Nepal - 3.5 Food and Additional Suppliers

Nepal’s economy is largely dependent on agriculture and remittances. In 2022, the agriculture sector’s contribution to GDP stood at 23.95% (source: Nepal Economic Forum).

Despite being an agricultural country, Nepal largely depends upon Indian market on the supply of foods and commodities. Rice, one of the major staple food crops in Nepal, is still being imported from India, as the production is less than the demand. Although Nepal has harvested a record production of rice in recent years, it is still far behind in substituting rice imports. Various strategies are required to make Nepal self-sufficient in rice production. Nepal’s per capita rice consumption per year is 137.5 kg, one of the highest in the world. But there is a huge rice yield gap – the difference between attainable yield and potential yield which is between 45-55% in Nepal. [source: Nepali Times – The rise in Rice, June 24, 2020]

|

Year |

Area(ha.) |

Production Paddy (MT) |

Yield |

|---|---|---|---|

|

2009/10 |

1,481,289 |

4,023,823 |

2.72 |

|

2010/11 |

1,496,476 |

4,460,278 |

2.98 |

|

2011/12 |

1,531,493 |

5,072,248 |

3.31 |

|

2012/13 |

1,420,570 |

4,504,503 |

3.17 |

|

2013/14 |

1,486,951 |

5,047,047 |

3.39 |

|

2014/15 |

1,425,346 |

4,788,612 |

3.36 |

|

2015/16 |

1,362,908 |

4,299,079 |

3.15 |

|

2016/17 |

1,552,469 |

5,230,327 |

3.37 |

|

2017/18 |

1,469,545 |

5,151,925 |

3.51 |

|

2018/19 |

1,491,744 |

5,610,011 |

3.76 |

(Source: Statistical Information on Nepalese Agriculture 2018/2019, MoALD)

Low agricultural surplus is the key reason for Nepal’s growing negative trade balance in food products. Nepal imports rice worth 28 billions of dollars (source online news portal June 24, 2021 – https://english.onlinekhabar.com/nepal-imported-rice-worth-rs-28-6-billion-in-11-months.html) each year mainly from India, China, Japan, Philippines, and Thailand making it a major drain on the national budget. This diverts resources away from achieving food and nutrition security, reducing rural poverty, and the delivery of sustainable development goals (SDGs).

The UN’s World Food Programme (WFP) in a recent survey found that about 4.26 million Nepalis eat insufficient diets. There are also regional disparities in household food consumption, with the lowest level in Karnali Province consuming an inadequate diet (22.5%), followed by Sudurpaschim Province (16.9%).

While food security in Nepal has improved in recent years, 4.6 million people are food-insecure, with 20 percent of households mildly food-insecure, 22 percent moderately food-insecure, and 10 percent severely food-insecure, according the 2016 Nepal Demographic and Health Survey (DHS). Overall, households in rural areas of the country—where food prices tend to be higher—are more likely to be food-insecure than people living in urban areas, according to the survey

The retail sector in Nepal is highly fragmented. Approximately 78.55 percent of the population lives in rural areas (according to 2022 Statista), who are highly dependent upon the traditional family-run small stores with a limited selection of products where the use of credit purchase is applicable. While consumers in urban areas have access to supermarkets and convenience stores with a high variety of options. Surface access within the country is difficult and market access is a challenge. Poor infrastructure and high transportation costs negatively impact the price of local food crops and imported goods, especially in mid and high-mountain regions.

The World Bank estimates Nepal’s GDP growth will decrease to 1.9% in the fiscal year 2023 and is estimated to grow by 3.9% in the fiscal year 2024. Nepal has a persistent trade deficit, it has imported USD 15.3 billion worth of goods and services and exported USD 1.74 billion worth of goods and services in the year 2021 according to the data published by the World Bank. Nepal’s main trade partners are India and China due to geographic and infrastructure constraints.

The following product groups represent the highest dollar value in Nepal’s import purchases during 2021.

