3 Burkina Faso Services and Supply

The following sections contains information on the logistics services of Burkina Faso.

Disclaimer: Registration does not imply any business relationship between the supplier and WFP/Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please Note: WFP/Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.1 Burkina Faso Fuel

Fuel Overview

The SONABHY (Société Nationale Burkinabè

d’Hydrocarbures ) under the authority of the Ministry of Trade,

holds a monopoly on the import and storage of hydrocarbons in the

country. Supplies of petroleum products are mainly contracted

through calls for tenders and long-term contracts (suppliers with

port storage capacities and direct purchases).

The transit storage of products purchased on the international

market is carried out at the Storage Company (STSL) in Lomé (Togo),

at the ORYX depot in Cotonou (Benin), at the National Company for

the Marketing of Petroleum Products (SONACOP) in Téma and

Bolgatanga (Ghana) and GESTOCI in Côte d'Ivoire.

Hydrocarbon products purchased are generated from coastal depots to

inland depots in Burkina Faso by rail (SITARAIL) and road (private

transporters). SONABHY has three main storage depots located in

Bobo Dioulasso, Bingo and Péni with currently construction projects

ongoing in Bingo to increase the storage capacity.

Hydrocarbon products are then distributed to end consumers through

key account players or customers (members of the Groupement

Professionnel Pétrolier) who obtain their supplies directly from

SONABHY. These large account customers (around 85 as date of

September 2021) consist of marketers, subsidiaries of

multinationals (Vivo Energy, Total Energies, Orix Energy, Ola

Energy) and independent national companies distributing petroleum

products (Otam, Petrofa).

Brochure on SONABHY (French version) here.

Last October 2018, the SONABHY had obtained its ISO 9001/2015 certification.

For more information on government and fuel provider contact details, please see the following links: 4.1 Government Contact List and 4.7 Fuel Providers Contact List.

Information may also be found at: http://www.mytravelcost.com/petrol-prices/ which is updated monthly.

Fuel Pricing

The prices of hydrocarbons and butane gas, together with the

duties and taxes levied on hydrocarbon imports, are fixed monthly

by the CIDPH (Comité Interministériel de Détermination des Prix des

Hydrocarbure) which includes 13 indicators to structure the

price.

The isolation of the country and taxes partly explain the

relatively high level of hydrocarbon prices in Burkina Faso to

compare with others UEMOA countries.

|

Fuel Prices per Liter as of: 01/09/2021 Exchange rate 1 USD = 552.25 XOF (source BCEAO) |

Ouagadougou |

Bobo-Dioulasso |

|---|---|---|

|

Super 91 |

610 CFA / 1.10 US$ |

605 CFA / 1.09 US$ |

|

Gazoil |

540 CFA / 0.97 US$ |

545 CFA / 0.98 US$ |

|

Petrol |

540 CFA / 0.97 US$ |

535 CFA / 0.96 US$ |

|

DDO (Diesel Distillate Oil) |

495 CFA / 0.89 US$ |

490 CFA / 0.88 US$ |

|

Paraffin |

n/a |

|

|

Jet A-1 |

0.58 US$ |

|

Seasonal Variations

|

Are there national priorities in the availability of fuel? (i.e., are there restrictions or priorities for the provision of fuel such as to the military?) |

No |

|---|---|

|

Is there a rationing system? |

No |

|

Is fuel to lower income / vulnerable groups subsidized? |

n/a |

|

Can the local industry expand fuel supply to meet humanitarian needs? |

No |

|

Is it possible for a humanitarian organization to directly contract a reputable supplier / distributor to provide its fuel needs? |

Yes |

Fuel Transportation

SONABHY has a fleet of 1300 tank trucks (capacity from 30,000 to 65,000 liters) contracted through private transporters to collect hydrocarbon from coastal depots to inland depots in Burkina. Then marketers manage the delivery of hydrocarbons to their own gas station or depots across the country.

Standards, Quality and Testing

|

Industry Control Measures |

|

|---|---|

|

Do tanks have adequate protection against water mixing with the fuel? |

Yes |

|

Are there filters in the system which monitor where fuel is loaded into aircraft? |

Yes |

|

Is there adequate epoxy coating of tanks on trucks? |

Yes |

|

Is there a presence of suitable firefighting equipment? |

Yes |

|

Standards Authority |

|

|---|---|

|

Is there a national or regional standards authority? |

Yes |

|

If yes, please identify the appropriate national and/or regional authority. |

ABNORM (Agence Burkinabé de Normalisation, de Métrologie et de la Qualité) |

|

If yes, are the standards adequate/properly enforced? |

Yes |

|

Testing Laboratories |

|

|---|---|

|

Are there national testing laboratories? |

Yes. Each storage deposit has its own laboratory to perform quality control. |

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.2 Burkina Faso Transporters

