3 Cambodia Services and Supply

Overview

Over the past two decades, Cambodia has undergone a significant transition, reaching lower middle-income status in 2015 and aspiring to attain upper middle-income status by 2030. Driven by garment exports and tourism, Cambodia’s economy has sustained an average annual growth rate of 7.7 percent between 1998 and 2019, making it one of the fastest-growing economies in the world.

However, Cambodia is experiencing a resurgence of COVID-19 cases, which has slowed the recovery, especially of the service, construction, and real estate sectors. The growth projection for 2021 is now revised down to 2.2 percent, despite strong export performance supported by improved external demand conditions. Cambodia’s outlook remains highly uncertain, and risks are tilted to the downside. Despite accelerated vaccination progress, risks of a protracted COVID-19 outbreak, and further disruption remain high.

Employment and income had not recovered to their pre-pandemic levels even before the recent COVID-19 resurgence. About 69 percent of households’ main earners were employed in March 2021, 13 percentage points lower than before the pandemic. About 45 percent of households continued to experience income losses in March 2021. Disruptions to economic activities due to stringent measures to curb the outbreak have led to job losses or decreased working hours. School closures have disrupted education since late March 2021, especially for poor students.

Health and education, especially issues of quality and equitable access, remain important challenges and development priorities.

Cambodia has made considerable strides in improving maternal and child health, early childhood development, and primary education in rural areas. The maternal mortality ratio per 100,000 live births decreased from 472 in 2005 to 170 in 2014; the under-five mortality rate decreased from 83 per 1,000 live births in 2005 to 35 per 1,000 in 2014; and infant mortality rate decreased from 66 per 1,000 live births in 2005 to 28 per 1,000 in 2014. Despite the progress in health and education outcomes, human capital indicators lag behind lower middle-income countries. A child born in Cambodia today will be only 49 percent as productive when grown as she could be if she enjoyed full quality education, good health, and proper nutrition during childhood. An estimated one in three children under the age of five suffer from stunting and only 36 percent of children between three and five years old are enrolled in early education. While net enrolment in primary education increased from 82 percent in 1997 to 97 percent in 2020, lower secondary completion rates are at 45 percent in 2019. As of 2020, 15 percent of Cambodia’s population (2.5 million people) did not have access to improved water, and 23 percent (3.8 million people) did not have access to improved sanitation.

Key reforms are needed for Cambodia to sustain pro-poor growth, foster competitiveness, sustainably manage natural resource wealth, and improve access to and quality of public services. Cambodia continues to have a serious infrastructure gap and would benefit from greater connectivity and investments in rural and urban infrastructure. Further diversification of the economy will require fostering entrepreneurship, expanding the use of technology, and building new skills to address emerging labor market needs. Accountable and responsive public institutions will also be critical. The quality of human capital will be of utmost importance to achieve Cambodia’s ambitious goal of reaching middle-income status by 2030.

Last Updated: Oct 20, 2021

Source: https://www.worldbank.org/en/country/cambodia/overview#1

Agriculture

Cambodia is a least-developed country on its way to becoming a middle-income economy. While the garment industry, construction and tourism are the engines of the economic growth, the agricultural sector accounts for about 35 per cent of the GDP and employs a large majority of the population. Agriculture is therefore central to poverty reduction and hunger eradication in Cambodia. Cambodia is blessed with an abundance of natural resources including land and water, favourable climatic conditions and geographic position, which represent potential comparative advantages for increased agricultural production and livelihood improvements. Crop production contributes about 54 per cent of the sector GDP, with fisheries accounting for 25 per cent, livestock for 15 per cent and forestry and logging for about 6 per cent. Although only 8 per cent of the rice is irrigated, the rice production has increased steadily and made Cambodia not only self-sufficient in rice, but even an important exporter. Other important food crops include corn, soybean, mung bean, cassava and fruits such as mango, pineapple, jackfruit, durian, rambutan and banana. Cash crops have also seen a significant expansion in particular sugar cane, and rubber and palm oil. Fish is the main source of protein in people’s diet and marine fisheries and freshwater fishing in lakes and waterways, in particular the Tonle Sap and the Mekong, contribute substantially to incomes, jobs and food security. The livestock sector is underdeveloped with small animals such as pigs, ducks and chickens raised mainly for household consumption.

Source: https://www.fao.org/cambodia/fao-in-cambodia/cambodia-at-a-glance/en/

Banking

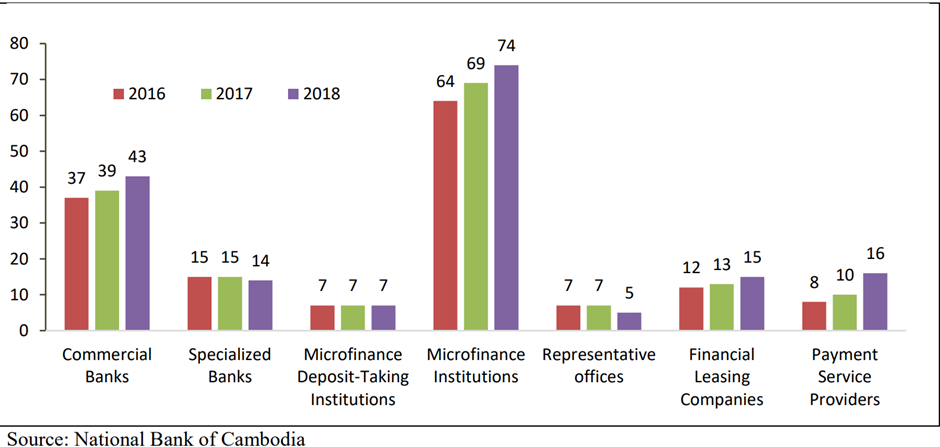

Cambodia is a bank-based economy. Commercial banks are the primary source of funding. The Cambodian banking system is a two-tier system comprising the Central Bank (National Bank of Cambodia), and private sectors such as commercial banks, specialized banks, microfinance institutions, and a number of NGOs involved in rural credit activities. The key players in Cambodia’s banking sector are NBC, 43 commercial banks, 14 specialized banks including one state bank, 5 Representative office of foreign commercial banks, 74 microfinance institutions where 7 are eligible to collect customer deposits, and 15 financial leasing companies. As of December 2018, there were 151 financial institutions operating in Cambodia. By December 2017, the financial institutions reported an outstanding loan balance of $16.127 billion with the number of borrowers of 2.589 million.

Recent liberal investment regime and open market trade policies have gathered momentum for Cambodia's economic prospects and banks are also enjoying benefits from such strong growth opportunities. The Cambodian banking sector has been improving and growing steadily over the past two decades; yet; it still lacks financial depth and is being fragmented. To gain more international confidence, significant progresses are necessitated to address structural distortions such as inadequate legal framework for secured transactions, and information asymmetry arising from poor disclosure standards.

Information Technology (IT)

As Cambodia’s development progresses and its youth and businesses get to grips with the available and emerging technologies, the Information Technology sector is one that is seen as having exponential growth and opportunity. Demand for the internet, mobile phones and other forms of technologies continue to increase, with the youthful population and entrepreneurs realising the future potential in this area. Cambodia also skipped past landlines and moved quickly to adopt smartphones and embrace the internet with one of the highest mobile phone and internet penetrations in the region.

Updated December 2020.

Source: https://www.b2b-cambodia.com/industry-overviews/it-communications/

Manufacturing

Cambodia’s economy is forecast to grow 4.0% this year and 5.5% in 2022, as the economic recovery in major trading partners boosts demand for Cambodia’s exports, according to an Asian Development Bank (ADB) report. The economy contracted by 3.1% in 2020 because of the global coronavirus disease (COVID-19) pandemic. According to the Asian Development Outlook (ADO) 2021, industrial production is expected to rise 7.1% in 2021 and 7.0% in 2022 on the back of a rebound in the garments, footwear, and travel goods sector, as well as growth in other light manufacturing such as electronics and bicycles.

Electricity Supply

The Electricity Law was promulgated in February 2001 with the view to regulate the power sector and the Electricity Authority of Cambodia (EAC) was established as a legal public entity to act as the Regulator and the arbitrator of power sector business activities. The Cambodian strategy for the development of electricity supply is to construct transmission lines between major cities in southern and western regions [1] in order to construct large-scale power generating plants and to import electric power from neighbouring countries during the construction period of such power plants.