-

Refined Petroleum worth USD 1.5 billion (9.85%)

-

Semi-furnished iron worth USD 591 million (3.87%)

-

Soybean Oil worth USD 517 million (3.39%)

-

Rice worth USD 430 million (2.82%)

-

Gold worth USD 417 million (2.73%)

-

Petroleum Gas worth USD 412 million (2.7%)

-

Motorcycles and cycles worth USD 288 million (1.89%)

-

Vaccines, blood, antisera, toxins, and cultures worth USD 271 million (1.78%) Packaged Medicaments worth USD 248 million (1.63%)

-

Palm Oil worth USD 243 million (1.59%).

The major import partners for Nepal are India (USD 9.4 B), China (USD 2.32 B), United Arab Emirates (USD 505 m), Argentina (USD 389 m) and Indonesia (USD 302 m).

The following export product groups represent the highest dollar value in Nepalese global shipments during 2021. Below is the percentage share of each product category in terms of overall exports from Nepal.

-

Soybean Oil worth USD 591 million (34%)

-

Palm Oil worth USD 252 million (14.5%)

-

Non-Retail Synthetic Staple Fibers Yarn worth USD 72.5 million (4.17%)

-

Knotted Carpets worth USD 71.9 million (4.13%)

-

Nutmeg, mace, and cardamoms worth USD 47.5 million (2.73%)

-

Fruit juice worth USD 43 million (2.47%) and flavored water worth USD 41.5 million (2.39%)

-

Synthetic Filament Yarn Woven Fabric worth USD 28.3 million (1.63%)

-

Other Vegetable Residues worth USD 26.2 million (1.51%)

-

Felt worth USD 26 million (1.5%).

The major export partners for Nepal are India (USD 1.34 b), United States (USD 144 m), Germany (USD 36.5 m), United Kingdom (USD 27.1 m) and Turkey (USD 20.2 m)

Source: Nepal (NPL) Exports, Imports, and Trade Partners | OEC - The Observatory of Economic Complexity

Regarding the purchasing power of the population as per WFP data the purchasing power of daily wage labor marginally increased in January 2024 compared to December 2023, however remained relatively low, particularly in areas with a higher prevalence of food insecurity.

An unskilled labor could purchase 10.1 kgs of medium rice in the mountains, 10.3 kgs in the hills and 11.4 kgs in the Terai from their daily wage in January, compared to 8.9, 9.2 and 10 kgs respectively in December 2023. The increase in purchasing power is mainly attributable to a decrease in the retail prices of essential food commodities in January 2024 compared to daily wage.

Provincial disparities in purchasing power were observed in January 2024. For example, an unskilled labor could purchase 14 kgs and 12.7 kgs of medium rice with a day’s wage in Koshi and Lumbini provinces, respectively, while in Sudurpaschim and Karnali provinces a daily wage labor could purchase only 8.4 kgs and 9.1 kgs of medium rice, respectively, in January 2024.

The difference in purchasing power is mostly attributed to the variations in the price of food commodities compared to wage rates due to relatively low competition and high transportation costs in remote areas, with a poor road network across the mountain belt of the country.

Migration of youth has led to a serious shortage in labour and families are leaving their land fallow in hilly regions. A million hectares of land is uncultivated in the hilly districts.

Besides high costs of agricultural inputs, low productivity in all three major cereal crops like paddy, wheat and maize are of serious concern. Fragmentation in farm size means challenges with achieving economies of scale in modernisation and corresponding profitability of farming.

It is estimated that Nepal currently produces 10.5 million tons of cereals (5.5 million tons of rice, 2.7 million tons of maize, 2 mil. tons of wheat and about 0.3 million tons of other crops such as millets. There is an estimated supply gap of around 2 million tons of paddy for this year.

