Ethiopia - 3 Ethiopia Services and Supply

Ethiopia is the second most populous country in Africa (120,283,026 in 2020 according to the World Bank)1, is a one-party state with a planned economy.

Ethiopia is a growing Horn of Africa construction- and services-based economy, with annual GDP growth rate of 5.6% in 2021. In 2022, the real GDO growth fell to 5.3% but remained above East Africa’s average.2 The fall in GDP growth and the rise in inflation to 34% in 2022 result from internal conflict and humanitarian crises, but also macro-economic conjunctures. According to the African Development Bank, the GDP of Ethiopia is projected to grow 5.8% in 2023 and 6.2% in 2024. The industries projected to support this growth include tourism, industry, private consumption and investment, as well as the prospect of liberalizing additional sectors.3

The agricultural sector remains the largest contributor to Ethiopia’s GDP (37.57%), followed by Services (36.25%) and Industry (21.85%).4 According to the African Development Bank, recent supply-side drivers of growth include industry and services, while demand-side drivers include private consumption and investment.

Ethiopia - 3.1 Ethiopia Fuel

Overview

Ethiopia consumes daily one million litres of benzene, 6.5 million litres of diesel and two million litres of jet fuel. The annual kerosene consumption is 260,000 metric tons. The consumption of kerosene is dwindling as the public is using electric stoves instead of kerosene ones. The country has 13 fuel depots in different parts of the country that can store 360,000 cubic meters of petroleum products.

Local supply (domestic refinery production and imports combined) does meet the needs of the country, especially for aviation and ground fuels. There are some national priorities in the availability of fuel but the local industry can expand the fuel supply to meet the needs of humanitarian organisations. It is also possible for humanitarian organizations to contract a reputable supplier/distributor directly to provide its fuel needs.

Fuel transactions in Addis Ababa has gone digital in all the gas stations as part of a planned nationwide roll out. The gas stations started implementing mandatory fuel transactions through digital payments electronically through ethio telecom’s platform, telebirr after instructions from the Petroleum and Energy Authority. The platform will offer a seamless and secure payment system that will benefit both customers and fuel stations. This has also created some initial bottlenecks; large ques are seen at the fuel stations because vendors and public are still learning how to use this newly implemented system. https://ethiopianmonitor.com/2023/04/25/gas-stations-in-addis-start-digital-fuel-transactions-ahead-of-nationwide-rollout/

For more information on government and fuel provider contact details, please see the following links: 4.1 Government Contact List and 4.7 Fuel Providers Contact List

Information may also be found at: http://www.mytravelcost.com/petrol-prices/ which is updated monthly.

Energy Pricing

Energy Pricing Energy pricing policy plays a crucial role in mainstreaming energy markets such that certain preferred energy forms and services could be used in lieu of other less preferred options. Energy production and utilization efficiency, energy transition, access to modern energy services, expansion of renewable energy technologies, carbon neutrality in energy utilization, competition and investment decisions in the energy sector could all be influenced through the application of appropriate pricing instruments. The most desirable pricing policy is to follow market prices whenever the conditions exist for competitive markets. However, market imperfections prevail in energy markets requiring pricing policy interventions to reflect true costs of energy services that internalize financial, economic, social and environmental costs.

The energy pricing policy instruments allows market mechanisms to play central role if the presence of market imperfections do not obstruct the realization of certain basic energy objectives and principles. It applies basic principles of longer-term cost-effectiveness and financial viability, economic efficiency, income distribution/ social well-being, and sustainable development as main drivers for energy pricing intervention. It Introduces targeted and time-bound subsidies and pricing instruments in areas where market mechanisms fail to promote access to certain energy services for low-income groups, and when certain energy forms fail to compete until bottlenecks are removed. Provides clear signal to energy consumers and producers through pricing mechanisms. Keeps updated pricing information for biomass and other fuels (at key geographic areas).

The Federal Democratic Republic of Ethiopia Ministry of Trade and Industry revises the price of fuel every month based on the world market.

Source ( Ethiopia: Ministry Announces Revised Fuel Prices (2merkato.com)

|

Fuel Prices per Litre as of: May 2023 (local currency and USD - $) |

|

|---|---|

|

Petrol |

69.43 ETB 1.27USD |

|

Diesel |

71.08 ETB 1.28 USD |

|

Paraffin |

71.08 ETB 1.28 USD |

|

Jet A-1 |

66.60 ETB 1.22 USD |

Seasonal Variations

The seasonal variations are mostly based on the world market rates. Priorities are therefore given to key bodies like medical ambulance, military, police and firefighting equipment. Rationing is done in locations that are dependent on generators. For the UN, WFP imports bulk fuel which augments supply from the local market. WFP has also prepositioned bulk fuel for its operation in cities with limited supply, this also supports other UN Agencies and International Humanitarian Organizations.

|

Seasonal Variations |

|

|---|---|

|

Are there national priorities in the availability of fuel? (i.e. are there restrictions or priorities for the provision of fuel such as to the military?) |

Yes |

|

Is there a rationing system? |

No |

|

Is fuel to lower income / vulnerable groups subsidized? |

No |

|

Can the local industry expand fuel supply to meet humanitarian needs? |

Yes |

|

Is it possible for a humanitarian organization to directly contract a reputable supplier / distributor to provide its fuel needs? |

Yes |

Fuel Transportation

Ethiopia being a landlocked country, its fuel and lubricants imports are through the port of Djibouti and stored in Horizon Djibouti terminal (HDT) This facility has two berths that accommodates 12 fuel tanker trucks loading bay. Road transportation is done from two (2) corridors via Galafi border mille-Awash or Dewele. The major fuel importers are Ethiopian Petroleum Supply Enterprise (EPSE) who does importation for diesel, fuel and kerosene while Ethiopian Airlines Enterprise does aviation fuel.

