3 Guatemala Services and Supply

The macro overview

Currently, there is a global logistics imbalance due to the repercussions of the war between Ukraine and Russia, macroeconomic forecasts, the increase in prices in supply chain, inflation, rise in fuels and covid-19 pandemic consequences. Due to delays and closures in customs in some countries, transport ships were stranded and this hampered the continuity of the supply chain, increasing transportation costs, affecting the final prices to the consumer and quality of services

The increase in the prices of maritime and air transport represents a crisis for the economy, that affects inevitably the services quality however, Guatemala has a privileged geographical position close to the North American market, its main business partner, and rest of the Americas countries on the Caribbean, and, for the north and south bound corridor on the Pacific maritime traffic for nearshoring opportunities in the region. It also has a stable macro economy, and offers incentives such as the Law on Free Trade Zones and the Free Trade and Industry Zone (ZOLIC), among other favourable aspects.

Logistics Infrastructure

Guatemala does not have dedicated logistics centers exclusively to the activity, the current offer is located in industrial zones and especially in free zones, which are used more for logistical support than for industrial activity properly speaking, since the maquila activity applies to throughout the country and is covered by the Law for the Promotion and Development of the Export and Maquila Activity. There are 18 active free zones, the largest located in the metropolitan area of Ciudad de Guatemala, around Quetzaltenango, Tecun Umán and San Marcos, and in Puerto Barrios (the latter rather categorized as logistics shelter).

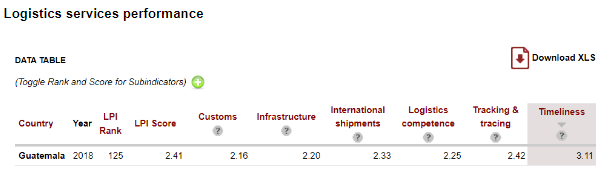

The value for Logistics Performance Index*: competitiveness and quality of logistics services (1= low to 5= high) in Guatemala was 2.25 in 2018. During the last 11 years this indicator has reached a maximum value of 2.78 in 2012 and a minimum value of 2.25. We do not have access to recent data regarding this point but as reasonable average according to the last year’s performance, including general crisis conditions, economics, pandemic 2019 and other variables, is 2.38 (LPI)

According to the 2016 (LPI), Guatemala is ranked 111 out of 160 countries rated by the World Bank in different logistics areas. His average score was 2.48. Regarding the indicator of quality and competence of logistics services, it was positioned in 130th place with a score of 2.30, and in infrastructure it was the component with the lowest score with 2.20, that is, it ranked 127th.

(*)https://lpi.worldbank.org/international

Infrastructure, services and supplies

Historically, the Guatemalan supply chain has not registered scarcity or lack of products or services. In terms of quality and capacity, it would have to be evaluated on a case-by-case basis. Definitely, as in any system, it can and should experience a permanent improvement process. The Guatemalan system, both public and private sectors, are aware of these challenges and objectively confront them with investments and development plans, agreed between sectors.

Intra-regional supply is dominated by manufactured products, food, paints, cosmetics, fabrics, plastics, pharmaceuticals, rubber, cement and construction materials. Some products need controlled temperature in intra-regional trade, but its ratio is low. large proportion of the products fresh perishables are transported through the own transport units of the intermediaries or exporters of these products.

The products are varied and come well from the market national or extra-regional: handicrafts, decorative items, fresh and processed foods, white goods, medical supplies and instruments, cosmetics and perfumery, materials and articles cleaning, furniture and equipment, construction items.

The light manufacturing sector is a national priority in terms of job creation and value. Guatemala seeks to maintain the competitive position in the yarn segment and garments, and consolidate, grow and conquer markets in the light manufacturing segment (electronic products, automotive parts, batteries, medical instruments), both for export and local consuming.

Current circumstantial cases, due to the general global crisis of chips and containers, can be identified, e.g. delays of 6 months in deliveries in the local market of the IT sector, computers, laptops, printers and other accessories.

The opportunity and nearshoring

Guatemala has the opportunity to compete and actively perform in nearshoring as a tool to attract investment. It is essential that the corresponding authorities work on the improvement of the maritime, air and road infrastructure, as well as on the planning of imports and exports, logistics and strategy of raw material movements. Guatemala has the potential to be a supply centre for the North American market and the rest of Central America, and having the adequate infrastructure depends on this.

Supply Services

Guatemala has a growing trend in supply services and logistics resulting in part from the larger size population of the country and therefore of its industrial sector, at the same time than its proximity to Mexico. But as a sector it has a lot of room to develop; e.g. , there is no packing services and sufficient consolidation in centers of storage for perishable products, although agriculture is the largest Guatemalan activity its production focuses on products with very small added value. On the other side, the big players in the Guatemalan agro-business system, just as an example, know and adapt very well to all the specifications including hydro cooling and every phase in cold chain for perishable cargo, to meet and exceed requirements for export at destination. This gives a clear idea of the fast capacity to perform accordingly in these lay outs.

Sustainability

Efficiency is also an issue that will continue to be important within supply chains, operations, services and logistics. It will continue to be necessary to develop more ethical and efficient processes in the use of resources.

The vision

This would contribute to the establishment of Central America as a priority at an economic level. To achieve this, it is necessary to: reduce resistance to change, digitize processes, regenerate bilateral agreements, develop human capital and improve customs procedures and infrastructure in ports and airports.

3.1 Guatemala Fuel

Fuel Overview

Guatemala is a net importer of oil-derived fuels, most of which come from the United States. Among the ten main imported products to Guatemala, Gasoline occupies position number 4. At national level, the main fuel consumed is diesel, and it has a high impact on the cost of transporting goods and passengers.

The import of fuel is mainly done through two corridors: From the Atlantic side, through Puerto Barrios and Santo Tomas de Castilla. In Puerto Barrios, the import is done by Chevron, and in Santo Tomas, Unopetrol and Puma Energy. The imports consist of gasoline, diesel, kerosene, bunker and aircraft fuel. On the pacific side, though San Jose port and Puerto Quetzal, the import is done by Unopetrol, Chevron, Puma Energy, Blue Oil and Pacific Oil. Those companies import mainly gasoline, diesel, kerosene dual use and bunker.