India is the main source of food commodities for Nepal. In absence of price stabilisation measures in Nepal, when India announces restrictions on global food exports, there is concern about sudden food price rises across Nepal.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Nepal - 3.5.1 Food Suppliers

Overview

Source: WFP Nepal

Source: WFP Nepal

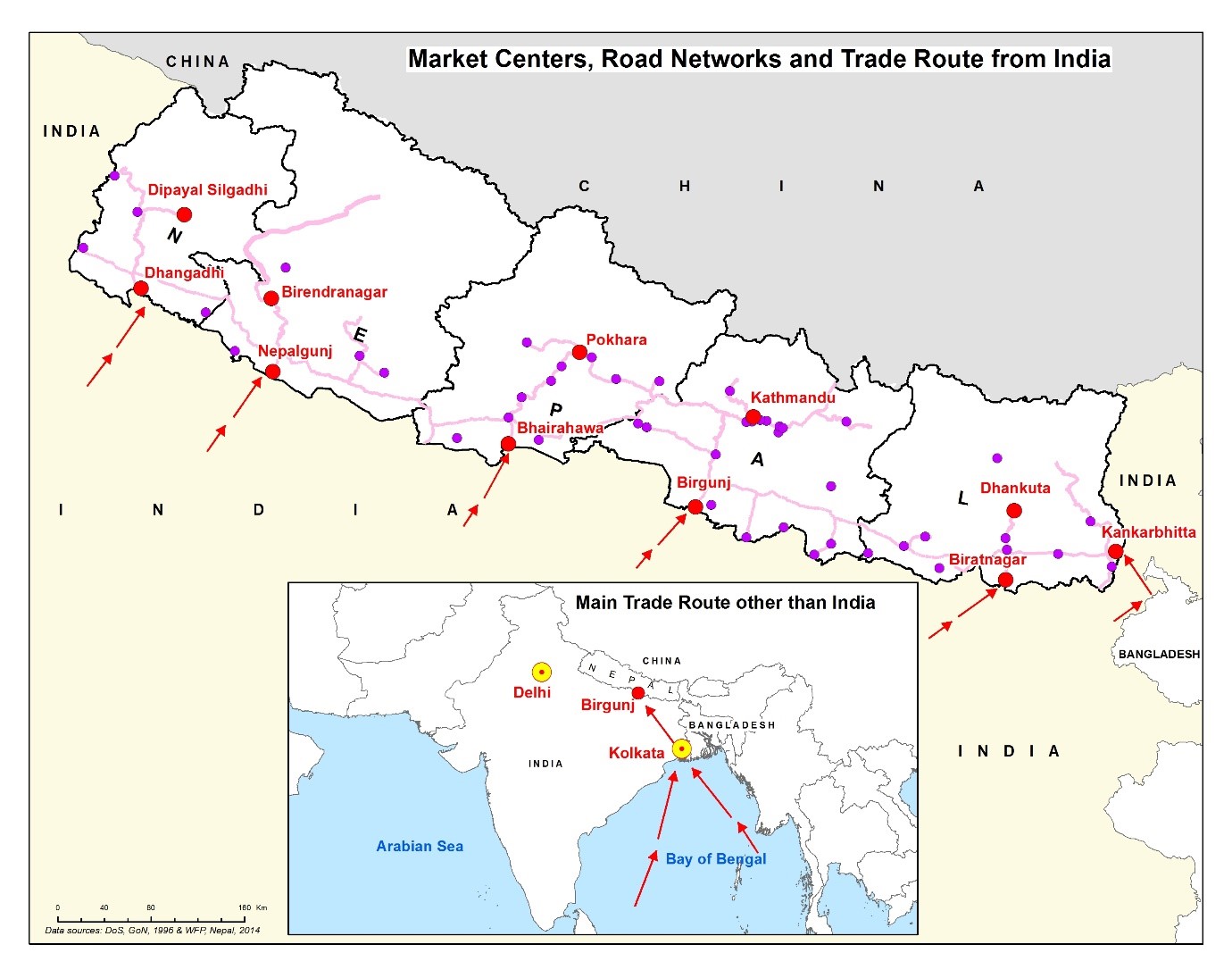

The above map illustrates the market centres, road networks and trade route in Nepal. In Nepal, there are various types of markets viz. national, regional and local markets which are categorized on the basis of size, area coverage and volume of trade. Most big markets (e.g. Birgunj, Biratnagar, Bhairahawa, Nepalgunj and Dhangadi) are located in the Terai belt and adjacent to Indian border because of easy access to roads, pocket area for food production and proximity to overseas trade (See Figure 4). Most international trades including India are often made from these markets, mainly from Birgunj which is major route for international trade (other than India) through Haldia port in Kolkata, India. Moreover, some hilly markets such as Kathmandu, Pokhara and Surkhet are also considered as major markets which can have larger influences on domestic food prices (e.g. cereals, lentils, vegetables, fish and meat etc.) in the national market. In addition to major markets, there are large number of market centers across the country, mostly located either at the district headquarters or at along the roadside, mainly in the major junctions. These markets (e.g., Dhankuta, Baglung, Ilam, Palpa, Jumla, Dipayal Silgadhi, Sanfebagar etc.) can also play a significant role to meet the local demand in the particular area and are the major market centers to purchase food and non-food items for the people living in remote areas of the mountain and hilly belts.

Despite being an agricultural country, Nepal imports a large number of agricultural commodities as processed and packaged food from other countries to fulfil the needs of its people. (Source: Nepal imports agricultural products worth Rs 250 billion in 10 months (nagariknetwork.com)

Because of a trade imbalance in food commodities as well as an overall trade deficit, cost of food in Nepal is expected to rise. The trend in food prices can be observed at: Nepal Food Inflation. Increased food costs, poor market access, and lack of land ownership have led to food deficit areas in the mid-west and far-west of Nepal.

WFP Vulnerability and Analysis Mapping (VAM): WFP Nepal – mVAM Market Update (January 2024)

For more information on food supplier contact details, please see the following link: 4.10 Supplier Contact List.

Retail Sector