Some existing bottleneck in the transportation of fuel is impacted by high port and handling charges, indirect additional transit costs, vehicle operating cost which is caused by fuel levy and in some section of the country poor rood network. Main transportation mode is railway and road. There’s a growing demand against the supply in commercial market. Long queues are regularly seen in most fuel stations across the country including the capital city. This is characterized by shortage of road freight transport capacity in the country. The gradual reduction of fuel subsidy has also seen an upward price change.

Standards, Quality and Testing

The Ethiopian ministry of energy established regulatory body to control fuel adulteration practice. However, consumer have challenges in identifying if fuel quality in the market is within set standards. Ethiopian Standard Authority (ESA) is an agency mandated to conduct fuel quality test. Other companies have acquired own density testing equipment for instance glass hydrometer for streamlining their own internal controls

|

Industry Control Measures |

|

|---|---|

|

Do tanks have adequate protection against water mixing with the fuel? |

Yes |

|

Are there filters in the system which monitor where fuel is loaded into aircraft? |

Yes |

|

Is there adequate epoxy coating of tanks on trucks? |

n/a |

|

Is there a presence of suitable firefighting equipment? |

Yes |

|

Standards Authority |

|

|---|---|

|

Is there a national or regional standards authority? |

Yes |

|

If yes, please identify the appropriate national and/or regional authority. |

National: Regional: |

|

If yes, are the standards adequate/properly enforced? |

Yes |

|

Testing Laboratories |

|

|---|---|

|

Are there national testing laboratories? |

Yes |

|

Fuel Quality Testing Laboratory |

|

|---|---|

|

Company |

n/a |

|

Name |

n/a |

|

Address |

n/a |

|

Telephone and Fax |

n/a |

|

Contact |

n/a |

|

Standards Used |

n/a |

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Ethiopia - 3.2 Ethiopia Transporters

In Ethiopia there are currently 12,766 cross border vehicles. Of which, 2871 are of 20 – 29.9MT capacity, 710 are of 30 – 34.9 MT capacity, 1,734 are of 35 – 37.9MT capacity and 7,451 are of 38 MT and above capacity.

The usage age of these vehicles ranges between 0 and 20. Out of the 12,766 total trucks, 5,811 are between 0-10 years, 2,703 are between 10.1 and 15, while 1,860 are between 15.1 and 20 with 2,392 trucks aging 20 years and above.

For more information on transport company contact details, please see the following link: 4.8 Ethiopia Transporter Contact List.

Below is summary table of transporters available for both inland and overland transportations (source WFP June 2023)

