Tanzania, United Republic of - 1 Country Profile

Generic Information

The United Republic of Tanzania (Swahili: Jamhuri ya Muungano wa Tanzania), is the largest country in East Africa within the African Great Lakes region. It borders Uganda to the north; Kenya to the northeast; the Indian Ocean to the east; Mozambique and Malawi to the south; Zambia to the southwest; and Rwanda, Burundi, and the Democratic Republic of the Congo to the west. Mount Kilimanjaro, Africa's highest mountain, is in northeastern Tanzania. According to the 2022 national census, Tanzania has a population of nearly 67 million, making it the most populous country located entirely south of the equator.

Geography: Tanzania's geography is characterized by three distinct physiographic regions: the coastal plains along the Indian Ocean, an inland saucer-shaped plateau, and highlands in the northeast. The northeast region features stunning mountain ranges, including the iconic Mount Kilimanjaro, Africa's highest peak, and Mount Meru, an active volcano. This area also forms part of the Great Rift Valley, with vast salt lakes such as Lake Natron, Lake Manyara, and Lake Eyasi. The Crater Highlands, encompassing the Ngorongoro Conservation Area and the Ngorongoro Crater, are key conservation areas for wildlife.

Population: In 2022 the Demographic and Health Survey recorded the population of Tanzania at 62 million, an increase of 37% from 2012 (60 million in Mainland and -1.9 million in Zanzibar approx.). The current population of Tanzania is estimated to be 67,728,532 as of July 2023 based on projections of the latest United Nations data.

Economy: Tanzania is a lower-middle-income country with a population of 67 million. The country has experienced steady economic growth in recent years. However, 27 percent of the population still live below the poverty line and an additional 8 percent live in extreme poverty.

A significant share of the population remains malnourished, with high stunting (impaired growth due to undernutrition) and increasing rates of overweight, obesity and vitamin and mineral deficiency. An estimated 20 percent of families are unable to afford a diet with sufficient calories, while 59 percent cannot afford a nutritious diet.

Tanzania's economy is diverse, with agriculture, mining, tourism, and services playing crucial roles. Agriculture employs a substantial portion of the population, and the country is known for its exports of cash crops like coffee, tea, and cotton. Tanzania is also rich in mineral resources, including gold, diamonds, and gemstones, which contribute significantly to its export revenue.

Tourism is a major economic driver, thanks to Tanzania's unparalleled natural beauty and wildlife. The country's national parks, such as the Serengeti and the Ngorongoro Conservation Area, are renowned worldwide for their diverse ecosystems and abundant wildlife, including the "Big Five" – lions, elephants, buffalo, leopards, and rhinoceroses

Tanzania's strong economic fundamentals helped the country weather the COVID-19 pandemic, but its economic recovery has been slower than expected due to the ongoing war in Ukraine, tightening global financial conditions, and the global economic slowdown.

Wikipedia Country Information Website of Wikipedia on Tanzania

IMF Country Information Website of the IMF on Tanzania

Economist Intelligence Unit Website of the Economist on Tanzania

Humanitarian Info

World Food Programme Website of the WFP on Tanzania

Facts and Figures

Wolfram Alpha Website of Wolframalpha on Tanzania

World Bank Website of the Worldbank on Tanzania

Population Information: Website of the Worldpopulationreview

Tanzania, United Republic of - 1.1 Humanitarian Background

Disasters, Conflicts and Migration

|

Natural Disasters |

||

|---|---|---|

|

Type |

Occurs |

Comments / Details |

|

Drought |

Yes |

Droughts affect several areas such as in Northern Manyara region, Kilosa District in Morogoro region and Dodoma region. The drought events which occurred in Bahi district in Dodoma in 2005/2006, Arusha and Manyara regions in 2008/2009. Drought is the major reason for both water and food shortage and severely affects agricultural development. Droughts also have a major effect to hydropower electricity production which may lead to huge economic loss during power rationing. Climate change and environment degradation pose high possibility of drought occurrences with major consequence and high risk as large populations depend on rain fed agriculture for their economic livelihood. |

|

Earthquakes |

Yes |

Earthquakes remain rare events in Tanzania however impacts such as landslides, soil movement, widespread disease outbreaks, tsunami waves, property damage, loss of lives, fire, economic loss and lack of food and clean water. Analysis of earthquakes for the areas that fall within the East African Rift System (EARS) in Tanzania which is well-known as prone to seismic activities has been categorized in high certainty of occurrence with minor to moderate consequences but with high risk. Earthquakes were reported in Northern Dodoma in July 2002 (magnitude 5.6), Lake Tanganyika in December 2005 (magnitude 6.8), Lake Natron in July, 2007 (magnitude 5.9), Mwanza region in May, 2017 (magnitude 5.0), Sumbawanga in March, 2019 (magnitude 5.5) and Kagera region in September, 2016 (magnitude 5.9). Another earthquake event which occurred in 2017 in Mwanza killed 1 and injured 2 people and damaged some buildings in 4 schools. Earthquake incident in Bariadi in May, 2002 killed 2 and injured 5 people, destroyed 690 and damaged 636 houses. |

|

Epidemics |

Yes |

The longest cholera outbreak which started from August, 2015 to December, 2018 caused 550 deaths and affected 33,319 people in 129 districts. The majority of these cases had been reported from 23 regions in mainland Tanzania including Dar es Salaam, Tanga and Morogoro. There were 43,078 confirmed cases and 846 deaths from of COVID-19 in Tanzania reported to WHO during the global pandemic. Epidemics such as Cholera, Acute and Chronic hepatitis and newly emerging and reemerging diseases like Dengue fever, Ebola, Avian Influenza, COVID-19 and Chikungunya pose a great risk to human life and the economy of Tanzania |

|

Extreme Temperatures |

Yes |

Extreme temperature remains rare. Over the past few years, Dar es Salaam and other regions in the country recorded hotter weather. Along the coast and in the off shore islands of Tanzania, the average temperature ranges between 27°C and 29°C, while in the central, northern and western parts temperatures range between 20°C and 30°C. Tanzania is the 45th most vulnerable country to climate change among 182 assessed in the ND-GAIN Country index and the 58th least prepared to leverage investments to adaptation actions among 192 assessed |

|

Flooding |

Yes |

Floods are among the most frequent and costly natural disasters in the country in terms of loss of life, infrastructure destruction, livelihood and economic disruptions. Most of flood events have been caused by heavy or steady rain for several hours or days that saturate the ground. Flash floods occur suddenly due to rapidly rising water along a stream or low-lying areas are common in urban centres and large cities like Dar es Salaam and Mwanza. The most flood prone regions in the country are Dar es Salaam, Pwani, Morogoro, Tanga, Mtwara, Arusha, Lindi and Iringa. Due to weather variability and climate change floods are likely to occur in many regions and considering rapid development their consequences can be major with high potential of losses in lives and economic gains. For example, in 2009/10 floods affected Kilosa district in Morogoro region whereby 2 people died and affected 26,000 people. The same flood event also affected 19,000 people in Kongwa and Mpwapwa districts in Dodoma region, destroyed infrastructure including roads, railway and bridges and contaminated water sources. Another flood event occurred in Dar es Salaam in December, 2011 which killed 41 people, displaced 5,000 and affected 50,000 people. |

|

Insect Infestation |

Yes |

Outbreaks are a major constrains to the development of agricultural sector in Tanzania which may result in devastating crop losses, it is estimated that they can cause pre and post-harvest crop losses between 30 – 40 percent and sometimes can cause up to 100 percent crop if not controlled in some areas. Common pests in different regions of the country include: locusts (Katavi, Rukwa, Kigoma, Tabora and Dodoma), armyworms (all regions), queleaquelea (Dodoma, Singida, Mbeya, Kilimanjaro) and banana wilt (Kagera and Mara). , American fall armyworm invasion in 2017 mainly affected cereal crops with maize and rice paddy severely impacted in Geita, Rukwa, Kagera, Pwani, Simiyu, Mwanza, Morogoro, Kilimanjaro, and Njombe regions. |

|

Mudslides |

Yes |

Mudslides can occur in mountain regions during the peak of the raining season (March to April). The consequences are major because of high exposure of buildings and livelihood activities like mining and quarry sites. Landslide in Same in 2009 caused 24 deaths and damaged 15 kilometres of road and 15 irrigation reservoirs due to impact of mudflow |

