3 Afghanistan Logistics Services

Disclaimer: Registration does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities. Please note: WFP / Logistics Cluster maintain complete impartiality and are not in a position to endorse,comment on any company's suitability as a reputable service provider.

The following section contain information on the logistics services in Afghanistan

3.1 Afghanistan Fuel

As a net importer of petroleum fuels, and where long distances and poor transport infrastructure add to the cost of the imports, Afghanistan is vulnerable to fuel price shocks on the international market. Increases in the prices of fuel have a serious impact on households, small businesses and macroeconomic growth. In this way security of petroleum fuel supply and stability of prices ultimately have a significant impact upon livelihoods and economic growth.

At the top of the chain, the fuel market is dominated by a very small number of large players. At the opposite end of the chain, there are very large numbers of small players making very small margins. In Kabul, diesel generators are often used to produce the cities electricity at base and at peak times. In Kandahar, a very high percentage of emergency electricity is supplied this way, making it some of the most expensive electricity per kilowatt in the world.

Low-quality fuel specifications and adulteration of fuel pose serious public health risks to the Afghan population in terms of urban pollution as well as accidents. The efficiency and life span of engines is also reduced by these practices. Smuggling of fuel over the porous border with Iran is reported, where petrol and diesel are heavily subsidized and therefore have a much lower retail price than in Afghanistan. This smuggling is mostly conducted by a large number of small players, from who the fuel is then bought and mixed by wholesalers, although this practice is reported to be reducing. Routes for importing fuel into Afghanistan have been, and continue to be, tied up with Afghanistan’s geopolitics.

In Afghanistan, there has been no reported shortage of availability of fuel in the country over the last 20 years, however price increases due to the seasonality and security context have reported. Fuel is mostly imported into Afghanistan from Central Asia in the north (specifically Turkmenistan – supplies approx. 75% of total fuel imports) and Iran in the west (supplies approx. 25% of total fuel imports).

Information may also be found at the following website which is updated monthly: My Travel Cost Website

Fuel Pricing

|

Fuel Prices as of: December 2021 (US$/ltr) for Kabul |

|

|---|---|

|

Petrol (per litre) |

0.84 |

|

Diesel (per litre) |

0.79 |

|

Paraffin (per litre) |

n/a |

|

Jet A1 (per litre) |

1.18 (November 2021) |

Seasonal Variations

|

Seasonal Variations |

|

|---|---|

|

Are there national priorities in the availability of fuel, e.g. are there restrictions or priorities for the provision of fuel such as to the military? |

No |

|

Is there a rationing system? |

No |

|

Is fuel to lower income/vulnerable groups subsidized? |

n/a |

|

Can the local industry expand fuel supply to meet humanitarian needs? |

Yes |

|

Is it possible for a humanitarian organization to contract directly a reputable supplier/distributor to provide its fuel needs? |

Yes |

Fuel Transportation

Fuel tankers are widely available both from neighbouring countries and through local transporters. Seasonal constraints related to road accessibility and storage exist as well as access concerns related to insecurity.

Standards, Quality and Testing

|

Industry Control Measures |

|

|---|---|

|

Tanks with adequate protection against water mixing with the fuel? |

Yes |

|

Filters in the system, monitors where fuel is loaded into aircraft? |

Yes |

|

Adequate epoxy coating of tanks on trucks? |

Yes |

|

Presence of suitable fire fighting equipment? |

Yes |

| Standards Authority | |

|---|---|

| Is there a national or regional standards authority? | Yes |

| If yes, are the standards adequate/properly enforced? | Yes |

| Testing Laboratories | |

| Are there national testing laboratories? | Yes |

|

Fuel Quality Testing Laboratory |

|

|---|---|

|

Company |

Afghanistan National Standards Authority (ANSA) |

|

Name |

n/a |

|

Address |

Industrial Parks Area, Jalalabad Road, Kabul |

|

Telephone |

+93(0) 20 232 1048 |

|

Contact |

|

|

Fuel Quality Testing Laboratory |

|

|---|---|

|

Company |

Red Star Co., Afghan National Fuel Co., Arrow Ltd., and Ghazanfar Co. |

|

Name |

n/a |

|

Address |

In Kabul and some border cities (Hairatan, Islamqala, Toorghundi, & Toorkham) |

|

Telephone |

n/a |

|

Contact |

n/a |

For information on Afghanistan fuel contact details, please see the following link:4.2.6 Afghanistan Fuel Provider Contact List.