|

No |

Name |

Number of trucks |

Capacity |

Focus Area |

|---|---|---|---|---|

|

1 |

Abdirashad Ahmed Local Inland Freight Private Transport |

10.00 |

239.95 |

Inland |

|

2 |

Abeba Transport Private Limited Company |

15.00 |

571.30 |

Djibouti |

|

3 |

Abiyot Woltaji (Gambella) |

|

|

Gambella Inland and Overland SS |

|

4 |

Ahmed Hassen Local Inland Freight Private Transport |

9.00 |

320.18 |

Inland |

|

5 |

Ahmed Yusuf (Boxooshe) local Inland level 4 Freight Private Transport |

8.00 |

205.80 |

Inland |

|

6 |

Al-Nasri Inland Level 3-B Transport Owners Association |

50.00 |

615.73 |

Inland |

|

7 |

Asefa Gurmessa |

|

|

Gambella Inland and Overland SS |

|

8 |

Asmamaw Layke Local Inland Freight Private Transport |

18.00 |

521.15 |

Inland |

|

9 |

Asmamaw Melesse Local Inland Level-4 Freight Private Transport |

10.00 |

447.30 |

Inland |

|

10 |

Atlantic Local Inland Level 3-B Freight Transport Owners association |

57.00 |

1839.90 |

Inland |

|

11 |

Awash cross border Level 4 Dry Freight Private Company |

66.00 |

2820.60 |

Djibouti |

|

12 |

Awel Ansha Agri. Development, Grain Trade & Pvt Cargo Freight Tr. |

34.00 |

1306.27 |

Inland |

|

13 |

Awsa Dry Freight Service Private Limited Company |

10.00 |

158.38 |

Inland |

|

14 |

Aynalem Seyoum Level 2 Cross Border Private Transport |

17.00 |

637.10 |

Djibouti |

|

15 |

Babile Domestic Level 2-B Freight Transport Owners association |

80.00 |

1095.57 |

Inland |

|

16 |

Bekelcha Transport Share Company |

97.00 |

3667.20 |

Djibouti |

|

17 |

Bekele Wolde Local inland Level 4 Freight Pvt. Transport |

20.00 |

765.00 |

Inland |

|

18 |

Berhe Hagos Import Export |

24.00 |

904.00 |

Djibouti |

|

19 |

Birhan Cross Border Level 2-A Freight Transport Owenrs Association. |

|

7964.74 |

Inland |

|

20 |

Bollore Transport and Logistics Ethiopia SC |

|

|

Djibouti |

|

21 |

Chilalo Enterprise PLC |

7.00 |

221.21 |

Inland |

|

22 |

Dallol Transport and Trade Share Company |

6.00 |

226.20 |

Djibouti and Inland |

|

23 |

Darul Iman Local inland Level 3B Freight T.O.A |

50.00 |

675.61 |

Inland |

|

24 |

Dejen Transport and Logistics Share Company |

|

|

Djibouti |

|

25 |

Deyah Local Inland Level 3-B Freight Tranbsport OA |

50.00 |

678.45 |

Inland |

|

26 |

Edmealem Ejigu Tesema |

49.00 |

1879.60 |

Djibouti |

|

27 |

Emal trading and Logistics PLC |

10.00 |

513.70 |

Djibouti |

|

28 |

Emergency Relief Transport Enterprise (ERTE) |

42.00 |

1802.90 |

Djibouti |

|

30 |

Express Cross Border Level 1 Dry Freight Private Transport |

56.00 |

2114.80 |

Djibouti |

|

31 |

Fafan Transport and Construction Co. |

13.00 |

437.59 |

Inland |

|

32 |

Fana Transport and Trading PLC |

2.00 |

80.00 |

Djibouti |

|

33 |

Fikadu Yilma Azule |

|

|

Gambella Inland and Overland SS |

|

34 |

Gashaw Bishaw Local Inland Freight Private Transport |

15.00 |

415.43 |

Inland |

|

35 |

Get - As International Pvt.Ltd.Co Tran. Unit |

53.00 |

2005.50 |

Djibouti |

|

36 |

Global Transport and Trade Share Company |

|

|

Djibouti |

|

37 |

GS trading PLC |

77.00 |

3080.00 |

Djibouti |

|

38 |

Habtamu Tamene Local Inland Level 4 Freight Private Transport |

12.00 |

411.58 |

Inland |

|

39 |

Haile Tesfakiros Cross Border L-4 Pvt Freight Tra. |

42.00 |

1601.90 |

Djibouti |

|

40 |

Hailemariam Mazengia Local Inland Level 4 Private FT |

12.00 |

418.45 |

Inland |

|

41 |

Hargele Hamole PLC |

25.00 |

957.50 |

Djibouti |

|

42 |

Hidase Transport and Trade Share Company |

|

|

Djibouti |

|

43 |

Hire Local inland Freight transport Cooperation |

48.00 |

591.97 |

Inland |

|

44 |

Hodosan Local Inland Level 3-B Freight Transport Owners Association |

56.00 |

709.29 |

Inland |

|

45 |

Horu Transport and Trade Share Company |

10.00 |

385.70 |

Djibouti and Inland |

|

46 |

Hossana Freight Transport |

24.00 |

920.70 |

Inland |

|

47 |

Idil Transport and Trading PLC |

10.00 |

345.75 |

Inland |

|

48 |

Jet Transport PLC |

|

|

Djibouti |

|

49 |

Jilcha Ketema Weldetsadik |

|

|

Gambella Inland and Overland SS |

|

50 |

Kokeb Transport and Trade Share Company |

|

|

Djibouti |

|

51 |

Loul Riek Jock Freight Transport |

|

|

Gambella Inland and Overland SS |

|

52 |

Lusidle Logistics and Transport PLC |

|

|

Gambella Inland and Overland SS |

|

53 |

Maccfa Freight Logistics Private Limited Company |

14.00 |

507.70 |

Djibouti |

|

54 |

Medin Fana Transport Logistics and Trade Share Company |

6.00 |

229.80 |

Djibouti |

|

55 |

Mekonen Seid Private Freight Transport |

18.00 |

577.80 |

Inland |

|

56 |

Midnimo Local Inland level 3 B Freight Transport Owners Association |

20.00 |

|

Inland |

|

57 |

Mohammed Mohamud Abdi level 4 Local Inland Freight transport company |

9.00 |

185.35 |

Inland |

|

58 |

Mubarak Local Inland Level 3-B Freight Transport OA |

56.00 |

689.39 |

Inland |

|

59 |

Myseru General Trading PLC |

69.00 |

2609.80 |

Djibouti and Inland |

|

60 |

Nefas Silk Paints Factory PLC |

105.00 |

4289.60 |

Djibouti |

|

61 |

Nigat shumiye local grade 4 dry freight private transport |

19.00 |

638.21 |

Inland |

|

62 |

Nuredin Aliye Freight Transport |

13.00 |

428.97 |

Inland |

|

63 |

Region 5 Transport and Construction Company |

10.00 |

484.25 |

Inland |

|

64 |

Sahid Transport |

8.00 |

173.96 |

Inland |

|

65 |

Selam Cross Border Level 2-A Freight Transport Owners Association |

|

|

Djibouti and Inland |

|

66 |

Semien Transport and Trade Share Company |

|

|

Djibouti |

|

67 |

Shewaye Gebru Transport |

|

|

Gambella Inland and Overland SS |

|

68 |

Shewaye W/mairam Memorial Local Inland Dry Freight Pvt. Transport |

12.00 |

426.54 |

Inland |

|

69 |

Shikur Abder Local Inland Level 4 Freight Private Transport |

8.00 |

147.37 |

Inland |

|

70 |

Shikur Abubeker Local Inland Freight Private Transport |

19.00 |

725.13 |

Inland |

|

71 |

Star Local Inland Transport L-3B Freight Transport A |

31.00 |

548.35 |

Inland |

|

72 |

Teff Transport Private Limited company |

40.00 |

1534.40 |

Djibouti and Inland |

|

73 |

TEKHAF Trading Private Limited Company |

36.00 |

1359.10 |

Djibouti |

|

74 |

Tenagnework Transport |

15.00 |

516.41 |

Inland |

|

75 |

Tikur Abay Transport PLC |

153.00 |

6307.70 |

Djibouti and Inland |

|

76 |

Trans-Ethiopia Transport PLC |

|

|

Djibouti |

|

77 |

Tsehay Transport and Trade Share Company |

|

|

Djibouti |

|

78 |

Ugaadah Transportation Company |

8.00 |

216.00 |

Inland |

|

79 |

Umer Hassen Dry Freight Pvt. Transport |

20.00 |

780.14 |

Inland |

|

80 |

Yaregal Dereje Zerhun Freight Transport |

26.00 |

949.00 |

Djibouti |

|

81 |

Yibelu Mosseiewa Private Freight Transport |

25.00 |

955.40 |

Djibouti |

|

82 |

Yohanes Kebede Local Inland Freight Transport |

10.00 |

384.82 |