Food and retail market in Nepal is expanding from urban to rural markets with an increase of access to roads and information technology. It is expected that the growth of retail markets is over 20 percent, indicating an opportunity of market expansion and investment. It also contributes nearly 15 percent of Nepal’s GDP and provide employment opportunities of over 1.2 million people across the country. In Nepal, local traders mostly hold the retail market business because the country does not exist global supermarket chains. However, the trend of operating supermarkets and marts is increasing over the period. For example, Bhatbhateni Supermarket, Big marts, Salesberry etc. including some local and small-scale marts are operating in different parts of the country.

Moreover, digital market has also been rapidly increasing in Nepal with increasing trend of digital payment mechanism and the prominence of social media like facebook and instrgram. The digital commerce market in Nepal is projected to grow by 9.62 percent (2024 – 2028) resulting in a market volume of an estimated of US$3.35bn in 2028. However Nepali e-commerce is more prevalent in urban areas where road and internet accesses are better.

Koshi Province

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

4 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

2 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

1 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

3 |

Madhesh Province

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

4 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

3 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

1 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

2 |

Bagmati Province

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

3 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

2 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

5 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

4 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

1 |

Supermarket chain stores are mostly limited to Kathmandu. Some of the largest chain stores, such as Bhatbhateni, Bigmart, Saleways and KK Supermarket are expanding to other cities in Nepal. International supermarket brands have not yet established stores in Nepal. Below are listed some of the largest supermarkets that have more than one outlet and offer local and imported consumer goods, food, beverages, cleaning and sanitation products:

-

Bhatbhateni supermarket and departmental store 24 locations (12 outlets in Kathmandu Valley, plus stores in Biratnagar, Bhairahawa, Nepalgunj, Butwal, Bharatpur, Dharan, Pokhara, Itahari, Birtamode, Birgunj, Dhangadhi and Janakpur)

-

Saleways supermarkets (2 outlets in Kathmandu/Lalitpur, 2 stores in Pokhara)

-

Big Mart supermarket, (74 outlets in Kathmandu Valley)

-

KK Mart (5 convenience stores in Kathmandu/Lalitpur)