3.2 Afghanistan Transporters

When operational, Afghanistan's postal and package services such as FedEx, DHL and others make deliveries to major cities and towns. Newer automobiles have recently become more widely available after the rebuilding of roads and highways. As of 2012, vehicles older than 10 years have been banned from being imported into the country contributing positively for the increase of road worthy vehicles.

Transport Associations and Unions

Afghanistan has a national transport union whose office is located in Kabul. The union has around 760 transport companies and associations who are registered with the Ministry of Transport as its members. The chairperson of the union is elected annually by the members. In addition to the Transport Union office in Kabul, the union has 22 branches throughout major cities in Afghanistan including at border crossing points. Local union representatives are nominated by local transport associations and companies who operate in those areas. An annual fee of 1000AFN/truck is required to renew a transport license registration.

The Transport Union is used as a platform to raise issues and challenges that disrupt the transport sector. Ministry of Transport regulation dictates that a minimum of 15 trucks are required to register as a local transport company. As a result, individual truck owners form associations to be able to form a company. There is no maximum limit on the number of trucks per association. On the other hand, a foreign company will require a minimum of 30 trucks to be registered as a transport company in Afghanistan and compete in the local market. It is a complicated and long process for Afghan transport companies to obtain a permit to be able to operate in neighbouring countries.

There are no official transport brokers in the country registered with the Ministry of Transport. But there are individuals who work as traditional brokers to connect supply and demand. If a transporter for example needs to subcontract other transporters, usually this transporter goes to a local broker to get information.

Overall transport business has decreased after the withdrawal of the international coalition force from the country. In the past, additional transport capacity was brought into the country when the demand for transport was high. Most companies have no intention of investing in the transport sector as the current political situation is unpredictable and also due to restrictions on the financial sector.

The National Transport Union does not engage on transport tariff setting as this is against the transport regulation. The Ministry of Transport only sets transport tariff for the public transport sector. All transport companies are required to abide by axel limitations set by the Ministry of Transport and Public Works along major highways.

Common Challenges

Due to dynamic security environments, certain areas are not reached by all transporters. In some cases, a transshipment of cargo to local trucks might be needed.

Remote locations located in mountainous areas are not reachable by average commercial trucks.

During summertime mainly in South region trucks availability can be scarce due to seasonal fruit harvest.

3.4 Afghanistan Manual Labour

In Afghanistan, labourers are not organised into associations and services are generally readily available. The cost of labour, skilled or unskilled, needs to be negotiated with the labourers or labourer team, and is often arranged either per MT (independent of the number of labourers) or per labourer themselves.

The below companies can be contacted to provide manual labour.

|

Companies |

Representative |

Email Address |

Contact number |

|---|---|---|---|

|

Wahed Nasib Logistics Services Company |

Ali Nasib |

0777 841 010 |

|

|

Skyways Logistics Services |

Zia Dinarkhil |

0783035380 |

|

|

Great Valley Logistics Services Co |

Najibullah Sharifi |

0702040149 |

|

|

Ecolog International |

|

+ 971 (0)4 2994 500 |

|

|

Eagle Cage Logistics Services Co. |

Hameed "Ghafoori" |

0795822224 |

|

|

Dunya Afghanistan Logistics and Supplies Services |

Sayed Zahir Shah Enayat |

0779 555 333 |

|

|

Committed to Good (CTG) |

Fahim Shirzada |

+971 4 566 8385 |

3.5 Afghanistan Telecommunications

Overview

Communications in Afghanistan is under the control of the Ministry of Communications and Information Technology (MCIT). It has rapidly expanded in late 2001 and has embarked on wireless companies, internet, radio stations, and television channels. The Afghan Government signed a $64.5 agreement in 2006 with China's ZTE to establish a countrywide optical fibre cable network. The project began to improve telephone, internet, television and radio broadcast services throughout Afghanistan. As of 2016, about 92% of the country's population has access to communication services.