Overview

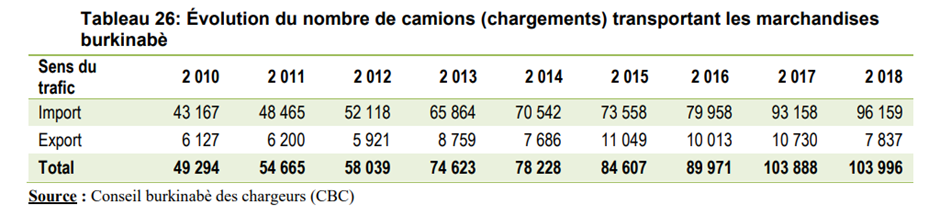

The road transport market is highly developed in Burkina Faso and represents the first mean to carry goods in and out of the country as per showed in the below table from the last 2018 statistics report published by the MTMUSR (Ministère des Transports, de la Mobilité Urbaine et de la Sécurité Routière) in December 2019[1].

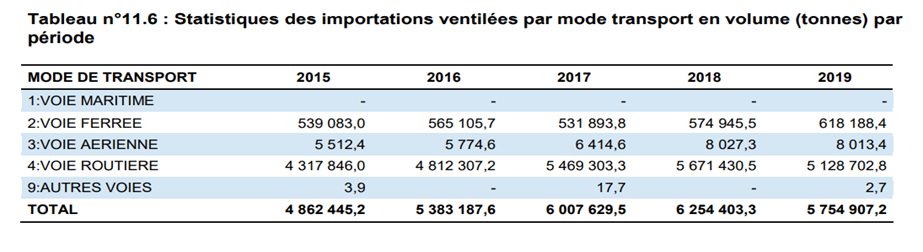

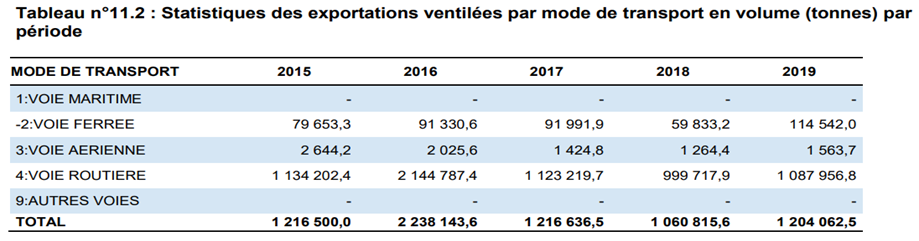

This is also highlighted with the below figures related to the trade volume in 2019 published by INSD[2] (Institut National de la Statistique et de la Démographie ) showing goods are mainly transported by road first if comparing with the sea and air transportation.

According to the last statistics report of CCI published in March 2020[3], 2 356 companies are registered as transporters and offer a remarkably high number of trucks available within the country (trailer, semi-trailer, etc). However, according to main syndicate of transporters represented by the FUTRB (Faitière Unique des Transporteurs Routier du Burkina), there is around 8000 transporters companies operating in Burkina Faso as follows:

- 80% are micro and small size companies with less than five truck and not legally registered

- 16% are medium size companies and legally operating in country

- 3% are administratively organized companies

- Only 1% are considered as professional and developed companies

As observed, transporter companies belong mainly to the informal sector with a high number micro companies without any legal registrations and owning a few trucks. Therefore, this is a point to be considered when contracting a company to respect all the local legislation and to be in position to meet all customers’ requirements.

In this regard, the DGTTM is implementing since 2019 the

Licence d’Exploitation

de Transport Routier, a mandatory certificate for all the

transporters to operate in the country. The transporter must submit

a set of documents to obtain this certificate then a blue number

plate will be assigned for each registered truck. A blue plate is

stating that the truck is dedicated for transportation of goods and

passed the yearly technical control with the CCVA.

Target is 2024-2025 to achieve this process with campaign of

awareness from the DGTTM regional offices to mobilize the

transporters to apply for the license.

Organization & Structure of National Transporters

There are 19 different unions of transporters in country which

created some issues in term of negotiations with the government

illustrated by several and repetitive strikes in the past. Last

February 2021, an umbrella structure gathering all the union was

created under the FUTRB then has presented officially the board to

the MTMUSR in June 2021. Main challenges for the road transport in

country is to renew the fleet characterized by trucks in poor

mechanic condition (mainly due to the overloaded practice) and to

work on the awareness of road safety. In this regard, the

government has launched last 25 October 2021 the first phase of

subscriptions to the credit access mechanism on behalf of the

transporter for the renewal of the fleet. The budget allocated for

this first phase with the support of the World Bank represents

5.500.000.000 CFA with a target of 150 new trucks (here the

DGTTM ‘s communication)

In addition, the FUTRB is doing advocacy to have a ceiling price

system in place as of October 2021, below is the current

T.KM[4] (will

depend on the type and destination of the cargo)

- From 32 to 44 FCFA at international level

- From 80 to 160 FCFA at national level

Transporter capacity to meet humanitarian needs

At this stage, domestics and humanitarian needs are fully covered by the national capacity of the market and none tension to meet both private and humanitarian requirements was observed during the past years. Even in case of a sudden increase of transportation needs by the humanitarian community, the national market will be able to absorb an influx in demand.