In Cambodia, electricity is generated and/or distributed by the following entities.

- Electricite Du Cambodge (EDC), a government enterprise

- Private entities including Independent Power Producers (IPP) in the provincial towns

- Licensees in smaller towns, and

- Rural Electricity Enterprises (REE) in the rural areas

EDC has a consolidated license (generation, distribution and transmission) for electricity supply in Phnom Penh, Knadal, in the 12 following provincial capitals, namely, Sihanoukville, Kampong Cham, Takeo and Battambang, Siem Reap, Bonteay Meanchey, Kampot, Kampong Speu, Steng Treng, Svay Rieng, Prey Veng, Rattanakiri (Banlung), and in the four following regions bordering on Vietnam, namely Bavet (Svay Rieng), Memot (Kampong Cham), Phonhea Krek (Kampong Cham) and Kampong Trach (Kampot).

The electricity supply currently does not meet the basic demands, where 24-hour supply of electricity is not assured, and the quality of electricity is not reliable. According to the Power Development Plan of the Kingdom of Cambodia in 2007, electricity demand is expected to show a rapid increase until 2020. The future power demand is summarized in below table.

Power Demand Forecast (MW)

|

2012 |

2015 |

2018 |

2020 |

|---|---|---|---|

|

1,062 |

1,643 |

2,283 |

2,770 |

For more information, please go to link: http://www.cambodiainvestment.gov.kh/investors-information/infrastructure/electricity.html

Disclaimer: The inclusion of a logistics service provider in this LCA does not imply any business relationship between the supplier and WFP/Logistics Cluster, and is provided for information purposes only.

Please Note: WFP/Logistics Cluster maintain complete impartiality and are not in a position to endorse or comment on any company's suitability as a reputable service provider.

3.1 Cambodia Fuel

Fuel Overview

In Cambodia, gasoline, diesel oil, and liquefied petroleum gas (LPG) demand has been increasing rapidly, and the demand has depended on imports. Also, according to Cambodia’s energy outlook, which is a part of the East Asia Summit (EAS) energy outlook prepared by ERIA, these petroleum sectors will increase their demand continuously up to 2040. In this regard, the following countermeasures are recommended: (1) The major use of gasoline and diesel oil as well as LPG is transportation (vehicle), so that Cambodia can shift to highly efficient vehicles under the appropriate regulations (reduction by 10% from the business-as-usual [BAU] scenario). (2) Petroleum products are convenient and useful, and they are used across the industry, transport, residential, and commercial sectors. If a petroleum supply disruption occurs, Cambodia will face serious damage on both the economic and social aspects. Therefore, appropriate stockpiling volumes, including commercial stocks, will be needed. (3) Biofuel, especially bioethanol, is one of the options for reducing imports of gasoline. In addition, biofuel affects the economic growth of Cambodia, such as through agriculture and industry activities and reductions in CO2 emissions. The General Department of Petroleum is seeking business opportunities for biofuel (E3 gasoline will be possible by 2025). (4) The BEPC also states that the petroleum supply chain will be resilient through business activities under the appropriate petroleum policies and regulations.

Fuel imported by private sectors such as SOKIMEX, TOTAL Cambodia, CALTEX, SAVIMEX, Kampuchea TELA, PTT Cambodia Limited, Bright Victory Mekong Petroleum, LHR and PAPA Petroleum.

Source: https://www.eria.org/uploads/media/CAMBODIA_BEP_Fullreport_1.pdf

For more information on government and fuel provider contact details, please see the following links: 4.1 Government Contact List and 4.7 Fuel Providers Contact List.

Information may also be found at: http://www.mytravelcost.com/petrol-prices/ which is updated monthly.

Fuel Pricing

The Cambodia Government controls fuel prices to calculate price formula in line with international prices (governed through a government decree). The retail prices of gasoline are determined with the consent of all major petroleum distributors. The new price ceilings are calculated according to a formula based on the average Means of Platts Singapore (MOPS) plus taxes, net profit, VAT and operating costs. The Ministry of Commerce provides price updates every 10 days and gasoline stations will be fined $1,000 if they charge more than the set price.

|

Fuel Prices per Litre as of: 27 Dec 2021 |

|

|---|---|

|

Petrol |

KHR4600 = USD $1.129 |

|

Diesel |

KHR3750 = USD $0.92 |

|

Paraffin |

N/A |

|

Jet A-1 |

KHR2140 = USD $0.525 |

Seasonal Variations

There are no significant seasonal variations regarding fuel prices in Cambodia.

|

Seasonal Variations |

|

|---|---|

|

Are there national priorities in the availability of fuel? (i.e. are there restrictions or priorities for the provision of fuel such as to the military?) |

No |

|

Is there a rationing system? |

No |

|

Is fuel to lower income / vulnerable groups subsidized? |

No |

|

Can the local industry expand fuel supply to meet humanitarian needs? |

Yes |

|

Is it possible for a humanitarian organization to directly contract a reputable supplier / distributor to provide its fuel needs? |

Yes |

Fuel Transportation

The transportation infrastructure and fleet are limited, but currently sufficient to handle domestic needs as well as demand from the humanitarian community.

In Cambodia, petroleum is traditionally the main source of energy for transportation. Petroleum fuels used for transportation include gasoline, diesel, heavy fuel and fuel oil. Cambodia has currently eight big petroleum distributors including Caltex, Sokimex Group Co. Ltd., Kampuchea Tela Co. Ltd., PTT (Cambodia) Limited, Total Cambodge, Bright Victory Mekong Petroleum, Savimex, and LHR.

Each company have their own fuel transport truck to transport from entry point to individual storage facility. There is no bottle facing in this country. The fuel consumption drops during the COVID19 country lockdown and increase when the country opens back to normal live.

Standards, Quality and Testing

Standard fuel testing is under Ministry of Commerce, Department of Consumer Protection Competition and Fraud Directorate-General (CCF).

|

Industry Control Measures |

|

|---|---|

|

Do tanks have adequate protection against water mixing with the fuel? |

N/A |

|

Are there filters in the system which monitor where fuel is loaded into aircraft? |

Yes |

|

Is there adequate epoxy coating of tanks on trucks? |

Yes |

|

Is there a presence of suitable firefighting equipment? |

Yes |

|

Standards Authority |

|

|---|---|

|

Is there a national or regional standards authority? |

Yes |

|

If yes, please identify the appropriate national and/or regional authority. |

National: Ministry of Commerce |

|

If yes, are the standards adequate/properly enforced? |

Not always |

|

Testing Laboratories |

|

|---|---|

|

Are there national testing laboratories? |

Yes |

|

Fuel Quality Testing Laboratory |

|

|---|---|

|

Company |

Ministry of Commerce, Department of Consumer Protection Competition and Fraud Directorate-General (CCF). |

|

Name |

Mak Pichrith |

|

Address |

St.18, Kdey Takoy Village, Sangkat Veal Sbov, Phnom Penh. |

|

Telephone and Fax |

(855) 23 42 61 66 |

|

Contact |

Kim Meas Sok Seiha, Director of Consumer Protection & Fraud Repression Department (CP&FRD) H/P Phone: (855) 12 38 78 78 E-Mail: cp_frd@yahoo.com Website: http://www.camcontrol.gov.kh/ |

|

Standards Used |

|

Overall Cambodia Government Policy Goal for Energy Efficiency

The above calculated Saving Potentials form the basis of the National Energy Efficiency Policy objective:

- Reduce the future National energy demand by 20% until 2035, compared to business-as-usual projections.

- Reduce National CO2 emissions in 2035 by 3 million tons of CO2.

To achieve these main objectives, MIME has defined the goals of energy development in the Kingdom as follows:

- From the year of 2015, the national grid has sufficient capacity to support all kinds of demands of consumers already connected to the national grid and in 2018 the national grid will provide a 25% reserve capacity for the system.

- In 2020 the high-tension transmission line will cover all 24 cities and provinces of Cambodia. And these cities and provinces will have at least one sub-station each to receive electricity supply from the national grid.