There are about 18 million mobile phone users in the country. Etisalat, Roshan, Afghan Wireless, MTN, Wasel are private companies, and Salaam Telecom, a semi-government company part of Afghan Telecom, are the leading telecom companies. Afghanistan Wireless Communication Company became the first company to launch 4G services in 2017. It is predicted that over 50% of the population will have access to the internet, with over 114,192 fixed-telephone-lines mobile communications have improved because of the introduction of wireless carriers into this developing country. All GSM companies covered almost 95%. There are major cities such as Kabul, Kandahar, Herat, Mazari Sharif, Faizabad and Jalalabad connected through fiberoptic lines, including many more cities.

There are no restrictions regarding the competition, but the general rate is controlled by a special government authority by the name of ATRA (Afghanistan Telecom Regulatory Authority), recently as per newly enforced law by ATRA, the 10% tax charged on all telecommunication users while adding top-up, due to security concern the SIM card registration is compulsory through the authorized document (Tazkira, Passport and Driving License).

For more information on telecoms contacts, please see the following link: 4.11 Additional Services Contact List.

|

Telephone Services |

|

|---|---|

|

Is there an existing landline telephone network? |

Yes, with limited coverage at major cities (Kabul, Mazar, Herat, Kunduz, Jalalabad and Kandahar). |

|

Does it allow international calls? |

Yes |

|

Number and Length of Downtime Periods (on average) |

Very limited |

|

Mobile Phone Providers |

AWCC, Roshan, Etisalat, MTN, Salaam and Wasel only in Mazar. |

|

Approximate Percentage of National Coverage |

96% |

Ministry of Communication and Information Technology

The Ministry of Communications and Information Technology was established in 1955, when the country had a one-to-one wired telephone network only, as part of communications facilities, which was later developed to a small telephone facility. The Ministry then pushed to the next development of the time through providing telegraph services. However, it was used for military purposes only. Afghanistan became a member of the International Telegraph Union (ITU) in 1928. In the 1960s, Afghanistan has been connected to the world through an international radio transceiver that was installed in Kabul.

After the formation of the Interim Government in 2001, followed by the elected Government, new legislations were introduced to encourage private sectors to invest in different fields, including telecommunications. Many private companies emerged in the communications and information technology sector, providing many communication services.

Telecommunications Regulations

Afghanistan Telecommunications Regularity Authority (ATRA) is the main body governing the Telecoms rules and regulations. Both licensing and importation of Telecom equipment are possible but will take some time, and it is essential to involve the Government before ordering any of these items and get the license and importation approval well in advance.

|

Regulations on Usage and Import |

||

|---|---|---|

|

Regulations in Place? |

Regulating Authority |

|

|

Satellite |

Yes |

MoI, MCIT & ATRA |

|

HF Radio |

Yes |

MoI, MCIT & ATRA |

|

UHF/VHF/HF Radio: Handheld, Base and Mobile |

Yes |

MoI, MCIT & ATRA |

|

UHF/VHF Repeaters |

Yes |

MoI, MCIT & ATRA |

|

GPS |

Yes |

Organization Legal Authorization |

|

VSAT |

Yes |

MCIT & ATRA |

|

Individual Network Operator Licenses Required |

||

|

Yes |

||

|

Frequency Licenses Required |

||

|

Yes, under the MCIT & ATRA rule and regulation, charges are also applied. |

||

Existing Humanitarian Telecoms Systems

There are 2 to 3 standards or technologies currently used by the humanitarian agencies; there is an old analogue VHF system for a short distance and Codan HF for long-distance. There is already a setup and infrastructure in place in almost all locations where the UN operates. Simultaneously, the DPKO/UNAMA uses Tetra, the new digital radio system deployed in Kabul and in some field locations. UNHCR is using the ICOM digital radio system.