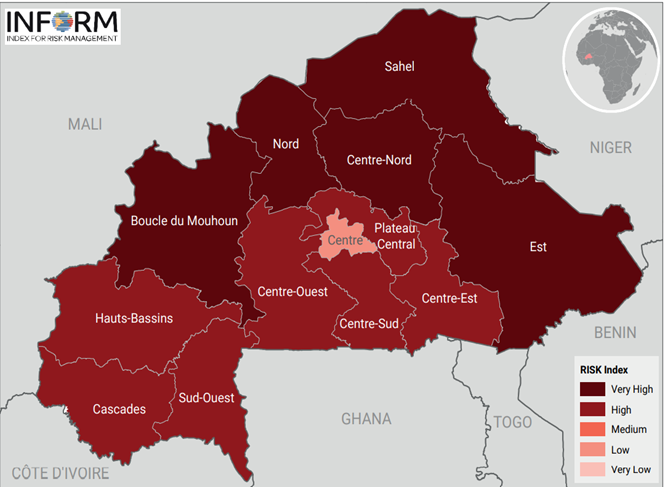

Source: INFORM Risk Index September 2021

However, the main challenge is the access to IDPs located in areas where security is the major issue (North, North Center, Sahel, Est regions). Transporters are reluctant or refuse to dispatch their trucks in those borders regions due to the high risk of ambush, kidnapping by terrorist groups and the increase of IEDs on the road.

Regional Transporters Overview

To have a better understanding and knowledge of the transportation sector within the main regions impacted by the humanitarian crisis, meetings with syndicates were conducted during field visits last October 2021.

For more information on transport company & syndicate contact details, please see the following link: 4.8 Transporter Contact List.

|

Faitière Unique des Transporteurs Routier du Burkinabé (FUTRB) |

|

|---|---|

|

Regions Covered |

All regions |

|

Representative |

Issoufou MAIGA (based in Ouagadougou) - President of FUTRB |

|

Comments |

Umbrella organization which gathers eighteen different unions within the country and represented by the President Mr. Issoufou MAIGA. FUTRB’s role is to be the interface between the government and the carriers in a participatory relationship and with the main objective of contributing to the development of national transport. Below is the structure of the Faitière:

FUTRB’s goal is the respect of the transportation rules within the country by the companies and with the support of the local authorities. Main issues are the overload practice which damages seriously the roads and the exclusion of truck more than twenty years of service. |

|

Syndicat Régional des Transporteurs Routiers des Voyageurs du Nord (SRTRVN) |

|||

|---|---|---|---|

|

Regions Covered |

Region Nord |

||

|

Representative |

Laminé SAWADOGO (based in Ouahigouya) – Secretary, Member of F.U.T.R.B |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Condition of Vehicles |

|

Vehicle Type |

>150 |

7 MT / 10 MT |

Trucks are available from individual companies based in Ouahigouya and main cities within the region. Drivers have a good knowledge of the area which is a source to get information about road conditions. |

|

Comments |

Since 2018, freight activity is facing a huge decrease up to 80% due to the security situation and from now only food transportation represents their main core of activities. Due to this situation, the syndicates implemented a system where transportation contracts are shared among several individual companies to guarantee income. |

||

|

Organisation des Transporteurs du Faso (OTRAF) |

|||

|---|---|---|---|

|

Regions Covered |

Sahel |

||

|

Representative |

Mamadou CISSÉ (based in Dori), Member of FUTRB |

||

|

FROM |

Number of Vehicles |

Capacity per Vehicle (MT) |

TO |

|

|

20 |

7,10,20 MT |

Tinakoff: Every Thursday (market day), road is asphalted, and fuel is available. |

|

Déou |

|||

|

Tasmakatt: Every Monday (market day) via R3 with tricycles. |

|||

|

Markoye |

6 |

7,10 MT |

Tinagadé: via D3 with only 7 MT truck |

|

Dori |

7 x 13 MT 17 x 10 MT 25 x 25 MT 3 x 40 MT |

Arbinda via Gorgadji: Unsafe areas therefore transporters take the opportunity to go only when there is a military convoy to shift troops. |