Fuel Supply & Storage

|

Maximum hydrocarbons storage capacity (source: M.E.M.) |

||

|---|---|---|

|

Location |

Total Barrels |

Total Gallons |

|

Oil terminals on the Pacific coast |

4,197,650 |

176,301,313 |

|

Oil terminals on the Atlantic coast |

193,744 |

58,579,256 |

|

GLP (in country) |

16,332 |

685,957 |

|

International Airport |

9,857 |

414,000 |

|

Other |

114,630 |

4,814,460 |

|

Petrol |

666,500 |

27,993,000 |

Guatemala Infrastructure of Service Stations

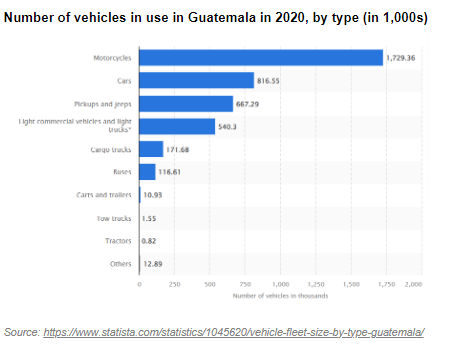

The registry of companies of the General Directorate of Hydrocarbons indicates that there are 1,534 operating licenses for service stations in force in the country. The largest concentration of service stations is in the department of Guatemala, where the largest percentage of the vehicle fleet in the country, followed by the departments of Quetzaltenango, Petén and San Marcos.

Guatemala Fuel Monthly Consumption 2022, volume expressed in barrels (55 US gl = 250 lt)

According to figures from the Ministry of Energy and Mines (MEM), between January and May 2021, the national consumption of gasoline and diesel was 13 million 170 thousand 761.54 barrels (of 42 gallons), while in the first five months of In 2022, consumption was 12 million 847 thousand 507.09 barrels, a drop of 2.45%.

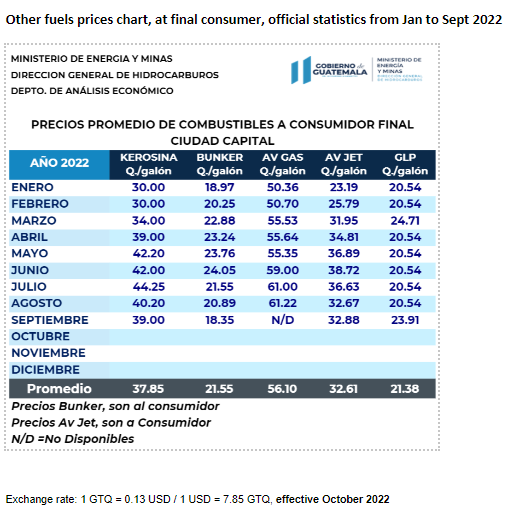

The prices of liquefied petroleum gas in Guatemala, El Salvador, Honduras, Costa Rica and Panama include subsidies; even so, Guatemala maintains the highest pricing, according to the Fuel Price Report of the Ministry of Energy and Mines.

Use of Gas LPG

In 2020, the final energy consumption in Guatemala determined that Liquefied Petroleum Gas (LPG) represents 3.6% of the energy matrix. That is, 3,410.52 kBEP (kilo barrel of oil equivalent).

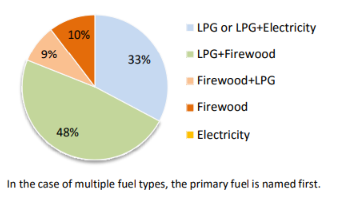

In domestic use, it is the second main source of energy for cooking. A total of 1,432,144 homes (43.7%) use propane gas, although the main source of energy for most of the homes in the country continues to be firewood, which is used by 1,782,861 homes (54.4%).

LPG is used in households with a wide range of incomes, including those below the poverty line. Households are quite resilient to price volatility in both directions (increase/decrease). The desire for the cylinder to last as long as possible contributes to continued reliance on firewood, especially when a large quantity of food must be cooked. Moreover, firewood continues to pay a role as an emergency source of energy when LPG is unavailable for technical or economic reasons. In other words, firewood contributes to a sense of energy security of the household.

Use of Ethanol

The actual Guatemalan government, through the Ministry of Energy and Mines would be promoting the use of ethanol to alleviate, in the long term, the effects of the fuel market. They are currently hosting a series of workshops with the ethanol-producing industry in Guatemala, with vehicle and fuel importers. There are 3 sugar mills and 5 ethanol distillers whose production is exported and consumed in California (USA).

For more information on government and fuel provider contact details, please see the following links: 4.1 Government Contact List and 4.7 Fuel Providers Contact List.

Information may also be found at: http://www.mytravelcost.com/petrol-prices/ which is updated monthly.

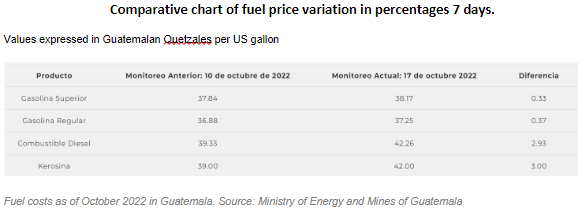

Fuel Pricing

Until the end of May 2022, Guatemala is the nation that recorded the highest fuel prices in Central America. For example, if one considers that there was already an upward trend before the European conflict, from January 2021 to May 2022, the price of superior gasoline in Guatemala rose more than 180%, going from 3.09 dollars per US gallon (24.34 quetzals) in January 2021, at 5.59 dollars per US gallon (44 quetzales as of May 2022).

Exchange rate: 1 GTQ = 0.13 USD / 1 USD = 7.85 GTQ , effective October 2022

01 US liquid gallon = 3.79 Litres / 1 litre = 0.26 US liquid gallon

Despite the fact that Guatemala approved in mid-May a subsidy of five quetzals (0.64 usd) for a gallon of superior and regular gasoline, and seven quetzals (0.89 usd) for diesel, it continues to have high prices.

|

Fuel Prices per Litre as of: 17 October 2022 (local currency and USD - $)* |

|

|---|---|

|

Petrol |

GTQ 37.25 / US gallon USD 4.75 / US gallon USD 1.25 / litre |

|

Diesel |

GTL 42.26 /US gallon USD 5.39 / US gallon USD 1.42 / litre |

|

Paraffin Kerosene* in Guatemala |

GTL 42 / US gallon USD 5.35 / US gallon USD 1.42 / litre |

|

Jet A-1 |

GLT 32.88 / US gallon USD 4.19 / US gallon USD 1.11 / litre |

|

Gas LPG |

GLT 23.91 / US gallon USD 3.05 / US Gallon USD 0.81 / litre |

(*)Kerosene is a specific type of paraffin. Paraffin tends to be a more refined and distilled version of kerosene. This makes it more suitable for use within the home. Paraffin is more refined, which ensures that it will produce a lot less soot when it's burnt. Kerosene is often referred to as kerosene so, while there is an overlap between the terms paraffin and kerosene, paraffin has a broader meaning and a wider range of applications.