WFP implemented a DMR system, while UNAMA using Tetra more advanced and costly. WFP is leading the telecom working group for all UN agencies and INGOs across the country, therefore the obtained frequencies can be used for all humanitarian communication services.

|

Existing UN Telecommunication Systems |

||

|---|---|---|

|

UNAMA |

WFP |

|

|

UHF Frequencies |

The list will be provided separately. |

|

|

HF Frequencies |

The list will be provided separately. |

|

|

Locations of Repeaters |

Across the country |

Across the country |

|

VSAT |

All UN Using their specific VSAT/Satellite providers, WFP connected through Marlink Vsat Services. |

|

Telephone and Mobile Network Operators in Afghanistan

There are about 32 million GSM mobile phone subscribers in Afghanistan as of 2016, with over 114,192 fixed-telephone lines and over 264,000 CDMA subscribers. Mobile communications have improved because of the introduction of wireless carriers into this developing country. There are also a number of VSAT stations in major cities such as Kabul, Kandahar, Herat, Mazari Sharif, and Jalalabad, providing international and domestic voice/data connectivity. The international calling code for Afghanistan is +93. The following is a partial list of mobile phone companies in the country:

- Afghan Telecom

- Afghan Wireless

- Etisalat provides

- MTN Group

- Roshan

- Salaam Network

Afghan Telecom

Afghan Telecom is a telecom company offering fixed-line, wireless voice and data services under a 25-year license in Afghanistan. The company was previously Government-owned and operated until 2005, when the Afghan Ministry of Communications spun it off into a private entity. In 2008, investors were being sought for an 80% stake in the company. The Government will retain 20%, and the investment payment will go to the general budget of the Government of Afghanistan.

AfTel has roughly 20,000 employees in 34 provincial capitals and 254 district centres and villages. It offers traditional wire-line telephones and internet access in the major cities, a third-generation GSM-based wireless local loop telephony, WiMAX and Fibre-based internet services based on switching, wireless access and satellite equipment.

Roshan

In January 2003, Roshan was awarded the second GSM license in Afghanistan. Roshan's GSM network reaches 240 cities and towns across all of Afghanistan's 34 provinces. The network covers over 60% of the population, including the most remote rural areas. Roshan is one of the largest investors, private companies and taxpayers in Afghanistan. Roshan employs over 1,100 people, of whom 20% are women. Indirectly, the company has added over 30,000 jobs to the Afghan economy through its top-up stations, retail stores and public call offices.

Roshan introduced 3G in April 2013. The third company in the market was granted a 3G license after Etisalat (UAE-based telecom), and MTN (South Africa-based telecom). It has 3G service in Kabul, Jalalabad, Kandahar, Mazar, Herat, and Kunduz.

MTN Afghanistan

MTN Group Limited, formerly M-Cell, is a South Africa-based multinational mobile telecommunications company operating in many African, European and Asian countries. In Afghanistan, the MTN services provided are GSM (900/1800 MHz), GPRS/EDGE, UMTS (2100 MHZ), HSDPA. There are 4.5 million subscribers in 2012. MTN owns the company.

Etisalat Afghanistan

Etisalat Afghanistan is a 100% owned subsidiary of Etisalat UAE. Etisalat is one of the largest telecommunications companies in the world and the leading operator in the Middle East and Africa, headquartered in the UAE. Etisalat Afghanistan started its operations in August 2007. Etisalat provides voice and data services in 34 provinces and more than 200 districts supported by more than 12,000 retail outlets. In addition, Etisalat has 3G coverage in the 21 provinces of Afghanistan. Etisalat Afghanistan has roaming agreements with 231 operators in 116 countries.

AWCC (Afghan Wireless Communication Company)

Afghan Wireless Communication Company, also known as Afghan Wireless and AWCC, is Afghanistan's first wireless communications company. Founded in 1998, it is based in Kabul, Afghanistan, with various regional offices. Headquartered in Kabul, Afghan Wireless provides 4G LTE and other services, such as internet and mobile payments, to about five million subscribers across Afghanistan's 34 provinces. The company has partnerships with 425 carrier networks in 125 countries. Founded in 2002 by Ehsan Bayat, Afghan Wireless is a joint venture of Telephone Systems International and the Afghan Ministry of Communications.