|

|

Mansila via Sebba: Unsafe areas therefore transporters take the opportunity to go only when there is a military convoy to shift troops |

|||

|

Mansila: Accessible by road during the dry season only. Seytenga: Road to reach the Niger border (67 km) however increase of security incidents during the last months. |

|||

|

Arbinda |

|

Sibré: Accessible by tricycle only |

|

|

Boundoré |

Accessible with only 7 MT and 10 MT truck |

||

|

Falagountou |

Accessible with only 10 MT and 20 MT truck |

||

|

Comments |

Estimated tariff from Dori to:

|

||

|

Organisation des Transporteurs du Faso (OTRAF) |

|||

|---|---|---|---|

|

Regions Covered |

Region Est |

||

|

Representative |

Djibril TRAOERE (based in Fada) – Regional Representative, member of FUTRB |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Condition of Vehicles |

|

Vehicle Type |

>150 |

From 5 MT to 70 MT |

Around 50 transporters companies are operating in Est Region mainly based in Namounou/ Kompienga (cities closed to Niger and Benin borders) and Fada. Each transporter owns an average of 2-3 trucks. |

|

Comments |

However, the commercial transportation within the region is very impacted by the insecurity on the roads with the presence of terrorist groups and IEDs. Incidents occurs on weekly basis and trucks stopped moving in many axes like:

This situation is delaying the humanitarian response to reach the beneficiaries in those areas. Main roads going to Niger border (Kantchari) and Benin border (Nadiagou) are also targeted by the terrorist groups to rob goods and to do carjacking. In addition, transporters have been requested by the terrorist groups not to use security convoys when travelling otherwise they will be targeted. At this stage, transporters are facing a tough economic situation and to maintain their business activity, some transporters decided to leave the region to deliver goods to Ouagadougou from the main corridors (Lomé, Abidjan, etc). The second main issue reported by the Syndicate is the very poor conditions of the roads destroyed in some axes with huge potholes. Then, construction companies awarded to do the rehabilitation within the region are victims of attack by terrorist groups (kidnapping of workers, destruction of building machines, etc) which stopped the activities. |

||

|

Organisation des Transporteurs du Faso (OTRAF) |

|||

|---|---|---|---|

|

Regions Covered |

Region Centre-Nord |

||

|

Representative |

Mahamadi ZAMTAKO (based in Kaya) – Regional Representative, member of FUTRB |

||

|

|

Number of Vehicles |

Capacity per Vehicle (MT) |

Condition of Vehicles |

|

Vehicle Type |

>650 |

From 4 MT to 50 MT |

Around 200 transporters companies are operating in Kaya and each transporter owns an average of 2-3 trucks. Few transporters are in Kongoussi (12) and in Tougouri (20) however they are mainly based in Kaya. According to the Syndicate, 70% of the companies well are registered with the CCI and the remaining belongs to the informal sector. |

|

Comments |

The transportation sector is facing a significant decrease of their activities since local markets closed three years ago in some areas like Kelbo, Foubé due to the insecurity within the region. There are no more goods to be transported so many companies have stopped operating. As a date of November 2021, the axes to Bouroum (D22), Silmangué and Pensa are still accessible by road according to the Syndicate. |

||

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

[1] Full report available here

[2] Full report available here

[3] Full report available here

[4] Ton per Kilometre

3.3 Burkina Faso Manual Labour

Manual Labor is available within all the country and can be implemented through different channels like a private logistics company, a job center agency or inclusive with a service agreement. This service is usually contracted on daily basis for warehousing operations with a flat rate charged per ton or per unit and according to the type of operation. Additional costs can occur such like PPE (Personal Protective Equipment e.g. helmet, closed shoes, gloves, etc), liability insurance or a supervisor. To ensure a permanent manual labour service, it is recommended to implement a long-term agreement which also provides an advantage to maintain the same workers deployed in the warehouse.

|

Labor Rate(s) Overview as of June 2020 (Rate is indicative only and subject to change) |

|

|

Food Items |

Cost (Local Currency & USD - $)[1] |

|---|---|

|

Loading/Offloading sack 25kg /50kg/80kg (rice, corn, sesame…) |

1000 FCFA (1.81 US$) / ton |

|

Loading/Offloading carton or can 5kg to 25kg (oil…) |

50 FCFA (0.091 US$) / unit |

|

Loading/Offloading carton or can |

100 FCFA (0.018 US$) / unit |

|

Repacking sack or carton |

200 FCFA (0.36 US$) / unit |

|

Stacking |

1000 FCFA (1.81 US$) / ton |

|

Non-Food Items |

|

|

Loading/Offloading/Shifting Construction materials, equipment, tools etc. |

Specialized equipment such as forklift are available on the local market and hired either per hour or on daily basis. Rate depends on the lifting capacity required (from 2.5 MT to 15 MT) and starts from 40 000 CFA/hour or 125 000 CFA/day for a 2.5MT/4MT forklift. |

|

Miscellaneous |

|

|

Supervisor |

500 FCFA / hour |

|

Shifting items within the warehouse |

1000 FCFA (1.81 US$) / ton |

|

Shifting items between warehouses |

1000 FCFA (1.81 US$) / ton |

|

Transshipment (truck) |

1000 FCFA (1.81 US$) / ton |

For more information on company contact details, please see the following link: 4.11 Additional Services Contact List.