Seasonal Variations

|

Seasonal Variations |

|

|---|---|

|

Are there national priorities in the availability of fuel? (i.e. are there restrictions or priorities for the provision of fuel such as to the military?) |

No |

|

Is there a rationing system? |

No |

|

Is fuel to lower income / vulnerable groups subsidized? |

No |

|

Can the local industry expand fuel supply to meet humanitarian needs? |

Yes |

|

Is it possible for a humanitarian organization to directly contract a reputable supplier / distributor to provide its fuel needs? |

Yes |

Fuel Transportation

The Internal transport is done though tanker truck. The transport of petroleum products (gasoline, diesel, kerosene, AV-Jet, AV-gas, bunker C, oily mixtures y liquefied gas), at national level is done through road tanker and, for liquefied gas, with gas tanker. https://www.mem.gob.gt/wp-content/uploads/2015/06/4._RTCA_Transporte_de_liquidos.pdf. Fuel transport fleet vehicles in Guatemala is US built, observing US fuel transportation standards.

For intra Central America transport the standards meet the: Technical Regulation of The Central American Customs Agreement

Standards, Quality and Testing

|

Industry Control Measures |

|

|---|---|

|

Do tanks have adequate protection against water mixing with the fuel? |

Yes. Also, Fuel transport tanks are regulated by: https://www.mem.gob.gt/wp-content/uploads/2015/06/4._RTCA_Transporte_de_liquidos.pdf Other: Fuel transport fleet vehicles in Guatemala is US built, observing US fuel transportation standards. Other: Guatemalan government regulation. https://www.mem.gob.gt/wp-content/uploads/2015/06/4._RTCA_Transporte_de_liquidos.pdf “7.8 Drainage, exhaust or vent valves. Other: the norm applies to: Technical Regulation of The Central American Customs Agreement |

|

Are there filters in the system which monitor where fuel is loaded into aircraft? |

N/A |

|

Is there adequate epoxy coating of tanks on trucks? |

If Yes, it will be indicated on the identification tab see: https://www.mem.gob.gt/wp-content/uploads/2015/06/4._RTCA_Transporte_de_liquidos.pdf Other: the norm applies to: Technical Regulation of The Central American Customs Agreement |

|

Is there a presence of suitable firefighting equipment? |

Yes |

|

Standards Authority |

|

|---|---|

|

Is there a national or regional standards authority? |

Yes |

|

If yes, please identify the appropriate national and/or regional authority. |

National: General Directorate of Hydrocarbons of the Ministry of Energy and Mines. (Dirección General de Hidrocarburos del Ministerio de Energía y Minas) |

|

If yes, are the standards adequate/properly enforced? |

Yes |

|

Testing Laboratories |

|

|---|---|

|

Are there national testing laboratories? |

Yes |

|

Fuel Quality Testing Laboratory |

|

|---|---|

|

Company |

Government Laboratory |

|

Name |

Laboratorio Técnico del Ministerio de Energia y Minas |

|

Address |

Diagonal 17, 29-78 Zona 11, Colonia Las Charcas, Guatemala, Guatemala |

|

Telephone and Fax |

+502 2419 6464 Ext. 1133 fax +502 24762459 |

|

Contact |

Ing. Quimica Mayra Villatoro, jefela@men.gob.gt

|

| Standards Used | API “American Petroleum Institute”, ºAPI “API degrees” |

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.2 Guatemala Transporters

In Guatemala, the transport sector and transporters have a close relationship with the rest of the activities that make up the economy, and the problems that arise in each sector have an impact on transport activity, as well as an impact on its costs, such as agriculture, mining, manufacturing and construction, among others. A Guatemala rank 125th out of 160 in the logistics performance index and that is a clear challenge for the sector.

For example, the issue of transporters-highways is too sensitive. According to data from the National Traffic Safety Observatory of the National Civil Police, 39 percent of accidents occur on the highway, and half of all these events occur on the western route, which proves that western routes they are dangerous, in addition, a real registry of the buses and heavy transport that circulates in the portfolios of Guatemala must be carried out, because there is an under-registration of buses that circulate without permits.

In addition to current fuel costs increase, the cost of ground transportation is perceived as high, compared to neighbour countries in Central America. This contributes to road insecurity since the cargo, in particularly the export inland freight (not limited to) must travel in convoy and with armed escort provided by dedicated private security companies and its additional costs. Inefficiency in border management is also key cause of this situation

The heavy cargo transporters are represented by different unions, depending on the type market. The main unions of cargo carriers are classified into two groups:

a) Carriers engaged in the transport of international cargo containers (local transport or International), represented by the Association of International Carriers (ATI), and the Chamber of Central American Carriers (CATRANSCA), affiliated at the Central American level in the Federation Central American Freight Carriers (FECATRANS) and in the Transport Coordinator Central American (CTC), and,

b) Carriers specialized by product, affiliated with specific chambers. (Guild of Specialized Fuel Carriers; Union of Cement Transporters, etc.)

It should be noted that in addition to these unions, there is a significant number of carriers that are not affiliated with any organization, as well as private carriers operating fleets on their own. (Essentially regional cast, teams special services for fast food transportation, mail, groceries, home delivery of purchases to pantries, utilities, etc.)

Cámara Guatemalteca de Transporte de Carga

The CGT has been recently created on April 28 of this year 2022 with 12 companies that bring together 1,600 tractor units and generate 4,800 direct jobs and around 900 indirect jobs. Data from the Bank of Guatemala indicate that transportation and storage grew 11.2 percent in the first quarter of 2022, influenced by cargo and passenger transportation activities by land. Its main purpose is strengthening its associates through pilot training to promote innovation, dealing with issues related to the movement of goods and safety and quality of its services, channel of communication with the government and ministries, etc. The Chamber does not intend to be a division among other existing organizations. The Chamber was born with 12 associates and 20 more in the process of integration between large and medium-sized companies, although more than 200 firms dedicated to this service operate in the formal economy.

