3 Kenya Logistics Service & Supply

Kenya Logistics Services

Disclaimer: Registration does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities. Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse,comment on any company's suitability as a reputable service provider.

Kenya is probably the fastest growing economy of eastern Africa, and the entry point for most of the goods for such an area. Service providing capacity all over the country is quickly growing in terms of both hardware and software commodities. It is the hub for many important retailers and distributors for most of the brands that commercialize their products in central and eastern Africa.

Kenya - 3.1 Fuel

Fuel Overview

History of Petroleum Regulation in Kenya

The Petroleum Act CAP 116 was enacted in 1948 (with a major revision in 1972) and was the major law governing the petroleum sub-sector until 2006. The petroleum sub-sector was highly regulated with price controls for the main products. When the sector was liberalized in 1994, various challenges were experienced such as proliferation of substandard petroleum facilities and products. To address the challenge, Sessional Paper No. 4 of 2004 set pace for a new law to regulate petroleum sector, hence the Energy Act No. 12 which was enacted in 2006. This Act established the now defunct Energy Regulatory Commission (ERC).

On 22nd March 2019, the Energy Act No. 1 of 2019 and Petroleum Act No. 2 of 2019 were passed into law. This effectively repealed the Energy Act No. 12 of 2006. The new laws established the Energy and Petroleum Regulatory Authority with an added mandate of regulating the upstream and midstream petroleum subsectors.

Infrastructure

Petroleum supply chain is supported by the following critical infrastructure:

-

Petroleum Receipt and back-loading jetties:

-

Kipevu Oil Jetty (KOT): This is located at Kipevu area, Mombasa County and handles large petroleum vessels. Product is then transferred to the government owned Kipevu Oil Storage Facility (KOSF).

-

Shimanzi Oil Terminal (SOT): This is used for importation of petroleum by small vessels.

-

Mbaraki: This is a privately owned facility.

-

Africa Gas & Oil Limited (AGOL): This is a dedicated LPG (Liquefied Petroleum Gas) facility built under concessionary terms from the Kenya Ports Authority. It is connected to a common user manifold. The only storage depot connected to it is the AGOL mainland facility.

-

Kisumu Oil Jetty: This is located on the shores of Lake Victoria and is used for the exportation of petroleum products to the countries bordering the lake and into the Eastern DRC and South Sudan.

-

Petroleum storage tanks: Kenya’s total storage capacity is over 1,500,000,000 litres spread out across the country. Over 700,000,000 litres of this are operated by the Kenya Pipeline Company as primary and intermediate storage.

-

Petroleum pipelines: The pipeline system consists of trunk lines and distribution lines from Mombasa running through Nairobi to the Western Kenya towns of Nakuru, Eldoret and Kisumu totalling to about 1,804km.

-

Retail networks: Kenya has over 2,762 retail stations. The stations are classified as Tier 1, 2, 3 and 4 depending on land area, services offered and storage capacity.

Licensees

Petroleum licensees are classified into the following categories:

-

Importers of Petroleum Products (Currently totalled at 94 licensees)

-

Storage depots (Currently totalled at 27 licensees)

-

LPG Storage and Filling Plants (Currently totalled at 65 licensees)

-

Pipeline transportation (1 licensed pipeline transporter)

-

Refineries (1 licensed refinery)

-

Wholesalers and Exporters (Currently totalled at 832 licensees)

-

Transporters (by road for LPG) (Currently totalled at 94 licensees)

-

Retailers (Currently totalled at 42 licensees)

-

Petroleum Tankers (Currently totalled at 798 licensees)

-

Petroleum Drivers (Currently totalled at 432 licensees)

-

Storage of Crude Oil (There is only one licensed facility)

Some of the companies operate in all the above licensable activities. Observance of fair competition is regulated in liaison with the Competition Authority of Kenya.

|

Kenya Ministry of Energy Name: Peter Nduru Address: Nyayo House, Kenyatta Ave, P.O. Box 30582 – 00100, Nairobi, Kenya Tel: +254 020 310 112 Fax: +254 020 240 910 Email: pnduru@energy.go.ke Website: www.energy.go.ke

|

Energy and Petroleum Regulatory Authority |

|

State Department for Energy Kawi Complex, Off Red Cross Rd, Nairobi. +254 (0) 20 4841000

|

Kenya Pipeline Company Physical Address: Kenpipe Plaza, Sekondi Road, Off Nanyuki Road, Industrial Area, Nairobi Website: www.kpc.co.ke

|

|

Kenya Fuel Refineries Limited Address: Refinery Road, Changamwe, Mombasa, P. O. Box 90401 – 80100, Kenya Tel: +254 041 3433 511 Cell: +254 724 257 102 Fax: +254 041 3432 603 Email: refinery@kprl.co.ke Website: www.kprl.co.ke/

|

|

![]()

![]()

The Kenya Petroleum Refineries Limited is owned on a 50:50 equity holding between the government and India’s Essar Energy who acquired a 50% stake in September 2009 from Shell, BP & Chevron

The Kenya Petroleum Refineries Limited, Kenya Pipeline Company Limited, National Oil Corporation of Kenya (www.nockenya.co.ke) and Rift Valley Railways represent the government’s presence in the petroleum industry.

-

The domestic demand for various petroleum fuels on average stands at 2.5 million tonnes per year, all of it imported, either as crude oil for processing at the Kenya Petroleum Refineries Ltd or as refined petroleum products. The Kenya Petroleum Refinery at Mombasa has a current capacity of only 1.6 million tonnes per year.

