1 Tunisia Country Profile

Generic Information

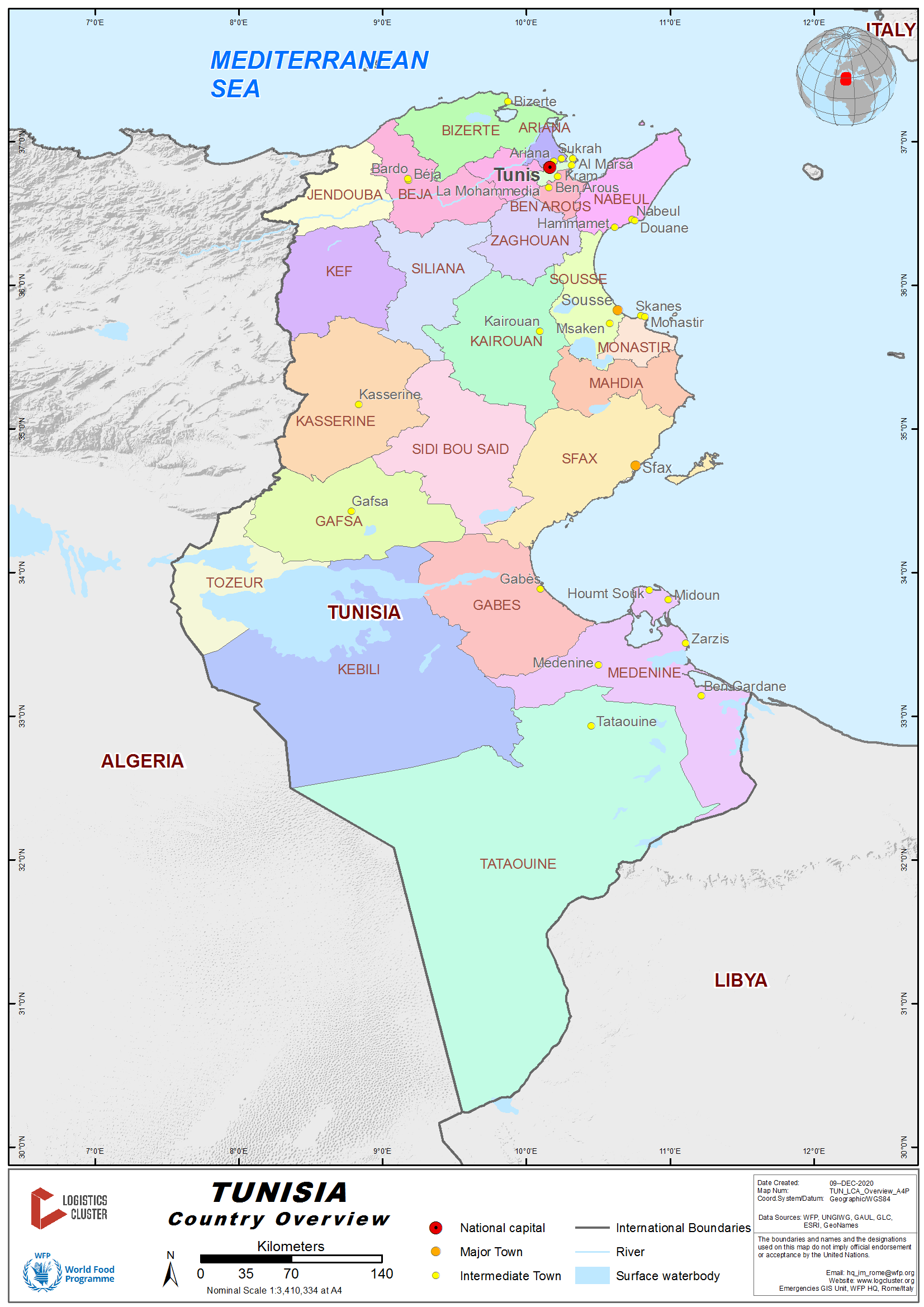

Tunisia is a country with three thousand years of history and is located in the Maghreb region of North Africa. It is the smallest country in North Africa by land area and is bordered by Algeria to the west, Libya to the southeast and the Mediterranean Sea to the north and east. Tunisia is the northernmost country in Africa, with the northernmost point on the African continent, Ras ben Sakka. Tunisia contains the eastern streamers of the Atlas Mountains, while the south of the country contains the northern reaches of the Sahara desert. Tunisia is almost 165,000 square kilometers (64,000 mi2) in area and 1,300 km of Mediterranean coastline, with an estimated population of just about 12 million.

Tunisia has a temperate climate, with average temperatures ranging from 13 °C in winter to 28 °C in summer) and sunshine which reaches on average, 7.8 hours per day (4.9 hours per day in January and 11.6 hours per day in July).

The majority of the population is concentrated in coastal cities. The capital, Tunis, is home to almost 3.5 million people. The three most important cities are Tunis, Sousse and Sfax. Islam is professed by over 99% of Tunisians. The official language is Arabic but Derja, an Arabic dialect and French is also spoken throughout the territory. The currency of the country is the Tunisian Dinar.

Generic country information can be located from sources which are regularly maintained and reflect current facts and figures. For a generic country overview, please consult the following sources:

Wikipedia Country Information: https://en.wikipedia.org/wiki/Tunisia

IMF Country Information: https://www.imf.org/en/Countries/TUN

Economist Intelligence Unit*: http://country.eiu.com/tunisia

(*note - this is a paid service)

Humanitarian Information

World Food Programme: http://www.wfp.org/countries/

Office for the Coordination of Humanitarian Affairs: https://www.unocha.org/middle-east-and-north-africa-romena/tunisia

Facts and Figures

Wolfram Alpha Country page: http://www.wolframalpha.com/input/?i=Countries