|

Volcanic Eruptions |

Yes |

There are areas which have active volcano, such as Ol Doinyo Lengai mountain. |

|

High Waves / Surges |

No |

|

|

Wildfires |

Yes |

Wildfire cause huge destruction to humans and environment with the most common occurrence in Kilimanjaro, Arusha, Manyara, Mara, Morogoro, Lindi, Njombe, Iringa, Songea, Katavi, Rukwa, Kigoma and Tabora regions. Wildfire can cause major losses of ecosystem and biodiversity, forest degradation, air pollution and impact on human health and wellbeing. |

|

High Winds |

No |

|

|

Other Comments |

Analysis of earthquakes for the areas that fall within the East African Rift System (EARS) in Tanzania which is well-known as prone to seismic activities has been categorized in high certainty of occurrence with minor to moderate consequences but with high risk. Earthquakes were reported in Northern Dodoma in July, 2002 (magnitude 5.6), Lake Tanganyika in December, 2005 (magnitude 6.8), Lake Natron in July, 2007 (magnitude 5.9), Mwanza region in May, 2017 (magnitude 5.0), Sumbawanga in March, 2019 (magnitude 5.5) and Kagera region in September, 2016 (magnitude 5.9). Another earthquake event which occurred in 2017 in Mwanza killed 1 and injured 2 people and damaged some buildings in 4 schools. Earthquake incident in Bariadi in May, 2002 killed 2 and injured 5 people, destroyed 690 and damaged 636 houses. |

|

|

Man-Made Issues |

||

|

Civil Strife |

No |

N/A |

|

International Conflict |

No |

|

|

Internally Displaced Persons |

No |

|

|

Refugees Present |

Yes |

Tanzania hosts some 250,000 refugees and asylum-seekers with the bulk of the population being from Burundi followed by the DRC and other countries such as the Comoros, Eritrea, Kenya Iran, Lebanon, Somalia, Syria, South Sudan, Turkey, Uganda and Yemen. Most of the refugees and asylum seekers reside in 2 camps in North-western Kigoma Region, while some 70,000 refugees from the 1972 Burundian population live in Kigoma villages and the three old settlements. |

|

Landmines / UXO Present |

No |

|

|

Other Comments |

N/A |

|

For a more detailed database on disasters by country, please see the Centre for Research on Epidemiology of Disasters Country Profile.

Seasonal Effects on Logistics Capacities

|

Seasonal Effects on Transport |

||

|---|---|---|

|

Transport Type |

Time Frame |

Comments / Details |

|

Primary Road Transport |

December to April |

Most of primary roads are affected by rain thus they are highly used during the dry season. |

|

Secondary Road Transport |

December to April |

They are highly affected during rainy season. Some are difficult to access, or even impassable. |

|

Rail Transport |

December to April |

Seasonal effects like floods or rain are encountered. However, due to the ongoing improvement on central railway line, the line is used throughout the year with occasional minor interruptions. |

|

Air Transport |

December to April |

Heavy rain during this period, affects the operation of air transport leading to delays in timetable implementations. |

|

Waterway Transport |

N/A |

|

Tanzania has two major rainfall periods: one is uni-modal (October–April) and the other is bi-modal (October–December and March–May). The former is experienced in southern, central, and western parts of the country, and the latter is found in the north from Lake Victoria extending east to the coast.

Seasonal effects have various impacts on transport and other social and economic activities, such as during the rainy season due to inadequacy of transport infrastructures, the cost of operations tends to increase. Following are some seasonal effects on:

Air transport – Short-term delays due to adverse weather conditions, heavy rains cause the suspension of flights especially to airports with ‘Non-Asphalt ‘runways.

Port operations – The operations relevant to ships and port warehouse activities are suspended during heavy rains.

Road - The improvement and upgrading of roads have a positive result in the main corridors being considered all weather, however there are still road links that become impassable during the rains.

Rail – The rail systems, TAZARA and TRC in principle should be ‘all-weather’, sectors of the rail links have been closed in the past due to flooding and wash ways.

In December, the road transport tends to be congested particularly from the main cities to other regions because a lot of people like Chaga people return to their areas of origin for ceremonies, thus demand for transport is increased.

During the harvest period, the demand for transport in various areas is increased since farmers need to move their harvests to the market or storage areas. Sometimes a lot of crops damaged in farm areas due to poor transportation services especially in rural areas.

|

Seasonal Effects on Storage and Handling |

||

|---|---|---|

|

Activity Type |

Time Frame |

Comments / Details |

|

Storage |

December - April |

Effective warehouse management during the rainy season is critical to prevent damage and spoilage of stored goods. To mitigate risks, maintain proper moisture control by monitoring and regulating humidity levels, facilitate airflow through ventilation systems, and increase aeration frequency. Given the heightened risk of insect infestations, implement robust pest control measures, inspect for potential entry points, and consider using insect-resistant packaging. Regular warehouse maintenance to address leaks and ensure proper drainage is essential, as is elevating goods off the floor to prevent moisture absorption. Detailed record-keeping, weather monitoring, and an emergency response plan should also be part of your rainy season warehouse management strategy to safeguard goods and reduce potential losses. |

|

Handling |

December - April |

During the rainy season, it's essential to take extra precautions when loading, securing, and covering commodities transported by rail and road. Open-air handling of food commodities should be avoided due to moisture risks, necessitating the use of covered loading and unloading bays to protect goods from potential damage or spoilage during transit. |

|

Other |

Continued improvements in Tanzania’s transport infrastructure has created greater demand for services and as a result higher volumes of sea freight traffic in Dar es Salaam port can result in longer waiting time for berths and higher demand for road transport which is exasperated by delays caused in loading/unloading during heavy rain. |

|

Tanzania's climate exhibits distinct rainy and dry seasons, each carrying implications for commodity handling and storage. During the rainy season, characterized by heavy rainfall and elevated humidity levels, there exists a notable risk to goods stored outdoors or within inadequately ventilated warehouses. Furthermore, the potential for flooding and landslides can disrupt transportation networks, hampering the movement of goods to and from storage facilities. To safeguard assets during this period, businesses should consider relocating inventory to more secure, weather-resistant storage spaces and investing in waterproof packaging solutions. Additionally, prudent pre-stocking measures become essential to ensure ample inventory availability when transportation becomes challenging.

Conversely, the dry season in Tanzania provides a more favourable operational environment for businesses involved in commodity handling and storage. Transportation is generally less susceptible to weather-related disruptions, fostering efficient movement of goods to and from warehouses and production sites. Moreover, the reduced congestion at ports and airports during this period facilitates smoother logistics operations. Nevertheless, it's crucial to acknowledge that the dry season coincides with heightened agricultural activities, leading to increased demand for specific commodities like packaging materials. To meet this demand and maintain a competitive edge, proactive pre-stocking strategies should be considered.

In light of Tanzania's seasonal climate variations, businesses operating in the realm of commodity handling and storage should adopt a strategic approach. This involves meticulous planning and adaptation to weather-related challenges, such as the protection of goods during the rainy season and the anticipation of heightened demand during the dry season. Effective supply chain management, risk assessment, and proactive inventory management are pivotal elements in ensuring business continuity and resilience amidst these seasonal fluctuations. By optimizing resource allocation and mitigating weather-related risks, businesses can navigate Tanzania's climate intricacies and maximize their operational efficiency.

Capacity and Contacts for In-Country Emergency Response

GOVERNMENT

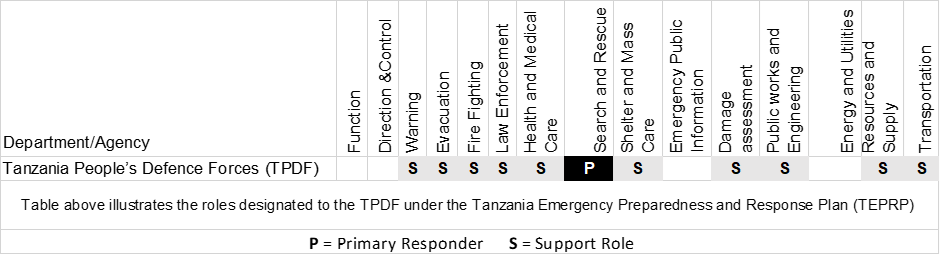

The Prime Minister’s Office through Disaster Management Department is the pivotal point for coordination of all disaster risk management in Tanzania mainland. The DMD provides central coordination for emergency preparedness and response operations and promotes and implements prevention, mitigation and preparedness initiatives to minimize the adverse effects of disasters to the Tanzanian population, properties and environment. The Disaster Risk Management Framework is governed by the Disaster Management Act No. 6 of 2022, the Disaster Management Regulations of 2022 and National Disaster Management Policy of 2004. Other instruments used are National Operational Guidelines 2014, National Disaster Risk Reduction Strategy 2022 – 2027, National Disaster Communication Strategy (TDCS) of 2022, National Disaster Preparedness and Response Plan of 2022 and Districts Emergency Preparedness and Response Plans. The Emergency Preparedness and response plan have clearly analyzed and mapped key stakeholders involved in disaster risk management, their roles and responsibilities during hazard mitigation and prevention, disaster preparedness, disaster response and recovery.

