1 Papua New Guinea Country Profile

Generic Information:

Papua New Guinea is rich in gold, oil, gas, copper, silver, timber and is home to abundant fisheries. Although it has a population of only 7.28 million, its people are strikingly diverse, organized in small, fragmented social groups and speak over 800 distinct languages. The economy is highly dualistic consisting of an enclave based formal sector that focuses mainly on large-scale export of natural resources, and an informal sector dominated by the subsistence and semi-subsistence activities of the majority rural population.

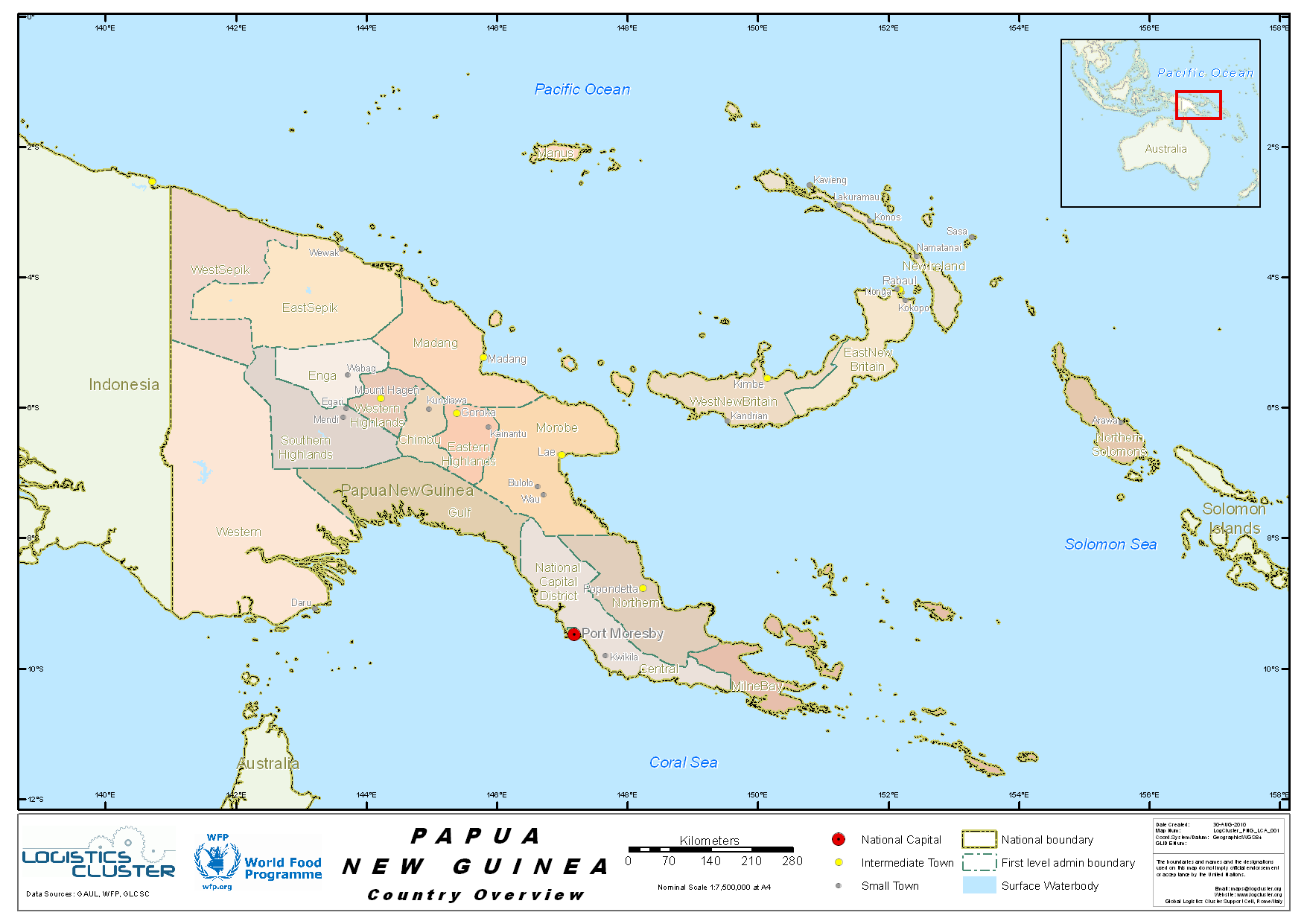

The country is located in the South West Pacific between latitudes of 1° and 12° south and, at 463,000 square kilometres, is the largest of the Pacific island states. It occupies the eastern half of the Mainland Island of New Guinea with three additional Islands (New Britain, New Ireland and Bougainville) and over 600 lesser islets and atolls to the North and East. The main islands are volcanic in origin with rugged interiors up to an elevation of 4,496 meters.

Papua New Guinea Additional Country Information

General Information

Website of Wikipedia on Papua New Guinea

Website of the IMF on Papua New Guinea

Website of the Economist on Papua New Guinea*

(*note - this is a paid service)

Humanitarian Information

Website of UNOCHA on Papua New Guinea

Facts and Figures:

Website of Wolframalpha on Papua New Guinea

1.1 Papua New Guinea Humanitarian Background

Papua New Guinea is prone to numerous natural hazards including earthquakes, volcanic eruptions, tsunami, drought, floods, tropical cyclones, landslides, the impact of climatic change and climate variability and sea level rise. PNG is ranked within the top 6 countries having the highest percentage of population exposed to earthquake hazard, as well as having one of the highest total populations exposed to earthquake in the Asia-Pacific region. PNG also ranked close behind the Philippines, Indonesia, and Vanuatu in having the highest percentage of population exposed to severe volcanic risks.

In addition, there is high risk of technological and human-caused disasters from oil spill, industrial pollution, unregulated and destructive land use practices and infrastructural development, as well as a rapid growth in population. Societal crisis such as civil unrest and HIV/AIDS have also made their presence known in Papua New Guinea. Many parts of PNG have a history of inter-community violence (tribal fighting) which remains common particularly in highlands provinces.

