports, and Trade Partners | OEC - The Observatory of Economic Complexity

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Türkiye - 3.5.1 Food Suppliers

Overview

Türkiye is the 7th largest agricultural producer in the world and the largest one in Europe. It is the world’s largest producer of apricots, hazelnuts, figs, cherries and sour cherries, quinces. It is Europe’s largest producer of apples, green beans, beeswax, chestnuts, chickpeas, green chilies and peppers, cotton lint, cottonseed, cucumbers and gherkins, eggplants, grapefruits, natural honey, leeks, lemons and limes, lentils, chicken meat, melons, whole fresh sheep milk, dry onions, green onions, pistachios, safflower seed, spices, spinach, strawberries, tea, tomatoes, vanilla, vetches, walnuts, watermelons.

The share of household expenditure allocated to food, beverages, and tobacco will remain high by Western standards. It was 22.6 percent of household spending in 2022. According to the latest statistics published by TURKSTAT There are over 47,617 registered food processing companies in Türkiye; but the increase in the population of the country, together with the increasing local production costs, open the doors, allowing the entrance of more foreign products to the domestic markets.

By the end of 2018, there were 611 instances of direct foreign investment in food and beverages with 101 investors from Germany, 44 from the Netherlands, 33 from France, 31 from the USA, 30 from Italy, 26 from Russia, 25 from Iran and 25 from Switzerland

For more information on food supplier contact details, please see the following link: 4.10 Supplier Contact List.

Retail Sector

The food retail sector in Türkiye can be put into two major groups: organised and unorganised retailers. Organised retailers include multi-format retailers, local or regional supermarkets, and discount retailers. Unorganised retailers, also called the traditional market, constitute smaller, individual convenience stores called bakkals in bazaars.

The Turkish retail market mainly consists of traditional players, despite steady growth of local and international chain stores and recent acquisitions and mergers. Some of the biggest Turkish retailers include the likes of BİM A.Ş, Migros Ticaret A.Ş, A101, and CarrefourSA.

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

1 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

2 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

3 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

3 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

4 |

Wholesale – BİM A.Ş

BİM Birleşik Mağazalar A.Ş., the company having the highest market share in organized retail sector in Türkiye. BİM has 9,451 stores (9,611 stores including FILE stores) in Türkiye. BİM operates not only in Türkiye but also abroad including in Morocco and Egypt. in Morocco it reached a total of 578 stores while in Egypt, its second international operation, it has 300 stores.

|

Supplier Overview |

|

|---|---|

|

Company Name |

BİM Birleşik Mağazalar A.Ş. |

|

Address |

Ebubekir Cad. No: 73 Sancaktepe 34887 İstanbul / Türkiye |

|

Does the supplier have its own production / manufacturing capacity?

|

No |

|

Does the supplier have its own retail capacity?

|

Yes |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Payment Methods Accepted |

Cash & Visa |

|

Other Comments or Key Information |

Website: https://english.bim.com.tr/ |

*

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

i.e. sheep and goats, swine, poultry… |

Not Available |

|

01 - Meat and meat preparations |

i.e meat of bovine animals, meat of sheep, dried or smoked meat of swine, sausages… |

Yes |

|

02 - Dairy products and birds’ eggs |

i.e. milk, yogurt, butter, cheese, eggs… |

Yes |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

i.e. fish (chilled or frozen), fish (salted or in brine), fish liver and roes… |

No |

|

04 - Cereals and cereal preparations |

i.e. wheat, rice, flour of maize, pasta... |

Yes |

|

05 - Vegetables and fruit |

i.e. vegetables, fruit and nuts, jams/jellies, fruit juices… |

Yes |

|

06 - Sugars, sugar preparations and honey |

i.e. sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar … |

Yes |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

i.e. coffee, cocoa, chocolate, tea, mate, pepper… |

Yes |

|

09 - Miscellaneous edible products and preparations |

i.e. ready-to-eat foods, margarine, sauces, soups and broths, yeasts… |

Yes |

|

41 - Animal oils and fats |

i.e. lard, fats and oils… |

Yes |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

i.e. soya bean oil, olive oil, maize oil, vegetable oil… |

Yes |

Wholesale – Migros Ticaret A.Ş

Together via Migros supermarkets, Macrocenter Stores, international Ramstore shopping centers, online and mobile shopping, wholesale stores, and mobile sales units, Migros Türkiye serves an estimated 160 million customers. the company operates a total of 1,156 stores: 852 Migros stores, 212 Tansaş stores, 24 5M stores and 27 Macro Centers stores in Türkiye,

|

Supplier Overview |

|

|---|---|

|

Company Name |

Migros Ticaret A.Ş |

|

Address |

Ataturk Mah. Turgut Özal Bulvarı No:7 34758 Ataşehir / İSTANBUL |

|

Does the supplier have its own production / manufacturing capacity?