World Bank: Country page: http://www.worldbank.org/en/country

Population Information: country page (https://worldpopulationreview.com/countries/tunisia-population/

1.1 Tunisia Humanitarian Background

Disaster, Conflicts, and Migration

|

Natural Hazards |

||

|---|---|---|

|

Type |

Yes / No |

Comments / Details |

|

Drought |

Yes |

Droughts are especially challenging for the poorest regions, where livelihoods are mostly agriculture-based and potential adaptive measures are often underused due to financial constraints and information access. |

|

Earthquakes |

Yes |

In 2019an earthquake measuring 3.4 on the Richter scale hit Siliana province in northwestern Tunisia without causing much damage. The epicenter of the earthquake was at 36.04 degrees north latitude and 9.20 degrees east longitude, about 15 km west of Siliana province. |

|

Epidemics |

Yes |

Positive COVID-19 cases reached in October 2020, 22,230 and death toll of 321 Source: Global Cases by the Center for Systems Science and Engineering (CSSE) |

|

Extreme Temperatures |

Yes |

In Tunis, the summers are short, hot, humid, dry, and clear while the winters are long, cold, windy, and partly cloudy. Over the course of the year, the temperature typically varies from 7°C to 34°C and is rarely below 4°C or above 39°C. |

|

Flooding |

Yes |

Torrential rains and flooding in Tunisia have lead to deaths and loss of property. |

|

Insect Infestation |

N/A |

|

|

Mudslides |

N/A |

|

|

Volcanic Eruptions |

No |

|

|

High Waves / Surges |

N/A |

|

|

Wildfires |

Yes |

On the 31st of July 2020, a fire in the Jendouba Governorate and Bizerte resulted in the destruction of houses, displacing around 500 persons. |

|

High Winds |

N/A |

|

|

Other Comments |

Some of the most common natural hazards that have affected Tunisia over the years have been floods, landslides and earthquakes (particularly in the areas of Regions that have experienced earthquakes are Tunis, Ben Arous, Nabeul, Bizerte, Monastir, El Kef, Jendouba, Sidi Bouzid, Tozeur), soil erosion, desertification, and others, such as forest fires. |