[1] Exchange rate 1US$ = 552,45 FCFC (BCAO, 8/09/2021)

3.4 Burkina Faso Telecommunications

Overview

The MDENP (Ministère de l’Économie

numérique, des Postes et de la Transformation Digitale) is

responsible of the development of infrastructures and to promote a

local industry based on ICT (Information Communication

&Technology). In addition, the MDENP is working in closed

coordination with the ARCEP, an

independent structure in charge to monitor compliance with

regulations and commitments made by network operators and service

providers, internet DNS (Domain Name System) domain management,

approval of imported/local made electronic equipment or radio

frequencies management. As of September 2021, three private

operators share the mobile market in Burkina Faso: Moov Africa, Telecel Faso SA, and Orange Burkina Faso SA. According to the last

Q1 2021 report from ARCEP[1], there is currently a total of 23

466 416 active sim cards in country for a population estimated

around 21 million persons. There is no restriction to register a

sim card and only requires a valid identity card to buy either a

postpaid or prepaid subscription. Then, all current operators have

a broad range of mobile plans and internet solutions for both

individual and business with competitive offers and bundles. In

addition, there is also ISPs companies available in country

offering VSAT (Very Smart Aperture Terminal) installation, fiber

connection or IT solution (server, maintenance etc.)

For more information on telecoms contacts, please see the

following link: 4.11

Additional Services Contact List.

|

Telephone Services |

|

|---|---|

|

Is there an existing landline telephone network? |

Yes |

|

Does it allow international calls? |

Yes |

|

Number and Length of Downtime Periods (on average) |

n/a |

|

Mobile Phone Providers |

Moov Africa (formerly Onatel S.A) Telecel Faso S.A Orange Burkina Faso SA |

|

Approximate Percentage of National Coverage |

2G national coverage is between 98% & 100% 3G national coverage is between 56% & 99,9% [2] |

Telecommunications Regulations

ARCEP is the regulatory authority in charge to manage, to deliver authorizations and to control the frequencies. For the below equipment under a regulation in place, a process of certification (more information here) and a license to operate/use the equipment in country (list of forms available here) are required.

|

Regulations on Usage and Import |

||

|---|---|---|

|

Regulations in Place? |

Regulating Authority |

|

|

Satellite |

Yes |

ARCEP |

|

HF Radio |

Yes |

ARCEP |

|

UHF/VHF/HF Radio: Handheld, Base and Mobile |

Yes |

ARCEP |

|

UHF/VHF Repeaters |

Yes |

ARCEP |

|

GPS |

No |

n/a |

|

VSAT |

Yes |

ARCEP |

|

Individual Network Operator Licenses Required |

||

|

Yes |

||

|

Frequency Licenses Required |

||

|

Yes |

||

Existing Humanitarian Telecoms Systems

The United Nations agencies have a national telecom system under the same umbrella and managed by UNDSS (United Nations Department of Safety and Security). A common radio room is operating 24/7 from Ouagadougou.

|

UN Agencies |

|

|---|---|

|

VHF Frequencies |

Yes |

|

HF Frequencies |

Yes |

|

Locations of Repeaters |

Yes |

|

VSAT |

Yes |

Meanwhile, WFP is leading a project to implement a Common Technology Services to its partners, NGOs and other humanitarian organizations (more information here).

Photo: WFP/ICT Department

In this regard, WFP ICT has opened last November 2021 in Djibo (Sahel region) a cybercafe located in the UNHCR office. WFP ICT team has installed a V-SAT solution with a free access to internet (dedicated room with equipment and Wi-Fi) including backup up system with generator and solar panels. In this area, the mobile network coverage is unstable due to antennas damaged by the armed groups.

Internet Service Providers (ISPs)

For the government, the development of the fiber optic network

is a priority in 2021 with the aim to boost the digital economy, to

offer quality services, connectivity and technological innovation.

In country, Virtual Technologies

& Solutions, Group Vivendi

Africa, Orange and Moov Africa are the main operators

developing the fiber optic technology.