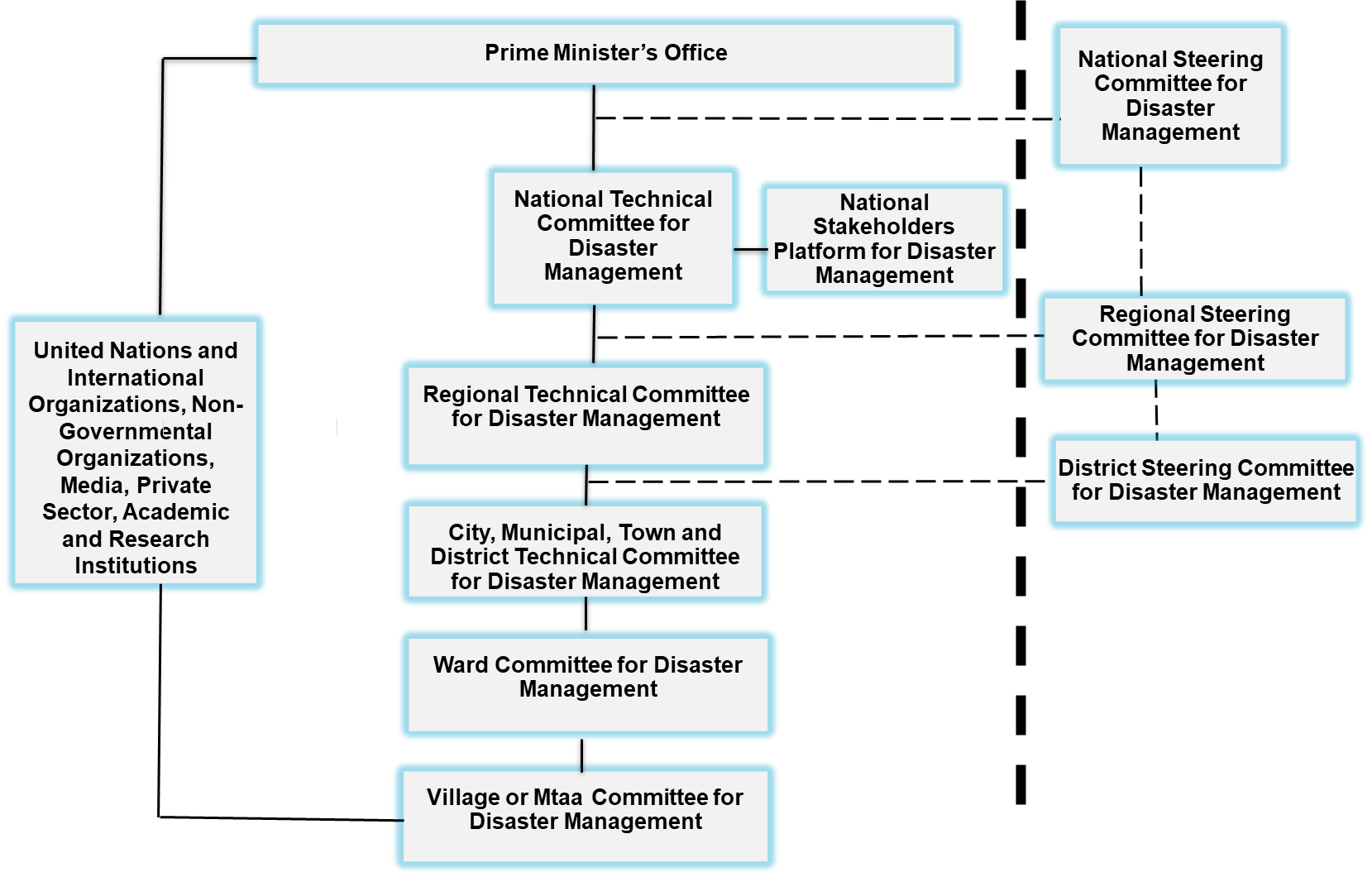

The DRM framework in the country consists of two parts – decision-making and technical execution. The decision-making side has the DRM Steering Committees (DRM-SCs) at the national, regional and district levels. Technical execution is through the DRM Technical Committees also at the national, regional and district levels. The technical part is responsible for analyzing and proposing technical measures to the decision-makers. To fulfil their mandates, the technical part may form various functional groups such as a special task force or technical working groups. Other components are the Ward DRM Committee and Village/Street DRM Committee that act at the local levels to realize strategies and technical measures.

Figure: National Disaster Management Organogram

(Source: Tanzania Prime Minister’s Office – Disaster Management Department)

Tanzania efforts on disaster risk management are in line with global and regional initiatives such as Sendai Framework for Disaster Risk Reduction (SFDRR) 2015 – 2030, Programme of Action for the Implementation of the Sendai Framework for Disaster Risk Reduction 2015 – 2030 in Africa, the 2030 Agenda for Sustainable Development, the Paris Agreement under United Nations Framework Convention on Climate Change, The Agenda for Humanity on the Core Commitments from the World Humanitarian Summit of 2016, the New Urban Agenda and Agenda 2063.

The primary responsibilities for disaster risk management and humanitarian services lies to core sectors which has legal mandates within Government MDAs, RS and LGAs with shared responsibilities among each other and all stakeholders including UN Agencies, Private sector, International and Local NGOs, Academic and Research Institutions (ARI), CBOs, FBOs and the media.

The following is a summary of planned co-ordination arrangements and activities between Government, UN and International agencies, and NGOs:

- As the ultimate coordinator of all actors involved in an emergency response, the Government through the PMO-DMD is responsible for disaster prevention, mitigation, preparedness, response and recovery. Emergency response is led by the PMO-DMD, assisted by the relevant line ministries. Regional Secretariats (RS) and LGAs are mandated to coordinate any emergency-related activities in their jurisdictions through Disaster Management Committees. Following the end of the rainy season, DMD in collaboration with RS and LGAs will conduct a post-disaster assessment with all stakeholders to determine the overall effectiveness of the plan, and preparedness, response and recovery activities executed. This feedback will serve as input to future contingency plan preparation.

- The UN Resident Coordinator (UNRC) is also the designated Humanitarian Coordinator. Under the guidance of the UNRC, the Emergency Coordination Group (ECG), made up of heads of UN Agencies and Non-Government Organisations is responsible for the effective and efficient implementation of inter-agency disaster management activities in Tanzania for players outside the government.

- UN Agencies, TRCS and network of NGO implementing partners will respond to an emergency in collaboration with and through the coordination of PMO-DMD in collaboration with leading Government sector.

- In accordance with UN Humanitarian Reform and the Cluster (here referred as Sectoral) directions of the Inter-Agency Standing Committee (IASC), Sector Lead agencies will ensure a coordinated action among partners in their respective sectors. This responsibility requires coordination with Government, other agencies and NGOs to ensure that the needs of these sectors are addressed, information is shared, and reporting is carried out.

- Where a state of emergency requires extra-ordinary and urgent measures the National Steering Committee for Disaster Management will inform the President of the event necessitating the proclamation of a state of emergency that stipulates immediate measures which may be taken including deployment of military support to facilitate availability of human resources, funds and equipment for disaster management activities.

The following are the lead ministries coordinating different Sectors as well as the lead UN agency supporting those ministries. Early recovery and protection, as cross-cutting issues, are considered by all sectors through the coordination of DMD.