Disasters in PNG vary in speed, extent and level of impact. Natural disasters range from widespread slow onset events such as drought, which may affect the health and livelihoods of many but ultimately result in few deaths; to floods and cyclones that may have a sudden, high impact on the health and livelihoods of communities. The country has numerous small scale emergencies each year as a result of violent inter-community conflict (tribal fights), storms and disease outbreaks, which usually affect small numbers of people.

In PNG natural disasters have consistently affected key sectors of the economy such as agriculture, infrastructure and community livelihoods. In the period between 1997- 2002, 63 major calamities were reported in PNG that affected 4.1 million people. Over the past 25 years, the country has had 508 earthquake-related fatalities, 9 deaths from volcanic eruptions, 3,210 from tsunami/wave surges, 47 from cyclones, 58 from flooding, 314 from landslides, and 98 from drought. The social and economic ramifications of these many hazards is multiplied when overlaid with the high levels of vulnerability of people due to the lack of infrastructure, low human development indicators, and a high population growth rate. The highlands, with 2.2 million people, are subject to weather extremes of heavy rainfall and drought. Increasingly, landslides are occurring from population pressures on uncontrolled land use. The coastal areas and the many coral atolls are low-lying and nearly 500,000 people in 2,000 coastal villages are vulnerable to weather extremes and inundation. Over 80 percent of the population live in a rural environment and are susceptible to extremes of climate (rains and drought) related to the El Niño Southern Oscillation (ENSO).

Scientific evidence suggest that frequency and intensity of El Niño events has increased over the last 50 years and a major El Niño event may result in severe drought conditions in most parts of PNG. Climate change is also likely to exacerbate the risk of natural hazards by causing extreme weather events more frequently and sea-level rise to magnify the impact of storm surges and waves on coastal areas. The northern portion of New Guinea mainland and the islands are vulnerable to volcanoes, tsunami, coastal flooding, landslides, earthquake and rising sea level. Similarly, with the Highlands interior and other upland areas of the country, frost, hailstorms, drought, bush-fires, and landslides are frequent. However, just as flooding and drought conditions are experienced in the entire New Guinea Islands, tropical cyclones are also common along the southern and the far eastern coastal and islands region of Papua New Guinea. On the other hand, human caused disasters maybe categorized under technological, industrial and biological hazards.