Internet Service Providers (ISPs)

Afghanistan was given legal control of the .af domain in 2003, and the Afghanistan Network Information Center (AFGNIC) was established to administer domain names. As of 2016, there are at least 55 internet service providers (ISPs) in the country. Currently, in Afghanistan, more than 66 ISP operating and providing VSAT, WiMAX, microwave and other services.

|

Internet Service Providers |

||

|---|---|---|

|

Are there ISPs available? |

Yes |

|

|

If yes, are they privately or Government-owned? |

Both |

|

|

Dial-up only? |

No |

|

|

Approximate Rates (local currency and USD - $) |

Dial-up |

256kbp/ 800AFN = 12USD |

|

Broadband |

Average 1MB/ 100USD |

|

|

Max Leasable 'Dedicated' Bandwidth |

As much as required |

|

Mobile Network Operators (MNOs)

The MNO Services initially started by Roshan in 2008, followed by AWCC in 2011. Etisalat started these services across the country, and all MNO services and money transfer processes are managed by the Afghan Central Bank (DAB). The service coverage is almost the entire country with different cost. WFP recently started the process of money transfer for their several projects under CBT. Currently, ABMMC (Afghan Besim Mobile Money Company), managing by AWCC, and Etisalat under the mHawala have a valid agreement with WFP in implementing the SCOPE platform in Afghanistan.

For information on MNOs please visit the GSM Association website.

|

Company |

Number of Agent Outlets by Area |

Network Strength by Area |

Contracted for Humanitarian or Government Cash Transfer Programmes? |

Services Offered (i.e. Merchant Payment, Bulk Disbursement, Receive & Make Payment) |

|---|---|---|---|---|

|

ABMMC (AWCC) |

10 – 20 |

90% |

Yes |

Cash Transfer |

|

M-Paisa (ROSHAN) |

10 - 20 |

95% |

Yes |

Cash Transfer |

|

mHawala (Etisalat) |

10 - 20 |

89% |

Yes |

Cash Transfer |

|

MoMo (MTN) |

10 -20 |

70% |

Yes |

Cash Transfer |

3.6 Afghanistan Food Suppliers

Afghanistan Food Suppliers

Overview

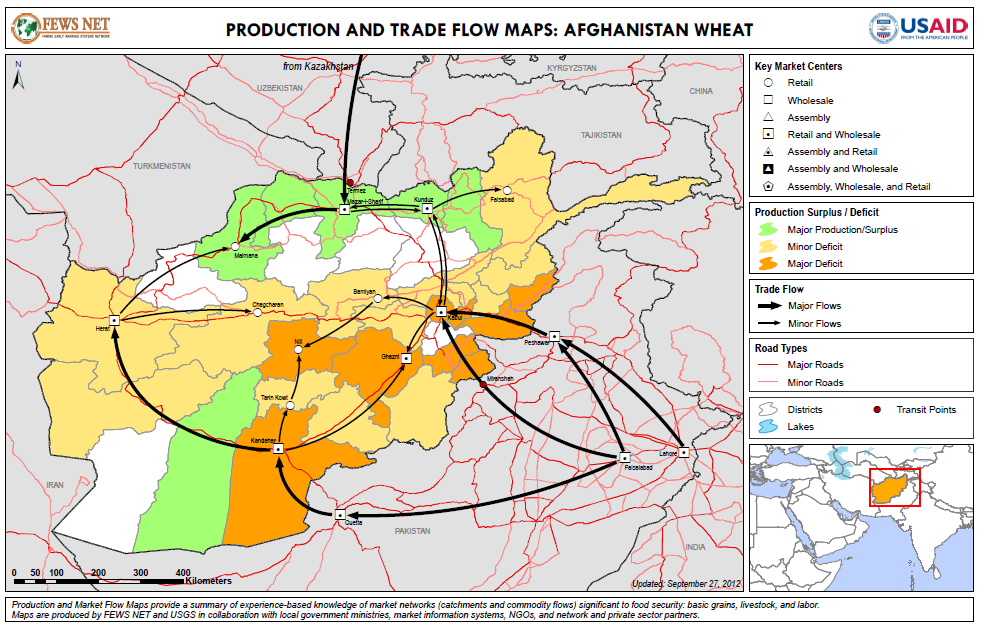

Afghanistan food market mainly depends on the import from neighbouring countries Pakistan, Kazakhstan, Tajikistan and Iran for the commodities of wheat flour, pulses, oil and sugar. Afghanistan local production cannot meet the requirement and there is deficit of 1.3 million metric tons of wheat for the year 2017 and almost similar deficit for the years before. There are few provinces in west, north east and south west which have surplus wheat and it is sold to local traders and exported to the provinces where there is demand and need within Afghanistan. Afghanistan’s major food export is the dry fruit and fresh fruits mainly to India and Pakistan.