-

The Mombasa refinery currently processes Murban and Arab Medium crude from the United Arab Emirates and Saudi Arabia

-

Processing heavier crude oil from Uganda would require additional spending on technology and equipment, but it would secure supplies closer to the refinery and reduce transportation cost.

![]()

Kenya Pipeline Company

The Kenya Pipeline Company Limited is a State Corporation established on 6th September 1973 under the Companies Act (CAP 486) of the Laws of Kenya and started commercial operations in 1978. The Company is 100% owned by the Government and complies with the provisions of the State Corporations Act (Cap 446) of 1986. The Company operations are also governed by relevant legislations and regulations such as the Finance Act, the Public Procurement Regulations, and Performance Contracting.

To achieve its mandate KPC operates multi-product pipelines currently transporting the following grades of petroleum products:

i) Automotive Gas Oil (AGO)

ii) Premium Motor Spirit (PMS)

iii) Illuminating Kerosene (IK)

iv) Jet A-1 (Aviation Turbine Fuel).

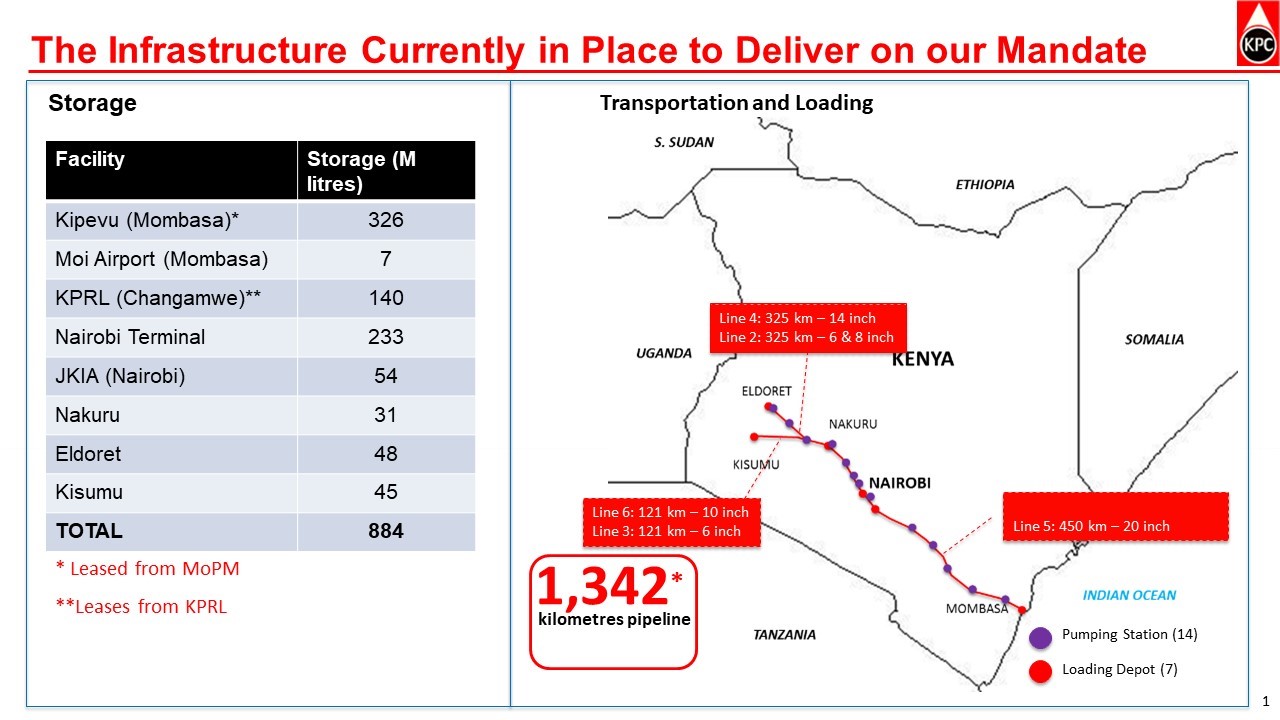

The pipeline system currently consists of a network of 1,792 km of pipelines running from Mombasa through Nairobi to the Western Kenya towns of Nakuru, Eldoret and Kisumu.

KPC has petroleum products storage facilities at its depots located in Nairobi and the major towns of Mombasa, Nakuru, Eldoret and Kisumu with a total capacity of 417,980m3. The Company manages and operates the 326,233m3 imports storage facility at Kipevu (KOSF) and another 143,014m3 under a lease arrangement with the Kenya Petroleum Refineries Limited (KPRL).

To date, KPC has cost effectively, efficiently, and safely transported petroleum products through the pipeline, for consumption in Kenya and the neighbouring countries which include Uganda, Rwanda, Burundi, Eastern Democratic Republic of Congo (DRC), South Sudan and Northern Tanzania. The pipeline throughput has increased from 800m3 in 1978 to 8.1millionm3 in 2020/21.

KPC also runs a NEMA (National Environmental Management Authority) designated environmental laboratory for effluent water, soil and drinking water analyses.