Inland |

|

83 |

YORRAT Level-4 Local Inland freight Private Transport |

10.00 |

400.00 |

Inland |

|

Medin Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

1 |

370 in working condition 16 under maintenance

|

|

30 – 34.9 MT |

3 |

|

|

35 – 37.9 MT |

57 |

|

|

38 MT and > |

335 |

|

|

Total Capacity |

386 |

|

|

Bright Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

7 |

236 in working condition 13 under maintenance 46 not in service |

|

30 – 34.9 MT |

3 |

|

|

35 – 37.9 MT |

80 |

|

|

38 MT and > |

205 |

|

|

Total Capacity |

295 |

|

|

Grand United Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

18 |

348 in working condition 20 under maintenance 5 not in service |

|

30 – 34.9 MT |

9 |

|

|

35 – 37.9 MT |

42 |

|

|

38 MT and > |

304 |

|

|

Total Capacity |

373 |

|

|

Welel Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

24 |

304 in working condition 26 under maintenance 3 not in service |

|

30 – 34.9 MT |

4 |

|

|

35 – 37.9 MT |

90 |

|

|

38 MT and > |

215 |

|

|

Total Capacity |

333 |

|

|

Tsehay Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

275 in working condition 16 under maintenance 5 not in service |

|

30 – 34.9 MT |

16 |

|

|

35 – 37.9 MT |

83 |

|

|

38 MT and > |

236 |

|

|

Total Capacity |

335 |

|

|

Miraf Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

29 |

198 in working condition 18 under maintenance 5 not in service |

|

30 – 34.9 MT |

7 |

|

|

35 – 37.9 MT |

37 |

|

|

38 MT and > |

148 |

|

|

Total Capacity |

221 |

|

|

Fetan Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

1 |

270 in working condition 3 under maintenance 19 not in service |

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

73 |

|

|

38 MT and > |

213 |

|

|

Total Capacity |

292 |

|

|

Kokeb Africa Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

9 |

223 in working condition 2 under maintenance 16 not in service |

|

30 – 34.9 MT |

3 |

|

|

35 – 37.9 MT |

55 |

|

|

38 MT and > |

174 |

|

|

Total Capacity |

241 |

|

|

Continental Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

1 |

128 in working condition 12 under maintenance 1 not in service |

|

30 – 34.9 MT |

1 |

|

|

35 – 37.9 MT |

40 |

|

|

38 MT and > |

99 |

|

|

Total Capacity |

241 |

|

|

Dejen Cross Border Level-1A Freight Transport Owners Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

1 |

246 in working condition 10 under maintenance

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

73 |

|

|

38 MT and > |

182 |

|

|

Total Capacity |

256 |

|

|

Ethiopia Sea Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

330 in working condition 17 under maintenance 2 not in service |

|

30 – 34.9 MT |

24 |

|

|

35 – 37.9 MT |

8 |

|

|

38 MT and > |

317 |

|

|

Total Capacity |

349 |

|

|

Trans Ethiopia Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

389 working 44 not in service |

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

433 |

|

|

Total Capacity |

433 |

|

|

Derba Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

All working |

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

314 |

|

|

Total Capacity |

314 |

|

|

Tikur Abay P.L.C Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

4 |

152 working trucks 73 under maintenance 31 not in service |

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

73 |

|

|

38 MT and > |

179 |

|

|

Total Capacity |

256 |

|

|

Get - As International Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

All working |

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

127 |

|

|

Total Capacity |

127 |

|

|

Bakkalcha Transport Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

127 working trucks 19 under maintenance

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

146 |

|

|

Total Capacity |

146 |

|

|

Orkid Business Group Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

103 working trucks 17 under maintenance 24 not in service

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

144 |

|

|

Total Capacity |

144 |

|

|

Mayseru General Business P.L.C Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

77 working trucks 25 under maintenance

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

102 |

|

|

Total Capacity |

102 |

|

|

Haile Tesfakiros Private Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 1 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

13 |

157 working trucks 15 under maintenance 4 not in service

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

24 |

|

|

38 MT and > |

139 |

|

|

Total Capacity |

176 |

|

|

United Border Crossing Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

60 |

167 working trucks 43 under maintenance 33 not in service

|

|

30 – 34.9 MT |

25 |

|

|

35 – 37.9 MT |

45 |

|

|

38 MT and > |

113 |

|

|

Total Capacity |

243 |

|

|

Gose Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

17 |

92 working trucks 2 under maintenance

|

|

30 – 34.9 MT |

7 |

|

|

35 – 37.9 MT |

21 |

|

|

38 MT and > |

49 |

|

|

Total Capacity |

94 |

|

|

Ghion Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

5 |

84 working trucks 10 under maintenance 19 not in service

|

|

30 – 34.9 MT |

9 |

|

|

35 – 37.9 MT |

23 |

|

|

38 MT and > |

76 |

|

|

Total Capacity |

113 |

|

|

Birhan Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

11 |

106 working trucks 6 under maintenance 18 not in service

|

|

30 – 34.9 MT |

8 |

|

|

35 – 37.9 MT |

36 |

|

|

38 MT and > |

75 |

|

|

Total Capacity |

130 |

|

|

Star Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

13 |

77 working trucks 23 under maintenance 13 not in service

|

|

30 – 34.9 MT |

12 |

|

|

35 – 37.9 MT |

23 |

|

|

38 MT and > |

65 |

|

|

Total Capacity |

113 |

|

|

Alpha Cross Border Level-2A Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

11 |

106 working trucks 6 under maintenance 18 not in service

|

|

30 – 34.9 MT |

8 |

|

|

35 – 37.9 MT |

36 |

|

|

38 MT and > |

75 |

|

|

Total Capacity |

112 |

|

|

Speed Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

36 |

97 working trucks 16 under maintenance 8 not in service

|

|

30 – 34.9 MT |

11 |

|

|

35 – 37.9 MT |

17 |

|

|

38 MT and > |

57 |

|

|

Total Capacity |

121 |

|

|

Africa Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

1 |

97working trucks 10 under maintenance 19 not in service

|

|

30 – 34.9 MT |

30 |

|

|

35 – 37.9 MT |

22 |

|

|

38 MT and > |

73 |

|

|

Total Capacity |

126 |

|

|

Selam Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

8 |

68 working trucks 11 not in service

|

|

30 – 34.9 MT |

10 |

|

|

35 – 37.9 MT |

35 |

|

|

38 MT and > |

26 |

|

|

Total Capacity |

79 |

|

|

Blue Nile Cross Border Level-2A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