Table: Lead Sector Ministries and corresponding Country UN sector lead

|

|

Sector |

Lead Ministry |

Co-lead |

|---|---|---|---|

|

1. |

CAMP COORDINATION & CAMP MANAGEMENT (CCCM) |

Ministry responsible for disaster management and PO-RALG |

IOM, TRCS |

|

2. |

EMERGENCY SHELTER- NFIs |

Ministry responsible for disaster management and PO-RALG |

IFRC, IOM, TRCS |

|

3 |

FOOD SECURITY |

Ministry responsible for agriculture |

WFP/FAO |

|

4 |

HEALTH |

Ministry responsible for health and PO-RALG |

WHO |

|

5 |

PROTECTION |

Ministry responsible for community development and social welfare |

UNHCR, UNICEF, UNFPA, SAVE THE CHILDREN, |

|

6 |

NUTRITION |

Ministry responsible for health and PO-RALG |

UNICEF |

|

7 |

WASH |

Ministry responsible for water and health |

UNICEF |

|

8 |

LOGISTICS |

Ministries responsible for transport, infrastructure, information and communication |

WFP |

|

9. |

EDUCATION |

Ministry responsible for education and PO-RALG |

UNESCO, UNICEF |

https://www.pmo.go.tz/documents/acts-and-regulations

For more information on government contact details, please see the following link: 4.1 Government Contact List.

HUMANITARIAN COMMUNITY

The humanitarian situation in Tanzania is characterized by a collaborative approach among government bodies, United Nations (UN) agencies, international organizations, and non-governmental partners. Tanzania benefits from the active involvement of UN agencies in addressing pressing issues. UNICEF is working to improve child health and education, while the World Food Programme (WFP) addresses food security challenges especially in vulnerable regions. The United Nations Development Programme (UNDP) collaborates with national counterparts to promote economic growth, governance, and environmental sustainability.

The World Bank has played a vital role in supporting Tanzania's development through projects like the Tanzania Social Action Fund (TASAF) and infrastructure development initiatives. These projects have had a substantial impact on poverty reduction and improved access to social services. The collaborative efforts of these agencies demonstrate Tanzania's commitment to achieving its Sustainable Development Goals. The World Bank also plays a big role in supporting the Government of Tanzania in disaster management response, recovery and preparedness activities.

The Tanzanian government has taken significant actions to advance its progress toward meeting the Sustainable Development Goals (SDGs). These efforts encompass a range of sectors, including health, education, poverty reduction, and environmental sustainability. Initiatives such as improved healthcare access, increased enrolment in primary education, and the implementation of social safety nets like the Tanzania Social Action Fund (TASAF) have contributed to progress in health and education outcomes and poverty reduction.

Furthermore, Tanzania is actively addressing environmental sustainability through initiatives aimed at natural resource management, wildlife conservation, and renewable energy development. These actions align with the country's commitment to addressing climate change and promoting sustainable practices. The government's commitment to these various SDG-related initiatives reflects its dedication to achieving the global goals and fostering a more sustainable and prosperous future for its citizens.

For more information on humanitarian agency contact details, please see the following link: 4.2 Humanitarian Agency Contact List.

Tanzania, United Republic of - 1.2 Regulatory Departments & Quality Control

Tanzania's regulatory framework is a complex system of laws, regulations, and policies that govern a wide range of economic and social activities. The primary responsibility for developing and implementing the regulatory framework lies with the Government of Tanzania. However, the government also delegates regulatory authority to several independent agencies. The framework is designed to protect consumers, promote competition, and ensure the safety and quality of goods and services.

Tanzania Revenue Authority (TRA)

The Tanzania Revenue Authority is the government agency of Tanzania, charged with the responsibility of managing the assessment, collection and accounting of all central government revenue. It is a semi-autonomous body that operates in conjunction with the Ministry of Finance and Economic Affairs.

The major functions of Tanzania Revenue Authority (TRA) consist in assessing, collecting and accounting for Government Revenue; administrating revenue laws; advising Government on fiscal policy; promoting voluntary tax compliance; improving quality of service; counteracting fraud-tax evasion; producing trade statistics and publications.

|

Tanzania Revenue Authority |

Telephone Number |

Email and Website |

|---|---|---|

|

28 Edward Sokoine Drive, 11105 Mchafukoge, Ilala CBD, P.O.Box 11491, Dar es salaam, Tanzania |

Free: 0800110019 Free: 0800110020 +255262323930 |

E-mail: info@tra.go.tz

Website: https://www.tra.go.tz/index.php

|

Land Transport Regulatory Authority (LATRA)

The Land Transport Regulatory Authority (LATRA) is a Government Authority established by the Act of Parliament No. 3 of 2019. This law repealed the former Surface and Maritime Regulatory Authority (SUMATRA) Act. LATRA has been tasked with regulating the transport sector on the ground, particularly freight and passenger transport (long-haul buses, urban buses, freight cars, taxis, two- and three-lane motorcycles) rail transport and wire transport. LATRA's headquarters is in Dodoma the Authority has offices in all twenty-six (26) regions of mainland Tanzania.

Increasing use of modern technologies is revolutionizing transportation sector, LATRA has implanted two technological solutions with the participation of public and private sector stakeholders. One key system has been the Vehicle Trend Tracking System (VTS) for public service vehicles (PSV), this system has been in operation since 2017 and has shown positive results in saving lives and property. LATRA has also introduced a Railway & Road Information Management System (RRIMS), this system monitors PSV’s movements and driver behaviour and is mandatory on all PSVs. RRIMS is currently fitted to 18 wagons of TAZARA’s rolling stock to monitor the movement of rail on the southern rail corridor and will be extended to the central corridor after a trial period.

|

Land Transport Regulatory Authority |

Telephone Number |

Email and Website |

|---|---|---|

|

SLP 174241104 Tambukareli Dodoma, Tanzania

|

Free: 0800110019 – 800110020 Tel: +255262323930 Mob: +255738000069 |

E-mail: info@latra.go.tz

Website: https://www.latra.go.tz/ |

Energy And Water Utilities Regulatory Authority (EWURA)

This is an autonomous multi-sector regulatory Authority established by the Energy and Water Utilities Authority Act, Cap 414 of the Laws of Tanzania. EWURA is responsible for technical and economic regulation of the energy (electricity, petroleum, natural gas) and water sector in Tanzania. The Authority’s functions among others include licensing, tariff review, monitoring performance and standards regarding quality, safety, health and environment. The authority is also expected to establish standards for goods and services provided, regulate rates and charges, make rules and monitor the regulated sectors performance. EWURA publishes the national Cap Prices for petroleum products applicable in Tanzania Mainland on a monthly basis, for the lates Petroleum Fuel Prices see link Tanzania fuel-prices

|

EWURA

|

Telephone Number |

Email and Website |

|---|---|---|

|

EWURA House, 3 EWURA Street, 41104 Tambukareli, P.O Box 2857, Dodoma, Tanzania.

|

Tel: +255-26 2329003 Tel: +255-26 2329004 Fax: +255-26 232900

|

E-mail: info@ewura.go.tz Website: www.ewura.go.tz |

Tanzania Bureau of Standards (TBS)

The main functions of Tanzania Bureau of Standards (TBS) are:

- formulation and promulgation of Tanzania Standards in all sectors of the country economy; implementation of the promulgated standards through third party certification schemes

- improving the quality industrial products both for export and local consumption through various certification schemes.

- promotion of standardization and quality assurance service in industry and commerce through training of personnel Company Standardization, Quality Assurance and Management system, Quality Assurance and Management System, Quality Improvement, Laboratory Techniques and Accreditation, Packaging Technology and Hazard Analysis and Critical Control Points (HACCP).

- undertaking tasting of product sample drawn by TBS inspectors in the course of implementing standards (certification samples), requested by manufacturers themselves (type testing samples) brought by consumers (customer complaints samples) or for checking laboratory proficiency (proficiency testing samples).

- undertaking calibration of industrial and scientific measuring equipment and instrument in the areas of mass, length value, energy, temperature, etc.