Papua New Guinea OCHA Country Overview Map_070301

Papua New Guinea OCHA Natural Hazards Risks Map_070301

|

Disasters, Conflicts and Migration |

||

|---|---|---|

|

Natural Disasters |

Yes / No |

Comments / Details |

|

Drought |

Yes | 1997

drought and frost in Highland provinces (El Niño). Left many

agricultural communities in the highlands without food, and larger

landlocked settlements that rely heavily on river shipping. Death

toll is unknown. Many people permanently

moved. |

|

Earthquakes |

Yes | Papua New

Guinea sits on the "Pacific Ring of Fire", a hotspot for seismic

activity due to friction between tectonic plates. |

|

Epidemics |

Yes | Cholera Epidemic, December 2009 (1,500 cases and 35 deaths) |

|

Extreme Temperatures |

Yes | Southern Highlands province in September 2012 – 200,000 people were affected |

|

Flooding |

Yes | Oro province in December 2007 – 150,000 people have been affected and at least 13,000 homeless (source NNG government) |

|

Insect Infestation |

- | |

|

Mudslides |

Yes | Very

regularly in Highlands, due to inappropriate land

use |

|

Volcanic Eruptions |

Yes | Manam island volcanic eruption in 2004, 2015 |

|

High Waves / Surges |

Yes | The Aitape tsunami of 17 July 1998 was focussed on a 14-km sector of coastline centred on the villages of Arop, Warapu and Nimas. The wave height was 10 m or more and all structures within 400-500 m of the shoreline were destroyed. More than 2200 people were killed and 10,000 survivors were forced to relocate inland. |

|

Wildfires |

Yes | - |

|

High Winds |

Yes | - |

|

Other Comments |

Climate change is projected to impact heavily on agriculture,

forestry and fisheries in the Pacific islands, leading to increased

food insecurity and malnutrition (FAO) |

|

|

Man-Made Issues |

||

|

Civil Strife |

Yes | A nine-year secessionist revolt on the island of Bougainville ended in 1997 after claiming some 20,000 lives. A peace deal signed in 2001 provided the framework for the election in 2005 of an autonomous government for Bougainville. |

|

International Conflict |

No | Relies on assistance from Australia to keep out illegal cross-border activities from primarily Indonesia, including goods smuggling, illegal narcotics trafficking, squatters and secessionists |

|

Internally Displaced Persons |

Yes | Yes, many IDPs due to tribal conflict, natural disasters |

|

Refugees Present |

Yes |

The separatist struggle in the neighbouring Indonesian province of West Papua (formerly known as Irian Jaya) prompted the flight of thousands of West Papuans into Papua New Guinea from the mid-1980s onwards (10,177 people in 2007). Many of them remain in border-area jungle camps. Manus Regional Processing Centre was reopened in November 2012 to where asylum seekers to Australia would be sent there to be processed prior to resettlement in PNG as part of the Regional Resettlement Arrangement between Australia and PNG (“the PNG solution”). |

|

Landmines / UXO Present |

No | - |

|

Other Comments |

Papua New Guinea is a source and destination country for men, women, and children subjected to sex trafficking and forced labour. An estimated 19% of the country’s labour market is comprised of child workers. |

Website of Emdat - Natural Disaster Database

Disaster History in Papua New Guinea

Calamities and Seasonal Affects

| Seasonal Affects on Transport | ||

|---|---|---|

|

Transport |

Comments |

From (month) to (month) |

|

Primary Road Transport |

During the wet season, flash floods and landslides, particularly on stretches of the Highlands Highway between Lae and Mount Hagen, can result in road closures. November to May in the South March to July in the North |

November to May in the South March to July in the North |

|

Secondary Road Transport |

Flooded roads susceptible to landslides and causing traffic to come to a standstill or be stranded. |