Coordinadora Nacional de Transporte, CNT

The National Departmental Urban Transport Coordinator of Guatemala "CNTUDEG" is a private, non-political, non-religious, non-profit entity, with its own legal registration; Its main purpose is the promotion and comprehensive development of urban and rural carriers in the different departments of the Republic of Guatemala. The Coordinator maintains bilateral communication channels with the Vice Presidency of the Republic, with the Guatemalan Chamber of Commerce and other entities and unions.

Sindicato Gremial de Pilotos de Transporte Pesado de Guatemala "SIGPITRANSPEGUA"

Is a very powerful union, which gathers and represents the vast majority of truck drivers and truck owner in Guatemala. The “SIGPITRANSPEGUA” better known as “La Gremial de Transporte Pesado” has also no few controversies among its members and the union presidency* when facing the common transport issues e.g. regional transit restrictions. The Guatemala City municipality, approximately 5 years ago, prohibited the transit of heavy transport through the city in between 04:00 to 09:00 hrs. and 16:00 to 21:00 hrs. to alleviate bottlenecks and general city traffic. The Union protested this regulation. On the other side, due to the city expansion the peripheral highway is today in the middle of the city and drastic traffic regulations are needed. Another issue is the new law of vehicle accident insurance against third parties which is perceived by the union members as an extra cost. Same dynamics have been noted regarding the norm for implementing in-cabin speed limit regulators, etc. The union is very well organized in terms of call for road blockade and strikes as act of force, looking to negotiate with the Guatemalan government.

(*) Current President of the Union is Mr. Rony Mendoza, +502 4509 9333 · remendoza81@hotmail.com

The General Directorate of Transport, Dirección General de Transporte

DGT is the dependency of the Ministry of Communications, Infrastructure and Housing, in charge of the control and regulation of extra-urban passenger transport by road, exclusive special service for tourism, agriculture and industry and the registration of the equipment transport service, road freight, nationwide

The Chamber of Central American Carriers CATRANSCA

The Chamber of Central American Carriers, better known by its acronym CATRANSCA, is a private, non-profit entity with its own legal status, which is made up of formal road transport companies. Guatemala is an active member.

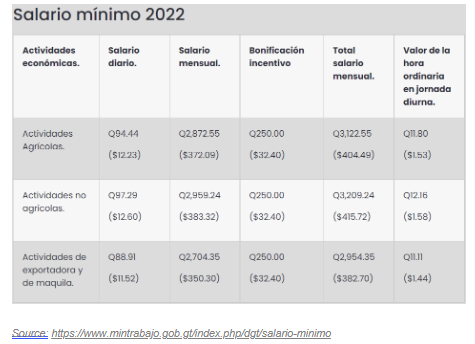

3.3 Guatemala Manual Labour

Ministry of Labor and Social Welfare https://www.mintrabajo.gob.gt/ is the Government institution responsible to promote the efficient usage of policies related to labour legislation, as well as to dictate minimum wages. Usually minimum wages will be updated every year and in some occasions every other year.

The minimum wages categories are:

- Actividades Agrícolas (Agricultural Activities)

- Actividades No Agrícolas (Non Agricultural Activities)

- Actividades de Exportadora y de Maquila (Export and There are some institutions with organized unions, which can stop the logistics system flows. Some of the most active unions are: transport, school teachers, public health employees, Port Santo Tomas and Port Quetzal stevedoring.

There is availability of manual labour in the country. In some areas of the country manual labour can be more difficult to find due to coffee, sugar can and perishables farms demand. The busiest times of the year are from October-November until April-May

Note 1: The classification on payroll is determined by the nature of the employer as registered, not by the capacity or skills of the worker.

Note 2: As per Guatemalan law there is no “daily worker” contract concept.

Note 3: By year 2023, the labor sector proposes raising the minimum wage per day to Q180 / USD 23.04, without making any difference by region (11 Oct 2022 exchange rate 1 USD = Q. 7.87)

| Labour Rates Overview Rates as of January 2022 | ||||

|---|---|---|---|---|

|

|

Cost /

Daily

|

Month |

Bonus |

Total Month |

|

Category: Actividades Agrícolas |

Q. 94.44 USD 12.23 |

Q. 2,872.55 USD 372.09 |

Q. 250 USD 32.40 |

Q. 3,122.55 USD 404.49 |

|

Category: Actividades no agrícolas |

Q. 97.29 USD 12.60 |

Q. 2,959.24 USD 383.32 |

Q. 250 USD 32.40 |

Q. 3,209.24 USD 415.72

|

|

Category: Actividades de Exportadora y de Maquila |

Q. 88.91 USD 11.52 |

Q. 2,704.35 USD 350.30 |

Q. 250 USD 32.40 |

Q. 2,954.35 USD 382.70

|

On December 17, 2021, Government Agreement No. 278-2021 of the Ministry of Labor and Social Welfare was published in the Official Gazette, which establishes the minimum wage for agricultural, non-agricultural and export and maquila activities as of January 1, 2022.

How is the monthly minimum wage payment calculated?

According to the criteria of the National Salary and Labor Inspection Commission, it is established that the amount of the monthly minimum wage is determined by the following formula: the multiplication of the daily minimum wage by 365 days of the year and the result divided by 12 months.

Child Labour Exploitation

Guatemala presents significant advances in the fight against child labour and exploitation. At least 28 children who were subjected to labor exploitation have been rescued in Guatemala so far in 2022, a figure that, according to authorities from the Ministry of Labor (Mintrab), could increase considerably at the end of November, when operations are carried out in the agricultural sector.

https://www.congreso.gob.gt/noticias_congreso/8582/2022/1

3.4 Guatemala Telecommunications

Overview

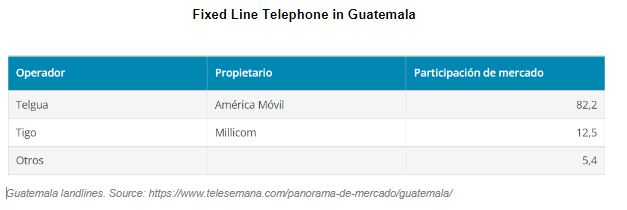

Guatemala has one of the lowest fixed-line teledensities in the region; in many rural regions of the country there is no fixed-line access available, and so mobile services are adopted by necessity; private investment has been supported by government and regulatory efforts, resulting in a steady growth in the number of fixed lines which has supported growth in the fixed broadband segment.