- In 2020, 80% of villages will be connected to the national grid and another 20% will be supplied by other energy sources such as electricity imported from neighbouring countries or single supply systems. In 2030, 95% of villages of the whole country will be connected to the national grid while another 5% of the villages will be connected to single supply systems with a quality of supply similar to the national grid.

- In 2020, at least 50% of households in Cambodia will be grid-connected with the same quality of supply as those connected to the national grid and 70% of households will follow up to 2030.

- In 2020, the gap of electricity selling prices between urban and rural areas will be reduced and the price difference should not exceed 15%.

These highly ambitious energy policy goals can only be achieved, if energy is used in the most efficient, cost effective and sustainable manner in all economic sectors as presented in the sectorial energy analysis hereafter. To reach the overall energy efficiency objective, MIME’s “Alternative Policy Scenario” was adjusted by the results of assumed energy efficiency improvements in the five sectors identified as priority areas for the national energy efficiency policy, strategy and action plan.

- Energy efficiency in industry

- Energy efficiency of end-user products

- Energy efficiency in buildings

- Energy Efficiency of rural electricity generation and distribution

- Efficient use of biomass resources for residential and industrial purposes.

In close collaboration with MIME, these priority areas were selected according to their share on the overall energy consumption and to their importance for the socio-economic development of the country. The residential sector is still the biggest energy consumer counting for 37% of the total energy consumption, followed by the commercial sector (including buildings) and the industrial sector. 75% of the national primary energy supply is covered by biomass, 25% by imported petroleum products. In the process of identification of the 5 priority areas it was decided to leave out the transport sector for the time being because of the specific requirements concerning the collection of reliable data on fuel consumption by the various means of transport, which could not be met in the framework of this project. It is recommended to launch a study on its own on this sector. The energy saving potentials in the various subsectors was assumed as follows:

- In the INDUSTRY SECTOR, saving potentials ranging from 20% (garment industry) to 70% (ice factories) have been identified, mainly depending on changes in behaviour and on the replacement of inefficient devices.

- Concerning the energy efficiency of END USER PRODUCTS in the residential sector, an energy saving potential of up to 50% was assumed according to international experiences by introducing energy efficiency labelling schemes for household appliances.

- In the BUILDING SECTOR energy saving potentials between 20 and 30% are assumed for new commercial buildings according to international benchmarks by making use of appropriate building materials and construction principles with special emphasis to be put on standardized wiring.

- The energy saving potential in RURAL ELECTRICITY GENERATION AND DISTRIBUTION is estimated at up to 80% corresponding to the reduction of the huge generation and distribution losses of the Rural Energy Enterprises (REE’s).

- Concerning the USE OF BIOMASS resources for residential and industrial purposes, energy saving potentials between 30 and 50% can be achieved by introducing improved cook stoves, more efficient charcoal kilns and char briquettes, substituting fuel wood and charcoal.

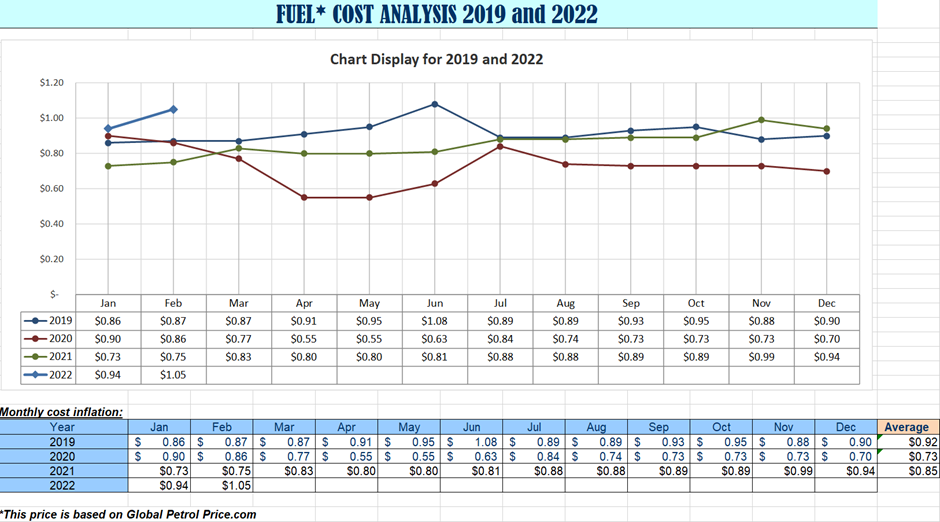

Additional information on Cambodia fuel trends from 2019, 2020, 2021 and 2022:

Figures monitored by WFP Logistics, attached file in Annex.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.2 Cambodia Transporters

Road transport is the principal mode for the movement of goods and people within Cambodia and between GMS countries. Roads are critical to social and economic development, especially in areas where they are the only available transport mode. The domestic need is to provide access between cities and to enhance rural connectivity; the regional need is to facilitate connectivity and trade within the Greater Mekong Subregion (GMS) and with the economies. 90% of passengers and freight came through sea or river ports continue with second leg of overland transport to final storage and distribution markets.

The trucking sector, Cambodia’s major road transport industry, is fragmented. It can be classified into three segments: (i) about 20 companies, including the biggest fleet owners, organized under the Cambodian Trucking Association (CAMTA), own about 2,000 trucks and focus almost exclusively on international container freight business; (ii) about 90 registered companies of different sizes, most of which qualify as small and medium sized enterprises, own 2,870 trucks; and (iii) nonregistered micro businesses and some small and medium sized enterprises, with old vehicles that often run without registration or inspection. The increasing number of trucks engaging in international trade encouraged Ministry of Public Works and Transport to make border crossings more efficient, maintain road safety, and avoid overloading to maintain road quality.

The fleet is limited although sufficient to serve the market at present. Main issues are encountered with specialized equipment and tertiary transport in provincial areas. Specialized equipment (truck crane, forklift, cranes, etc) are mainly available in large cities.

Foreign operators must register in Cambodia to operate domestically. Cross border agreements signed with Thailand and Vietnam enabled their respective registered national trucking companies to operate in Cambodia for cross border trade prior to COVID. Since March 2020, all cargos are transshipped at the border zero point.

For more information on transport company contact details, please see the following link: 4.8 Transporter Contact List.

|

Master Freight (Cambodia) Co., Ltd |

|||

|---|---|---|---|

|

Regions Covered |

Covers transport from seaport to the FDP along the primary road. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Breakbulk |

11 |

Medium |

|

|

Trailer |

21 |

|

Medium |

|

Total Capacity |

546 |

|

|

|

Speed Logistics |

|||

|---|---|---|---|

|

Regions Covered |

Covers transport from seaport to the FDP along the primary road. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

33 |

25 |

Medium |

|

Total Capacity |

33 |

825 |

|

|

CKR1 |

|||

|---|---|---|---|

|

Regions Covered |

Covers transport from seaport to the FDP along the primary road. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Trailer |

10 |

25 |

Medium |

|

Total Capacity |

10 |

250 |

|

|

Al Multimodal Transportation (Cambodia) Co., Ltd |

|||

|---|---|---|---|

|

Regions Covered |

Covers transport from seaport to the FDP along the primary road. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Trailer Truck |

55 |

20 |

Medium |

|

Total Capacity |

55 |

1,100 |

|

|

TKY Construction and Transport Co., Ltd. |

|||

|---|---|---|---|

|

Regions Covered |

Covers all destinations on primary, secondary and tertiary roads. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

15 |

11 |

Medium condition |

|

Vehicle Type |

18 |

25 |

Medium condition |

|

Vehicle Type |

14 |

30 |

Medium condition |

|

Total Capacity |

47 |

1,035 |

|

|

Ea Pov Transport |

|||

|---|---|---|---|

|

Regions Covered |

Covers all destinations on primary, secondary and tertiary roads. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

8 |

11 |

Medium condition |

|

Vehicle Type |

7 |

25 |

Medium condition |

|

Total Capacity |

15 |

263 |

|

|

RTC Company Ltd |

|||

|---|---|---|---|

|

Regions Covered |

Covers all destinations on primary, secondary and tertiary roads. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

11 |

11 |

Medium condition |

|

Vehicle Type |

21 |

25 |

Medium condition |

|

Total Capacity |

32 |

646 |

|

|

Sorakan Transport |

|||

|---|---|---|---|

|

Regions Covered |

Covers all destinations on primary, secondary and tertiary roads. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

5 |

11 |

Medium condition |

|

Vehicle Type |

10 |

25 |

Medium condition |

|

Total Capacity |

15 |

305 |

|

|

KN Transport |

|||

|---|---|---|---|

|

Regions Covered |

Covers all destinations on primary, secondary and tertiary roads. |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Comments / Condition of Vehicles |

|

Vehicle Type |

28 |

11 |

Medium condition |

|

Vehicle Type |

10 |

25 |

Medium condition |

|

Total Capacity |

38 |

788 |

|

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.3 Cambodia Manual Labor Costs

Cambodia’s labour market remains characterized by widespread working poverty and informality, which are likely to worsen due to COVID-19. The main labour market component of its social protection system consists of technical and vocational education and training schemes for informal sector workers, but its coverage is very low in relation to its informal sector size (footnote 3). COVID-19 is expected to result in major job and income losses in Cambodia, affecting workers across the board, and particularly vulnerable groups including women, informal, and own-account workers who have very limited access to social protection, many of whom either live in poverty or run a serious risk of falling into poverty.