KPC’s first Laboratory accreditation to ISO/IEC 17025:2005 was attained on 08th July 2016.

|

Top 5 Oil Distributing Companies in Kenya |

||

|---|---|---|

|

NO |

Name of Company |

Contacts |

|

1 |

Vivo Energy Kenya |

|

|

2 |

Email: customerservice@total.co.ke, |

|

|

3 |

Avenue 5 Building |

|

|

4 |

KAWI house – South C, Popo Lane, Off Red Cross Road |

|

|

5 |

Libya Oil Kenya (OLA) |

Address: OiLibya Plaza Muthaiga Road Nairobi, 0620 Kenya; |

For more information on government and fuel provider contact details, please see the following links: 4.1 Government Contact List and 4.7 Fuel Providers Contact List.

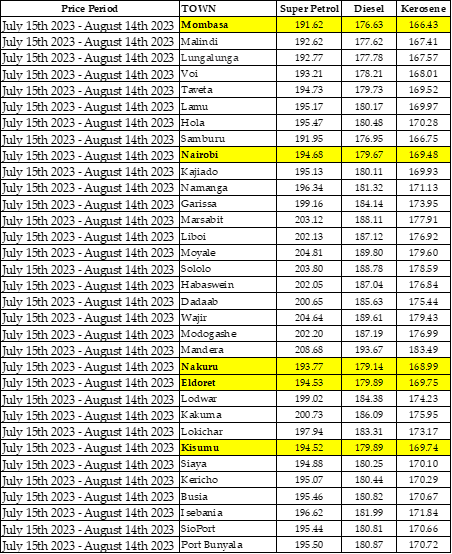

Fuel Pricing

Fuel prices are controlled by Energy petroleum and Refinery authority (EPRA). The review of prices normally happens every mid-month. Various locations within the country will therefore have different fuel prices.

|

Fuel Prices as of: August 2023 (local currency and US$) |

|

|---|---|

|

Petrol (per litre) |

1.393 USD |

|

Diesel (per litre) |

1.114 USD |

|

Paraffin (per litre) |

1.286 USD |

|

Jet A1 (per litre) |

0.859 |

Retail Petroleum Prices - Energy and Petroleum Regulatory Authority (epra.go.ke)

Fuel Prices in (Kenya Shillings) in various towns across the country as of August 2023

Seasonal Variations

|

Seasonal Variations |

|

|---|---|

|

Are there national priorities in the availability of fuel? (Yes / No) |

No |

|

Is there a rationing system? (Yes / No) |

No |

|

Is fuel to lower income/vulnerable groups subsidized? (Yes / No) |

No |

|

Can the local industry expand fuel supply to meet humanitarian needs? (Yes / No) |

Yes |

|

Is it possible for a humanitarian organization to directly contract a reputable supplier/distributor to provide its fuel needs? (Yes / No) |

Yes |

Fuel Transportation

Fuel distribution within Kenya is by truck and by pipeline from Mombasa to Nairobi and Eldoret

The railways do offer a service but due to the poor condition of the rail network this is not used as much.

Fuel distribution by road is well organised but fuel shortages do occur due to the fuel pipeline having insufficient capacity to meet demand.

Kenya Pipeline corporation is currently building a new, 20-inch pipeline to replace the existing line. The new pipeline would be able to carry 287,000 barrels per day by 2023.

Standards, Quality and Testing

Even though authorities are implementing quality surveillance system, second treatment of fuel is advised.

|

Industry Control Measures |

|

|---|---|

|

Tanks with adequate protection against water mixing with the fuel. (Yes / No) |

Yes |

|

Filters in the system, monitors where fuel is loaded into aircraft. (Yes / No) |

yes |

|

Adequate epoxy coating of tanks on trucks (Yes / No) |

Yes |

|

Presence of suitable firefighting equipment (Yes / No) |

Yes |

|

Standards Authority |

|

|

Is there a national or regional standards authority? (Yes / No) |

Yes |

|

If yes, are the standards adequate/properly enforced? (Yes / No) |

Yes |

|

Testing Laboratories |

|

|

Are there national testing laboratories? (Yes / No) |

yes |

|

Fuel Quality Testing Laboratory |

|

|

Name SHELL BP Kenya LTD |

|

|

Address Shimanzi Oil Terminal Laboratory, P.O. Box 90250 – 80100, Mombasa, Kenya |

|

|

Telephone +254 041 249 5051 Fax +254 041 249 5054 |

|

|

Contact Nicholas OCHIENG |

|

|

Standards Used

|

|

|

Fuel Quality Testing Laboratory |

|

|

Name Caltex Kenya Ltd

|

|

|

Address 90431 – 80100, Mombasa, Kenya

|

|

|

Telephone +254 041 249 4751 Fax +254 041 249 4204

|

|

|

Contact John MWANGI |

|

|

Standards Used

|

|

![]()

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse, comment on any company's suitability as a reputable service provider.

Kenya - 3.2 Transporters

The current road transport capacity of the country resides in private contractors, most of them based in Mombasa, however for WFP Transporters a majority have their administrative offices in Nairobi but are also very well positioned in Mombasa.

The Aid and Relief cargo continues to be a reliable source of cargo for transport actors as the port of Mombasa continues to position itself as the premier gateway for cargo within the region particularly the Northern Corridor.

Major investments have also been witnessed among the different players with the industry players being agile enough to shift to different cargo considerations to suit current need. A good example is upon the discovery of crude oil in Northern Kenya, it is a local company that was able to sufficiently haul the entire consignment.

In short, the commercial transport sector is robust and depending on the right incentive can mobilise the required capacity to deliver as required.