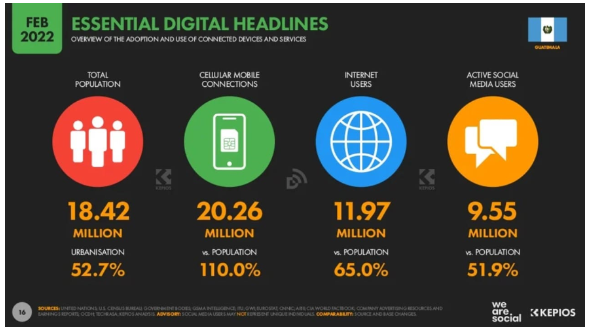

The total number of inhabitants of Guatemala is 18.42 million, of which 52.7% reside in urbanized areas. Likewise, there are 20.26 million cellular mobile connections, which in comparison with the population represents 110%.

On the other hand, Internet users are 11.97 million, which represents 65% of the total population of the country, this means that just over half of the population has Internet access.

There are 9.55 million active users on social networks, thus being 51.9% of the population who are active on these platforms.

Two new submarine cables are due for completion by 2022; improved international connectivity should drive further uptake of both fixed and mobile broadband services; intense competition among the networks has helped to improve services and lower prices for end-users; given the commercial impetus of networks, insufficient government financial investment has resulted in many regional areas remaining with poor or non-existent services; the country benefits from one of the most open regulatory frameworks, with all telecom sectors having been open to competition since 1996.

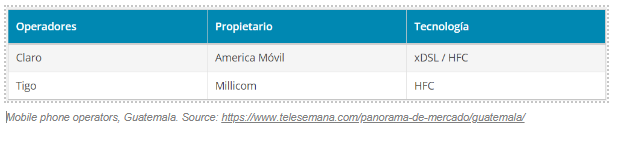

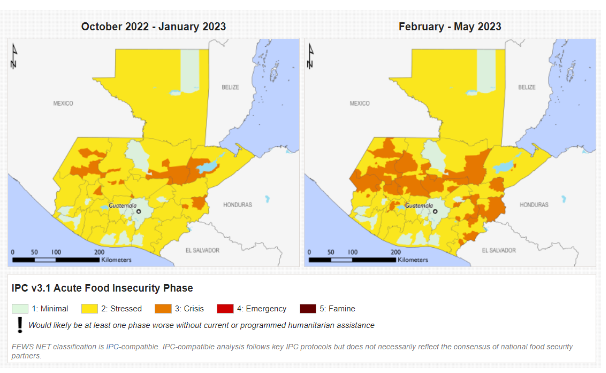

The two leading operators in the mobile telephony market in Guatemala have total hegemony in the sector, being the only ones to have their own infrastructure network to offer coverage throughout the national territory. Regarding the most used operator in Guatemala, Tigo is the leading company in the sector and the one with the largest number of users in the country. Despite this, the difference in market dominance with respect to Claro is not so marked, where in fact, each year the margin of difference becomes smaller.

Telecomunicaciones de Guatemala (TELGUA), belongs to the international operator América Móvil based in Mexico; currently being the largest fixed telecommunications operator in the country with 78.66% corresponding to more than 1,500,000 customers.1

Communications Cellular, better known under its brand of mobile services TIGO, is the second operator in fixed telephony users, exceeding 325,000 active clients corresponding to 16.80%.1

Claro Guatemala, is a national operator that also belongs to América Móvil and that covers 2.35% of the market with 45,644 clients in 2022. It previously belonged to the international operator Telefónica based in Spain; and managed to be the second largest fixed telecommunications operator in the country with just over 200,000 customers.

Cablenet is the fourth largest fixed telephony operator in the country, exceeding 42,000 active clients, equivalent to 2.18% of the market.

For more information on telecoms contacts, please see the following link: 4.11 Additional Services Contact List.

|

Telephone Services |

|

|---|---|

|

Is there an existing landline telephone network? |

Yes |

|

Does it allow international calls? |

Yes |

|

Number and Length of Downtime Periods (on average) |

Not significant |

|

Mobile Phone Providers |

|

|

Approximate Percentage of National Coverage |

|

In Guatemala there are more than 64,000 public telephones in operation.

Guatemala has fixed telephony services in most of its land area. In this sense, after the opening of the telecommunications market in the country, different private companies arrived in the country and acquired tenders to operate within the country.

There are currently at least 4 large fixed line operators in Guatemala, with TELGUA (Guatemala Telecommunications, owned by América Móvil) being the leading company in this market. The most important landline telephone companies in the country are: TELGUA, Comunicaciones Celulares (TIGO), Cablenet, Unitel Guatemala

Telecommunications Regulations

he Superintendence of Telecommunications is an eminently technical body of the Ministry of Communications, Infrastructure and Housing, whose main functions are the following: Manage and supervise the exploitation of the radio spectrum.

General Telecommunications Law

The Ley General de Telecomunicaciones establishes a new regulatory framework, creates the Telecommunications Superintendence as an eminently technical entity, and creates a fund destined to subsidize, through market mechanisms, telephone services in low-income rural and urban areas.

file:///C:/Users/Utente/Downloads/LEY%20GENERAL%20DE%20TELECOMUNICACIONES.pdf

General overview of Guatemalan regulations

For distributor, seller

Distributors and sellers of mobile terminal equipment must keep a control or file of the people to whom they sell or supply a mobile, which they must keep for a period of 3 years. In the case of mobile importers, they must keep a detailed database of each mobile that they will keep for a period of 5 years from importation.

They must release the mobile to be used in the network of any national telephone operator, at the user's choice. Only Operators that offer contract plans among their services that benefit the user are excepted, which may not be longer than 24 months. At the end of this period, the mobile must be released by the Operator at no additional cost to the user.

For buyer, user

SIM card vendors must ask the buyer for the respective identification document stating that they are of legal age, which can be DPI or passport if they are foreigners. They must verify that the document corresponds to the person presenting it, and they will receive a physical or electronic copy of it, where they will write down the telephone number that the user is acquiring. They may also fill out a form, which may be electronic, with the aforementioned data, and in any case they must keep the documents and information for three years

Theft, Loss of Cellular devices

Complaints about theft of cellular devices (must be managed by those affected, reporting the theft of your cell phone to the company that provides the service for blocking it. At the same time, make the complaint in the Public Minister Prosecutor Offices.