There are few companies provide labour services on top of their main business. For example, transport include labour service, or warehouse rental include labour service etc. Contracts can be signed with those companies in case of activities which require manpower irregularly. Labour is easily available at port in Phnom Penh and Sihanoukville but as well in few large cities, with regular commercial activities and at the border with Vietnam and Thailand. Prices are often negotiated based on the work to be done, per crew and not per person. Following prices are only an indication of the current market price based on WFP internal survey.

|

Labour Rate(s) Overview |

|

|---|---|

|

|

Cost (as of 2021) |

|

Daily General Worker (Unskilled casual labour) |

40,000 KHR/US$ 10 |

|

Daily General Worker (Semi-skilled labour) |

60,000 KHR/US$ 15 |

|

Skilled Worker |

80,000 KHR/US$ 20 |

3.4 Cambodia Telecommunications

The Ministry of Posts and Telecommunications is the authority responsible for the oversight of the postal system and telecommunications throughout the country.

For information on Cambodia Telecommunications contact details, please see the following link: 4.11 Additional Services Contact List.

|

Telephone Services |

|

|---|---|

|

Is there an existing landline telephone network? |

Yes |

|

Does it allow international calls? |

Yes |

|

Number and Length of Downtime Periods (on average) |

3 times a year; 1-3 days (landlines) |

|

Mobile Phone Providers |

|

|

Approximate Percentage of National Coverage |

Good coverage for 25 provinces nationwide. |

Telecommunications Regulations

The Directorate of International Telecom of the Ministry of Posts and Telecommunications is responsible for provision, management and promotion of international telecom services, administration of international access numbers and provision of general information to callers.

The Directorate of Frequency Management and Licensing is responsible for the administration of operating and radio communication licenses, radio operator certifications, approval of telecommunications contractors, telecommunications equipment licensing services, telecommunications inspection services and allocation of radio frequencies.

|

Regulations on Usage and Import |

||

|---|---|---|

|

Regulations in Place? |

Regulating Authority |

|

|

Satellite |

Yes |

Telecommunication Regulator Cambodia (TRC) |

|

HF Radio |

Yes |

Telecommunication Regulator Cambodia (TRC) |

|

UHF/VHF/HF Radio: Handheld, Base and Mobile |

Yes |

Telecommunication Regulator Cambodia (TRC) |

|

UHF/VHF Repeaters |

Yes |

Telecommunication Regulator Cambodia (TRC) |

|

GPS |

Yes |

Telecommunication Regulator Cambodia (TRC) |

|

VSAT |

Yes |

Telecommunication Regulator Cambodia (TRC) |

|

Individual Network Operator Licenses Required |

||

|

License requests must be submitted for approval at the Telecommunication Regulator Cambodia (TRC). |

||

|

Frequency Licenses Required |

||

|

The Telecommunication Regulator of Cambodia (TRC) provides to individuals and to the general public an off-line application system to request Radio Frequency Licenses in the Kingdom of Cambodia. The frequency spectrum is a limited resource for the nation, and TRC plays an important role in the management and coordination of the planning, allocation and assignment of frequencies to ensure the efficient delivery of services such as mobile, fixed, satellite, short-range devices and broadcasting. Eligible users for this service are Cambodian citizens, foreign individuals and legal entities. Details of imported equipment have to be submitted in the requests of radio-frequency licenses directly to TRC’s administration. |

||

Existing Humanitarian Telecoms Systems

Based on current security arrangements in Cambodia, the VHF and HF Telecom systems are managed by UNDSS and hosted at UNOPS building in central Phnom Penh. HF has to be installed in the field vehicles and all UN agencies have to use the same frequency and channel. Moreover, satellite phone communication is an alternative in case of VHF/HF not being available.

|

Existing UN Telecommunication Systems |

||

|---|---|---|

|

UNDP |

WFP |

|

|

VHF Frequencies |

CH2. Tx161.975 - Rx156.975 CH4. Tx162.025 - Rx157.025 CH5. Tx158.175 - Rx158.175 CH6. Tx158.2 - Rx158.2 CH7. Tx157.05 - Rx157.05 |

CH2. Tx161.975 - Rx156.975 CH4. Tx162.025 - Rx157.025 CH5. Tx158.175 - Rx158.175 CH6. Tx158.2 - Rx158.2 CH7. Tx157.05 - Rx157.05 |

|

HF Frequencies |

CH5. 6.26 CH6. 6.475 CH7. 6.771 CH8. 7.434 |

CH5. 6.26 CH6. 6.475 CH7. 6.771 CH8. 7.434 |

|

Locations of Repeaters |

Exchange Square Building |

No. Repeater |

|

VSAT |

|

1371-2000 |

Internet Service Providers (ISPs)

In Cambodia, internet connection is received through fibre optic cable coming from Hong Kong, Vietnam, and Thailand. There are more than 10 private companies that provide internet through the fibre optic network. Individual organizations can get contracts through these private companies.

Some of the major ISPs in Cambodia are EZECOM, ONLINE, MEKONGNET, WinCAM, CityLink, TC, and Chuanwei.

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? |

Yes |

|

|

If yes, are they privately or government owned? |

Private |

|

|

Dial-up only? |

No, also ADSL/Fiber Optic |

|

|

Approximate Rates |

Dial-up |

N/A |

|

Broadband |

N/A |

|

|

Max Leasable ‘Dedicated’ Bandwidth |

No limits, based on customer requirement. |

|

Mobile Network Operators (MNOs)

Mobile data penetration deepens as rural areas gain access to smartphones. Cambodia’s telecommunications main players are investing heavily to expand quality services across the Kingdom. The Cambodian mobile market is fragmented among six mobile network operators (MNOs), sharing a volume of over 21 million mobile phone users. This represents a 130% mobile penetration. In 2019, more than 75% of mobile subscribers had access to the internet, largely compensating the very low penetration of fixed broadband services.

For information on MNOs please visit the https://www.trc.gov.kh/en/consumer/tariff-for-services/mobile-services/

|

Company |

Number of Agent Outlets by Area |

Network Strength by Area |

Contracted for Humanitarian or Government Cash Transfer Programmes? |

Services Offered |

|---|---|---|---|---|

|

CELLCARD |

It is available in 25 provinces. |

Good in all areas |

No |

GSM (900Mhz), UMTS (2100Mhz),4G |

|

Smart Cambodia |

It is available in 25 provinces. |

Good in all areas |

No |

GSM (900Mhz), UMTS (2100Mhz),4G |

|

Seatel Cambodia |

It is available in 14 provinces. |

Good in all areas |

No |

GSM (900Mhz), UMTS (2100Mhz),4G |

|

METFONE |

It is available in 25 provinces. |

Good in all areas – strong coverage in remote area |

No |

GSM (900Mhz), UMTS (2100Mhz),4G |

|

CooTel Cambodia |

No information |

Good in town |

No |

GSM (900Mhz), UMTS (2100Mhz),4G |

|

Qbmore |

No information |

No information |

No information |

No information |

3.5 Cambodia Food and Additional Suppliers

The food items usually available in Cambodia include rice, meat, fish and vegetables. All food commodities are available in markets at the city, provincial, district and commune levels, especially rice. Rice is the most important food item in the daily diet of Cambodians. The price is reasonable and offer is sufficient at the national level, with a surplus for export. The total paddy rice in production has been steadily increasing since 2005.