3 |

87 working trucks 13 under maintenance 3 not in service

|

|

30 – 34.9 MT |

1 |

|

|

35 – 37.9 MT |

18 |

|

|

38 MT and > |

81 |

|

|

Total Capacity |

103 |

|

|

Anbesa Beandinet Level-2A Cross Border Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

3 |

39 working trucks 6 under maintenance 16 not in service

|

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

7 |

|

|

38 MT and > |

46 |

|

|

Total Capacity |

61 |

|

|

Vision Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

4 |

75 working trucks 6 under maintenance 3 not in service

|

|

30 – 34.9 MT |

|

|

|

35 – 37.9 MT |

12 |

|

|

38 MT and > |

68 |

|

|

Total Capacity |

84 |

|

|

Solution Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

3 |

52 working trucks 40 under maintenance 14 not in service

|

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

15 |

|

|

38 MT and > |

83 |

|

|

Total Capacity |

106 |

|

|

FAST Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

3 |

42 working trucks 16 under maintenance 32 not in service

|

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

22 |

|

|

38 MT and > |

60 |

|

|

Total Capacity |

90 |

|

|

Unity Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

392 |

381 working trucks 28 under maintenance

|

|

30 – 34.9 MT |

11 |

|

|

35 – 37.9 MT |

3 |

|

|

38 MT and > |

3 |

|

|

Total Capacity |

409 |

|

|

Yegna Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

184 |

179 working trucks 13 under maintenance 12 not in service

|

|

30 – 34.9 MT |

17 |

|

|

35 – 37.9 MT |

3 |

|

|

38 MT and > |

3 |

|

|

Total Capacity |

204 |

|

|

Guna Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

10 |

180 working trucks 1 under maintenance 3 not in service

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

6 |

|

|

38 MT and > |

180 |

|

|

Total Capacity |

184 |

|

|

Id Yor Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

147 |

132 working trucks 11 under maintenance 9 not in service

|

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

- |

|

|

Total Capacity |

152 |

|

|

Addis Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

17 |

119 working trucks 15 under maintenance 6 not in service

|

|

30 – 34.9 MT |

21 |

|

|

35 – 37.9 MT |

4 |

|

|

38 MT and > |

98 |

|

|

Total Capacity |

140 |

|

|

Ketef Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

37 |

117 working trucks 11 under maintenance 1 not in service

|

|

30 – 34.9 MT |

46 |

|

|

35 – 37.9 MT |

22 |

|

|

38 MT and > |

24 |

|

|

Total Capacity |

129 |

|

|

Abiykiber Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

116 |

126 working trucks 7 under maintenance 9 not in service

|

|

30 – 34.9 MT |

12 |

|

|

35 – 37.9 MT |

3 |

|

|

38 MT and > |

11 |

|

|

Total Capacity |

142 |

|

|

Biza Cross Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 2B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

68 |

71 working trucks 3 under maintenance

|

|

30 – 34.9 MT |

1 |

|

|

35 – 37.9 MT |

4 |

|

|

38 MT and > |

1 |

|

|

Total Capacity |

74 |

|

|

Union Cross Border Level-3A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

6 |

149 working trucks 14 under maintenance 4 not in service

|

|

30 – 34.9 MT |

85 |

|

|

35 – 37.9 MT |

35 |

|

|

38 MT and > |

41 |

|

|

Total Capacity |

167 |

|

|

Yemisrach Africa Cross Level-3A Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

48 |

51 working trucks 7 under maintenance 25 not in service

|

|

30 – 34.9 MT |

14 |

|

|

35 – 37.9 MT |

3 |

|

|

38 MT and > |

18 |

|

|

Total Capacity |

83 |

|

|

Millennium Cross Border Level-3A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

25 |

80 working trucks 1 under maintenance

|

|

30 – 34.9 MT |

8 |

|

|

35 – 37.9 MT |

18 |

|

|

38 MT and > |

30 |

|

|

Total Capacity |

81 |

|

|

Buna Cross Border Level-3A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

16 |

60 working trucks 14 under maintenance 15 not in service

|

|

30 – 34.9 MT |

20 |

|

|

35 – 37.9 MT |

22 |

|

|

38 MT and > |

31 |

|

|

Total Capacity |

89 |

|

|

Tekeze Cross Border Level-3A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

25 |

57 working trucks 10 under maintenance 3 not in service |

|

30 – 34.9 MT |

15 |

|

|

35 – 37.9 MT |

9 |

|

|

38 MT and > |

21 |

|

|

Total Capacity |

70 |

|

|

Misrak Cross Border Level-3A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

18 |

74 working trucks 5 under maintenance 3 not in service

|

|

30 – 34.9 MT |

42 |

|

|

35 – 37.9 MT |

6 |

|

|

38 MT and > |

16 |

|

|

Total Capacity |

82 |

|

|

Gibe Cross Border Level-3A Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3A |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

2 |

28 working trucks 4 under maintenance

|

|

30 – 34.9 MT |

7 |

|

|

35 – 37.9 MT |

12 |

|

|

38 MT and > |

11 |

|

|

Total Capacity |

74 |

|

|

Yetebaberut Cross Level-3B Border Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