WFP Kenya does not have any dedicated fleet in Kenya but relies on their contracted commercial transporters who in turn when needed subcontract this capacity.

Even though the road transport of the country is one of the best in the region, availability of vectors may be influenced in certain period of the year by bulky delivery of goods: it is the case for fertilizers delivery in February/March and July/August.

For more information on transport company contact details, please see the following link: 4.8 Transporter Contact List.

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not able to endorse, comment on any company's suitability as a reputable service provider.

Kenya - 3.3 Manual Labour Costs

Kenya - 3.4 Telecommunications

Kenya’s communication sector led by The Ministry of Information, Communications and The Digital Economy (MOIC-DE) has responsibility for formulating, administering, managing, and developing the Information, Broadcasting and Communication policy.

The Communications Authority of Kenya (CA) is mandated to license all communications systems and services in the country. In executing this and its other responsibilities, CA is guided by the provisions of the relevant statutes, including the Kenya Information and Communications Act, 1998 and the Kenya Communications Regulations 2001. Commercial telecommunications licensees are authorized to set up telecommunications systems and/or to provide telecommunications services to third parties in accordance with the license terms and conditions. CA issues commercial licenses on a first-come-first-served basis and the turn-around time is 135 days. The Authority has in place a Unified Licensing Framework (ULF), which is technology and service neutral. The ULF market is structured into three main licenses: 1. Network Facilities Provider. 2.Application Service Provider. 3.Content Service Provider.

CA also issues licences for postal and courier services. The Postal Corporation of Kenya was established by an Act of Parliament (PCK Act 1998) and operates as a commercial public enterprise. The Corporation’s mandate includes provision of accessible, affordable, and reliable postal services to all parts of Kenya as public postal license whereby communication through the post office forms part of the basic human right as is enshrined in the 1948 United Nations Charter. Its mission is to deliver innovative superior communication, Distribution and Financial (Payment) solutions. The Post Office has a total of 623 outlets spread across the country.

Mobile Telecommunication Industry in Kenya

The mobile telecommunications industry in Kenya has witnessed immense growth. There are profiles of five companies, including Safaricom, which holds the highest market share for mobile data subscriptions, and other major players such as Airtel Networks, Telkom Kenya, Jamii Telecom, and Finserve (Equitel).

To register sim cards / mobile numbers in Kenya, one is required to provide an original and a copy of the national identity card, passport, or alien card. A subscriber is only allowed to own not more than 10 sim cards. There are numerous data plans easily available as the providers compete for the market's dominance.

For more information on telecoms contacts, please see the following link: https://kampusville.com/telecommunication-companies-kenya/

|

Telephone Services |

|

|---|---|

|

Is there an existing landline telephone network? |

Yes |

|

Does it allow international calls? |

Yes |

|

Number and Length of Downtime Periods (on average) |

The network is well monitored and maintained to alleviate minimal down time (0.01%). 99.99% up time

|

|

Mobile Phone Providers |

Safaricom, Airtel Networks, Telkom Kenya, Finserve (Equitel) and Jamii Telecommunications

|

|

Approximate Percentage of National Coverage |

Over 90 percent |

Telecommunications Regulations

The Communications Authority of Kenya (CA) is responsible for the development and implementation of policies and strategies with respect to telecommunications services in Kenya. The Authority licences, telecommunications operators, service providers monitor their performance on a continuous basis to ensure that they discharge the obligations as stipulated in their licences and are adhering to the provisions of the Kenya Information and Communications (Amendment) Act, 2013.

An application is deemed received when the Authority accepts the application fees and issues a receipt, and the applicant has met all the requirements. Applications sent by post are logged in as letters until or unless the applicable license application fee is received. Once an application is accepted, it undergoes processing, which may include publication in the Kenya Gazette in accordance with the law. At the conclusion of the licensing process, an applicant is advised of the outcome in writing.

The licensing process commences with the submission of a duly completed application form available for download at Licensing Overview | Communications Authority of Kenya. Within the form, details of the minimum requirements for acceptance of an application for each type of license and applicable fees are available. All applicants for commercial licenses should meet the following minimum conditions:

-

The entity should be registered in Kenya as a company, sole-proprietor, or partnership.

-

Have a duly registered office and permanent premises in Kenya.

-

Provide details of shareholders and directors.

-

Issue at least 30% of its shares to Kenyans on or before the end of three years after receiving a license.

-

Provide evidence of compliance with tax requirements.

|

Regulations on Usage and Import |

||

|---|---|---|

|

|

Regulations in Place? |

Regulating Authority |

|

Satellite |

Yes |

CA due to Frequency allocation |

|

HF Radio |

Yes |

CA to Frequency monitoring and allocation |

|

UHF/VHF/HF Radio: Handheld, Base and Mobile |

Yes |

CA to Frequency monitoring and allocation |

|

UHF/VHF Repeaters |

Yes |

CA to Frequency monitoring and allocation |

|

GPS |

No |

|

|

VSAT |

Yes |

CA due to Frequency allocation |

|

Individual Network Operator Licenses Required |

||

|

Yes, the Licence is required for the individual Network operators |

||

|

Frequency Licenses Required |

||

|

Yes, Frequency Licence need to be obtained from CA |

||

Existing Humanitarian Telecoms Systems

Apart from UNHCR, whose equipment is situated within the UNHCR Compound, the remaining systems are located at the UNON Compound in Gigiri. VHF and HF frequencies are commonly shared, and the movement of UN vehicles and personnel is tracked and monitored within the UN Common Radio Room. This administration is carried out by UNON as mandated by UNDSS Kenya.