Cambodia is one of the counties in Asia exporting rice. There are many companies exporting rice and a large number of rice millers are located in the provinces, especially in Battambang, Kampong Thom Siem, Kampong Cham, Kampong Speu, and Phnom Penh.

As the COVID-19 pandemic is rapidly accelerating the transition to digital commerce, consumers are being asked to practice social distancing, e-commerce orders for foodservice. Many families, in the capital, have started exploring and using digital services. The number of online food and grocery service providers is also increasing in response to the consumer’s inclination toward online delivery systems. Sighting the rising demand for online food delivery services,

Strong economic growth, rapid urbanization, and constant rise in disposable incomes are the key factors that contribute to the development of the Cambodian foodservice market. Sales of consumer foodservice continue to be led by the full-service restaurants segment, which is dominated by independent restaurants.

https://www.mordorintelligence.com/industry-reports/cambodia-foodservice-market-growth

Annually rice production up to 12.21million tones, up by about 11.6 per cent year-on-year. In 2021, official milled-rice exports reached 617,000 tonnes, rising by 10.68 per cent from 2020, and paddy sales to neighbouring countries stood at 3.53 million tonnes, ticking up 61.16 per cent year-on-year, it said. Exports of both categories combined rose by 50.9 per cent last year, topping the four-million tonne mark.

Source:https://www.phnompenhpost.com/business/paddy-exports-rocket-2021-milled-rice-underperforms

For other productions such as, Citrus fruit production: 70,698 tonnes, Sugar cane production: 2,123,185 tonnes, Maize production: 895 thousand tonnes, Roots and tubers production: 7,745,478 tonnes

Source: https://www.google.com/search?q=Cambodia+rice+supply+annually

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a general overview of country data related to the service and supply sectors, please consult the following sources:

The Observatory of Economic Complexity – MIT (OEC): http://atlas.media.mit.edu/en/

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.5.1 Cambodia Food Suppliers

Overview

The Cambodia food market has experienced tremendous growth since 2007. Initially, the country went from experiencing a significant number of its citizens living below the poverty line and among the 29 nations deemed most vulnerable to food insecurity to adopting the trend of ready-to-eat cooked foods and frozen products. Today, Cambodia's food market industry displays higher demand for frozen food than fresh and prepared food, requiring industry players to enhance their quality of retailers, storage, and distribution infrastructure.

The shift to western culture of frozen food consumption happens due to the increasing exposure of international tourism to Cambodia. Since 2010, the tourists' number entering Cambodia doubled from 250.000 to over 800.000, with a slight decrease in 2020 due to the mobility restrictions as preventive measures containing the COVID-19 pandemic. The country's rising tourism industry posed a demand for more diverse food categories, tweaking Cambodia's agriculture industry to cater to the growing needs for different tastebuds.

Numerous institutions have emphasized food business growth in Cambodia. For example, the Institute of Standards of Cambodia (ISC), alongside the United Nations Industrial Development Organization (UNIDO) has collaborated in 2016 to increase the export level of the four most dominant seafood products, implementing international standards for all the merchandise to attract more export demands. The standardized measures for export goods coming out of Cambodia have helped the country gain credibility for its domestic goods, bringing Cambodia's food industry globally.

Today, the market share of food and beverage in Cambodia is dominated by international players, such as Thailand's giant Food and Beverage (FnB) holding, Thai Beverage, and Unilever. Albeit the local players' contribution to the industry is still in its nascent stage, the frozen food market, specifically, grows at a steady pace. As a result, the country still fulfils most of the packaged and frozen goods demand through imports due to the disparate number of importers compared to producers.

As the middle class grew vastly, Cambodia forecasted the number of producers and standardized domestic agriculture players to change the market eventually. The rise of the food market in recent years has also spark digitalization and development for agricultural products, specifically rice, taking two-thirds of the total calorie intake of Cambodians in a year. Previously, several international NGOs and development partners have emphasized the importance of improving farming practices by monitoring seed quality and fertilizer application. However, as the country experiences a technological era by providing the internet to rural places, the agricultural industry has gradually adopted a digital way to record and track operational activities.

The government has also integrated nine different food markets across Cambodia to control fluctuations from externalities and seasonal shocks. Yet, the prices of raw food materials in Cambodia remain volatile in wet seasons from supply bottlenecks.

While holding massive potential in the agricultural food market, Cambodia's food market growth relies heavily on packaged and frozen products traffic. The reason being Cambodia has yet to leverage its agricultural operations, leading domestic players to remain to their traditional farming practices. Similarly, the packaged and frozen food products market is also heavily dominated by foreign players, requiring local and smaller players in the industry to compete in a highly fragmented sector.

Source: https://www.marketresearchcambodia.com/insight/cambodia-food-market-analysis

WFP Vulnerability and Analysis Mapping (VAM): http://vam.wfp.org/

USAID Famine Early Warning Systems Network (FEWS NET): http://www.fews.net/

For more information on food supplier contact details, please see the following link: 4.10 Supplier Contact List.

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

i.e. sheep and goats, swine, poultry… |

imported and produced locally |

|

01 - Meat and meat preparations |

i.e meat of bovine animals, meat of cattle, buffaloes, goats, pigs, poultry |

Locally raised and imported |

|

02 - Dairy products and birds’ eggs |

i.e. milk, yogurt, butter, cheese, eggs… |

Milk, yogurt, butter, cheese-Imported Eggs-locally produced and imported |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

i.e. fish (chilled or frozen), fish (salted or in brine), fish liver and roes… |

Fish is mostly produced locally but also imported |

|

04 - Cereals and cereal preparations |

i.e. wheat, rice, flour of maize, pasta... |

Rice and maise produced locally. |

|

05 - Vegetables and fruit |

i.e. vegetables, fruit and nuts, jams/jellies, fruit juices… |

Vegetables, fruits, and nuts are locally produced but also imported. |

|

06 - Sugars, sugar preparations and honey |

i.e. sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar … |

Locally produced and imported |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

i.e. coffee, cocoa, chocolate, tea, mate, pepper… |

Imported and locally produced (pepper, coffee) |

|

09 - Miscellaneous edible products and preparations |

i.e. ready-to-eat foods, margarine, sauces, soups and broths, yeasts… |

Imported and locally produced |

|

41 - Animal oils and fats |

i.e. lard, fats and oils… oil made from pork |

Locally produced |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

i.e. soya bean oil, olive oil, maize oil, vegetable oil… |

Imported |

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.5.2 Cambodia Additional Suppliers

Overview

The additional suppliers for supply good and services of computer/IT equipment, office furniture are available in Cambodia. All suppliers are the traders and based in Phnom Penh, but they can supply the goods and services till final destinations.

For more information on suppliers’ contact details, please see the following link: 4.10 Supplier Contact List.

AnAnA Computer Co., Ltd

AnAnA Computer Co., Ltd is one of the local companies provide IT solutions, including systems integration, networking, hardware, and software, they established in 2001.

|

Supplier Overview |

|

|---|---|

|

Company Name |

AnAnA Computer Co., Ltd |

|

Address |

#95, Preah Noromdom Blvd, Sangkat Boeung Raing, Khan Daun Penh, Phnom Peng, Cambodia Mr. Sophal Sorn, +855 70 954 439 |

|

Does the supplier have its own production / manufacturing capacity? |

No, they are distributors. |

|

Does the supplier have its own retail capacity? |

Yes, the supplier provides commodities directly to the consumer or end user. |

|

Does the supplier have its own transport capacity? |

N/A |

|

Does the supplier have its own storage facilities? |

N/A |

|

Approximate turnover in USD - $ |

N/A |

|

Payment Methods Accepted |

Yes |

|

Other Comments or Key Information |

N/A |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

24/27 - Crude materials, inedible, except fuel |

ICT Equipment |

Import products |

|

51 to 59 - Chemical and related products |

|

N/A |

|

61 to 69 - Manufactured goods classified chiefly by material |

|

N/A |

|

71 to 79 - Machinery and transport equipment |

|

N/A |

|

81 to 89 - Miscellaneous manufactured articles |

|

N/A |

|

91/93/96/97 - Commodities not classified elsewhere |

|

|

ICE Electronics Co., Ltd.

