Overview

Over the past two decades, Cambodia has undergone a significant transition, reaching lower middle-income status in 2015 and aspiring to attain upper middle-income status by 2030. Driven by garment exports and tourism, Cambodia’s economy has sustained an average annual growth rate of 7.7 percent between 1998 and 2019, making it one of the fastest-growing economies in the world.

However, Cambodia is experiencing a resurgence of COVID-19 cases, which has slowed the recovery, especially of the service, construction, and real estate sectors. The growth projection for 2021 is now revised down to 2.2 percent, despite strong export performance supported by improved external demand conditions. Cambodia’s outlook remains highly uncertain, and risks are tilted to the downside. Despite accelerated vaccination progress, risks of a protracted COVID-19 outbreak, and further disruption remain high.

Employment and income had not recovered to their pre-pandemic levels even before the recent COVID-19 resurgence. About 69 percent of households’ main earners were employed in March 2021, 13 percentage points lower than before the pandemic. About 45 percent of households continued to experience income losses in March 2021. Disruptions to economic activities due to stringent measures to curb the outbreak have led to job losses or decreased working hours. School closures have disrupted education since late March 2021, especially for poor students.

Health and education, especially issues of quality and equitable access, remain important challenges and development priorities.

Cambodia has made considerable strides in improving maternal and child health, early childhood development, and primary education in rural areas. The maternal mortality ratio per 100,000 live births decreased from 472 in 2005 to 170 in 2014; the under-five mortality rate decreased from 83 per 1,000 live births in 2005 to 35 per 1,000 in 2014; and infant mortality rate decreased from 66 per 1,000 live births in 2005 to 28 per 1,000 in 2014. Despite the progress in health and education outcomes, human capital indicators lag behind lower middle-income countries. A child born in Cambodia today will be only 49 percent as productive when grown as she could be if she enjoyed full quality education, good health, and proper nutrition during childhood. An estimated one in three children under the age of five suffer from stunting and only 36 percent of children between three and five years old are enrolled in early education. While net enrolment in primary education increased from 82 percent in 1997 to 97 percent in 2020, lower secondary completion rates are at 45 percent in 2019. As of 2020, 15 percent of Cambodia’s population (2.5 million people) did not have access to improved water, and 23 percent (3.8 million people) did not have access to improved sanitation.

Key reforms are needed for Cambodia to sustain pro-poor growth, foster competitiveness, sustainably manage natural resource wealth, and improve access to and quality of public services. Cambodia continues to have a serious infrastructure gap and would benefit from greater connectivity and investments in rural and urban infrastructure. Further diversification of the economy will require fostering entrepreneurship, expanding the use of technology, and building new skills to address emerging labor market needs. Accountable and responsive public institutions will also be critical. The quality of human capital will be of utmost importance to achieve Cambodia’s ambitious goal of reaching middle-income status by 2030.

Last Updated: Oct 20, 2021

Source: https://www.worldbank.org/en/country/cambodia/overview#1

Agriculture

Cambodia is a least-developed country on its way to becoming a middle-income economy. While the garment industry, construction and tourism are the engines of the economic growth, the agricultural sector accounts for about 35 per cent of the GDP and employs a large majority of the population. Agriculture is therefore central to poverty reduction and hunger eradication in Cambodia. Cambodia is blessed with an abundance of natural resources including land and water, favourable climatic conditions and geographic position, which represent potential comparative advantages for increased agricultural production and livelihood improvements. Crop production contributes about 54 per cent of the sector GDP, with fisheries accounting for 25 per cent, livestock for 15 per cent and forestry and logging for about 6 per cent. Although only 8 per cent of the rice is irrigated, the rice production has increased steadily and made Cambodia not only self-sufficient in rice, but even an important exporter. Other important food crops include corn, soybean, mung bean, cassava and fruits such as mango, pineapple, jackfruit, durian, rambutan and banana. Cash crops have also seen a significant expansion in particular sugar cane, and rubber and palm oil. Fish is the main source of protein in people’s diet and marine fisheries and freshwater fishing in lakes and waterways, in particular the Tonle Sap and the Mekong, contribute substantially to incomes, jobs and food security. The livestock sector is underdeveloped with small animals such as pigs, ducks and chickens raised mainly for household consumption.