November to May in the South March to July in the North |

|

Rail Transport |

No rail transport within the country | n/a |

|

Air Transport |

Airports may be temporary closed and air transport may face problems during volcano eruption | n/a |

|

Waterway Transport |

During dry seasons and droughts, rivers and connected waterways may become impassible to surface vessels | n/a |

Capacity and Contacts for In-Country Emergency Response

Government

Disaster risk reduction and disaster management planning and implementation have been impeded by resource constraints, a serious lack of capacity in the 22 provinces/regions and their respective communities, and lack of a trained cadre of skilled disaster managers. The country’s vulnerability is made worse by incomplete hazard information, shortage of models of good practice, lack of strong legislative framework, and shortcomings of early warning arrangements and communication systems. Dual tracked disaster management and disconnect between national and provincial, ineffective devolved disaster management systems, competency

At the national level, the development of an integrated framework will involve a whole- of-government approach to disaster risk reduction and disaster management with key agencies coordinating closely with local, provincial, national, regional and international stakeholders. Strengthening national legislative and regulatory frameworks will be necessary. Applicable and affordable models of best practices will need to be developed and adopted to support disaster risk reduction and disaster management. At the local level, partnerships between Government, Provincial Administrations, Provincial Disaster Coordinators, community groups and civil society will be necessary to support and enhance the resilience and management capacity of local communities.

The Disaster Management Legislation

Papua New Guinea was among the first countries to adopt the Hyogo Framework for Action (2005-2015) in November 2005, but has been unable to integrate the actions into its national development priorities. The Disaster Management Plan, in place since 1987, is considered outdated and not relevant to contemporary best practices. The current operational document for response management is the 2003 National and Provincial Disaster and Risk Management Handbook, which contained information is totally outdated. The Papua New Guinea Disaster Risk Reduction and Disaster Management National Framework for Action 2005–2015 is still in draft form and has not yet been adopted by the GoPNG. However various partners and stakeholders like UNDP (PNG) and the University of Papua New Guinea have been aligning their work plans and teachings based on this Framework.

The National Disaster Management Act of 1984 (amended in 1987) is the country’s Disaster Risk Management law and focuses only on preparedness and response arrangements during disasters. A National Disaster Mitigation Policy was prepared and approved by the National Executive Council in November in 2003 and launched in early 2004. The Policy would have created the National Environment and Disaster Mitigation Authority whose responsibilities would have included not only disaster management but environment and disaster mitigation as well.

The National Disaster Management Plan

A Disaster Management Plan has been in place since 1987. However, this Plan was under review and is expected to be completed and endorsed by the Government in 2009. The responsibility for Programming and Projects Planning to reflect the aims and the objectives of the National Disaster Management Plan is vested on the National Disaster Committee (NDC). The National Disaster Management Plan provides guidance and direction for disaster management activities for all stakeholders and partners throughout the country, including all levels and sectors, both government and non-government. The plan has an aim, objectives and outlines the roles and responsibilities for various government levels, departments, agencies, authorities and communities. It encourages self-reliance, as it is one of the greatest assets in coping with the threat of disasters.

The plan and Act complement each other, and they have other supporting documents such as the Mitigation Policy, Five Year Cooperate Plan, Supporting Work plans, Standard Operating Procedures, and National and Provincial Response Plans, and the PNG Disaster Risk Reduction and Disaster Management National Framework for Action 2005—2015.

Papua New Guinea National Disaster Management Plan and Structure

Papua New Guinea National Disaster Management Framework Structure

4.1 Papua New Guinea Government Contact List

Humanitarian Community

NGOs those are active in Disaster Management in PNG include the PNG Red Cross Society, OXFAM, World Vision, Salvation Army, CARE, MSF, church groups and the Council of Social Services. These organizations, active in the country with disaster and emergency programs, have representatives in most of the Provinces and Districts of the country. As part of effective coordination and monitoring of short term and long term responses, only registered NGOs are now permitted to involve in any emergency or disaster situation.