ICE Electronics Co., Ltd. is one of the local companies provide IT solutions, including systems integration, networking, hardware, and software, they established in 2015.

|

Supplier Overview |

|

|---|---|

|

Company Name |

ICE Electronics Co., Ltd. |

|

Address |

No. 293-295, Preah Sihanouk Blvd, Sangkat Veal Vong, Khan 7 Makara, Phnom Penh, Cambodia. Kimsour Kon, +855 23 222 924, +855 77 888 443, +855 16 95 42 97 |

|

Does the supplier have its own production / manufacturing capacity? |

No, they are distributors. |

|

Does the supplier have its own retail capacity? |

Yes, the supplier provides commodities directly to the consumer or end user |

|

Does the supplier have its own transport capacity? |

N/A |

|

Does the supplier have its own storage facilities? |

N/A |

|

Approximate turnover in USD - $ |

N/A |

|

Payment Methods Accepted |

Yes |

|

Other Comments or Key Information |

N/A |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

24/27 - Crude materials, inedible, except fuel |

ICT Equipment |

Import products |

|

51 to 59 - Chemical and related products |

|

N/A |

|

61 to 69 - Manufactured goods classified chiefly by material |

|

N/A |

|

71 to 79 - Machinery and transport equipment |

|

N/A |

|

81 to 89 - Miscellaneous manufactured articles |

|

N/A |

|

91/93/96/97 - Commodities not classified elsewhere |

|

|

LEECO Modern Furniture Shop

LEECO Modern Furniture Shop is one of the local company supply office furniture in Cambodia.

|

Supplier Overview |

|

|---|---|

|

Company Name |

LEECO Modern Furniture Shop |

|

Address |

No. 250, Monivong Blvd, Phnom Penh, Cambodia Ms. Ly Chou, +855 86 292 667, +855 93 73 73 36 |

|

Does the supplier have its own production / manufacturing capacity? |

No. All furniture products were imported. |

|

Does the supplier have its own retail capacity? |

Yes, the supplier provides commodities directly to the consumer or end user |

|

Does the supplier have its own transport capacity? |

N/A |

|

Does the supplier have its own storage facilities? |

N/A |

|

Approximate turnover in USD - $ |

N/A |

|

Payment Methods Accepted |

Yes |

|

Other Comments or Key Information |

|

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

24/27 - Crude materials, inedible, except fuel |

Office Furniture |

Import products |

|

51 to 59 - Chemical and related products |

|

N/A |

|

61 to 69 - Manufactured goods classified chiefly by material |

|

N/A |

|

71 to 79 - Machinery and transport equipment |

|

N/A |

|

81 to 89 - Miscellaneous manufactured articles |

|

N/A |

|

91/93/96/97 - Commodities not classified elsewhere |

|

|

- Leang Hong Modern Office Furniture is one of the local company supply office furniture in Cambodia.

|

Supplier Overview |

|

|---|---|

|

Company Name |

Leang Hong Modern Office Furniture |

|

Address |

No. 386, Monivong Blvd, Phnom Penh, Cambodia Ms. Lay Sive +855 23 213 838 |

|

Does the supplier have its own production / manufacturing capacity? |

No. All furniture products were imported |

|

Does the supplier have its own retail capacity? |

Yes, the supplier provides commodities directly to the consumer or end user |

|

Does the supplier have its own transport capacity? |

N/A |

|

Does the supplier have its own storage facilities? |

N/A |

|

Approximate turnover in USD - $ |

N/A |

|

Payment Methods Accepted |

Yes |

|

Other Comments or Key Information |

|

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

24/27 - Crude materials, inedible, except fuel |

Office Furniture |

Import products |

|

51 to 59 - Chemical and related products |

|

N/A |

|

61 to 69 - Manufactured goods classified chiefly by material |

|

N/A |

|

71 to 79 - Machinery and transport equipment |

|

N/A |

|

81 to 89 - Miscellaneous manufactured articles |

|

N/A |

|

91/93/96/97 - Commodities not classified elsewhere |

|

|

**For FOOD products please see section 3.5.1 Food Suppliers, and for FUEL/PETROLEUM products please see section 3.1 Fuel.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.6 Cambodia Additional Services

Overview

Most of the services required are available in Cambodia, though the capacity could be limited and quality in most of the main cities reached to international standard. However, in remote areas especially in some isolated districts away from the major towns and cities services quality still limited. Availability and capacities of various service providers are explained in more details in the following sections.

For contact details, please see the following link: 4.11 Additional Services Contact List.

Accommodation

Hotel is set minimum levels ranging from one star (1) up to a maximum five-star rating (5). Control procedures and hotel ratings technical procedure is the Committee's review and evaluation hotel ratings used for monitoring and evaluation ratings Hotel.

Control procedures and hotel ratings are divided into 3:

- Procedure 1: Application Procedures hotel through technical consultation

- Procedure 2: Application Procedures hotel

- Procedure 3: Procedure suspension revoked downgrade hotel

Reference: https://www.cambodiahotelassociation.com.kh/about-cha/contact-us/

Electricity and Power

Electricity service units in some provinces are still under the control of provincial authorities, but are funded by the Ministry of Industry, Mines and Energy.

Electricite du Cambodge (EDC) became a limited liability company of the state with the responsibility of generation, transmission and distribution of energy. Electricity throughout the Kingdom of Cambodia. Electricite du Cambodge (EDC) is an autonomous, administrative and financial entity with commercial objectives, rights and responsibilities determined by law. Electricite du Cambodge (EDC) is directly responsible for all fees and losses, as well as all liabilities at the cost of its resources. At the same time, the provincial electricity units were gradually transferred from the provincial Department of Industry, Mines and Energy:

Reference: https://www.edc.com.kh/aboutus.php

According to Cambodia Power Report 2011, Cambodia's power consumption is forcast to rise from 1.4TWh in 2010 to 3.4TWh by the end of 2020, representing average annual growth of 9.4% in 2011-2020.Jul 10, 2018

Electricity Consumption per Capita: 112

Electricity Consumption: 1.64

Energy Production: 3.64

TPES per Capita: 0.36

Ref. https://www.edc.com.kh/plan_page/plan

Financial Services

The Cambodian banking sector is a two-tier system comprising the public sector (represented by the National Bank Cambodia ‘NBC”), and the private sector such as commercial banks, specialized banks, microfinance institutions, and a number of NGOs involved in rural credit activities.

Under the Law on Banking and Financial Institutions, all banks shall be licensed and supervised by the NBC. In the past, a large number of banks had been inactivated due to poor management making people distrust the banking system. To solve this situation, the NBC implemented the Law on Banking and Financial Institutions and conducted a bank re-licensing program. Through this change, the Cambodian financial system has developed and stabilized.

As of December 2014, there are 36 commercial banks, 11 specialized banks, 40 microfinance institutions, 38 registered credit operators and six leasing companies in operation.