|

Yes – It has its own brand products including – but not limited to - dairy products, rice, lentils, meat products, oil, and cleaning products , the list can be found from this link: https://www.migros.com.tr/sadece-migrosta-ptt-2 |

|

Does the supplier have its own retail capacity?

|

Yes |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Payment Methods Accepted |

Cash & Visa |

|

Other Comments or Key Information |

Website: https://www.migros.com.tr/ |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

i.e. sheep and goats, swine, poultry… |

No |

|

01 - Meat and meat preparations |

i.e meat of bovine animals, meat of sheep, dried or smoked meat of swine, sausages… |

Available |

|

02 - Dairy products and birds’ eggs |

i.e. milk, yogurt, butter, cheese, eggs… |

Available |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

i.e. fish (chilled or frozen), fish (salted or in brine), fish liver and roes… |

Available |

|

04 - Cereals and cereal preparations |

i.e. wheat, rice, flour of maize, pasta... |

Available |

|

05 - Vegetables and fruit |

i.e. vegetables, fruit and nuts, jams/jellies, fruit juices… |

Available |

|

06 - Sugars, sugar preparations and honey |

i.e. sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar … |

Available |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

i.e. coffee, cocoa, chocolate, tea, mate, pepper… |

Available |

|

09 - Miscellaneous edible products and preparations |

i.e. ready-to-eat foods, margarine, sauces, soups and broths, yeasts… |

Available |

|

41 - Animal oils and fats |

i.e. lard, fats and oils… |

Available |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

i.e. soya bean oil, olive oil, maize oil, vegetable oil… |

Available |

Wholesale – CarrefourSA

Originally wholly owned by French hypermarket leaders Carrerfour, Carrefoursa is a joint venture of Sabancı Holding and Carrefour. CarrefourSA reached 72 franchise stores in 17 cities and launched grocery shopping and delivery partnerships with marketplaces and 150 independent outlets.

|

Supplier Overview |

|

|---|---|

|

Company Name |

CarrefourSA |

|

Address |

Cevizli Mahallesi, Tugay Yolu Caddesi , No: 67 Block: B 34846, Maltepe / İSTANBUL |

|

Does the supplier have its own production / manufacturing capacity?

|

Yes – CarrefourSA has products that hold his brand name |

|

Does the supplier have its own retail capacity?

|

Yes |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Payment Methods Accepted |

Cash & Visa |

|

Other Comments or Key Information |

General Manager Email: kutaykartallioglu@carrefoursa.com Website: https://kurumsal.carrefoursa.com/tr/ |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

i.e. sheep and goats, swine, poultry… |

Not Available |

|

01 - Meat and meat preparations |

i.e meat of bovine animals, meat of sheep, dried or smoked meat of swine, sausages… |

Available |

|

02 - Dairy products and birds’ eggs |

i.e. milk, yogurt, butter, cheese, eggs… |

Available |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

i.e. fish (chilled or frozen), fish (salted or in brine), fish liver and roes… |

Available |

|

04 - Cereals and cereal preparations |

i.e. wheat, rice, flour of maize, pasta... |

Available |

|

05 - Vegetables and fruit |

i.e. vegetables, fruit and nuts, jams/jellies, fruit juices… |

Available |

|

06 - Sugars, sugar preparations and honey |

i.e. sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar … |

Available |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

i.e. coffee, cocoa, chocolate, tea, mate, pepper… |

Available |

|

09 - Miscellaneous edible products and preparations |

i.e. ready-to-eat foods, margarine, sauces, soups and broths, yeasts… |

Available |

|

41 - Animal oils and fats |

i.e. lard, fats and oils… |

Available |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

i.e. soya bean oil, olive oil, maize oil, vegetable oil… |

Available |

Wholesale – A101

Operating in 81 provinces of Türkiye with over 12,000 stores as of the end of 2022, A101 is not only the most widespread chain in Türkiye, but also one of the leading companies in the retail sector with its more than 70,000 employees and over 600 suppliers. According to the Deloitte Global Powers of Retail 2022 Report, it is a Turkish company with 100% domestic capital among the top 10 fastest growing retail companies in the world, and ranks 5th in the list.