Clarify with Robert (UNDSS)

|

Existing UN Telecommunication Systems |

|||||

|---|---|---|---|---|---|

|

|

UNDP |

WFP |

UNHCR |

UNICEF |

UNON |

|

VHF Frequencies |

No |

Yes |

Yes |

Yes |

Yes |

|

HF Frequencies |

No |

Yes |

Yes |

Yes |

Yes |

|

Locations of Repeaters |

No |

Yes UNON |

Yes UNHCR |

Yes UNON |

Yes UNON |

|

VSAT |

Yes |

Yes |

Yes |

Yes |

Yes |

Internet Service Providers (ISPs)

According to, CA Third Quarter Sector Statistics Report for the Financial Year 2022/2023, the total mobile data/Internet subscriptions stood at 47.96 million out of which 67.1 percent were on mobile broadband. This being 42.0 percent of the total population. In contemporary Kenya, there are many Internet service providers. Some have national coverage, while others are limited to specific locations. The prices they charge for connectivity depend on the speed, location, and number of users.

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? |

Yes |

|

|

If yes, are they privately or government owned? |

Privately and government owned |

|

|

Dial-up only? |

No |

|

|

Approximate Rates (local currency and USD - $) |

Broadband |

Kes.10,000 ($70) |

|

Minimum Leasable ‘Dedicated’ Bandwidth |

30mbps |

|

List of Internet service providers in Kenya

|

|

Fixed Data Subscriptions by Operator |

||

|---|---|---|---|

|

|

Service Provider/Indicator |

Number of data subscriptions |

Percentage Market share (%) |

|

1 |

Safaricom PLC |

399,333 |

35.9 |

|

2 |

Jamii Telecommunications Ltd |

257,951 |

23.2 |

|

3 |

Wananchi Group (Kenya) Limited* |

252,066 |

22.7 |

|

4 |

Poa Internet Kenya Ltd |

136,022 |

12.2 |

|

5 |

Liquid Telecommunications Kenya |

17,594 |

1.6 |

|

6 |

Mawingu Networks Ltd |

16,255 |

1.5 |

|

7 |

Dimension Data Solutions East Africa Limited |

14,891 |

1.3 |

|

8 |

Vilcom Network Limited |

4,760 |

0.4 |

|

9 |

Telkom Kenya Ltd |

4,545 |

0.4 |

|

10 |

Other Fixed Service providers |

8,871 |

0.8 |

Mobile Network Operators (MNOs)

Accessing the internet in Kenya is easy. Broadband is widely used, particularly in the main cities, at 13.7 megabits per second. Kenya's average data connection speed ranks as the 14th fastest in the world, which is also double the speed of the global average data connection speed. In 2022, 85.2 percent of Kenya's population was connected to the internet, according to World Stats (IWS).

Concerns in Mobile Financial Services (MFS) regulation in Kenya include interoperability in view of a dominant Mobile Network Operator (MNO), and transparency in terms of costing of the services. MNOs also play a double role of being the providers of the access channel especially USSD and as competitors of other providers of mobile payments. To mitigate against the highlighted concerns, the regulators have put in place short term and long-term measures. The short-term measures include the implementation of cooperation framework amongst the regulators and moral suasion. In the long-term, it is envisaged that a specialized agency to regulate the sector, the Financial Services Authority, will be formed through the enactment of the relevant legislation.

|

Company |

Number of Agent Outlets by Area |

Network Strength by Area |

Contracted for Humanitarian or Government Cash Transfer Programmes? |

Services Offered (i.e., Merchant Payment, Bulk Disbursement, Receive & Make Payment) |

|---|---|---|---|---|

|

Safaricom |

160,000 |

2G, 3G, 4G and 5G |

Yes |

Yes

|

|

Airtel Kenya |

24,000 |

3G, 4G and 5G |

Yes |

Yes

|

|

Telkom Kenya |

100,000

|

2G, 3G, 4G and 5G |

Yes

|

Yes

|

To access network Strength by Area for each provider, kindly refer to the link below:

https://www.nperf.com/en/map/KE/

For more information on Humanitarian Cash Transfer Programmes, refer to the links below:

https://cdn.odi.org/media/documents/8790.pdf

https://pdf.usaid.gov/pdf_docs/PBAAC032.pdf

Digital Infrastructure

According to the Kenya Digital Masterplan 2022-2032, Kenya currently boasts of being one of the most connected countries on the Eastern Coast of Africa. There are six submarine cables, namely TEAMS (5.2TB), EASSY (27.4TB), SEACOM (12TB), DARE (36TB), PEACE (192TB), and LION2 (12.33TB), that offer connectivity to the rest of the world. The Government's network is connected to the international broadband highway through TEAMS, in which the government holds a 20% share (1.04TB). The government has utilized its capacity in TEAMS by activating an internet capacity of 10 Gbps to serve its needs.

Regarding National Connectivity, over the last ten (10) years, the government has constructed approximately 9000km of terrestrial fibre, extending to the sub-county level, connecting key government institutions and offices to provide government services through the National Optic Fibre Backbone Infrastructure Project (NOFBI). Telecommunications companies such as Safaricom, Airtel, Jamii Telcom, and Telkom Liquid have also built fibre infrastructure.