|

|

Man-Made Issues |

||

|

Civil Strife |

Yes |

A series of street demonstrations took place in Tunisia and led to the ousting of the President in January 2011. |

|

International Conflict |

N/A |

|

|

Internally Displaced Persons |

N/A |

|

|

Refugees Present |

The number of refugees in Tunisia is estimated to increase to 1,680 people by the beginning of 2020, with the majority residing in urban areas. |

|

|

Landmines / UXO Present |

N/A |

|

|

Other Comments |

N/A |

|

For more detailed database on disasters by country, please see the Centre for Research on Epidemiology of Disasters: http://www.emdat.be/country_profile/index.html

Seasonal Effects on Logistics Capacities

|

Seasonal Effects on Transport |

||

|---|---|---|

|

Type |

Time Frame |

Comments / Details |

|

Primary Road Transport |

The roads are wet as it rains once every 2 or 3 days. |

December to February |

|

Secondary Road Transport |

Not affect by the weather. |

December to February |

|

Rail Transport |

Not affect by the weather. |

December to February |

|

Air Transport |

Flights are delayed or cancelled by rain and fog. |

December to February |

|

Waterway Transport |

High waves during winter and can close the port & presents a threat to small boats. |

December to February |

Northern Tunisia has a tropical climate while the central and southern regions have an arid climate. Average annual temperatures of northern mountains are lower than on the rest of territory of Tunisia. They are between 5 °C (41 °F) and 12 °C (54 °F). Summer is hot and humid and winter is mildly warm and rainy. Deserts are cold at nights; temperature may drop to 0 °C (32 °F). The north of the country receives more precipitation so there lots of olive, orange and almond groves as well as fields of sunflowers and pine forests. Flora of southern part of the country is poor for this is the land of sands. Actual spring comes to Tunisia at March where temperatures may rise to 20 °C (68 °F). However, mornings and nights are as cold. Precipitation decreases on coasts and in north of the country it still rains.

Capacity and Contacts for In-Country Emergency Response

Government

Decree No. 75671 of September 25th, 1975 established that the Minister of National Defense. Aside from ensuring the security and defense, it is tasked to organize the contribution of the Armed Forces to fight natural disasters.

Address: Boulevard Bab Mnara Tunis 1008

Telephone: 216 - 71 560 244

E mail: defnat@defense.tn

Website : http://www.defense.tn

For more information on government contact details, please see: 4.1 Government Contact List.

Humanitarian Community

A Tunisian Government-UN coordination meeting is held every month basis to review humanitarian activities and any preparations on the ground under the joint contingency plan.

Link: List of the International Organization and Regional in Tunisia

For more information on humanitarian agency contact details, please see: 4.2 Humanitarian Agencies Contact List.

1.2 Tunisia Regulatory Departments and Quality Control

Although Tunisia has liberalized its import regime as part of its negotiations with the WTO, a number of restrictions still exist. Thus approximately 3% of goods require an import license (agricultural products, cars, textiles) issued by the Ministry of Commerce. There are also some quotas, notably for consumer goods that compete with local industry. In order to obtain these licenses, a certain number of documents are required, such as the commercial contract (or any other equivalent document), as well as information on contractors, products, origin and provenance. Licenses are in principle valid for 12 months from the decision of the Ministry of Commerce, which may however reduce this period for certain products (but it can never be less than 2 months). The license can be used partially. It is not transferable.

There is a general rate, ranging from 10% to 230%. Tunisia sometimes applies anti-dumping duties for which the bases and the reasons for application are not clearly defined and which can sometimes be considered as minimum prices for the calculation of customs duties.

Pharmaceutical industry

The pharmaceutical industry is protected. All imports of pharmaceutical products are controlled by the Pharmacy Center (http://www.phct.com.tn/en).