|

Supplier Overview |

|

|---|---|

|

Company Name |

A101 |

|

Address |

Burhaniye Mah. Nagehan Sok. No: 4 B / 1 Uskudar, Istanbul |

|

Does the supplier have its own production / manufacturing capacity?

|

No |

|

Does the supplier have its own retail capacity?

|

Yes |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Payment Methods Accepted |

Cash & Visa |

|

Other Comments or Key Information |

Website: https://www.a101.com.tr/ |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

i.e. sheep and goats, swine, poultry… |

N/A |

|

01 - Meat and meat preparations |

i.e meat of bovine animals, meat of sheep, dried or smoked meat of swine, sausages… |

N/A |

|

02 - Dairy products and birds’ eggs |

i.e. milk, yogurt, butter, cheese, eggs… |

Available |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

i.e. fish (chilled or frozen), fish (salted or in brine), fish liver and roes… |

N/A |

|

04 - Cereals and cereal preparations |

i.e. wheat, rice, flour of maize, pasta... |

Available |

|

05 - Vegetables and fruit |

i.e. vegetables, fruit and nuts, jams/jellies, fruit juices… |

Available |

|

06 - Sugars, sugar preparations and honey |

i.e. sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar … |

Available |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

i.e. coffee, cocoa, chocolate, tea, mate, pepper… |

Available |

|

09 - Miscellaneous edible products and preparations |

i.e. ready-to-eat foods, margarine, sauces, soups and broths, yeasts… |

Available |

|

41 - Animal oils and fats |

i.e. lard, fats and oils… |

N/A |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

i.e. soya bean oil, olive oil, maize oil, vegetable oil… |

Available – Corn & Sunflower oil |

**For non-FOOD products please see section 3.5.2 Additional Suppliers, and for FUEL/PETROLEUM products please see section 3.1 Fuel.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Türkiye - 3.6 Additional Services

Overview

Türkiye's manufacturing industries are diverse and growing. Public-sector entities dominate manufacturing, accounting for about 40 percent of value added. Private-sector firms are dominated by a number of large firms that have diversified across several industries.

According to the Ministry of Economy, Türkiye has Free Trade Agreements with 19 countries and has started negotiations with another 13 countries. There are also 19 free trade zones in Türkiye which enable corporate, income and customs tax, and VAT exemptions, along with many other opportunities.

For more information on company contact details, please see the following link: 4.11 Additional Services Contact List

Accommodation

Türkiye has a well-developed housing construction industry, building nearly 800,000 units per year. The statistics shows that there is about a 20 percent increase in prices annually, but costs are also increasing.

Rental properties are plentiful throughout Turkish cities, but are less common in rural areas. You will probably find the market overwhelming at first. Turkish apartments vary in size and quality, sometimes seemingly without rhyme or reason. In general, you will find newer apartments toward the outer edges of cities and older ones toward the middle. Most apartments in the new building have a security guards and surveillance cameras, where as those in the old cities do not have.

Türkiye’s geographical position makes it a first reception and transit country for many refugees and migrants. As the result of an unprecedented influx of people seeking refuge, the country currently hosts more than 3.2 million registered Syrian refugees and is making commendable efforts to provide them with humanitarian aid and support and the large unregistered refugee population may mean the true figure is even larger. Turkish reception policies at the outset were predicated on the assumption that the conflict would come to a swift conclusion, allowing the displaced Syrians to return home, but as conditions continue to deteriorate in Syria and the conflict stretches into its fifth year, it has become clear that a shift in policy to encompass longer-term solutions is needed.