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? |

Yes.

|

|

|

If yes, are they privately or government owned? |

Private |

|

|

Dial-up only? |

No, broadband and fiber also available in country |

|

|

Approximate Rates (local currency and USD - $) |

Dial-up |

n/a |

|

Broadband |

Depends on subscription: from 12,500 CFA (22 US$) to 150,000 CFA (257 US$) |

|

|

Max Leasable ‘Dedicated’ Bandwidth |

n/a |

|

Mobile Network Operators (MNOs)

As date of September 2021, three mobile companies are operating in country with a license valid for 15 years and renewable by the ARCEP:

- Moov Africa with a license valid until 21/06/2037

- Orange Burkina Faso SA with a license valid until 27/05/2035

- Telecel Faso SA with a license valid until 27/05/2035

National coverage is not fully effective considering many remote areas are not connected to any network. Regarding this matter, the ARCEP – through the Universal Service – is managing a dedicated fund and the project implementation to allow localities deemed unprofitable by operators and people with low purchasing power to access electronic communications services.

For information on MNOs please visit the GSM Association

website.

|

Company |

Number of Agent Outlets by Area |

Network Strength by Area |

Contracted for Humanitarian or Government Cash Transfer Programmes? |

Services Offered |

|---|---|---|---|---|

|

Moov Africa |

n/a |

n/a |

Yes |

Merchant Payment, Money Transfer, Receive & Make Payment |

|

Telecel Faso SA |

50 across the country, see here |

Coverage map here |

Yes |

|

|

Orange Telecom |

43 across the country, see here |

Coverage map here |

Yes |

[2] Depending on the area, source ARCEP – further information here

3.5 Burkina Faso Food and Additional Suppliers

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a general overview of country data related to the service and supply sectors, please consult the following sources:

The Observatory of Economic Complexity – MIT (OEC): (http://atlas.media.mit.edu/en/)

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.5.1 Burkina Faso Food Suppliers

Overview

In Burkina Faso, the food availability comes mainly from the

national production but a significant increase of importation of

rice has been observed. The main dry cereals produced and consumed

in country are sorghum, millet, and maize. In general, the country

is self-sufficient in sorghum and millet then produces a surplus in

maize. However, the country has to import most of what it consumes

in terms of wheat and wheat flour, palm oil and sugar.

Then, the national market is organized as follows: the production

and trade of local products are done almost entirely by small

producers and wholesalers then the trade in imported products

(especially rice) is carried out in bulk by large companies with

the capacity to make purchases on international markets.

Additional information can be located from sources which are regularly maintained and reflect current facts and figures. For more specific and detailed overviews of food availability and market conditions, please consult the following sources:

WFP Vulnerability and Analysis Mapping (VAM): https://dataviz.vam.wfp.org/

USAID Famine Early Warning Systems Network (FEWS NET): https://fews.net/west-africa/burkina-faso

Réseau des Systèmes d’Information des Marchés en Afrique de l’Ouest : https://www.inter-reseaux.org/

For more information on food supplier contact details, please see the following link: 4.10 Supplier Contact List.

Retail Sector

The supermarket sector is mainly controlled by Lebanese traders who import international brands with stores in Ouagadougou or Bobo Dioulasso (Marina Market, Liza Market…) and also by local companies who have retail food chain across the country (Alimentation Le Bon Samaritain, Les Bons Amis…). Otherwise, the food retail sector is dominated by local market with stands (fruit, vegetables…) small general store and street vendors offering same category of product but with a limited range of choice.

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

4 |

|

Permanent shop with strong supply capacity – individually/family-owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

1 |

|

Permanent shop with limited supply capacity – individually/family-owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

1 |

|

Mobile Shop/Market Stand – individually/family-owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps, or unstable environments. |

1 |

Wholesaler

Wholesalers are mainly located in the major towns and manage

either the storage and /or the packaging of the food collected from

the producers (sorghum, millet, maize…). Once completed, the food

is ready to sell within the local market.

Regarding the rice market, this sector is mainly controlled by

large wholesalers with a financial capacity to trade within the

international market. In addition, prices for imported products are

often determined based on negotiations between private companies

and the government.

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

i.e. sheep and goats, swine, poultry… |

Locally produced |

|

01 - Meat and meat preparations |

i.e. meat of bovine animals, meat of sheep, dried or smoked meat of swine, sausages… |