-

Bluebird Mart (2 outlets in Kathmandu)

|

Supplier Overview |

|

|---|---|

|

Company Name |

The Kathmandu Suppliers |

|

Address |

Banasthali, 16, Kathmandu 9851097662 |

|

Does the supplier have its own production / manufacturing capacity? |

No |

|

Does the supplier have its own retail capacity? |

Yes, and manages its own retail location and also delivers to consumers |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate Turnover in MT |

200 MT monthly |

|

Payment Methods Accepted |

Cash and Cheques Accepted |

|

Other Comments or Key Information |

Provides services to Kathmandu and Lalitpur Districts |

Gandaki Province

|

Types of Retailers Available

|

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

2 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

3 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

4 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

1 |

Lumbini Province

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

4 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

3 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

1 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

2 |

Karnali Province

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

5 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

2 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

1 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

3 |

Sudurpaschim Province

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

4 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

3 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

2 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

1 |

Wholesale

BLC Instant Foods Pvt. Ltd

Operating since 1998 A.D. BLC Instant Pvt. Ltd are mainly active in Agri business in Nepal with production and distribution of Sarvottam Lito (Baby Foods) Fortified Flour (Super Cereal). BLC Instant Foods is predominantly a national supplier.

|

Supplier Overview |

|

|---|---|

|

Company Name |

BlC Instant Food Pvt. Ltd |

|

Address |

Head Office: Thapathali, Kathmandu |

|

Does the supplier have its own production / manufacturing capacity?

|

Yes, food processing. |

|

Does the supplier have its own retail capacity?

|

Yes |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes, 200 mt |

|

Approximate Turnover in MT

|

NPR. 1.59 crore. yearly. (figures for 2079/80 B.S) approximately million USD (1$= 132 NPR) |

|

Payment Methods Accepted |

Any form of banking institutions |

|

Other Comments or Key Information |

Biscuits, flour mills, dairy, seed, and Flexi packs are manufactured by a sister company under BLC Group. |

|

Other Locations |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Koshi Province |

Biratnagar, Nepal |

|

Bagmati Province – Liaison Office/Depo |

Kathmandu, Nepal |

Description of availability of Major food items and Ready to Eat Food items.

|

|

Seed & Flexi pack |

Imported, processed, and available the whole year |

|---|---|---|

|

|

Dairy and flour mills |

Manufactured locally and available the whole year |

|

Ready to Eat (packaged food) |

Biscuits |

Manufactured locally and available the whole year |

Nutri Foods Pvt. Ltd

Operating since 2004 A.D. Nutri Foods Pvt. Ltd is mainly active in Agribusiness in Nepal with the production and distribution of Wheat Flour, White Wheat Flour Semolina, Pulses, Oats, Fortified Flour (Super Cereal). Nutri Foods is predominantly a national supplier.

|

Supplier Overview |

|

|---|---|

|

Company Name |

Nutri Foods Pvt. Ltd. |

|

Address |

Head Office- Satghumti Road, Biratnagar, Nepal Corporate Office- 155 Panchayan Marga, Thapathali-11, Kathmandu, Nepal |

|

Does the supplier have its own production / manufacturing capacity? |

Yes |

|

Does the supplier have its own retail capacity? |

No |

|

Does the supplier have its own transport capacity? |

Yes. 1. Two Vehicles of 17 MT each load capacity 2. One Vehicle of 12 MT load capacity 3. Five Vehicles of 2.5 MT each load capacity |

|

Does the supplier have its own storage facilities? |

Yes. 18000 MT storage capacity |

|

Approximate turnover in USD - $

|

NPR. 150 crores yearly. (Figures for 2076-2077 B.S) approximately 12.5 million USD (1$=120.76 NPR) |

|

Payment Methods Accepted |

Any form of Banking instruments |

|

Other Comments or Key Information |

Oil, Ghee, Instant noodles, and biscuits are manufactured by our sister company under the Sharda Group |

|

Other Locations (Branches) |

|

|---|---|

|

Region(s) |

Service Location(s) |

|

Koshi Province - Level 1 |

Biratnagar, Nepal |

|

Bagmati Province-Liaison Office / Depo |

Kathmandu, Nepal |

Description of availability of major food items and ready-to-eat food items.