Electricity and Power

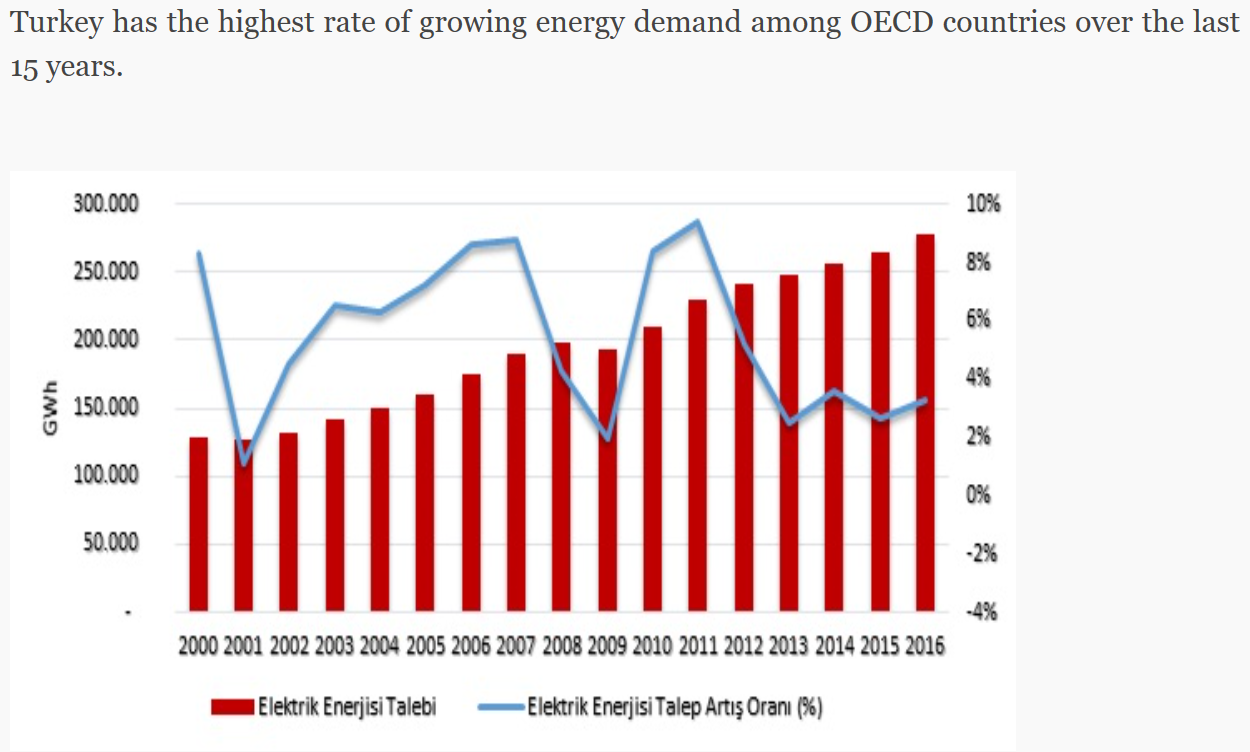

Electricity demand in Türkiye is expected to grow at 4.5 to 5.0 per cent per annum, and the Turkish government is keen to diversify its energy sources away from imported oil and gas and meet future demand through increased use of renewable energy resources (RES) such as wind and hydropower thereby meeting demand in an environmentally sustainable manner while improving energy security. Türkiye tends to use more RES for electricity generation. Wind energy is a major RES and Türkiye has a potential for generating an estimated 48,000 MW of power from wind energy. The present installed capacity however is only about 2,700 MW, and the government aims to install 20,000 MW of wind capacity by 2023, which would account for some 25-30% of the projected peak demand in 2023. Türkiye’s energy import dependency, mainly on oil and natural gas, is increasing due to this growing energy demand. Currently, Türkiye is able to meet only around 26 % of its total energy demand from its own domestic resource

|

Electricity and Power Summary Table |

|||

|---|---|---|---|

|

Production Unit |

Type |

Installed Capacity (MW) |

Current Production (MW) |

|

Thermal |

Thermal resources meet approximately 60% of Türkiye’s total installed capacity for electric power generation, while 75% of total electricity is generated from TPPs. Of the total thermal generation, natural gas accounts for 49.2%, followed by coal for 40.65%, and 9.9% for liquid fuel. Nineteen TPPs belonging to the Turkish Electricity Generation and Transmission Cooperation (TEAS) and its affiliated partnership produce 74.6% of total electricity. Türkiye’s average load factor is 61%, while the net unit generation cost is 4.19 cent/kWh. The availability of low-grade lignite’s in the country has led to the construction of lignite-fired TPPs. The use of coal, especially for power generation, is very essential to the continued economic growth of Türkiye. However, advanced clean coal technologies should be considered for improving the environmental performance of coal combustion.