146 |

112 working trucks 24 under maintenance 34 not in service

|

|

30 – 34.9 MT |

17 |

|

|

35 – 37.9 MT |

7 |

|

|

38 MT and > |

- |

|

|

Total Capacity |

170 |

|

|

Miraj Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

118 |

90 working trucks 16 under maintenance 18 not in service

|

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

1 |

|

|

Total Capacity |

124 |

|

|

Generation 2000 Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

113 |

75 working trucks 16 under maintenance 22 not in service

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

- |

|

|

Total Capacity |

113 |

|

|

Wegagen Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

112 |

88 working trucks 12 under maintenance 16 not in service

|

|

30 – 34.9 MT |

1 |

|

|

35 – 37.9 MT |

2 |

|

|

38 MT and > |

1 |

|

|

Total Capacity |

116 |

|

|

A J K Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

78 |

62 working trucks 18 under maintenance 2 not in service

|

|

30 – 34.9 MT |

4 |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

- |

|

|

Total Capacity |

82 |

|

|

Netsanet Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

99 |

83 working trucks 7 under maintenance 19 not in service

|

|

30 – 34.9 MT |

8 |

|

|

35 – 37.9 MT |

2 |

|

|

38 MT and > |

- |

|

|

Total Capacity |

109 |

|

|

Wukiyanos Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

67 |

47 working trucks 20 under maintenance

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

- |

|

|

Total Capacity |

67 |

|

|

Sebrina Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

116 |

79 working trucks 13 under maintenance 33 not in service

|

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

1 |

|

|

38 MT and > |

3 |

|

|

Total Capacity |

125 |

|

|

International Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

72 |

50 working trucks 14 under maintenance 14 not in service

|

|

30 – 34.9 MT |

6 |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

- |

|

|

Total Capacity |

78 |

|

|

Elshaday Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

75 |

62 working trucks 11 under maintenance 9 not in service

|

|

30 – 34.9 MT |

3 |

|

|

35 – 37.9 MT |

2 |

|

|

38 MT and > |

2 |

|

|

Total Capacity |

82 |

|

|

Waliyadi Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

55 |

31 working trucks 20 under maintenance 7 not in service

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

3 |

|

|

Total Capacity |

58 |

|

|

Nuniyat Cross Border Level-3B Freight Transport Company Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 3B |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

62 |

60 working trucks 7 under maintenance 4 not in service

|

|

30 – 34.9 MT |

5 |

|

|

35 – 37.9 MT |

1 |

|

|

38 MT and > |

3 |

|

|

Total Capacity |

71 |

|

|

J.S Trading Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 4 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

82 working trucks

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

82 |

|

|

Total Capacity |

60 |

|

|

Noah Transport Association Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 4 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

13 working trucks 53 not in service

|

|

30 – 34.9 MT |

32 |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

34 |

|

|

Total Capacity |

66 |

|

|

Geda transport PLC Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 4 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

- |

29 working trucks 16 under maintenance 53 not in service

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

38 |

|

|

38 MT and > |

|

|

|

Total Capacity |

45 |

|

|

Freighters International Transport PLC Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 4 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

14 |

28 working trucks 24 under maintenance 6 not in service

|

|

30 – 34.9 MT |

32 |

|

|

35 – 37.9 MT |

- |

|

|

38 MT and > |

12 |

|

|

Total Capacity |

58 |

|

|

Jer PLC Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 4 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

1 |

20 working trucks

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

8 |

|

|

38 MT and > |

11 |

|

|

Total Capacity |

20 |

|

|

Kiya Transport PLC Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 4 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

8 |

22 working trucks 6 under maintenance 19 not in service

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

3 |

|

|

38 MT and > |

47 |

|

|

Total Capacity |

66 |

|

|

Mekonnen Abriha Cross Border Transporter Transport Capacity Summary |

||

|---|---|---|

|

Regions Covered |

Level 4 |

|

|

Capacity |

Number of Vehicles |

Comments / Condition of Vehicles |

|

20 – 29.9 MT |

30 |

33 working trucks 8 under maintenance

|

|

30 – 34.9 MT |

- |

|

|

35 – 37.9 MT |

3 |

|

|

38 MT and > |

8 |

|

|

Total Capacity |

41 |

|

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Ethiopia - 3.3 Ethiopia Manual Labor

Employees who earn Ethiopian Birr (ETB) 601 per month and above are liable to pay employment income tax.

Tax brackets:

For salaries between 601 Birr and 1650 Birr per month: 10%

For salaries between 1651 Birr and 1650 Birr per month: 15%

For salaries between 3201 Birr and 5250 Birr per month: 20%

For salaries between 5251 Birr and 7800 Birr per month: 25%

For salaries between 7801 Birr and 10,900 Birr per month: 30%

Over 10,900 Birr per month: 35%

Please find more details here: http://www.erca.gov.et/index.php/news/international-news/473-income-from-employment-schedule-a

The revised loading and unloading rate for Commodities as of 8 June 2022

Table 1 Revised rates for bagged and cartooned commodities

|

Commodity Type |

Current Rate (ETB) |

Revised Rate (ETB) |

||||||

|---|---|---|---|---|---|---|---|---|

|

|

|

Per Quintal |

Per mt |

Per Cartoon |

Per Quintal |

Per mt |

Per Cartoon |

Adj. Rate |

|

Except Somali and |

Cereals |

6.5 |

65 |

- |

8.0 |

80 |

- |

23% |

|

Cartooned oil and other liquids (20-25 Kgs) |

10 |

100 |

2 |

17.5 |

175 |

3.5 |

75% |

|

|

Cartooned oil and other liquids (<20 Kgs) |

8.75 |

87.5 |

1.75 |

12.5 |

125 |

2.5 |

43% |

|

|

Cartooned for non-liquid and non-food (<25 Kgs) |

8.75 |

87.5 |

1.75 |

12.5 |

125 |

2.5 |

43% |

|

|

Except Somali and Gambella |

Cereals |

7 |

70 |

- |

10 |

100 |

- |

43% |

|

Cartooned oil and other liquids (20-25 Kgs) |

11.25 |

112.5 |

2.25 |

17.5 |

175 |

3.5 |

56% |

|

|

Cartooned oil and other liquids (<20 Kgs) |

10 |

100 |

2 |

13.75 |

137.5 |

2.75 |

38% |

|

|

Cartooned for nonliquid and non-food (<25 Kgs) |

10 |

100 |

2 |

13.75 |

137.5 |

2.75 |

38% |

|

Table 2 Revised rate for re-bagging and restacking services

|

Activity |

Current Rate (ETB) |

Revised Rate (ETB) |

|

|---|---|---|---|

|

Per Bag |

Adj. Rate |

||

|

Re-bagging |

2 |

4 |

100% |

|

Restacking |

2 |

4 |

100% |

Table 3 Revised rate for fumigation

|

Activity |

Current Rate (ETB) |

|

Revised Rate (ETB) |

|||

|---|---|---|---|---|---|---|

|

Per Stack |

Per mt |

Per Quintal |

Per Stack |

Per mt |

Adj. Rate |

|

|

Fumigation |

600 |

1.2 |

0.12 |

800 |

1.6 |

100% |

Remark

-

For fumigation ETBC suggested the same rate as the current working rate.