The Tunisian Ministry of Health regulates pharmaceutical product and activities. It ensures that any pharmaceutical product having the same pharmaceutical form and the same qualitative and quantitative composition in active ingredients as well as the reference product, and for which bioequivalence with the reference medicinal product, has been demonstrated by appropriate bioequivalence studies. The scientific criteria defining the exemption of bioequivalence studies are set by the decree law of the Ministry of Health.

(Reference: Act N°2008-32 of 13 May 2008 amending and supplementing the law N°73-55 of 03/08/1973).

The different oral pharmaceutical forms with immediate release are considered as the same pharmaceutical form. Similarly, any salts, esters, ethers, isomers, mix of isomers, complexes or derivatives of the active ingredients are considered as having the same composition in active ingredient, except if they show significantly different properties regarding the safety or the efficacy. In such case, additional information providing proof of safety and efficacy of the different salts, esters or derivatives of the authorized active ingredient must be provided by the applicant for the marketing authorization (Reference: French Public Health Code).

Telecommunications

The telecommunications market regulatory agency is the Instance Nationale des Telecommunications (INT). It guarantees an environment conducive to investment by establishing healthy and fair competition between the various market players (operators and providers of telecommunications services). It has participated, since its creation by virtue of law n ° 2001-1 of January 15, 2001, promulgating the telecommunications code, as supplemented and modified by laws n ° 2002-46 of May 7, 2002 and n ° 2008- 01 of January 8, 2008, to promote the development of the telecommunications sector.

In accordance with the regulatory framework, INT examines disputes relating to the installation, operation and operation of networks and which relate to interconnection, local loop unbundling, physical co-location, common use of infrastructure and any other telecommunications service.

Requests relating to these disputes may be brought by the Minister in charge of telecommunications, network installers and operators, Internet service providers, legally established consumer organizations or groups as well as by professional organizations in the field of telecommunications. INT can also take action ex officio to rule on infringements of legislative and regulatory provisions in the field of telecommunications. In addition, INT manages the national plans relating to numbering and addressing, sets the conditions and modalities for activating number storage, in particular the procedures for introducing and using number portability. and sets the conditions and procedures for granting domain names. INT also ensures the economic regulation of the market, on the one hand, by approving operator offers relating to interconnection, national roaming agreements and any model contract relating to any service offer; on the other hand, by fixing the method for determining the costs of networks and services, the method for sharing the costs between the various services provided by each network operator as well as the methods adopted to determine the costs taken into account in the calculation interconnection tariffs, local loop unbundling, physical co-location and common use of infrastructure. In accordance with article 3 of decree n ° 2008-3026 of September 15, 2008 setting the general operating conditions of public telecommunications networks and access networks, INT issues an opinion on the notice advertising the tariffs of details of services before they are marketed. In addition, INT conducts monthly measurement campaigns and annual surveys to assess the quality of service of telecommunications networks and to monitor compliance by telecommunications operators with their obligations and commitments relating to quality of service. as stipulated in particular in their specifications.

Energy sector

The Ministry of Industry and Energy is in charge of the energy sector. The energy regulator is the National Agency for Energy Management. The state-owned Tunisian Company of Electricity and Gas (STEG) is the sole generator, transmitter and distributor of electric energy. On a regional level, Tunisia is a member of Committee Maghrebin de Electricity (COMELEC), the power pool of the Maghreb region. There are also interconnections with the European Electricity Grid to export up to 1,000 MW (800 MW gas and 200 MW Renewable Energy (RE)).