3.5 Kenya Food and Additional Suppliers

Kenya Food Suppliers, Accommodation and Other Markets

For information on contact details, please see the following link:

4.2.9 Kenya Additional Service Provision Contact List

Main Food Suppliers

WFP Kenya has a unit providing local food purchase that may provide quick food response in case of emergency.

Such commodities should be purchased carefully and one should not consider it for really bulky quantities, as it may negatively influence the overall country food availability

Accommodation

As said elsewhere Kenya should not represent a big challenge under the point of view of accommodation availability. Commercial compounds are available all over the country as well as hostelling solutions.

Additional Operational Support

Many kind of operational support are available in the country.

Kenya - 3.5.1 Food Suppliers

Overview

The ability to procure food in the Kenyan depends on the availability and prices of the food commodities available in the markets. The foods in the markets are either imported or locally produced. During failed rain seasons, imported food commodities dominating the markets are mostly imported and their prices are likely to be higher due to inflationary trends mainly due to fall in value of the local currency against the major currencies like the US dollar.

Competition in the Kenyan food markets is high pitting large suppliers and importers against small traders mostly dealing with locally production.

Local food production is not able to meet local food demands as agriculture is heavily reliant on rain-fed systems, which are vulnerable to droughts and floods. This has led to frequent crop failures, which in turn have contributed to food shortages and high food prices. The strategy for achieving food security has been two pronged: 1. The Government supports efforts to increase agricultural productivity through development and application of technology and strengthening of extension services. 2. The Government supports purchase and storage of Strategic Grain Reserves (SGR).

Kenyan buys more than 80% of what is consumed with more than 15% of food consumed by households being what they produce. Food purchases are highest among households living in urban areas where at least 93.5%of food is bought with Nairobi and Mombasa cities leading the way. None of the 47 counties does a third of food consumed by households come from their own production, while only 10 counties do at least a quarter of food consumed come from household production. Nationally, food consumed from purchases accounts for 82.5% of food consumed. Only 7 counties, Elgeyo Marakwet (31,2%), Nyandarua (30.9%), Homabay (29.2%), Nandi (27.7%), Kisii (27.3%), West Pokot (26.2%) and Bomet (25.9%) have homegrown food consumption above a quarter of food consumed.

Estimated maize production decreased from 36.7 million bags in 2021 to 34.3 million bags in 2022, similarly tea production decreased from 537,800 tonnes in 2021 to 535,000 tonnes in 2022 due to low rainfall in tea growing areas. Additionally, volume of marketed milk declined from 801.9 million litres in 2021 to 764.3 million litres in 2022, largely due to drought leading to shortage of fodder for livestock.

As agricultural output has declined, rate of food importation has risen, increasing the rate at which households must buy what to eat. For example, maize import has increased by 50% from 2018 to 2023 reaching 793,751 tonnes in 2022 while Rice import has increased from 599,339 tonnes to 678,088 in the same period.

For more information on availability of food in Kenya, refer to the link below;

https://nation.africa/kenya/business/report-kenyans-now-buy-80pc-of-the-food-they-eat-4285902

Retail Sector

The Kenya retail sector continue to register increased market activities as evidenced by aggressive expansion of major local and international retailers, and developments. Some of the retailers who have been on an aggressive expansion drive during in the year 2022 include;

-

Naivas supermarket which opened 5 new stores spread across Nairobi, Machakos, Kiambu, and, Nakuru Counties, and plans to open a new outlet in Meru County.

-

QuickMart supermarket which opened 3 new stores in Nairobi and Kitengela Counties, and.

-

Chandarana Food Plus which opened a new outlet in Nairobi’s Westlands, and plans to open 4 new outlets in the country.

For more information on retail sector, please see the following link;

https://cytonnreport.com/topicals/kenya-retail-report-2

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

1 |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

1 |

|

Permanent shop with strong supply capacity – individually/family-owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

1 |

|

Permanent shop with limited supply capacity – individually/family-owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

1 |

|

Mobile Shop/Market Stand – individually/family-owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

2 |

Wholesale – HELENA AGSPACE LIMITED

Helena Agspace was formed in Homabay county in Kenya 2017 but officially registered by the government of Kenya as a company in 2019. Its main aim was to lift the living standards of farmers in that region by linking them to markets, teaching them about modern ways to farm and also giving them access to proper farm inputs.

It started off with around 20 farmers with maize aggregation then beans and finally found a home in white sorghum farming as its more structured and the farmers are very sure of the prices before they plant. Now it has around 1500 contracted farmers under its name and still hoping to recruit more under the same program.