For more information go through : EDRMC | Disaster Risk Management Commission

Ethiopia - 3.4 Ethiopia Telecommunications

Ethio telecom, previously known as the Ethiopian Telecommunications Corporation (ETC), is an Ethiopian telecommunication company founded in 2010 serving as the major internet and telephone service provider. Ethio telecom is owned by the Ethiopian government and maintains a monopoly over all telecommunication services in Ethiopia till 2021. Based in Addis Ababa, it is one of the "Big-5" group of state owned corporations in Ethiopia, along with Ethiopian Airlines, the Commercial Bank of Ethiopia, Ethiopian Insurance Corporation, and the Ethiopian Shipping Lines.

As part of the Ethio Telecom network expansion strategic plan, in November 2022 the company has launched 4G LTE services in 67 towns and made additional 4G LTE network expansions in the already service launched 27 towns. Based on this, a total of 181 towns, are connected with the 4G LTE service countrywide.

In May 2022, Ethio Telecom announced the launching of 5G services in Addis Ababa in six mobile stations and plan to extend to other major cities.

The Ethio Telecom has about 97% telecom services coverage in Ethiopia, being the biggest Telecom operator in the Country.

Safaricom Telecommunications Ethiopia started operating in Ethiopia in 2021 after winning applicant for a license to operate telecommunication services in Ethiopia. Safaricom Ethiopia is an international consortium named the Global Partnership for Ethiopia, comprising Safaricom Plc, Vodafone Group, , Sumitomo Corporation and British International Investment (formerly known as CDC Group). They were granted a nationwide full-service Unified Telecommunications Service License on 9 July 2021 and were officially registered as Safaricom Telecommunications Ethiopia Plc in July 2021.

Safaricom Telecommunications Ethiopia Officially Launched their services in October 2022. The current network coverage is accessible from this link https://safaricom.et/index.php/contact-us

Existing Humanitarian Telecoms Systems

UN telecommunication system:

For Voice

-

HF and VHF

-

VSAT Foodsat Local

-

PBX integrated with Extension.

-

Thuraya Satphone devices

For Data

-

Ethio Telecom Fiber ISP link

-

VSAT link and

-

Thuraya IP Data terminal

WFP depends mainly on Local ISP and VSAT link for the data connectivity in the field. WFP’s vehicles are fitted with HF & VHF mobile radios. Additionally portable handset radios are distributed to staffs to facilitate operations in the field.

|

Existing UN Telecommunications Systems |

|

|---|---|

|

Organisations |

UN /WFP |

|

VHF frequencies |

Rx: 152.75 MHz, Tx: 157.675 |

|

HF frequencies |

8.94 Mhz, 5.44 Mhz, 6.88 Mhz, 5.118 Mhz, 7.510 Mhz, 7.855 Mhz, 9.185Mhz, 10.960Mhz, and 11.105 Mhz. |

|

Repeaters (Locations) |

ECA, JIJGA, Gode, Dire dawa , Mekelle, and Dessie |

|

VSAT |

All WFP offices have the Corporate VSAT solution except for the Bahir Dar, Kombolcha and Gondar Offices. WFP Ethiopia has 18 Offices in the Country. |

3.5 Ethiopia Food and Additional Suppliers

Approximately 250 mills are found in Ethiopia. In recent years Addis Ababa has lost the central function with mills being constructed in other parts of the country. Main Food Suppliers are identified in the Service Provider Contact list. Link attached.

WFP Vulnerability and Analysis Mapping (VAM): (http://vam.wfp.org/)

USAID Famine Early Warning Systems Network (FEWS NET): (http://www.fews.net/)

For more information on food supplier contact details, please see the following link: 4.10 Supplier Contact List.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a general overview of country data related to the service and supply sectors, please consult the following sources:

The Observatory of Economic Complexity – MIT (OEC): INSERT a link directly to the OEC country page if available (http://atlas.media.mit.edu/en/)

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.5.2 Ethiopia Additional Suppliers

Vehicle Rental

Vehicle rental service is available but can only be expected to meet the initial needs of a small company or organization. Vehicle rental companies are identified in the service providers contact list. Link attached.

Taxi Companies

Taxi service is available. Taxis in Addis Ababa are of two types. Yellow colour and blue colour taxis. UNDSS advises more precaution against the use of blue taxis in comparison to the yellow ones

Freight Forwarding Agents

Freight forwarding agents are identified in the service providers contact list.

Electricity and Power

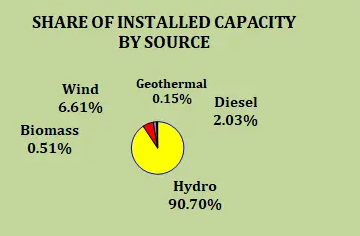

Regarding power generation plants, currently, Ethiopian Electric Power administers 18 power plants there by generating a total of 4244 mega watt electricity nationwide.

Among the 18 power plants, 14 are from hydro namely Aba Samuel (6.6MW the first hydro power plant in Ethiopia), Gilgel Gibe III (1870MW), Beles (460MW), Gilgel Gibe II (420MW),Tekeze (300MW),Gilgel Gibe I(184MW), Melka wakena (153MW), Fincha (134MW), Amerti Neshi (95MW),Tis Abay II (73MW), Koka (43.2MW), Awash II (32MW), Awash III (32MW), and Tis Abay I (14.4MW) with a total installed capacity of 3814MW electricity.

Adama II (153MW), Ashegoda (120MW) and Adama I (51MW) are the wind power plants that has been generated electricity in Ethiopia which amounted 324MW on aggregate.