The Tanzania Bureau of Standards (TBS) has implemented a product conformity assessment programme for the control of certain categories of imported consumer goods. The programme, known as Pre-Export Verification of Conformity (PVoC) to standards implemented from 01 February 2012. The objective of the PVoC is to ensure that all imports of regulated products comply with the approved Tanzanian technical regulations, (i.e. Tanzanian or other approved international standards), prior to shipment. (TBS, 2017)

|

TANZANIA BUREAU OF STANDARDS

|

Telephone Number |

Email and Website |

|---|---|---|

|

Headquarters Office P O Box 9524, Sam Nujoma Road / Morogoro Road, Ubungo, Dar es Salaam.

|

Ph: 0800110827

Fax No:0800110827 Toll Free No: 0800110827 |

E-mail: info@tbs.go.tz

Website: https://www.tbs.go.tz/ |

Tanzania Medicines and Medical Devices Authority (TMDA)

Tanzania Medicines and Medical Devices Authority (TMDA) is an Executive Agency under the Ministry of Health (MOH). TMDA which was formerly known as Tanzania Food and Drugs Authority (TFDA) was established in 2003 after enactment of the Tanzania Food, Drugs and Cosmetics Act, Cap 219 by the Parliament. This Act was later amended in 2019 to Tanzania Medicines and Medical Devices Act, Cap 219 after the shift of responsibilities of regulating food and cosmetics to Tanzania Bureau of Standards (TBS). The change in legislative framework, which was done through the Finance Act, No. 8 of 2019 also resulted into the change of name to TMDA

TMDA is now responsible for regulating quality, safety and effectiveness of medicines, medical devices, diagnostics, biocidal and tobacco products. To improve public service delivery, TMDA is managed as an Executive Agency in accordance with the Executive Agencies Act, Cap. 245 which was also amended in 2009.

The Tanzania Medicines and Medical Devices Authority (TMDA) is an executive agency under the Ministry of Health, (MoH). It was established under the Tanzania Food, Drugs and Cosmetics Act (TFDCA) Cap. 219 as amended by the Finance Act of 2019. TMDA provides for the efficient and comprehensive regulation and control of safety and quality of medicines, medical devices, diagnostics, biocidal and tobacco products. To improve public service delivery, TMDA is managed as an Executive Agency in accordance with the Executive Agencies Act, Cap. 245 as amended in 2009.

The TMDA is responsible for regulating the safety, quality, and efficacy of human and veterinary medicines, herbal medicines, medical devices, and diagnostics in Tanzania. It also regulates the safety of biocidal products and tobacco products.

The TMDA's core functions include:

- Registering medicines, medical devices, and diagnostics

- Regulate Imports and Exports

- Inspecting manufacturing and distribution facilities

- Monitoring the safety of medicines, medical devices, and diagnostics

- Investigating adverse drug reactions and medical device incidents

- Providing information and advice to the public on medicines, medical devices, and diagnostics

- The TMDA is governed by a Board of Directors, which is appointed by the President of Tanzania. The Board is responsible for setting the strategic direction of the TMDA and overseeing its operations.

- Registry of Manufacturers, Wholesalers and importers.

- Supervises disposal of unfit and expired products.

The TMDA has a staff of over 200 people. The staff is responsible for carrying out the day-to-day operations of the TMDA, including registering medicines, medical devices, and diagnostics; inspecting manufacturing and distribution facilities; monitoring the safety of medicines, medical devices, and diagnostics; investigating adverse drug reactions and medical device incidents; and providing information and advice to the public on medicines, medical devices, and diagnostics.

The TMDA has several zonal offices located throughout Tanzania which are each responsible for several of regions. Zonal offices are responsible for providing services to manufacturers, distributors, and retailers of medicines, medical devices, and diagnostics in their respective regions.

The TMDA is a member of several international and regional organizations, including the World Health Organization (WHO), the African Medicines Regulatory Harmonization (AMRH), the Africa Medicines Agency (AMA)and the East African Medicines Regulatory Authority (EMRA).

The TMDA has played a key role in improving the quality and safety of medicines, medical devices, and diagnostics in Tanzania. It has also played a key role in promoting the development of the pharmaceutical and medical device industries in Tanzania.

The TMDA is facing several challenges, including the increasing number of counterfeit and substandard medicines on the market, the emergence of new and emerging diseases, and the need to keep up with the latest technological developments. The TMDA is also facing challenges in regulating the online sale of medicines and medical devices.

The TMDA is committed to ensuring the safety, quality, and efficacy of medicines, medical devices, and diagnostics in Tanzania. It is also committed to promoting the development of the pharmaceutical and medical device industries in Tanzania.

Here are some of the ways that the TMDA is contributing to the improvement of the quality and safety of medicines, medical devices, and diagnostics in Tanzania:

- Registering medicines, medical devices, and diagnostics only after they have met the required standards of safety, quality, and efficacy.

- Inspecting manufacturing and distribution facilities to ensure that they meet the required standards.

- Monitoring the safety of medicines, medical devices, and diagnostics after they have been marketed.

- Investigating adverse drug reactions and medical device incidents and taking corrective action where necessary.

- Providing information and advice to the public on medicines, medical devices, and diagnostics.

- Supervise the disposal of medical products.

The TMDA is an important institution in the healthcare system in Tanzania. It plays a key role in protecting the public from unsafe, ineffective, and poor-quality medicines, medical devices, and diagnostics.

|

Tanzania Medicines and Medical Devices Authority |

Telephone Number |

Email and Website |

|---|---|---|

|

P.O. Box 1253, Dodoma or P.O. Box 77150, Dar es Salaam, Tanzania |

Hotline: +255 22 262961989 +255 22 262961990 |

E-mail: info@tmda.go.tz

Website: https://www.tmda.go.tz/

|

The Tanzanian National Roads Agency (TANROADS)

The Tanzania National Roads Agency (TANROADS) was established on 1st July 2000 by an order published in the Government Gazette, Notice No. 293 of 2000 under Section 3(1) of the Executive Agencies Act No. 30 of 1997, with the expectation of witnessing a significant improvement in road maintenance and development with respect to quality, efficiency and cost-effectiveness. The Agency is responsible for the management of 35,000 Km of roads made up of 12,786 Km of trunk roads and 22,214 Km of regional roads according to the Roads Act No. 13 of 2007 and subsequent reclassification up to June 2015.

|

Tanzania National Roads Agency |

Telephone Number |

Email and Website |

|---|---|---|

|

3rd Floor, 10 Shaaban Robert Road/Garden Avenue Junction. Dodoma |

Tel: +255 22 2926001/6 |

E-mail: tanroadshq@tanroads.go.tz Website: https://www.tanroads.go.tz/

|

Tanzania Communications Regulatory Authority (TCRA)

Tanzania Communications Regulatory Authority (TCRA) is a statutory regulatory body responsible for regulating the electronic and postal communication sector in Tanzania. It was established under the Tanzania Communications Regulatory Authority Act, No.12 of 2003, which merged the Tanzania Communications Commission (TCC) and the Tanzania Broadcasting Commission (TBC).

Tanzania Communications Commission (TCC) was established in 1993 with the mandate of regulating the telecommunications and postal services. Tanzania Broadcasting Commission (TBC) was established in 1993 with the mandate of regulating the broadcasting sector.

Following technological advancement, there was a need to streamline government services to enhance public service delivery, minimising bureaucracy and increase efficiency, the two regulatory bodies (TCC and TBC) were merged in 2003 to form Tanzania Communications Regulatory Authority (TCRA).

The Authority became operational on 1st November 2003 and effectively took over the functions of the merged two Commissions. This is mandated by section 4 (1) to (7) of the TCRA Act, 2003.

he Tanzania Communications Regulatory Authority (TCRA) is an independent regulatory authority for the postal, broadcasting, and electronic communications industries in the United Republic of Tanzania. It was established under the TCRA Act No. 12 of 2003 by merging the Tanzania Communications Commission (TCC) and the Tanzania Broadcasting Commission (TBC).

The TCRA is responsible for promoting competition and protecting consumers in the communications sector. It also plays a key role in the development of the communications sector in Tanzania.

The TCRA's core functions include:

- Licensing and regulating communications service providers.

- Promoting competition and protecting consumers in the communications sector.

- Developing and implementing policies and regulations for the communications sector.

- Monitoring and enforcing compliance with communications laws and regulations.

- Resolving disputes between communications service providers and consumers.

The TCRA is governed by a Board of Directors, which is appointed by the President of Tanzania. The Board is responsible for setting the strategic direction of the TCRA and overseeing its operations.

The TCRA has a staff of over 300 people. The staff is responsible for carrying out the day-to-day operations of the TCRA, including licensing and regulating communications service providers, monitoring, and enforcing compliance with laws and regulations, and resolving disputes.

The TCRA has several regional offices located throughout Tanzania. The regional offices are responsible for providing services to communications service providers and consumers in their respective regions.