Locally produced |

|

02 - Dairy products and birds’ eggs |

i.e. milk, yogurt, butter, cheese, eggs… |

Locally produced |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

i.e. fish (chilled or frozen), fish (salted or in brine), fish liver and roes… |

Imported |

|

04 - Cereals and cereal preparations |

i.e. wheat, rice, flour of maize, pasta... |

Imported |

|

05 - Vegetables and fruit |

i.e. vegetables, fruit and nuts, jams/jellies, fruit juices… |

Both locally produced and imported |

|

06 - Sugars, sugar preparations and honey |

i.e. sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar … |

Both locally produced and imported |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

i.e. coffee, cocoa, chocolate, tea, mate, pepper… |

Imported |

|

09 - Miscellaneous edible products and preparations |

i.e. ready-to-eat foods, margarine, sauces, soups and broths, yeasts… |

Imported |

|

41 - Animal oils and fats |

i.e. lard, fats and oils… |

Imported |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

i.e. soya bean oil, olive oil, maize oil, vegetable oil… |

Locally produced |

**For Non-FOOD products please

see section 3.5.2

Additional Suppliers, and for FUEL/PETROLEUM products

please see section 3.1

Fuel.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

3.5.2 Burkina Faso Additional Service Providers

Overview

The national market is offering a broad range of services

however the level of quality will depend on the service provider’s

capacity (number of equipment/items, level of technology etc.…)

Additional services are mainly centralized in the major towns of

Ouagadougou and Bobo Dioulasso then might be variable at regional

level (Kaya, Fada Ngourma, Dori, Ouahigouya…).

For more information on company contact details, please see the

following link: 4.11

Additional Services Contact List.

Accommodation

Major towns and main regional cities offer accommodation solutions from hotel, guesthouse to rental house with a large panel of services when available (catering, laundering, internet, car rental, airport transfer etc…). However, due to the current insecurity situation in the country, it is strongly recommended by UNDSS to stay in places which meet minimum security criteria (e.g. fence with a protection wall, generator back-up, professional guard service etc.…). Therefore, humanitarian organizations need to conduct a security assessment prior clearing a place for their own staff. Last 2019, the MCAT issued a list of establishment authorized to operate in country (see here) then additional options are available on Booking.com, Airbnb, rental agencies or announced published on specific groups in social network (e.g. Facebook).

Electricity and Power

The national electricity production is managed by the SONABEL a State Company created by decree n ° 76/344 / PRES / MTP / URB of September 15, 1976. Its role is to produce, import, transport, distribute and export electric power plus to ensure the management of the public service of electricity. In addition, the Burkina Faso's rural electrification process under the program « Electricité pour tous » is developed in collaboration with the Coopel (coopératives d’électricité) which is playing a local role on behalf of the SONABEL. According to the latest ARSE 2019 Activity report[1], SONABEL customers experienced an average of 149 cuts which lasted a total of 86 hours. Therefore, a generator backup is recommended to face power cuts which often occur in the country.

Financial Services

Last September 2021, the BCEAO

(Banque Centrale des États de l'Afrique de l'Ouest ) has published

the updated list of banks and financial institutions operating in

Burkina Faso. They offer a broad range of services (credits card,

currency exchange, loan credit and web services) with an agency

network across the country.

Money transfer is also available in the country with Western Union,

MoneyGram

or through mobile operators (Orange Money, Moov Money).

List of Banks (15)

- Bank of Africa - (BOA)

- Banque Atlantique

- Banque Agricole du Faso (BADF)

- Banque Commerciale du Burkina (BCB)

- International Business Bank (IB Bank)

- Vista Bank Burkina

- Banque Sahelo-Saharienne pour l’investissement et le Commerce (BSIC)

- Coris Bank International (CBI)

- Ecobank

- Banque de l’Union (BDU-BF)

- Société Générale BF

- United Bank for Africa Burkina (UBA)

- Wendkuni Bank International

- Orabank Cote d’Ivoire (succursale du Burkina)

- CBAO Groupe

Attijariwafa Bank (succursale du Burkina)

List of financial institution with banking activities (4)

- Fidelis Finance Burkina Faso

- Société Burkinabè de Crédit Automobile (SOBCA)

- Société Financière de Garantie Interbancaire du Burkina (SOFIGIB)

- Société Africaine de Crédit Automobile (ALIOS Finance, succursale du Burkina)

Clearing and Forwarding Agents

There is currently 62 forwarding agents approved and authorized by the Customs to operate in country (see list here) as date of February 2021. Their head offices are mainly based in Ouagadougou with representatives across the country (land border entries, ports at corridor level…). Both local and international companies are covering this sector in Burkina Faso with major actors like Bolloré Logistics, Maersk, R-Logistics or Ceva Logistics.

Handling Equipment

Forwarding agents and specialized companies (e.g. Premium Burkina Faso, Burkina Equipment CAT, CFAO Equipment…) have the capacity to provide handling equipment when required. This service can be negotiated either through a rental service contract or a lease plan (forklift, trolley, trans-pallet, crane…) Wooden pallets are available locally with different quality level while plastic pallets need to be imported.