The remaining 104MW electricity is being generated from diesel generator and Aluto Geothermal plant (7.3MW).

|

Production Unit |

Type [1] |

Installed Capacity (MW) |

Current Production (MW) |

|

EEP |

Hydroelectric Power |

3814 |

|

|

EEP |

Geo-thermal power plants |

7.3 |

|

|

EEP |

Wind farm power plants |

324 |

|

[1] E.g. Hydroelectric power, Thermal power…

Internet Service Providers (ISPs)

The ISP is Ethiopian Telecom (ETC) and the options of ADSL, GPRS/3G and V-SAT. There are no other service providers for internet in country.

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? (Yes / No) |

Yes |

|

|

Private or Government |

Government |

|

|

Dial-up only (Yes / No) |

No |

|

|

Approximate Rates |

Dial-up: |

No Info |

|

Broadband: |

No Info |

|

|

Max leasable ‘dedicated’ bandwidth |

No Info |

|

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a general overview of country data related to the service and supply sectors, please consult the following sources:

The Observatory of Economic Complexity – MIT (OEC): INSERT a link directly to the OEC country page if available (http://atlas.media.mit.edu/en/)

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Ethiopia - 3.6 Ethiopia Additional Services

For more information on company contact details, please see the following link:

4.11 Additional Services Contact List

Vehicle Rental

Vehicle rental service is available especially in Addis to meet the needs of a company or organization and can be deployed to other regions. Vehicle rental companies are identified in the service providers contact list. Link attached.

Taxi Companies

Taxi services are available. Taxis in Addis Ababa has significantly expanded with the introduction of taxi App services, this is in addition to the blue colour taxis. There are several taxi services that can be ordered through the Apps. These include Ride, Zayride, Polo trip, Ze-Lucy, Catch, Seregela, Catch Taxi, Hello Taxi and Feres. UNDSS advises more precaution against the use of blue taxi.

10 Best Uber-Like Ride & Taxi Service Companies in Ethiopia — allaboutETHIO

Freight Forwarding Agents

Freight forwarding agents are identified in the service providers contact list.

Electricity and Power

Ethiopia has abundant renewable energy resources and has the potential to generate over 60,000 megawatts (MW) of electric power from hydroelectric, wind, solar and geothermal sources. As a result of Ethiopia's rapid GDP growth over the previous decade, demand for electricity has been steadily increasing. The electrification process causes GDP growth and high public demand for 110 million of its population. On total, Ethiopia produces 11 billion kWh from all facilities and exports other resources like natural gas or crude oil. However, the country is experiencing energy shortages and load shedding as it strives to offer supply for over 110 million people and predicted to grow 30% per year. With current ongoing projects, the country is constructing 4,500 MW of installed generation capacity. There is also a plan to increase power generation capacity in exponent to 17,000 MW in 10 years

Currently, Ethiopian Electric Power is managing 22 power generating stations. Among them, 16 are from hydro, these are Gibe III (1870 M.W), Beles (460 M.W), Gilgel Gibe II (420 MW), Tekeze (300 MW), Gilgel Gibe I (184 MW), Melka Wakena (153 MW), Fincha (134 MW), Amarti Neshe (95 MW), Tis Abay II (73 MW), Koka (43.2 MW), Awash II (32 MW), Awash III (32 MW), Tis Abay I (11.4 MW) Aba Samuel (6.6MW); Genale Dawa III (254 MW) and the Grand Ethiopian Renaissance Dam (the two early generation units of 750 MW) generate a total of 4818.2 MW from hydro.

In terms of wind, Adama II (153 MW), Ashgoda (120 MW) and Adama I (51 MW), additionally Ayisha II have been partially completed and started operation with the capacity of 80 MW. The rest is expected from steam power and diesel reserves.

There are numerous restraints over electrification with most people in rural areas utilize traditional biomass energy sources and lack of modernized transmission and distribution. To solve this, the government set up big projects to construct hydroelectric dams such as the Grand Ethiopian Renaissance Dam (GERD) and Koysha Dam that provide fertile electricity throughout the country. The other issue is the power outrages that can adversely affects households from daily interruptions. Frequent power outage may lead to serious threat to people such as fear and discomfort to the environment as well as the use of alternative energy sources like charcoal, firewood, and candle.

Grand Ethiopian Renaissance Dam (GERD)

The primary purpose of the dam is electricity production to relieve Ethiopia's acute energy shortage and for electricity export to neighbouring countries. With a planned installed capacity of 5.15 gigawatts the dam will be the largest hydroelectric power plant in Africa when completed, as well as among the 20 largest in the world

First phase of filling the reservoir began in July 2020 and in August 2020 water level increased to 540 meters (40 meters higher than the bottom of the river which is at 500 meters above sea level). The second phase of filling was completed on 19 July 2021, water level increased to around 575 meters. The third filling was completed on 12 August 2022 to a level of 600 metres (2,000 ft), 25 m (82 ft) higher than the prior year completed second fill. Actual water level (November 2022) is at around 605 meters and was measured at Sentinel images. It will take between 4 and 7 years to fill with water, depending on hydrologic conditions during the filling period.

On 20 February 2022, the dam produced electricity for the first time, delivering it to the grid at a rate of 375 MW A second 375 MW turbine was commissioned in August 2022.

https://en.wikipedia.org/wiki/Grand_Ethiopian_Renaissance_Dam

The power outages are regular and are more elsewhere than are in Addis Ababa.

|

Production Unit |

Type [1] |

Installed Capacity (MW) |

Current Production (MW) |

|---|---|---|---|

|

EPCO |

Hydroelectric Power |

814 |

1534 |

![]()

[1] E.g. Hydroelectric power, Thermal power…

Internet Service Providers (ISPs)

The ISP is Ethiopian Telecom (ETC) and the options of ADSL, GPRS/3G and V-SAT. Recently Safaricom has been registered in the country as an additional service provider for mobile phone voice and Internet in select areas.

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? (Yes / No) |

Yes |

|

|

Private or Government |

Both |

|

|

Dial-up only (Yes / No) |

No |

|

|

Approximate Rates |

Dial-up: |

No Info |

|

Broadband: |

No Info |

|

|

Max leasable ‘dedicated’ bandwidth |

No Info |

|