Disaster Management Team (DMT)

The Government of PNG and the UN system have also established a Disaster Management Team (DMT) mechanism, which comprises all the key agencies working on DRM with Government, including development partners, NGOs, church-based organisations, and is co-chaired by the Director of NDC and UN Resident Coordinator with a Disaster Risk Management consultant from the UN Resident Coordinator’s Office providing secretarial support.

Some Disaster Management Team activities include in theory: following up on the implementation of the UNDAC Mission recommendations; revision of the existing national contingency plan; ensuring that coordination mechanisms are in place; and becoming the Inter-Agency Standing Committee in case of a disaster.

1.2 Papua New Guinea National Regulatory Departments

The Civil Aviation Safety Authority (CASA) of Papua New Guinea

The recent reorganization of the Civil Aviation Authority, previously responsible for all aspects of national airports, places NAC in charge of on-ground airports operations and maintenance, while PNG Air Services Limited (PNGASL) is in control of communications and navigation. The Civil Aviation Safety Authority (CASA) regulates air safety. The Civil Aviation Safety Authority (CASA) of Papua New Guinea is the government statutory authority responsible for the regulation of civil aviation and air safety. Registration of international airplanes, facilitation of emergency operations falls within CASA’s mandate.

National Information and Communications Technology Authoirty (NICTA)

The National Information and Communications Technology Authority (NICTA) is the converged regulator established by an Act of Parliament, the National Information and Communications Technology Act 2009 (NICT Act). The functions of NICTA include the issuance of all Telecommunications licences (Operator and Radio communications) as well as ensuring that provision of ICT services conform to National and International standards. The NICT Act allows for converged regulatory authority to address economic and consumer issues which were previously dealt by ICCC. The NICTA Act further created a secretariat called the Universal Access and Fund Secretariat (UAF Secretariat) within NICTA to manage donor, government and industry levies used to rollout ICT projects to rural areas and communities around the country.

National Maritime Safety Authority

The National Maritime Safety Authority was established by an Act of Parliament in 2003 as a not-for-profit statutory authority, to raise standards of maritime safety and prevent and control marine pollution from shipping services within Papua New Guinea waters.

The Authority's primary responsibilities are to undertake government regulatory functions on safety of shipping services and to meet expectations of the shipping industry, its customers and coastal communities for a safe, efficient and environmentally responsible shipping sector as it is regarded very crucial to Papua New Guinea's social and economic development. The Authority's functions and responsibilities are defined in the NMSA Act 2003 and are summarised under the following headings:

1. Maritime Safety

- Ensure a fully - functioning and effective network of maritime navigational aids;

- Ensure the availability of high-quality, up-to-date navigational charts;

- Ensure that vessels meet the safety standards required by PNG's legislation, regulations and commitments under International Maritime Organisation (IMO) conventions;

- Ensure seafarers competency through certification and documentation of work experience;

- Help to coordinate responses to distress calls.

2. Marine Pollution Control

- Issue and enforce pollution control standards in accordance with international agreements;

- Help to coordinate the clean-up of marine pollution;

3. Corporate Governance - Efficiency, Transparency, Accountability and Sustainability

- Maintain full cost recovery, control costs and ensure efficient and effective management reporting;

- Equip Staff with the skills and resources needed to carry out their tasks efficiently and effectively;

- Collaborate with international agencies, national, provincial and local governments and coastal communities;

- Keep the public, industry and the Government fully informed of the Authority's activities.

NMSA Departments:

Departments under Technical Division

- Ships Safety & Inspections Dept

- Navigational Aids Dept

- Community Development Dept

- Hydrographic Dept

Department under Corporate Division

- Information Technology

- Finance & Administration Dept

- Human Resource Dept

- Legal Dept

Technical Departments depending from the National Port Corporation Ltd

The Engineering Department headed by the General Manager Engineering, is responsible for managing all aspects of infrastructure maintenance and development. Infrastructure includes wharves, storage areas, roads, drainage, paving, buildings and premises. Engineering is also responsible for repairs and maintenance of all buildings. The Operations Department headed by the Chief Operations Officer is responsible for managing all operational aspects of the all 16 ports to ensure that PNG Ports Corporation Ltd meets the needs of all stakeholders, achieve expected levels of productivity and efficiency and comply with both PNG regulatory requirements and international standards. Operations are also responsible for overseeing security and the management of pilotage services in all the ports. The Finance Department headed by the Chief Finance Officer is responsible for the sound financial management of PNG Ports Corporation Ltd including preparation and monitoring of budgets, ensuring compliance with PNG Legislative requirements and financial reporting. The Corporate Services Department headed by the General Manager Corporate Services is responsible for providing support to the organisation through effective of human resource management, legal services, property management and employee housing, fleet management and procurement and community affairs. The Commercial and New Business Department headed by the Chief Commercial Officer is responsible for maintaining relationships with stakeholders and developing new business opportunities. Corporate communication is a key focus for this department as the organisation seeks to rebuild its corporate reputation. The department also provides support to the organisation by way of financial and economic analysis which inform managerial decision making. Policy development and reporting on corporate performance to the Board are further responsibilities. The Information and Communications Technology headed by the Chief Information Officer is responsible for IT and communications infrastructure including hardware and software, which is vital to the organisation as data management is critical to business success and running efficient and effective port operations. Maritime Compliance division is headed by the Chief Maritime and Compliance Officer who reports to the CEO. The division is responsible for managing and controlling the overall physical environment of the ports, harbours and the facilities that are controlled and managed by PNG Ports Corporation Limited to ensure marine, companies and communities lives are protect and operate in a safe and clean environment. Furthermore, it is responsible for managing and maintaining the legal and regulatory compliance matters relating to safety, security and environmental concerns consistent with PNG Ports Corporation Limited policies and procedures. Business Assurance is headed by the Business Assurance Manager. Their main responsibilities are to provide assurance on the adequacy of the internal control system and in particular;

- The extent of compliance with relevant established policies, plans and procedures;

- The adequacy and application of financial and other related management controls;

- The extent to which the PNG Ports assets and interests are accounted for and safeguarded from loss.

In other words they provide assurance to PNG Ports on best business practices and in compliance with the national statutory bodies policies and procedures like IPBC and IRC etc.

1.3 Papua New Guinea Customs Information

Duties and Tax Exemption

For contact information regarding government custom authorities, please follow the link below:

4.1 Papua New Guinea Government Contact List

Information on Customs Offices and Main Offices in the Region listed by entry points can be found in the following document:

Papua New Guinea Customs Information by Entry Point and Clearing System

Papua New Guinea

Customs Information for Ports

Emergency Response:

[Note: This section contains information which is related and applicable to ‘crisis’ times. These instruments can be applied when an emergency is officially declared by the Government. When this occurs, there is usually a streamlined process to import goods duty and tax free.]

In the following table, state which of the following agreements and conventions apply to the country and if there are any other existing ones

|

Agreements / Conventions Description |

Ratified by Country? (Yes / No) |

|---|---|

|

WCO (World Customs Organization) member |

Yes |

|

Annex J-5 Revised Kyoto Convention |

Yes |

|

OCHA Model Agreement |

No |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

n/a |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

n/a |

Exemption Regular Regime (Non-Emergency Response):

Exempted Goods

The owner must still report the import of such goods to Customs in the same way every other person is required to report imports, but where the goods would normally have attracted duty, Customs instead applies a zero rate. The power to exempt goods from duty lies with the Head of State who applies his powers, acting on advice, as stated in legislation such as the Diplomatic and Consular Privileges and Immunities Act, the Aid Status (Privileges and Immunities) Act and the Customs Tariff Act. Goods imported under any of these exemption laws are relieved from taxes and duties, irrespective of their normal classification or normal liability, provided that they are imported in specified circumstances and for specific purpose.

Diplomatic and Consular Privileges

Papua New Guinea is a signatory to the international agreement that governs the diplomatic relations between countries. This is known as the Vienna Convention. The privileges and immunities offered to foreign diplomats based in this country, including an exemption to paying Customs duties and other taxes, is exactly the same as those enjoyed by Papua New Guinea’s diplomats based in overseas missions.