|

||

|

Hydroelectric |

458 power plants operate as hydroelectricity in Türkiye, the total installed capacity of which is 22,804. For the time being 165 hydroelectric power plant projects are under construction with a total installed capacity of 8,500 MW.

|

||

| Wind | There are 172 wind farms in Türkiye, of which 171 were active in production with a total installed capacity of 6.195 GW making out 7.7% of the total installed power capacity of the country. The generated electricity was 15.685 TWh in 2016, which supplies 6% of the total electrical energy consumption | ||

Financial Service Providers

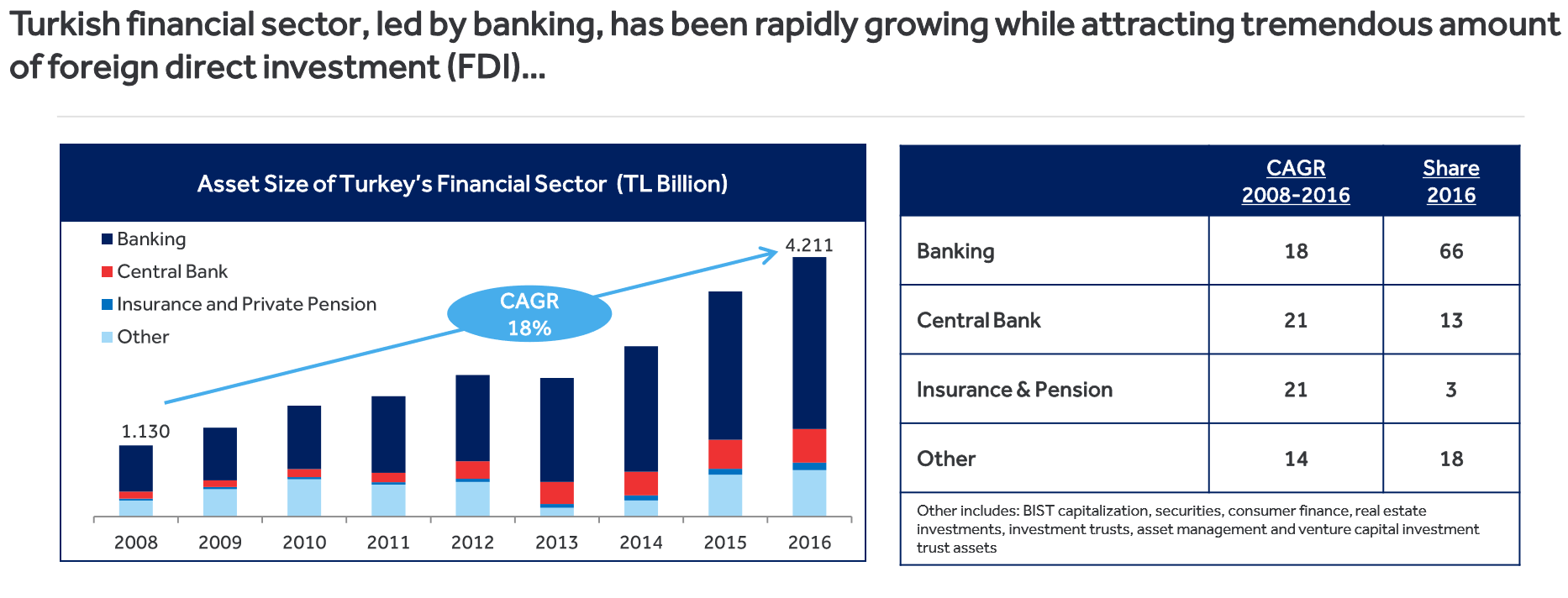

Banking dominates the Turkish financial sector, accounting for over 70 percent of overall financial services, while insurance services and other financial activities also show significant growth potential. There are 52 banks in Türkiye (34 deposit banks, 13 development and investment banks, 5 participation banks). Out 52 banks, 21 hold significant foreign capital (30% of total assets are held by foreign investors).