Helena Agspace has not only brought the market nearer to the farmers but has also helped farmers with access to seeds on credit and promoted farm mechanization by letting farmers access to these services on loan which they later pay on credit.

|

Supplier Overview |

|

|---|---|

|

Company Name |

HELENA AGSPACE LIMITED |

|

Address |

|

|

Does the supplier have its own production / manufacturing capacity?

|

Yes. The supplier is directly engaged in farming and agriculture. |

|

Does the supplier have its own retail capacity?

|

Yes. The supplier provides commodities directly to the consumer. |

|

Does the supplier have its own transport capacity? |

Yes |

|

Does the supplier have its own storage facilities? |

Yes |

|

Approximate Turnover in MT

|

- |

|

Payment Methods Accepted |

Cheques and electronic transfers |

|

Other Comments or Key Information |

Helena Agspace tries as much as possible to partner with like-minded individuals and organizations to make work easier for the farmers. Farm to Market Alliance (FtMA) which offers training to farmers on good agricultural practices thereby equipping them with knowledge and the skills required to be good farmers. This has improved their yields which means that they are earning more from the same parcels of land. They have also linked farmers to financial institutions who aid in giving them short term credit in the form of farm implements like certified seeds and fertilizer. |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

i.e. sheep and goats, swine, poultry… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

01 - Meat and meat preparations |

i.e meat of bovine animals, meat of sheep, dried or smoked meat of swine, sausages… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

02 - Dairy products and birds’ eggs |

i.e. milk, yogurt, butter, cheese, eggs… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

i.e. fish (chilled or frozen), fish (salted or in brine), fish liver and roes… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

04 - Cereals and cereal preparations |

i.e. wheat, rice, flour of maize, pasta... |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

05 - Vegetables and fruit |

i.e. vegetables, fruit and nuts, jams/jellies, fruit juices… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

06 - Sugars, sugar preparations and honey |

i.e. sugars (beet or cane) raw, natural honey, fruit/nuts preserved by sugar … |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

i.e. coffee, cocoa, chocolate, tea, mate, pepper… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

09 - Miscellaneous edible products and preparations |

i.e. ready-to-eat foods, margarine, sauces, soups and broths, yeasts… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

41 - Animal oils and fats |

i.e. lard, fats and oils… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

i.e. soya bean oil, olive oil, maize oil, vegetable oil… |

Imported, produced / manufactured locally; with seasonal variations in stocks. |

**For non-FOOD products please see section 3.1 Fuel for FUEL/PETROLEUM products

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please note: WFP / Logistics Cluster maintain complete impartiality and are not able to endorse, comment on any company's suitability as a reputable service provider.

3.6 Kenya Additional Services

Kenya - 3.7 Waste Management and Recycling Infrastructure Assessment

Overview

In Kenya, waste collection is a multifaceted process involving various stakeholders and methods. It involves households/organizations sorting waste into categories like organic, recyclable, and non-recyclable. Municipal and private companies collect these separated wastes using trucks on set routes. Urban areas see informal "waste pickers" collecting items like plastic, glass, and paper for recycling. Challenges like limited infrastructure, irregular schedules, and low public awareness about proper waste disposal continue, affecting the efficiency of waste management.

Waste Management and Recycling Regulations in Kenya

-

The Environmental Management and Coordination Act (EMCA), 1999: This is the principal law regulating environmental management in Kenya, including waste management. It establishes NEMA and empowers it to regulate waste management, pollution control, and environmental impact assessments. Refer:https://www.nema.go.ke/index.php?option=com_content&view=article&id=24&Itemid=163

-

Sustainable Waste Management Act, 2022-It gives a comprehensive framework for sustainable waste management in Kenya, involving extended producer responsibility, proper labelling and handling of products, cooperation between different levels of government, and various measures to reduce waste and promote recycling.

Refer: http://kenyalaw.org:8181/exist/kenyalex/actview.xql?actid=No.%2031%20of%202022

-

Environmental Management and Co-ordination (Waste Management) Regulations, 2006: These regulations provide specific guidelines for the collection, transportation, storage, treatment, and disposal of solid waste in Kenya.

Refer:https://www.nema.go.ke/images/Docs/Regulations/Waste%20Management%20Regulations-1.pdf

Waste Management and Recycling Service Providers

In Kenya, waste management and recycling services are provided by a combination of government agencies and private companies. The key players involved in waste management and recycling include:

-

Government Agencies

National Environmental Management Authority (NEMA) is the principal government agency responsible for overseeing and coordinating all environmental management activities in Kenya. They play a significant role in waste management regulation, policy development, and environmental enforcement. Please follow link below for more information: https://www.nema.go.ke/images/Docs/Regulations/Waste%20Management%20Regulations-1.pdf

County Governments: Waste management responsibilities have been devolved to county governments in Kenya. Each county has its own Department of Environment or similar body responsible for waste management within its jurisdiction. These departments develop and implement waste management strategies aligned with national policies.

-

Private Companies

Private companies play a crucial role in waste management and recycling services in Kenya. The roles of these companies are classified as follows: Private Waste Collection Companies, Recycling Companies, Waste-to-Energy solution Companies that generate electricity or other forms of energy, informal Waste Pickers and NGOs and Community-Based Organizations. Below is a list of major waste management service providers in Kenya.

-

Waste Recycling Programme

There are recycling programs in Kenya, involving both private and public/governmental recycling facilities. Some of recycling initiatives by different organizations in Kenya are detailed below:

|

Firms |

Recycled Product |

Location |

Telephone Numbers |

Email address |

|---|---|---|---|---|

|

Kenya PET Recycling Company Limited |

PET (polyethylene terephthalate) plastic bottles.

|

Coca-Cola Plaza, Kilimanjaro Avenue, Upperhill |

+25 4725 883 253 |

|

|

Nairobi City County |

Recyclable materials such as plastic, paper, and metal |

Nairobi City Hall, |

+254 725 624 489/ +254 738 041 292 |

|

|

|

Plastic lumber products for various applications like construction, fencing, and furniture. |