La Poste Burkina Faso is the

principal postal service in country with a network of 116 agencies

across the country and obtained the ISO 9001 V 2015 certification

last May 2019. La Poste Burkina Faso offers a broad range of

service to both individuals and business customers from mail,

parcel service, finance and e-service. As date of June 2021, the

postal sector is composed of 25 service providers authorized by the

ARCEP to operate in the country (see below table).

Then, main couriers services like Fedex,and DHL are

operating in Burkina Faso.

| ZONE DE DESSERTE : Nationale et Internationale | |

|---|---|

| 01 | SOCIETE EMS CHRONOPOST INTERNATIONAL BURKINA FASO |

| 02 | DHL INTERNATIONAL BURKINA FASO |

| 03 | SNTB SAGA EXPRESS |

| 04 | SILSON GLOBAL BUSINESS BURKINA SARL (UPS) |

| 05 | LA POSTE (EX SONAPOST) |

| 06 | FASO MAIL EXPRESS (FAMEX) |

| 07 | RED STAR EXPRESS |

| ZONE DE DESSERTE : Nationale et CEDEAO | |

| 08 | TRANSPORT CONFORT VOYAGEURS (TCV) |

|

09 |

COMPAGNIE BURKINABE DE TRANSPORT RAKIETA |

|

10 |

SOCIETE SISSIMAN TOURS (ELITIS) |

|

11 |

SOCIETE FAIRNESS TRANSPORT AND SERVICES (FTS) |

|

12 |

SOCIETE BURVAL CORPORATE SA |

|

13 |

SOCIETE SERVICE EXPRESS |

|

14 |

SOCIETE DE TRANSPORT EN COMMUN SOTRACO SA |

|

15 |

COMPAGNIE DE TRANSPORT RALLE OUEDRAOGO ET FRERE (CTROF) |

|

ZONE DE DESSERTE : Nationale |

|

|

16 |

SOCIETE DE TRANSPORT AOREOMA ET FRERES (STAF) |

|

17 |

SOCIETE DE TRANSPORT RAHIMO (NORANE SARL) |

|

18 |

SOCIETE DE TRANSPORT NORD FASO (SNTF) |

|

19 |

SOCIETE SARAMAYA TRANSPORT SARL |

|

20 |

SOCIETE SAHEL VOYAGE |

|

21 |

SOCIETE UNION EXPRES |

|

ZONE DE DESSERTE : Locale (Ouagadougou |

|

|

22 |

SOCIETE LE MESSAGER |

|

23 |

SMART SERVICE |

|

24 |

MTOPO PAYMENT SOLUTIONS |

|

25 |

LE COURSIER |

|

Source ARCEP |

|

Printing and Publishing

Offset and digital printing services are available mainly in Ouagadougou or Bobo Dioulasso with companies fitted with modern equipment and staff trained in the latest printing technologies to meet customers’ needs (e.g. Grande Imprimerie du Burkina, Graphi Imprim, Imprimerie Industrie Graphic du Faso…).

Taxi Companies

This sector is informal and shared taxis recognizable by their

green color are a common way to circulate in the urban area. A

shared taxi is following a set route then picks up passengers along

the road. Overall, shared taxis are not really in a good mechanic

state and drivers do not respect the number of passengers

authorized to sit in their car. Rate starts from 300 CFA and the

price will increase depending on the final destination and/or the

number of luggage. Therefore, it is not recommended to use a shared

taxi however there is alternative options like to privatize a taxi

for one hour or the full day, to rent a car with driver through a

hotel or to book a taxi from a newly company called Taxi Jaune

available in Ouagadougou.

Photo Lefaso.net

Vehicle Rental

Vehicle for rent is available in the country from sedan car to 4x4 and with or without driver. Rental can be negotiated on daily basis or through a long-term agreement (e.g. Locaufaso, CFAO Motors Burkina, Sags-sarl Location…)

Waste Management and Disposal Services

Waste management is under the responsibility of the municiplities but they do not have the capacity to organize such of activities therefore hygiene and water-borne diseases are a serious concern in country. In this regard, the government and municipalities are working closely to implement waste management solution like the SDGD (Schéma Directeur de Gestion des Déchets) in Ouagadougou. In addition, private companies or local initiative are participating to improve the waste management and to sensibilize the population to change their habits (stop burning or dumping trash everywhere).

Regarding bio medical waste management, the government is implementing a new plan called Plan de Lutte contre les Infections et de Gestion des Déchets (PLIGD) to improve the system for fighting infections associated with healthcare in the context of COVID-19.

Regarding the electrical and electronic equipment waste management, the MEEVCC (Ministère de l'Environnement, de l'Economie verte et du Changement Climatique) has signed an agreement with the group Société Générale de Surveillance SA which include a service covering all stage from production to recovery, from recycling to sustainable waste disposal.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

[1] Full report available here