Besides banking institutions, there are also non-banks service providers which act as a third-party processor. A third-party processor is an institution entrusted by a bank to conduct one or more parts of its payment services.

https://www.nbc.org.kh/english/payment_systems/overview_of_payments_instruments.php

National Banks of Cambodia

The nation's central bank, is the monetary and supervisory authority. The mission of the NBC is to determine and direct the monetary policy aimed at maintaining price stability in order to facilitate economic development within the framework of the kingdom's economic and financial policy. The NBC has 21 branches in 25 provinces and cities, staff 1,364 (959 Head quarters 405 provinces)

Ref. https://www.nbc.org.kh/english/about_the_bank/overview_of_functions_and_operation.php

|

Company Overview |

||

|---|---|---|

|

Company Name |

National Banks of Cambodia |

|

|

Address |

Address: #22-24 Norodom Blvd, Phnom Penh, Cambodia. Tel: (855-23) 722 563, 722 221 (855-23) 722 189 ( The Governor's Office ) Fax: (855-23) 426 117 Email: info@nbc.org.kh Website: http://www.nbc.org.kh |

|

|

|

Available? |

Comments |

|

Has IBAN, BIC, or SWIFT number? |

Yes |

SWIFT Number: NCAMKHPP |

|

Provides currency exchange? |

Yes |

|

|

Will initiate / receive wire transfers? |

Yes |

|

|

Provides Loan / Credit services? |

Yes |

|

|

Other Comments or Key Information |

N/A |

|

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

National Bank of Cambodia - Phnom Penh Branch

|

#273 , Street 110-67, Sangkat Wat Phnom, Khan Daun Pehn, Phnom Penh, Cambodia. Tel : (855-53) 223 741 Fax : (855-23) 223 745 |

|

National Bank of Cambodia - Kampong Cham Branch

|

Street Preah Monivong, Khum-Srok Kampong Cham , Kampong Cham Province, Cambodia. Tel : (855-42) 941 958 Fax : (855-42) 941 958 |

|

National Bank of Cambodia - Kampong Chhnang Branch

|

Street Norodom, Phum Klang Prak, Khum Phaei, Srok Kampong Chhnang , Kampong Chhang Province, Cambodia. Tel : (855-26) 988 674 Fax : (855-26) 988 674 |

|

National Bank of Cambodia - Battambang Branch

|

#70 - 71, Street 1, Phum 20 Ousaphea, Sangkat Svaypor, Krong Battambang , Battambang Province, Cambodia. Tel : 855-53) 941 958 Fax : (855-23) 730 166 |

|

National Bank of Cambodia - Kampong Speu Branch

|

National Road No 4, Phum Peanichkam , Khum Rokarthom, Srok Chbar Mon, Kampong Speu Province, Cambodia. Tel : (855-25) 987 214 Fax : (855-25) 987 214 |

|

National Bank of Cambodia - Koh Kong Branch

|

Street Matprek, Phum 1, Khum-Srok Smach Meanchey, Koh Kong Province, Cambodia. Tel : (855-35) 936 210 Fax : (855-35) 936 210 |

|

National Bank of Cambodia - Kratie Branch

|

Street Kosamak, Phum Kratie, Srok Kratie, Kratie Province, Cambodia. Tel : (855-72) 971 695 Fax : (855-72) 971 695 |

|

National Bank of Cambodia - Ratanakiri Branch

|

Street 78, Phum 1, Khum Labanseak, Srok Banlung, Ratanakiri Province, Cambodia. Tel : (855-75) 974 173 Fax : (855-75) 974 173 |

|

National Bank of Cambodia - Mondulkiri Branch

|

Phum Svay Cheik, Khum Sokadom, Srok Sen Monorum, Mondulkiri Province, Cambodia. Tel : (855-12) 656 070 |

|

National Bank of Cambodia - Svay Rieng Branch

|

Phum Suon Thmey, Khum Prek Chhlak, Srok Svay Rieng, Svay Rieng Province, Cambodia. Tel : (855-44) 945 989 Fax : (855-44) 945 989 |

|

National Bank of Cambodia - Banteay Meanchey Branch

|

Blok Uy, Phum 3, Khum Preah Punlear, Srok Serei Sophoan, Banteay Meanchey Province, Cambodia. Tel : (855-54) 710 169 Fax : (855-54) 710 169 |

|

National Bank of Cambodia - Stung Treng Branch

|

Street 2, Phum Prek, Khum-Srok Stung Treng, Stung Treng Province, Cambodia. Tel : (855-74) 973 906 Fax : (855-74) 973 906 |

|

National Bank of Cambodia - Kampong Thom Branch

|

Street Stung Sen, Phum 1, Khum Kampong Thom, Srok Stung Sen , Kampong Thom Province, Cambodia. Tel : (855-62) 961 309 Fax : (855-62) 961 309 |

|

National Bank of Cambodia - Pursat Branch

|

Street 1, Phum Popeal Nhek 2, Khum Ptas Prey, Srok Sampeuvmeas, Pursat Province, Cambodia. Tel : (855-52) 951 481 Fax : (855-52) 951 481 |

|

National Bank of Cambodia - Takeo Branch

|

Street 11, Phum 1, Khum Rokarknong, Srok Donkeo , Takeo Province, Cambodia. Tel : (855-32) 931 327 Fax : (855-32) 931 327 |

|

National Bank of Cambodia - Kampot Branch

|

Street Matprek, Phum 1 Ousaphea, Khum Kampong Kandal, Srok Kampong Bay, Kampot Province, Cambodia. Tel : (855-33) 932 830 Fax : (855-33) 932 830 |

|

National Bank of Cambodia - Prey Veng Branch

|

Street Matonlei, Phum 3, Khum-Srok Kampong Leav , Prey Veng Province, Cambodia. Tel : (855-43) 944 556 Fax : (855-43) 944 556 |

|

National Bank of Cambodia - Kandal Branch

|

Street 104, Phum Takmao, Khum-Srok Takhmao, Kandal Province, Cambodia. Tel : (855-23) 425 664 Fax : (855-23) 425 664 |

|

National Bank of Cambodia - Preah Sihanoukville Branch

|

Street Pokambor, Sangkat 3, Khan Mitapheap, Preah Sihanoukville Province, Cambodia. Tel : (855-34) 933 649 Fax : (855-34) 933 649 |

|

National Bank of Cambodia - Preah Vihear Branch

|

Street 2, Phum Kandal, Khum Kampong Pronark, Srok Tbeng Meanchey, Preah Vihear Province, Cambodia. Tel : (855-12) 952 035 |

ACLEDA Bank Plc

ACLEDA Bank Plc. is a public limited company, formed under the Banking and Financial Institutions Law of the Kingdom of Cambodia. ACLEDA Bank Plc. officially listed its equity securities on the Cambodia Securities Exchange (CSX) on May 25, 2020. Investors can trade the Bank's shares on the CSX from Monday to Friday from 8:00 am until 3:00 pm, except public holidays.

Ref. https://www.acledabank.com.kh/kh/eng/ff_overview

|

Company Overview |

||

|---|---|---|

|

Company Name |

ACLEDA Bank Plc |

|

|

Address |

Headquarters: #61, Preah Monivong Blvd., Sangkat Srah Chork,

Khan Website: http://www.acledabank.com.kh |

|

|

|

Available? |

Comments |

|

Has IBAN, BIC, or SWIFT number? |

Yes |

SWIFT Code: ACLBKHPP |

|

Provides currency exchange? |

Yes |

|

|

Will initiate / receive wire transfers? |

Yes |

|

|

Provides Loan / Credit services? |

Yes |

|

|

Other Locations |

||

|

Region(s) |

Service Location(s) |

|

|

The addresses of all branches are available at the link below: |

||

|

ACLEDA Bank Lao Ltd |

Headquarters: #372, Corner of Dongpalane and Dongpina Road, Unit

21, Phonesavanh Neua Village, Sisattanak District, Vientiane

Capital, Lao PDR. |

|

|

ACLEDA MFI Myanmar Co., Ltd |

Building No.186(B), Shwe Gon Taing Road, Yae Tar Shae Block,

Bahan Township, Yangon Region. |

|

ABA Bank

ABA Bank is Cambodia's leading private financial institution (not state-owned enterprise) founded in 1996 as the Advanced Bank of Asia Limited. ABA opened 11 new branches, bringing the total number of branches on offices to 77.