General Considerations

They (distributors, seller, buyers and users) may not market, store, transfer, distribute, supply, sell, sell, export, repair, exhibit or carry out any other activity carried out with one or more mobile terminal equipment or any of its components that are included in the Negative Database -BDN- , or that present evidence of having been reprogrammed, altered, replaced or duplicated with the IMEI of the device. Mobile phones with generic or duplicate IMEI cannot be imported or sold.

They cannot market mobile terminal equipment whose IMEI is altered or included in the Negative Database -BDN-, or they will automatically lose their registration certificate.

Note: HF radio systems will be no longer in use.

|

Regulations on Usage and Import |

||

|---|---|---|

|

Regulations in Place? |

Regulating Authority |

|

|

Satellite |

Yes |

https://sit.gob.gt/gerencia-de-frecuencias/ (check subtitle Funciones) |

|

HF Radio |

Yes for usage frequencies, No for import equipment |

Telecommunications Superintendency |

|

UHF/VHF/HF Radio: Handheld, Base and Mobile |

Yes for usage frequencies, No for import equipment |

|

|

UHF/VHF Repeaters |

Yes for usage frequencies, No for import equipment |

|

|

GPS |

n/a |

n/a |

|

VSAT |

Yes for usage frequencies, No for import equipment |

|

|

Individual Network Operator Licenses Required |

||

|

Yes, all holders of usufructs of frequencies, radio amateurs and users of state reserve bands https://sit.gob.gt/gerencia-de-frecuencias/ |

||

|

Frequency Licenses Required |

||

|

Yes, for all holders of usufructs of frequencies, radio amateurs and users of state reserve bands. https://sit.gob.gt/gerencia-de-frecuencias/ |

||

Existing Humanitarian Telecoms Systems

United Nations System

The UN system in Guatemala for communications, according to its Emergency Communications Systems established that standard means of communication, under normal condition and emergency situation is:

1) Personal cellular phone, (as part of the personal tool kit)

2) VHF radio

3) Satellite means of communication.

Note: HF radio equipment is being progressively withdrawn from service

Satellite phones, sat modem (Iridium, Began)

Regulations and norms apply for users. Please refer to:

https://sit.gob.gt/gerencia-de-frecuencias/sistemas/sistema-satelital/

Due to Guatemala country coordinates and geophysical characteristics Iridium and Began systems operate correctly.

Radio communications Law

The domain of the State over usable frequencies and channels in the country's radio communications is inalienable and imprescriptible, and it may exploit them by itself or assign the use to individuals in accordance with the prescriptions of this law...

file:///C:/Users/Utente/Downloads/Ley%20de%20Radiocomunicaciones.pdf

Law Regulating the Use and Collection of Satellite Signals and their Distribution by Cable

The purpose of this law is to regulate the use and operation of earth stations that are capable of capturing signals that come from satellites and their distribution through cable, or any other known means, and their use or operation by individuals or legal entities. Wire Law.

file:///C:/Users/Utente/Downloads/Ley%20Reguladora%20del%20Uso%20y%20Captaci%C3%B3n%20de%20Se%C3%B1ales%20V%C3%ADa%20Sat%C3%A9lite%20y%20su%20Distribuci%C3%B3n%20por%20Cable.pdf

Internet Service Providers (ISPs)

The total number of internet users in Guatemala is 11.97 million. The total percentage of Internet users in relation to the total population of the country is 65%. The year-over-year change in the number of internet users has increased by 1.8% compared to previous figures. Thus gaining 217 thousand new users. The total percentage of users of social networks who access them through mobile devices is 99.2%. In the same way, 95.7% of the population have access to electricity, and 94% have access to potable water suitable for drinking, in this way the most of the country has basic water and electricity services. However, only 67.9% of the population enjoys access to basic health services, thus a little more than half of the country has this basic service. Finally, only 24.4% of the population earn less than US$3.20 per day.

Internet sites in Guatemala are cataloged by domains: .com.gt, .net.gt, .org.gt, .edu.gt, .mil.gt, .gob.gt and .ind.gt The country code top level domain (ccTLD) for Guatemala is .gt.

| Internet Service Providers | |

|---|---|

|

Are there ISPs available? |

Yes, https://isp.today/es/list-of-all-services/GUATEMALA

|

|

If yes, are they privately or government owned? |

Private |

|

Dial-up only? |

n/a |

|

Approximate Rates (local currency and USD - $) |

Dial-up n/a Broadband https://isp.today/es/list-of-all-services/GUATEMALA |

|

Broadband |

https://isp.today/es/list-of-all-services/GUATEMALA

|

|

Max Leasable ‘Dedicated’ Bandwidth |

n/a |

Fixed Bandwidth

Broadband internet speed is considerably slower than the rest of the region, generating few incentives to hire it, as well as being more expensive than in many Latin American countries. This generates an access problem in which the offer is insufficient and the demand does not have the incentives to contract the broadband service. This endogenous problem could be exacerbated by the difficulty of installing antennas in the interior of the country. Speed is also one of the lowest in Latin America. Putting together the low speed of internet, as well as the high price for broadband, a problem of low supply and therefore high prices can be observed.

There are 14,640 base stations installed throughout the Guatemalan territory. According to a 2021 Banco Interamericano de Desarrollo, BID report, only 64% of the Guatemalan population has mobile broadband coverage.

Mobile Network Operators (MNOs)

Since 2020, some aspects of the telecom sector have experienced a downturn, particularly in mobile device production; progress toward 5G implementation has resumed, as well as upgrades to infrastructure; consumer spending on telecom services has increased due to the surge in demand for capacity and bandwidth; the crucial nature of telecom services as a tool for work and school from home is still evident (Covid-19 pandemic), and the spike in this area has seen growth in development of new tools and increased services.

Although the level of service is higher and more convenient rates in Claro, Tigo is positioned as the most popular phone company in Guatemala. This is thanks to its significantly higher number of loyal customers, growth rate, engagement rate and interaction per post.