Fuel

In Tunisia, fuel is regulated by Ministry of Industry, Energy and Mining. There is an entry into vigor of the hydrocarbons code, the holders of prospecting permits or exploration permits in course of validity and/or exploitation concessions instituted but not yet developed, have the possibility to opt, with regard to the said permits and concessions, for the application of the present hydrocarbons code and the regulating texts taken for its application. The exercise of the option foreseen above shall be subject to a notification in writing prepared on tax stamped paper and signed by the holder of the permit and/or the exploitation concession or by a representative duly mandated to that effect. Each hydrocarbons title shall be subject to a separate notification within a maximum period of six months as from the entry in vigor of the hydrocarbons code. This notification shall be addressed by registered mail with knowledge of receipt to be requested from the administration in charge of hydrocarbons or deposited directly at the said administration for a knowledge of receipt.

Failing to exercise the above-mentioned option by the holder of a hydrocarbon title, the said title shall remain governed till its expiry by the legislative and regulating provisions and by the particular convention applicable thereto.

Agricultural production

Agricultural products from Arab countries and North Africa benefit from preferential tariffs. The Food and Agricultural Import Regulations and Standards (FAIRS) report provides an overview of the food laws and regulatory environment in Tunisia as it relates to U.S. food and agricultural exports. In 2018, Tunisia expanded the list of imported agricultural and food products subject to required technical specifications in an effort to decrease import volumes overall. Meanwhile, Tunisia also appears poised to continue harmonizing its regulatory framework with the European Union.

Tunisia’s Food and Feed Safety Law was approved in early 2019 with the aim of harmonizing Tunisian legislation with EU food directives 178/2002, 852/2004, 853/2004, 183/2005, 882/204, and 854/2004. The creation of a one-stop shop national food safety authority is currently under way. While all current regulations will likely need to be reviewed for consistency with the new food safety law, Tunisia’s other relevant laws are as follows:

- Law #92-72 (completed by Law #99-5) concerns the quarantine and phytosanitary requirements applied to unprocessed agricultural products of plant origin,

- Law #99-24 sets the veterinary and sanitary controls of animals and animal products,

- Law #99-42 (amended by Law #2000-66) sets the procedures for seeds and seedlings production, propagation, import, marketing and protection of the rights relating thereto,

- Law #94-86 addresses market distribution channels and retail services, and

- Law #92-117 concerns consumer protections.

Through the Ministry of Trade’s Decree #2016-503, Tunisia established a National Commission to ensure its compliance with WTO regulations and facilitate trade, which also coincided with Tunisia’s third WTO Trade Policy Review. The Ministry of Industry’s Order, issued on May 20, 1998, validated Tunisian standard NT 117-01 (1995) governs the use of food additives. The purpose of this standard is to give an exhaustive listing of authorized additives (positive list), their conditions of use as well as their respective identification E-numbers. This standard is largely based on European regulations (directive 94/35/EC on sweeteners for use in foodstuffs, directive 94/36/EC on colors for use in foodstuffs, and directive 95/2/EC on food additives other than colors and sweeteners).

For goods having a shelf-life of three months or more, the mention of the month and the year is sufficient. For non-perishable goods, a time limit for optimum use must be indicated using one of the following sentences: ‘to be consumed preferably before.../to be consumed preferably before end of.../ to be consumed preferably within a period of...’ The use of a sticker to rectify or correct required information is prohibited; [Note: in practice, stickers are used by importers/retailers to include required information, e.g., Arabic]

The Ministry of Trade’s Order, dated September 3, 2008, is partially inspired by the European Union regulations of 2006 on the use of nutrition and health claims for foods. The Order sets forth the rules for health or nutritional claims (such as “low fat” and “helps lower cholesterol”) on foodstuffs based on nutrient profiles by means of positive lists of authorized claims that can be made on food. Health claims are prohibited on food intended for babies and children. Nutritional labeling of vitamins, minerals, and other nutrients is mandatory when a producer is making health or dietary claims on the label. This provision applies to fortified products and to food items intended for a particular use (e.g. infant formula). Otherwise, nutrition information is voluntary. If the nutritional content is declared on the label, it is mandatory to display the energetic value, protein, carbohydrates (food fibers excluded), and lipids, and the quantity of any other nutritional element subject to a nutritional claim. The quantity of protein shall be calculated according to the following formula: Protein = total nitrogen (kjeldhal) x 6.25. The quantity of energy must be calculated using the following coefficients:

|

Carbohydrates |

4 Kcal/g-17KJ |

|---|---|

|

Polyalcohol |

2.4 Kcal/g-10KJ/g |

|

Protein |

4 Kcal/g-17KJ |

|

Lipid |

9 Kcal/g-37KJ |

|

Alcohol (ethanol) |

7 Kcal/g-29KJ |

|

Organic acid |

3 Kcal/g/13KJ |

Transportation

In accordance with Decree No. 2014-209 of January 16, 2014, the mission of the Ministry of Transport is to establish, maintain and develop a comprehensive, integrated and coordinated transport system in Tunisia that contributes to promoting sustainable economic and social development and ensures the satisfaction of needs of people in transport in the best possible conditions, in particular in terms of safety, security, cost, quality and environmental protection. The logistics infrastructures system includes land, sea and air transport and traffic, logistics, vehicle rental and meteorology. To carry out its mission, the ministry is responsible for defining general policy, plans and programs in the field of transport and monitoring their execution, notably by exercising the following powers:

- develop and implement state policy in the areas of its competence and propose and monitor the execution of qualitative and quantitative objectives and the investment programs to be carried out within the framework of development plans;

- to give an opinion on regional development plans and urban and retail development plans, on regional development programs and on infrastructure projects relating to the areas of its competence and to take them into account in transportation;

- carry out sectoral research and prospective studies, implement strategies for the development and modernization of the transport system, draw up transport master plans in coordination with the parties concerned and ensure their implementation;

- ensure the development of human resources in the field of transport by promoting training and professional learning, work in collaboration with the parties concerned to meet the growing need for specialized managers and set up evaluation and followed;

- draw up programs and plans relating to transport safety and the quality of services and ensure their implementation;

- oversee the development and monitoring of the implementation of the national civil aviation security program and participate in the development and monitoring of the implementation of government programs in the security of commercial seaports and maritime transport;

- participate in the development of tax policy in the areas of its competence;

- study and follow up on legal matters and prepare draft legislative and regulatory texts relating to the fields of its competence;

- participate in the development and execution of programs to control energy consumption, use alternative energy and protect the environment, in collaboration with the ministries, professionals and organizations concerned;

- develop the statistical system relating to the fields of its competence;

- develop international cooperation programs in the fields of its competence, in coordination with the bodies concerned and consolidate relations with international and regional institutions and bodies dealing with matters falling within the competence of the ministry and participate in bilateral or multilateral international negotiations;

- develop the information and communication function in the fields of its competence, in collaboration with the bodies concerned and consolidate relations and coordination with civil associations and national organizations having a relationship with the fields of its competence.

For information on Tunisia Regulatory departments contact details, please see the following links: 4.1 Tunisia Government Contact List and 4.3 Tunisia Regulatory Departments and Quality Control Contact List.

1.3 Tunisia Customs Information

Duties and Tax Exemption

Under article 115 of the finance law governing the 1993 budget, exemption from customs duty on imported equipment and rolling stock is available to Tunisians who have lived abroad on a continual basis for more than two years and who have invested in one of the activities listed in the investment incentives code upon definitive or provisional return to Tunisia.

For contact information regarding government custom authorities, please follow the link below: 4.1 Government Contact List.

Emergency Response

|

Agreements / Conventions Description |

Ratified by Country? |

|---|---|

|

WCO (World Customs Organization) member |

Yes (1966-07-20) |

|

Annex J-5 Revised Kyoto Convention |

Yes (2017-07-07) |

|

OCHA Model Agreement |

No |

|

Tampere Convention (on the Provision of Telecommunication Resources for Disaster Mitigation and Relief Operations) |

Yes (1956-14-12) |

|

Regional Agreements (on emergency/disaster response, but also customs unions, regional integration) |

Yes, member of Middle East North Africa (MENA) Country since its creation. |

Exemption Regular Regime (Non-Emergency Response)

This information can be found in Tunisia Laws and TAX SYSTEM and Formalities register.