Business hours

Mon – Sun: 8.00 am – 8.00 pm

|

AEON Mall 2 (Sen Sok City) Branch |

Siem Reap Branch |

|

Borei Keyla Branch |

Sihanoukville Branch |

|

Mao Tse Toung Branch |

Stung Meanchey Branch |

|

Operational Hall of Head Office |

Toek Thla Branch |

|

Samdach Monireth Branch |

Toul Kork Branch |

|

Santhormok Branch |

Mon – Fri: 8.00 am – 4.00 pm

Sat: 8.00 – 11.00 am

|

Battambang Branch |

Memot Branch |

|

Central Branch |

Ou Baek K'am Branch |

|

Central Market Branch |

Poay Paet Branch |

|

Chamkar Dong Branch |

Phsar Daeum Thkov Branch |

|

Chaom Chau 2 Branch |

Russey Keo Branch |

|

Chbar Ampov Branch |

Sen Sok Branch |

|

Chhroy Chongvar Branch |

Samdach Sothearos Branch |

|

Chom Chao Branch |

Stade Chas Branch |

|

Independence Monument Branch |

Takhmao Branch |

|

Kampong Cham Branch |

Toul Kork 2 Branch |

|

Mittapheap Branch |

Mon – Fri: 8.00 am – 4.00 pm

|

Ang Snuol District Branch* |

Oudongk District Branch |

|

Bakan District Branch |

Ratanakiri Branch* |

|

Banteay Meanchey Branch* |

Pea Reang District Branch |

|

Baray District Branch |

Peam Ro District Branch |

|

Bati District Branch |

Preah Netr Preah Branch |

|

Bavet Branch* |

Prey Chhor District Branch |

|

Chamkar Leu District Branch |

Prey Nob District Branch |

|

Cheung Prey District Branch |

Prey Veng Branch* |

|

Chhuk District Branch |

Pursat Branch* |

|

Kampong Chhnang Branch* |

S'ang District Branch |

|

Kampong Speu Branch* |

Samraong Tong District Branch |

|

Kampong Thom Branch* |

Siem Reap (Phsar Leu) Branch* |

|

Kampong Tralach District Branch |

Snuol District Branch |

|

Kampot Branch* |

Soutr Nikom District Branch |

|

Kandal Stueng District Branch |

Stoung District Branch |

|

Kaoh Thom District Branch |

Stung Treng Branch* |

|

Kien Svay District Branch* |

Svay Chrum District Branch |

|

Koh Kong Branch* |

Svay Rieng Branch* |

|

Kratie Branch* |

Takeo Branch* |

|

Krong Siem Reap (Angkor) Branch* |

Tboung Khmum Branch* |

|

Mongkol Borei District Branch |

Thmar Kol District Branch |

|

Moung Ruessei District Branch |

Tram Kak District Branch |

|

Mukh Kampul District Branch* |

ABA 24/7

|

Company Overview |

|||||

|---|---|---|---|---|---|

|

Company Name |

Advanced Bank of Asia Limited (ABA) |

||||

|

Address |

Head Office: #141,146,148, 148ABCD Preah Sihanouk Blvd., and #15 and 153ABC St. 278, Boeung Keng Kang 1 Tel: (+855) 23 225 333 |

||||

|

|

Available? |

Comments |

|||

|

Has IBAN, BIC, or SWIFT number? |

Yes |

SWIFT Code: ABAAKHPP |

|||

|

Provides currency exchange? |

Yes |

|

|||

|

Will initiate / receive wire transfers? |

Yes |

|

|||

|

Provides Loan / Credit services? |

Yes |

|

|||

Ref. https://www.ababank.com/en/aba-locator/

Wing (Cambodia) Limited Specialised Bank

Wing (Cambodia) Limited Specialised Bank is one of Cambodia's leading mobile banking services providers, established in 2009. Wing provides services such as local money transfer, phone top up, bill payment, Wing ‘Ket Luy’ and online payment. Wing has nationwide networks with 3,700 agents throughout the country.

Source: https://www.wingmoney.com

|

Company Overview |

|

|---|---|

|

Company Name |

Wing (Cambodia) Limited Specialised Bank |

|

Address |

#721, Preah Monivong Blvd, Phnom Penh, 12304 Cambodia. Phone: (855) 23999 989 Website:www.winggmoney.com |

|

Has IBAN, BIC, or SWIFT number? |

Yes |

|

Provides currency exchange? |

Yes |

|

Will initiate / receive wire transfers? |

Yes |

|

Provides Loan / Credit services? |

Yes |

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Agents are located in provinces and towns beside Phnom Penh |

The addresses of all agents are available at the link below: |

Clearing and Forwarding Agents

In Cambodia, there are many agents that provide logistics solutions i.e. Air Freight, Sea Freight, Local and Cross Border Trucking, Warehousing, Inventory Management, Local and International Removal Services, Packing and Unpacking and Customs Clearance Services.

|

Name of company |

Address/ Contact list |

Service |

|---|---|---|

|

Bolloré Logistics - Cambodia

|

Tel: 012 802 346 |

Transportation Service · Cargo & Freight Company

|

|

GFS Logistics Cambodia LTD

|

Tel: 023 880 340/ 880 308 |

Handling Equipment

Handling equipment is available at the ports, construction & building companies, airports and main logistics centres.

Port: The three main international ports in Cambodia are: Sihanoukville on the Gulf of Siam, Phnom Penh on the Mekong river, and the provincial port of Koh Kong. https://www.pas.gov.kh/

Airports: corp.cambodia-airports.aero; telephone: 023 862 800

Postal and Courier Services

The Postal and Courier Services is managed by the Government Ministry of Posts and Telecommunications, and by smaller private companies.

https://www.cambodiapost.post/en

Printing and Publishing

There are many printing companies available to supply and print all kind of materials in Cambodia as well as publishing.

Taxi Companies

There are many taxi companies in Cambodia such as

- Trans-Choice Cambodia: +855 70 888 070 | +855 10 888 010

- Global (Cambodia) Trade Development Co. Ltd: 010/011/013 311 888

- Taxi Association of Phnom Penh International Airport: +855 12 846 507

- Taxi DCP Phnom Penh: +855 89 300 150

- Tuktuk (with meter): +855 92 711 711 | 96 2711 711 | 97 2711 711

Vehicle Rental

Vehicle rental companies have many types of vehicles for rent. Most of the companies are located in Phnom Penh and Siem Reap, being the main tourist destinations.

Vehicle Rental Company:

- Kim Se Transportation. Telephone number: +855 12 633 133

- A.V.A (Asia Vehicle Rental) Co., Ltd. Telephone: +855 23 884 744

Source: UNDP UNLTA no. 251 and no. 252

Waste Management and Disposal Services

Waste collection in Phnom Penh is handled by a private company and the Phnom Penh Municipality. In 1997, a company called PSBK signed a contract with Phnom Penh Municipality to manage the city’s waste for the next 50 years. However, in 2002, CINTRI took over and has monopolized waste collection in the city since then. In addition to the contributions of this private company, the Phnom Penh Municipality is also responsible for waste collection and management in some parts of Phnom Penh. Those areas include poor neighborhoods and squatter communities where there is limited road access. This is done by an agency of the Municipality called the Phnom Penh Waste Management Authority (PPWMA) whose role is to either provide waste management services itself, or contract out these services to a private company or monitor their performance.

Source: https://urbanvoicecambodia.net/waste-management-in-phnom-penh/?lang=en

Waste Disposal (Non-Hazardous)

In October 2019, the Cambodian Government declared to reform waste collection in the city. The city will be divided into operational zones. Waste collection and transportation will be provided by several companies. After Phnom Penh, Battambang – the second largest Cambodian city – generates 126 tonnes per day.

Waste collection in Phnom Penh is handled by a private company and the Phnom Penh Municipality. In 1997, a company called PSBK signed a contract with Phnom Penh Municipality to manage the city’s waste for the next 50 years. However, in 2002, CINTRI took over and has monopolized waste collection in the city since then. In addition to the contributions of this private company, the Phnom Penh Municipality is also responsible for waste collection and management in some parts of Phnom Penh. Those areas include poor neighborhoods and squatter communities where there is limited road access. This is done by an agency of the Municipality called the Phnom Penh Waste Management Authority (PPWMA) whose role is to either provide waste management services itself, or contract out these services to a private company or monitor their performance.

Ref. https://urbanvoicecambodia.net/waste-management-in-phnom-penh/?lang=en

Waste Disposal (Hazardous)

For the disposal of Hazardous waste the reference government body is the Ministry of Environment. The Sub-Decree at the following link provides some guidelines (http://www.wepa-db.net/policies/law/cambodia/03.htm).

In Cambodia, legislation on hazardous waste disposal, such as the Safe Dumpsite Operation, exists. However, enforcement of legislation is not comprehensive and could be improved through better coordination and technical capacity of governmental institutions, including the development of guidelines. As the main waste generators, the private sector could be better involved and better educated on safe hazardous waste management practices. Funds are needed for tasks such as equipment maintenance, collection of pollution data, and the construction of specific landfills for hazardous waste. Local communities can also be mobilized as key actors, reporting any illegal treatment of hazardous waste in their areas

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.