Ziraat Katilim – Ziraat Bankasi

Türkiye Cumhuriyeti Ziraat Bankası (English: Agricultural Bank of the Republic of Türkiye), commonly known as Ziraat Bankası, is a state-owned bank in Türkiye founded in 1863 and is wholly owned by Treasury of Türkiye.

According to a report on the "Top 1000 World Banks in 2004" published by The Banker magazine, T.C. Ziraat Bankası A.Ş. is ranked 115th. It had moved up 26 places from its previous ranking of 141

Ziraat Katılım is a member of Ziraat Finance Group, which has Türkiye's largest bank Ziraat Bankası both per number of branches and total assets, as of 2016.

They have foreign branches and representative offices in more than ten countries.

|

Company Overview |

||

|---|---|---|

|

Company Name |

Ziraat Bankasi |

|

|

Address |

Ankara | |

|

|

Available? |

Comments |

|

Has IBAN, BIC, or SWIFT number? |

Yes |

There is no limit for transfer |

|

Provides currency exchange? |

Yes |

Yes |

|

Will initiate / receive wire transfers? |

Yes |

Yes |

|

Provides Loan / Credit services? |

Yes |

Yes |

|

Other Comments or Key Information |

Provides various banking products and services to retail, small and medium-sized enterprises, and corporate customers in Türkiye and internationally |

|

*Basic details for the main office should be shown here, additional contact details for local/regional offices and full contact details for the main office to be included in 4.11 Additional Services Contact List.

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

All Regions of Türkiye |

All regions of Türkiye including internationally: |

Clearing and Forwarding Agents

Uni Logistics System - offers innovative logistics solutions for worldwide customers, not only between Türkiye and other countries but also between different countries other than Türkiye partnering with prestigious ship owners and a large network of agencies.

Caretta – Freight forwarding is one of the top 3 freight forwarding companies with full container export volume from Türkiye.

For more clearing and forwarding agents please open the link below:

http://www.logisticsTürkiye.org/Logistics_Türkiye

Handling Equipment

Logistics Plus Inc. (LP) is a leading worldwide provider of transportation, warehousing, global logistics and supply chain solutions. Founded in Erie, PA by local entrepreneur, Jim Berlin, 20 years ago, Logistics Plus has annual sales surpassing $150M and has been repeatedly recognized as one of the fastest-growing transportation and logistics companies in the country, a great supply chain partner, a top freight brokerage firm, and a great place to work. With a strong passion for excellence, our 400+ employees put the “plus” in logistics by doing the big things properly, and the countless little things, that together ensure complete customer satisfaction and success

Check the link below for other handling equipment companies in Türkiye: http://www.shipserv.com/category/cranes-winches-lifting/Türkiye/TR/18

Postal and Courier Services

PTT Türkiye-runs for the ever-growing quality and efficiency with the fully modernized technology. It owns an ISO-9000 Quality Certificate. The international outbound mail leaves the country within max. 3 days from International Mail Processing Center at the Istanbul Ataturk Airport (main hub). The most of the mail bags are transported by the state-owned Turkish Airlines (actually 219 destinations). EDI (Electronic Data Interchange) is provided whenever available.

There are other postal and courier services with the latest technology and equipment operating in Türkiye:

MNG Kargo - http://www.mngkargo.com.tr/en/

Aras Kargo - https://www.araskargo.com.tr/web_18712_2/

Yurtici Kargo – http://www.yurticikargo.com/en/Sayfalar/default.aspx

United Parcel Service of America (UPS) - http://www.ups.com.tr/

DHL - http://www.dhl.com.tr/en.html

Printing and Publishing

http://www.europages.co.uk/companies/printing%20company%20in%20Türkiye.html

Taxi Companies

http://www.Türkiye-taxi.com/tr/iletisim

Vehicle Rental

Waste Management and Disposal Services

Türkiye's waste management system is not a priority policy area. The country regardless employs several waste management practices including sanitary landfills incineration (only for hazardous waste), sterilization, composting, and other advanced disposal methods such as pyrolysis, gasification as well as plasma. The most common method of waste disposal in the country, especially for municipal waste, is landfilling. The municipal waste is collected on a regularly scheduled basis.The metropolitan municipality and other municipalities are responsible for providing collection, transportation, separation, recycling, disposal and storage of waste services.