The TCRA is a member of several international and regional organizations, including the International Telecommunication Union (ITU), the African Telecommunications Union (ATU), and the East African Communications Regulatory Authority (EACA).

The TCRA has played a key role in the development of the communications sector in Tanzania. It has issued licenses to several new communications service providers, which has led to increased competition and lower prices for consumers. The TCRA has also implemented a number of initiatives to promote the development of broadband internet in Tanzania.

The TCRA is facing several challenges, including the rapid growth of the communications sector and the need to keep up with the latest technological developments. The TCRA is also facing challenges in regulating the online content and social media platforms.

The TCRA is committed to promoting competition and protecting consumers in the communications sector. It is also committed to developing the communications sector in Tanzania and making it more accessible to all Tanzanians.

Here are some of the ways that the TCRA is contributing to the development of the communications sector in Tanzania:

- Issuing licenses to new communications service providers.

- Promoting competition and innovation in the communications sector.

- Implementing policies and regulations that support the development of the communications sector.

- Investing in research and development.

- Collaborating with other stakeholders to develop the communications sector.

- The TCRA is an important institution in the communications sector in Tanzania. It plays a key role in promoting competition, protecting consumers, and developing the communications sector.

|

Tanzania Communications Regulatory Authority

|

Telephone Number |

Email and Website |

|---|---|---|

|

Mawasiliano Towers 20 Sam Nujoma Road, 14414 Dar Es Salaam P.O Box 474 |

0800008272 +255 22 2199760 - 9 +255 22 2412011 - 2 +255 784558270 – 1 +255 22 2412009 - 10 |

E-mail: barua@tcra.go.tz

Website: https://www.tcra.go.tz/

|

TANZANIA SHIPPING AGENCIES CORPORATION (TASAC)

The Tanzania Shipping Agencies Act, 2017 was enacted to regulate, coordinate, and promote shipping agencies and related operations in Tanzania. It aims to ensure compliance with international maritime standards, improve safety and security in Tanzanian waters, and enhance the efficiency of port and maritime trade activities.

Key Provisions and Functions of the Act

The Act establishes the Tanzania Shipping Agencies Corporation (TASAC) as the regulatory authority responsible for overseeing shipping agencies and port operations. TASAC is mandated to:

- License and regulate shipping agencies.

- Promote safety and security in Tanzanian ports and waters.

- Ensure compliance with international maritime standards.

- Facilitate and promote maritime trade activities.

The Act also outlines the powers and functions of TASAC, including its role in:

- Granting and revoking licenses

- Setting fees and charges

- Conducting inspections and investigations

- Specifying penalties and offenses related to shipping agency operations and activities

Benefits of the Act

The Tanzania Shipping Agencies Act, 2017 is expected to provide a number of benefits, including:

- Improved safety and security in Tanzanian ports and waters

- Enhanced efficiency of port and maritime trade activities

- Increased compliance with international maritime standards

- Increased competitiveness of the Tanzanian maritime sector

- Reduced shipping costs for businesses and consumers.

Overall, the Tanzania Shipping Agencies Act, 2017 is a progressive piece of legislation that seeks to modernize and regulate the Tanzanian maritime sector. It is expected to play a key role in promoting the growth and development of the sector.

|

Tanzania Shipping Agencies Corporation |

Telephone Number |

Email and Website |

|---|---|---|

|

PSSSF Tower Building 8th Floor, Plot No. 20/21, Garden Avenue/Ohio Street, P.O. Box 989, Dar es Salaam, Tanzania |

Free: 0800 110 107 Ph: +255 22 2127314 Fax +255 22 2127313 |

E-mail: barua@tcra.go.tz Website: https://www.tasac.go.tz/

|

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List and 4.3 Laboratory and Quality Testing Company Contact List.

Tanzania, United Republic of - 1.2.1 Tanzania Medical Logistics - Regulatory Departmentsand Quality Control

|

Assessment Details |

|

|---|---|

|

From |

August 2020 |

|

To |

August 2020 |

|

Name of Assessor |

Alexandra Parisien |

|

Title and Position |

Emergency Preparedness & Response Officer – Supply Chain, WFP |

|

Contact |

|

Below are the main regulatory government agencies responsible for regulating both private and government suppliers and quality of health commodities. Tanzania Medicines and Medical Devices Authority (TMDA) and Tanzania Bureau of Standards (TBS) have laboratories to conduct quality control. A list of companies is provided in the 4.3 Tanzania Laboratory and Quality Testing Companies Contact List.

- Tanzania Medicines and Medical Devices Authority (TMDA)

- Government Chemist Laboratory Agency (GCLA)

- National Health Quality Laboratory Assurance Training Centre (NHLQATC)

Tanzania Medicines and Medical Devices Authority (TMDA)

TMDA is a governmental executive agency under Ministry of Health Community Development Gender Elderly and Children (MOHCDGEC) with the mandate to ensure the quality, the safety and the effectiveness of medicines and medical devices in order to protect and promote public health. It conducts laboratory analysis and testing to confirm and validate information provided on the health commodities and produce recommendations based on the outcomes. The major functions of TMDA as stipulated in the amended TFDA act 2003 include:

- Regulating the manufacture, importation, distribution and selling of medicines, medical devices and diagnostics;

- Prescribing standards of quality, safety and effectiveness for medicines, medical devices and diagnostics;

- Inspecting manufacturing industries and business premises dealing with regulated products and make sure the standards required are attained;

- Evaluating and registering medicines, medical devices and diagnostics so as to reach the required standards before marketing authorization;

- Issuance of business permits for premises dealing with regulated products;

- Assessing the quality, safety and efficacy of controlled drugs.

TMDA complies with the requirements of the ISO/IEC 17025:2017 and WHO Good Practices for Pharmaceutical Quality Control Laboratories to ensure that laboratory services rendered are of quality and efficient. TMDA has two main laboratories whereby one is based in the Sub-office in Dar es Salaam and the other in Mwanza at the Lake Zone.

|

Tanzania Medicines and Medical Devices Authority (TMDA) |

Telephone |

|

Website |

|---|---|---|---|

|

PSSF Building, 10th Floor, Makole Road, P. O Box 1253, Dodoma, Tanzania. |

Hotline: +255 22 2450512 / 2450751 / 2452108 |

Government Chemist Laboratory Agency (GCLA)

GCLA is a government agency with a mission to provide quality and cost-effective laboratory and regulatory services to the government, institutions, private sector and the general public for the purpose of safeguarding human health, environment and for execution of justice. One of its main objectives is to contribute to the protection of the environment and health of people of Tanzania, by participating in the establishment of integrated chemicals management systems and regulating consumer and industrial chemicals. GCLA perform laboratory analysis of pharmaceutical products to conformity of national and international standards.

|

Government Chemist Laboratory Agency (GCLA) |

Telephone |

|

Website |

|---|---|---|---|

|

Chief Government Chemist 5 Barack Obama Drive P.O.Box 164, Dar es Salaam, Tanzania. |

Tel: +255 22 2113383/4 Fax: +255 22 2113320; |

National Health Quality Laboratory Assurance Training Centre (NHLQATC)

NHLQATC has been established since 2008 under the MOHCDGEC for the purpose of improving quality of laboratory services all over the country. The NHLQATC is accredited under IEC/ISO 15189:2012 Medical laboratories requirements for quality and competence by Southern African Development Community Accreditation Services (SADCAS) in 2014 with certificate number MED 001.

Some of the services provided include:

- Certification of biosafety cabinet to verify integrity equipment so as to provide protection for personnel, product and environment.

- Laboratory diagnostic services for patient management and research purposes.

- Work as an advisory and specialist in outbreak situations as well as offering required laboratory support during outbreaks.

- Research and evaluation to ensure the accuracy and reliability of test results from specific test methods and testing equipment.

- Training and facilitation of public health laboratory science to in service personnel.

- Quality assurance and compliance; oversee all medical laboratory functions in Tanzania.

|

National Health Quality Laboratory Assurance Training Centre (NHLQATC) |

Telephone |

|

Website |

|---|---|---|---|

|

NHA-QATC Building Mandela Road, Mabibo external, next to TMDA Building, P.O.Box 9083, Dar es Salaam. |

+255 22 2126390 /1/2/3/4 |

For more information on regulatory departments and quality control laboratories’ contact details, please see the following links: 4.1 Government Contact List and 4.3 Laboratory and Quality Testing Company Contact List.