Customs Tariff Act

Section 9 of the Act allows the Head of State, acting on advice,

to either exempt from duty any goods provided that they are not

being imported in relation to a commercial project or to substitute

a reduced rate of duty for imported goods that would otherwise have

attracted duty.

The Head of State has advised that the following exemptions apply

with respect to:

- Goods which are imported by a community organisation, certified by the Secretary of the Department of Prime Minister as an organisation that is not engaged in any commercial activity but exclusively devoted to the public interest and relating to the advancement of education and vocational training; or the provision of medical services; and

- Goods for educational or training purposes: to be used by the education institutions or training institutions officially recognized by the Secretary for Education or the Commissioner for Higher Education; and not for sale, exchange or trade within 5 years; and which are imported on a firm and specific order; and which in the opinion of the Commissioner-General cannot be locally produced or manufactured; and certified by the Secretary for Education or the Commissioner for Higher Education to be necessary for the purposes of approved curriculum or of education or training institutions themselves; and if such exempt goods be disposed of within 5 years from the date of import without prior written approval of the Commissioner-General the duty apportioned in relation to the remaining unused period shall be payable; and when purchased on the basis of duty free quotation/tender, the sale price shall not exceed 120% of the C.I.F. value and is supported by import documents.

Other Exemptions under the Tariff Act

The Head of State has also reduced the tariff rates of duty in respect of specified goods originating from certain countries in the Pacific region and on other goods the importation of which assists local industry. For further details of these exempted goods importers are asked to contact the Tariff and Trade Branch of Customs.

Bi-lateral Treaties and Agreements

Papua New Guinea has Bilateral Trade Agreement/ Multilateral Agreements with countries and international organisations. Clauses or Articles included in the content of these agreements as per the provisions of section 8 of the Loans and Assistance Act provide for an exemption to pay Customs duties and other Tax under certain conditions. Such agreements usually impose an end use obligation where exempt duties or taxes become liable if those conditions are not met certain conditions are met.

|

Organizational Requirements to obtain Duty Free Status |

|---|

|

United Nations Agencies |

|

An organisation and personnel attached to those organisations

may be granted by the Head of State, acting on advice, designated

aid status. Such status frees the organisation or individual from

the requirement to pay Customs duties or other taxes under certain

conditions but imposes an end use obligation where such duties or

taxes must be paid if those conditions are not met. The

privileges and immunities offered to designated aid status

organisations ensures aid being provided to Papua New Guinea by

foreign aid organisations is not impeded or restricted by Papua New

Guinea’s domestic laws. |

|

Non Governmental Organizations |

|

An organisation and personnel attached to

those organisations may be granted by the Head of State, acting on

advice, designated aid status. Such status frees the organisation

or individual from the requirement to pay Customs duties or other

taxes under certain conditions but imposes an end use obligation

where such duties or taxes must be paid if those conditions are not

met. The privileges and immunities offered to designated aid

status organisations ensures aid being provided to Papua New Guinea

by foreign aid organisations is not impeded or restricted by Papua

New Guinea’s domestic laws. |

Exemption Certificate Application Procedure:

|

Duties and Taxes Exemption Application Procedure |

|---|

|

Generalities (include a list of necessary documentation) |

|

So that exemption requests can be considered and a reply given

within a suitable time period applicants are advised to submit

their written applications together with supporting documentation

prior to the intended arrival date of the goods.

Applications should be submitted to Customs marked for the

attention of the Director- Tariff and Trade Branch. Customs will

confirm receipt of your application and will process it as quickly

as possible, although this may take a few days especially if

Customs asks for further documentation in respect of the

application. Normal clearance formalities still apply to exempt goods and Customs or Quarantine may still inspect the goods. Goods are of a type that can only be imported under a permit or license will only be released on its production to Customs even if the goods are exempt goods. The importer is responsible for ensuring the importation of the goods meets the requirements of Customs. Although the goods may be exempt Customs duty and other taxes, any charges levied by Quarantine or handling charges levied by the wharf or transport company are the responsibility of the importer and must be paid. This applies to any fees levied by the customs agent in clearing the goods through Customs formalities. Delays in clearing exempt goods will occur if either the application for exemption is not made prior to the arrival of the goods and in sufficient time for Customs to properly consider the application or if the exemption approval letter is not lodged with the import entry. Customs is not responsible for any wharf charges or other costs incurred as a result of any delays in clearing exempt goods unless the importer can demonstrate that the delay occurred because of the neglect or willful act of an officer |