|

|

Rice |

Imported, processed, and available the whole year |

|---|---|---|

|

|

Lentil |

Manufactured locally and available the whole year |

|

Ready to Eat (packaged food) |

Instant Noodles, Biscuit, Etc |

Manufactured locally and available the whole year |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

Buffalo, Sheep , goats, swine, poultry, Duck etc. |

A small quantity is imported from India and China and around 80% is produced locally. 25% of meat consumption is in festival season during October/November (Dashain, Tihar). |

|

01 - Meat and meat preparations |

Meat of bovine animals, meat of sheep, dried or smoked meat of swine, sausage |

There is no large meat processing industry in Nepal, but one can find small butcher shops everywhere in the city and rural area. Beef is not consumed for religious reasons, but buffalo is consumed widely, incl. mutton, goat, chicken, duck, and pig. |

|

02 - Dairy products and birds’ eggs |

Milk, yogurt, butter, cheese, egg |

Chicken/egg farming is a growing business in Nepal. In rural areas agricultural families often own one or two cows, buffalo, goats and some chickens per household. Nepal is self-sufficient on dairy, cheese and eggs. Although there is a general increase in the number of birds, cows, goats, buffaloes, ducks and rabbits in the financial year 2020, the number of chickens has decreased by 11% of chicken production. (Source: STATISTICAL INFORMATION.indd (moald.gov.np) |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

Fish (chilled or frozen), fish (salted or in brine), fish liver and roes |

Fish culture is an emerging enterprise in the country, with carp and trout. River fish is also imported from India. In the fiscal year 2022 A.D. 104,623 MT of fish was produced in fisheries and productivity was 5.3 metric tons per hectare in Nepal. |

|

04 - Cereals and cereal preparations |

Wheat, rice, flour of maize, pasta, pulse, noodles |

Produced at local level. Import of fine rice from India has been growing. High quality pulses are exported, while lower quality lentils are imported from India (pasta is imported).Various brands of instant noodles are produced locally. In the fiscal year 2022, Cereals accounted for 50.56% of the production in the fiscal year 2022, followed by maize 26.96% and wheat 19.13%. (Source: STATISTICAL INFORMATION.indd (moald.gov.np) |

|

05 - Vegetables and fruit |

Vegetables, fruit and nuts, jams/jellies, fruit juice |

Local fruits are about 10% of the market, with the rest dominated by imports of apple from China and banana, orange, mango and grapes from India. In the fiscal year 2022, the total productivity including winter, summer and citrus varieties of fruits was 10.54 metric tons per hectare in Nepal. |

|

06 - Sugars, sugar preparations and honey |

Sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar. |

Honey is emerging as export product for Nepal. Sugar is imported from India. |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

Coffee, cocoa, chocolate, tea, mate, pepper |

Nepal Exports Tea, Coffee, cardamom, turmeric and cinnamon, but imports cocoa, chocolate and pepper. |

|

09 - Miscellaneous edible products and preparations |

Ready-to-eat foods, margarine, sauces, soups and broths, yeast |

Instant Noodles and ready-to-eat beaten rice (known as chiura) are very common in Nepal |

|

41 - Animal oils and fats |

Lard, fats and oils |

Not a significant market |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

Soya bean oil, olive oil, mustard oil, sunflower and vegetable oil. |

Some raw materials (soy, mustard seed) are sourced locally, but most is imported (sunflower, palm, soy) and refined and produced locally and sold locally. N Based on a comparison of 14 countries in 2021, Nepal ranked the highest in mustard seed production with 220,250 tonnes followed by Russia and Canada. On the other end of the scale was Iran with 3.26 tonnes, Kyrgyzstan with 14.1 tonnes and Bhutan with 331 tonnes. |

**For FUEL/PETROLEUM products please see section 3.1 Fuel.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.