UN/Humanitarian imported commodities, are generally exempted from import duties and other taxes. Staff working in Tunisia are allowed to import a vehicle free of customs dues and also their personal effects.

|

Organizational Requirements to obtain Duty Free Status |

|---|

|

United Nations Agencies |

|

In Tunisia, UN agencies are officially registered and accredited to the country by an official letter passed by the Ministry of Foreign Affairs in order to be able to operate in the country. For each Agency in place has government direct counterparts with who it can officially coordinate with. The Ministry of Foreign Affairs will provide all the necessary clearances such as entry visas, stay permits for international staff, and the Ministry of Finance for the necessary tax and customs exemptions. |

|

Non Governmental Organizations |

|

Same as for UN Agencies. Prior to importing or to receiving donations from donor countries, the NGO also should be registered by the Government through the Ministry of Foreign Affairs and a certificate or permission is issued. All official documents and related certificates are required prior to start the clearance. Exemptions are based on the agreement with the government at the initial stage of registration which define which items to be exempted. |

Exemption Certificate Application Procedure

In Case of importation authorized by the government of Tunisia, the UN or NGOs should present:

- Original shipping documents (invoice, bill of lading or airway bill, certificate of origin, fumigation certificate in case of food, lab test certificate, and packing list);

- Cover letter form the counterpart ministry stating the reason for requesting all type of dues exemptions to be addressed to Ministry of Finance;

- Authorized clearing agent to handle the process with the customs authorities.

|

Duties and Taxes Exemption Application Procedure |

|---|

|

Generalities (include a list of necessary documentation) |

|

|

Process to be followed (step by step or flowchart) |

|

UN Specialized Agencies should obtain all exemptions prior to the arrival of their consignment. In case of telecommunications, equipment has to be checked by the telecommunication department prior to installation or use by the Agency. Approval to import telecommunication is obtained from the Ministry of Telecommunications. Importation of medicines during emergencies is to be coordinated with and approved by the Ministry of Health. |

Exemption Certificate Document Requirements

|

Duties and Taxes Exemption Certificate Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicle & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

Invoice |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

AWB/BL/Other Transport Documents |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Donation/Non-Commercial Certificates |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Packing Lists |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

Yes, original |

|

Other Documents |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

Customs Clearance

General Information

The customs tariff applied in Tunisia is the same as that of the harmonized system of Brussels. The normal level of customs duty is not higher than 25%. However, some goods are subject to much higher duty which is around 40 to 50%. Some products are not taxed at all or taxed at a very low rate (3.7 or 15%).

|

Customs Information |

|

|---|---|

|

Document Requirements |

A customs declaration drawn up by an approved customs agent and filed with the customs bureau of the entry of the goods, to be accompanied by the following documents: 1. Certificate of Goods drawn up by the donor for the beneficiary and which contains a detailed list of the goods being offered; 2. Transport document drawn up in the name of the beneficiary, also considered the consignee; 3. Document bearing the promise of a representative of the benefiting organization, to keep the goods for their prescribed purpose, and to record these in the inventory record. |

|

Embargoes |

None |

|

Prohibited Items |

1. Goods which are absolutely prohibited out of considerations for public order, morals, and security; 2. Goods not conforming to consumer protection norms (quality and packaging, environmental, hygiene, and the health of humans, animals, and plants); Regulated sensitive material; Restored medical materials covered by the Order mentioned below (See Relevant Regulatory Framework); 3. Vehicles and engines covered by the finance laws mentioned below. |

|

General Restrictions |

On 27 January 2020, the EU Council adopted Decision (CFSP) 2020/117, which renewed the EU’s sanctions on Tunisia for 1 year. Those measures designate 48 people said to be responsible for the misappropriation of state funds. |