There is a number of strategic grain reserves available in the country with total capacity of 241,000 metric tons. The below table elaborates in details.

|

S/N |

Province |

Silo (MT) |

Store (MT) |

|---|---|---|---|

|

1 |

Kabul |

50,000 |

22,000 |

|

2 |

Baghlan |

40,000 |

|

|

3 |

Balkh |

40,000 |

5,000 |

|

4 |

Hirat |

20,000 |

2,000 |

|

5 |

Badakshan |

|

6,000 |

|

6 |

Kunduz |

|

5,000 |

|

7 |

Bamyan |

|

5,000 |

|

8 |

Daikundi |

|

5,000 |

|

9 |

Ghor |

|

5,000 |

|

10 |

Ghazni |

|

3,000 |

|

11 |

Badghis |

|

5,000 |

|

12 |

Parwan |

|

5,000 |

|

13 |

Nangarhar |

|

10,000 |

|

14 |

Laghman |

|

2,000 |

|

15 |

Takhar |

|

2,000 |

|

16 |

Khost |

|

1,000 |

|

17 |

Hilmand |

|

8,000 |

|

Total |

150,000 |

91,000 |

|

Statistics are approximate as Afghanistan border of trade for food commodities is very porous and is difficult to determine the actual import data. Based on the data from USDA the import of wheat and wheat flour was ranged between 0.5-2.5 MMT with highest in year 2008 (3.8 MMT) and 2011 (3 MMT). The government official data trend of wheat flour trade between Pakistan and Kazakhstan shows that in year 2003 up to year 2006/07 Afghanistan wheat flour market was fully dominated by Pakistan product, but since then it drastically declined in year 2008 and this trend continued and recently it was ranging between 20-30 percent of the wheat flour market. The official data of 4th quarter of 2016 shows that Pakistan occupies 30 percent of the total wheat and wheat flour market in Afghanistan for which Kazakhstan and Turkmenistan account for 67 percent. Which means that Afghanistan is benefiting from these competitions in term of wheat and wheat flour price stability and any sudden changes in export policy of Pakistan.

The province in table below are the one with surplus production where local procurement is feasible.

|

Province with surplus production |

||

|---|---|---|

|

S.N. |

Province |

|

|

1 |

Baghlan |

|

|

2 |

Takhar |

|

|

3 |

Kunduz |

|

|

4 |

Balkh |

|

|

5 |

Jawzjan |

|

|

6 |

Faryab |

|

|

7 |

Samangan |

|

|

8 |

Helmand |

|

|

9 |

Herat |

|

The current milling capacity is 1 MMT per year. In 2016, 0.1 MTT

wheat grain was milled which is only 10 percent of the existing

capacity. There is therefore more potential which could be used

towards country self-sufficiency in term of milling

capacity.

Additional information can be located from sources which are

regularly maintained and reflect current facts and figures. For

more specific and detailed overviews of food availability and

market conditions, please consult the following sources:

WFP Vulnerability and Analysis Mapping (VAM):

http://vam.wfp.org/sites/mvam_monitoring/afghanistan.html

USAID Famine Early Warning Systems Network (FEWS NET):

http://www.fews.net/es/central-asia/afghanistan

Retail Sector

|

Types of Retailers Available |

|

|---|---|

|

Type of Retailer |

Rank (1-5) |

|

Supermarket – concentrates mainly in supplying a range of food, beverage, cleaning and sanitation products; have significant purchasing power; are often part of national/regional/global chains. |