According to the Turkish Ministry of Environment and Urbanization, the management of municipal waste is under the responsibility of municipalities as a regional management approach by the Ministry of Environment and Urbanization. Ongoing initiatives towards improving the municipal solid waste management in Türkiye aimed to set up a waste management system acting in accordance with the related national legislation and EU legislation, covering the establishment of necessary waste treatment facilities (pre-treatment facilities and landfills) and transfer stations, reduction of the amount of waste, ensuring recycling and reuse, and reducing the waste transportation costs.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Türkiye - 3.7 Waste Management and Recycling Infrastructure Assessment

Overview

Türkiye generates about 30 million tons of solid municipal waste per year; the annual amount of waste generated per capita amounts to about 400 kilograms. According to Waste Atlas, Türkiye's waste collection coverage rate is 77%, whereas its unsound waste disposal rate is 69%. While the country has a strong legal framework in terms of laying down common provisions for waste management, the implementation process has been considered slow since the beginning of 1990s.

The management of municipal waste is under the responsibility of municipalities as a regional management approach.

The municipal waste is collected on a regularly scheduled basis.

Türkiye's waste management system is not a priority policy area. The country regardless employs several waste management practices including sanitary landfills, incineration (only for hazardous waste), sterilization, composting, and other advanced disposal methods such as pyrolysis, gasification as well as plasma. The most common method of waste disposal in the country, especially for municipal waste, is landfilling. The municipal waste is collected on a regularly scheduled basis. The metropolitan municipality and other municipalities are responsible for providing collection, transportation, separation, recycling, disposal and storage of waste services.

Türkiye uses a diffuse approach to manage waste by distributing duties and powers among many institutions and organizations.

Legal framework

Waste management in Türkiye is subject to numerous environmental laws. The country had only three laws concerning waste between 1983-2003, whereas ten more regulations were introduced between 2003-2008. Most environmental regulations in Türkiye are based on Article 56 of the Constitution, which states:

It is the duty of the State and citizens to improve the natural environment, to protect the environmental health and to prevent environmental pollution.

— Article 56

Turkish Law on Environment no.2872 creates the basis of the legal framework for waste management practices in Türkiye:

It is prohibited to discharge all sorts of waste and residue directly or indirectly into receiving environment, storing them or being engaged in a similar activity.

— Article 8

In addition, Law on Amendments in Law on Environment no.5491 (Article 11); Law on Metropolitan Municipalities no.5216 (Article 7); and Municipal Law no.5393 (Article 14 and 15) explain the duties of municipal authorities, whereas Law on Municipal Revenues no. 2464 (Article 97) establishes the polluter-pays principle. Finally, Articles 181 and 182 of the Turkish Penal Code no.5237 (under the section "Crimes Against the Environment") state that intentional pollution of the environment is punishable by law up to five years in prison. The degree of the punishment is decided upon the severity of the pollution and impact on the environment.

Government efforts

According to the Turkish Ministry of Environment and Urbanization, the management of municipal waste is under the responsibility of municipalities as a regional management approach by the Ministry of Environment and Urbanization. Since 2003, municipalities are implementing municipal waste management projects by cooperating with other municipalities in the region (through the municipalities union). Turkish government drew up a master plan for 2007- 2009 based on the recognition that uncontrolled and unsafe waste disposal is an integral part of daily life in Türkiye and poses a serious risk to the environment and to the health of the country's 70 million inhabitants. The number of controlled landfill sites was raised to roughly 3000 - a steep increase on the 90 that existed in the 1990s. As of 2011, there is approximately one sanitary landfill site per municipality.

Ongoing initiatives towards improving the municipal solid waste management in Türkiye aimed to set up a waste management system acting in accordance with the related national legislation and EU legislation, covering the establishment of necessary waste treatment facilities (pre treatment facilities and landfills) and transfer stations, reduction of the amount of waste, ensuring recycling and reuse, and reducing the waste transportation costs.