Tanzania, United Republic of - 1.3 Customs Information

Duties and Tax Exemption

Emergency Response:

[Note: This section contains information which is related and applicable to ‘crisis’ times. These instruments can be applied when an emergency is officially declared by the Government. When this occurs, there is usually a streamlined process to import goods duty and tax free.]

In the following table, state which of the following agreements and conventions apply to the country and if there are any other existing ones

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes 07 Jun 64 |

|

Annex J-5 Revised Kyoto Convention |

No |

|

OCHA Model Agreement |

No |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

No |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

Yes, 01 Jan 95 |

Exemption Regular Regime (Non-Emergency Response):

On 16 December 2004, the East African Legislative Assembly enacted the newer East African Community Customs Management Act, 2004. The purpose of this Act is to govern the administration of the East African Customs Union (newly launched on 01 January 2005), covering all legal, administrative and operational matters, including the exemption regime.

|

Organizational Requirements to obtain Duty Free Status |

|---|

|

United Nations Agencies |

|

All United Nations and its specialized agencies, commonwealth High Commissions, foreign embassies, consulates or diplomatic missions and NGO’s are exempted from duty & taxes on the importation of items for their purposes. However, there are exemption procedures which must be adhered to by the agency. |

|

Non-Governmental Organizations |

|

NGOs are exempted from Import Duty and Excise Duty on Excisable Products (With Exception to Excise Duty on Aged Motor Vehicles beyond eight (8) years from the date of Manufacture. VAT is payable on Importations by NGOs, with exception to a scenario where a particular NGO has a signed performance agreement by the United Republic of Tanzania on implementation of a particular project. |

Exemption Certificate Application Procedure:

|

Duties and Taxes Exemption Application Procedure |

|

|---|---|

|

Generalities (include a list of necessary documentation) |

|

|

All imports will normally be cleared from customs on presentation of the following documents, please note that not all of the following documents may be required.

VAT Act, 2014 (R.E 2017) for VAT exemption in case of the project implemented by the beneficiary. |

|

|

Process to be followed (step by step or flowchart) |

|

The Process to clear and forward transit traffic as follows:

NB: TAX EXEMPTION PROCEDURE IS NOT APPLICABLE FOR TRANSIT GOODS |

|

|

Refund to diplomats, international bodies Act No. 4 of 2018 s.68 |

|

|

85.-(1) The Commissioner General may refund part or all of the input tax incurred on an acquisition or import by- (a) a public international organization, a foreign government, or other person prescribed by regulations, to the extent that the person is entitled to exemption from value added tax under an international assistance agreement; (b) a person to the extent that such person is entitled to exemption for value added tax under the Vienna Convention on Diplomatic Relations or under any other international treaty or convention having force of law in United Republic, or under recognised principles of international law; or (c) a diplomatic or consular mission of a foreign country established in Mainland Tanzania, relating to transactions concluded for the official purposes of such mission. |

|

|

APPLICATION FOR UTILIZATION OF VAT RELIEF GRANTED UNDER THE THIRD SCHEDULE TO THE VALUE ADDED TAX ACT CAP 148(EXCLUDING DIPLOMATS/DIPLOMATIC MISSIONS) |

|

|

https://www.foreign.go.tz/services/category/services-for-diplomats

|

|

|

VALUE ADDED TAX (VAT) General Observations:

6. PROCEDURE FOR OBTAINING TAX REFUND AND RELIEF Missions and personnel will get tax refund from Tanzania Revenue Authority, once per month with the approval of the Protocol Department of the Ministry of Foreign Affairs and International Cooperation. In effecting duty free purchases, Diplomatic Missions and their non - Tanzania personnel are required to fill in PRO 6 forms available from the Ministry of Foreign Affairs. Tanzanian citizens employed in International Organizations in the professional category as officers or advisers are exempted from paying customs duties. Such personnel should also use the PRO 6 forms for clearance of articles they import when goods are allowed to be imported free of customs duties as explained above; they are also exempt from other indirect taxes collected on importation, e.g., Value added tax and excise duty. The exemption from customs duty and excise duty also applies to goods which are purchased in tax free customs warehouse or other bonded warehouses (these goods are usually imported by importing agents or companies). In such case, VAT is refunded upon application. The PRO 6 form shall contain the following information: -

Country of purchase. If the goods are to be received by a person other than the head of the mission or consulate, the letter is to sign the application, as required by the customs, in acknowledgement of having seen it. After establishing the consignee’s entitlement to immunity from taxation and having regard with the principle of reciprocity, if applicable, the Ministry for Foreign Affairs stamps its seal of approval directly on the application form, after which it is returned to the applicant together with two copies of the list of goods. When a mission takes the goods from a provision depot for its official use, a provision declaration in these copies must be filled in. The copy for the customs office should indicate the date and number of the PRO 6 form issued by the Ministry for Foreign Affairs. The control copy, which has to bear the missions stamp and acknowledgement of receipt, is certified by the Ministry and forwarded by the depot manager to the customs office, together with a copy of the invoice addressed to the mission. If for any reason exempted goods are sold or imported a non - entitled person/s the customs and other duties chargeable on the goods upon importation must be paid as required by regulations in force at the time of the customs declaration irrespective of the time they have been used. For all local purchases by mission and international organizations Form VAT 222 will be utilized and may be obtained from the ministry of Foreign Affairs, Protocol Division. Other entitled personnel will use their Diplomatic identity cards while making purchases from VAT registered traders whereby they will be provided with VAT from 207 for the purpose of refund.

|

|

|

Import of goods by non-profit organisation for the provision of emergency and disaster relief |

|

|

THE VALUE ADDED TAX ACT [PRINCIPAL LEGISLATION] REVISED EDITION 2019 PART II IMPORTS EXEMPT FROM VALUE ADDED TAX |

|

|

5. |

An import of goods made available free of charge by a foreign government or an international institution with a view to assisting the economic development United Republic. |

|

6. |

An import of food, clothing and shoes donated to non-profit organisation for free distribution to orphanage or schools for children with special needs in Mainland Tanzania. |

|

7. |

Import of goods by non-profit organisation for the provision of emergency and disaster relief, and where such goods are capital goods, the goods shall be handled to the National Disaster Committee upon completion or diminishing of the disaster. |

|

8. |

An import of goods by the religious organisation for the provision of health, education, water, religious services in circumstances that, if services are supplied-

|

Exemption Certificate Document Requirements

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes, original/ proforma |

Yes, original/ proforma |

Yes, original/ proforma |

Yes, original/ proforma |

Yes, original/ proforma |

Yes, original/ proforma |

|

AWB/BL/Other Transport Documents |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Donation/Non-Commercial Certificates |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

|

Packing Lists |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Other Documents |

Government Organizational Registration Certificate |

Government Organizational Registration Certificate |

Government Organizational Registration Certificate |

Government Organizational Registration Certificate |

Government Organizational Registration Certificate |

Government Organizational Registration Certificate |

|

Additional Notes |

||||||

|

Government registration certificate is important for an organization to get duties and tax exemption. These requirements apply to both UN agencies and NGO's. |

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

Bill of lading/airway bill; Commercial invoice; Packing list; Fumigation certificate in case of used clothing. Other documents required which are obtained in Tanzania (permit documents): Registration certificate of the organization; Recommendation letter from the District Commissioner; Approval letter from Deputy Commissioner Customs and Excise; Fully completed Treasury Vouchers forms. |

|

Embargoes |

N/A |

|

Prohibited Items |

Arms, Ammunition, Drugs (All goods Listed under the Second Schedule of the East African Community Customs Management Act, 2004) |

|

General Restrictions |

Seeds, plants and plant products (Genetic Modified Organism) and dangerous goods (Refer the list of goods Listed under the Second Schedule of the East African Community Customs Management Act, 2004) |