5 (There are only few of the supermarkets available in urban cities of Kabul, Kandahar, Nangarhar, Mazar and Hirat, these are like finest, kefayat etc) |

|

Convenience Store/Mini Market – medium sized shop; offers a more limited range of products than supermarkets; usually has good/stable purchasing power; may be part of chain or cooperative. |

3 |

|

Permanent shop with strong supply capacity – individually/family owned store; usually offers fewer commodities and a limited selection of brands; good storage and reliable supply options. |

1 |

|

Permanent shop with limited supply capacity – individually/family owned store; offers fewer commodities and a limited selection of brands; limited storage and unstable supply options. |

3 |

|

Mobile Shop/Market Stand – individually/family owned store; usually offers fewer commodities and a limited selection of brands; may be found at outdoor markets, camps or unstable environments. |

3 |

|

Primary Goods / Commodities Available |

||

|---|---|---|

|

Commodities by Type** (SITC Rev 4 Division Code - Title) |

Comments |

|

|

00 - Live animals (other than fish, crustaceans, molluscs, etc.) |

Live small animals as sheep and goat in the country are available and even some are exported to other neighbouring countries mainly Pakistan and Iran. The availability of sheep and goat or supply mainly increase in Autumn as the male offspring’s are marketed. The country also import live animal like cattle and buffalos from Pakistan. Poultry production is limited, although there are some poultry farms exist in the country, but live poultry coming mainly through import from Pakistan. |

|

|

01 - Meat and meat preparations |

Meat of produced and processed locally - including poultry cattle, sheep and goat - is available in the country, but does not satisfy the demand. |

|

|

02 - Dairy products and birds’ eggs |

Locally produced dairy complement the imported product from manly Iran and Pakistan. Some government ran farms and private farms are present in the country, but does not fulfil the demand. Some dairy processing companies recently established. |

|

|

03 - Fish (not marine mammals), crustaceans, molluscs… |

Local produced natural and fish farming exist in the country, but at the very low capacity. Fish is mainly imported from Pakistan. |

|

|

04 - Cereals and cereal preparations |

Wheat is staple food in Afghanistan; local production is minor, compared to imported. Main sources are Kazakhstan, Pakistan and Turkmenistan. |

|

|

05 - Vegetables and fruit |

Locally cultivated vegetables complement the imported. Fresh and dry fruits and nut are cultivated for internal consumption and exportation. |

|

|

06 - Sugars, sugar preparations and honey |

Cultivation of sugarcane and sugar beet exists but for the internal request is reached through Pakistan importation. |

|

|

07 - Coffee, tea, cocoa, spices and manufactures thereof |

Afghanistan is not a big coffee consumer, nor coffee producer. Tea is widely used almost by all Afghan population and the source is purely import as local production is existent. |

|

|

42/43 - Fixed vegetable fats and oils, crude, refined or fractionated |

Vegetable oil is mainly imported, but some locally produced oil of oil seeds and olive oil are available in a limited amount in the country. |

|

Disclaimer: Inclusion of company information in the LCA does not imply any business relationship between the supplier and WFP / Logistics Cluster, and is used solely as a determinant of services, and capacities.

Please

note: WFP / Logistics Cluster maintain complete impartiality and

are not in a position to endorse, comment on any company's

suitability as a reputable service

provider.

3.7 Afghanistan Waste Management and Disposal Providers

Years of conflict, mismanagement, and societal disengagement have left Kabul's waste management system in ruins. One of the most pressing problems facing the city is the disposal of solid waste. This problem is especially acute in Kabul, which has experienced rapid urban growth due to a large number of returnees and new urban dwellers and the increase in waste from previously growing economic activity.

It is exacerbated by the absence of an effective strategy to deal with the problem and the municipality's lack of capacity to respond. The capacity deficit is reflected in the estimated 70% of total solid waste that is accumulated on roadsides, back yards, in drains, rivers and open places, and represents a significant environmental hazard. It was estimated in 2020 that waste services could only be delivered to 52.5% of residents and out of the 2,527 tons of waste generated during each day, only 1,314 tons of waste could be collected.

Source: Analyzing Waste Management System Alternatives for Kabul City, Afghanistan: Considering Social, Environmental, and Economic Aspects. 2020. MDPI. <https://doi.org/10.3390/su12239872>