Baba Dogo Rd, Ruaraka, Opposite Roy Transporters Depot, |

254(0)725 351 032/ 254(0)721 953 768 |

|

|

Kamongo Wastepaper Ltd |

Recycles paper waste |

Branches in Nairobi, Mombasa, Nakuru and Eldoret |

07924 10410 |

|

|

Chandaria Industries Ltd |

Recycles paper waste |

Location: Baba Dogo, Ruaraka. |

0723 414 172/ 0733 872 828. |

Status of Landfills in Kenya

Waste in Kenya is frequently disposed of in open dumpsites or informal landfills. Like many other countries, Kenya encounters challenges in waste management, particularly in the administration of landfills. The precise count of landfills in Kenya can fluctuate. However, the country has been actively striving to shift from open dumping sites to engineered sanitary landfills that adhere to higher environmental standards. The Sustainable Waste Management Bill, 2019 mandates the closure of open and uncontrolled dumpsites and the expansion of the market for recycled products. Notably, the Dandora dumpsite in Nairobi is recognized as the most prominent in the country and ranks among the largest unregulated landfills in Africa.

The management of landfills in Kenya is overseen by various entities, including local government authorities, county governments, and waste management companies.

National Government is responsible for crafting standards, including classification, licensing, and engineering guidelines for various landfill categories. They formulate regulations that require either public entities or licensed materials' recovery facilities to conduct landfill activities, facilitated through licenses, contracts, or concessions. The national government also addresses special waste conditions, such as e-waste, asbestos, radioactive, and hazardous waste, setting stipulations for permits, handling protocols, and disposal methods. They establish operational guidelines for overall landfill management, encompassing operations, automation, and general oversight.

County Governments undertakes specific roles: ensuring that landfills exclusively handle residual waste, establishing engineered landfills within their jurisdiction (except in inter-county or county economic bloc agreements), developing frameworks for public-private partnerships and concessions to optimize landfill management, implementing landfill fees to discourage waste disposal in landfills and dumpsites, and localizing national landfilling guidelines and regulations for effective application within their administrative boundaries. This comprehensive strategy is designed to achieve efficient landfill management, mitigate environmental impacts, and promote responsible waste disposal practices across Kenya.

https://www.environment.go.ke/wp-content/uploads/2023/03/SWM_Policy_2021_final_copy.pdf

Waste Management and Recycling Challenges in Kenya

Waste management and recycling in Kenya face several significant challenges, which can hinder effective waste disposal practices, environmental protection, and sustainable resource management. Some of the major challenges include:

-

Lack of Infrastructure: Inadequate waste collection, disposal, and recycling facilities result in open dumping and uncontrolled landfills.

-

Low Public Awareness: Limited understanding of proper waste management leads to improper disposal habits.

-

Informal Waste Sector: Challenges faced by waste pickers hinder efficient recycling practices.

-

Segregation Issues: Poor waste segregation at the source makes recycling less effective.

-

Funding Constraints: Insufficient funding hampers the development of waste management infrastructure.

-

Recycling Market Challenges: Lack of robust markets for recycled materials affects sustainability.

-

Plastic Pollution: High levels of single-use plastics contribute to environmental pollution.

-

Landfill Mismanagement: Poorly managed landfills lead to contamination and health risks.

-

Urbanization Impact: Rapid urban growth increases waste generation pressure.

-

Hazardous Waste Handling: Inadequate management of hazardous waste poses risks.

-

Illegal Dumping: Dumping waste illegally harms the environment and public health.

Hazardous Waste Disposal

Hazardous waste in Kenya includes substances like oils/water, hydrocarbons/water mixtures, emulsions, and explosive or flammable materials. Kenya's approach to hazardous waste disposal is guided by stringent regulations, emphasizing safe handling from creation to disposal. Operators generating hazardous waste are required to secure an Environmental Impact Assessment License (EIA license), highlighting the nation's commitment to responsible waste management.

Furthermore, hazardous waste generators ensure container security and labelling. Containers must be securely sealed and labelled in both English and Kiswahili, providing essential information for safe handling and disposal.

Detailed specifications for container labels include waste identity, generator's contact details, composition, storage guidelines, and active ingredient percentages. Warning/caution statements and recognizable symbols alert individuals to hazards, with mandatory first aid measures and medical assistance contacts. Refer: https://www.nema.go.ke/images/Docs/Selelah_OilandGas/Waste%20Management%20Guidelines%20for%20O&G%20sector_120320-min.pdf

Non-Hazardous Waste Disposal

The disposal procedures for non-hazardous waste in Kenya adhere to the Waste Management Regulations, ensuring responsible waste management. Waste generators are mandated to collect, segregate, and properly dispose of waste according to the provided guidelines.

To guarantee proper disposal, waste generators must transfer waste exclusively to licensed entities for transportation and disposal, preventing improper waste handling.

Additionally, the regulations emphasize that waste generators must integrate anti-pollution technology for waste treatment at their premises, based on the best available practices. Industrial waste cannot be disposed of until treated according to established methodology. This approach underscores Kenya's commitment to sustainable waste management practices and environmental protection.

Refer procedure in the link below: https://www.nema.go.ke/images/Docs/Selelah_OilandGas/Waste%20Management%20Guidelines%20for%20O&G%20sector_120320-min.pdf

CONTACTS

National Environment Management Authority (NEMA)

Popo Road,South C, off Mombasa Road

P.O.BOX 67839-00200, Nairobi. Kenya

Mobile: 0724 253398, 0735 013046.

Email:dgnema@nema.go.ke