Source: https://www.fao.org/cambodia/fao-in-cambodia/cambodia-at-a-glance/en/

Banking

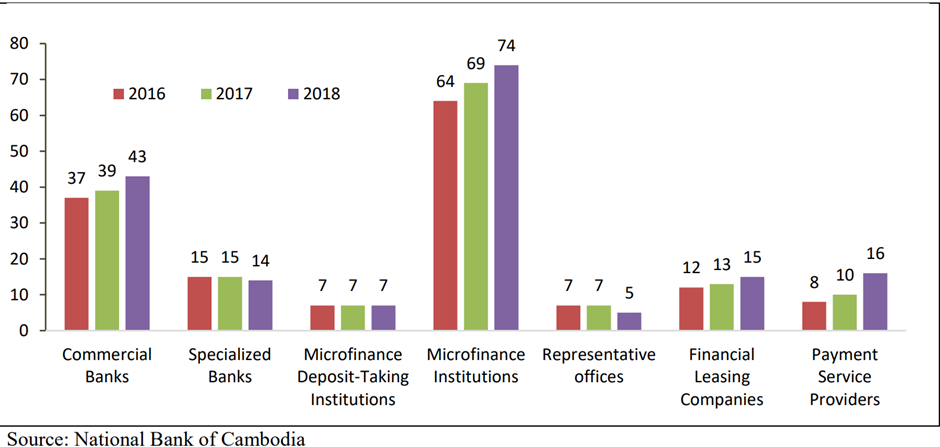

Cambodia is a bank-based economy. Commercial banks are the primary source of funding. The Cambodian banking system is a two-tier system comprising the Central Bank (National Bank of Cambodia), and private sectors such as commercial banks, specialized banks, microfinance institutions, and a number of NGOs involved in rural credit activities. The key players in Cambodia’s banking sector are NBC, 43 commercial banks, 14 specialized banks including one state bank, 5 Representative office of foreign commercial banks, 74 microfinance institutions where 7 are eligible to collect customer deposits, and 15 financial leasing companies. As of December 2018, there were 151 financial institutions operating in Cambodia. By December 2017, the financial institutions reported an outstanding loan balance of $16.127 billion with the number of borrowers of 2.589 million.

Recent liberal investment regime and open market trade policies have gathered momentum for Cambodia's economic prospects and banks are also enjoying benefits from such strong growth opportunities. The Cambodian banking sector has been improving and growing steadily over the past two decades; yet; it still lacks financial depth and is being fragmented. To gain more international confidence, significant progresses are necessitated to address structural distortions such as inadequate legal framework for secured transactions, and information asymmetry arising from poor disclosure standards.

Information Technology (IT)

As Cambodia’s development progresses and its youth and businesses get to grips with the available and emerging technologies, the Information Technology sector is one that is seen as having exponential growth and opportunity. Demand for the internet, mobile phones and other forms of technologies continue to increase, with the youthful population and entrepreneurs realising the future potential in this area. Cambodia also skipped past landlines and moved quickly to adopt smartphones and embrace the internet with one of the highest mobile phone and internet penetrations in the region.

Updated December 2020.

Source: https://www.b2b-cambodia.com/industry-overviews/it-communications/

Manufacturing

Cambodia’s economy is forecast to grow 4.0% this year and 5.5% in 2022, as the economic recovery in major trading partners boosts demand for Cambodia’s exports, according to an Asian Development Bank (ADB) report. The economy contracted by 3.1% in 2020 because of the global coronavirus disease (COVID-19) pandemic. According to the Asian Development Outlook (ADO) 2021, industrial production is expected to rise 7.1% in 2021 and 7.0% in 2022 on the back of a rebound in the garments, footwear, and travel goods sector, as well as growth in other light manufacturing such as electronics and bicycles.

Electricity Supply

The Electricity Law was promulgated in February 2001 with the view to regulate the power sector and the Electricity Authority of Cambodia (EAC) was established as a legal public entity to act as the Regulator and the arbitrator of power sector business activities. The Cambodian strategy for the development of electricity supply is to construct transmission lines between major cities in southern and western regions [1] in order to construct large-scale power generating plants and to import electric power from neighbouring countries during the construction period of such power plants.

In Cambodia, electricity is generated and/or distributed by the following entities.

- Electricite Du Cambodge (EDC), a government enterprise

- Private entities including Independent Power Producers (IPP) in the provincial towns

- Licensees in smaller towns, and

- Rural Electricity Enterprises (REE) in the rural areas

EDC has a consolidated license (generation, distribution and transmission) for electricity supply in Phnom Penh, Knadal, in the 12 following provincial capitals, namely, Sihanoukville, Kampong Cham, Takeo and Battambang, Siem Reap, Bonteay Meanchey, Kampot, Kampong Speu, Steng Treng, Svay Rieng, Prey Veng, Rattanakiri (Banlung), and in the four following regions bordering on Vietnam, namely Bavet (Svay Rieng), Memot (Kampong Cham), Phonhea Krek (Kampong Cham) and Kampong Trach (Kampot).

The electricity supply currently does not meet the basic demands, where 24-hour supply of electricity is not assured, and the quality of electricity is not reliable. According to the Power Development Plan of the Kingdom of Cambodia in 2007, electricity demand is expected to show a rapid increase until 2020. The future power demand is summarized in below table.

Power Demand Forecast (MW)

|

2012 |

2015 |

2018 |

2020 |

|---|---|---|---|

|

1,062 |

1,643 |

2,283 |

2,770 |

For more information, please go to link: http://www.cambodiainvestment.gov.kh/investors-information/infrastructure/electricity.html

Disclaimer: The inclusion of a logistics service provider in this LCA does not imply any business relationship between the supplier and WFP/Logistics Cluster, and is provided for information purposes only.

Please Note: WFP/Logistics Cluster maintain complete impartiality and are not in a position to endorse or comment on any company's suitability as a reputable service provider.