Uncovered landfills are potential sources of flammable biogases, carcinogen and toxic waste, as well as microbial diseases.

Lack of public and sectoral environmental consciousness is a problem in Türkiye.

Waste mismanagement practices

The main question in the field of waste management is not the legal arrangement itself; but the deficiencies in implementing them. While Türkiye uses a diffuse approach to manage its waste, the effectiveness of application process has been negatively affected due to repetitions and gaps in sharing roles and responsibilities among different agencies. This situation, coupled with insufficient institutional capacity and weak technical infrastructure, limits the ability of related legislation to direct the implementation. Türkiye is also yet to develop a comprehensive and specific national strategic plan on waste management.

Eurostat data indicates that Türkiye did not recycle any of its municipal solid waste between 2001-2010, although poor reporting, not performance, was given as the cause for the absence of data. The Turkish Ministry of Environment and Urbanization reports the total amount of recycled packaging waste in 2009 to be 2.5 million tonnes, and certainly part of this recycled packaging waste is from MSW sources, but the share is unknown. Out of the approximate 30 million tonnes of municipal waste generated in 2010, 25 million tonnes or 84% were collected and about 98% of this collected waste was landfilled either in sanitary landfills (54%) or dumpsites (44%).

As of 2013, Türkiye imposes no landfill tax. According to The Turkish Ministry of Environment and Urbanization, EU Landfill Directive (99/31/EC) will be carried out by 2025

Impact of poor waste management

The biggest problem in terms of waste management in the country stems from uncovered landfills, where the garbage is simply left to rot. Türkiye's waste financing system does not take into consideration the polluter-pays principle sufficiently, so economical tools are weak to deter pollution and financial sources are inadequate for investments. Usage of natural areas (forests, seasides etc.) still causes a great threat to the environment. In addition, insufficient capacity for treatment and disposal of hazardous waste leads to illegal dumping to the nature. Furthermore, recycling rates are poor due to the lack of adequate facilities and incentives in the waste sector. Uncovered landfills remain to be potential sources of flammable biogases, carcinogen and toxic waste, as well as microbial diseases due to the inadequate changes on their status since 1990s. Along with poor funding and reporting, recycling sector in Türkiye also suffers from poor environmental consciousness on both public and industrial level.

Hazardous Waste Disposal

Efforts for the reuse and recycling of hazardous waste often focuses on waste that requires simple technologies for collection and disposal. The most striking example of this could be recycling barrels and silver. Waste markets are established under the chambers of commerce, by Union of Chambers of Commerce and Commodity Exchanges of Turkey (TOBB) with the support of MOEF, in order to reduce the amount of industrial waste and allow their reuse.

As of 2008, there are 3 disposal facilities in Turkey for hazardous waste through incineration. Capacities of these facilities are inadequate in meeting the needs of industry. Except these, a pilot scale facility which received license for recycling hazardous wastes through gasification with a capacity of 29.000 tons/year is put into operation in Istanbul. Moreover some cement factories are accepting hazardous wastes as alternative fuels for purposes of energy recovery. Due to technological inadequacy of stack gas treatment systems in cement factories in eliminating stack gases that are produced as a result of hazardous waste incineration, these factories are only able to accept certain types of wastes. Among these are used tires, I. and II. category waste oils, paint sludge, solvents, plastic wastes etc. Energy recovery license is being distributed to allow the use of hazardous waste in cement kilns as an alternative fuel with 24 facilities already in possession of this license. Some of the hazardous wastes are also exported to be disposed in incineration facilities abroad.

Production industry in Turkey is annually producing more than 20 million tons of waste. Approximately 1.12 million tons of this amount is made up of hazardous wastes. 8% of this amount is being recovered, 47% is being disposed and 45% is being reused.

Approximately 80% of the established capacity of 6 facility licensed by Ministry of Environment and Forestry (MOEF) for the disposal of industrial waste is currently in use. 5.586 tons of ash and slag coming from incineration facilities are disposed in sanitary landfills.

Provision of services by hazardous waste facilities in regions of high population density and high industrialization rates in Turkey is advantageous both in terms of costs, utility, and to keep the environmental loads at minimum.

Non-Hazardous Waste Disposal

Disclaimer: Registration does not imply any business relationship between the supplier and WFP/Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please Note: WFP/Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.