|

Process to be followed (step by step or flowchart) |

|

The owner must still report the import of such goods to Customs in the same way every other person is required to report imports, but where the goods would normally have attracted duty, Customs instead applies a zero rate. Import Clearance Procedures The owner of the goods and anyone who causes the goods to be imported must retain all relevant records in relation to those goods for a period of 5 years from the date of import. If the owner or other person is selected for an audit these records will be examined to ensure compliance with the Customs Act. Failure to retain these records carries severe penalties including a term of imprisonment. http://www.customs.gov.pg/customs_act_2006.html

|

Exemption Certificate Document Requirements

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

AWB/BL/Other Transport Documents |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Donation/Non-Commercial Certificates |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Packing Lists |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Additional Notes |

||||||

|

Other Documents required:

|

||||||

Customs Clearance

General Information

|

Customs Information |

|

|---|---|

|

Document Requirements |

|

|

Embargoes |

n/a |

|

Prohibited Items |

Restrictions and prohibitions generally apply to goods such as dangerous weapons including firearms, illicit drugs, pornographic materials and copyright infringing goods. For further information please contact any Customs office. |

|

General Restrictions |

Quarantine procedures are strongly enforced in the PNG. For detailed information, please refer to www.customs.gov.pg |

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

D&T Exemption Certificate |

- |

- |

- |

- |

- |

- |

|

Invoice |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

AWB/BL/Other Transport Documents |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Donation/Non-Commercial Certificates |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Packing Lists |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

Yes, Original, applies to UN and NGOs |

|

Phytosanitary Certificate |

- |

- |

- |

- |

- |

- |

|

Other Documents |

- |

- |

- |

- |

- |

- |

|

Additional Notes |

||||||

|

Additional Documents required:

For medicines:

For telecoms equipment,

Quarantine

PROHIBITED / restricted IMPORTS

|

||||||

Outline of Import Clearance

When a shipment of goods is imported into Papua New Guinea whether it is by sea, air or land, the owner of those goods must declare them to Customs. The owner or his agent (known as a Customs Agent or Customs Broker) is required to prepare and lodge with Customs an import declaration (known as an entry) describing the nature, quantity, value, supplier and country of origin of the goods imported or to be imported. This entry, containing the name, address and Tax File Number of the owner, is a legal document and any errors may attract the imposition of administrative penalties. Deliberately making a false declaration to Customs may cause the goods to be seized and the owner or agent prosecuted. The owner of imported goods should be aware that the import of some goods is restricted in that they may only be imported under the authority of a permit or license without which the goods are prohibited. The import of some other goods is prohibited absolutely.

Restrictions and prohibitions generally apply to goods such as dangerous weapons including firearms, illicit drugs, pornographic materials and copyright infringing goods. For further information please contact any Customs office.

Customs is currently modernizing its business processes and migrating to the electronic reporting system called Asycuda++, which provides Electronic Data Interchange (EDI) clearance process. This system is replacing the need to physically lodge paper-based reports and supporting documents for each shipment although at present only Port Moresby is fully electronic. Other ports are slowly being upgraded to accept the system in a graduated roll out across the country. When fully functional up to 80% of entries will be cleared without Customs intervention at the time of import, the remaining 20% either being subject to documentary or physical checks at the time of import to ensure compliance with the Customs Act. In addition to targeted cargo inspections, Post Clearance Audit (PCA) teams will conduct audits at importers premises at any time within 5 years after the goods have been imported as part of a strategy to ensure importers are honest with Customs. Customs’ compliance strategy commences with education of importers and customs agents and progresses through administrative penalties to seizure and prosecution action. Customs aim is to achieve voluntary compliance within the importing industry, which in turn will be reflected in a lesser need for Customs intervention at the time of import.