The two leading operators in the mobile telephony market in Guatemala have total hegemony in the sector, being the only ones to have their own infrastructure network to offer coverage throughout the national territory. Regarding the most used operator in Guatemala, Tigo is the leading company in the sector and the one with the largest number of users in the country. Despite this, the difference in market dominance with respect to Claro is not so marked, where in fact, each year the margin of difference becomes smaller.

Cellphone national coverage network

https://www.nperf.com/es/map/GT/-/-/signal/?ll=15.79026861482683&lg=-90.23&zoom=7

Note: Select the cell phone operator to visualize country coverage.

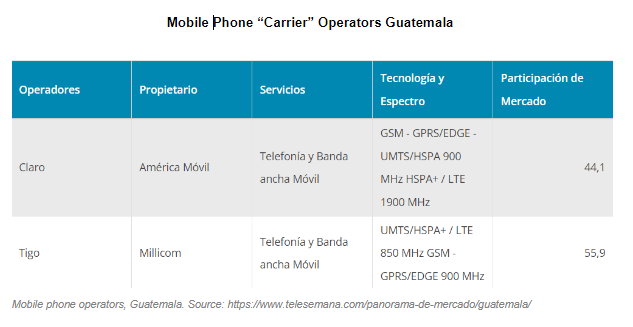

National Coordinator for Disaster Reduction CONRED

Radio base network

3.5 Guatemala Food and Additional Suppliers

The local markets in Guatemala are plentiful and currently meet the local population demands in regards to food and non-food items. If there was a requirement to scale up due to an emergency response items would be able to be sourced from the Central America region.

Main Food Suppliers

There is no shortage of food supplies available in Guatemala via local markets as well as supermarkets. Food supplies are either produced locally (fresh vegetables and fruit) or are imported from other provinces within Guatemala.

The main food suppliers’ long list can be summarized as follows:

Maize is the main source of calories and protein in the Guatemalan diet. White maize is more heavily consumed than yellow maize, but the latter is preferred in some regions and used as poultry feed.

Every Guatemalan household consumes black beans: as a source of protein which is particularly valuable complement to cereals in regions where households have limited access to animal products.

Consumption habits are strongly linked to tradition and culture. Rice is mainly consumed in urban and peri-urban, but some rural households consume it as well. Guatemala is highly dependent on imported rice. The market in Guatemala City is the largest in the country and feeds the highest concentration of the population.

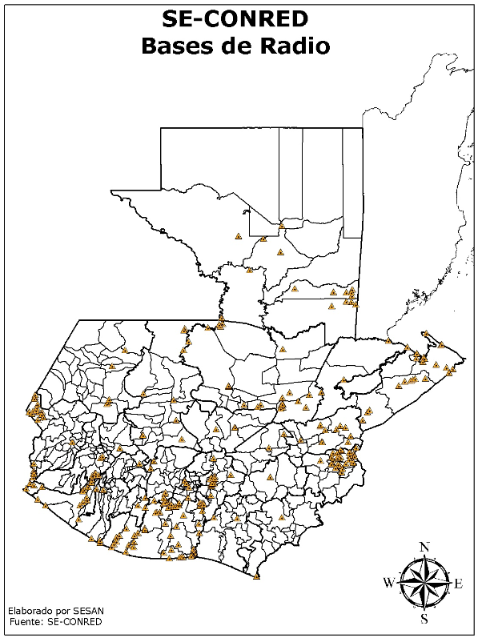

Guatemala Food Security Outlook

Crisis Results to persist in targeted areas despite seasonal improvements. November 2022

The stability in the exports of commercial crops and the better sales prices will allow the demand for temporary labour for the harvest to be in normal ranges. However, the purchasing power of households will be pressured by the high prices of food, transportation, and gasoline, particularly diesel, which is no longer subsidized.

In most of the country, basic grain crops developed adequately and the rains favoured plant growth; since the end of September the fresh grain began to flow in the markets. At the national level, harvests have been reported in ranges close to the average, especially for surplus and commercial farmers.

Source: https://fews.net/central-america-and-caribbean/guatemala/food-security-outlook/october-2022

The Famine Early Warning Systems Network is a leading provider of early warning and analysis on food insecurity. Created by USAID in 1985 to help decision-makers plan for humanitarian crises, FEWS NET provides evidence-based analysis on approximately 30 countries. Implementing team members include NASA, NOAA, USDA, USGS, and CHC-UCSB, along with Chemonics International Inc. and Kimetrica.

Aside from lower production costs, other advantages that domestic companies like these enjoy over their multinational rivals include strong distribution networks (which cover both major cities and provincial areas, as well as modern and more traditional retail channels) and superior knowledge of the traditional tastes and preferences of Guatemalan consumers.

The entry into the market of recent corn and bean crops, which usually drives the seasonal decline in prices, has been barely perceptible this year as prices have remained well above average. The price reduction between August and September 2021 was 11 percent, while between August and September of this year only a 1 percent decrease is reported. In September, wholesale prices for corn and beans were 62 and 41 percent above the five-year average, respectively. Other causes, in addition to the influence of international factors on prices, pushed prices above normal, such as the high price of fuel, particularly diesel, and the poor state of the roads. After the storm Julia, the damages caused by the heavy rains have increased the cost of freight transportation. The localized losses of basic grains due to rains and speculation have also contributed to this situation.

Tropical Storm Julia-22, impact. 2022

The passage of storm Julia at the beginning of October particularly affected the region of the Northern Transversal Strip and the Polochic area. In these areas, the soils were already saturated, so the rains quickly caused damage and loss of basic grain crops. It was the farmers in these areas who suffered the most, since the maize crops were already drying on the land (in doubles) or already harvested in the drying process in their homes where they do not have appropriate spaces for post-harvest handling. Damages and losses were also reported in land recently planted with beans from the Postrera cycle; as well as the deterioration of highways, roads and bridges that affected the movement of people and merchandise for several days and left some places cut off. On October 11, 2022, the government decreed a State of Calamity to respond to the effects caused by Tropical Storm Julia, but its actions have not yet been carried out until the end of October.

For official pricing information please see: https://precios.maga.gob.gt/

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.7 Guatemala Waste Management and Recycling Infrastructure Assessment

Overview

On average, each Guatemalan generates 0.519 kilograms of waste and solid residues daily. Of this amount, 53% corresponds to organic matter, 9% to sanitary waste, 9% to plastic and 6% to paper and cardboard.