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

D&T Exemption Certificate |

Yes |

Yes |

N/A |

No |

N/A |

N/A |

|

Invoice |

Yes |

Yes |

N/A |

Yes |

N/A |

N/A |

|

AWB/BL/Other Transport Documents |

Yes |

Yes |

N/A |

Yes |

N/A |

N/A |

|

Donation/Non-Commercial Certificates |

Yes |

Yes |

N/A |

Yes (2) |

N/A |

N/A |

|

Packing Lists |

Yes |

Yes |

N/A |

Yes |

N/A |

N/A |

|

Phytosanitary Certificate |

Yes |

No |

N/A |

No |

N/A |

N/A |

|

Import Permit |

Yes |

Yes |

N/A |

No |

N/A |

N/A |

|

Certificate of Origin |

Yes |

Yes |

N/A |

Yes (3) |

N/A |

N/A |

|

Additional Notes |

||||||

|

Import permits is required whether cargo is transit that is temporarily stored in a bonded warehouse or is for domestic use. Again, domestic cargo must be certified by Tanzania Bureau Standards (TBS), Tanzania Atomic Energy and Tanzania Food and Drugs Authority (TMDA) has to certify food staff. For cargo in transit that goes straight across the border after entering in the country, import permit is not required. Required documentation applies to both UN agencies and NGO's. (1) Note that GMO food is not permitted to be imported into Tanzania. (2) For donations, the certificate is required only if you have to claim the exemption of duties. (3) The certificate of origin helps only if the goods originate from the East Africa Community or SADC as it can be used to reduce the taxation rates. |

||||||

Transit Regime

The process is similar to the one applied for local cargo. However, some regulatory bodies such as TBS and Radiation might not apply. Transit cargo may present different challenges as the release of trucks changed recently. Previously, trucks were going to Dodoma for direct truck to wagons transfer. Now, for certain destinations trucks are going straight, such as the cargo destined to DRC.

In general, here is the procedure to be followed by the agent for transit cargo:

- Custom releases order, C65 and vehicle registration card must be submitted to customs wharf for generation of T1.

- Then, copy of T1, vehicle registration card, driving license of the truck driver as well as tax invoice of the cargo have to be submitted to Delivery section of the port authority for loading permit, thereafter the truck is allowed to enter into the port and load the cargo.

- After cargo loading, the agent submits a copy of T1, c65, passport and driving license of the driver as well as filled movement sheet to the sealing office. The Customs sealing officer puts remarks on the relevant documents, seals the trucks individually and then puts the paperwork in a sealed envelope which travels with the trucks through two check points within Dar es Salaam City limits.

Note that for goods in transit, a security bond is required by the clearing agent.

1.3.1 Tanzania Medical Customs Information

|

Assessment Details |

|

|---|---|

|

From |

August 2020 |

|

To |

August 2020 |

|

Name of Assessor |

Alexandra Parisien |

|

Title and Position |

Emergency Preparedness & Response Officer – Supply Chain, WFP |

|

Contact |

|

Regulations

The Tanzania Food, Drugs and Cosmetics (Registration of Medicinal products) Regulations – 2015: https://trade.business.go.tz/media/GN%20314%20-%20Registration%20medicines.pdf

The Tanzania Food, Drugs and Cosmetics Act – 2003: https://trade.business.go.tz/media/TFDA%20ACT.pdf

Mainland Tanzania - Regular Regime for Import of Medical Devices and In Vitro Diagnostics: https://trade.business.go.tz/procedure/539/step/350?l=en

Mainland Tanzania - Regular Regime for Import of Medicine: https://trade.business.go.tz/procedure/545?l=en

Duties and Tax Exemption

General infomation on duties and tax exemption in Tanzania can be found on the following page: 1.3 Tanzania Customs Information.

For contact information regarding government custom authorities, please follow the link: 4.1 Tanzania Government Contact List

Emergency Response

There is currently no Emergency Importation/Customs Clearance process applicable only to ‘crisis’ times. However, for importation of medical supplies and medicines to support the Tanzanian Ministry of Health, Community Development, Gender, Elderly and Children or the Zanzibar Ministry of Health, there are guidelines for donations and independent procedures to follow for both Mainland Tanzania and Zanzibar.

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

No |

|

Annex J-5 Revised Kyoto Convention |

No |

|

OCHA Model Agreement |

Yes, 01/01/1995 |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

No |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

Yes, 07/06/1971 |

Exemption Regular Regime

|

Generalities |

|---|

|

All imports should be cleared from customs on presentation of the following documents (please note that not all the documents may be required):

|

|

Exemption Certificate Application Procedure |

|

|

Import Permit Application Procedure |

|

Requirements for Donated Medicines and Medical Supplies for Tanzania (29 April 2020)

|

| Clearance Procedure |

|

Exemption Certificate Document Requirements (for both UN and NGOs)

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||

|---|---|---|

|

|

Medicines |

Medical Devices |

|

Invoice |

Yes (1 soft copy, applies to both UN and NGOs) |

Yes (1 soft copy, applies to both UN and NGOs) |

|

AWB/BL/Other Transport Documents |

Yes (1 copy of the original, applies to both UN and NGOs) |

Yes (1 copy of the original, applies to both UN and NGOs) |

|

Donation/Non-Commercial Certificates |

Yes (1 soft copy, applies to both UN and NGOs) |

Yes (1 soft copy, applies to both UN and NGOs) |

|

Packing Lists |

Yes (1 soft copy, applies to both UN and NGOs) |

Yes (1 soft copy, applies to both UN and NGOs) |

|

Other Documents |

Government registration certificate is required for an organisation to get duties and tax exemption. |

|

|

Additional Notes |

||

|

Certificate of Donation is required only if you have to claim the exemption of duties. |

||

Import Permit Document Requirements

|

Import Permit Document Requirements (by commodity) |

||

|---|---|---|

|

|

Medicines |

Medical Devices |

|

Invoice |

Yes (One original and two copies of the original, applies to both UN and NGOs) |

Yes (One original and two copies of the original, applies to both UN and NGOs) |

|

AWB/BL/Other Transport Documents |

Yes (1 copy of the original, applies to both UN and NGOs) |

Yes (1 copy of the original, applies to both UN and NGOs) |

|

Donation/Non-Commercial Certificates |

Yes (1 soft copy, applies to both UN and NGOs) |

Yes (1 soft copy, applies to both UN and NGOs) |

|

Packing Lists |

Yes (1 soft copy, applies to both UN and NGOs) |

Yes (1 soft copy, applies to both UN and NGOs) |

|

Other Documents |

MOHCDGEC cover letter TMDA application form |

MOHCDGEC cover letter TMDA application form |

|

Additional Notes |

||

Government registration certificate is required for an organisation to get duties and tax exemption. |

||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

Bill of lading/airway bill; Commercial invoice; Packing list. Other documents required which are obtained in Tanzania (permit documents): import permit, TRA tax exemption form, registration certificate of the organisation. |

|

Embargoes |

N/A |

|

Prohibited Items |

Medicines not in the Standard Treatment Guidelines and national essential medicines list (NEMLIT) |

|

General Restrictions |

Medicines not in the Standard Treatment Guidelines and national essential medicines list (NEMLIT) |

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||

|---|---|---|

|

|

Medicines |

Medical Devices |

|

Invoice |

Yes ( 1 copy of the original) |

Yes ( 1 copy of the original) |

|

AWB/Bill of Lading |

Yes ( 1 copy of the original) |

Yes ( 1 copy of the original) |

|

Authorization Letter from importer |

Yes ( 1 copy of the original) |

Yes ( 1 copy of the original) |

|

Packing Lists |

Yes ( 1 copy of the original for each batch) |

Yes ( 1 copy of the original for each batch) |

|

Exemption Document & Import Permit |

TMDA import permit TRA tax exemption form 265 (2 originals) |

TMDA import permit TRA tax exemption form 265 (2 originals) |

|

Additional Notes |

||

| Government registration certificate is required for an organisation to get duties and tax exemption. | ||

Transit Regime

Process is similar to the one applied for local cargo. However, some regulatory bodies such as TMDA do not apply. Transit cargo is for trucks that are going straight to the destination, such as the cargo destined for DRC. The trucks for transit cargo must be registered by TRA online system.

In general, here is the procedure to be followed by the agent for transit cargo:

- Custom releases order, C65 and vehicle registration card must be submitted to customs wharf for generation of T1.

- Then, copy of T1, vehicle registration card, driving license of the truck driver as well as tax invoice of the cargo have to be submitted to Delivery section of the port authority for loading permit, thereafter the truck is allowed to enter into the port and load the cargo.

- After cargo loading, the agent submits a copy of T1, C65, passport and driving license of the driver as well as filled movement sheet to the sealing office. Customs sealing officer puts remarks on the relevant documents, seals the trucks individually and then puts the paperwork in a sealed envelope, which travels with the trucks through two checkpoints within Dar es Salaam City limits.

Note that for goods in transit, a security bond is required by the clearing agent.