Customs Clearance Document Requirements

|

Customs Clearance Document Requirements (by commodity) |

||||||

|---|---|---|---|---|---|---|

|

|

Food |

NFI (Shelter, WASH, Education) |

Medicines |

Vehicles & Spare Parts |

Staff & Office Supplies |

Telecoms Equipment |

|

D&T Exemption Certificate |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

|

Invoice |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

|

AWB/BL/Other Transport Documents |

3 Originals + 3 copies, applies to UN and NGOs |

3 Originals + 3 copies, applies to UN and NGOs |

3 Originals + 3 copies, applies to UN and NGOs |

3 Originals + 3 copies, applies to UN and NGOs |

3 Originals + 3 copies, applies to UN and NGOs |

3 Originals + 3 copies, applies to UN and NGOs |

|

Donation/Non-Commercial Certificates |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

|

Packing Lists |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

Original Invoice, applies for UN and NGOs |

|

Phytosanitary Certificate |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

|

Other Documents |

|

|

|

|

|

|

Transit Regime

Transit regime is Legal basis from the Articles 115 to 126 of the customs code. Order of the Minister of Finance dated 12/29/1955 regulating the conditions of application of the general regime of bail and transit. Transit is a suspensive system which essentially allows goods from abroad either to cross the customs territory without being subject to the payment of import duties and taxes applicable to products intended for the internal market, or to circulate in suspension of said duties and taxes between two offices or warehouses:

- between two border points.

- between a border point and an interior point.

- between an interior point and a border point.

- between two interior points.

- There are two forms of transit

- International transit.

Ordinary transit: Ordinary or national transit or internal transit allows foreign goods to move in Tunisia between two customs offices or between two warehouses in suspension of duties and taxes and prohibitions. Ordinary transit is a regime which allows the transfer of warehouse without changing the customs condition of the products. Indeed, the goods which stay in temporary duty-free warehouse, can be directed on another warehouse under a mode comprising the same advantages.

Formalities to be applied and the principle

- a departure office

- a destination office

- a deposit

- a principal

- bail or deposit

- customs monitoring of the goods

- a clearance then a raised hand, a discharge from the deposit

To be able to cross Tunisian territory, the transporter must subscribe a detailed declaration of type T (TE, TI) which means transport from one point to another in the territory and must indicate in the box reserved for the customs procedure the type of transit. to be performed using a 3-digit code.

International transit: In order to avoid the application of national legislation and each country's own rules on goods which cross several borders to reach their final destination, an international transit system has been put in place to allow goods in transit to keep the documents as well as the guarantees presented to the country of departure and to save all of these goods while avoiding handling during transport and to present them under intact seals to the customs administration of destination.

For Food Aid directed to other CO passing trough Tunisia, usually the transit procedure is chosen. The receiving CO, must assure that on the B/L accompanying the Cargo is stated “Cargo in transit to…” In this way the receiving CO will pay only for the handling fees at Tunisia Port (usually lower than for food direct to Tunisia) and will obtain a Custom escort until the border. Then all the Custom Clearance procedures will be executed with the custom authorities of the receiving country. Normally neither Tunisia Country Office nor Regional Bureau of Cairo are involved in this procedure, as the operation is carried out by the Forwarding Agent charged by WFP receiving CO.

RESPONSIBILITY OF AVAILING TRANSIT GOODS TO CUSTOMS

The declarant shall commit himself upon requesting for transit operation to the responsibility of paying duty of transit goods, follow the prescribed custom routes for transit together with finally availing the transit the transited goods to customs office of destination and notify same to the office of departure. The carrier as well has to commit itself to customs for transiting the shipment to customs Transit and clearance control offices within a limited time and through prescribed routes by the freight declaration format transit manual.