The collection system in Guatemala City is carried out as follows: the municipality of Guatemala collects 13.7%, 71.3% by private companies, and 15% is deposited in illegal dumps or is burned in the open.

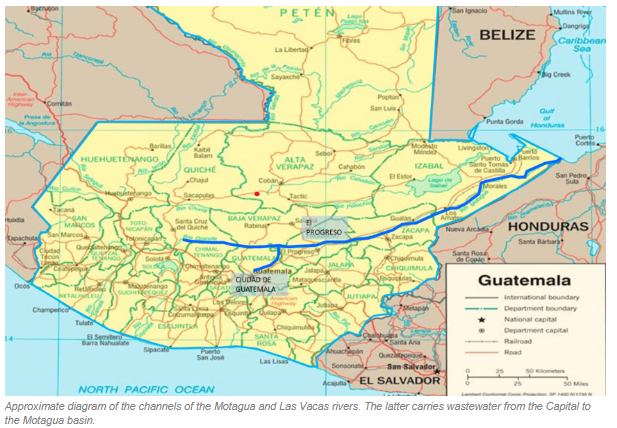

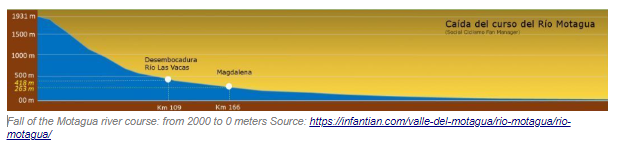

Only in Guatemala City, the residual waters, both domestic and industrial (65% of the companies in the country's industrial sector are located there which generates downloads of wastewater) in several cases do not pass through treatment plants and are discharged into the watercourses of the ravines. This has favoured the fact that water contamination has reached all the hydrographic basins of the City. The greatest load (63%) is received by the Motagua River.

The Motagua river receives, through the Las Vacas river basin, a large part of the wastewater residential, industrial and rainwater in Guatemala City, the water from the Motagua River is is the main source of water in the northeastern region of the country, both for irrigation of crops and for consumption by human and animal populations.

For more information on company contact details, please see the

following link:4.12

Waste Management Companies Contact

List.

The Guatemalan Regulation for Waste Management

Please see: https://sgp.gob.gt/wp-content/uploads/2021/08/AG-164-2021.pdf

About the regulation

This regulation of the Ministry of Environment and Natural Resources (MARN) involves all those individuals or legal entities, public or private, national or foreign that, as a result of their activities, produce residues or common solid waste, which must separate them at the moment of its generation and disposal.

The regulation is in force since August 2021, and in these first two years of its implementation, the classification is primary. In year 2023, secondary separation will begin (paper and cardboard, glass, plastic, metal, multilayer, plywood and others), which is mandatory.

This is the first regulation in Guatemala that regulates, in an integral way, the separation from the home, office, company or industry, the collection, transfer, storage, treatment and final disposal of garbage.

The new regulations also seek to promote the circular economy, a production and consumption model that values the materials of the products, in which the raw materials are kept longer in the production cycles, which implies recycling, reusing, repairing, renewing and to share.

Spaces for temporary storage of residues and waste must have minimum standards applicable to spaces or sites, as well as infrastructure, containers, collection vehicles, authorized procedures and adequate transportation.

The breach, omission and violation of the rules established in the regulation, as well as any infraction committed by the entities subject to the regulation that fail to comply with the provisions, will receive sanctions of one to 40 minimum wages.

Other efforts

Hidroeléctrica Río Las Vacas generates electrical energy that is 100% environmentally friendly, using the course of the Las Vacas River, which is made up of approximately 60% of the drains in Guatemala City. Is the first Guatemalan company certified by the United Nations for production free of carbon dioxide. The hydroelectric extract non-organic waste such as plastics and rubber from the Las Vacas River, which is processed in their own recycling plant and later transformed into useful elements.

https://www.hidrovacas.com/index.html

350 tons of waste are removed from the Motagua River during the first half of 2021

https://agn.gt/retiran-350-toneladas-de-desechos-del-rio-motagua-durante-primer-semestre-de-2021/

The Problem of Plastic Pollution in the Rio Motagua, Guatemala https://www.youtube.com/watch?v=DZ32lSQjWU0

Interceptor Trashfence Guatemala https://www.youtube.com/watch?v=4rVTWsQ23Pk

|

Company |

Street / Physical Address |

Name |

Title |

|

Phone Number (office) |

Fax Number |

Website |

Description of Waste Management Services |

|---|---|---|---|---|---|---|---|---|

|

Ecotermo |

9 Ave. 16-29 Zona 10, Guatemala |

n/a |

|

|

PBX: (502) 2305-5400 |

|

Bio waste management

|

|

|

Eco-reprocesos |

Oficina: Km.29.6 Carr.al Pacifico C.C. Flores del lago, Plaza D, 3er. Nivel Of. 13, Amatitlán, Guatemala 01063 |

n/a |

|

Tel: (502) 6671-6600 WhatsApp: (502) 4278-9328 |

|

Technical management of Non Hazardous , solid, liquid, industrial and commercial waste |

||

|

Thermodinamica |

Carr. Amatitlán Km. 12, Flexibodega 2, Bodega 4, Zona 0, Villa Nueva. |

n/a |

|

mercadeo@thermodinamica.net |

(502) 2234-9724 al 26 |

|

Comprehensive Management of Hospital Solid Waste and Industrial Waste.

|

|

|

Biotrash |

Offices: 15 Av. "A" 14-34 zona 10 Colonia Oakland II, Guatemala. Compound: 9na Calle 11-39 zona 5 Paraíso del Frutal, Villa Nueva |

|

|

gerente.financiero@biotrash.com

|

PBX: (502) 2291-2800 |

|

Guatemalan company focused on integral management of biohazardous waste from hospital solid waste, hazardous waste from industry, commerce and final consumer sector; electrical and electronic equipment, chemical products, PCBs and POPs. Provide training and assessment. Has ISO 9001 and 14001 certifications. Has licenses granted by the Ministry of Environment and Natural Resources, MARN |

|

|

Ministerio de Ambiente y Recursos Naturales Dirección para el Manejo de Residuos y Desechos Sólidos |

|

n/a |

|

|

MARN EN LINEA (502) 2423-0500 extensión 1021 PBX: (502) 2423-0500 |

|

|

Provide technical assistance to the public or private sector, for the management of residues and solid waste, when required |

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.